1. The Structural Re-Alignment of the Pharmaceutical Value Chain

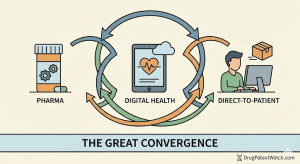

The pharmaceutical industry is currently undergoing a structural metamorphosis as significant as the transition from small molecule chemistry to biologics. For the better part of a century, the industry operated on a rigid B2B2C model. Manufacturers researched and developed compounds, sold them to wholesalers, who in turn distributed them to pharmacies and hospitals. The physician acted as the gatekeeper, and the patient was the end user but rarely the direct customer. In 2024 and moving into 2025, that model is fracturing. A direct-to-patient (DTP) channel, bypassing traditional intermediaries, has emerged from the convergence of telehealth infrastructure and the consumerization of chronic care.

This report analyzes the integration of pharmaceuticals and telehealth, a market projected to reach nearly $791 billion by 2032.1 While the aggregate market size draws headlines, the redistribution of value within that market demands scrutiny. We are witnessing a battle for the “digital front door” of healthcare, fought between vertically integrated telehealth startups like Hims & Hers and Ro, revitalized retail giants such as Amazon Pharmacy, and pharmaceutical manufacturers themselves, exemplified by Eli Lilly’s LillyDirect and Pfizer’s PfizerForAll.

This is not a temporary fluctuation driven by pandemic habits. It is a permanent realignment of how patients access, pay for, and adhere to therapy. For business development teams, IP counsel, and investors, the implications are binary: adapt to a model where customer acquisition cost (CAC) and lifetime value (LTV) are as critical as clinical efficacy, or risk disintermediation.

1.1 The End of the Hype Cycle and the Rise of Utility

The narrative that telehealth was merely a “pandemic bubble” has been empirically disproven, though the nature of its utility has shifted. While urgent care utilization has normalized, the management of chronic conditions via telehealth has accelerated. The global telehealth market, valued at $161.64 billion in 2024, is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.94%.1 This growth is not uniform; it is concentrated in high-frequency, high-retention therapeutic areas such as metabolic health, mental health, and dermatology.1

The “hype cycle” has ended, replaced by a “utility cycle.” In 2025, digital health funding is no longer chasing indiscriminate user growth but flows toward platforms demonstrating clinical outcomes and retention. The IQVIA Institute notes that while startups have faced headwinds and bankruptcies, innovation remains robust in “solutions” that combine diagnostics, therapeutics, and remote monitoring.2 This shift from “telehealth as a video call” to “telehealth as a care ecosystem” defines the current market.

1.2 The Consumerization of Prescription Drugs

A profound psychological shift has occurred: patients now view healthcare through the lens of e-commerce. The expectation of same-day delivery, transparent pricing, and seamless digital interfaces—standards set by Amazon and Uber—has migrated to prescription drugs. This is evident in the rise of the “E-pharmacy” sector, where diabetes and cardiovascular therapies command significant market share due to the recurring nature of the prescriptions.3

This consumerization forces pharmaceutical companies to rethink their value proposition. In a traditional model, the drug’s chemical efficacy was the product. In the telehealth age, the product is the drug plus the service wrap. A patient prescribed a GLP-1 receptor agonist for obesity is not just buying semaglutide; they are purchasing the telehealth consultation, insurance navigation support, at-home delivery, and the digital companion app for diet tracking.

1.3 The Emergence of “Specialty-Lite”

We are seeing the emergence of a “specialty-lite” drug category. These are medications not complex enough to require traditional specialty pharmacy handling—like oncology infusions—but too expensive or complex for a frictionless retail experience, unlike generic antibiotics. GLP-1s, dermatology biologics, and complex mental health formulations fit this category perfectly. They require prior authorization support and cold chain logistics, yet they are marketed directly to consumers. This category is the sweet spot for the new telehealth-pharma hybrids, combining the clinical rigor of specialty pharmacy with the user experience of consumer tech.

2. The Battle of Business Models: Vertical Integration vs. Horizontal Aggregation

The market is currently segmented into three distinct business models, each vying for dominance. Understanding the unit economics of these models is essential for predicting the future landscape.

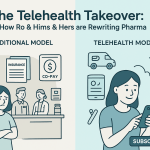

2.1 The Digital Native Disruptors: Hims & Hers and Ro

These companies began as “telehealth for taboo topics”—erectile dysfunction and hair loss—but have evolved into comprehensive health platforms. Their model is vertical integration: they own the marketing, the physician network (via affiliated Professional Corporations), and increasingly, the pharmacy fulfillment.

2.1.1 Hims & Hers: The Brand-First Approach

Hims & Hers has executed a strategy centered on brand equity and accessibility. In Q3 2024, the company reported revenue of $401.6 million, a 77% year-over-year increase, with an adjusted EBITDA of $51.1 million.5 This profitability is significant because it validates the unit economics of Direct-to-Patient (DTP) healthcare, proving it can be margin-positive rather than just a growth-at-all-costs venture.

A critical pivot for Hims was the introduction of compounded GLP-1s. By utilizing the shortage exemptions under the FD&C Act, Hims offered semaglutide access when brand-name Wegovy was unavailable. This move drove subscriber growth to 2 million.6 The company reports strong retention: for their compounded GLP-1 solutions, 85% of patients remain engaged at four weeks, and 70% at 12 weeks.7 The company’s ability to cross-sell acts as its moat. A patient entering for hair loss may eventually be treated for anxiety or weight loss, increasing Lifetime Value (LTV) without a proportional increase in Customer Acquisition Cost (CAC).

2.1.2 Ro: The Infrastructure-First Approach

Ro (formerly Roman) has taken a divergent path, focusing heavily on owning the “full stack” of healthcare delivery. Ro acquired competitive assets in diagnostics and in-home care to control the entire patient journey.8 Ro was estimated to hit nearly $600 million in annualized revenue in 2024, largely driven by its “Ro Body” obesity management program.9

While Hims leans into lifestyle branding, Ro positions itself closer to a primary care provider, emphasizing “continuity of care.” This model is more capital-intensive. Ro’s strategy involves deep workflow integration, managing labs, and insurance navigation. This creates a higher barrier to entry for competitors but slows scalability compared to Hims’ cash-pay focus.8 Ro’s model relies on the thesis that controlling the diagnostic layer (labs and testing) creates a stickier patient relationship than merely controlling the prescription.

2.2 The Pharmaceutical Giants: Direct-to-Patient (DTP)

Historically, Pharma feared channel conflict with Pharmacy Benefit Managers (PBMs) and wholesalers. In 2024, Eli Lilly shattered that fear with LillyDirect, and Pfizer followed with PfizerForAll.

2.2.1 LillyDirect: The Paradigm Shift

LillyDirect is a digital storefront connecting patients with independent telehealth providers and pharmacy fulfillment services for Lilly’s migraine, diabetes, and obesity medications.10 The strategic rationale for a $700 billion company to sell directly to consumers is threefold.

First, Data Ownership. It allows Lilly to capture “last-mile” data—who is buying, why they drop off, and their adherence patterns—data traditionally hoarded by PBMs and pharmacies.11 Second, Price Control. By partnering with third-party dispensing providers (like Amazon Pharmacy and Truepill), Lilly ensures the patient sees the intended price, mitigating the “sticker shock” often caused by high-deductible plans.12 Third, Anti-Counterfeit Measures. In a market flooded with fake Ozempic and compounded alternatives, LillyDirect serves as a “verified source” of Zepbound and Mounjaro.13 Lilly’s Q4 2024 revenue jumped 45% to $13.53 billion, driven by volume growth in Mounjaro and Zepbound.14 While LillyDirect is a small fraction of this, it is a strategic beachhead against commoditization.

2.2.2 PfizerForAll

Pfizer launched “PfizerForAll” in late 2024. This platform aggregates access to care for migraines, COVID-19, and vaccinations.15 Unlike Lilly, Pfizer leans heavily on existing payer infrastructure rather than trying to bypass it entirely. The platform is designed to reduce the “information overload” patients face.16 It represents a “soft” DTP model—facilitating the transaction rather than owning it. This distinction is crucial: Lilly is building a walled garden; Pfizer is building a concierge desk.

2.3 The Tech Incumbents: Amazon Pharmacy

Amazon plays a different game: logistics dominance. Amazon Pharmacy does not need to make a high margin on the drug if the transaction locks the user into the Prime ecosystem.

Amazon has integrated manufacturer coupons directly into the checkout flow, addressing a major inefficiency where patients fail to utilize available discounts.17 This automatic application of savings (e.g., for insulin or GLP-1s) mimics the friction-free experience of retail shopping. Unlike GoodRx, which provides coupons for use at other pharmacies, Amazon is the pharmacy. This vertical integration allows Amazon to control the price displayed to the consumer dynamically, often beating insurance copays for generic medications.18 Through Amazon Clinic (and the One Medical acquisition), Amazon now competes directly with Hims and Ro for low-acuity conditions (acne, hair loss).19

3. The GLP-1 Catalyst: Telehealth’s Economic Engine

If telehealth is the engine, GLP-1 receptor agonists (semaglutide, tirzepatide) are the fuel. This drug class has fundamentally altered the economics of digital health, providing a high-cost, high-demand, recurring revenue stream that was previously absent in the sector.

3.1 Demand Dynamics and Prescribing Patterns

Data from Truveta indicates that over 1.8 million patients were prescribed a GLP-1 between 2018 and late 2024, with a massive acceleration in 2023-2024.20 In December 2024, prescribing for anti-obesity medications (AOMs) spiked, driven largely by tirzepatide (Zepbound). A significant portion of this volume flows through telehealth channels. For patients in “pharmacy deserts” or those facing stigma from local PCPs, telehealth offers a judgment-free access point.

The shortage of branded GLP-1s created a vacuum filled by compounding pharmacies and telehealth platforms. Hims & Hers reported that excluding compounded GLP-1s, their subscriber growth was still 40%, but the inclusion of these drugs acted as a massive accelerant.5 This created a temporary but lucrative market for “compounded semaglutide”—effectively a generic authorized by regulatory loophole.

3.2 The Adherence Paradox

A critical question for the industry is whether telehealth leads to better adherence. The data is mixed and suggests a “fragmentation penalty.”

| Metric | Telehealth Adherence Note | In-Person/PCP Adherence Note |

| Real-World Persistence (12 mo) | ~27.2% (Prime Therapeutics Data) 21 | Higher when managed by Endocrinologists 22 |

| Adverse Event Management | Higher dropout due to GI issues; 39.8% reported adverse events 23 | Physical management allows for dose adjustment |

| Switching Behavior | 11.1% switch drugs within 1 year 24 | PCPs more likely to retain patient on therapy |

Blue Health Intelligence data suggests that patients prescribed weight management drugs by primary care providers (PCPs) or specialists (Endocrinologists) had higher persistence rates than those treated by fragmented providers.22 A study on liraglutide found that 39.8% of telemedicine patients reported adverse events (mostly GI), and those who dropped out reported significantly higher adverse event rates.23 This highlights a weakness in the telehealth model: without physical hand-holding, patients often quit when side effects hit.

3.3 The Cautionary Tale of Done Global

The GLP-1 boom must be viewed against the backdrop of the ADHD telehealth scandal. In 2024/2025, the Department of Justice (DOJ) indicted the leadership of Done Global for an alleged $100 million scheme to distribute Adderall illegally.25 The DOJ alleged the company “used lies and deceit” to facilitate easy access to stimulants, prioritizing subscription revenue over patient safety. This serves as a stark warning: the DOJ distinguishes between telehealth and drug dealing. Aggressive social media marketing combined with loose prescribing standards for controlled substances will invite federal prosecution.

4. Intellectual Property Strategy in the Digital Age

In this rapidly evolving landscape, intellectual property (IP) strategy is no longer just about protecting a molecule; it is about protecting the method of delivery and formulation that enables telehealth.

4.1 Leveraging Data for Competitive Advantage

For business development teams, patent intelligence is the compass for navigating this terrain. Tools like DrugPatentWatch are indispensable for identifying the “Patent Cliff”—the precise moment a drug loses exclusivity and becomes open for generic competition or 505(b)(2) modification.

4.2 The Paragraph IV Playbook

For telehealth companies looking to vertically integrate (like Ro or Hims), selling branded drugs is low margin. The real opportunity lies in generics. Generic manufacturers use Paragraph IV certifications to challenge patents and gain 180-day exclusivity. DrugPatentWatch allows companies to monitor these filings to predict when a generic version of a blockbuster (like semaglutide) might become available.27

Analysis indicates that while the primary patents for Wegovy/Ozempic run into the early 2030s in the US, patents in other jurisdictions (China, India, Brazil) expire as early as 2026.29 For a global telehealth player, this creates a fragmented opportunity map. A company could theoretically launch a generic semaglutide service in Brazil five years before it can do so in the United States, utilizing cross-border telehealth capabilities.

4.3 The 505(b)(2) Pathway: Innovation for Telehealth

The 505(b)(2) regulatory pathway allows companies to seek approval for a drug by relying on existing safety data from an approved drug, while adding a new twist—such as a new dosage form or route of administration.30

This is particularly relevant for telehealth. A company could use DrugPatentWatch to identify an off-patent active ingredient (e.g., sildenafil) and develop a novel oral disintegrating tablet (ODT) or a liquid formulation that is easier to ship and store. This proprietary formulation can be patented, preventing direct price comparisons with generic pills and increasing margins. The 505(b)(2) pathway offers 3-5 years of market exclusivity, creating a “mini-monopoly” perfect for a direct-to-consumer brand.32 This strategy turns a commodity generic into a premium branded product.

4.4 Patent Term Extensions

Understanding the difference between nominal patent life (20 years) and effective market exclusivity is crucial. Due to regulatory delays, effective life is often much shorter. DrugPatentWatch provides data on patent term extensions (PTE) that can add up to 5 years to a patent’s life, critical for valuing assets in M&A deals.33 For investors analyzing a telehealth company’s acquisition of a drug portfolio, knowing the real expiration date—not just the statutory one—is the difference between a good investment and a writedown.

5. Regulatory Friction: The Compliance Minefield

The convergence of pharma and tech is colliding with a regulatory framework designed in the 1970s.

5.1 The Ryan Haight Act and the “Permanent Temporary”

The Ryan Haight Act of 2008 generally prohibits prescribing controlled substances via the internet without an in-person medical evaluation. During COVID-19, the DEA waived this requirement. The DEA has issued a “Fourth Temporary Extension,” extending these flexibilities through the end of 2025 and likely into 2026.34

This uncertainty is toxic for long-term planning. Companies building models around tele-prescribing Adderall (Schedule II) or testosterone (Schedule III) are building on shifting sand. If the waiver expires without a special registration process, these business models collapse overnight. The “special registration” for telemedicine, promised for over a decade, remains unpublished in final form.

5.2 State Licensure and the “Compact” Maze

Telehealth is theoretically borderless, but medicine is regulated by the state. The Interstate Medical Licensure Compact (IMLC) attempts to streamline this, but it is not a “national license.” Providers still need to be licensed in the state where the patient is located.36

Washington D.C. requires that providers demonstrate their practice is not “primarily” through telehealth to serve on the board, though practice standards are evolving.37 Furthermore, the “Corporate Practice of Medicine” (CPOM) doctrine in states like California and New York prohibits corporations from practicing medicine. To navigate this, telehealth companies use the “PC-MSO” model (Professional Corporation – Management Services Organization). The MSO (the tech company) manages the admin, while the PC (owned by a doctor) practices medicine. This structure is under increasing scrutiny as regulators question whether the MSO is exerting undue influence over clinical decisions—a central theme in the Done Global indictment.

6. Operational Backbone: Cold Chain and Logistics

The shift to GLP-1s has forced telehealth companies to become logistics experts. Unlike erectile dysfunction pills, which can be thrown in a bubble mailer, semaglutide requires strict temperature control (2°C to 8°C).

6.1 The “Last Mile” Challenge

Maintaining the “cold chain” during the last mile of delivery is the most expensive part of the supply chain. Companies like Truepill (used by many telehealth startups) and Amazon Pharmacy have invested heavily in automated packaging that calculates the necessary coolant based on the destination’s weather forecast.38

Cost implications are severe. Packaging failures (temperature excursions) result in spoilage. If a $1,000 box of Zepbound freezes or overheats on a porch, the telehealth company eats the cost. This operational risk favors giants like Amazon, who have the density to optimize delivery routes, over smaller players using common carriers.40 Amazon uses “intelligent fulfillment” to predict weather impacts and route packages accordingly, reducing delivery misses by 85%.39

6.2 Packaging Innovation

To compete, E-pharmacies are adopting “discreet” cold packaging. The goal is to deliver a medical product that doesn’t look like a medical product, addressing privacy concerns for conditions like weight loss or hormone therapy.3 This is not merely aesthetic; it is a core component of the user experience and retention strategy.

7. Economics of Acquisition: CAC vs. LTV

The death knell for many digital health startups in 2023 was an upside-down unit economic model where the Cost of Customer Acquisition (CAC) exceeded the Lifetime Value (LTV).

7.1 The Marketing Spend Arms Race

Pharmaceutical companies spend nearly $14 billion annually on Direct-to-Consumer (DTC) advertising.41 Telehealth companies are joining this arms race. Hims & Hers deploys an annual marketing budget north of $150 million, utilizing a mix of performance marketing (TikTok/Instagram) and brand awareness (Super Bowl ads).8

There is an “Efficiency Gap.” Traditional pharma TV ads are inefficient “spray and pray.” Telehealth digital ads target specific demographics with immediate calls to action (“Click here to see a doctor”). This digital funnel allows for precise CAC measurement. However, as privacy changes (like Apple’s iOS updates) make tracking harder, CAC is rising.

7.2 LTV and the Subscription Model

The “gym membership” model of healthcare is the goal. The biggest threat to LTV is churn. As noted, adherence to GLP-1s drops significantly after 6-12 months. If a patient stops paying the $99/month subscription because they achieved their weight goal or couldn’t afford the medication, the LTV collapses. To mitigate this, companies like Hims are diversifying. A weight loss patient is cross-sold skincare or mental health support, increasing the “share of wallet” and making the platform stickier.6

8. The Fragmentation Risk: A Critical Downside

While convenient, the unbundling of primary care into “point solutions” (one app for weight, one for mental health, one for birth control) creates clinical risks.

8.1 Care Coordination Failures

Studies warn that telehealth can lead to disconnected care silos. A provider prescribing Adderall on one platform may not know the patient is receiving benzodiazepines from another, leading to dangerous drug interactions.42

There is a palpable concern regarding Primary Care Displacement. Young, healthy patients are bypassing traditional primary care entirely. When they eventually develop a complex condition (e.g., cancer), they lack a “medical home” to coordinate care.44 Furthermore, the lack of communication between these proprietary telehealth platforms and national Electronic Health Records (EHR) systems like Epic or Cerner exacerbates this fragmentation.45 The industry is building “digital islands” of data that do not speak to the mainland of the healthcare system.

9. Future Outlook: Strategic Recommendations for 2025-2026

The trajectory of the pharmaceutical industry is clear: the walls between payer, provider, and pharmacy are dissolving. The winners will be those who can navigate the regulatory grey zones while delivering a consumer-grade experience.

9.1 For Pharmaceutical Companies

- Embrace “Hybrid Commercialization”: Do not rely solely on sales reps. Build or partner with DTP channels (like LillyDirect) to capture patient data.

- Value-Based Contracting: Use the data from digital adherence programs to sign outcome-based contracts with payers. If the telehealth platform improves adherence, the drug rebate should be lower.

9.2 For Telehealth Platforms

- Diversify Supply Chains: Reliance on 503B compounding facilities for GLP-1s is a regulatory time bomb. As the shortage resolves, the FDA will crack down. Pivot back to branded partnerships or legitimate 505(b)(2) proprietary formulations.

- Invest in “Care Wraps”: To reduce churn, invest in human coaching and dietitians. The drug is the hook; the relationship is the retainer.

9.3 For Investors and Analysts

- Watch the “Regulatory Moat”: Avoid companies playing fast and loose with the Ryan Haight Act. Look for companies (like Ro) that are over-investing in compliance and physical infrastructure.

- Monitor Patent Cliffs: Use DrugPatentWatch to track when the next wave of generics will hit. The expiration of patents for drugs like Vyvanse or the future expiration of semaglutide patents will trigger new waves of low-cost telehealth entries.

Key Takeaways

- The Shift is Structural, Not Seasonal: Telehealth has evolved from a pandemic necessity to a permanent commercial channel, projected to reach nearly $800 billion by 2032. The market rewards “specialty-lite” ecosystems (GLP-1s, dermatology) over simple urgent care video visits.

- Vertical Integration Wins: The most successful models (Hims, Ro, Amazon) control the entire stack: marketing, prescribing, and fulfillment. This verticality allows for margin stacking and price control, disrupting the traditional PBM-Pharmacy dominance.

- Big Pharma is Now a Retailer: Eli Lilly’s launch of LillyDirect signals a historic shift. Pharma companies are no longer content to be manufacturers; they want to own the patient relationship and the data that comes with it to bypass intermediaries.

- GLP-1s are the “Killer App”: The obesity epidemic has provided the perfect use case for subscription-based telehealth. However, low long-term adherence rates (approx. 27% at one year) pose a massive threat to LTV models.

- Regulatory Risk is the Elephant in the Room: The “Done Global” indictment and the uncertain future of the Ryan Haight Act waivers create existential risks. Compliance is now a competitive advantage.

- Intelligence is Power: In a genericized market, intellectual property strategy is paramount. Utilizing tools like DrugPatentWatch to identify patent expirations and 505(b)(2) opportunities allows companies to build defensible product portfolios rather than competing in a race to the bottom.

FAQ: Navigating the Telehealth-Pharma Nexus

Q1: How does the “Ryan Haight Act” extension impact telehealth investment strategies?

The “Fourth Temporary Extension” through 2025 provides short-term breathing room but long-term volatility. Investors should be wary of business models solely dependent on prescribing controlled substances (like stimulants for ADHD) via remote-only relationships. The safest bets are hybrid models that have physical footprints or partnerships (like Amazon’s One Medical) which can satisfy potential future in-person requirements, whereas pure-play remote controlled substance platforms face binary regulatory risk.

Q2: Why are pharmaceutical companies like Eli Lilly launching Direct-to-Consumer (DTC) channels like LillyDirect?

It is primarily a data and margin play. By selling directly, Lilly bypasses the “black box” of Pharmacy Benefit Managers (PBMs), gaining visibility into why patients drop off therapy (“last-mile data”). It also allows them to ensure patients receive the branded drug rather than a PBM-preferred alternative, and helps mitigate the rise of counterfeit or compounded versions by establishing a “verified” supply chain.

Q3: Can telehealth companies legally create their own drugs to avoid generic competition?

Yes, through the 505(b)(2) regulatory pathway. This FDA route allows a company to take an existing, off-patent active ingredient (like sildenafil) and approve it in a new form (e.g., a quick-dissolve strip or a combined formulation). This grants them 3-5 years of market exclusivity. Companies use intelligence from platforms like DrugPatentWatch to identify these off-patent candidates and develop proprietary “telehealth-friendly” formulations that cannot be easily substituted by generic pharmacies.

Q4: How do “compounded” GLP-1s fit into the long-term strategy of companies like Hims & Hers?

Compounded drugs are a “bridge” strategy. They are legal currently due to the FDA’s shortage list status for semaglutide. They drive massive customer acquisition because they are cheaper and available. However, once the brand-name shortage is officially resolved, the legal exemption evaporates. Smart companies are using compounding to acquire customers now, with the intention of transitioning them to branded drugs or other proprietary weight management solutions once the regulatory window closes.

Q5: What is the “fragmentation penalty” in telehealth, and how does it affect ROI?

The fragmentation penalty refers to the loss of care coordination when a patient sees different telehealth providers for different body parts (e.g., Ro for weight, BetterHelp for mind, Curology for skin). Data shows this leads to lower adherence rates compared to centralized primary care. For business models, this manifests as high churn. If a patient isn’t getting holistic support, they are more likely to stop the medication when side effects occur. Therefore, ROI calculations must factor in higher retention costs (coaching, app engagement) to counteract this fragmentation.

Works cited

- Telehealth Market Size, Share, Growth | Trends Analysis [2032] – Fortune Business Insights, accessed December 29, 2025, https://www.fortunebusinessinsights.com/industry-reports/telehealth-market-101065

- Digital Health Trends 2024 | IQVIA, accessed December 29, 2025, https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/digital-health-trends-2024

- E-pharmacy Market Size, Share & Trends Report, 2030 – Mordor Intelligence, accessed December 29, 2025, https://www.mordorintelligence.com/industry-reports/epharmacy-market

- Hims & Hers Health, Inc. Reports Third Quarter 2024 Financial Results, accessed December 29, 2025, https://investors.hims.com/news/news-details/2024/Hims–Hers-Health-Inc.-Reports-Third-Quarter-2024-Financial-Results/default.aspx

- FINAL Q3 2024 Shareholder Letter, accessed December 29, 2025, https://s27.q4cdn.com/787306631/files/doc_financials/2024/q3/FINAL-Q3-2024-Shareholder-Letter.pdf

- Hims & Hers Health, Inc. (HIMS), accessed December 29, 2025, https://s27.q4cdn.com/787306631/files/doc_financials/2024/q3/CORRECTED-TRANSCRIPT_-Hims-Hers-Health-Inc-HIMS-US-Q3-2024-Earnings-Call-4-November-2024-5_00-PM-ET.pdf

- The Rise of Telehealth Companies Like Ro and Hims & Hers: How Direct-to-Consumer Telehealth Redefined the Pharmaceutical Value Chain – DrugPatentWatch, accessed December 29, 2025, https://www.drugpatentwatch.com/blog/novel-pharmaceutical-strategies-and-business-models-the-rise-of-telehealth-companies-like-ro-and-hims-hers/

- Ro revenue, valuation & funding | Sacra, accessed December 29, 2025, https://sacra.com/c/ro/

- New Trend: Eli Lilly’s Direct to Consumer Model Streamlining Services to Patients, accessed December 29, 2025, https://www.frierlevitt.com/articles/new-trend-eli-lillys-direct-to-consumer-model-streamlining-services-to-patients/

- Why pharma companies like Eli Lilly and Pfizer are going DTC – Healthcare Brew, accessed December 29, 2025, https://www.healthcare-brew.com/stories/2024/09/16/pharma-companies-going-dtc

- Pfizer and Lilly are elbowing into the direct-to-consumer market. Will it work?, accessed December 29, 2025, https://www.biopharmadive.com/news/pfizer-eli-lilly-direct-to-consumer-glp-1/716866/

- 2024 Year in Review – Eli Lilly, accessed December 29, 2025, https://www.lilly.com/about/year-in-review

- Lilly reports full Q4 2024 financial results and provides 2025 guidance, accessed December 29, 2025, https://investor.lilly.com/news-releases/news-release-details/lilly-reports-full-q4-2024-financial-results-and-provides-2025

- Pfizer Launches PfizerForAll™, a Digital Platform that Helps Simplify Access to Healthcare, accessed December 29, 2025, https://www.pfizer.com/news/press-release/press-release-detail/pfizer-launches-pfizerforalltm-digital-platform-helps

- Pfizer intros PfizerForAll, a digital platform that helps simplify access to health care, accessed December 29, 2025, https://chaindrugreview.com/pfizer-intros-pfizerforall-a-digital-platform-that-helps-simplify-access-to-health-care/

- Amazon Pharmacy patients can now automatically receive coupon savings on eligible medication purchases, accessed December 29, 2025, https://www.aboutamazon.com/news/retail/amazon-pharmacy-coupons

- Amazon Pharmacy vs GoodRx Prescription Pricing: Which is Cheaper? – YouTube, accessed December 29, 2025, https://www.youtube.com/watch?v=KY5Xv-iPllo

- Amazon Clinic: What Amazon’s Direct-to-Consumer Launch Means for Hims, Ro, and Healthcare – Hospitalogy, accessed December 29, 2025, https://hospitalogy.com/articles/2022-11-17/amazon-clinic-the-numbers-mason-what-do-they-mean/

- Monitoring Report: GLP-1 RA Prescribing Trends – December 2024 Data – medRxiv, accessed December 29, 2025, https://www.medrxiv.org/content/10.1101/2025.03.06.25323524v1.full.pdf

- Real-world persistence and adherence to glucagon-like peptide-1 receptor agonists among obese commercially insured adults without diabetes – NIH, accessed December 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11293763/

- Real-world trends in GLP-1 treatment persistence and prescribing for weight management, accessed December 29, 2025, https://www.bcbs.com/media/pdf/BHI_Issue_Brief_GLP1_Trends.pdf

- GLP-1 receptor agonist therapy for obesity via direct-to-consumer telemedicine: Clinical characteristics and treatment outcomes – NIH, accessed December 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12457751/

- Real-world persistence and adherence to glucagon-like peptide-1 receptor agonists among obese commercially insured adults without diabetes | Journal of Managed Care & Specialty Pharmacy, accessed December 29, 2025, https://www.jmcp.org/doi/10.18553/jmcp.2024.23332

- Digital Health Company and Medical Practice Indicted in $100M Adderall Distribution Scheme – Department of Justice, accessed December 29, 2025, https://www.justice.gov/opa/pr/digital-health-company-and-medical-practice-indicted-100m-adderall-distribution-scheme

- Digital Health Company Cofounder/CEO and Clinical President Convicted in $100M Adderall Distribution and Health Care Fraud Scheme – DEA.gov, accessed December 29, 2025, https://www.dea.gov/press-releases/2025/11/20/digital-health-company-cofounderceo-and-clinical-president-convicted-100m

- Landmark Paragraph IV Patent Challenge Decisions: A Strategic Playbook for Generic Manufacturers – DrugPatentWatch – Transform Data into Market Domination, accessed December 29, 2025, https://www.drugpatentwatch.com/blog/landmark-paragraph-iv-patent-challenge-decisions-a-strategic-playbook-for-generic-manufacturers/

- When will the WEGOVY patents expire, and when will generic WEGOVY be available? – Drug Patent Watch, accessed December 29, 2025, https://www.drugpatentwatch.com/p/tradename/WEGOVY

- Off-patent semaglutide in 2026: the next revolution in anti-obesity medications | IQVIA, accessed December 29, 2025, https://www.iqvia.com/locations/emea/blogs/2025/07/off-patent-semaglutide

- Leveraging 505(b)(2) to Innovate Beyond Existing Drug Patents – DrugPatentWatch, accessed December 29, 2025, https://www.drugpatentwatch.com/blog/leveraging-505b2-to-innovate-beyond-existing-drug-patents/

- Review of Drugs Approved via the 505(b)(2) Pathway: Uncovering Drug Development Trends and Regulatory Requirements – DrugPatentWatch, accessed December 29, 2025, https://www.drugpatentwatch.com/blog/review-of-drugs-approved-via-the-505b2-pathway-uncovering-drug-development-trends-and-regulatory-requirements/

- Strategic Pricing and Market Access for 505(b)(2) Therapeutics: A Framework for Optimal Launch – DrugPatentWatch, accessed December 29, 2025, https://www.drugpatentwatch.com/blog/strategic-pricing-and-market-access-for-505b2-therapeutics-a-framework-for-optimal-launch/

- Maximizing Pharmaceutical Patent Longevity: A Mechanistic and Strategic Guide to IP Term Extension and Lifecycle Fortification – DrugPatentWatch – Transform Data into Market Domination, accessed December 29, 2025, https://www.drugpatentwatch.com/blog/how-long-do-drug-patents-last/

- DEA Extends Telemedicine Flexibilities for Controlled Substance Prescribing Into 2026, accessed December 29, 2025, https://www.chesshealthsolutions.com/2025/12/16/dea-extends-telemedicine-flexibilities-for-controlled-substance-prescribing-into-2026/

- DEA signals extension of telemedicine flexibilities for controlled substance prescribing for 2026 – McDermott Will & Schulte, accessed December 29, 2025, https://www.mwe.com/insights/dea-signals-extension-of-telemedicine-flexibilities-for-controlled-substance-prescribing-for-2026/

- Brief Telehealth: Licensure and Interstate Compacts – National Conference of State Legislatures, accessed December 29, 2025, https://www.ncsl.org/health/the-telehealth-explainer-series/licensure-and-interstate-compacts

- District of Columbia Telehealth Laws – CCHP – Center for Connected Health Policy, accessed December 29, 2025, https://www.cchpca.org/district-of-columbia/

- Cold Chain Logistics: Challenges, Solutions & Best Practices 2025 – Hopstack, accessed December 29, 2025, https://www.hopstack.io/blog/cold-chain-logistics-challenges-solutions-best-practices

- The life of a prescription at Amazon Pharmacy, accessed December 29, 2025, https://www.amazon.science/blog/the-life-of-a-prescription-at-amazon-pharmacy

- Amazon’s newest AI and robotics systems are empowering employees and speeding up delivery, accessed December 29, 2025, https://www.aboutamazon.com/news/operations/amazon-delivering-future-2025-online-shopping-speed-delivery

- CSRxP ANALYSIS FINDS BIG PHARMA’S DIRECT-TO-CONSUMER (DTC) ADVERTISING COSTS U.S. TAXPAYERS BILLIONS OF DOLLARS, accessed December 29, 2025, https://www.csrxp.org/csrxp-analysis-finds-big-pharmas-direct-to-consumer-dtc-advertising-costs-u-s-taxpayers-billions-of-dollars/

- Navigating fragmented care: a qualitative study on multimorbidity management challenges in Beijing’s tiered healthcare system – PubMed Central, accessed December 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12392530/

- Telehealth in primary care risks fragmentation of patient info, accessed December 29, 2025, https://archive.thepcc.org/2019/03/21/telehealth-primary-care-risks-fragmentation-patient-info

- Primary Care Practice Telehealth Use and Low-Value Care Services – PMC – NIH, accessed December 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11544489/

- Digital Information Ecosystems in Modern Care Coordination and Patient Care Pathways and the Challenges and Opportunities for AI Solutions – Journal of Medical Internet Research, accessed December 29, 2025, https://www.jmir.org/2024/1/e60258/