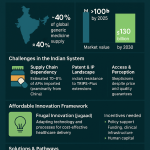

Executive Summary

The global pharmaceutical landscape is undergoing a profound transformation, with emerging markets increasingly at its epicenter. This report provides a comprehensive analysis of the escalating importance of generic drug development within these dynamic regions. Generic drugs, defined as clinically equivalent and substantially more affordable alternatives to brand-name medications, are proving indispensable in addressing the critical healthcare needs and fostering economic growth in emerging economies. These markets, characterized by large populations, burgeoning prosperity, and evolving disease patterns, face significant challenges including insufficient healthcare funding, inadequate infrastructure, and a complex dual burden of communicable and non-communicable diseases.

The imperative for generic drug development is driven by the looming “patent cliff” for blockbuster drugs, the rising disposable incomes of a growing middle class, and proactive government initiatives that promote generic utilization through various policy levers, including centralized procurement and local manufacturing incentives. The emergence of complex generics and biosimilars further signals a strategic evolution within the generic industry, moving beyond simple cost-cutting to encompass differentiated, high-value products.

However, the path forward is not without considerable hurdles. These include persistent mistrust of generics among some patients and physicians, the complex interplay of intellectual property rights and market access, and significant distribution challenges stemming from inadequate infrastructure and a lag in technological adoption. Despite these obstacles, strategic opportunities abound for companies that prioritize high-value generics, invest in R&D tailored to local needs, forge robust local partnerships, and leverage advanced competitive intelligence. The future of generic drug development in emerging markets will be shaped by continued technological advancements, including AI and advanced manufacturing, alongside critical policy implications focusing on regulatory harmonization and sustainable local production. This report concludes that generic drugs are not merely a cost-saving measure but a fundamental pillar for achieving universal health coverage, improving public health outcomes, and catalyzing economic development across the developing world.

1. Introduction: The Evolving Landscape of Global Pharmaceuticals

The global pharmaceutical industry is experiencing a significant paradigm shift, with emerging markets assuming an increasingly central role in shaping its future trajectory. This transformation is underpinned by the growing recognition of generic drugs as a cornerstone of accessible and affordable healthcare. These medications are not only vital for managing healthcare expenditures but also for expanding access to essential therapies for vast populations.

Definition and Characteristics of Generic Drugs

Generic drugs constitute a critical component of modern healthcare systems, offering clinically equivalent alternatives to brand-name medications at substantially lower costs.1 A generic drug is precisely defined as a pharmaceutical product that contains the identical active ingredient(s) as an innovator (brand-name) drug. It is designed to possess the same dosage form, strength, route of administration, quality, and clinical performance, making it therapeutically interchangeable with the originator product.1 The core characteristics of a generic drug include an identical active molecular entity, ensuring similar therapeutic effects, and equivalent dosage and strength for predictable pharmacodynamic outcomes.1 Therapeutic equivalence is rigorously established through bioequivalence studies, which demonstrate that the generic product delivers the same rate and extent of absorption as the reference drug, thereby guaranteeing similar efficacy and safety profiles.1

The development and market entry of a generic drug are fundamentally predicated on the expiration of exclusive rights and patent protection held by the innovator company.1 In regions such as Europe, this typically occurs after a 10-year exclusivity period for the original medicine has lapsed.3 While functionally equivalent to their brand-name counterparts, generic formulations may exhibit differences in appearance, such as shape, color, or packaging design, and may also contain different excipients, or inactive ingredients.1 These differences, however, are closely monitored by regulatory bodies like the European Medicines Agency (EMA) to ensure they do not compromise the overall safety or efficacy of the product.1 A primary advantage of generic drugs lies in their affordability, as they typically cost between 20% and 85% less than their brand-name equivalents.5

The subtle distinction between identical active ingredients and potentially different inactive ingredients (excipients) in generic drugs, despite regulatory assurances of bioequivalence and therapeutic equivalence, often creates a significant challenge related to public perception. Although regulatory bodies like the FDA and EMA rigorously ensure that generics are therapeutically equivalent to their branded counterparts, some public and professional apprehension persists. Reports indicate that mistrust remains, particularly among patients who may hold a belief that less expensive implies lower quality.10 This perception can be exacerbated by anecdotal reports of side effects or dissatisfaction, even if not clinically significant. Furthermore, some pharmacists and doctors have expressed concerns regarding the efficacy of generic drugs, sometimes believing they might necessitate more frequent patient visits or offer reduced satisfaction.11 This situation suggests that effective communication and comprehensive education campaigns, extending beyond mere scientific validation, are crucial for fostering widespread acceptance and adoption of generic medications in these markets. Such efforts would aim to clarify the rigorous approval standards and dispel common misconceptions, thereby building greater confidence among prescribers and patients.

Overview of Emerging Markets and Their Increasing Significance

Emerging markets, notably the BRICS nations (Brazil, Russia, India, China, and South Africa) and the MIST countries (Mexico, Indonesia, South Korea, and Turkey), have demonstrated remarkable growth in their pharmaceutical sectors.5 Over a five-year period, sales in these markets doubled, collectively capturing approximately 20% of the global pharmaceutical market share.5 This expansion is primarily attributed to their large and growing populations, increasing economic prosperity, and rising life expectancy.5

A notable development within these emerging economies is a strategic reorientation from being predominantly exporters of generic drugs to increasingly focusing on their domestic pharmaceutical markets.12 Historically, investment in the emerging markets healthcare sector often centered on identifying low-cost drug manufacturers capable of obtaining U.S. FDA approval to capitalize on patent expirations in Western markets, exemplified by the rise of Indian pharmaceutical companies challenging blockbuster drugs like Lipitor.12 However, this dynamic has evolved. The current trend indicates a growing emphasis on meeting internal healthcare demands, signifying a maturation of these markets into substantial consumption hubs with their own escalating healthcare needs and purchasing power.12 This shift necessitates a re-evaluation of traditional market entry strategies, moving beyond simple export models to embrace more localized production, distribution, and marketing approaches. Experts predict that emerging markets will be a primary engine of global pharmaceutical sales growth in the coming decade, potentially contributing 90% of the world’s pharmaceutical growth, with a significant proportion (75%) stemming from branded generics.13

Thesis Statement

The growing importance of generic drug development for emerging markets is a critical response to the urgent need for affordable, accessible, and high-quality healthcare solutions, driven by evolving disease patterns, persistent economic constraints, and strategic shifts in global pharmaceutical production and consumption.

2. The Healthcare Imperative in Emerging Markets

The healthcare landscape in emerging markets presents a complex array of challenges, characterized by significant funding deficits, infrastructural limitations, and a rapidly evolving disease burden. These factors collectively underscore the critical need for affordable and accessible medical solutions, a role increasingly fulfilled by generic drug development.

Current State of Healthcare Funding, Access, and Infrastructure

Emerging countries continue to grapple with gravely insufficient healthcare funding, which directly impedes access to quality care and negatively impacts the health status of their citizens.14 Global statistics highlight this disparity, with approximately 400 million people, primarily residing in Africa and South Asia, lacking access to essential healthcare services.14 The human resource deficit is particularly acute in low-income countries, where the physician-per-inhabitant ratio is less than one-thirtieth of that observed in high-income nations.14 This shortage of medical professionals contributes to severe health outcomes, such as maternal mortality rates in low-income countries being 60 times higher than in high-income counterparts, and a life expectancy at birth that falls short by over 20 years.14

Beyond low-income nations, funding gaps are also widening in middle and upper-middle-income countries. This is largely a consequence of accelerating medical inflation, which drives up the cost of treatments, and a higher prevalence of non-communicable lifestyle-related diseases.14 Governments in low-income countries allocate less than 2% of their GDP to health, leaving millions without essential care and hindering progress towards universal health coverage.15 The cumulative effect of these financial constraints is a substantial “health protection gap,” estimated by The Geneva Association at around USD 310 billion annually for all emerging markets, equivalent to 1% of their combined GDP. This gap is largely attributed to financially stressful out-of-pocket spending by individuals.14

While public funding remains constrained, the private healthcare sector is expanding in many emerging markets. Private sector hospitals are increasingly capturing market share from smaller nursing homes, standalone facilities, and government-run institutions, driven by a growing middle class that demands higher quality services.12 However, overall healthcare infrastructure remains woefully inadequate. For instance, bed density in India is only 15 beds per 10,000 people, significantly lagging behind China’s 43 beds per 10,000.12 Furthermore, health insurance coverage remains limited; in India, less than 20% of the population has access to insurance, despite government initiatives like the “National Health Protection Mission”.12

The confluence of inadequate public healthcare funding, significant out-of-pocket spending, and the burgeoning private healthcare sector creates a highly segmented and dynamic market for generic drugs. Generics are crucial for the financially vulnerable, helping them avoid catastrophic health expenditures and enabling access to essential treatments that would otherwise be unaffordable. Simultaneously, these affordable medications also appeal to the growing middle class. As incomes rise, this demographic seeks improved quality of service, often turning to private care options.12 However, even with increased income, affordability remains a concern, making cost-effective generics an attractive option within private healthcare settings. This situation implies that successful generic market entry necessitates nuanced strategies that cater to both public procurement systems, which prioritize broad access and cost containment, and the demands of private consumers, who may seek a balance of quality and affordability, potentially involving different branding and distribution approaches.

Evolving Disease Burden

Many developing countries are experiencing a significant health transition, marked by demographic shifts such as lower fertility rates and increased life expectancy, coupled with epidemiological changes.15 A striking aspect of this transition is the rapidly increasing burden of non-communicable diseases (NCDs), including cardiovascular illnesses, diabetes, and cancer, which are now mimicking trends observed in Western nations.5 NCDs are responsible for 70% of global deaths, with the vast majority occurring in low- and middle-income countries (LMICs).15 Projections indicate that the global NCD burden will increase by 17% over the next decade, with an even more pronounced rise of 27% expected in the African region.19

Despite the rising NCD burden, many emerging markets continue to face significant challenges from persistent infectious diseases such as HIV/AIDS, malaria, tuberculosis, and sexually transmitted diseases.5 This creates a complex “dual disease burden,” where healthcare systems must simultaneously manage acute infectious conditions and the long-term, chronic needs associated with NCDs. Furthermore, over 70% of LMICs are contending with a “double burden of malnutrition,” characterized by a high prevalence of both undernutrition and obesity.15 This multifaceted disease landscape necessitates a broad and diverse portfolio of pharmaceutical products, with a particular emphasis on affordable and sustainable treatment options.

The “dual disease burden” in emerging markets, where persistent infectious diseases coexist with a rapidly escalating prevalence of non-communicable diseases (NCDs), creates a complex and expanding demand for diverse pharmaceutical products. This means that generic drug development is no longer solely focused on addressing acute infectious conditions, but must increasingly encompass the long-term, chronic management required for NCDs. The rising incidence of NCDs, which account for a substantial portion of global deaths, particularly in LMICs, necessitates a broader portfolio of affordable medications for conditions such as cardiovascular diseases, diabetes, and cancer. This shift requires generic manufacturers to expand their research and development focus and ensure a sustained supply of cost-effective therapies for chronic care, thereby adapting their strategies to meet the evolving epidemiological profile of these regions.

Table 1: Healthcare Landscape in Emerging Markets: Key Indicators

| Indicator | Data/Description | Source Snippets |

| Healthcare Funding & Access | ||

| Total Health Expenditure as % of GDP (2022) | Varies, e.g., Egypt (4.70%), Eswatini (7.22%), Ghana (3.70%), Bolivia (8.43%), India (3.26%), China (5.28%) | 78 |

| Current Health Expenditure Per Capita (current US$) (2022) | Varies widely, e.g., India ($273.15), Indonesia ($390.15), Pakistan ($178.54), Egypt ($699.91) | 80 |

| Out-of-Pocket Expenditure (% of Current Health Expenditure) (2022) | Significant, e.g., India (52.56%), Pakistan (70.20%), Egypt (35.12%), Indonesia (38.94%) | 81 |

| Physician-per-inhabitant Ratio | Low-income countries: < 1/30th of high-income countries | 14 |

| Population Lacking Access to Essential Healthcare Services | ~400 million people, mostly in Africa and South Asia | 14 |

| Estimated Annualized Health Protection Gap (USD Billion) | ~$310 billion (1% of combined GDP) for all emerging markets | 14 |

| Infrastructure & Disease Burden | ||

| Hospital Beds per 10,000 Population | India (15), Malaysia (19), Vietnam (26), China (43) | 12 |

| Non-Communicable Diseases (NCDs) as % of Global Deaths | 70% globally, 80% in LMICs | 15 |

| Projected NCD Burden Increase (next 10 years) | Global: 17%; African region: 27% | 19 |

This table quantitatively illustrates the severe healthcare deficiencies and financial burdens prevalent in emerging markets, providing concrete evidence for the imperative need for affordable generic drugs. It offers a foundational data set, grounding the qualitative discussion in verifiable statistics and allowing for a quick comparison of the magnitude of these challenges across different emerging market contexts.

3. Economic and Public Health Impact of Generic Drugs

The proliferation of generic drugs has had a transformative impact on healthcare systems and patient access, particularly within emerging markets. Their economic and public health contributions are substantial and multifaceted.

Quantifiable Cost Savings for Healthcare Systems and Patients

Generic drugs consistently deliver significant cost savings, typically ranging from 20% to 85% compared to their brand-name equivalents.1 This affordability directly translates into substantial economic benefits at both individual and systemic levels. Studies have demonstrated that the entry of even a single generic competitor can lead to price reductions of 30%, while the presence of five or more competing generics can drive prices down by nearly 85%.20

In the United States, for instance, generic drugs saved the healthcare system an estimated $1.68 trillion between 2007 and 2016 8, and a remarkable $3.1 trillion over the past decade, with $445 billion in savings recorded in 2023 alone.22 Despite accounting for a high volume of prescriptions—91% of all prescriptions in the U.S. in 2022 20 and 90% in 2023 22—generics represent a considerably smaller share of total pharmaceutical expenditure, sometimes as low as 26% of total drug costs or less than 20% of overall spending.23 This disparity highlights their immense value in cost containment. For emerging markets, a World Health Organization (WHO) study estimated substantial annual savings from generic drugs: $1.2 billion in India, $800 million in Brazil, and $500 million in Nigeria.7

The substantial cost savings generated by generic drugs are not merely a reduction in expenditure but represent a critical opportunity for resource reallocation and reinvestment within resource-constrained emerging market healthcare systems. When governments and healthcare providers save hundreds of millions or even billions of dollars on drug procurement, that capital can be strategically redirected. This redirection can fund the expansion of essential healthcare infrastructure, such as hospitals and clinics, particularly in underserved rural areas. It can also be channeled into preventive health initiatives, such as vaccination campaigns or public health education programs, which have long-term benefits for population health. Furthermore, these savings can be used to increase health insurance coverage, reducing the burden of out-of-pocket spending for vulnerable populations, or to invest in training and retaining healthcare professionals, addressing the severe workforce shortages identified in many emerging countries. This creates a positive feedback loop, where generic drug affordability directly strengthens the overall public health capacity and moves countries closer to universal health coverage.

Enhanced Access to Essential Medicines

Generics play a pivotal role in expanding access to essential medicines, particularly in developing countries where affordability is a significant barrier to treatment.6 By providing cheaper alternatives, generic drugs enable healthcare systems to stretch their budgets further, making critical medications accessible to individuals who might otherwise be unable to afford them, especially in low- and middle-income countries where healthcare costs can be prohibitive.7

The impact of generics on public health is particularly evident in the fight against major infectious diseases. The introduction of generic antiretroviral drugs, for instance, has revolutionized HIV/AIDS management, dramatically improving the quality of life for millions and significantly reducing mortality rates worldwide.7 Similarly, affordable and effective generic antimalarials and tuberculosis treatments have been instrumental in controlling outbreaks and reducing the disease burden in endemic areas, often with vital support from international organizations like the WHO and the Global Fund.7 Beyond infectious diseases, generic medicines have also doubled access in chronic disease areas, helping to reduce the overall disease burden in underserved markets.25

The proven success of generics in combating major infectious diseases like HIV/AIDS, malaria, and tuberculosis provides a robust historical precedent and a validated operational model for addressing the rapidly escalating burden of non-communicable diseases (NCDs) in emerging markets. The infrastructure, regulatory pathways, and patient and physician acceptance built around infectious disease generics can be effectively leveraged and adapted for chronic disease management. NCDs, such as cardiovascular diseases, diabetes, and cancer, require long-term, consistent, and affordable medication, a need that generics are uniquely positioned to meet. The experience gained in scaling up production, distribution, and patient education for infectious disease treatments can inform strategies for expanding access to NCD medications, ensuring that the progress made in one area can be replicated to tackle another pressing public health challenge.

Contribution to Economic Growth and Job Creation

The generic drug industry holds substantial potential to stimulate economic growth and create job opportunities within emerging markets.24 This is achieved by fostering increased competition and innovation within the pharmaceutical sector, which can, in turn, accelerate the development of new treatments and therapies.24 The presence of a skilled workforce and lower labor costs in many emerging markets also makes these regions attractive for outsourcing various pharmaceutical activities, including clinical trials and research and development (R&D).5 This can significantly reduce overall drug development costs, making it easier for manufacturers to offer lower prices for their products while still maintaining healthy profit margins.5 This dynamic not only benefits local economies through job creation and industrial development but also reinforces the affordability aspect of generic drugs, further enhancing their importance in these markets.

Table 2: Global Generic Drug Market Size and Growth Projections

| Metric | 2020 | 2023 | 2024 | 2025 | 2033 | 2034 | CAGR (2025-2034) | Source Snippets |

| Global Generic Drug Market Size (USD Billion) | $245 | – | $445.62 | $468.08 | $775.61 | $728.64 | 5.04% – 5.25% | 8 |

| Generic Market Share (% of prescriptions/volume) | – | 90% (US) | – | – | – | – | – | 22 |

| Generic Market Share (% of total drug costs/value) | – | 13% (US) | – | – | – | – | – | 22 |

| Generic Market Share (% of volume in Europe) | – | 70% | – | – | – | – | – | 25 |

| Estimated Annual Savings (US Healthcare System) | – | $445 billion | – | – | – | – | – | 22 |

| Estimated Annual Savings (India) | – | – | – | – | – | – | – | 7 |

| Estimated Annual Savings (Brazil) | – | – | – | – | – | – | – | 7 |

| Estimated Annual Savings (Nigeria) | – | – | – | – | – | – | – | 7 |

This table quantifies the economic scale and future growth trajectory of the generic drug market, demonstrating its significant contribution to cost containment and its attractiveness for investment. It provides concrete, high-level financial data crucial for an expert audience, establishing the economic significance of the generic drug market globally and in key emerging regions, thereby validating the report’s premise from a financial perspective.

4. Key Drivers of Generic Drug Development in Emerging Markets

The increasing prominence of generic drug development in emerging markets is propelled by several interconnected factors, ranging from shifts in global intellectual property landscapes to evolving consumer demands and proactive government policies.

The “Patent Cliff” and Loss of Exclusivity for Blockbuster Drugs

The fundamental impetus for generic drug development is the expiration of patents on innovator products, which removes the exclusive rights held by brand-name manufacturers.1 This phenomenon, often referred to as the “patent cliff,” creates immense market opportunities for generic manufacturers as high-revenue “blockbuster” drugs lose their protection.5 The pharmaceutical industry is currently preparing for one of its most financially significant patent cliffs in over a decade, with numerous blockbuster drugs set to lose exclusivity by 2030.27 Projections indicate that major drugs such as Merck’s Keytruda and Johnson & Johnson’s Darzalex/Faspro will lose their U.S. exclusivity by 2029.27 The U.S. market alone is expected to experience a loss of over $230 billion between 2025 and 2030 due to these patent expirations.27

In 2025, several key small molecule drugs, including Xarelto, Entresto, and Stelara, are also facing patent expirations, opening the door for generic and biosimilar competition.28 This loss of exclusivity enables generic manufacturers to produce drug replicas at significantly lower costs, often up to 80% less than the branded versions, fundamentally altering market dynamics and increasing affordability.5

This “patent cliff” is not solely creating opportunities for simple, small-molecule generics but is increasingly driving the development and market entry of complex generics and biosimilars. This marks a crucial evolution in the generic pharmaceutical industry. The expiration of patents on complex injectable brands and biologics, for example, presents substantial market potential for generic manufacturers with the advanced technical expertise required to navigate the intricacies of developing these products.30 This shift demands higher investment in research and development, sophisticated manufacturing capabilities, and specialized formulation expertise from generic companies.21 By focusing on these higher-value, more technically challenging products, generic companies can differentiate themselves in the market and potentially achieve higher profit margins, moving beyond a purely commodity-driven model and fostering a new wave of innovation within the generic sector.

Growing Middle Class and Increasing Disposable Income

The rapid growth of populations, coupled with increasing prosperity and rising life expectancy in emerging markets, directly contributes to a surge in demand for pharmaceutical products.5 As disposable incomes rise, the burgeoning middle class in these regions becomes more willing and able to spend on healthcare and medicines.6 This demographic trend is also associated with increased health consciousness and a more proactive approach to seeking medical treatment.6 This growing purchasing power and health awareness create a robust domestic market for pharmaceutical products, particularly for affordable generic options that offer value without compromising on quality.

Government Initiatives and Policies Promoting Generic Use

Governments in emerging markets are actively promoting the use of generics within their national health plans. This policy stance is largely a response to the dual pressures of aging populations and rapidly increasing healthcare costs.5 Universal healthcare programs and initiatives aimed at broadening healthcare coverage often rely heavily on affordable generic medicines to achieve their objectives of widespread access.6

Many countries also provide incentives for local production of generic drugs, aiming to reduce dependence on imports and strengthen their domestic pharmaceutical industries, thereby enhancing supply chain resilience.6 Regulatory reforms designed to streamline drug approval processes further facilitate faster market entry for generic products.6 Furthermore, various price control measures, such as reference pricing—where a maximum reimbursement price is set for a group of interchangeable medicines—and tiered pricing—which sets maximum prices based on competition levels—are widely implemented to manage costs and promote competition. For example, in 2004, approximately 74% of countries had implemented a reference pricing system.23 These policies create a favorable environment for cost-effective generic alternatives.6

China’s Centralized Procurement system exemplifies a powerful government initiative. Utilizing a “volume-based pricing” mechanism, this system has achieved drastic reductions in drug prices, with an average price cut of 50%, and some products seeing reductions exceeding 90%.32 This system has significantly favored domestic generic drugs, which accounted for 96% of the winning bids.32 Beyond cost reduction, this system has also been instrumental in elevating the overall quality of generics in China. Prior to 2015, China had relatively lenient approval standards for generic drugs, leading to concerns about quality. However, the Centralized Procurement system has effectively forced lower-quality generics out of the market by requiring participants to demonstrate equivalence in quality and efficacy to their brand-name counterparts, aligning with international standards.32 This model demonstrates that government procurement policies can act as a catalyst for improving the quality of domestic generic drugs, addressing historical concerns about generic quality in emerging markets.

Similarly, Brazil’s Generic Drug Act, introduced in 1999, has significantly enhanced access to essential medicines and lowered drug costs, with generics typically entering the market at prices 40% lower than their patented counterparts.33

Rise of Biosimilars and Complex Generics

The pharmaceutical landscape in emerging markets is also being shaped by the increasing interest in the development and sale of biosimilars and complex generics.5 Biosimilars are biological products that are highly similar to approved reference biological products, with no clinically significant differences in efficacy and safety.5 These products offer substantial cost savings, typically being 20% to 35% less expensive than their branded biological counterparts, making them an attractive and increasingly viable option for emerging markets grappling with high healthcare costs.9

Beyond biosimilars, the development of complex generics, such as injectables and inhalers, represents a growing trend.8 These advanced formulations address unmet medical needs and provide opportunities for product differentiation within the generic sector. The impending loss of exclusivity for numerous complex injectable brands, including those that are challenging to develop, creates substantial market potential for generic manufacturers possessing the necessary technical expertise.30 This focus on complex generics and biosimilars is transforming generic companies from mere “cost-cutters” into innovators in their own right, capable of developing differentiated products with enhanced therapeutic profiles.21

Table 3: Major Blockbuster Drug Patent Expirations (2025-2030)

| Drug Name | Innovator Company | Therapeutic Area | Primary Patent Expiration Year (or estimated range) | Type of Drug | Generic/Biosimilar Opportunity | Source Snippets |

| Xarelto (Rivaroxaban) | Bayer/Janssen | Anticoagulant | May 2025 | Small Molecule | Yes | 28 |

| Entresto (Sacubitril/Valsartan) | Novartis | Heart Failure | Mid-2025 (key combination patent) | Small Molecule | Yes | 28 |

| Stelara (Ustekinumab) | Johnson & Johnson | Autoimmune (Psoriasis, Crohn’s, Colitis) | September 2023 (primary composition-of-matter) | Biologic | Yes (multiple biosimilars entering 2025) | 28 |

| Keytruda (Pembrolizumab) | Merck | Oncology | By 2029 (US exclusivity) | Biologic | Yes | 27 |

| Darzalex/Faspro (Daratumumab) | Johnson & Johnson | Oncology | By 2029 (US exclusivity) | Biologic | Yes | 27 |

| Eliquis (Apixaban) | Bristol Myers Squibb/Pfizer | Anticoagulant | By 2030 | Small Molecule | Yes | 27 |

| Opdivo (Nivolumab) | Bristol Myers Squibb | Oncology | By 2030 | Biologic | Yes | 27 |

| Humira (Adalimumab) | AbbVie | Autoimmune | 2024 (US exclusivity) | Biologic | Yes | 17 |

| Revlimid (Lenalidomide) | Bristol Myers Squibb | Oncology | 2024 (US exclusivity) | Small Molecule | Yes | 17 |

| Lantus (Insulin Glargine) | Sanofi | Diabetes | 2024 (US exclusivity) | Biologic | Yes | 17 |

| Ticagrelor | AstraZeneca | Cardiovascular | 2025 | Small Molecule | Yes | 28 |

| Denosumab (Prolia) | Amgen | Osteoporosis | February 2025 (primary US patent) | Biologic | Yes (Sandoz biosimilars approved) | 28 |

This table provides a forward-looking perspective on specific market opportunities arising from patent expirations, which is crucial for strategic planning and investment decisions within the generic pharmaceutical industry. Identifying which blockbuster drugs are losing exclusivity and when provides actionable intelligence for generic manufacturers to prioritize their R&D pipelines, allocate resources, and plan market entry strategies, thereby quantifying the scale of upcoming opportunities.

5. Regulatory Frameworks and Intellectual Property Dynamics

The journey of generic drugs into emerging markets is intricately shaped by diverse regulatory frameworks and complex intellectual property (IP) dynamics. Navigating these landscapes effectively is paramount for successful market penetration and sustainable growth.

Overview of Generic Drug Approval Processes

The approval process for generic drugs is a rigorous and systematic endeavor, encompassing scientific, manufacturing, and legal disciplines.1 A cornerstone of this process involves comprehensive bioequivalence studies, which are essential to demonstrate that the generic product delivers the same rate and extent of absorption as the reference brand-name drug, thereby ensuring comparable efficacy and safety profiles.1 Beyond bioequivalence, adherence to stringent manufacturing standards, specifically Good Manufacturing Practices (GMP), is mandatory. This includes robust quality control systems, in-process testing, and final product testing to ensure pharmacological potency, purity, and stability.1 Thorough labeling and documentation processes are also critical, requiring comprehensive records of manufacturing, quality control, batches, and stability testing to ensure traceability and accountability.1

Key international and national regulatory bodies oversee these processes. In the United States, the Food and Drug Administration (FDA) manages the Abbreviated New Drug Application (ANDA) process, specifically designed for generic drug products.2 The European Medicines Agency (EMA) oversees centralized approval processes in Europe, ensuring harmonized product-specific bioequivalence guidelines.1 The World Health Organization (WHO) also plays a vital role, particularly in providing prequalification for essential medicines, which is crucial for procurement by international aid organizations.7

National regulatory authorities in emerging markets have their own specific requirements. India’s Central Drugs Standard Control Organization (CDSCO) and the Drugs Controller General of India (DCGI) oversee drug approvals, with a process that can be as short as 90 days for generics.2 South Africa’s Medicines Control Council (MCC) aims for a 12-month approval timeline for generic medicines, though backlogs can extend this period.4 Australia’s Therapeutic Goods Administration (TGA) has an 11-month approval process.2 Common requirements across these jurisdictions often include legal documents such as GMP certificates, Letters of Authorization, Certificates of Pharmaceutical Product (COPP), and Free Sale Certificates, which frequently require notarization.35

Challenges in Regulatory Harmonization Across Diverse Emerging Markets

Despite global efforts, significant variations in regulatory requirements across different countries present a major challenge for pharmaceutical companies seeking to submit drug applications simultaneously across multiple jurisdictions.34 Even within economic blocs like BRICS, registration processes can differ substantially; for instance, Brazil and Russia have entirely different processes, while India, China, and South Africa, despite adopting the Common Technical Document (CTD) format, maintain distinct requirements for Module 1.35

Regulatory harmonization, often pursued through initiatives like the International Council for Harmonization (ICH), is viewed as crucial for streamlining filings and expediting market entry in emerging countries.35 Regulatory bodies such as the U.S. FDA have established initiatives to streamline approval processes, implement fast-track procedures, and simplify registration requirements specifically to expedite access to medications in emerging markets.9 Furthermore, interagency initiatives, including the FDA and EMA’s Parallel Scientific Advice (PSA) pilot program, the Generic Drug Cluster (GDC), and the International Pharmaceutical Regulators Programme (IPRP), are actively fostering convergence for complex generics, aiming to align standards and methodologies globally.38

Intellectual Property (IP) Landscape: Patents, Data Exclusivity, and Market Protection

Intellectual property rights, encompassing patents and regulatory exclusivities, are foundational to incentivizing pharmaceutical innovation. These rights grant inventors exclusive control over their inventions for a defined period, theoretically allowing them to charge higher-than-competitive prices to recoup substantial research and development (R&D) costs.39

Beyond patents, regulatory exclusivities also play a significant role. Data exclusivity, or regulatory data protection, prevents generic or biosimilar manufacturers from referencing an originator’s clinical and non-clinical data for their own marketing authorization applications for a specific period, typically eight years in the European Union.42 Market protection rules can further extend this period, preventing generic or biosimilar competition for up to 10 to 11 years after a new drug is licensed, irrespective of patent protection. This is exemplified by the “8+2+1” rule in Europe, ensuring originators receive a reasonable period of exclusivity even if patents expire earlier.43 These IP rights can effectively deter or delay the market entry of generic and biosimilar competition, thereby allowing rights holders to maintain higher prices for extended periods.40

The inherent tension between incentivizing pharmaceutical innovation through robust IP protection (patents, data exclusivity, market protection) and ensuring equitable access to affordable medicines (generics) is significantly amplified in emerging markets. While IP rights are designed to allow innovators to recoup R&D investments, practices like “patent evergreening” and the extended periods of data exclusivity directly counteract the affordability goals crucial for public health in these regions.26 This creates a continuous policy battleground where emerging market governments must balance adherence to global IP norms with their pressing national public health imperatives. The result is often prolonged litigation and policy debates, hindering the swift entry of affordable generics and disproportionately impacting populations with limited healthcare budgets.

Impact of “Patent Evergreening” on Generic Entry

“Patent evergreening” is a strategic maneuver employed by pharmaceutical companies to prolong market exclusivity beyond the original patent term. This is often achieved by securing secondary patents on minor modifications, such as new formulations, dosages, uses, or delivery methods of existing drugs.26 Critics argue that this practice exploits legal loopholes, primarily to delay generic entry, inflate drug prices, and undermine access to affordable medicines, particularly in developing countries where affordability is a critical determinant of access.44

The consequences of evergreening include delayed generic market entry due to the creation of “patent thickets” that complicate and prolong approval processes.44 This also leads to increased litigation, as generic manufacturers often face prolonged and expensive legal battles to challenge these secondary patents.44 The practice restricts market competition and can overload patent offices with a high volume of marginal patent applications, risking inconsistent or low-quality decisions.44 A notable example is medicine-device combination products, where patents on the delivery device alone can extend market exclusivity for the medicine by a median of 9 years, even after the drug’s active ingredient patent has expired.46

Role and Limitations of Compulsory Licensing and TRIPS Flexibilities

The World Trade Organization’s (WTO) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS Agreement) and the subsequent Doha Declaration of 2001 provide “policy space” and flexibilities for governments to interpret and implement IP standards in a manner consistent with their national public health needs.39 A key flexibility is compulsory licensing, which allows a government to authorize the use of a patented invention without the patent owner’s consent, typically to improve access to essential drugs during public health crises such as HIV/AIDS, tuberculosis, or malaria.48

Despite these provisions, the practical application of compulsory licensing has been problematic and limited. For instance, Canada’s use of the TRIPS flexibilities resulted in only one instance of drug delivery to a country with insufficient manufacturing capacity.49 The process of issuing a compulsory license is often demanding, requiring prior attempts at voluntary negotiation with the patent owner and entailing significant legal and administrative costs for the government.48

Historically, India has played a crucial role as the “pharmacy to the developing world” by producing cheap generics, which often mitigated the immediate need for other countries to invoke compulsory licensing.49 However, India’s adoption of new patent laws in 2005, to comply with TRIPS, impacts drugs patented after 1995.49 Nevertheless, compulsory licensing can still serve as a credible threat to force down prices, as demonstrated by Thailand’s decision to import generic Efavirenz from India after issuing a compulsory license for the Merck-patented drug.48 Recent cases in South Africa and Brazil further illustrate that assertive regulatory pressure and legal challenges against patent abuse can lead to significant price reductions by innovator companies.50

While compulsory licensing (CL) is a legitimate tool under TRIPS flexibilities, its practical effectiveness has been limited by legal complexities and administrative hurdles. A more potent force for price reduction and increased access appears to be the existence of strong domestic generic manufacturing capacity and assertive national regulatory action. India’s historical role as the “pharmacy to the developing world” illustrates that the availability of cheap generics from a country with robust production capabilities can significantly reduce the need for other LMICs to navigate the complex CL process.49 Furthermore, recent cases in South Africa and Brazil demonstrate that direct regulatory pressure and legal challenges against patent abuse by innovator companies can lead to substantial price reductions.50 This suggests that investing in and strengthening local generic industries, coupled with robust regulatory oversight and willingness to challenge anti-competitive practices, may be a more direct and effective policy lever for emerging markets than relying solely on the formal, often cumbersome, CL mechanism. This approach fosters internal market competition and reduces dependence on external legal mechanisms.

Table 4: Key Regulatory Bodies and Approval Timelines in Select BRICS Countries

| Country | Primary Regulatory Authority | Generic Drug Approval Timeline (Target/Typical) | Key Regulatory Requirements/Characteristics | Source Snippets |

| Brazil | ANVISA (National Health Surveillance Agency) | 180 days (legal target); can be longer in practice | Local office/agent required; GMP certificate, Letter of Authorization, COPP, FSC (notarized); Bioequivalence studies required; Registration valid for 5 years, renewable. | 35 |

| India | CDSCO (Central Drugs Standard Control Organization) / DCGI | 90 days (for drug approval); faster than US/Australia | Follows CTD format (Module 1 differences); GMP certificate, COPP, FSC required; Bioequivalence studies required; Focus on local production incentives. | 2 |

| China | NMPA (National Medical Products Administration) | Varies; recent reforms align standards with international criteria | Follows CTD format (Module 1 differences); Equivalence evaluation required for centralized procurement; Focus on improving domestic generic quality. | 32 |

| South Africa | MCC (Medicines Control Council) | 12 months (for generics); backlogs common, can take longer | Follows CTD format (Module 1 differences); High quality, strength, purity, stability required; Post-registration testing; MCC inspects manufacturing/packaging facilities for international standards compliance; Proof of comparable therapeutic effect (bioequivalence or clinical trials). | 4 |

This table is crucial for strategic planning, as it directly addresses the regulatory hurdles identified in the report. For companies considering market entry, understanding these differences is paramount for resource allocation, timeline estimation, and compliance. It visually reinforces the challenge of regulatory fragmentation and the need for tailored approaches, providing a practical framework for navigating diverse regulatory landscapes.

6. Market Access and Distribution Challenges

Despite the clear imperative and opportunities for generic drug development in emerging markets, several significant challenges persist, particularly concerning market access and the complexities of distribution.

Pricing Pressures

Generic drug prices are consistently lower than brand-name prices, with reductions intensifying significantly as the number of generic competitors increases. For instance, prices can decline by 70% to 80% relative to the pre-generic entry price in markets with 10 or more competitors within three years of the first generic entry.20 To manage costs and promote competition, many emerging markets widely utilize regulatory tools such as reference pricing, which sets a maximum reimbursement price for a group of interchangeable medicines, and tiered pricing, which adjusts maximum prices based on competition levels.23 Centralized public procurement systems, often involving pooled purchasing by multiple buyers, have also proven highly effective in achieving substantial price reductions. China’s centralized procurement, for example, has led to an average 50% reduction in drug prices, with some products seeing cuts of over 90%.32 Similarly, pooled procurement in low- and middle-income countries can command an average 15% price reduction.51 However, the effectiveness of these procurement mechanisms in reducing prices can be diminished when the supply side is concentrated, indicating a lack of robust competition.51

A growing concern is the increasing presence of “pseudo-generics” in the market. These are identical products launched by originator companies, often prior to patent expiry, at discounted prices to compete with genuine generics.52 While seemingly beneficial, this practice can hinder true generic competition by allowing originator companies to establish market presence and brand loyalty before independent generics can enter. This forces true generic manufacturers to invest more heavily in marketing and brand building to promote their products, thereby eroding their cost advantage and potentially limiting their market share.52

The “generics paradox” observed in some emerging markets, such as China, where generic entry has a limited effect on originator prices and can even lead to increases, combined with the proliferation of “pseudo-generics,” reveals that market competition is far more complex than a simple price-based dynamic.52 Innovator companies employ sophisticated strategies to retain market share and pricing power, challenging the conventional view that patent expiry automatically leads to widespread, deep price erosion. In China, for example, originator drugs maintained over 70% market share eight quarters after the first generic entry, and in some cases, originator prices even rose.53 This indicates that generic companies must develop equally nuanced competitive intelligence and market access strategies that extend beyond simply offering lower prices. They must anticipate and counter these sophisticated tactics, potentially through product differentiation, robust distribution networks, and targeted marketing, to truly capture market share and drive down costs.

Distribution Complexities

Expanding the pharmaceutical market to reach a larger share of the population, particularly in remote or underserved regions, represents a primary challenge in emerging markets.54 This is largely due to inadequate infrastructure, including poorly maintained roads, limited access to transportation hubs, unreliable electricity, and insufficient storage facilities, all of which significantly hinder efficient last-mile delivery.55

Maintaining the “cold chain” for temperature-sensitive products, such as biologics and vaccines, poses a major logistical hurdle. Deviations from required temperature ranges during transit can lead to spoilage or loss of potency, necessitating advanced monitoring systems that are often lacking.55 The pharmaceutical industry’s relatively slow adoption of modern technologies, such as IoT devices, sensors, and cloud-based integration, exacerbates these supply chain vulnerabilities, making them susceptible to cyberattacks, data manipulation, and overall inefficiency.58 Furthermore, high operational costs associated with last-mile delivery, including rising fuel prices, labor costs, and expenses from failed deliveries, add significant financial pressure.56 Unpredictable delivery conditions, such as traffic congestion and adverse weather, further complicate the timely and reliable distribution of essential medications.56

The pervasive challenges in pharmaceutical distribution in emerging markets, stemming from inadequate physical infrastructure (poor roads, unreliable power) and the pharmaceutical industry’s slow adoption of advanced digital technologies for supply chain management, create a critical bottleneck for generic drug access.55 Even if affordable, high-quality generics are developed and approved, their public health impact is severely limited if they cannot reach patients safely, reliably, and with maintained integrity (e.g., cold chain requirements for sensitive products). This situation highlights a systemic need for significant investment in logistics infrastructure and technological upgrades, potentially through collaborative public-private partnerships. Such investments are essential not just for efficient delivery but for ensuring product quality and efficacy upon arrival, thereby truly unlocking the value and public health benefits of generic drugs in these regions.

Challenges in Physician and Patient Trust/Acceptance of Generics

Despite the clear economic benefits and regulatory assurances of bioequivalence, a significant level of mistrust towards generic medicines persists among patients and physicians in many regions.10 This often stems from a deeply ingrained perception that “less expensive equals lower quality”.10 Patients may report more side effects when using generic drugs, and concerns about poor packaging and a general lack of trust can negatively impact their satisfaction.11

Some pharmacists and doctors also express reservations regarding the efficacy of generic drugs, believing they might necessitate more patient visits or offer lower overall satisfaction.11 Compounding this, pharmacists may face an ethical dilemma, as profit margins are often higher for branded drugs, potentially disincentivizing the recommendation of generics.11 Innovator manufacturers have historically contributed to this skepticism by attempting to cast doubt on the quality of generic medicines and actively hindering their market entry.10 A key factor in improving confidence in generic products is the provision of clear, consistent information and education regarding generic equivalency, the rigorous regulatory standards they must meet, and actively dispelling common myths.10 Given the high reliance of patients on their doctors’ suggestions and prescriptions, enhancing physicians’ opinions and trust in generics is particularly important for promoting wider usage and acceptance.10

7. Strategic Opportunities for Generic Pharmaceutical Companies

Despite the inherent challenges, emerging markets present substantial strategic opportunities for generic pharmaceutical companies. Success hinges on a combination of product innovation, tailored R&D, strategic partnerships, and sophisticated market intelligence.

Focus on High-Value Generics and Biosimilars

A significant strategic opportunity for generic pharmaceutical companies lies in developing complex generics and biosimilars.6 This focus allows for product differentiation, addresses unmet medical needs, and can potentially lead to higher profit margins compared to traditional, simple generics.21 The impending loss of exclusivity for numerous complex injectable brands, many of which are challenging to develop, creates substantial market potential for generic manufacturers possessing the necessary technical expertise.30 This strategic shift transforms generic companies from mere “cost-cutters” into innovators in their own right, capable of developing differentiated products with enhanced therapeutic profiles.21 This evolution allows them to capture higher value, address more specialized medical needs, and potentially overcome the intense price erosion often observed in simple generic segments. The emphasis on “branded generics” further supports this, as companies seek to combine the affordability of generics with the perceived reliability and marketing of a brand, appealing to the growing middle class in emerging markets.13

Investment in Research and Development (R&D) Tailored to Emerging Market Needs

To succeed in emerging markets, pharmaceutical companies must prioritize innovation and adaptability, which includes investing in R&D specifically tailored to the unique disease patterns and healthcare demands of these regions.9 Emerging markets face a dual burden of both persistent infectious diseases and a rapidly growing prevalence of non-communicable diseases (NCDs) such as cardiovascular illnesses, diabetes, and cancer.5 This necessitates a diverse R&D pipeline that addresses both acute and chronic conditions. Furthermore, conducting clinical trials in emerging countries can significantly reduce overall drug development costs, making it easier to offer lower prices for new generic products while maintaining profitability.5 This localized R&D approach not only meets specific market needs but also contributes to cost-effectiveness.

Importance of Strategic Alliances and Local Partnerships

Engaging in strategic alliances and fostering local partnerships is crucial for successful market entry and sustainable expansion in emerging markets.6 Partnering with local drug manufacturers allows international companies to leverage existing production capabilities, established distribution networks, and invaluable market knowledge, which can be difficult to build from scratch.6 A notable example is the 2011 joint venture between Merck & Co. and Sun Pharma, established to develop and commercialize “innovative branded generics” in emerging markets. This partnership effectively combined Sun Pharma’s proven R&D and manufacturing expertise with Merck’s clinical development and broad geographic commercial footprint.13 More recently, Sanofi’s collaborations with Indian companies like Dr. Reddy’s, Cipla, and Emcure for vaccine distribution in India underscore the value of leveraging local networks to enhance market presence and product offerings.31 While such partnerships offer significant benefits, it is important to acknowledge that managing multiple local partners can introduce complexities in ensuring consistent compliance and performance across diverse operational environments.60

Leveraging Competitive Intelligence and Patent Data for Market Entry

Competitive intelligence (CI) is an indispensable tool for pharmaceutical companies operating in the dynamic emerging markets. It enables them to anticipate competitor strategies, identify nascent market opportunities, inform pricing models, and optimize market access.61 CI involves systematically tracking competitor drug pipelines, R&D investments, regulatory filings, and product lifecycles, often utilizing specialized databases and industry publications.61

Patent and intellectual property (IP) analysis is a critical component of CI, essential for identifying potential competitive threats, uncovering licensing opportunities, and navigating the complex web of patents that generic manufacturers must contend with after a brand-name drug’s patent expiration.26 Advanced tools, including artificial intelligence (AI), are increasingly being leveraged to scan vast data sources—such as patents, clinical trials, and sales data—to identify high-potential generic development opportunities following a Loss of Exclusivity (LOE) and to accurately forecast market dynamics.63 Predictive modeling, which analyzes historical launch data, can estimate the likely performance of a generic drug, with companies employing such analytics reportedly achieving 20% higher market penetration within six months of launch.65

The successful market entry strategies of leading generic companies are not merely reactive to patent expirations but are highly proactive, data-driven, and often involve aggressive legal and commercial tactics. This highlights that competitive intelligence, patent analysis, predictive modeling, and strategic partnerships are not just supportive functions but are core competencies for achieving market dominance. Success hinges on anticipating market shifts, navigating regulatory complexities, and executing tailored launch strategies, often leveraging advanced analytics and AI. For example, Teva Pharmaceuticals successfully launched a urology generic by filing early, employing aggressive pricing ($35 per pill versus $65 for the brand), and targeting urologists with data-driven campaigns, ultimately capturing 70% of the market within a year.65 India’s Cipla, a global leader in affordable medicines, has played a pivotal role in expanding access to HIV/AIDS therapies as the first generic producer of antiretrovirals. Cipla focuses on developing generics post-patent expiry, including complex products and novel delivery methods, and has actively engaged in patent challenges based on public interest and affordability arguments, as seen in their legal battle over Erlotinib in India.66 Dr. Reddy’s Laboratories plans to launch a generic version of Novo Nordisk’s popular weight-loss drug, semaglutide, in 87 countries, including Canada, India, Brazil, and Turkey, starting next year, subject to patent expiry. This strategic move aims to capitalize on the burgeoning global obesity drug market, with the company expecting to generate “hundreds of millions of dollars” in sales.68 Sun Pharmaceutical Industries Ltd., a market leader in chronic therapies, emphasizes strategic acquisitions and a robust product portfolio with over 237 approved abbreviated new drug applications (ANDAs). Their growth strategy centers on cost leadership, effective marketing, and operational optimization, including investments in branded patented products and improving efficiencies in generics R&D.69 These examples collectively underscore that success in the generic market is a strategic battle requiring significant foresight and analytical capabilities, not merely manufacturing prowess.

Table 5: Strategic Approaches for Generic Drug Market Entry in Emerging Markets

| Strategic Approach | Description/Rationale | Key Actionable Steps | Relevant Examples | Source Snippets |

| Focus on High-Value/Complex Generics & Biosimilars | Capture higher value, address specialized medical needs, and differentiate products beyond simple cost-cutting. | Invest in advanced formulation technologies (e.g., nanoparticles, injectables, inhalers); Develop biosimilars for biologics losing exclusivity. | Merck/Sun Pharma JV (innovative branded generics); Cipla (complex products, novel delivery methods); Generic companies transforming into “innovators.” | 9 |

| Targeted R&D Investment | Address the specific dual disease burden (infectious & NCDs) and leverage lower R&D costs in emerging markets. | Conduct local clinical trials to reduce development costs; Prioritize R&D for high-demand therapeutic areas in specific emerging markets. | Clinical trials in emerging countries reducing costs; Focus on infectious diseases and NCDs in BRICS/MIST. | 5 |

| Strategic Alliances & Local Partnerships | Leverage existing local expertise, manufacturing capabilities, and distribution networks for efficient market penetration. | Form joint ventures (JVs) with local manufacturers; Collaborate with established distributors; Engage in co-marketing agreements. | Merck/Sun Pharma JV; Sanofi’s partnerships with Dr. Reddy’s, Cipla, Emcure in India. | 6 |

| Advanced Competitive Intelligence & Patent Analysis | Anticipate market shifts, identify opportunities, and navigate complex IP landscapes to gain first-mover or dominant positions. | Utilize AI for patent tracking and LOE forecasting; Monitor competitor pipelines and regulatory filings; Employ predictive modeling for launch performance. | Teva’s data-driven launch; Cipla’s patent challenges; Dr. Reddy’s semaglutide launch planning; AI for BD teams. | 26 |

| Tailored Pricing & Market Access | Balance affordability with perceived value, adapt to local payment systems, and secure favorable formulary placement. | Implement dynamic pricing adjustments based on market uptake and competition; Negotiate early formulary placement with payers; Offer incentives to pharmacy chains. | Teva’s aggressive pricing; China’s centralized procurement; Reference pricing and tiered pricing models. | 23 |

This table synthesizes the identified strategic opportunities into actionable categories, providing a practical framework for pharmaceutical companies aiming to succeed in emerging generic markets. It consolidates diverse strategic elements into a coherent framework, making the complex landscape of emerging market entry more manageable and actionable for decision-makers.

Table 6: Generic Drug Market Share (Volume/Value) in Key Emerging Markets

| Country | Generic Market Size (USD Billion, 2024) | Forecasted Market Size (USD Billion, 2033/2034) | CAGR (2025-2033/2034) | Generic Market Share (% of total pharmaceutical market, volume/value) | Key Market Characteristics/Drivers | Source Snippets |

| India | $28.06 | $51.47 (2033) | 6.97% | Largest exporter of generics by volume; ~40% of US generic approvals (FY17); Dominance of branded generics. | Robust manufacturing infrastructure, low production costs, supportive government policies, increasing chronic disease burden, growing middle class. | 31 |

| China | $134.4 (2021) | Projected to slow down | 0.45% (2017-2021) | 54% (2020, by value); Limited market penetration for generics (modest effect on originator prices). | Robust local manufacturing, significant reforms to elevate generic quality (Centralized Procurement), increasing health-conscious population. | 53 |

| Brazil | $22.4 | $39.3 (2033) | 6.43% | Continuously gaining market share; Generics enter at 40% lower price than patented counterparts. | Strong government support (Generic Drug Act), cost-effectiveness, growing aging population, substantial pharmaceutical investments. | 33 |

| South Africa | $1.0 (2022) | Forecasted to grow (no specific value) | 0% (2017-2022, value); 2.8% (2017-2022, volume) | 68.7% (2022, volume); Average generic cost R123 vs. R303 for valid patents. | Government policies for price transparency and generic uptake, increased registration of generics, improved patient acceptance, challenges from pseudo-generics. | 52 |

This table offers granular, country-specific data that complements the global market overview. It enables a deeper understanding of regional nuances, identifying which markets have high generic penetration, significant growth potential, and unique characteristics (e.g., China’s quality reforms, India’s manufacturing prowess). This level of detail is critical for targeted market expansion strategies.

8. Future Trends and Policy Implications

The trajectory of generic drug development in emerging markets will be significantly shaped by ongoing technological advancements and evolving policy landscapes. These interconnected forces will dictate the future of healthcare access and affordability in these regions.

Technological Advancements

Technological advancements are poised to revolutionize generic drug development and manufacturing. Continuous manufacturing processes, 3D printing, and advanced formulation technologies, such as nanoparticles and innovative drug delivery systems, are enhancing efficiency, reducing costs, and improving the quality and efficacy of generic drugs.6 These innovations enable generic companies to produce more complex and differentiated products, addressing unmet medical needs and potentially improving patient compliance.21

Artificial Intelligence (AI) is emerging as a transformative force across the pharmaceutical value chain. AI is projected to generate billions annually for the pharmaceutical sector, primarily by streamlining drug discovery, accelerating development and approval processes, and optimizing manufacturing operations.72 In drug discovery, AI is estimated to contribute to the discovery of 30% of new drugs by 2025 by analyzing large datasets to identify promising drug candidates and optimize chemical structures.72 In manufacturing, AI-driven systems are improving product consistency, reducing errors, and enabling predictive maintenance, leading to smoother operations and faster production cycles.72 AI also significantly enhances supply chain management through improved demand forecasting, inventory optimization, and real-time tracking, ensuring product integrity and timely deliveries.72 Recognizing the potential of these innovations, regulatory bodies like the FDA have established programs such as the Emerging Technology Program (ETP) to facilitate regulatory approval for novel manufacturing technologies, thereby encouraging their adoption by the industry.74

Digital Health and Personalized Medicine

The integration of digital health solutions and the growing emphasis on personalized medicine represent further transformative trends. Digital transformation in the pharmaceutical industry involves replacing traditional, paper-heavy processes with cutting-edge solutions, including autonomous labs and digital twins-based manufacturing.73 Telehealth and remote clinical trials are gaining traction, improving patient access and reducing logistical burdens, particularly in geographically diverse emerging markets.73 Personalized medicine, which involves developing treatments tailored to individual patient needs using genetic, environmental, and other patient-specific data, is a growing focus.71 While personalized medicine often involves innovative, high-cost therapies, the principles of precision and targeted treatment could eventually influence the development of more sophisticated generics or biosimilars that cater to specific patient subgroups, potentially improving treatment outcomes in a cost-effective manner.

Policy Implications: Local Manufacturing, Price Controls, Regulatory Harmonization, and IP Reforms

Policy decisions in emerging markets will continue to play a pivotal role in shaping the generic drug landscape. Promoting local manufacturing is a key objective for many governments, driven by the desire to increase access to medicines, improve public health, and enhance self-sufficiency in the face of global supply chain vulnerabilities.6 This involves providing incentives for domestic production of active pharmaceutical ingredients (APIs) and finished formulations, thereby reducing reliance on imports.76

Price controls, such as reference pricing and tiered pricing mechanisms, will remain essential tools for governments to manage healthcare costs and promote affordability.6 These policies create a direct market for affordable generic drugs by setting maximum allowable prices, encouraging competition among manufacturers.23

Regulatory harmonization is critical for streamlining drug approval processes and facilitating faster market entry for generics across diverse jurisdictions.6 Efforts by international bodies and national agencies to align standards and simplify registration requirements will reduce the administrative burden on manufacturers and expedite patient access to essential medications.35

Finally, intellectual property (IP) reforms will continue to be a contentious but vital area. The ongoing debate revolves around balancing the need to incentivize innovation through strong IP protection with the imperative to ensure affordable access to medicines, particularly in LMICs.39 Policies related to patent evergreening, data exclusivity, and the practical application of TRIPS flexibilities like compulsory licensing will be crucial in determining the speed and extent of generic market entry.40 Emerging markets may increasingly advocate for IP regimes that prioritize public health outcomes and facilitate the timely introduction of affordable generics, potentially through more flexible interpretations of international agreements or stronger domestic measures to curb anti-competitive practices.45

Conclusions

The growing importance of generic drug development for emerging markets is undeniable, driven by a convergence of critical healthcare needs, economic pressures, and strategic industry shifts. These affordable alternatives are not merely a cost-saving measure but a fundamental pillar for achieving universal health coverage, improving public health outcomes, and catalyzing economic development across the developing world.

Emerging markets face profound healthcare challenges, including severe funding insufficiencies, inadequate infrastructure, and a complex “dual disease burden” encompassing both persistent infectious diseases and a rapidly escalating prevalence of non-communicable diseases. Generic drugs offer a vital solution to these issues by providing substantial cost savings, enabling healthcare systems to expand access to essential medicines, and freeing up resources for critical investments in infrastructure and public health initiatives. The proven success of generics in combating major infectious diseases provides a robust operational model that can be effectively adapted to address the growing burden of chronic conditions.

The generic pharmaceutical industry is strategically positioned to capitalize on the impending “patent cliff” of blockbuster drugs, which increasingly includes complex generics and biosimilars, requiring higher R&D investment and advanced manufacturing capabilities. The rising disposable incomes of a growing middle class in these markets further fuel demand for affordable, yet quality, healthcare solutions. Proactive government initiatives, particularly through centralized procurement systems, demonstrate a powerful dual impact: not only do they drastically reduce drug prices, but they also act as a catalyst for elevating the quality of domestic generic drugs by requiring adherence to international equivalence standards.

However, significant hurdles remain. A persistent challenge is the mistrust of generics among some patients and physicians, often rooted in a perception that lower cost implies lower quality. This necessitates sustained educational campaigns and transparent communication about regulatory rigor. Furthermore, the complex interplay of intellectual property rights, particularly practices like “patent evergreening,” continues to impede timely generic entry, creating a continuous policy battleground between innovation incentives and access imperatives. The pervasive challenges in pharmaceutical distribution, stemming from inadequate physical infrastructure and a lag in technological adoption, also create critical bottlenecks, limiting the reach and integrity of even high-quality, affordable generics.

To navigate this complex landscape, generic pharmaceutical companies must adopt multi-faceted strategies. This includes focusing on high-value and complex generics and biosimilars, investing in R&D tailored to the unique disease patterns of emerging markets, and forging robust strategic alliances and local partnerships to leverage existing capabilities and market knowledge. Crucially, success will increasingly hinge on sophisticated competitive intelligence and patent analysis, utilizing advanced analytics and AI to anticipate market shifts, identify opportunities, and execute data-driven launch strategies.

Looking ahead, technological advancements, particularly in AI and advanced manufacturing, will continue to transform generic drug development, offering opportunities for enhanced efficiency, quality, and personalized approaches. Policy implications will center on strengthening local manufacturing capabilities, implementing effective price controls, fostering regulatory harmonization, and reforming IP regimes to strike a better balance between innovation and access. The future of global health and economic development in emerging markets is inextricably linked to the continued growth and strategic evolution of the generic drug industry.

Works cited

- What is a generic drug, and how does it get approved? – Patsnap Synapse, accessed July 24, 2025, https://synapse.patsnap.com/article/what-is-a-generic-drug-and-how-does-it-get-approved

- An Overview on Comparative Study of Generic Drug Approval Process in USA, India and Australia – IJPPR, accessed July 24, 2025, https://ijppr.humanjournals.com/wp-content/uploads/2025/01/1.Parth-Raval1-Khyati-Patel2-Khushi-Patel2-Arpi-Patel2-Mrs-Mona-Gupta3-Ms.-Sandhya-Bodhe-.pdf

- Generic medicine – EMA – European Union, accessed July 24, 2025, https://www.ema.europa.eu/en/glossary-terms/generic-medicine

- Generic Medicines – Anglo Medical Scheme, accessed July 24, 2025, https://www.angloms.co.za/portal/ams/generic-medicines

- The Influence of Emerging Markets on the Pharmaceutical Industry – PMC, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5717296/

- Finding Generic Drug Entry Opportunities in Emerging Markets – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/generic-drug-entry-emerging-markets/

- How Generics Are Revolutionizing Treatment in Developing Countries, accessed July 24, 2025, https://eaststreetpharmacy.com/how-generics-are-revolutionizing-treatment-in-developing-countries.html

- The Economics of Generic Medications – Number Analytics, accessed July 24, 2025, https://www.numberanalytics.com/blog/economics-generic-medications

- The Growing Importance of Generic Drug Development for Emerging Markets, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/the-growing-importance-of-generic-drug-development-for-emerging-markets/

- What do people really think of generic medicines? A systematic review and critical appraisal of literature on stakeholder perceptions of generic drugs – PubMed Central, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4520280/

- Acceptability and Perceptions of Generic Drugs among Patients, Pharmacists, and Physicians – ResearchGate, accessed July 24, 2025, https://www.researchgate.net/publication/347451664_Acceptability_and_Perceptions_of_Generic_Drugs_among_Patients_Pharmacists_and_Physicians

- Navigating Emerging Markets Healthcare Trends – Morgan Stanley, accessed July 24, 2025, https://www.morganstanley.com/im/publication/insights/articles/article_navigatingemergingmarketshealthcare_ltr.pdf

- Merck & Co., Inc., and Sun Pharma Establish Joint Venture to Develop and Commercialize Novel Formulations and Combinations of Medicines in Emerging Markets, accessed July 24, 2025, https://www.merck.com/news/merck-co-inc-and-sun-pharma-establish-joint-venture-to-develop-and-commercialize-novel-formulations-and-combinations-of-medicines-in-emerging-markets/

- Healthcare in Emerging Markets: Exploring the Protection Gaps | The Geneva Association, accessed July 24, 2025, https://www.genevaassociation.org/sites/default/files/research-topics-document-type/pdf_public/health_protection_gap_web.pdf

- Health Overview: Development news, research, data | World Bank, accessed July 24, 2025, https://www.worldbank.org/en/topic/health/overview

- Health Financing Revisited – World Bank Documents and Reports, accessed July 24, 2025, https://documents1.worldbank.org/curated/en/874011468313782370/pdf/370910Health0f101OFFICIAL0USE0ONLY1.pdf

- Generic Drugs Market Size, Global Trends, Demand & Growth | By 2033 – Straits Research, accessed July 24, 2025, https://straitsresearch.com/report/generic-drugs-market

- Burden and attributable risk factors of non-communicable diseases and subtypes in 204 countries and territories, 1990-2021: a systematic analysis for the global burden of disease study 2021 – PubMed, accessed July 24, 2025, https://pubmed.ncbi.nlm.nih.gov/39869379/

- The Global Epidemic – NCD Alliance, accessed July 24, 2025, https://ncdalliance.org/the-global-epidemic

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – HHS ASPE, accessed July 24, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- Overcoming Formulation Challenges in Generic Drug Development – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/overcoming-formulation-challenges-in-generic-drug-development/

- Association for Accessible Medicines: Home, accessed July 24, 2025, https://accessiblemeds.org/

- Strategies for Pricing Generic Drugs – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/strategies-for-pricing-generic-drugs/