I. The Evolving Landscape of Biopharma Intelligence

The strategic importance of robust intelligence cannot be overstated in an industry where the stakes are measured in billions of dollars and, more importantly, in patient lives. Understanding the historical context and contemporary forces driving this transformation is crucial for appreciating the urgency of this shift.

A. Defining Biopharma Intelligence and its Strategic Imperative

Biopharmaceutical Business Intelligence (BI) encompasses the systematic collection, meticulous analysis, and insightful interpretation of data spanning the entire biopharma value chain. This includes critical functions such as research and development (R&D), clinical operations, regulatory affairs, manufacturing, and commercialization. The role of BI is paramount for several reasons: it empowers companies to stay ahead of dynamic market trends, gain a profound understanding of the competitive environment, proactively identify emerging opportunities, and effectively mitigate potential risks.

Effective competitive intelligence in biopharma is built upon several interconnected pillars. First, competitor analysis involves a deep dive into rival businesses to understand their strengths and weaknesses. This includes scrutinizing their product offerings, development pipelines, pricing strategies, commercialization campaigns, licensing deals, R&D efforts, and operational efficiencies. Such granular insights are vital for keeping pace with emerging treatments and technologies, ensuring an organization does not lag behind, and identifying potential partnerships—all crucial elements for maintaining competitive advantage. Second, competitor benchmarking systematically compares a company’s performance metrics against industry peers. In the pharmaceutical and biotech sectors, this translates to evaluating R&D expenditure, time-to-market for new drugs, critical pricing decisions, and clinical trial updates. By benchmarking against competitors, biopharma companies can establish realistic goals, refine their strategies, and make informed decisions to enhance their competitive edge in drug development and commercialization. Finally, a comprehensive understanding of the competitive landscape is essential. This involves meticulously mapping out existing and potential competitors, rigorously analyzing their portfolios, and assessing the profound impact of broader market trends. In these highly regulated industries, factors such as patent expirations, market share for specific disease treatments or drugs, significant regulatory shifts, and emerging therapeutic approaches play a pivotal role. A robust competitive landscape analysis helps companies anticipate challenges, spot collaboration and business development & licensing (BD&L) opportunities, and strategically position themselves for long-term success.

This foundational understanding underscores that biopharma intelligence is not merely about data aggregation; it is about generating actionable insights that directly drive strategic decisions and maintain competitive advantage. The emphasis on proactively mitigating risks and staying ahead of market trends indicates that effective intelligence functions are transitioning from reactive reporting to becoming a predictive strategic asset. Consider the immense financial investment and high failure rates inherent in drug development, where bringing a new drug to market can take over a decade and cost billions of dollars, with nearly 90% of clinical drug development failing. In such a high-stakes environment, anticipating challenges and opportunities becomes not just beneficial, but absolutely paramount. This proactive stance elevates intelligence from a mere support function to a core strategic driver, profoundly influencing critical decisions such as capital allocation, R&D direction, and M&A strategies. It is about cultivating foresight, rather than simply relying on hindsight.

Furthermore, the components of competitive intelligence—competitor analysis, benchmarking, and landscape analysis—are not isolated activities but are deeply intertwined. Insights derived from one component inherently inform and enrich the others, fostering a holistic view of the market. For instance, a detailed competitor analysis revealing a rival’s R&D efforts provides valuable data for benchmarking an organization’s own R&D expenditure against industry peers. These insights then collectively contribute to a comprehensive landscape analysis, revealing emerging therapeutic approaches or shifts in patent landscapes that might impact market dynamics. This intricate connection means that modern data platforms must facilitate seamless integration and cross-referencing of these diverse intelligence facets. A platform that excels in one area but fails to integrate it with others risks providing incomplete, and potentially misleading, strategic guidance, thereby undermining the very purpose of competitive intelligence.

B. Historical Evolution of Biopharmaceutical Data and Analytics

The journey of biopharmaceutical data and analytics reflects a continuous quest for deeper understanding amidst increasing complexity. Over the past several decades, remarkable advancements in analytical tools have led to the generation of increasingly large and complex datasets for the characterization of biopharmaceuticals. Historically, however, interpreting these vast datasets proved challenging and often incomplete, leaving valuable information untapped.

Before the widespread adoption of AI and ML, drug target identification relied on a diverse array of methods. These included genomics and proteomics, which helped pinpoint disease-associated genes and proteins; biochemical assays used to identify and understand the function of potential targets; and animal and cell-based models for studying disease progression and testing compound effects. High-Throughput Screening (HTS) allowed for testing thousands of compounds against specific targets, while structure-based drug design focused on creating molecules that fit into known protein structures. Phenotypic screening, literature and knowledge mining, patient data analysis, and collaboration with academia also played crucial roles. While foundational, these traditional methods were often labor-intensive, sequential, and less efficient in handling the burgeoning data volumes.

The integration of AI in analytical chemistry began with foundational research in the 1950s and 1960s, laying the groundwork with basic algorithms designed to simulate human reasoning . By the 1970s, rule-based systems and early AI software were introduced to simulate chemical processes and model reactions. Significant progress was made in the 1980s, when neural networks were first applied to analytical chemistry, enhancing data modeling and pattern recognition. As computational power increased in the 1990s and 2000s, AI techniques became more sophisticated, enabling automated analysis of large chemical datasets and the development of predictive models. Over the last decade, the emergence of deep learning and big data approaches has dramatically accelerated AI adoption in analytical workflows, particularly in fields like proteomics, metabolomics, and process analytical technology (PAT). Today, AI is not just an emerging technology; it is increasingly “embedded in early discovery and trial planning” within biopharma.

The biopharma industry was accumulating “large, complex data sets” for decades before AI reached widespread adoption. This suggests that the urgent need for advanced analytical capabilities outpaced the readiness or availability of tools capable of effectively processing and interpreting such vast and intricate information. This created a significant bottleneck, leading to a “data rich, insight poor” environment where valuable information remained locked within complex, uninterpretable datasets. The delayed incorporation of AI meant that biopharma operated with a considerable efficiency gap for an extended period. The current surge in AI adoption, therefore, represents not just an innovation, but a necessary corrective measure to unlock the latent value residing in decades of accumulated data.

Furthermore, the inherent “complexity of biopharmaceutical products,” which necessitates the use of multiple high-resolution analytical tools, coupled with the multi-faceted nature of pre-AI drug target identification, clearly demonstrates that AI is uniquely suited to handle the biological intricacy that traditional methods struggled to fully grasp . The strength of AI lies in its ability to thrive on large datasets, extracting meaningful insights and streamlining data interpretation from such complexity. This capability fundamentally changes the pace and scope of scientific inquiry, enabling the rapid integration and analysis of multi-omic datasets in hours, a process that traditionally took months. This allows for a more comprehensive understanding of disease biology and drug mechanisms, paving the way for more targeted and effective therapies.

C. The Digital Transformation Imperative in Biopharma

For many years, the biopharma industry was notably slow in incorporating innovative digital technologies such as Artificial Intelligence (AI), cloud computing, and the Internet of Things (IoT) into its operations. This incremental approach meant that digital innovation was often not treated on par with other strategic priorities. However, the onset of the COVID-19 pandemic served as an unprecedented catalyst, forcing companies to prioritize investments in digital innovation and rapidly integrate it into every aspect of their work. Digital transformation roadmaps that were once planned for years were suddenly executed in months, bringing about radical changes in how companies conduct operations.

The industry is now at a critical “inflection point,” facing a stark choice: either decelerate the pace of digital innovation or aggressively pursue what many term “leapfrog digital innovation”. This landscape is characterized by accelerated scientific breakthroughs, rapidly evolving global regulatory dynamics, and intensifying cost-containment pressures. AI-driven changes in regulatory frameworks, assertive pricing models, and renewed scrutiny around intellectual property (IP) protections are fundamentally redefining the competitive environment. For biotech leaders, the mandate is clear: to lead in this landscape, organizations must elevate their competitive intelligence (CI) and market intelligence (MI) functions, making them faster, more connected, and deeply embedded across R&D, market access, and commercial strategy.

The COVID-19 pandemic served as an unprecedented accelerator for digital transformation within biopharma. This experience reveals that despite its traditional conservatism, the industry possesses a remarkable capacity for rapid adaptation when faced with existential pressures, thereby establishing a powerful precedent for future, proactive digital adoption. The fact that multi-year digital innovation plans were suddenly implemented in months demonstrates a previously untapped agility. This provides a compelling internal case study, proving that swift, large-scale transformation is indeed achievable. The current “inflection point” is not solely about technology; it signifies a profound cultural shift. Companies that effectively learned from the pandemic’s forced acceleration are now better positioned to embrace continuous digital innovation, securing a significant advantage over those that might revert to slower, incremental approaches.

Moreover, the contemporary landscape dictates that “innovation must be paired with ROI clarity,” particularly as clinical pipelines become increasingly costly and public scrutiny intensifies. This signifies a crucial shift from innovation for its own sake to a more data-driven, financially accountable approach to R&D and strategic investments. The escalating costs and high failure rates inherent in drug development necessitate a more rigorous, data-driven investment strategy. AI and direct data platforms, by providing real-time intelligence on competitors’ R&D direction, emerging AI applications, biomarker strategies, and market white spaces, directly support this demand for ROI clarity. They help de-risk assets earlier in the development cycle and facilitate the prioritization of high-potential programs. This focus on clear return on investment implies that intelligence platforms are no longer merely tools for information gathering but instruments for optimizing capital allocation. Firms equipped with integrated competitive intelligence and market intelligence dashboards gain a measurable edge in forecasting competitor behavior under volatile market conditions, directly impacting financial performance and market leadership.

II. The Limitations of Traditional Intelligence Models

While traditional intelligence models have long served the biopharmaceutical industry, their inherent limitations are becoming increasingly apparent and detrimental in today’s fast-moving, data-rich environment.

A. The Conventional Analyst-Mediated Model

Historically, pharmaceutical business intelligence has heavily relied on specialized analysts and consulting firms. These external experts would process and interpret vast amounts of industry data, subsequently delivering curated insights to pharmaceutical companies. This approach, while providing valuable expertise, presents several significant challenges that increasingly impact competitive positioning in today’s dynamic market landscape.

One of the most critical drawbacks of the conventional analyst-mediated model is the inherent delays it introduces between data generation and the delivery of actionable insights. This creates a significant “time-to-insight” bottleneck. In the rapidly evolving biopharma landscape, characterized by accelerated scientific breakthroughs and intensifying global competition, delayed insights can lead to missed opportunities or significant strategic missteps . The drug development process itself is already protracted, often taking 10-15 years and costing billions, with a staggering 90% clinical failure rate. Any additional delay in obtaining critical intelligence means that strategic decisions are made based on outdated information, substantially increasing the risk of costly failures, reputational damage, and lost market opportunities. This bottleneck is not merely an inconvenience; it represents a profound competitive disadvantage. Companies that continue to rely on delayed insights will consistently lag behind those with real-time access, particularly in high-stakes areas like mergers and acquisitions (M&A), R&D prioritization, and market entry, where speed and agility are paramount .

Furthermore, third-party analysts typically charge premium rates for their specialized knowledge and processing capabilities, creating significant ongoing expenses for pharmaceutical companies seeking comprehensive market intelligence. This creates a discernible cost-value discrepancy. While specialized knowledge is undoubtedly valuable, the traditional model often delivers generalized insights rather than the granular, real-time intelligence required for addressing modern biopharma challenges. For instance, traditional analytical approaches frequently fail to provide the granular, physician-level insights necessary to effectively address complex issues such as patient abandonment patterns, particularly when these patterns vary unexpectedly by geography and therapeutic class. This suggests a potential mismatch between the high cost and the actionable depth of the intelligence received, especially when contrasted with the direct, tailored analysis achievable through raw data platforms. This cost-value discrepancy implies that companies are paying for a service that, while historically necessary, is becoming less efficient and less precise for the nuanced, complex decisions demanded today. Shifting to direct data platforms represents a strategic cost optimization, allowing companies to reallocate resources to building robust internal analytical capabilities that yield more tailored and timely insights.

B. Data Quality and Integration Challenges

Beyond the limitations of external reliance, the biopharma industry has long grappled with internal data challenges that impede effective intelligence. Traditional analytical approaches often fall short in providing the granular insights needed, particularly for complex issues like patient abandonment patterns that vary significantly by geography and therapeutic class. This lack of granularity means that strategic responses can be broad and ineffective, rather than precisely targeted.

A pervasive problem within many pharmaceutical firms is the presence of “siloed intelligence operations.” Teams across R&D, regulatory, medical affairs, marketing, and strategy frequently operate in isolation, leading to duplicated efforts or, more critically, missed key insights. This fragmentation can prove detrimental, resulting in significant financial losses, reputational risks, and lost market opportunities. The challenges surrounding data infrastructure are equally significant, with a striking 70% of respondents in a global survey reporting difficulty accessing data for AI initiatives . This difficulty stems from persistent issues such as siloed systems, reliance on manual data capture, and outdated infrastructure . Furthermore, a concerning statistic reveals that only 39% of organizations currently utilize standardized data formats and ontologies, which severely hinders effective data harmonization and interoperability across departments .

The widespread presence of “siloed intelligence operations” and the reported difficulty in accessing data due to fragmented systems create a substantial hidden cost within biopharma . This fragmentation leads to duplicated efforts, missed opportunities, and suboptimal decision-making. The “detrimental” impact of these silos extends beyond mere inefficiency; it can result in critical “blind spots” that contribute to financial losses, reputational damage, and lost market opportunities. Furthermore, the lack of standardized data exacerbates this issue by making data integration a manual, error-prone, and time-consuming process, thereby further entrenching existing silos. The transition to direct data platforms is fundamentally about dismantling these barriers. Centralizing, structuring, and distributing actionable intelligence through integrated platforms becomes a strategic imperative not only for enhancing efficiency but also for mitigating the systemic risks inherent in fragmented operational structures.

The low confidence among scientists and informaticians in effectively leveraging scientific data for AI initiatives (only 32%) and the critical need for data standardization underscore that biopharma is currently navigating an “Age of Data Management” . This implies that establishing foundational data hygiene and robust infrastructure are essential prerequisites for truly unlocking AI’s transformative potential. The low confidence and lack of standardization indicate that many biopharma companies are not yet “AI-ready.” The emphasis on “foundational data challenges” and “data harmonization” suggests that simply acquiring AI tools is insufficient; without clean, well-described, and accessible data, AI models are prone to producing poor or unreliable results. This necessitates significant investment in data governance, quality control, and the development of robust data lakes and warehouses that can handle diverse datasets. Companies that fail to address these fundamental data management issues will find their AI investments yielding limited return on investment, potentially leading to disillusionment and a widening competitive gap. The true competitive advantage will accrue to those who build a robust data foundation, enabling them to transition effectively from data management to harnessing the full power of AI.

III. The Rise of Direct Raw Data Platforms: A New Paradigm

The limitations of traditional intelligence models have paved the way for a transformative shift in biopharma: the emergence of direct raw data platforms. This new paradigm empowers organizations with unprecedented access and control over their intelligence needs.

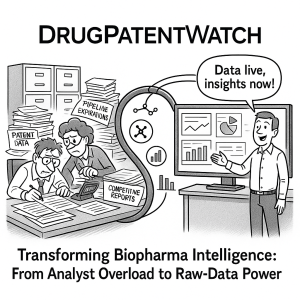

A. The Paradigm Shift: From Intermediaries to Direct Access

The evolution of specialized platforms, such as DrugPatentWatch, represents a truly transformative approach to pharmaceutical business intelligence. These platforms provide direct, unmediated access to raw industry data . This direct access model fundamentally empowers companies to conduct their own analyses, precisely tailored to their specific strategic needs, rather than relying on external analytical intermediaries who might offer generalized or delayed insights . This shift is not merely a technological upgrade; it represents a fundamental change in how biopharma organizations approach market intelligence, competitive analysis, and R&D prioritization .

This transition signifies a profound democratization of intelligence within the biopharma sector. It effectively moves analytical power from external, often expensive, intermediaries to internal teams, fostering significantly greater agility and responsiveness. This direct access eliminates the “inherent delays” and “premium rates” associated with third-party analysts. It empowers internal teams to ask more granular questions and receive immediate, tailored answers, thereby fostering a more agile and iterative decision-making process. The essence of this transformation lies in bringing the intelligence function in-house and establishing it as a core organizational competency. This democratization is not merely about achieving cost savings; it is fundamentally about cultivating a “data-centric culture” where insights are generated and acted upon with unprecedented speed, leading to a measurable competitive edge in forecasting and strategic resource allocation .

Moreover, direct data platforms are not simply technological solutions; they are powerful “enablers of more effective business strategies and decision-making processes”. This perspective suggests a deeper, more intrinsic integration of intelligence into core strategic planning. The platforms enable pharmaceutical companies to “explore multiple strategic angles simultaneously” and to translate “raw data into strategic insights and actions”. This implies that the design and features of these platforms must be intrinsically linked to addressing critical business questions, such as identifying the right patient populations for therapies in development, optimizing key opinion leader engagement, and formulating market entry strategies that are properly informed by patent and competitive intelligence. The ultimate success of adopting these platforms hinges on an organization’s ability to “build internal analytical capabilities to extract maximum value from raw data” and to “invest in training programs to develop data literacy among both technical and non-technical staff”. This underscores that the transformation demands not only technological investment but also significant human capital development and, often, organizational restructuring.

B. Key Features and Data Offerings of Direct Platforms

Modern direct data platforms are distinguished by their comprehensive features and diverse data offerings, which collectively empower biopharma companies to make more informed and timely decisions. Platforms like DrugPatentWatch, for instance, offer constantly-updated insights on crucial aspects such as drug patent expiration, generic entry opportunities, and critical litigation updates . This direct access to raw data enables companies to proactively identify invalidity opportunities within existing patents, anticipate generic entry windows for their own products or competitors’, and efficiently navigate complex patent roadblocks .

A defining characteristic of modern systems is the integration of AI-powered insights. These advanced capabilities allow pharmaceutical companies to explore multiple strategic angles simultaneously, which is particularly valuable given the inherent complexity of pharmaceutical market dynamics and the myriad factors influencing strategic decisions . These platforms align with broader business intelligence trends in pharma, combining sophisticated business analytics, data mining, data visualization, and robust infrastructure to help organizations make more data-driven decisions . Beyond patent data, major providers offer a wide array of information, including comprehensive R&D pipelines, detailed clinical trial data, real-time regulatory developments, granular pricing information, market access strategies, commercial performance metrics, company financials, and extensive scientific literature .

Table 1: Key Data Types and Their Strategic Value in Biopharma Intelligence

| Data Type | Description | Strategic Value for Biopharma |

| Patent Data | Information on drug patent expirations, litigation, and intellectual property filings . | Identifies generic entry opportunities, informs IP defense/offense strategies, and guides R&D investment to avoid patent roadblocks . |

| Clinical Trial Data | Details on ongoing and completed trials, including phases, endpoints, patient populations, and outcomes . | Optimizes trial design, accelerates patient recruitment, predicts trial success, and identifies emerging treatment trends . |

| Regulatory Data | Information on drug approvals, regulatory shifts, and policy updates from agencies like FDA and EMA . | Ensures compliance, informs market entry strategies, and helps adapt regulatory submission approaches . |

| Sales & Market Data | Prescription volumes, market share, pricing trends, and commercial performance across geographies and therapeutic areas . | Forecasts demand, assesses market potential, informs pricing strategies, and optimizes commercial engagement . |

| Scientific Literature | Research papers, conference proceedings, and academic publications . | Identifies emerging technologies, potential drug targets, and informs R&D direction . |

| Real-World Data (RWD) & EHRs | De-identified patient claims, electronic health records, and remote monitoring data . | Provides patient-level insights, supports personalized medicine, and enhances post-market surveillance . |

The emphasis on drug patent expiration, generic entry, and litigation updates highlights that patent intelligence, when directly accessible and enhanced by AI, transforms from a mere legal compliance function into a proactive strategic weapon for market entry and competitive positioning . This goes beyond basic patent tracking. The ability to identify “invalidity opportunities” means actively seeking weaknesses in existing patents, which can lead to earlier market entry. Monitoring “ongoing patent disputes and litigation” enables real-time adjustments to market strategies in response to competitor actions. This is not just about avoiding legal pitfalls but actively shaping market dynamics. Effective utilization of patent intelligence necessitates robust cross-functional collaboration between legal, R&D, and commercial teams. This signifies that intellectual property strategy is no longer confined to the legal department but is deeply integrated into R&D prioritization, market access planning, and competitive intelligence efforts, ensuring that IP insights directly influence core business decisions, especially in a landscape characterized by “shrinking patent windows”.

The fact that direct data platforms aggregate diverse datasets—including patent, clinical, regulatory, sales, and scientific literature—and aim for harmonization is profoundly significant . This indicates that the true value of these platforms lies not merely in providing access to raw data, but in the integration and standardization that renders this data analysis-ready. The sheer volume and variety of data sources are overwhelming without proper organization. The “standardization” and “harmonization” capabilities are critical because they directly address the “data quality and integration challenges” that plague traditional intelligence methods . Without this foundational work, raw data remains fragmented and difficult to analyze, even with direct access. The ability to integrate multi-omic datasets and perform complex analyses in hours, a task that traditionally took months, directly translates into accelerated target identification and significantly improved R&D efficiency. This integrated view allows for more comprehensive competitive intelligence and better-informed strategic decisions across the entire biopharma value chain.

IV. Technological Foundations: AI, Machine Learning, and Generative AI

The transformative power of direct raw data platforms in biopharma is inextricably linked to the advancements in Artificial Intelligence, Machine Learning, and Generative AI. These technologies form the bedrock upon which modern intelligence capabilities are built.

A. Understanding AI, ML, and Generative AI in Biopharma

Artificial Intelligence (AI) refers to machine-based systems designed to make predictions, recommendations, or decisions based on a defined set of human objectives . These systems operate by perceiving real and virtual environments through a combination of machine and human inputs, abstracting these perceptions into models through automated analysis, and then using model inference to formulate options for information or action . Within the biopharma context, AI and Machine Learning (ML), a subset of AI that enables systems to learn from data without explicit programming, have emerged as transformative tools for extracting meaningful insights and streamlining data interpretation from increasingly large and complex datasets.

A particularly exciting development is Generative AI (Gen AI), a powerful subset of AI capable of creating new content. In biopharma, this translates into groundbreaking applications such as predicting novel protein structures for drug design or automatically generating draft corrective and preventive actions (CAPAs) in manufacturing .

AI’s fundamental power for biopharma lies in its ability to “abstract such perceptions into models through analysis in an automated manner” . This means AI moves beyond simple data processing to create higher-level, predictive representations of complex biological and market realities. The “abstraction into models” is crucial because it allows AI to identify hidden patterns, correlations, and underlying mechanisms that are often imperceptible to human analysis due to the sheer volume and complexity of the data. This capability is particularly critical for understanding multi-factorial diseases or intricate drug interactions, which are inherent challenges in biopharma. This “abstraction” capability enables biopharma to transition from descriptive analytics, which merely explain “what happened,” to predictive and prescriptive analytics, which forecast “what will happen” and suggest “what should be done.” This fundamental shift forms the basis for accelerating drug discovery, optimizing clinical trials, and generating more accurate market forecasts, thereby profoundly changing the nature of strategic decision-making.

Generative AI’s capacity to “predict new protein structures” or “create novel compounds faster” signifies a qualitative leap from purely analytical insights to active design and innovation . This transforms drug development from a process primarily focused on discovery to one that actively incorporates creative design. For example, in drug design, Gen AI can explore vast chemical spaces far more efficiently than human chemists or traditional virtual screening methods. This creative capability suggests a future where AI is not merely an assistant but a co-creator in the drug development process, potentially leading to a significant reduction in R&D timelines and the exploration of previously “undruggable” areas . This evolution is set to fundamentally alter the competitive landscape, creating new avenues for innovation and therapeutic breakthroughs.

B. Evolution of AI in Biopharma Analytics

The journey of AI into biopharma analytics has been a gradual yet accelerating process, culminating in its current transformative impact. Initial AI research in the 1950s and 1960s laid the foundational groundwork, with basic algorithms designed to simulate human reasoning . By the 1970s, rule-based systems and early AI software were introduced to simulate chemical processes and model reactions. A significant milestone occurred in the 1980s when neural networks were first applied to analytical chemistry, marking an enhancement in data modeling and pattern recognition capabilities.

As computational power continued to increase throughout the 1990s and 2000s, AI techniques became more sophisticated, enabling automated analysis of large chemical datasets and the development of more robust predictive models. However, it is truly over the last decade that the emergence of deep learning and big data approaches has dramatically accelerated AI adoption in analytical workflows. This acceleration is particularly evident in data-intensive fields such as proteomics, metabolomics, and process analytical technology (PAT). Today, AI is no longer a futuristic concept; it is increasingly “embedded in early discovery and trial planning” within the biopharma industry, demonstrating its growing practical application.

The decades-long evolution of AI before its “widespread adoption” and “accelerated AI adoption” in biopharma indicates that the current transformation is the culmination of long-term technological maturation meeting a critical industry need, rather than a sudden overnight phenomenon. This “long tail” suggests that while foundational algorithms existed, the computational power, data availability (ushered in by the “big data” era), and algorithmic sophistication (such as deep learning) necessary to make AI truly impactful in data-intensive fields like biopharma only matured recently. The industry’s inherent conservatism and stringent regulatory environment also played a role in the slower initial adoption . This historical context implies that the current wave of AI integration is more robust and sustainable because it is built on decades of foundational research and technological advancements. It is not merely hype, although some hype exists, but a pragmatic evolution driven by demonstrable capabilities .

C. Market Size and Growth Projections for AI in Biopharma

The financial projections for AI in the biopharmaceutical sector underscore its immense and rapidly growing importance. AI is projected to generate a staggering $350 billion to $410 billion annually for the pharmaceutical sector by 2025 . This value is driven by innovations across various stages of drug development, clinical trials, precision medicine, and commercial operations .

Current AI spending in the pharmaceutical industry is expected to reach $3 billion by 2025, reflecting a significant surge in its adoption to reduce the hefty time and costs associated with drug development . The global AI in pharmaceutical market is estimated at $1.94 billion in 2025 and is forecasted to reach approximately $16.49 billion by 2034, accelerating at a remarkable compound annual growth rate (CAGR) of 27% . Looking further ahead, the AI in biopharmaceuticals market is projected to reach an even more substantial $26.05 billion by 2033, with software solutions specifically experiencing the fastest CAGR of 29.46% .

The impact on drug discovery is particularly striking: by 2025, it is estimated that 30% of new drugs will be discovered using AI, marking a significant shift in the drug discovery process . Beyond discovery, AI’s involvement could lead to monumental savings, with projections indicating up to $25 billion in savings in clinical development alone .

The staggering market projections and potential savings transform AI from a mere technological novelty into a critical economic imperative for biopharma . Companies that fail to adopt AI risk being significantly outcompeted on cost, speed, and innovation. These figures represent fundamental shifts in industry economics. The potential for billions in savings and revenue generation means AI is a direct driver of profitability and market share. The projection that 30% of new drugs could be discovered using AI by 2025 implies that non-AI-driven companies will face a significant disadvantage in terms of pipeline novelty and speed to market . This creates a discernible “digital divide” within the industry. “AI-first” biotech firms are already heavily integrating AI into drug discovery (75%), while traditional pharma companies lag significantly, with adoption levels five times lower . This suggests that the competitive landscape will increasingly become bifurcated, with AI adopters gaining a decisive edge in R&D efficiency, time-to-market, and overall financial performance. The pressure to invest is no longer solely about fostering innovation, but about ensuring economic survival and leadership in a rapidly transforming market.

V. Core Functionalities of Modern Biopharma Data Platforms

Modern biopharma data platforms are engineered with a suite of sophisticated functionalities that enable them to transform raw data into actionable intelligence, fundamentally changing how organizations operate.

A. Data Aggregation and Integration

At the heart of modern biopharma data platforms lies their robust capability for data aggregation and integration. These platforms utilize advanced connectors to ingest raw data directly from a multitude of sources, including high-resolution laboratory instruments, vast clinical databases, and real-time IoT sensors. This comprehensive ingestion ensures that no valuable data remains siloed or inaccessible.

A prime example of this capability is AbbVie’s R&D Convergence Hub (ARCH) platform, which centralizes and connects data from over 200 internal and external sources. This massive integration effort enables scientists to access and collaborate on more than 2 billion points of knowledge, fostering a unified and accessible data environment . Beyond scientific data, these platforms are designed to integrate diverse commercial data types, such as channel data (inventory, shipments), claims data, and contract data. This often necessitates out-of-the-box connectors to widely used Customer Relationship Management (CRM) systems like Veeva and Salesforce, as well as robust Application Programming Interfaces (APIs) to enterprise data warehouses or data lakes, including platforms like Snowflake and Databricks.

The ability to aggregate data from a multitude of diverse sources—including laboratory instruments, clinical databases, IoT sensors, CRM systems, Enterprise Resource Planning (ERP), and Electronic Health Records (EHR)—into a “single source of truth” is not merely a technical feature but a strategic imperative for eliminating data silos and ensuring consistent decision-making across the organization . The pervasive problem of “siloed intelligence operations” is directly addressed by this aggregation. When different departments operate with fragmented data, they frequently “duplicate efforts or miss key insights”. A unified data repository ensures that all stakeholders are working from the same, most up-to-date information, leading to “consistent decision-making while reducing redundancies and miscommunication” . This foundational capability is what enables “enhanced research efficiency” and “operational effectiveness” . It transforms data from a fragmented liability into a unified, accessible asset, allowing for holistic analysis of the entire value chain, from early R&D through to commercialization, a feat that was previously impossible or prohibitively expensive.

B. Data Standardization and Harmonization

Once aggregated, raw data must be standardized and harmonized to become truly usable and comparable. Modern biopharma data platforms achieve this through sophisticated mechanisms. They employ built-in ontologies and templates that harmonize diverse data formats, units, and metadata, thereby creating analysis-ready records. This crucial step transforms disparate data points into a coherent, consistent dataset suitable for advanced analytics.

Sophisticated data change engines within these platforms automatically convert between various data formats, apply consistent naming schemas, and rigorously ensure that all data adheres to industry standards, such as the FAIR principles (Findable, Accessible, Interoperable, Reusable). Furthermore, enforced templates guarantee consistent naming, units, and metadata across all incoming data streams, which is absolutely vital for ensuring reproducibility in scientific and commercial contexts.

The emphasis on standardizing data formats, units, metadata, and adherence to principles like FAIR directly addresses the critical challenge that “data quality is crucial; poor data lead to poor results”. It also speaks to the low confidence reported by many in leveraging scientific data for AI initiatives . This implies that standardization is not just a best practice, but an absolute prerequisite for effective AI and Machine Learning application. AI and ML models thrive on large datasets, but they are highly sensitive to data quality and consistency. Inconsistent formats, disparate units, or missing metadata mean that AI models cannot effectively learn patterns or make accurate predictions. The low percentage of organizations currently using standardized data highlights a significant impediment to widespread AI adoption, making data harmonization a critical bottleneck . Companies that invest in robust data integration and standardization strategies will therefore be “better positioned to innovate, comply, and compete” . This foundational work ensures that AI investments yield meaningful results, accelerating drug discovery, optimizing clinical trials, and improving manufacturing efficiency, ultimately leading to significant cost savings and faster time-to-market.

C. Advanced Analytics and AI Tools

The true power of modern biopharma data platforms lies in their advanced analytical and AI capabilities, which transform standardized data into actionable intelligence. These platforms provide intuitive dashboards, sophisticated statistical tools, and cutting-edge AI capabilities to turn raw data records into actionable answers.

AI and ML capabilities extend far beyond simple statistical analysis; they are designed to identify subtle patterns in complex process data, predict potential quality issues hours or even days before they manifest, and dynamically optimize process control strategies. For example, machine learning models are adept at analyzing vast amounts of Electronic Health Records (EHRs) to identify eligible clinical trial participants quickly and with high accuracy, as seen with tools like TrialGPT . This significantly streamlines patient recruitment, a historically time-consuming and error-prone task.

Natural Language Processing (NLP) plays a crucial role in optimizing pharmaceutical data. It leverages machine learning for data analytics, data comparison, and answering complex questions, particularly by processing unstructured text. NLP is invaluable for evaluating market potential, precisely targeting patients, and extracting critical information from diverse unstructured sources like clinical notes, scientific literature, and customer interactions. Furthermore, predictive analytics, powered by AI, provides a forward-looking perspective. It uses sophisticated algorithms to forecast demand, identify unmet medical needs, and track competitor activity for strategic positioning .

The integration of AI/ML and predictive analytics transforms raw data into “powerful foresight” . This signifies a crucial shift from reactive analysis to proactive strategic planning, enabling companies to anticipate market shifts and mitigate risks before they fully materialize. This is the essence of moving beyond traditional intelligence. Instead of merely reporting historical data, these advanced tools can model future scenarios, identify leading indicators of success or failure, and even suggest optimal actions. For example, the ability to predict patient dropouts in clinical trials allows for proactive intervention, saving significant time and resources. This predictive capability directly impacts capital allocation and R&D prioritization. By accurately understanding unmet needs and forecasting demand, companies can target their R&D efforts more effectively, thereby reducing the notoriously high failure rates and costs associated with drug development . It empowers organizations to make smarter, data-backed strategic bets.

Natural Language Processing’s ability to extract valuable information from “unstructured text” sources—such as clinical notes, scientific literature, and customer interactions—is profoundly significant. This capability unlocks a vast, previously inaccessible reservoir of qualitative data, which can now be leveraged for strategic insights. A substantial portion of critical biopharma intelligence, including nuanced physician insights, detailed patient feedback, and subtle regulatory updates, exists in unstructured formats. Traditional methods struggled to process this information at scale. NLP overcomes this by allowing for sentiment analysis, the identification of core issues, and more efficient literature review . This provides a richer, more nuanced understanding of market dynamics and patient needs. This capability enhances decision-making in diverse areas like market access (by identifying unmet needs from patient feedback), pharmacovigilance (by detecting adverse reactions from unstructured reports), and clinical trial design (by screening medical records) . It provides a vital qualitative layer of intelligence that complements quantitative data, leading to more holistic and patient-centric strategies.

D. Workflow Automation and Orchestration

Beyond raw data processing and advanced analytics, modern biopharma data platforms excel in workflow automation and orchestration, driving significant efficiency gains and optimizing resource allocation. These platforms are capable of orchestrating complex analytical pipelines, encompassing a wide range of steps from initial data ingestion and rigorous quality control checks to sophisticated statistical analysis, visualization generation, and comprehensive report compilation.

These sophisticated workflows can be triggered automatically when new data arrives, scheduled to run at specific intervals, or initiated manually when needed. This level of automation allows routine analyses that once required dedicated analyst time to run continuously in the background, freeing up valuable human resources. Generative AI further enhances this automation. For example, Gen AI supervisors can automate shift preparation, aggregate performance data from previous shifts, and create detailed reports, thereby liberating human supervisors to focus on higher-value tasks such as mentoring, coaching, skill development, and fostering a more engaged and productive workforce .

Workflow automation and AI-assisted tasks are not designed to replace human analysts but rather to profoundly augment their capabilities and liberate them from tedious, repetitive, and time-consuming operational duties . This implies a strategic shift towards a more strategic and less operational role for human intelligence professionals. The key benefit derived from this automation is not merely increased speed but the intelligent reallocation of human capital. By automating routine processes like data ingestion, quality control, and basic reporting, human analysts can redirect their focus towards higher-order tasks: interpreting complex patterns, developing novel hypotheses, and translating sophisticated insights into actionable strategic recommendations. This elevation of human expertise makes it significantly more impactful. This “force multiplier” effect means that fewer resources can achieve more sophisticated analysis, leading to “quantifiable productivity improvements” . It also necessitates a proactive re-skilling of the workforce, transitioning individuals from manual data wrangling to strategic data interpretation and high-level decision support.

VI. Strategic Applications: Unlocking Competitive Advantage

The true measure of direct raw data platforms lies in their ability to translate raw data and advanced analytics into tangible competitive advantages across every stage of the biopharma value chain.

A. Transforming Drug Discovery and R&D Optimization

AI’s impact on drug discovery and R&D optimization is nothing short of revolutionary. Quantifiable benefits include a reduction in discovery timelines by 30-40%, a decrease in preclinical failure rates, and a significant improvement in candidate selection. Furthermore, AI has the potential to dramatically increase the probability of clinical success, moving beyond the traditional 10% success rate with AI-driven methods . AI-powered analytics accelerates the entire drug discovery process by accurately predicting drug interactions, efficiently identifying promising compounds, and even repurposing existing medications for novel uses.

A compelling real-world example is AbbVie’s ARCH platform, which leverages AI and ML to identify new drug targets. This is achieved by aggregating knowledge from over 200 internal and external sources, visualizing complex patterns and connections, and conducting advanced data analyses across billions of data points . Generative AI further optimizes R&D processes by refining process parameters, streamlining experiment design, and guiding technology transfer. These capabilities collectively reduce integrated development costs by minimizing the need for extensive lab space, reducing the number of experiments, and optimizing the quantity of materials required .

AI’s remarkable ability to reduce discovery timelines, lower preclinical failure rates, and improve candidate selection fundamentally de-risks the notoriously expensive and high-failure-rate drug development process . This signifies a strategic shift towards more predictable and efficient R&D pipelines. Considering that bringing a new drug to market typically takes 10-15 years and costs billions, with nearly 90% of clinical drug development failing, any technology that significantly improves these metrics is truly game-changing. AI’s impact in the early stages means fewer resources are wasted on non-viable candidates, and promising leads are identified and advanced faster, leading to a more robust and cost-effective pipeline. This de-risking capability directly influences crucial capital allocation decisions. Companies can pivot towards “late-stage and de-risked assets” with greater confidence, leading to more strategic investments and potentially higher return on investment from their R&D efforts. It transforms R&D from a high-risk gamble into a more calculated and predictable endeavor.

AbbVie’s ARCH platform exemplifies how AI’s value in R&D extends beyond mere raw data processing to integrating and connecting “over 2 billion points of knowledge” from diverse internal and external sources . This demonstrates that AI functions as a sophisticated knowledge management system, unlocking previously siloed scientific understanding. This is more than just data aggregation; it is about creating a unified “knowledge graph” that allows scientists to “visualize patterns and connections” that would be impossible to discern manually . This capability directly addresses the “literature and knowledge mining” challenge of traditional methods by automating and significantly enhancing it. It ensures that institutional knowledge and external scientific breakthroughs are immediately accessible and interconnected, fostering a more comprehensive understanding of complex biological systems. This integrated knowledge base accelerates “the discovery of new drug targets” and “optimize drug design,” with the ultimate goal of delivering “life-changing therapies in half the time” . It promotes a more collaborative and informed R&D environment, reducing duplication of effort and accelerating the overall pace of innovation.

B. Revolutionizing Clinical Trials and Patient Insights

Clinical trials, traditionally a bottleneck in drug development, are being fundamentally revolutionized by AI and direct data platforms. AI streamlines patient recruitment by analyzing vast Electronic Health Records (EHRs) to identify eligible participants quickly and accurately, thereby predicting patient dropouts and ensuring greater diversity in trials . This significantly reduces the time and cost associated with recruitment.

AI further enhances trial design, making it more dynamic and patient-focused. By leveraging real-world data (RWD), AI algorithms can identify specific patient subgroups most likely to respond positively to treatments and refine inclusion criteria, potentially cutting trial duration by up to 10% without compromising data integrity . During trials, AI enables real-time data analysis, continuously processing patient data to identify emerging trends, predict outcomes, and even adjust trial protocols on the fly. For instance, Generative AI can predict the success rate of a trial by analyzing historical data, leading to potential savings of up to $25 billion in clinical development alone . Beyond trials, data analytics plays a crucial role in interpreting data from remote patient monitoring systems, enabling the detection of anomalies and providing actionable insights for early intervention and personalized patient care .

AI’s pivotal role in predicting patient dropouts, refining inclusion criteria, and enabling real-time data analysis profoundly transforms clinical trial management from a reactive, post-hoc analysis process into a predictive, adaptive system . This implies a significant reduction in the financial and time risks traditionally associated with clinical trials. Clinical trials are a major bottleneck and cost driver in drug development, often extending for long periods and requiring substantial financial investments due to recruitment problems and deviations from study protocols. AI’s predictive capabilities directly address these pain points, leading to “more efficient, targeted trials that bring drugs to market faster and more accurately”. The ability to adjust protocols in real-time based on emerging data is a game-changer for trial integrity and success. This predictive capability translates into substantial cost savings, potentially up to $25 billion in clinical development alone, and significantly accelerated market entry . It also enhances patient safety by allowing for earlier detection of adverse events and better-tailored treatment approaches, aligning with the industry’s ultimate goal of improving patient outcomes.

The integration of Real-World Data (RWD) and remote patient monitoring, powered by AI, allows for a more comprehensive and continuous understanding of patient responses and disease progression outside of controlled trial environments . This signifies a crucial move towards more personalized and effective treatments. While traditional clinical trials are rigorous, they are often limited in scope and duration. RWD and remote monitoring provide a continuous, broader view of drug effectiveness and patient experience in real-world settings. AI’s ability to analyze this vast, often unstructured data enables the identification of subtle patient responses, side effects, and adherence patterns that might be missed in a controlled trial setting. This capability directly supports the development of “precision medicine,” which tailors treatments based on genetics, lifestyle, and environment . This leads to more precise patient selection for trials, improved post-market surveillance, and the ability to tailor therapies based on individual patient needs. It effectively closes the loop between clinical development and actual patient outcomes, ensuring that drugs are not only safe and effective but also optimized for specific patient populations, thereby enhancing market access and fostering patient trust.

C. Enhancing Manufacturing and Supply Chain Efficiency

The operational benefits of AI and direct data platforms extend far beyond R&D, profoundly impacting manufacturing and supply chain efficiency. AI-driven systems are optimizing pharmaceutical manufacturing by reducing errors, improving product consistency, and enabling dynamic adjustments based on real-time analytics. This transforms production from a static process to a continuously optimized one.

AI plays a pivotal role in powering Industry 4.0 initiatives, integrating robotics and IoT for enhanced control, smoother operations, and faster production cycles. A key application is AI-powered predictive maintenance, which analyzes sensor data from equipment to identify potential issues before they cause failures. This proactive approach avoids costly delays and maximizes equipment uptime .

Generative AI further boosts shop floor efficiency by providing technical assistance, automating shift preparation, and enhancing team leadership. This leads to quantifiable benefits such as a 5% reduction in breakdown time, speed losses, and minor stoppages, and a significant 30-40% reduction in workload for corrective maintenance . In production maintenance, Gen AI streamlines processes by identifying similar deviations, accelerating root cause analysis, suggesting effective Corrective and Preventive Actions (CAPAs), and automating documentation. This results in a remarkable 30-40% reduction in deviations and a 40% reduction in deviation closure time . For supply chain performance, Gen AI optimizes operations by consolidating fragmented data, improving decision-making through what-if scenarios, optimizing inventory management, and mitigating risks. These capabilities can potentially double the productivity of supply chain organizations and reduce overall costs by 2-3% .

The application of AI in manufacturing optimization, predictive maintenance, and shop floor efficiency signifies a transformative move towards a “smart factory” model in biopharma . This implies a significant shift from reactive, human-intensive operations to proactive, automated, and data-driven production. Traditionally, pharmaceutical manufacturing has been highly labor-intensive, often plagued by human intervention and resulting errors. AI fundamentally changes this by enabling real-time monitoring, dynamic adjustments, and predictive capabilities across the production line. This leads to reduced waste, improved yields, enhanced product safety and efficacy, and minimizes costly downtime . The quantifiable benefits, such as a 5% reduction in breakdown time and a 30-40% reduction in deviations, demonstrate a direct and tangible impact on the bottom line . This transformation in manufacturing and supply chain management is critical for addressing persistent challenges like “global supply chain instability” and intensifying “cost-containment pressures”. It ensures capital efficiency and robust production, which are essential for maintaining market supply and competitive pricing, especially for complex biologics and advanced cell and gene therapies.

D. Mastering Market Access and Commercial Strategy

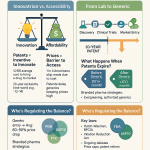

Direct data platforms empower commercial teams with granular market understanding and predictive capabilities, fundamentally reshaping market access and commercial strategy. Business intelligence (BI) is instrumental in analyzing patient populations, understanding disease prevalence, and identifying unmet medical needs. It also provides crucial forecasts for drug sales and assesses overall market potential, including anticipating the profound impact of patent expirations.

IQVIA’s MIDAS platform exemplifies this by offering unparalleled market intelligence for pharmaceutical sales and prescription data, meticulously integrating patient-level metrics by disease for comprehensive market views . This platform is vital for aligning portfolio decisions with genuine patient needs and market dynamics, supporting global lifecycle and Loss of Exclusivity (LoE) strategies, and identifying promising therapy and franchise expansion opportunities . Furthermore, predictive models anticipate shifts in market needs and prescribe demand for upcoming therapies, providing a forward-looking perspective essential for proactive planning . AI-driven analytics elevate commercial models with precision and speed, illuminating previously hidden insights within vast datasets that traditional methods often overlooked.

The integration of patient-level metrics and disease insights with commercial data signifies a profound shift towards truly patient-centric commercialization strategies . This implies that market access and sales efforts are increasingly driven by a deep, nuanced understanding of patient needs and treatment patterns. This approach moves beyond traditional market sizing, which often relies solely on sales volume. By comprehending patient dynamics, detailed disease segmentation, and real-world treatment patterns, companies can identify genuine unmet needs, tailor marketing messages with greater precision, and optimize engagement with healthcare professionals . This personalized approach not only enhances patient trust but also strengthens brand loyalty. This patient-centricity allows for more precise targeting of patient segments and more effective resource allocation within commercial activities . It directly impacts market share and revenue by ensuring that commercial strategies are deeply informed by real-world patient needs and behaviors, ultimately leading to improved patient outcomes and stronger market positioning.

The ability to accurately forecast drug sales, comprehensively assess market potential, and anticipate the impact of patent expirations, combined with real-time tracking of competitive pricing trends, enables proactive market defense and agile opportunity identification . This capability extends beyond simple forecasting. Anticipating patent expirations allows companies to prepare strategically for generic entry, adjust their market strategies accordingly, and even identify new market entry points . Continuously tracking competitor pricing and new drug launches facilitates dynamic pricing adjustments and effective product positioning . This is particularly crucial in a market characterized by “assertive pricing frameworks” and “renewed scrutiny around IP protections”. This proactive market intelligence directly contributes to “capital efficiency” by informing critical decisions on when to pivot or double down on investments. It empowers companies to defend existing products more effectively against generic competition and to seize new growth opportunities, ensuring sustained revenue streams in a highly competitive and evolving environment.

E. Fortifying Intellectual Property and Risk Management

In the high-stakes world of biopharma, protecting intellectual property (IP) and proactively managing risks are paramount. Direct data platforms offer unparalleled capabilities in these areas. Platforms like DrugPatentWatch provide constantly-updated insights on drug patent expiration, generic entry opportunities, and critical litigation updates . This real-time, direct access to patent data helps companies identify invalidity opportunities within competitor patents and navigate complex patent roadblocks more efficiently than through traditional analytical intermediaries .

Furthermore, the ability to monitor ongoing patent disputes and litigation allows companies to anticipate early generic entry opportunities and adjust their market strategies accordingly, a critical advantage in a landscape of shrinking patent windows . Beyond IP, AI systems leverage predictive algorithms to mine vast datasets from patents, clinical trials, and scientific publications. This capability not only helps identify new therapeutic opportunities, unmet market requirements, and potential business partnerships but also plays a crucial role in minimizing a wide range of risks. Predictive modeling, a core component of these platforms, identifies risks and opportunities early across clinical, operational, and market metrics, including potential regulatory compliance issues and supply chain disruptions .

Direct access to patent intelligence, encompassing litigation updates and invalidity opportunities, fundamentally transforms intellectual property from a static legal asset into a dynamic strategic lever . This implies that IP management becomes an active, real-time component of competitive strategy. This goes far beyond basic patent searching. Identifying “invalidity opportunities” means actively looking for weaknesses in competitors’ patents, which can lead to earlier market entry. Monitoring “ongoing patent disputes and litigation” allows for proactive adjustments to market strategies, rather than merely reacting to court decisions. This approach encompasses both offensive and defensive IP strategies, moving beyond simple registration. Effective utilization of patent intelligence demands robust “cross-functional collaboration between legal, R&D, and commercial teams”. This signifies that intellectual property strategy is no longer confined to the legal department but is deeply integrated into R&D prioritization, market access planning, and competitive intelligence, ensuring that IP insights directly influence core business decisions.

The application of predictive algorithms to mine diverse data sources—including patents, clinical trials, and scientific publications—and the use of predictive modeling across operational and market metrics enable a crucial shift from reactive risk management to proactive risk assessment . This implies a significant reduction in unforeseen challenges and their associated costs. In an industry characterized by high financial stakes and complex regulatory environments, unforeseen risks, such as clinical trial failures, regulatory setbacks, or supply chain disruptions, can be catastrophic . Predictive analytics, by identifying subtle patterns and forecasting potential issues, empowers companies to implement “early intervention” and adjust strategies proactively, thereby avoiding or significantly mitigating costly problems . This proactive risk management capability directly enhances “capital efficiency” by avoiding investments in high-risk programs and optimizing resource allocation. It also contributes to robust regulatory compliance by anticipating policy shifts and ensuring data integrity, which is paramount in a highly regulated industry .

VII. Navigating the Transition: Challenges and Best Practices

The journey from traditional intelligence models to direct raw data platforms, while promising immense benefits, is not without its hurdles. Organizations must proactively address both technical and organizational challenges to ensure a successful and impactful transition.

A. Technical Challenges: Data Quality, Integration, and Infrastructure

Despite the clear advantages, significant technical challenges persist in the adoption of direct data platforms. Data access and integration remain top hurdles, with a striking 70% of respondents in a global survey reporting difficulty due to deeply entrenched siloed systems, reliance on manual data capture, and outdated infrastructure . This fragmentation means that valuable data often remains locked away, inaccessible for comprehensive analysis.

Furthermore, a pervasive lack of interoperability and aging infrastructure continues to undermine progress. Most traditional data management tools, such as electronic lab notebooks (ELNs), are simply ill-equipped to handle the vast, unstructured data generated in high-performance computing environments, leaving a critical gap in the AI pipeline . A concerning statistic highlights that only 39% of organizations currently utilize standardized data formats and ontologies, which severely hinders effective data harmonization and cross-functional analysis . Additionally, the high initial costs and inherent complexities involved in integrating new technologies pose significant obstacles, particularly for small and medium-sized enterprises (SMEs) that may have limited resources.

The stark statistics on data access, integration, and standardization challenges reveal a significant “data readiness gap” within biopharma . This indicates that many companies, despite strong interest in AI, are not yet adequately prepared to fully leverage its capabilities. This gap means that simply purchasing AI software is insufficient; the primary challenge lies in “establishing a foundation of clean, well described data” . Without this fundamental groundwork, AI models are prone to producing “poor results” due to poor data quality. This necessitates significant upfront investment in robust data governance, the establishment of data lakes and warehouses, and the development of efficient Extract, Transform, Load (ETL) pipelines. These foundational investments are critical before AI can truly deliver its promised value. Companies that prioritize foundational data infrastructure and harmonization will gain a decisive competitive advantage by enabling more effective AI implementation and achieving faster time-to-insight. Those that neglect this crucial step will find their AI initiatives stalled, potentially leading to wasted investment and a widening competitive gap.

The inadequacy of traditional data management tools, such as Electronic Lab Notebooks (ELNs), for handling “vast, unstructured data generated in high-performance computing environments” points to a critical scalability challenge . This implies that new, specialized tools and infrastructure are required to manage the sheer volume and complexity of modern biopharma data. The biopharma industry generates immense amounts of diverse data, ranging from genomic sequences to mass spectrometry outputs and complex clinical notes . Traditional, structured databases and manual entry systems are simply not designed for this scale and heterogeneity. This creates a “critical gap” where valuable raw data cannot be effectively ingested, standardized, or made available for advanced AI analysis. This necessitates investment in “specialised analytical tools” and “integrated end-to-end R&D platforms” that are purpose-built for big data and AI readiness. The ability to seamlessly capture and process high-dimensional, unstructured data is crucial for accelerating drug discovery, optimizing clinical trials, and enhancing manufacturing quality control, ultimately driving innovation across the value chain.

Table 2: Key Challenges and Solutions for Data Integration in Biopharma Intelligence

| Challenge Area | Specific Hurdles | Recommended Solutions & Best Practices |

| Data Access & Silos | Data fragmented across departments; difficulty accessing data for AI projects; manual data capture . | Implement unified data platforms and centralized repositories (data lakes/warehouses) . Utilize APIs and connectors for seamless data ingestion . |

| Data Quality & Consistency | Lack of standardized formats and ontologies (only 39% use them); inconsistent naming and metadata; poor data leading to poor results . | Establish robust data governance frameworks . Implement built-in ontologies and templates for harmonization. Prioritize data cleansing and validation . |

| Infrastructure & Scalability | Outdated infrastructure; traditional tools ill-equipped for vast, unstructured data from high-performance computing . | Invest in cloud-based, scalable infrastructure. Adopt specialized analytical tools and integrated end-to-end R&D platforms designed for big data. |

| Interoperability | Lack of seamless data exchange across research, development, manufacturing, and clinical operations . | Develop common data models and APIs. Foster cross-functional collaboration and data-sharing agreements. |

| Initial Costs & Complexity | High upfront costs for technology integration; complexities in transitioning from conventional systems. | Plan for incremental AI adoption . Prioritize specific use cases with clear ROI. Seek strategic partnerships with technology providers . |

B. Organizational and Cultural Hurdles

Beyond technical complexities, the transition to direct data platforms introduces significant organizational and cultural hurdles. Moving from reliance on external analysts to internal direct data access necessitates building robust internal analytical capabilities. This requires a substantial investment in training programs to develop data literacy among both technical and non-technical staff across the organization.

Successful integration of these new platforms demands not only technical proficiency but also the establishment of clear data governance structures. These structures are crucial for ensuring data quality, consistency, and appropriate access controls, particularly given the sensitive nature of biopharma data . Furthermore, many biopharma companies are still in exploratory stages of AI adoption, grappling with inherent skepticism and the substantial need for effective change management strategies to overcome resistance to new ways of working.

The imperative to “build internal analytical capabilities” and “invest in training programs to develop data literacy among both technical and non-technical staff” highlights that technological adoption alone is insufficient for successful transformation. This underscores that human capital development and a profound cultural shift towards data-driven decision-making are as critical as the underlying technology itself. Direct access to raw data is only valuable if internal teams possess the skills to accurately interpret it and translate it into actionable insights. Without adequate data literacy, raw data can be overwhelming or misinterpreted, leading to suboptimal decisions. This means that investment must extend beyond IT infrastructure to include continuous learning initiatives, fostering a “data-first mindset” and encouraging collaborative, data-centric thinking across all departments . This emphasizes that the “transformation” is fundamentally organizational and cultural, not just technological. Companies that successfully embed data literacy and a data-driven culture throughout their operations will be better positioned to “outpace rivals” and achieve sustainable competitive advantage .

The requirement for “clear data governance structures that ensure data quality, consistency, and appropriate access controls” underscores that trust in the data and its derived insights is paramount, especially in a highly regulated industry handling sensitive information . Data governance extends beyond mere compliance; it is about building unwavering confidence in the data’s integrity and reliability. In biopharma, where decisions directly impact patient lives and involve significant financial and legal risks, the integrity and reliability of data are non-negotiable. This includes ensuring data provenance, maintaining comprehensive audit trails, and establishing consistent definitions to prevent bias and errors . Robust data governance mitigates risks related to “inaccuracy and data breaches” and ensures strict regulatory compliance . It builds the essential trust necessary for widespread adoption of AI-driven insights, particularly when making critical business decisions based on sensitive information such as patent expiration data, litigation information, or market entry opportunities.

C. Best Practices for Successful Transition

For organizations embarking on this transformative journey, adopting several best practices can significantly enhance the likelihood of success. First, it is crucial to establish clear, streamlined processes for converting data-driven insights into concrete business initiatives. This ensures that intelligence is not merely consumed but actively translated into tangible actions. Second, companies should develop clear policies defining what constitutes raw data for regulatory purposes, while simultaneously ensuring robust audit trails and comprehensive data provenance. This is vital for compliance and maintaining data integrity.

Third, aligning departments under unified data platforms is essential to improve collaboration and eliminate the pervasive silos that hinder holistic intelligence gathering . Fourth, a pragmatic approach involves planning for incremental AI adoption, starting with specific use cases that demonstrate clear value, and enhancing change management strategies to ease the organizational transition . Finally, organizations should actively co-create solutions with ecosystem partners and meticulously consider the broader technology stack to ensure seamless integration, scalability, and future-proofing of their intelligence capabilities .

The emphasis on “converting data-driven insights into concrete business initiatives” highlights that the true value of direct data platforms is realized only when insights lead to tangible actions and measurable business results. This implies that organizational agility and a strong, seamless link between intelligence generation and execution are paramount. This addresses the “last mile” problem of data analytics: generating insights is one aspect, but embedding them into operational workflows and strategic decision-making processes is another entirely. It requires clear accountability, robust cross-functional collaboration, and a culture that actively rewards data-driven experimentation and adaptation. Without this crucial “action layer,” even the most sophisticated data platform risks becoming a costly, underutilized data repository. This means that the transformation is not just about technology implementation but fundamentally about organizational design and effective change management. Companies that foster an environment where insights are not just consumed but actively debated, refined, and translated into measurable business outcomes—such as optimizing resource allocation or targeting new market opportunities—will achieve sustained competitive advantage.

VIII. Ethical Considerations and Regulatory Frameworks

The integration of AI and advanced data analytics in biopharma, while offering unprecedented opportunities, also introduces a complex web of ethical considerations and necessitates evolving regulatory frameworks. Navigating these challenges responsibly is critical for maintaining public trust and ensuring patient safety.

A. Core Ethical Concerns: Privacy, Bias, and Accountability