1. Introduction: The Confluence of Cost and Customization in Modern Medicine

The pharmaceutical landscape stands at a pivotal juncture, characterized by the escalating cost of life-saving medications and the transformative promise of precision medicine. This complex scenario compels a critical examination: how can the imperative for accessible healthcare be reconciled with the relentless pursuit of scientific breakthroughs? This report delves into this intricate balance, highlighting the dual challenges and the urgent need for strategic, integrated solutions that benefit both patients and the broader healthcare ecosystem.

1.1. The Enduring Challenge of High Prescription Drug Prices

For years, the United States has grappled with prescription drug prices that significantly exceed those in other developed nations. This is not merely an abstract economic problem; it represents a tangible burden on patients, healthcare systems, and the national economy. The magnitude of this challenge and its pervasive impact are profound.

Current public sentiment underscores the severity of this issue. KFF polling from July 2023 indicates that more than one in four adults currently taking prescription drugs report difficulty affording their medication . This figure escalates to a concerning 40% for individuals with household incomes below $40,000 per year, highlighting a substantial barrier to access for a significant portion of the population . Furthermore, a striking 82% of U.S. adults perceive the cost of prescription drugs as unreasonable, even though 65% report finding their medication “very” or “somewhat” easy to afford . This suggests a widespread public perception of unfair pricing, regardless of individual affordability.

Historically, the trajectory of prescription drug spending in the U.S. has shown a nuanced pattern. While per capita out-of-pocket prescription drug spending has notably declined since the mid-2000s and is projected to decrease further by 8% by 2031, overall per capita retail prescription drug spending increased in 2021 after a slight dip in 2020 . This trend suggests that while patients may be bearing less direct financial responsibility at the pharmacy counter, the overall cost burden has not diminished; rather, it has shifted to other payers, predominantly private insurers and government programs. Medicare, for instance, has emerged as a major payer for prescription drugs since the launch of Part D in 2006, with its contribution to total national health spending on retail prescription drugs rising from 2% in 2005 to 32% in 2021, making it the second-largest payer after private insurance .

This redistribution of financial responsibility means that the “affordability crisis” for patients may manifest less as immediate financial hardship at the point of sale, and more as increased premiums, higher taxes, or reduced coverage benefits across the broader healthcare system. For businesses, this translates into elevated healthcare benefit costs for employees and a greater societal burden that ultimately circles back to economic productivity. It also highlights the inherent opacity of the true cost of drugs, as the “list price” often diverges significantly from the “net price” paid after accounting for various rebates and supply chain markups .

Periods of significant spending growth have often been linked to the market entry of high-cost specialty drugs. A notable example occurred between 2013 and 2015, when the introduction of two high-cost specialty Hepatitis C drugs led to a surge in spending . This pattern indicates a fundamental shift in the pharmaceutical market’s business model. It is moving from blockbuster drugs designed for mass markets to highly specialized, often curative, therapies intended for smaller, more defined patient populations. This has profound implications for pricing strategies, as companies seek to recoup massive research and development (R&D) investments from a narrower base, inevitably leading to exceptionally high per-unit costs. This trend also sets the stage for the discussion of precision medicine, which inherently targets smaller, stratified patient groups, further intensifying this pricing dynamic .

The stark international discrepancies in drug pricing further emphasize the unique nature of the U.S. market. For example, Harvoni, an oral medication for chronic hepatitis C infection, is listed at a price 132% higher in the U.S. than in Switzerland and 89% more than in the U.K. . Similarly, Humira, prescribed for conditions like rheumatoid arthritis and Crohn’s disease, is priced a staggering 265% higher in the U.S. than in other comparable nations . These contrasts underscore a distinct pricing dynamic within the American healthcare system that warrants deeper investigation.

1.2. The Dawn of Precision Medicine: A Paradigm Shift

Precision medicine, frequently lauded as the vanguard of healthcare, promises to revolutionize treatment by tailoring interventions to individual patient characteristics. Understanding its essence and its intersection with existing drug pricing challenges is crucial for navigating the future of medicine.

At its core, precision medicine, also referred to as precision healthcare, represents an innovative approach to customizing disease treatment and prevention . It achieves this by leveraging vast datasets that encompass an individual’s unique attributes, such as their genome, molecular makeup, environmental factors, and electronic health records . This data-driven methodology empowers doctors and researchers to more accurately predict which treatments are most likely to be effective for a specific patient, moving beyond a one-size-fits-all approach .

This paradigm shift is actively transforming disease management across a wide spectrum of therapeutic areas. From oncology, where treatments can be tailored to the molecular characteristics of an individual’s tumor, to rare diseases where it facilitates the identification of new molecular targets and accelerates discovery, precision medicine is reshaping how conditions are approached . In respiratory diseases like asthma, it enables the precise targeting of inflammatory pathways, allowing for the segmentation of patient populations based on individual biomarkers . The ultimate aim is to uncover the underlying genetic and molecular drivers of disease to identify the “right treatment for the right patient,” thereby reducing the often frustrating and costly “trial and error” approach common in traditional medicine .

The potential benefits of precision medicine are immense and multifaceted. For patients, it promises reduced trial and error, leading to more effective and efficient care . Physicians can anticipate improved patient outcomes, while payers benefit by only reimbursing for treatments that demonstrate efficacy . Regulators, in turn, can ensure the safety and effectiveness of therapies tailored to specific patient profiles . As former U.S. President Barack Obama articulated, “What if matching a cancer cure to our genetic code was just as easy, just as standard?” . This vision encapsulates the profound impact precision medicine seeks to achieve.

A critical implication of this transformative approach is the paradox it introduces: the tension between targeted efficacy and broad affordability. Precision medicine aims for superior patient outcomes by meticulously tailoring treatments to individual genetic and molecular profiles . This inherent specificity means that a given drug will often target a smaller, more defined patient population . While this approach promises to reduce “trial and error” and minimize “waste in the system” , the economic models for drug pricing remain largely value-based. Consequently, a reduced market size for a drug, necessitated by patient stratification, makes it imperative to determine the value of this enhanced drug specificity to realize its full pricing potential . This creates a fundamental tension: highly effective, targeted therapies are undeniably valuable to the individual patient, but their development and commercialization often necessitate very high per-unit prices to recoup substantial R&D investments from a narrower patient base. This challenges traditional notions of market size and incentivizes premium pricing, potentially exacerbating the overall affordability crisis, even when the treatment offers clear clinical superiority. The very definition of “value” in value-based pricing becomes more complex and contentious across different stakeholders when the patient population is highly segmented.

1.3. Navigating the Intersection: Why This Matters for Business and Patients

The convergence of high drug prices and the advent of precision medicine presents both profound challenges and unprecedented opportunities. For business professionals, understanding this intricate intersection is not merely an academic exercise; it is a strategic imperative that will define future success and societal impact.

The shift towards precision medicine, coupled with intense public and governmental scrutiny over drug prices, demands a fundamental re-evaluation of traditional business models within the pharmaceutical industry. Companies must now navigate a labyrinth of complex market dynamics, evolving regulatory pressures, and shifting payer expectations . This necessitates a comprehensive overhaul of R&D investment priorities, the reimagining of commercialization strategies, and a deeper, more collaborative engagement with providers and patients . The ability to adapt swiftly and strategically to these changes will be a defining characteristic of successful pharmaceutical enterprises in the coming decade.

The ultimate goal of medical innovation is, unequivocally, to improve patient lives. However, if high prices create insurmountable barriers to access, even the most groundbreaking precision medicines become ineffective for those who need them most. The human cost of this challenge is stark: nearly 30% of Americans report not taking their medication as prescribed due to cost . Furthermore, it is estimated that over 1.1 million Medicare patients could face premature death over the next decade because they cannot afford their prescribed medications . This grim statistic underscores the critical and undeniable link between drug pricing, patient access, and broader public health outcomes. The societal burden of unaffordable medicines extends beyond individual patients, impacting workforce health, productivity, and the overall economic well-being of a nation.

Addressing this multifaceted challenge requires a truly integrated and collaborative approach. It demands that pharmaceutical companies, payers, policymakers, and patient advocacy groups work in concert to build a sustainable and patient-centric healthcare ecosystem . This collaborative effort must balance the essential incentives for innovation with the equally vital goals of affordability and equitable access. Without such a concerted effort, the promise of precision medicine risks remaining largely unfulfilled for a significant portion of the population, undermining its transformative potential.

The very concept of “value” becomes a central conundrum in a stratified market. Precision medicine focuses on tailoring treatments to unique patient attributes, leading to highly specific and often smaller patient segments . While drug pricing is increasingly shifting towards “value-based” models , measuring this value becomes inherently complex when treatments are highly individualized . Traditional cost-effectiveness metrics, designed for broader populations, may not be directly applicable or sufficient. The value of a life-saving treatment to a small, specific patient group might be immense, yet the societal perception of “value” (and willingness to pay) for a drug with a limited market size can be contentious . This complexity creates significant challenges for payers and health systems in determining appropriate reimbursement. Simultaneously, it compels pharmaceutical companies to set prices that reflect true patient benefit while still recouping substantial development costs. This dynamic pushes the industry towards more sophisticated data analytics and the collection of real-world evidence to rigorously demonstrate value. However, it also opens the door to ongoing debates about fairness and equity, particularly when the cost per patient is exceptionally high.

2. The Anatomy of High Drug Prices: Unpacking the Core Drivers

To effectively address the pervasive challenge of high-priced prescription drugs, a thorough dissection of the fundamental components contributing to their cost is essential. This section will delve into the primary drivers: the immense investment and inherent risks associated with research and development, the significant expenditures on marketing and sales, and the intricate web of regulatory hurdles and intellectual property protections that shape market dynamics.

2.1. Research and Development: The Innovation Engine’s Fuel

Pharmaceutical companies frequently cite the enormous costs and inherent risks associated with R&D as the primary justification for the high prices of their drugs. A closer examination reveals a more nuanced picture of this innovation engine.

Developing a new drug is, without question, one of the most expensive and protracted ventures in modern business. Estimates for the average cost to bring a new medicine to market vary, ranging from less than $1 billion to more than $2 billion, with some studies suggesting figures as high as $2.6 billion or $2.87 billion (in 2013 dollars) . This staggering sum encompasses not only the direct out-of-pocket expenditures but also the substantial capital costs incurred over the lengthy development timeline, which can span 10 to 15 years from initial discovery to final market approval .

The components of these R&D costs are multifaceted. Key variables determining the capitalized cost of a new drug include direct out-of-pocket expenses, the success rates of compounds progressing through development, the duration of development times, and the cost of capital . Preclinical research alone, conducted before human trials, can take 3 to 6 years and incur costs ranging from $300 million to $600 million . Clinical trials, while often representing a smaller proportion of the total R&D cost, can still be substantial, with a median cost of $19 million for pivotal trials and reaching up to $347 million for large studies of heart-failure drugs . The cost of capital, which accounts for the value of other forgone investments during the long R&D process, can constitute a significant portion of the total cost, sometimes as much as 33% .

The journey to approval is notoriously fraught with failure, often referred to as the “valley of death.” Only approximately 12% of drug candidates that enter clinical trials ultimately receive FDA approval . The primary reasons for these failures include safety concerns, a lack of demonstrated effectiveness, or unacceptable toxicity levels . The estimated R&D costs inherently factor in expenditures on drugs that do not make it to market. For instance, Roche’s $11 billion R&D spend in 2018 included the costs associated with two failed Phase III Alzheimer’s drug candidates . This high failure rate necessitates that successful drugs generate sufficient revenue to offset the substantial investments made in numerous unsuccessful ventures.

Trends in R&D spending reflect the industry’s increasing commitment to innovation. The pharmaceutical industry’s R&D expenditure has grown significantly, reaching $83 billion in 2019, an amount approximately 10 times higher than the annual spending in the 1980s when adjusted for inflation . On average, pharmaceutical companies allocated about one-quarter of their revenues to R&D in 2019, nearly double the share observed in 2000 . Furthermore, spending on drug R&D increased by almost 50% between 2015 and 2019, indicating a sustained and growing investment in new drug development .

A critical observation arises when examining the “innovation premium” justification often put forth by the industry versus the actual cost recovery dynamics. Pharmaceutical companies consistently cite high R&D costs to justify their elevated drug prices . However, a 2022 study found no direct correlation between investments in drugs (where transparency was sufficient) and their final costs . Furthermore, when pressed, industry executives have acknowledged that the significantly lower prices obtained in other countries do cover their costs . This suggests that while R&D is undeniably expensive, the largely unregulated pricing environment in the U.S. allows for a premium far beyond what is strictly necessary for simple cost recovery, effectively subsidizing global R&D efforts . This contradiction challenges the industry’s primary narrative for high prices. It implies that the U.S. healthcare system, particularly patients and both public and private payers, bears a disproportionate share of global R&D costs, functioning as a global “piggy bank” for pharmaceutical innovation. For businesses, this means that potential policy changes in the U.S., such as drug price negotiation, could significantly alter global revenue streams and necessitate a re-evaluation of R&D investment strategies, potentially leading to higher prices in other countries or a shift in R&D focus .

Another important dynamic is the therapeutic area cost disparity, which acts as a hidden driver of overall drug expenses. R&D costs vary substantially across different therapeutic areas due to considerable differences in success rates, development times, and out-of-pocket expenditures . Oncology, neurology, and respiratory diseases are consistently identified as the most expensive areas for drug R&D, primarily because drugs in these categories experience lower success rates and longer development times . This observation is reinforced by the fact that many of the drugs approved in recent years are high-priced specialty drugs targeting relatively small numbers of potential patients . Even for oncology drugs, which could be cheaper to develop through precision approaches, premium pricing remains the norm . This suggests that the “average” R&D cost often cited by the industry may not accurately reflect the cost structure of all drugs. Companies may strategically prioritize R&D in these high-cost, high-reward therapeutic areas, understanding that the potential for premium pricing for breakthrough therapies in these complex diseases justifies the elevated investment and risk. This strategic focus contributes to the overall rise in drug costs, as a greater proportion of new approvals fall into these inherently more expensive categories.

2.2. Marketing and Sales: Beyond the Lab

Beyond the extensive scientific endeavors, significant financial resources are consistently allocated to marketing and sales activities within the pharmaceutical industry. Understanding how these expenditures compare to R&D and their role in shaping drug prices and market dynamics is crucial.

There is a notable divergence in reports regarding the relative spending on R&D versus marketing and sales. Public perception often suggests that drugmakers spend more on advertising than R&D . Some analyses indeed indicate that in 2020, seven out of the ten largest pharmaceutical companies spent more on selling and marketing expenses than on R&D. For example, Abbvie reportedly allocated $11 billion to sales and marketing compared to $8 billion for R&D in that year . However, other comprehensive analyses present a different picture. A time-series analysis spanning from 1979 to 2018 found that R&D spending (which includes amortization for externally acquired drugs) increased dramatically from 4.6% of sales in 1979 to 24.2% in 2018. In contrast, direct advertising expenses, as a percentage of sales, actually shrunk by half from 6.1% to 2.8% over the same period. By 2018, drugmakers spent $9 billion on advertising, which was only 15% of the $61.1 billion allocated to R&D .

This apparent contradiction stems from the nuanced definition of “marketing spend.” The latter study specifically defines “advertising expense” as distinct from broader “selling, general, and administrative costs” (SG&A), which encompass a wide array of commercialization efforts including salesforce expenses, legal fees, and administrative salaries. The AHIP analysis , on the other hand, lumps “selling and marketing costs” with SG&A, which includes these broader commercial activities. This distinction is crucial for policy discussions. If the public perceives excessive “advertising” when the bulk of “marketing” is actually spent on professional engagement (e.g., sales representatives, medical science liaisons, educational conferences), it can lead to misdirected policy efforts. For businesses, this means that optimizing commercial models isn’t just about cutting traditional advertising; it requires a re-evaluation of the entire go-to-market strategy, especially as direct-to-consumer models gain traction and the influence of Pharmacy Benefit Managers (PBMs) faces increasing scrutiny . The focus for pharmaceutical companies should increasingly shift towards demonstrating tangible “value” rather than simply driving “sales volume” .

Marketing efforts, encompassing activities like salesforce visits to healthcare professionals, sponsorships of medical conferences, and distribution of product samples, are designed to influence prescribing patterns and secure market share . Ultimately, the main objective of pharmaceutical companies when setting drug prices is to maximize revenue . This often involves a delicate balancing act: pricing a drug too low might lead payers to be unwilling to reimburse it or physicians to be disinclined to prescribe it, as they may perceive it as a “discounted form of therapy” or less effective than more expensive alternatives . Conversely, pricing a drug too high risks rejection by payers and prescribers who may believe the drug’s benefits do not justify its cost . This implies that price itself serves as a powerful signal of perceived quality or efficacy in the market. This is a critical psychological and market dynamic. It means that even if a drug could be profitably sold at a lower price, companies might intentionally price it higher to signal its “premium” value and avoid being perceived as a “discounted” or less effective option. This contributes to the upward pressure on drug prices, as companies are incentivized to maintain high list prices to preserve perceived value, even if net prices are lower due to rebates .

Globally, pharmaceutical marketing spend reached nearly $40 billion in 2022 . The top 10 pharmaceutical companies, on average, allocate between 20% and 25% of their annual revenues to marketing and sales activities . Emerging markets, particularly in Asia and Latin America, are experiencing even faster growth in marketing budgets, with yearly increases of 8-10%, reflecting expanding healthcare infrastructure and rising consumer awareness in these regions .

2.3. Regulatory Hurdles and Market Exclusivity

The journey of a pharmaceutical product from laboratory discovery to patient availability is heavily regulated, and intellectual property rights play a pivotal role in shaping market dynamics and, consequently, pricing.

The FDA approval process is notoriously lengthy and rigorous, typically spanning 10 to 15 years from the initial discovery of a compound to its final market approval . This multi-step process is designed to ensure the safety and efficacy of new drugs and involves extensive preclinical testing, multiple phases of clinical trials (Phase I, II, and III), and the submission of a comprehensive New Drug Application (NDA) . While the median cost of pivotal clinical trials is around $19 million, and can reach up to $347 million for large studies , the overall regulatory process, including the substantial costs of preclinical development and the high failure rate of drug candidates, contributes significantly to the total development cost . For instance, the FDA itself charges between $1 million and $2 million for an NDA submission .

This rigorous regulatory framework, while critical for public health, indirectly contributes to high drug prices by extending the period of investment before revenue generation and by adding significant direct and indirect costs. This creates a tension where calls for faster approvals (to reduce costs) must be carefully balanced against the paramount need for patient safety. It also highlights the importance of efficient trial design and the early identification of potential failures to mitigate these escalating costs .

Intellectual property (IP) rights, primarily patents and regulatory exclusivities, are foundational to the pharmaceutical industry’s business model. These rights are crucial for protecting pharmaceutical discoveries and encouraging the substantial investment required for new treatments . Patents, issued by the United States Patent and Trademark Office (USPTO), generally provide 20 years of exclusive rights from the date of application filing, allowing the inventor to exclude others from making, using, offering for sale, or selling the invention . In addition to patent protection, regulatory exclusivities are granted by the FDA upon drug approval, providing exclusive marketing rights that can run concurrently with or independent of patents . These exclusivities vary in length depending on the type of drug and its specific designation, ranging from 6 months (e.g., pediatric exclusivity) to 7 years (Orphan Drug Exclusivity) or 5 years (New Chemical Exclusivity) . These periods of exclusivity are designed to prevent generic or biosimilar competition for a defined time, allowing companies to recoup their substantial R&D investments . Patent information is publicly available and published in the FDA’s Orange Book, providing a degree of transparency regarding protected drugs .

The Hatch-Waxman Act, officially known as the Drug Price Competition and Patent Term Restoration Act, plays a significant role in balancing innovation incentives with the promotion of generic competition. It provides mechanisms, such as 180-day exclusivity for the first generic applicant to challenge a listed patent, designed to encourage generic drug development and market entry .

| Year | R&D Spending (2018 USD Billions) | Advertising Spending (2018 USD Billions) | R&D as % of Sales | Advertising as % of Sales |

| 1979 | $6.3 | $8.4 | 4.6% | 6.1% |

| 2018 | $61.1 | $9.0 | 19% | 2.8% |

The table above illustrates a significant shift in pharmaceutical company spending priorities over time. While public perception often suggests that marketing expenses outweigh R&D, the data from 1979 to 2018 reveals a starkly different trend. R&D spending, when adjusted for inflation and considered as a percentage of sales, has dramatically increased, demonstrating the industry’s growing investment in innovation . Conversely, direct advertising expenses have shrunk as a percentage of sales, indicating a strategic reallocation of resources. This quantitative evidence helps to clarify the actual allocation of pharmaceutical revenues, informing both public policy and internal business strategies.

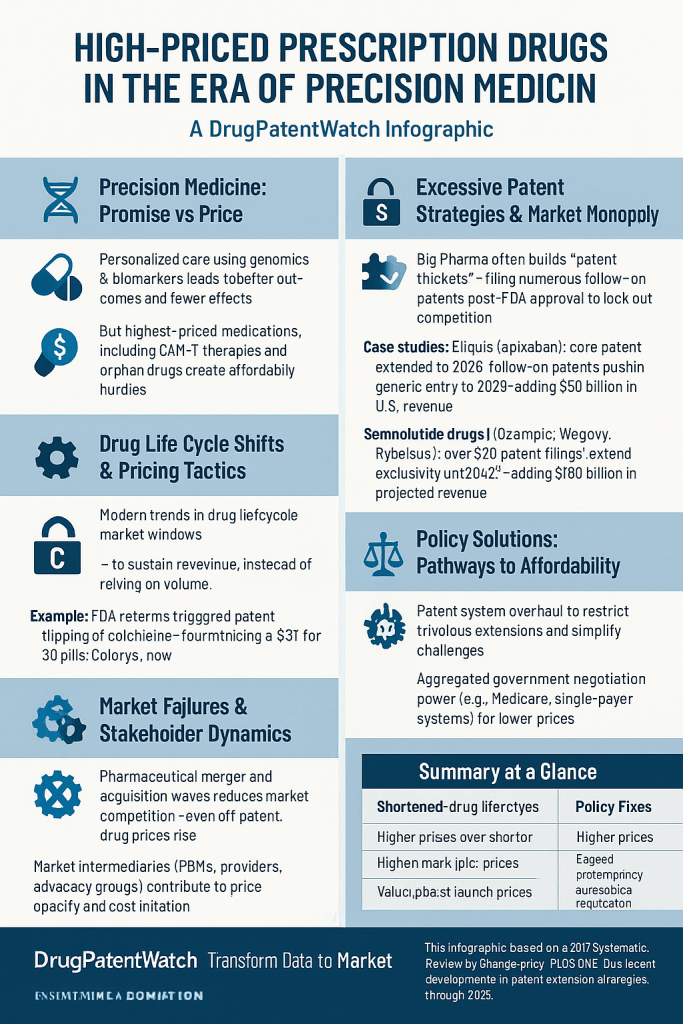

The dual role of intellectual property as both an innovation enabler and a potential “monopoly enabler” beyond R&D recovery is a contentious issue. IP rights are fundamentally justified as necessary to allow manufacturers to recoup their R&D costs . However, critics argue that these rights, particularly through practices like “evergreening” and the creation of “patent thickets,” are utilized to “unduly extend the period of exclusivity” and “keep drug prices high, without significant benefits for consumers or innovation” . The fact that U.S. drug prices are significantly higher than those in countries with comparable R&D investments further suggests that the robust IP protection in the U.S. enables a market monopoly that generates profits beyond what is strictly necessary for R&D recoupment . This implies that the current IP system in the U.S. may be over-incentivizing certain types of “innovation,” such as minor modifications, rather than truly novel breakthroughs, while simultaneously delaying the entry of more affordable generic alternatives. For businesses, this means that competitive advantage can be gained not just through superior scientific innovation, but also through sophisticated patent strategies, which then become a primary target for policy reforms aimed at increasing market competition.

3. Precision Medicine: Promise, Price, and Paradox

Precision medicine stands as a beacon of hope, promising highly effective, tailored treatments that could redefine healthcare. Yet, this revolutionary approach introduces its own set of economic complexities, particularly concerning pricing models and the dynamics of smaller, highly specific patient populations.

3.1. Defining Precision Medicine: Tailoring Treatment to the Individual

Understanding what precisely defines this cutting-edge approach is essential to grasping how it is transforming the very fabric of disease management and, by extension, the pharmaceutical market.

At its core, precision medicine is fundamentally about leveraging vast individual datasets to customize healthcare interventions. This includes an individual’s genomic information, molecular makeup, environmental factors, and lifestyle data . The approach involves the sophisticated use of biomarkers to identify specific patient subgroups and the application of advanced technologies such as multi-omics, novel imaging techniques, artificial intelligence (AI), and machine learning (ML) to delve deeper into the understanding of disease biology . This comprehensive data-driven strategy enables a more precise and personalized approach to treatment and prevention.

This methodology is actively transforming disease management across a diverse range of therapeutic areas. In oncology, for instance, precision medicine allows for the tailoring of treatments to the unique molecular characteristics of an individual’s tumor, moving beyond a one-size-fits-all chemotherapy regimen . For rare diseases, where patient populations are inherently small and diverse, precision medicine offers unparalleled opportunities to understand fundamental biological mechanisms, identify new molecular targets, and accelerate the discovery of novel treatment options . Similarly, in respiratory conditions like asthma, this approach enables the precise targeting of specific inflammatory pathways, allowing for the stratification of broad patient populations into more manageable subgroups based on their individual disease biomarkers . The overarching promise is to move away from protracted “trial and error” approaches, reducing the need for multiple rounds of ineffective treatments and minimizing associated side effects, ultimately leading to better health outcomes by ensuring the “right treatment for the right patient” .

3.2. The Economic Implications of Personalization

While precision medicine holds immense promise for patient care, its highly individualized nature introduces unique economic challenges, particularly concerning initial costs and the dynamics of serving smaller patient populations.

The development and application of precision medicine, which often includes extensive genetic testing and personalized drug development, can be extremely expensive in its initial phases . However, a growing body of evidence suggests that despite these high upfront costs, precision medicine can prove to be economically efficient in the long term. This efficiency arises from its ability to accurately identify the most effective treatments, thereby significantly reducing wasteful “trial-and-error” approaches and minimizing the incidence of adverse reactions . For example, a precision approach to oncology drug research and development (R&D) was estimated to be over $1 billion less expensive than non-precision methods, leading to both improved patient outcomes and substantial reductions in R&D costs . One report even suggests that the use of precision medicine in drug development could lead to potential industry savings of 17%, translating to an estimated $26 billion worldwide annually . This demonstrates that while the inputs for precision medicine can be costly, the efficiency gained in development and patient outcomes can yield significant savings.

A fascinating observation emerges from the interplay of cost in precision medicine development. While the development of precision medicines is often cited as more expensive due to the necessity of companion diagnostics and extensive genetic testing , it can paradoxically be cheaper for specific therapeutic areas, such as oncology. For instance, oncology drugs developed with a companion diagnostic (CDx) strategy were estimated to be $1 billion cheaper to develop . The resolution to this apparent contradiction lies in the efficiency gained through precision. Although the inputs (diagnostics, specialized testing) add to the upfront cost, the precision in patient selection dramatically increases clinical trial success rates and reduces wasted R&D on patients who would not respond to the treatment. This leads to overall lower development costs for successful drugs . This suggests that precision medicine, when fully optimized, can be a significant driver of R&D efficiency, not merely an additional cost burden. For pharmaceutical companies, this implies that investing in robust diagnostic strategies early in development can yield substantial long-term R&D savings and higher success rates. However, the persistent challenge remains in translating these development cost efficiencies into lower patient prices, as current business models often prioritize premium pricing for these highly effective, targeted therapies, regardless of the R&D efficiency gains .

The inherent nature of precision medicine often leads to smaller patient populations, which presents a significant per-unit price conundrum. By targeting highly stratified patient segments, precision medicine drugs inherently serve smaller market sizes . This directly impacts pricing decisions, as manufacturers must recoup substantial R&D costs from a more limited patient base, resulting in higher per-unit prices . This dynamic is particularly pronounced in orphan drug development, which also targets small patient populations and consequently faces very high per-patient costs to justify R&D investment . For example, per-patient costs for orphan drugs can range from $137,000 to over $5 million for gene therapies, even with smaller trial sizes . The regulatory allowances for smaller patient data in orphan drug trials reflect an adaptation to this economic reality. The economic challenges and pricing debates surrounding orphan drugs therefore serve as a critical precedent and potential blueprint (or warning) for the broader precision medicine landscape. The industry’s existing strategies for orphan drugs—characterized by high per-unit pricing and reliance on value-based arguments for small populations—are likely to be replicated and intensified for precision medicines. This highlights the urgent need for policymakers to consider how current orphan drug policies might influence the pricing trajectory of future precision therapies.

The integral role of companion diagnostics (CDx) and genetic testing further adds to the economic complexities. Precision medicines frequently necessitate these diagnostic tools to accurately identify the appropriate patient population for a given therapy . These diagnostic components contribute to the overall cost of treatment and often require larger patient pools for testing during development, further elevating R&D expenses . A particular challenge arises from the differing pricing models: molecular testing for diagnostics is typically cost-based, while drug pricing is increasingly value-based . This creates a complex interplay in determining the final value and reimbursement of targeted medicines, as the diagnostic component’s cost structure must be integrated into the overall value proposition.

4. Intellectual Property: The Double-Edged Sword of Innovation

Intellectual property (IP) rights are foundational to the pharmaceutical industry, designed to incentivize groundbreaking innovation and reward significant R&D investments. However, their application, particularly through practices like “evergreening” and the creation of “patent thickets,” has become a contentious issue, raising profound questions about market competition, patient access, and the very spirit of innovation.

4.1. Patents and Exclusivity: Incentivizing Innovation

Understanding how patents and regulatory exclusivities function is key to appreciating their role in protecting pharmaceutical discoveries and encouraging the substantial investment required for new treatments.

The legal framework protecting pharmaceutical discoveries is multifaceted, primarily comprising patents granted by the U.S. Patent and Trademark Office (USPTO) and regulatory exclusivities granted by the U.S. Food and Drug Administration (FDA) . Patents typically provide 20 years of exclusive rights from their filing date, legally preventing others from making, using, offering for sale, or selling the invention throughout the United States . These protections are fundamental to allowing companies to recoup their substantial R&D investments and generate profits, which are then theoretically reinvested into future drug discovery . They are crucial for establishing the initial pricing and market exclusivity of newly developed drugs . Patent information, including details about a drug’s protection, is publicly available and published in the FDA’s Orange Book, offering a degree of transparency regarding protected drugs .

Regulatory exclusivities, granted by the FDA upon drug approval, provide exclusive marketing rights that can run concurrently with or independently of patent protection . These exclusivities vary in length depending on the type of drug and its specific designation. For instance, Orphan Drug Exclusivity (ODE) provides 7 years of market protection for drugs treating rare diseases, while New Chemical Exclusivity (NCE) grants 5 years for new chemical entities . Pediatric Exclusivity (PED) can add an additional 6 months to existing patents or exclusivities if pediatric studies are conducted . These periods of exclusivity are designed to prevent the submission or effective approval of generic drug applications or biosimilars for a defined period, thereby allowing the innovator company a window of market exclusivity to recoup their substantial R&D costs without immediate competition .

The Hatch-Waxman Act (Drug Price Competition and Patent Term Restoration Act) further shapes this landscape by providing incentives for generic drug development. A key provision is the 180-day exclusivity granted to the “first” generic applicant who successfully challenges a listed patent . This mechanism aims to strike a delicate balance between incentivizing innovation in brand-name drugs and promoting timely competition from more affordable generic alternatives .

4.2. The Shadow of “Evergreening” and Patent Thickets

While patents are ostensibly intended to foster genuine innovation, critics argue that certain practices extend monopolies beyond their intended purpose, thereby stifling competition and artificially inflating drug prices.

One such practice is “patent evergreening,” which refers to the strategy employed by pharmaceutical companies to extend the market exclusivity of their drugs beyond the expiration of the original patent . This is often achieved by securing new patents on secondary features of an existing drug, such as novel formulations, different dosages, new methods of use, or even new crystalline forms (polymorphs) or isomers . While proponents of these practices argue that they encourage incremental innovation and lead to improvements in drug safety, delivery, or effectiveness , critics contend that these modifications often do not meet the threshold of substantial innovation and primarily serve to prolong market dominance without commensurate public benefit .

These strategies contribute to the creation of “patent thickets”—dense, overlapping webs of patents on a single drug . Such thickets make it incredibly difficult and prohibitively costly for generic and biosimilar manufacturers to enter the market. They face extensive and expensive litigation, often spanning years, to challenge these numerous patents . For example, AbbVie filed over 100 secondary patents for Humira, a blockbuster autoimmune drug, which effectively delayed the entry of U.S. biosimilars until 2023, five years after they became available in the European market . This delay alone is estimated to have extracted an additional $80 billion from American consumers . Similarly, Celgene’s Revlimid, a cancer drug, was subject to 18 years of litigation that blocked generic entry despite its primary patents having expired .

The direct consequences of restricted market competition due to patent thickets are profound. They undermine price competition, leading to inflated drug prices and imposing significant burdens on healthcare budgets . This practice is often viewed as “unjust enrichment,” as it allows companies to extend monopoly rights without commensurate innovation, resulting in economic gain that does not align with public value. This creates a “double burden” on consumers, who first contribute through public funding of R&D and then again through inflated prices protected by layers of patents . The inability to access more affordable generic alternatives directly leads to patients rationing their medications or foregoing treatment altogether due to cost .

The core tension surrounding intellectual property lies in whether it genuinely fosters breakthrough innovation or is exploited to extend monopoly power . The industry’s justification of evergreening as encouraging “incremental innovation and improvements” is often contrasted with real-world examples like Humira, where over 100 patents seemingly delayed biosimilar competition for minor tweaks, rather than truly novel advancements . This strongly suggests that the system is being used to delay competition. This creates a crisis of legitimacy for the pharmaceutical industry’s IP arguments. For business professionals, it highlights that a significant portion of “competitive advantage” in the U.S. market is derived not solely from superior science, but also from sophisticated legal maneuvering and aggressive patent strategies. This dynamic will inevitably lead to increased regulatory scrutiny and calls for reform aimed at differentiating between genuine innovation and “patent abuse” .

Furthermore, the U.S. patent practices have a significant global ripple effect. The U.S. market, with its high prices and robust patent protections, is widely acknowledged as the “world’s most innovation-friendly pharmaceutical market” . This implies that U.S. consumers effectively subsidize global R&D efforts . When patent thickets delay generic entry in the U.S., as seen with Humira biosimilars being delayed by five years compared to Europe , it means that U.S. patients continue to pay premium prices for longer. Meanwhile, patients in other countries benefit from earlier generic competition. The U.S. patent system, by allowing extended monopolies, therefore impacts not just domestic affordability but also global access and pricing strategies. It incentivizes companies to prioritize the U.S. market for initial launches and extended exclusivity, potentially delaying access or leading to higher prices in other markets if U.S. policies shift, for instance, through the adoption of International Reference Pricing . This creates a complex global interdependence where changes in one major market can have far-reaching consequences for worldwide pharmaceutical accessibility.

4.3. Leveraging Patent Data for Competitive Advantage: The DrugPatentWatch Edge

In this intricate and often opaque landscape of pharmaceutical intellectual property, access to comprehensive and timely patent information is paramount for strategic decision-making. Businesses can transform raw patent data into a significant competitive advantage.

Strategic patent landscaping and competitive intelligence are critical for all stakeholders within the pharmaceutical ecosystem. This includes branded pharmaceutical companies, generic manufacturers, and even payers. Tools like DrugPatentWatch provide deep knowledge on pharmaceutical drugs, encompassing patents, suppliers, generics, and formulation information . This enables a comprehensive search for potential competitors, including smaller companies and those in emerging markets, extending beyond immediate rivals . For branded manufacturers, DrugPatentWatch helps in assessing the past successes of patent challengers and elucidating the research paths of competitors, offering valuable insights into market dynamics . For buyers, wholesalers, and distributors, the platform assists in predicting branded drug patent expiration and identifying generic suppliers, thereby preventing overstock of expensive branded drugs . Generic drug and API (Active Pharmaceutical Ingredient) manufacturers can leverage this data for informed portfolio management, identifying opportune market entry points .

The platform’s key features underscore its utility. DrugPatentWatch offers a fully integrated database of drug patents and other critical information, including litigation details, tentative approvals, patent expirations, clinical trials data, and Paragraph IV challenges, along with information on top patent holders . It incorporates data directly from authoritative sources such as the U.S. Food and Drug Administration (FDA), the U.S. Patent and Trademark Office (USPTO), and various international governments, providing global coverage from over 130 countries . Users can conduct highly specific searches based on pharmacology, patent expiration dates, application names, trade names, country of origin, biologics license applications, and product ingredients. The ability to set up daily email alerts further ensures that users stay abreast of the latest developments . This comprehensive and dynamic intelligence is vital for making strategic business decisions in the highly competitive biopharmaceutical sector .

The ability to leverage this information creates an asymmetric information advantage in patent strategy. While raw patent information is publicly available, for instance, through the Orange Book , the sheer volume, complexity, and interconnectedness of patents, especially in the context of “thickets” , create a significant information asymmetry. Tools like DrugPatentWatch aggregate, analyze, and present this data in an actionable format, providing “deep knowledge” and “business intelligence” . This suggests that merely having access to raw patent data is insufficient; the true competitive advantage lies in the ability to analyze and interpret this information to identify strategic opportunities and risks. For businesses, this means that investment in competitive intelligence platforms and skilled analysts is no longer optional but essential for navigating the complex patent landscape. For policymakers, it highlights that even with transparency mandates, the inherent complexity of patent information can still be exploited by sophisticated players, necessitating more proactive regulatory oversight and potentially simplified patent structures to genuinely foster market competition.

5. Policy Interventions: A Global and Domestic Tug-of-War

The persistent challenge of high drug prices has spurred a variety of policy interventions, both domestically within the United States and across the international landscape. This section will explore the efficacy and implications of these efforts, ranging from direct price negotiation and fostering competition to the exploration of novel payment models.

5.1. U.S. Policy Landscape: From Free Market to Negotiation

Historically, the U.S. has maintained a largely unregulated drug pricing environment, allowing pharmaceutical companies significant autonomy in setting prices. However, recent legislative actions signal a notable shift towards greater government intervention and price control.

The Inflation Reduction Act (IRA) of 2022 represents a landmark piece of legislation in this regard. For the first time, it authorizes the federal government to directly negotiate prices for certain high-cost drugs covered by Medicare Part D, with these negotiated prices taking effect starting in 2026, and for Medicare Part B drugs, starting in 2028 . The Centers for Medicare & Medicaid Services (CMS) is tasked with identifying eligible drugs, prioritizing those with high Medicare spending and no generic or biosimilar competition. The negotiated prices become applicable after a specified period following FDA approval: 7 years for small-molecule drugs and 11 years for biologic products . The initial round saw 10 Part D drugs selected for negotiation in 2024, with their new prices effective in 2026. An additional 15 Part D drugs were selected for 2027 .

The introduction of the IRA has ignited a fervent debate regarding its potential impact on pharmaceutical innovation and R&D investment. The pharmaceutical industry has consistently argued that government price negotiation will stifle innovation, citing estimates from the Congressional Budget Office suggesting a potential 9% reduction in new drugs entering the market over a 30-year period . A specific concern revolves around the “pill penalty,” a perceived disincentive for small-molecule drug development due to their shorter negotiation eligibility period (7 years) compared to biologics (11 years) . This disparity, critics argue, could reduce the timeframe for recouping R&D costs for small molecules. Some early research indicates a drop-off in industry-sponsored trials on post-approval drugs since the IRA’s passage, which could be an early indicator of this effect .

This “pill penalty” and its potential unintended consequences for drug development represent a significant area of concern. The IRA’s differential negotiation eligibility periods for small molecules and biologics creates a direct financial disincentive for companies to invest in small-molecule drug development, as they face a shorter window to recoup R&D costs before negotiated prices take effect . The observed “drop-off in industry-sponsored trials on post-approval drugs” since the IRA’s passage could be an early signal of this shift. This policy design, while aiming to control costs, could inadvertently steer pharmaceutical R&D away from small-molecule drugs, which often form the basis for widely accessible oral medications. This could have long-term consequences for patient access to convenient, orally administered therapies, potentially favoring more expensive, complex biologic treatments. For businesses, it necessitates a strategic re-evaluation of pipeline priorities and investment allocation based on the IRA’s new incentives.

The negotiation paradox—balancing immediate savings against potential innovation risk—is at the heart of the IRA’s controversy. The Act aims to generate billions in savings for Medicare and its beneficiaries . However, the primary counter-argument centers on the potential “loss of innovation” . This presents a classic economic trade-off: immediate cost savings versus the potential long-term impact on the development of future life-saving drugs. The pharmaceutical industry’s strong opposition and ongoing litigation efforts underscore the perceived threat to their established business model. This ongoing debate highlights the inherent difficulty of balancing critical public health goals, such as affordability and access, with market-based incentives for private innovation. For policymakers, the challenge lies in designing negotiation frameworks that achieve meaningful cost savings without severely chilling R&D investment. For pharmaceutical companies, it means demonstrating the true value of their innovation beyond just the price tag, and potentially exploring new R&D models that are less dependent on unfettered pricing in the U.S. market.

Beyond the IRA, other U.S. policy efforts are also underway. Federal policy generally aims to cap or limit the growth of drug prices, promote price competition, increase transparency, and encourage drug development . At the state level, initiatives include the implementation of price transparency laws, the establishment of drug affordability review boards, and policies allowing for drug importation . There are also proposals to limit how much drug companies can increase prices each year, tying increases to no more than the rate of inflation .

5.2. International Reference Pricing: Learning from Global Models

Many countries worldwide regulate drug prices by referencing prices paid in other nations. The question of whether the U.S. could or should adopt such a model, and the implications of doing so, is a subject of intense debate.

International Reference Pricing (IRP) is a method where a country uses the prices of pharmaceutical products in one or several other countries to inform or set its own domestic drug prices . Proponents argue that IRP is an effective tool to lower U.S. drug costs, potentially cutting prices by nearly half and addressing the perceived “freeloading” by other nations that benefit from lower prices while the U.S. subsidizes global R&D . Former U.S. President Donald Trump, for instance, stated that the U.S. would no longer be forced to pay almost three times more for the exact same medicines, often made in the same factories, and would institute a “Most Favored Nation’s Policy” to ensure the U.S. pays the lowest price globally .

However, critics caution that adopting IRP could “severely chill investment in new cures and therapies” and “jeopardize access to these medicines for patients in need” . Concerns also exist that it could lead to manufacturers delaying product launches or limiting supply to low-price countries that are used as reference points, or even increasing prices in comparator nations to offset reductions in the U.S. market .

The “Most Favored Nation” (MFN) concept, pursued by the Trump administration, aimed to peg U.S. drug prices to the lowest price a drug company offers to countries with similar income levels . This policy was explicitly designed to end the “abuse of Americans’ generosity” who pay significantly more for the same medicines .

The “global freeloading” narrative and its dual impact are central to this debate. U.S. policymakers and executives frequently contend that other nations “freeload” on American innovation by paying lower drug prices, operating on the premise that the U.S. disproportionately subsidizes global R&D . However, implementing policies like MFN in the U.S. could inadvertently “undermine mechanisms that enable affordable access to essential medicines in low-income countries” . This is because such policies could disrupt tiered pricing arrangements, which allow pharmaceutical companies to offer lower prices to low- and middle-income countries (LMICs) while recouping R&D costs in wealthier markets . This reveals a complex ethical and economic dilemma. While the U.S. seeks fairness for its own citizens, its actions could inadvertently harm global health equity by disrupting established mechanisms that provide affordable drugs to the poorest countries. For pharmaceutical companies, it forces a difficult choice between maximizing revenue in the U.S. and maintaining global access strategies, potentially leading to a re-evaluation of their overall global pricing and market entry models.

The interplay of transparency and negotiation power is another critical consideration. Price transparency is often lauded as a “powerful tool for competition” . However, it can also “weaken the negotiation positions of certain payers by preventing manufacturers from granting additional, confidential rebates or discounts” . This suggests that the current opaque system of list prices versus net prices, and confidential rebates, allows for differentiated pricing that may benefit some payers but simultaneously obscures the true cost of drugs. This implies that simply mandating price transparency might not automatically lead to lower prices if it removes the ability for payers to negotiate confidential discounts. For businesses, this highlights the strategic importance of managing both list and net prices, and the potential for new regulations to disrupt existing rebate structures. It also suggests that true price reduction might necessitate more direct negotiation or regulation, rather than relying solely on transparency.

Table 1: Comparison of U.S. vs. Select International Drug Prices (Illustrative)

| Drug Name | Indication | U.S. Price Premium (%) vs. Switzerland | U.S. Price Premium (%) vs. U.K. |

| Harvoni | Hepatitis C | 132% | 89% |

| Humira | Autoimmune | (Not specified vs. Switzerland) | 265% |

The table above provides concrete, comparative data on how much higher U.S. prices are for specific, high-profile drugs compared to other developed nations. This stark contrast immediately highlights the core issue of U.S. drug pricing being an outlier . This quantitative evidence directly underpins the rationale for policies like International Reference Pricing (IRP) and Most Favored Nation (MFN) clauses, by illustrating the significant discrepancies in what other countries pay . For pharmaceutical executives, this table quantifies the market opportunity and potential risk associated with the U.S. pricing environment, while for payers and employers, it provides a clear justification for their push for lower costs.

5.3. Fostering Competition: Accelerating Generic and Biosimilar Entry

A widely recognized and impactful strategy to lower drug prices is to promote robust competition from generic and biosimilar alternatives once brand-name drugs lose their patent protection.

Regulatory reforms are actively being pursued to streamline the approval process for these alternatives. The FDA is working to expedite biosimilar approvals, evidenced by a sharp increase from 5 approvals in 2023 to 19 in 2024 . This acceleration aligns with broader government initiatives to increase the use of reference drugs and foster greater generic and biosimilar competition . Legislative efforts, such as the “Biosimilar Red Tape Elimination Act,” aim to remove outdated FDA requirements to bring more biosimilars to market more quickly, thereby increasing the availability of affordable alternatives to high-priced biologic medications .

The impact of generic and biosimilar entry on drug prices is well-documented. Generic drugs typically lead to rapid and significant price declines, with prices often decreasing to less than 20% of the original brand-name drug’s price, particularly when multiple generic manufacturers enter the market . The economic benefits are substantial: generic and biosimilar medicines generated a record $408 billion in savings for the U.S. healthcare system in 2022 alone, contributing to a cumulative $2.9 trillion in savings over the past decade . Biosimilars, specifically, are launched at an average sales price 50% lower than the reference brand biologic price at the time of launch, and their competition has further reduced the average sales price of their corresponding brand biologics by an average of 25% .

However, a critical dynamic at play is the observation that the “generic wave” is ending, which is increasing pressure on the pricing of new drugs. A healthcare policy expert notes that the “end of the generic wave” is a significant factor contributing to rising drug prices . Historically, the widespread availability of generics created “headroom” by lowering overall drug spending, which allowed for the entry of new, expensive drugs without dramatically increasing total healthcare expenditures . Now, with generic prices not declining as they once did, and even increasing in some cases, coupled with fewer major drugs going off-patent, this “self-correcting” market mechanism is weakening . This implies that the pressure to control costs for new high-priced drugs, especially precision medicines, will intensify. Without the “headroom” provided by a robust generic market, every new expensive drug will have a more pronounced impact on overall healthcare budgets. For businesses, this suggests that the market for new, innovative drugs will face even greater scrutiny and pressure on pricing, as the system can no longer absorb high costs by readily shifting patients to cheaper generic alternatives.

Despite the immense benefits of generics, the U.S. has also experienced rising costs and persistent shortages of generic drugs. In 2023, there was an average of 301 drugs in shortage per quarter . A significant concern is that generic drugs account for as much as 83% of these shortages, often attributed to a lack of incentives for manufacturers to produce low-margin medications . Managing these shortages imposes substantial financial burdens on hospitals, adding as much as 20% to their drug expenses as they scramble to find and procure alternative therapies . This reveals a systemic flaw where the pursuit of aggressively low generic prices, while beneficial in theory, can lead to market failures in the form of shortages that ultimately drive up overall costs and jeopardize patient access. For businesses, this highlights a critical supply chain vulnerability and underscores the need for policies that ensure the sustainability of the generic drug market, perhaps through mechanisms that guarantee a minimum viable margin for essential generics or through diversified manufacturing strategies.

5.4. Beyond Price Controls: Value-Based and Novel Payment Models

As the pharmaceutical industry and healthcare systems grapple with the complexities of drug pricing, innovative payment models are emerging that aim to link drug costs more directly to patient outcomes and real-world performance.

Outcomes-based agreements (OBAs), also known as value-based contracts (VBCs) or risk-sharing agreements, represent a significant shift in this direction. These models link drug pricing and reimbursement to a treatment’s demonstrated clinical benefits or real-world performance . The core principle is to incentivize pharmaceutical companies to focus on interventions that deliver the most effective, efficient, and sustainable outcomes . Examples include agreements where payments are partially contingent on a drug’s performance, or where payments cease if predefined efficacy criteria are not met . VBCs offer several advantages: they allow payers to gain experience with a product, reducing uncertainty regarding its clinical value and financial impact, and they can potentially provide earlier patient access to new treatments, particularly for small patient populations where traditional clinical data may be limited .

The shift from volume to value represents a fundamental business model transformation for the pharmaceutical industry. Traditional pharmaceutical pricing has often been volume-based, driven by the sheer quantity of drugs sold . Value-based pricing (VBP) and subscription models, however, signify a fundamental shift towards linking payment directly to outcomes and broader population health benefits . This evolution is driven by the reality of “stagnant healthcare budgets” and the increasing demand for pharmaceutical companies to “demonstrate to payers and regulators that the price versus established products is justified by the improved outcomes achieved” . For pharmaceutical companies, this is not merely a pricing adjustment; it necessitates a strategic overhaul. It requires a deeper understanding of real-world evidence, the development of robust data collection infrastructure, and a willingness to share financial risk with payers . Success in this new paradigm demands a shift from a “sales push” to a “value demonstration” business model, which can be complex to implement due to data challenges, the need for new legislation, and the inherent difficulties in quantifying individualized benefits .

Another innovative approach gaining traction is the “subscription model,” often dubbed the “Netflix model” for drug access. This model involves a lump sum payment to manufacturers, granting unlimited access to a specific drug for a defined patient population over a set period, thereby moving away from traditional per-unit payment . This approach is being explored for high-cost drugs, such as hepatitis C therapies in Australia and for Medicaid recipients in Louisiana and Washington states . Amazon Pharmacy’s RxPass, which offers access to 60 prescription medications for a flat fee of $5 per month, has demonstrated positive results, showing improved medication adherence and reduced out-of-pocket expenses for subscribers .

The “Netflix model” for drugs can be viewed as a solution for budget predictability, not solely for cost reduction. While subscription models can indeed lower per-unit costs for patients (e.g., RxPass ), they also offer “more stable and predictable earnings” for pharmacies and “overcome issues around affordability in each budget cycle” for payers . This suggests that a key driver for the adoption of these models is not exclusively to reduce the total cost of drugs, but rather to make the financial impact more manageable and predictable for healthcare systems and patients. This highlights that budget predictability and effective risk management are as crucial as absolute price reduction for healthcare systems. For pharmaceutical companies, offering such models could be a strategic way to gain market access and build trust with payers, even for high-cost therapies, by demonstrating a commitment to shared financial responsibility and long-term patient benefit. It shifts the conversation from sticker price shock to predictable, outcome-linked expenditure.

Cost-plus pricing represents a more transparent, yet potentially less value-driven, model. This approach involves setting the drug price based on its production costs plus a fixed profit margin . While it offers greater transparency, it may not accurately reflect the drug’s therapeutic value to patients or the competitive pressures within the market . Mark Cuban’s Cost Plus Drug Company is a prominent example, charging a flat 15% markup over its acquisition cost, plus pharmacy fees . CVS Health is also launching similar “CostVantage” and “Caremark TrueCost” programs in 2025, which aim to define drug costs and reimbursement based on net costs with transparent fee structures .

6. Addressing Access and Equity: A Societal Imperative

Beyond the intricate economic models and policy debates, the profound human impact of high drug prices is undeniable. This section explores the real-life struggles of patients, the disparities in access that exacerbate existing inequities, and the role and limitations of current support programs, emphasizing the broader societal and global health equity implications.

6.1. Patient Affordability Crisis: Real Stories, Real Struggles

The statistics on drug affordability translate directly into profound personal challenges for countless individuals and families across the United States.

The human cost of high drug prices is stark. Nearly 30% of Americans report not taking their medication as prescribed due to cost, a practice that directly leads to negative patient outcomes . The consequences can be dire, with an estimated 1.1 million Medicare patients potentially facing premature death over the next decade because they cannot afford their prescribed medications . This is not merely a financial burden; it represents a burgeoning public health crisis .

The “invisible” rationing of medication is a critical consequence of this affordability crisis. The statistic that “nearly 30% of Americans say they haven’t taken their medication as prescribed due to high drug prices” extends beyond simple non-adherence. It encompasses a range of behaviors such as not filling prescriptions, opting for over-the-counter drugs instead, or even cutting pills in half or skipping doses . This is a pervasive form of “invisible rationing,” often undertaken by patients without direct medical consultation. This widespread practice has severe public health consequences, leading to poorer patient outcomes, increased complications, higher hospitalization rates, and greater strain on the overall medical system . For businesses, this translates into a less healthy workforce, higher long-term healthcare costs, and reduced productivity, even if the initial drug price appears to benefit the pharmaceutical company. It underscores that high prices do not just affect individual patients; they create systemic health risks that ripple throughout society.

Case studies vividly illustrate these struggles:

- Vincent Burns, a cancer patient, experienced a dramatic increase in cost when his chemotherapy treatment shifted from hospital-administered (with no out-of-pocket expense) to a home-administered pill. This change resulted in a $1,000 monthly cost, rapidly draining his savings. He contemplated reverting to hospital infusions due to the financial burden, highlighting the irrationality of pricing structures that vary significantly based on the setting of care rather than the drug itself .

- Patricia Munn, a diabetes patient on a fixed income, witnessed her insulin costs spike from $80 to nearly $800 for a 90-day supply during the COVID-19 pandemic. Even after a subsequent reduction, she still pays more than double her previous cost, severely impacting her ability to cover other essential household bills .

- William “Mike” McMichael, a retired EMT with a heart condition, was confronted with a $380 monthly price for his prescribed blood thinner, Eliquis. He declined the prescription due to cost, opting instead for a less expensive generic alternative (warfarin), despite the inconvenience of monthly lab tests. He also experienced frustrating and unpredictable fluctuations in the price of his generic medication, leading him to feel exploited .

These personal narratives underscore the “fixed income” trap and the erosion of retirement security. The experiences of Patricia Munn and Mike McMichael vividly highlight the disproportionate impact of high drug prices on individuals with fixed incomes, particularly seniors . McMichael’s observation that his modest pension was being “eaten up” by drug costs powerfully illustrates how medication expenses can systematically erode financial security in retirement. The stark contrast between a typical Medicare beneficiary’s annual income of approximately $23,500 and the average price of some new specialty drugs, which can be around $53,000 per year , paints a grim picture of the financial strain faced by this demographic. This points to a systemic challenge to the financial well-being of a significant portion of the population, particularly as the population ages. It suggests that drug pricing is not just a healthcare issue but a fundamental retirement security and social welfare concern. For policymakers, this emphasizes the urgency of targeted reforms for Medicare beneficiaries and low-income populations, as their inability to afford essential drugs creates a ripple effect of broader societal costs and health deterioration.

The impact of high drug prices extends beyond individual patients to the very fabric of healthcare delivery. Hospitals, as major purchasers of drugs for patient care, are significantly affected by rising costs and frequent drug shortages. In 2023, there was an average of 301 drugs in shortage per quarter, including critical medications like chemotherapy and IV saline bags . These challenges consume an increasing share of hospitals’ finite resources, forcing them to delay crucial infrastructure investments or even reduce staffing levels . Managing drug shortages alone can add as much as 20% to hospitals’ drug expenses, as staff time is diverted to finding, procuring, and administering alternative therapies, often at higher prices .

6.2. Disparities in Access: The Burden on Vulnerable Populations

High prescription drug prices do not affect all segments of the U.S. population equally; they exacerbate existing health inequities, disproportionately burdening certain demographic groups.

The link between high prescription drug prices and systemic racism in healthcare is a critical and often underreported aspect of the affordability crisis. The report explicitly states, “High Prescription Drug Prices Perpetuate Systemic Racism” . This is not merely a correlation but a causal relationship. Black and Hispanic Americans are statistically more likely to suffer from chronic diseases, be uninsured, and have lower incomes . When drug prices are excessively high, these demographic groups are disproportionately compelled to ration or forgo essential medications, leading to worse health outcomes and perpetuating existing health disparities . Furthermore, there are broader income-related inequities in pharmaceutical use in the U.S. compared to other developed nations . While 25% of white Americans report not taking medications as prescribed due to cost, this figure rises to 30% for Black Americans and a striking 42% for Hispanics . This reframes the drug pricing debate from a purely economic one to a profound social justice and human rights issue. For businesses, it highlights the ethical imperative to consider equitable access in their pricing and market strategies, moving beyond mere profit maximization. For policymakers, it underscores the urgent need for reforms that explicitly address health equity and target the systemic barriers that disproportionately affect vulnerable populations.

A concerning observation is the “innovation gap” in under-researched diseases. The fact that “Diseases that disproportionately affect Black Americans are often under-researched by drug corporations” points to a significant market failure. If R&D investment decisions are primarily driven by “anticipated lifetime global revenues” , and patient populations for certain diseases (even if prevalent in specific demographics) are perceived as less profitable due to affordability issues or historical underinvestment, then pharmaceutical innovation will naturally gravitate towards more lucrative areas. This suggests that the current market-driven R&D model may not adequately address all societal health needs, particularly for diseases affecting marginalized communities. It calls for increased public funding for basic research in these neglected areas and potentially new incentive structures—often termed “push” incentives, as opposed to the “pull” incentives of high prices—to ensure more equitable innovation and address unmet medical needs across all populations.

Geographic disparities further complicate access. Areas characterized as “pharmacy deserts” or resource-constrained practice settings face significant challenges in navigating administrative barriers, such as prior authorizations, which are often required for high-cost medications . These hurdles disproportionately affect underserved populations, exacerbating existing inequities in access to care.

6.3. The Role and Limitations of Patient Assistance Programs

Patient Assistance Programs (PAPs) are frequently presented by pharmaceutical manufacturers as a vital safety net for individuals struggling to afford their prescription drug costs. However, their overall effectiveness and true intent are subjects of considerable debate and scrutiny.

PAPs are designed to help patients afford their prescriptions, often through direct discounts or financial assistance . They are often highlighted as crucial for ensuring that patients who would otherwise be unable to access necessary medications can receive them .

Despite their stated purpose, PAPs are subject to significant limitations and criticisms:

- Complexity and Accessibility: The application processes for PAPs are frequently complex, with reading levels often exceeding those recommended for individuals with low health literacy, making them challenging for the very patients most in need . Furthermore, many programs are narrowly focused on only one or two specific drugs, lacking standardization for patients who require assistance with multiple medications .

- Lack of Transparency: There is a notable lack of transparency regarding the number of people who have been helped by these programs and their specific financial eligibility requirements. This opacity makes it difficult to assess their true effectiveness as a broad “safety net” for the population .

- Business Strategy, Not Pure Philanthropy: Critics argue that PAPs are fundamentally a “business strategy,” a “budgeted operating cost” that is essentially “baked in” to the overall pricing of pharmaceuticals . These programs are perceived to promote newer, higher-cost treatments and can function as a “cost-shifting or subsidy strategy” where the expense is effectively shared across all commercially insured beneficiaries, ultimately contributing to an increase in the overall cost of care for everyone .

- Exclusion of the Uninsured and Distortion of Choice: A significant limitation is that 97% of PAPs exclude uninsured individuals, which disproportionately harms Black Americans who are nearly twice as likely to be uninsured . Moreover, PAPs can distort patient and clinician decision-making by making a branded drug appear cheaper for individual patients than a generic alternative, leading to greater overall expense for the government or other payers .

- Accumulator and Maximizer Programs: The emergence of “accumulator” and “maximizer” programs, implemented by payers and Pharmacy Benefit Managers (PBMs), further complicates the landscape. These programs prevent PAP funds from counting towards patient deductibles or set co-pays based on PAP contributions, effectively diverting funds away from patients and towards for-profit companies. For instance, maximizer programs can take a fee as high as 25% of the PAP amount . This practice has generated considerable patient dissatisfaction and led to legal challenges .