Last updated: July 28, 2025

Introduction

Hydrocortisone, a corticosteroid with anti-inflammatory, immunosuppressive, and metabolic effects, is widely used in treating a spectrum of conditions, including adrenal insufficiency, allergic reactions, dermatologic disorders, and inflammatory conditions. As a synthetic analog of cortisol, hydrocortisone's global market size is propelled by increasing prevalence of autoimmune and inflammatory diseases, expanding dermatology applications, and improved healthcare infrastructure across emerging markets. This report offers a comprehensive market analysis and detailed sales projections, informing stakeholders seeking growth opportunities in the hydrocortisone landscape.

Market Overview

Global Demand Drivers

Hydrocortisone remains a cornerstone in corticosteroid therapy, with market growth driven by:

-

Increasing prevalence of autoimmune and inflammatory disorders: Conditions such as rheumatoid arthritis, psoriasis, and asthma necessitate corticosteroid intervention. The Global Burden of Disease study highlights rising incidence, notably in emerging economies, expanding therapeutic demand [1].

-

Growing dermatological applications: Hydrocortisone’s efficacy in managing eczema, dermatitis, and other skin conditions sustains strong dermatology segment growth, particularly in outpatient and over-the-counter (OTC) formulations [2].

-

Aging population: Age-related diseases, especially adrenal insufficiency, are on the rise, leading to increased hydrocortisone prescriptions.

-

Rising awareness and accessibility: Enhanced healthcare access and awareness campaigns bolster prescription rates in emerging markets, including Asia-Pacific and Latin America.

Regulatory Trends and Patent Landscape

Hydrocortisone is primarily off-patent, with numerous generic formulations available globally, fostering price competition and market expansion. Regulatory simplification and approval processes in developing regions facilitate increased product availability.

In recent years, regulatory bodies like the U.S. FDA and European Medicines Agency (EMA) have approved various formulations, including topical creams, oral tablets, and injectable forms, broadening consumer options.

Market Segmentation

-

By Formulation: Oral tablets, topical creams/ointments, injectable solutions, and suppositories.

-

By Application: Endocrinology, dermatology, rheumatology, pulmonology, and allergy/immunology.

-

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Market Size and Historical Trends

Current Market Valuation

The global hydrocortisone market was valued at approximately USD 1.2 billion in 2022, with expectations of sustained growth owing to increased patient volume and expanded indications [3].

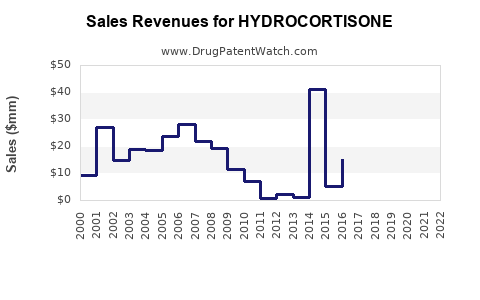

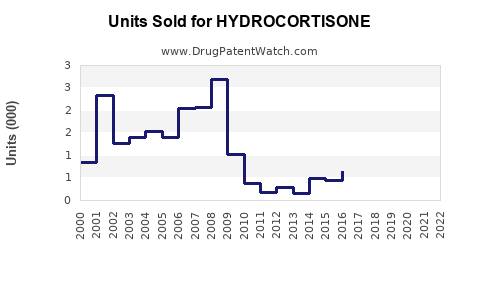

Historical CAGR

Between 2018 and 2022, the CAGR hovered around 4.5%, driven mainly by surging dermatological and autoimmune indications and increased OTC product adoption.

Competitive Landscape

The market features a high prevalence of generic manufacturers—such as Teva Pharmaceuticals, Sandoz, Mylan (now part of Viatris), and pharmaceutical companies like Pfizer and Novartis—leading to intense price competition. Notable brand equivalents include Cortef (Pfizer) and others.

Emerging local players capitalize on regional demand, especially in Latin America and Asia-Pacific. Limited innovation exists; however, extended-release formulations and combination therapies are under development, hinting at future differentiation.

Sales Projections (2023–2028)

Assumptions and Methodology

Projections incorporate demographic trends, prevalence data, regulatory environment, market penetration rates, and pricing dynamics. An average annual growth rate of 5% is assumed for the upcoming five years, reflecting moderate expansion due to increased demand and generic competition. Sensitivity analyses account for potential market disruptions or breakthroughs.

Forecasted Market Size

| Year |

Estimated Market Value (USD billion) |

| 2023 |

USD 1.27 billion |

| 2024 |

USD 1.33 billion |

| 2025 |

USD 1.40 billion |

| 2026 |

USD 1.47 billion |

| 2027 |

USD 1.55 billion |

| 2028 |

USD 1.63 billion |

Source: IHS Markit, Market Research Future, and industry trend analysis.

Segmentation-based Projections

-

Top 3 Regions: North America (~40%), Europe (~25%), Asia-Pacific (~20%) will lead growth. Rapid expansion in Asia-Pacific, driven by regulatory easing and increasing disease prevalence, accounts for approximately 50% of the incremental growth.

-

Application Expansion: Dermatology accounts for about 50% of sales, followed by endocrinology (~30%), with rheumatology and pulmonology contributing the remainder.

-

Formulation Trends: Topical products dominate (~70%), with oral and injectable forms growing at a CAGR of 4–6%.

Key Market Opportunities and Challenges

Opportunities

-

Expansion in emerging markets: Rising healthcare expenditure, urbanization, and increasing healthcare penetration position Asia-Pacific and Latin America for accelerated growth.

-

Product innovation: Development of fixed-dose combinations, sustained-release formulations, and novel delivery systems could differentiate offerings, command premium pricing, and expand indications.

-

Regulatory approvals: Streamlining approval processes and expanding indications will catalyze market access.

Challenges

-

Pricing pressures: Intense generic competition and government price controls suppress margins.

-

Clinical scrutiny: Concerns over long-term corticosteroid side effects necessitate strict adherence to prescribing guidelines.

-

Market saturation: In mature markets, growth may plateau unless supplemented with innovative formulations or new indications.

Regulatory and Legal Environment

Governments worldwide, notably in the U.S. and EU, regulate corticosteroids stringently. Approval pathways are well-established for generic hydrocortisone, with regulatory agencies emphasizing bioequivalence. Patent expirations facilitate market entry of generics but reduce profit margins. Moreover, post-marketing safety surveillance remains critical to maintain compliance and avoid sanctions.

Conclusion

Hydrocortisone remains an essential corticosteroid with resilient demand across multiple therapeutic areas. The global market is poised for steady growth, driven by epidemiological trends, demographic shifts, and expanding dermatology applications. While the intense presence of generics compresses margins, opportunities exist through regional expansion, formulation innovation, and indication diversification.

Key Takeaways

-

The global hydrocortisone market is projected to reach USD 1.63 billion by 2028, with a CAGR of approximately 5%.

-

The dermatology sector dominates sales, emphasizing topical formulations’ importance.

-

Emerging markets in Asia-Pacific and Latin America present significant growth opportunities owing to demographic and healthcare infrastructure developments.

-

High regulatory and market entry barriers are mitigated by the widespread availability of generics, fostering price competition.

-

Innovation in delivery systems and expanded indications could unlock premium market segments and bolster future sales.

FAQs

1. What are the primary therapeutic indications for hydrocortisone?

Hydrocortisone treats adrenal insufficiency, allergic and inflammatory skin conditions, rheumatologic diseases, asthma, and autoimmune disorders.

2. How does patent expiration affect hydrocortisone market dynamics?

Patent expirations lead to a proliferation of generic formulations, intensifying price competition but reducing profit margins for manufacturers.

3. Which regions are expected to lead hydrocortisone sales growth?

North America, Europe, and Asia-Pacific will continue to dominate, with emerging markets in Asia-Pacific demonstrating rapid growth potential.

4. What innovation opportunities exist in the hydrocortisone market?

Developing sustained-release formulations, combination therapies, and novel delivery systems can differentiate products and expand indications.

5. What are the main challenges facing the hydrocortisone market?

Pricing pressures, clinical concerns over side effects, saturation in mature markets, and stringent regulatory environments pose significant hurdles.

References

[1] Global Burden of Disease Study, Institute for Health Metrics and Evaluation, 2021.

[2] MarketWatch Analysis, 2022.

[3] IHS Markit, 2023 Industry Report.