HYDROCORTISONE Drug Patent Profile

✉ Email this page to a colleague

When do Hydrocortisone patents expire, and what generic alternatives are available?

Hydrocortisone is a drug marketed by Actavis Mid Atlantic, Alpharma Us Pharms, Altana, Ambix, Chartwell Molecular, Encube, Everylife, Fougera Pharms Inc, G And W Labs, Ingram Pharm, Ivax Pharms, Naska, Padagis Us, Perrigo New York, Pharmaderm, Pharmafair, Rising, Stiefel, Syosset, Taro, Teva, Topiderm, Usl Pharma, Whiteworth Town Plsn, Teva Pharms, Fougera Pharms, Mericon, Sun Pharma Canada, Paddock Llc, Aurobindo Pharma Ltd, Barr, Elkins Sinn, Ferrante, Hibrow Hlthcare, Hikma Intl Pharms, Impax Labs, Impax Labs Inc, Inwood Labs, Nexgen Pharma Inc, Novitium Pharma, Panray, Parke Davis, Purepac Pharm, Roxane, Sandoz, Strides Pharma, Strides Pharma Intl, Watson Labs, Cenci, Imperium, Bel Mar, Epic Pharma Llc, Fera Pharms, X Gen Pharms, Genus, Bausch And Lomb, Cosette, Wockhardt, Glenmark Pharms Ltd, Taro Pharm Inds, Lupin Ltd, The J Molner, Cmp Pharma Inc, Abraxis Pharm, Baxter Hlthcare, Cipla, Intl Medication, Encube Ethicals, and Padagis Israel. and is included in one hundred and thirty-five NDAs.

The generic ingredient in HYDROCORTISONE is hydrocortisone valerate. There are sixty-seven drug master file entries for this compound. Six suppliers are listed for this compound. Additional details are available on the hydrocortisone valerate profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Hydrocortisone

A generic version of HYDROCORTISONE was approved as hydrocortisone valerate by SUN PHARMA CANADA on August 25th, 1998.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for HYDROCORTISONE?

- What are the global sales for HYDROCORTISONE?

- What is Average Wholesale Price for HYDROCORTISONE?

Summary for HYDROCORTISONE

| US Patents: | 0 |

| Applicants: | 69 |

| NDAs: | 135 |

| Finished Product Suppliers / Packagers: | 30 |

| Raw Ingredient (Bulk) Api Vendors: | 96 |

| Clinical Trials: | 478 |

| Patent Applications: | 4,262 |

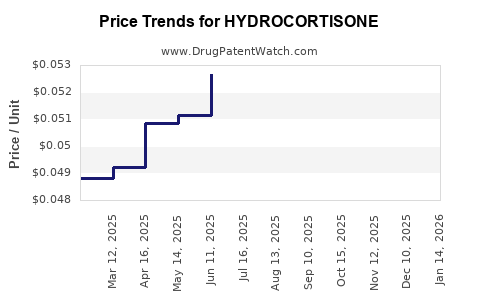

| Drug Prices: | Drug price information for HYDROCORTISONE |

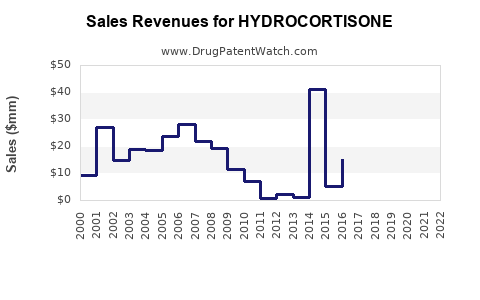

| Drug Sales Revenues: | Drug sales revenues for HYDROCORTISONE |

| What excipients (inactive ingredients) are in HYDROCORTISONE? | HYDROCORTISONE excipients list |

| DailyMed Link: | HYDROCORTISONE at DailyMed |

See drug prices for HYDROCORTISONE

Recent Clinical Trials for HYDROCORTISONE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Assistance Publique - Hôpitaux de Paris | PHASE3 |

| Children's Oncology Group | PHASE2 |

| University of British Columbia | PHASE2 |

Pharmacology for HYDROCORTISONE

| Drug Class | Corticosteroid |

| Mechanism of Action | Corticosteroid Hormone Receptor Agonists |

Medical Subject Heading (MeSH) Categories for HYDROCORTISONE

Anatomical Therapeutic Chemical (ATC) Classes for HYDROCORTISONE

US Patents and Regulatory Information for HYDROCORTISONE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Aurobindo Pharma Ltd | HYDROCORTISONE | hydrocortisone | TABLET;ORAL | 214649-003 | Jul 17, 2023 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Strides Pharma | HYDROCORTISONE | hydrocortisone | TABLET;ORAL | 207029-001 | Apr 27, 2017 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Alpharma Us Pharms | HYDROCORTISONE | hydrocortisone | LOTION;TOPICAL | 087315-001 | Jun 7, 1982 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Teva | HYDROCORTISONE | hydrocortisone | CREAM;TOPICAL | 080400-003 | Approved Prior to Jan 1, 1982 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Lupin Ltd | HYDROCORTISONE VALERATE | hydrocortisone valerate | CREAM;TOPICAL | 210307-001 | Aug 15, 2019 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for HYDROCORTISONE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Takeda Pharmaceuticals International AG Ireland Branch | Plenadren | hydrocortisone | EMEA/H/C/002185Treatment of adrenal insufficiency in adults. | Authorised | no | no | no | 2011-11-03 | |

| Diurnal Europe B.V. | Alkindi | hydrocortisone | EMEA/H/C/004416Replacement therapy of adrenal insufficiency in infants, children and adolescents (from birth to < 18 years old). | Authorised | no | no | no | 2018-02-09 | |

| Diurnal Europe B.V. | Efmody | hydrocortisone | EMEA/H/C/005105Treatment of congenital adrenal hyperplasia (CAH) in adolescents aged 12 years and over and adults. | Authorised | no | no | no | 2021-05-27 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

Market Dynamics and Financial Trajectory for Hydrocortisone

More… ↓