The global pharmaceutical industry stands at a pivotal juncture. While established markets continue to offer stability, the undeniable trajectory of growth points overwhelmingly towards emerging economies. These regions, once considered secondary, are rapidly ascending to become central pillars of global pharmaceutical expansion, driven by burgeoning populations, increasing disposable incomes, and evolving healthcare infrastructures. For pharmaceutical companies, navigating this shifting landscape requires more than just market entry; it demands a sophisticated, proactive intellectual property (IP) strategy that transforms patent data into a potent source of competitive advantage.

The Unfolding Opportunity: Why Emerging Markets are Critical for Pharma IP

The strategic imperative for pharmaceutical companies to prioritize emerging markets (EMs) is clear. These regions represent not merely an additional revenue stream but a fundamental component of future global growth. Securing robust intellectual property rights within these dynamic economies is no longer a reactive measure but a proactive, core business development strategy.

The Shifting Global Pharmaceutical Landscape

The pharmaceutical market is undergoing a profound transformation, with a notable shift in its growth epicenters. Traditional developed markets are reaching saturation, experiencing slower growth rates, while emerging economies are demonstrating remarkable dynamism. This demographic and economic realignment necessitates a fundamental re-evaluation of global market strategies, placing emerging markets at the forefront of strategic planning. Projections indicate that the pharmaceutical market in emerging markets is poised for substantial expansion, with a Compound Annual Growth Rate (CAGR) of 6.9% through 2027, ultimately reaching an estimated $500 billion . This robust growth trajectory underscores the immense commercial potential that these regions hold.

Nations such as Brazil, Russia, India, China, and South Africa, collectively known as the BRICS nations, are consistently identified as key emerging markets, representing significant growth opportunities for pharmaceutical innovators . The sheer scale of this projected market, approaching half a trillion dollars, transforms the investment in complex IP strategies from a desirable option into an absolute necessity for securing future revenue streams. This substantial growth indicates that emerging markets are no longer merely supplementary territories but are becoming central to global pharmaceutical growth strategies. Consequently, the traditional approach of focusing initial patenting efforts on developed markets and then “cascading” to emerging economies is becoming increasingly outdated. Instead, simultaneous, or even earlier, consideration of IP protection in emerging markets is now critical for long-term success.

The Strategic Imperative of Early Patent Protection

In high-growth, competitive pharmaceutical markets, securing intellectual property rights early is paramount for establishing market exclusivity and effectively deterring generic competition. The pharmaceutical industry, characterized by immense research and development (R&D) costs, relies heavily on market exclusivity as the primary mechanism for recouping these substantial investments. Early and robust patenting provides a crucial competitive moat, enabling innovators to capture significant market share and establish brand loyalty before the inevitable entry of generic alternatives. This proactive IP stance also significantly influences subsequent pricing and reimbursement negotiations, allowing companies to command a premium for their innovations.

Given the rapid growth observed in emerging markets and the inherent complexities of their diverse IP regimes , early patent filing extends beyond mere protection; it embodies a strategic move to establish a “first-mover advantage” within the IP landscape. This proactive approach can effectively preempt competitors, secure broader patent claims, and potentially even influence future regulatory pathways or local patent office interpretations, thereby creating a formidable barrier to entry for rivals. Furthermore, as pharmaceutical companies increasingly look to commercialize their products in emerging markets, partnerships, including licensing agreements and joint ventures, become critical avenues for market access . A strong, early patent portfolio in these markets significantly enhances a company’s negotiating leverage and the perceived value of its assets during mergers and acquisitions (M&A) or licensing discussions . Such a portfolio signals a serious, long-term commitment to the market, attracting more reputable and capable partners who recognize the value of secured IP.

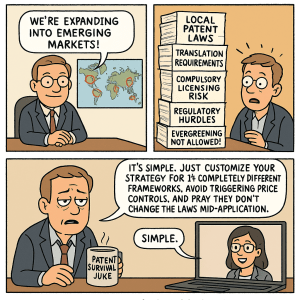

Navigating the Labyrinth: Understanding Diverse Patent Regimes

A deep understanding of the heterogeneous nature of intellectual property laws across emerging markets is fundamental. A “one-size-fits-all” approach to patent filing and enforcement in these regions is not only ineffective but can also prove detrimental to a company’s strategic objectives and commercial success.

Key Characteristics of Emerging Market IP Frameworks

Unlike the relatively harmonized intellectual property landscape found in many developed regions, emerging markets present a complex mosaic of legal frameworks. These frameworks often reflect unique national priorities, varying stages of economic development, and distinct public health considerations. The intellectual property regimes in emerging markets are characterized by their complexity, dynamic evolution, and inherent diversity, necessitating the development and implementation of highly tailored strategies for each jurisdiction . Despite ongoing efforts towards IP harmonization on a global scale, progress remains slow, further underscoring the critical need for country-specific approaches to patent protection .

This inherent diversity means that patentability criteria, examination procedures, and enforcement mechanisms can vary significantly from one emerging market to another. While this presents considerable challenges for pharmaceutical innovators, it also offers unique opportunities for strategic navigation. The diversity and complexity observed in these IP systems are not arbitrary; they often directly reflect deeply embedded national priorities. For instance, India’s Section 3(d), which imposes restrictions on the patentability of new forms of known substances unless their efficacy is significantly enhanced , is a direct manifestation of its public health agenda aimed at promoting access to affordable medicines. This implies that a successful IP strategy in emerging markets must be intrinsically linked to a nuanced understanding of the socio-economic and political context of each country, extending beyond mere legal texts. It requires the ability to anticipate potential policy shifts and adapt accordingly.

Moreover, the complexity and slow pace of harmonization in these jurisdictions translate into tangible operational costs. These include increased legal fees for engaging local counsel , potentially longer timelines for patent prosecution , and greater uncertainty surrounding patent enforcement . These often “hidden” costs must be meticulously factored into the overall market entry and IP budget, as they can significantly influence market prioritization and resource allocation decisions.

Country Spotlights: Patenting Nuances in Major Emerging Economies

A detailed examination of specific major emerging markets, particularly the BRICS nations, reveals the practical implications of their unique IP frameworks, highlighting the need for granular strategic planning.

Patentability Criteria and Scope Variations

The definition of what constitutes a patentable invention, especially concerning pharmaceutical compounds, can differ substantially across emerging markets, directly impacting the breadth and enforceability of granted patents. India, for example, employs a stringent provision, Section 3(d), which specifically restricts the patentability of new forms of known substances unless a significant enhancement in their efficacy can be demonstrated . This provision aims to prevent “evergreening” strategies, where minor modifications to existing drugs are patented to extend market exclusivity, and instead promotes genuine innovation that offers clear therapeutic advantages. In contrast, South Africa operates a deposit-based patent system that does not involve substantive examination . While this system can lead to quicker patent grants, it places a higher burden on the patent holder to defend the validity of their patent during any subsequent infringement litigation.

India’s Section 3(d) directly influences the R&D strategy for pharmaceutical products targeting the Indian market. Companies cannot simply make minor modifications to existing compounds; they are compelled to pursue truly novel compounds or demonstrate significant efficacy enhancements. This pushes innovation towards higher therapeutic value, a trend that can have positive global implications for product development. Conversely, South Africa’s deposit-based system means that while the initial filing process might be expedited, the true strength of a patent is only tested during litigation. This necessitates a proactive approach to evidence gathering and a robust legal strategy from the outset, shifting the focus from pre-grant examination to post-grant enforcement readiness. This system inherently implies a higher litigation risk and potentially increased costs associated with defending patent validity .

Grace Periods and Novelty Requirements

Grace periods offer a crucial window of flexibility for inventors, allowing them to publicly disclose their inventions before filing a patent application without jeopardizing the novelty requirement. Some emerging markets provide such grace periods for disclosures made prior to patent filing, offering valuable flexibility for applicants . Understanding these grace periods is vital for pharmaceutical companies that might present research findings at scientific conferences or publish them in academic journals before formal patent applications are submitted.

The existence of grace periods allows for a more flexible and potentially advantageous publication strategy. Companies can present early research findings at scientific conferences or in peer-reviewed journals, gaining scientific recognition, soliciting feedback from the broader scientific community, and even attracting potential collaborators, all without immediately forfeiting their patent rights in certain emerging markets. This can accelerate scientific discourse and collaboration while still preserving crucial IP options. However, it demands meticulous tracking of all disclosure dates and a thorough understanding of country-specific grace period rules to avoid inadvertently compromising patentability.

The Role of International Treaties and Local Adaptations

International agreements, most notably the TRIPS Agreement (Agreement on Trade-Related Aspects of Intellectual Property Rights), establish baseline intellectual property standards that signatory countries are expected to uphold. However, national laws in emerging markets frequently adapt or go beyond these minimum standards, reflecting specific local priorities and developmental stages. For instance, Brazil’s National Health Surveillance Agency (ANVISA) requires prior consent for pharmaceutical patents, a unique regulatory hurdle that often causes significant delays in the overall patent examination process . While China has made considerable efforts to improve its IP enforcement mechanisms, persistent challenges remain . Similarly, Russia continues to face ongoing IP enforcement challenges despite legislative improvements aimed at strengthening its IP framework .

The ANVISA requirement in Brazil exemplifies a unique regulatory linkage, where the grant of a patent is tied to a health authority’s review. This creates a significant bottleneck, directly impacting a product’s time-to-market and potentially delaying revenue generation. Pharmaceutical companies must factor these potential delays into their R&D and commercialization timelines, potentially prioritizing markets without such linkages or developing specific strategies to expedite ANVISA review processes. The situations in China and Russia highlight a critical distinction: the existence of intellectual property laws versus their effective enforcement in practice. This means that a patent grant is merely the first step; a robust enforcement strategy, encompassing local litigation expertise , active market monitoring, and potentially engagement with government bodies, is absolutely crucial. This gap between legal framework and practical enforcement implies higher operational risk and increased costs for maintaining market exclusivity.

To provide a clearer comparative perspective on the diverse patentability criteria across key emerging markets, the following table summarizes essential aspects:

Table 1: Comparative Overview of Key Patentability Criteria in Select Emerging Markets

| Country | Novelty Requirements | Inventive Step/Non-obviousness Criteria | Industrial Applicability/Utility | Specific Pharma Restrictions (e.g., 3(d), ANVISA) | Grace Period (Yes/No, Duration) |

| China | Absolute novelty | High standard, non-obvious to person skilled in the art | Yes | No specific pharma restrictions like 3(d) | Yes, 6 months for certain disclosures |

| India | Absolute novelty | High standard, non-obvious to person skilled in the art | Yes | Yes, Section 3(d) restricts new forms of known substances unless efficacy is significantly enhanced | Yes, 12 months for certain disclosures |

| Brazil | Absolute novelty | High standard, non-obvious to person skilled in the art | Yes | Yes, ANVISA prior consent required for pharmaceutical patents, causing delays | Yes, 12 months for certain disclosures |

| Russia | Absolute novelty | High standard, non-obvious to person skilled in the art | Yes | No specific pharma restrictions like 3(d) | Yes, 6 months for certain disclosures |

| South Africa | Absolute novelty | Deposit-based system, no substantive examination | Yes | No specific pharma restrictions like 3(d) | Yes, 6 months for certain disclosures |

This table serves as a quick reference for strategists, allowing for a rapid understanding of the patentability landscape across these critical markets. It helps identify jurisdictions where a specific drug might encounter unique challenges, such as India’s Section 3(d), or where the patent system is more permissive, as seen with South Africa’s deposit system. This information is invaluable for informing filing priorities and guiding R&D focus, acting as a practical tool for initial market assessment.

Strategic Approaches to Patent Filing and Portfolio Management

Moving beyond an understanding of the diverse IP landscape, pharmaceutical companies must adopt actionable strategies for building and managing a robust patent portfolio in emerging markets. This involves careful consideration of filing pathways, prioritization, and ongoing maintenance.

To PCT or Not to PCT? Optimizing Filing Pathways

The Patent Cooperation Treaty (PCT) offers a streamlined international patent filing procedure, allowing a single application to initiate the patent process in numerous member countries . A key advantage of the PCT system is its ability to delay national phase entry, providing applicants with more time to make strategic decisions regarding their patent applications . This delay, typically up to 30 or 31 months, offers valuable time to conduct further market assessments, evaluate clinical trial outcomes, and secure additional funding before committing significant resources to national filings in each target country.

The “delaying national phase entry” aspect of the PCT is more than a mere procedural convenience; it represents a significant strategic advantage. It allows companies to gather more comprehensive market intelligence, assess the full implications of clinical trial results, and closely monitor competitor activity in emerging markets before committing substantial financial and human resources to individual national filings. This reduces the risk of investing in patents for drugs that may not ultimately succeed commercially or that face unexpected competitive pressures, thereby optimizing the allocation of valuable resources. Furthermore, the PCT effectively functions as a global “screening” mechanism for intellectual property. By filing a single international application, companies can keep their options open across a wide array of emerging markets without incurring immediate high costs. This fosters a more flexible and responsive global IP strategy, enabling them to pivot to specific emerging markets as commercial opportunities or competitive threats become clearer, rather than being locked into early national decisions that might later prove suboptimal.

Prioritization and Phased Filing Strategies

Given the considerable resource intensity associated with global patenting, a strategic approach to prioritizing markets and phasing patent filings is absolutely essential. Pharmaceutical companies typically prioritize markets based on a confluence of factors, including market size, projected growth potential, regulatory stability, and the enforceability of intellectual property rights. A phased filing approach might involve an initial focus on core strategic markets, followed by a gradual expansion into secondary markets as commercial strategies evolve and market intelligence matures.

The evolving nature of emerging market IP regimes and their dynamic growth trajectories mean that patent filing prioritization cannot be a static exercise. It must be a continuous, dynamic process, regularly updated with fresh market intelligence, changes in regulatory frameworks, and shifts in the competitive landscape . This necessitates robust internal analytics capabilities and a consistent commitment to external market monitoring. A phased filing strategy also allows for a “risk-adjusted” intellectual property investment. Companies can front-load their investment in markets that offer strong IP protection and high commercial potential, while adopting a more cautious or delayed approach in markets with higher IP risks, such as those prone to compulsory licensing or weak enforcement, until commercial viability is more thoroughly proven or local conditions improve. This approach ensures that resources are deployed efficiently and strategically.

Building a Robust Patent Portfolio for Emerging Markets

A truly robust patent portfolio extends far beyond a single patent; it encompasses a comprehensive network of patents and related intellectual property rights designed to provide multi-faceted protection. This involves strategically filing multiple types of patents, such as those covering the core compound, specific formulations, methods of use, or polymorphic forms of a drug. Crucially, it also entails leveraging other forms of intellectual property, such as data exclusivity, particularly in markets where patentability criteria are stringent, as exemplified by India’s Section 3(d) . Data exclusivity protects clinical trial data, preventing generic manufacturers from relying on it for a specified period, thereby offering a crucial complementary layer of IP protection .

Relying solely on a single compound patent in emerging markets is often insufficient, especially given the varying patentability criteria and ongoing enforcement challenges . A “multi-layered” approach, incorporating patents for formulations, methods of use, and, critically, data exclusivity , creates a far more resilient intellectual property fortress. Data exclusivity, being a regulatory rather than a patent-based right, can offer a period of market protection even in jurisdictions where patent grants are difficult to obtain or where patents are successfully challenged. Furthermore, a robust portfolio is not merely about legal protection; it is fundamentally about creating commercial barriers. By covering various aspects of a drug, such as specific manufacturing processes or particular indications, companies can significantly complicate generic entry, even if the primary compound patent is challenged or expires. This forces generic manufacturers to invest more heavily in R&D to “design around” the innovator’s IP, increasing their costs and delaying their market entry, thereby extending the innovator’s period of commercial advantage.

Managing Patent Annuities and Maintenance Costs

Maintaining a global patent portfolio incurs significant ongoing costs in the form of annuities and renewal fees. These recurring expenses necessitate careful and strategic management to ensure that resources are allocated efficiently. Pharmaceutical companies must regularly review their patent portfolios, making informed decisions about which patents to maintain and which to abandon. These decisions should be based on a dynamic assessment of market potential, the evolving competitive landscape, and the overarching commercial strategy for each product and market.

Patent annuities and maintenance costs necessitate a rigorous “lifecycle management” approach to intellectual property. Companies must continuously evaluate the commercial value and strategic importance of each patent in every emerging market against its ongoing maintenance cost. This involves a dynamic assessment, potentially leading to the abandonment of patents in markets where commercial prospects have diminished or where enforcement is deemed unfeasible, thereby freeing up resources for more valuable intellectual property assets. The decision to maintain a patent in an emerging market should be driven by a clear cost-benefit analysis. This analysis must consider not only the direct annuity fees but also the potential for revenue generation, the deterrence value against generic competitors, and the overall strategic importance of the market. This elevates IP management from a purely legal function to a core financial and strategic responsibility within the organization.

Mitigating Risks: Challenges in Enforcement and Market Access

Despite meticulous patent filing strategies, pharmaceutical companies operating in emerging markets inevitably face significant risks related to the practical challenges of protecting and commercializing their patented drugs. These challenges extend beyond the grant of a patent to the complexities of enforcement and market access.

The Shadow of Counterfeiting and Infringement

Counterfeiting and patent infringement represent pervasive issues in many emerging markets, posing severe threats to innovator revenue, patient safety, and brand reputation. The illicit trade in counterfeit medicines is a significant concern in emerging markets, directly impacting patient health outcomes and leading to substantial revenue losses for legitimate pharmaceutical companies . While some major markets like China have made commendable efforts to improve intellectual property enforcement, challenges continue to persist . Similarly, Russia continues to grapple with ongoing IP enforcement challenges despite legislative improvements designed to strengthen its IP framework . These issues demand proactive monitoring, robust legal strategies, and close collaboration with local authorities. The persistent enforcement challenges in major markets like China and Russia underscore the critical need for unflagging vigilance.

Counterfeiting is not merely a matter of revenue loss; it poses a grave threat to patient safety and can severely damage a company’s brand reputation. This elevates intellectual property enforcement from a purely legal concern to a critical public health and corporate social responsibility issue. Companies must invest in advanced anti-counterfeiting technologies, implement secure supply chain measures, and engage in public awareness campaigns, extending beyond traditional legal action, to protect both their valuable assets and, more importantly, the consumers who rely on their products. The persistence of enforcement challenges in major emerging markets further implies that an IP strategy must incorporate a robust, multi-jurisdictional enforcement plan. This involves coordinating legal action across different countries, understanding the varying court procedures and legal precedents, and potentially engaging with international bodies, all of which add layers of complexity and cost to IP management .

Understanding Compulsory Licensing and Parallel Imports

Compulsory licensing and parallel imports are mechanisms, often rooted in public health concerns, that allow governments to override patent rights under specific conditions. These measures pose a significant risk to pharmaceutical innovators, potentially eroding market exclusivity and revenue streams. Compulsory licensing permits a government to authorize a third party to produce a patented product without the patent holder’s consent, typically in situations deemed public health emergencies or for reasons of national security. Brazil, for instance, has a notable history of issuing compulsory licenses for public health reasons . Parallel imports, on the other hand, involve importing a patented product from a country where it is sold at a lower price into a market where it commands a higher price, effectively bypassing the patent holder’s control over distribution. Both mechanisms can significantly diminish the value of patent protection and impact profitability.

Brazil’s history with compulsory licensing vividly illustrates how public health concerns can, and often do, override intellectual property rights in emerging markets. This means that a comprehensive IP strategy must incorporate a “public health risk assessment” alongside traditional legal and commercial evaluations. Companies need to proactively consider strategies such as tiered pricing models or voluntary licensing agreements to preempt the imposition of compulsory licenses, thereby balancing profitability with the critical need for access to medicines. Compulsory licensing and parallel imports highlight a fundamental tension: the imperative to protect innovation through patents versus the societal demand for equitable access to essential medicines. This dilemma is particularly acute in emerging markets, where healthcare needs are often immense and resources are constrained. Companies must proactively engage with governments and other stakeholders to demonstrate their commitment to access, potentially through differential pricing strategies or local manufacturing initiatives , to reduce the likelihood of such measures being invoked.

Data Exclusivity and Regulatory Linkage: A Critical Interplay

Beyond traditional patents, data exclusivity offers another vital layer of protection for pharmaceutical innovators, while regulatory linkage can either strengthen or complicate the exercise of intellectual property rights. Data exclusivity protects clinical trial data, preventing generic manufacturers from relying on the innovator’s proprietary data for a specified period to obtain their own marketing approvals . This provides a de facto period of market exclusivity, regardless of patent status. Conversely, regulatory linkage, as exemplified by Brazil’s ANVISA requirement for prior consent for pharmaceutical patents, can tie the patent grant to regulatory approval, introducing significant delays .

In markets where patent protection is inherently weak, perhaps due to stringent patentability criteria like India’s Section 3(d) , or where enforcement is consistently challenging , data exclusivity becomes a crucial fallback or complementary form of protection. It provides a period of market exclusivity independent of patent status, offering a vital window for commercialization and revenue generation. Companies must therefore possess a thorough understanding of the specific data exclusivity regimes and their durations in each target emerging market. Regulatory linkages, such as ANVISA’s prior consent , are not merely procedural delays; they function as intellectual property risk magnifiers. They extend the period of uncertainty before a patent grant, potentially exposing the innovator to earlier generic entry or increasing the risk of litigation. Companies must meticulously factor these regulatory timelines into their IP filing strategies and overall market entry plans, adjusting their global launch sequences accordingly.

Navigating Local Litigation and Dispute Resolution

Despite the most meticulous efforts in patent filing and portfolio management, disputes are an inevitable part of operating in complex markets. Therefore, a deep understanding of the local legal landscape for litigation and alternative dispute resolution is absolutely critical. Patent litigation in emerging markets can be both costly and time-consuming . This underscores the paramount importance of filing robust initial patent applications and implementing proactive enforcement strategies to deter infringement from the outset. Engaging highly experienced local counsel is indispensable for navigating the unique procedural and substantive aspects of local legal systems .

Given the significant costs and time commitment associated with litigation in emerging markets , pharmaceutical companies cannot afford to be reactive. A proactive “litigation readiness” strategy is essential. This involves continuous monitoring for potential infringement, systematically gathering evidence, and preparing legal arguments even before a dispute formally arises. Such preparedness can significantly reduce the time and cost burden once litigation commences. The inherent complexity of emerging market intellectual property laws and the persistent enforcement challenges make the role of local counsel not merely beneficial but absolutely indispensable. Local counsel provides not only crucial legal expertise but also invaluable cultural and political insights, understanding the unwritten rules and relationships that can profoundly influence litigation outcomes. This partnership with local experts is a strategic asset that can determine the success or failure of IP enforcement efforts.

Unlocking Competitive Advantage: Leveraging Patent Data

Beyond the defensive aspects of patent protection, intellectual property data, when analyzed effectively, can be transformed into a powerful strategic asset. This involves moving beyond simply protecting existing innovations to proactively leveraging patent intelligence for competitive advantage.

Patent Analytics for Strategic Intelligence

Patent data, when subjected to rigorous analysis, offers an exceptionally rich source of intelligence about competitors’ strategies, emerging market trends, and potential “white spaces” for future innovation. Patent analytics helps identify competitor IP strategies, pinpoint areas of unmet need or unpatented innovation, and track broader market trends . This analytical capability extends to critical business activities such as mergers and acquisitions, where thorough intellectual property due diligence is vital, particularly in emerging markets with their diverse IP landscapes . By meticulously analyzing competitor patent filings, monitoring patent expiry dates, and tracking litigation activities, companies can anticipate future market entries, identify potential threats from generic manufacturers, and uncover previously unaddressed market needs or areas ripe for new patentable inventions.

Patent analytics is not merely descriptive; it possesses significant predictive power. By closely tracking competitor patent applications, especially those filed in emerging markets, pharmaceutical companies can anticipate their rivals’ R&D focus, potential new product launches, and market entry strategies years in advance. This foresight enables the development of proactive counter-strategies, such as accelerating their own R&D efforts or strategically strengthening their IP portfolio in relevant therapeutic areas. Furthermore, the emphasis on IP due diligence for M&A activities in emerging markets highlights that intellectual property is a critical component of overall business strategy, not merely a legal silo. The strength or weakness of an IP portfolio can profoundly impact the valuation, risk assessment, and ultimate success of mergers or acquisitions, making IP analysts key players in corporate development and strategic decision-making.

Market Access Strategies Driven by Patent Insights

Patent data can directly inform and optimize market access strategies, from the sequencing of product launches to the determination of pricing. By understanding patent expiry dates and the broader intellectual property landscape of a specific therapeutic area, companies can strategically time their market entries, prepare for the inevitable arrival of generic competition, and tailor their commercial strategies to maximize market penetration and profitability. Specialized tools, such as DrugPatentWatch, provide invaluable data on patent expiry dates, litigation status, and generic entry information .

Patent expiry data obtained from platforms like DrugPatentWatch empowers companies to strategically sequence product launches across various emerging markets. They can prioritize markets where their patents offer a longer period of exclusivity or where competitor patents are expiring sooner, thereby maximizing early revenue capture and minimizing exposure to immediate generic competition. Moreover, the ability to monitor generic entry information through patent data facilitates proactive generic threat management. Companies can anticipate which generic manufacturers are likely to enter which markets and when, allowing them to prepare robust market defense strategies. These might include implementing patient support programs, developing new formulations or delivery methods, or making strategic competitive pricing adjustments to maintain market share and profitability.

The Power of Specialized Tools: Insights from DrugPatentWatch

Specialized databases and analytical platforms are indispensable for effectively leveraging the vast amounts of patent data available. Tools like DrugPatentWatch aggregate complex patent information, making it readily accessible and actionable for business intelligence purposes . This enables pharmaceutical companies to efficiently monitor competitor activities, track the lifecycles of their own and competitors’ patents, and identify both emerging opportunities and potential threats within the global pharmaceutical landscape.

Platforms such as DrugPatentWatch play a vital role in democratizing access to complex patent information. They enable a broader range of teams within a pharmaceutical company—including business development, market access, and R&D—to integrate patent intelligence into their strategic planning. This fosters a more holistic, intellectual property-aware organizational culture, where patent insights are not confined to legal departments but inform decisions across the enterprise. Furthermore, the capability of DrugPatentWatch to provide “litigation status and generic entry information” facilitates real-time competitive monitoring. This is particularly crucial in the fast-evolving landscapes of emerging markets, allowing companies to react swiftly to new threats or opportunities, rather than relying on outdated or incomplete information.

To illustrate the practical utility of such tools, the following table presents hypothetical data points that could be derived from a platform like DrugPatentWatch for a specific therapeutic area.

Table 2: Illustrative Data Points from DrugPatentWatch for a Hypothetical Therapeutic Area (Type 2 Diabetes)

| Drug Name (Hypothetical) | Therapeutic Area | Key Emerging Market | Patent Number | Patent Expiry Date (Estimated) | Litigation Status | Generic Entry (Yes/No, Date) | Competitor (if applicable) |

| DiabetoGuard | Type 2 Diabetes | China | CN1234567 | 2030-05-15 | Active | No | PharmaCo A |

| GlucoShield | Type 2 Diabetes | India | IN9876543 | 2028-11-20 | Resolved (Invalidated) | Yes, 2024-03-01 | BioGen Inc. |

| InsulEase | Type 2 Diabetes | Brazil | BR5432109 | 2032-01-01 | None | No | InnovatePharma |

| SugarBlock | Type 2 Diabetes | Russia | RU1122334 | 2029-07-10 | Active | No | GlobalMeds |

| MetaboFix | Type 2 Diabetes | South Africa | ZA7654321 | 2027-04-25 | None | No | LocalPharma |

This illustrative table visually demonstrates the actionable insights that can be derived from patent analytics. It shows how specific data points—such as patent expiry dates, litigation status, and generic entry information—directly translate into strategic intelligence for market timing, risk assessment, and competitive positioning. For instance, knowing that “GlucoShield” has an invalidated patent in India and generic entry is imminent would prompt “BioGen Inc.” to adjust its market strategy for that region immediately. Conversely, “InsulEase” having a patent until 2032 in Brazil with no litigation suggests a stable market for “InnovatePharma.” This makes the value proposition of such specialized tools clear and compelling for pharmaceutical strategists.

Beyond the Patent Grant: Commercialization and Partnerships

The successful commercialization of patented drugs in emerging markets extends beyond the mere grant of a patent. It requires a sophisticated integration of intellectual property strategy with broader commercialization efforts, recognizing the critical role of local partnerships.

Licensing and Collaboration Models in Emerging Markets

Given the inherent complexities of market access and the diverse local regulatory landscapes, licensing agreements and collaborative ventures are frequently the preferred routes for commercialization in emerging markets. These models can range from straightforward distribution agreements to complex joint ventures that involve significant technology transfer. Local manufacturing and technology transfer, for example, can often be explicit requirements for market access in certain emerging markets . In all such negotiations, a strong intellectual property portfolio serves as a key asset, ensuring a fair exchange of value and robust protection of proprietary information. The importance of IP due diligence for M&A activities in emerging markets, owing to their diverse IP landscapes, further underscores this point .

In discussions around licensing and collaboration, particularly when local manufacturing or technology transfer is involved, a robust intellectual property portfolio acts as a powerful negotiating lever. It ensures that the innovator maintains control over their proprietary technology and receives fair compensation for its use, thereby mitigating the risks of unauthorized use or dilution of IP rights. Furthermore, partnerships are not solely about gaining market access; they are fundamentally about mitigating risk. Local partners possess invaluable expertise in navigating complex regulatory environments , managing intricate local supply chains, and assisting with intellectual property enforcement in challenging jurisdictions . The strength of the innovator’s intellectual property naturally attracts more reputable and capable partners, which in turn reduces overall commercial and IP risk, leading to more successful and sustainable ventures.

Tailoring Commercial Strategies to Local IP Realities

Commercial strategies must be inherently flexible and meticulously adapted to the specific intellectual property landscape of each individual emerging market. This involves adjusting various elements, including pricing, marketing approaches, and distribution channels, based on the strength of patent protection, the perceived risk of generic entry, and the prevailing local competitive environment. A deep understanding of local market dynamics is absolutely essential for achieving commercial success .

The inherent diversity of emerging market intellectual property regimes means that a single, uniform commercial strategy is unlikely to succeed. Instead, the strength of intellectual property protection can and should inform market segmentation. For instance, premium pricing and aggressive market penetration strategies may be viable where IP is strong and enforceable. Conversely, volume-based strategies or even tiered pricing models (often relevant in the context of compulsory licensing ) might be more appropriate where IP protection is weaker or the risk of compulsory licensing is higher. This nuanced approach ensures that commercial efforts are aligned with the realities of the IP landscape. Furthermore, intellectual property strength directly influences pricing and reimbursement negotiations . In emerging markets, where public health access is often a paramount priority, companies might need to adopt dynamic pricing models that reflect local purchasing power and government policies, while still leveraging their IP to secure favorable reimbursement terms where possible for their innovative therapies.

The Interplay of IP, Pricing, and Reimbursement

Intellectual property protection significantly influences a pharmaceutical product’s potential pricing strategy and its ability to secure favorable reimbursement status within a healthcare system. Strong patent protection typically allows for premium pricing and provides substantial negotiation leverage with payers and government health authorities . Conversely, the persistent threat of compulsory licensing or the imminent entry of generic competitors can compel innovators to reduce prices, sometimes substantially. Brazil’s history of issuing compulsory licenses for public health reasons serves as a stark reminder of this dynamic.

Strong intellectual property allows pharmaceutical companies to articulate a more compelling value proposition to payers in emerging markets. It signals genuine novelty, high quality, and a sustained commitment to innovation, which can justify higher prices and secure broader reimbursement coverage, particularly for novel therapies that address significant unmet medical needs. Moreover, the risk of compulsory licensing necessitates a proactive and strategic pricing approach. Companies might consider offering tiered pricing or implementing patient access programs in emerging markets to visibly demonstrate a commitment to affordability. Such proactive measures can effectively reduce the political and public health pressure that might otherwise lead to the invocation of a compulsory license. This represents a strategic trade-off between maximizing short-term revenue and ensuring long-term market access and intellectual property security.

Future Horizons: Trends Shaping Pharma IP in Emerging Markets

The landscape of intellectual property in emerging markets is not static; it is constantly evolving, influenced by technological advancements, shifts in regulatory paradigms, and growing societal expectations. Looking ahead, several key trends will significantly shape the future of drug patenting and IP strategy in these dynamic regions.

The Impact of Digitalization and AI on Patenting

Technological advancements, particularly in digitalization and artificial intelligence (AI), are rapidly transforming various aspects of the intellectual property lifecycle, from the initial stages of invention to the complexities of enforcement. Digitalization and AI are poised to revolutionize IP management, offering unprecedented opportunities for enhanced efficiency and advanced analytics . AI, for instance, can assist significantly in patent searching, drafting, and analysis, improving the speed and accuracy of these processes while also identifying subtle trends and connections that human analysis might miss. Digital platforms, meanwhile, can streamline the entire patent filing and portfolio management process, reducing administrative burdens.

The ability of AI to process and synthesize vast amounts of patent data will enable far more sophisticated competitive foresight than previously possible. Beyond merely identifying existing patents, AI algorithms can predict future areas of innovation, identify emerging competitors, and even forecast potential litigation hotspots in emerging markets. This proactive intelligence allows pharmaceutical companies to adjust their R&D and IP strategies well in advance, gaining a significant competitive edge. Furthermore, digitalization also offers powerful new avenues for intellectual property enforcement, particularly in combating the pervasive issue of counterfeiting . Technologies such as blockchain can be used for secure supply chain verification, AI can identify infringing online content, and advanced data analytics can track illicit trade flows. These digital tools can significantly enhance enforcement capabilities in emerging markets, where traditional physical enforcement can often be challenging and resource-intensive.

Evolving Regulatory Landscapes and Harmonization Efforts

While the pace of intellectual property harmonization remains slow, efforts continue, and regulatory environments in emerging markets are in a constant state of evolution. Despite ongoing efforts towards IP harmonization, progress remains gradual, necessitating continued reliance on country-specific approaches . The intellectual property regimes in emerging markets are inherently complex, dynamic, and diverse, requiring highly tailored strategies for sustained success . Pharmaceutical companies must therefore remain exceptionally agile, continuously monitoring legislative changes and adapting their intellectual property strategies accordingly in real-time.

The “slow progress” of harmonization creates a paradoxical challenge: pharmaceutical companies cannot rely on it for immediate strategic decisions, yet they must meticulously monitor it for long-term shifts. This implies a need for dual-track intellectual property strategies – one designed for the current, fragmented realities of diverse emerging markets, and another that anticipates and prepares for future, potentially more harmonized, landscapes. Moreover, the evolving and diverse nature of emerging market IP regimes can present unique opportunities for “regulatory arbitrage.” Companies that are adept at identifying and capitalizing on favorable regulatory nuances or newly introduced intellectual property protections in specific emerging markets can gain a temporary but significant competitive advantage. This underscores the immense value of deep, localized regulatory intelligence and the ability to act swiftly on emerging legislative changes.

Sustainability and Access Considerations

The global focus on sustainable development and the increasing demand for equitable access to essential medicines are profoundly influencing intellectual property policies in emerging markets. This growing emphasis on public health and social responsibility is shaping the environment in which pharmaceutical companies operate. Brazil’s historical use of compulsory licenses for public health reasons is a notable example of how these considerations can directly impact patent rights. Companies will face increasing pressure to balance their intellectual property rights with the critical public health needs of the populations they serve. This may lead to a greater prevalence of voluntary licensing agreements, the adoption of tiered pricing models, or the establishment of local manufacturing initiatives to ensure broader access.

The increasing emphasis on sustainability and access means that intellectual property strategy is no longer solely a legal or commercial function; it is becoming an integral component of a pharmaceutical company’s Environmental, Social, and Governance (ESG) strategy. Proactive engagement on access issues, such as through transparent pricing or patient assistance programs, can significantly enhance corporate reputation, build trust with governments and local communities, and potentially preempt more aggressive intellectual property interventions like compulsory licensing. To effectively address access concerns, future intellectual property strategies in emerging markets might increasingly involve collaborative models that aim for “shared value.” This could include public-private partnerships, participation in patent pools, or technology transfer initiatives that go beyond traditional licensing agreements, demonstrating a genuine commitment to strengthening local health systems while still securing a fair return on innovation and investment.

Key Takeaways

Navigating the complex landscape of drug patenting in emerging markets is a strategic imperative for pharmaceutical companies seeking sustainable growth and competitive advantage. The following key takeaways summarize the critical insights and actionable advice for success:

- Proactive IP Strategy is Paramount: Emerging markets represent the future of pharmaceutical growth, making early and robust patent protection a core business development strategy, not an afterthought. This proactive stance secures market exclusivity and enhances valuation for partnerships.

- Embrace Diversity, Reject Uniformity: The IP regimes in emerging markets are highly diverse and complex. A “one-size-fits-all” approach is ineffective. Success hinges on tailored, country-specific strategies that account for unique patentability criteria, regulatory linkages, and enforcement realities.

- Build Multi-Layered Protection: A single compound patent is often insufficient. Companies must build robust portfolios incorporating formulation patents, method-of-use patents, and critically, leverage data exclusivity, which can provide vital market protection even where patent grants are challenging.

- Mitigate Risks Proactively: Counterfeiting, compulsory licensing, and enforcement challenges are significant. Companies must develop proactive litigation readiness plans, engage expert local counsel, and consider tiered pricing or voluntary licensing to balance IP rights with public health needs.

- Leverage Patent Data for Intelligence: Patent analytics tools, such as DrugPatentWatch, are indispensable for transforming raw patent data into actionable competitive intelligence. This enables companies to anticipate competitor moves, optimize product launch sequencing, and manage generic threats effectively.

- Integrate IP with Commercialization: IP strategy must be seamlessly integrated with broader commercialization efforts. This includes tailoring market access strategies to local IP realities, leveraging IP as a negotiating tool in partnerships, and understanding its profound influence on pricing and reimbursement.

- Prepare for Future Trends: Digitalization, AI, evolving regulatory landscapes, and increasing demands for sustainability and access will continue to shape the IP environment. Companies must remain agile, embrace new technologies for IP management and enforcement, and proactively engage on access issues to maintain their social license to operate.

Frequently Asked Questions (FAQ)

Q1: How can pharmaceutical companies best prepare for the risk of compulsory licensing in emerging markets?

Preparation involves a multi-faceted approach. Companies should proactively engage with governments and public health organizations, demonstrating a clear commitment to access through transparent pricing or voluntary licensing agreements. Maintaining a strong understanding of national public health priorities and potential triggers for compulsory licensing is also crucial. Legally, it involves having robust arguments against such measures and understanding the specific procedures and conditions under which compulsory licenses can be invoked in key markets .

Q2: What is the role of data exclusivity in markets with challenging patentability criteria, like India’s Section 3(d)?

Data exclusivity becomes a critical complementary or even primary form of market protection in markets characterized by stringent patentability criteria, such as India’s Section 3(d) . It provides a period during which generic manufacturers are legally prevented from relying on the innovator’s proprietary clinical trial data for their own marketing approvals. This offers a de facto period of market exclusivity, regardless of whether a patent is granted or successfully challenged. Companies must therefore thoroughly understand the specific data exclusivity periods and requirements in each target emerging market.

Q3: How can patent analytics tools like DrugPatentWatch be leveraged beyond basic competitive intelligence for strategic market entry?

Beyond tracking competitor patents and expiry dates, tools like DrugPatentWatch can inform strategic market entry by identifying “white spaces” for new formulations or indications where intellectual property protection is weak or entirely absent. They can also help forecast the likely timing of generic entry , allowing companies to optimize their launch timing, prepare robust market defense strategies, and even identify potential merger and acquisition targets by assessing the strength and breadth of their intellectual property portfolios .

Q4: What are the key considerations for managing patent litigation costs and time in diverse emerging market legal systems?

Managing litigation costs and time in emerging markets necessitates proactive strategies. This includes conducting thorough intellectual property due diligence before market entry, maintaining robust evidence of use for patented products, and engaging highly experienced local counsel who possess a deep understanding of the nuances of the local legal system, cultural context, and unwritten rules. Exploring alternative dispute resolution mechanisms, where appropriate, can also significantly mitigate both costs and delays associated with formal litigation.

Q5: How do evolving regulatory linkages, such as Brazil’s ANVISA prior consent, impact overall drug development timelines and IP strategy?

Regulatory linkages, such as Brazil’s ANVISA prior consent requirement , significantly impact drug development timelines by introducing a potentially lengthy and unpredictable step into the patent prosecution process. This necessitates integrating intellectual property filing timelines with regulatory approval processes from the very outset of drug development. Companies must factor these potential delays into their R&D and commercialization schedules, potentially adjusting global launch sequences and resource allocation to account for the extended time required for both patent grant and market entry in such jurisdictions.

References

- https://www.marketsandmarkets.com/Market-Reports/personalized-medicine-market-137991268.html

- https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/the-global-use-of-medicines-2023

- https://en.wikipedia.org/wiki/BRICS

- https://www.ijdra.com/index.php/journal/article/view/509

- https://nopr.niscpr.res.in/bitstream/123456789/55114/1/JIPR%2025%283-4%29%2065-73.pdf

- https://www.drugpatentwatch.com/blog/indian-pharmaceutical-patent-prosecution-the-changing-role-of-section-3d/

- https://www.vonseidels.com/service/patents/

- https://pctlegal.wipo.int/eGuide/view-doc.xhtml?doc-code=ZA&doc-lang=en

- https://www.demarest.com.br/new-law-in-brazil-extinguishes-the-need-for-prior-consent-by-anvisa-to-grant-pharmaceutical-patents/

- https://www.kasznarleonardos.com/en/the-brazilian-fda-will-no-longer-examine-pharmaceutical-patent-applications/

- https://www.kwm.com/cn/en/insights/latest-thinking/enforcing-medical-use-patents-in-china-challenges-and-insights.html

- https://cubioinnovation.com/chinas-improving-intellectual-property-protections/

- https://www.researchgate.net/publication/355124754_The_Brazilian_Case_Study_of_Compulsory_Licensing

- https://www.ip-watch.org/2017/03/27/situation-ip-rights-russia-continues-deteriorate/

- https://www.etblaw.com/what-is-a-patent-cooperation-treaty-application/

- https://www.wipo.int/en/web/pct-system

- https://www.jnj.com/innovation/how-johnson-and-johnson-is-fighting-medical-counterfeiting

- https://truemedinc.com/blog/the-economic-impact-of-counterfeit-healthcare-products/

- https://medicamentalia.org/access/compulsory-license/

- https://www.researchgate.net/publication/355124754_The_Brazilian_Case_Study_of_Compulsory_Licensing

- https://pmc.ncbi.nlm.nih.gov/articles/PMC5347964/

- https://www.ema.europa.eu/en/glossary-terms/data-exclusivity

- https://www.softwaresuggest.com/drugpatentwatch