Last updated: July 27, 2025

Introduction

Rosuvastatin calcium, marketed primarily under brand names such as Crestor, is a potent lipid-lowering agent used in managing hyperlipidemia and preventing cardiovascular disease. Since its market entry in 2003, rosuvastatin has experienced significant growth, driven by evolving healthcare needs, increasing prevalence of cardiovascular disorders, and expanding clinical indications. This comprehensive analysis explores the current market dynamics and forecasts the financial trajectory of rosuvastatin calcium, considering factors such as patent status, competitive landscape, regulatory influences, and emerging therapeutic trends.

Global Market Overview

The global statin market, within which rosuvastatin holds a substantial share, is projected to grow at a CAGR of approximately 3.5-4% over the next five years (2023–2028)[1]. As of 2022, the market valuation exceeded USD 15 billion, with rosuvastatin accounting for roughly 25-30% of the market share in the statin segment. This prominence stems from its superior potency and favorable safety profile compared to older statins such as atorvastatin and simvastatin.

Major markets include North America, Europe, and Asia-Pacific. North America remains dominant due to high cardiovascular disease prevalence and advanced healthcare infrastructure, while Asia-Pacific presents rapid growth opportunities owing to expanding healthcare access and rising awareness about cholesterol management.

Market Drivers and Opportunities

Rising Incidence of Cardiovascular Diseases:

The global burden of cardiovascular disease (CVD) continues to escalate, driven by sedentary lifestyles, unhealthy diets, and aging populations. According to the World Health Organization, CVD accounts for approximately 17.9 million deaths annually[2], amplifying demand for lipid-lowering therapies like rosuvastatin.

Expanding Clinical Indications:

Initially approved for hypercholesterolemia, rosuvastatin’s use has expanded to include prevention of atherosclerotic cardiovascular disease (ASCVD), familial hypercholesterolemia, and off-label applications such as non-alcoholic fatty liver disease. Regulatory approvals for additional indications bolster its market reach.

New Formulations and Combination Therapies:

Development of fixed-dose combinations (FDCs) with other lipid-lowering agents, such as ezetimibe, enhances adherence and efficacy. Notably, rosuvastatin/ezetimibe FDCs have gained regulatory approval in various regions, opening new revenue streams.

Technological Advancements and Personalized Medicine:

Genetic testing facilitating personalized lipid management enhances the drug’s relevance. Pharmacogenomic insights could optimize dosages and minimize adverse effects, ensuring better patient outcomes.

Market Challenges and Constraints

Patent Expiry and Generic Competition:

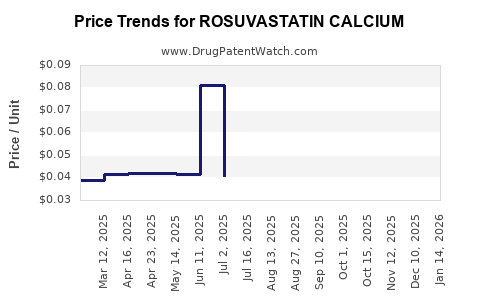

A critical factor influencing rosuvastatin’s financial trajectory is patent expiration. The U.S. patent for Crestor expired in 2016[3], leading to the entry of generic versions that captured significant market share. Similar patent lapses occurred in other jurisdictions, exerting downward pressure on prices and profit margins.

Pricing Pressures and Healthcare Budget Constraints:

Price erosion due to generic competition, especially in cost-sensitive markets such as India and parts of Europe, limits revenue growth. Payer negotiations and formulary restrictions also restrict access and reimbursement levels.

Regulatory and Safety Considerations:

Rigorously monitored post-marketing safety data influence market stability. Reports of rare adverse effects, such as rhabdomyolysis, necessitate ongoing pharmacovigilance and may impact prescribing behaviors.

Competitive Landscape

Rosuvastatin faces competition from other high-potency statins like atorvastatin and rosuvastatin’s own generic versions. Innovator brands had a period of exclusivity, which fostered premium pricing strategies. However, patent expiry ushered in competitiveness from generics and biosimilars.

Furthermore, emerging lipid-lowering agents, such as PCSK9 inhibitors (evolocumab, alirocumab), though costly, challenge statins in high-risk populations, especially those with familial hypercholesterolemia or statin intolerance[4].

Market Share Dynamics:

While generics have dominated sales volumes globally, the branded variants retain premium pricing in certain markets, supported by clinical data and physician preferences. Additionally, combination drugs featuring rosuvastatin enjoy niche markets, particularly when managing complex dyslipidemia.

Regulatory Environment and Patent Landscape

Patent protections provided a period of market exclusivity for Crestor, but their expiration has triggered a shift toward generics. Regulatory pathways for biosimilars and approvals of new formulations shape future market access.

Regulatory agencies worldwide have stringent requirements for safety and efficacy, affecting the timing and success of launches for generics and biosimilars. IP litigations and patent settlements continue to influence market entry strategies.

Financial Projections

Revenue Trends:

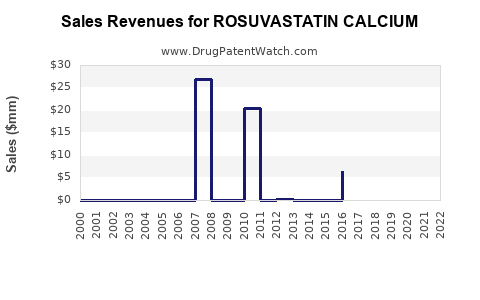

Pre-expiry, rosuvastatin generated peak global revenues exceeding USD 5 billion annually. Post-patent expiry, revenues declined sharply in mature markets, but growth persists in emerging markets via generic proliferation and expanding indications.

Forecast for 2023–2030:

The pharmaceutical industry anticipates a compound annual growth rate (CAGR) of around 2-3% globally for rosuvastatin, driven partly by emerging markets and label extensions. The market is projected to stabilize after the initial patent cliffs, with revenues consolidating around USD 2-4 billion annually by 2030, factoring in generic competition and new formulation launches.

Emerging Markets and Market Penetration:

India and China are expected to be key growth regions, with expanding access to affordable generics and increasing urban populations at risk for CVD. These markets could nearly double their current statin consumption levels within five years, favoring rosuvastatin's inclusion.

Impact of Combination Therapies:

The rise of combination therapies incorporating rosuvastatin aligns with the goal of improving compliance and therapeutic outcomes, thus providing incremental revenue opportunities.

Emerging Trends Influencing the Future Market

Personalized Medicine and Pharmacogenomics:

Tailored therapy based on genetic markers (e.g., CYP2C9 variants affecting statin metabolism) may enhance efficacy and minimize adverse effects, potentially leading to specialized formulations and dosing strategies that could command premium pricing.

Digital Health Integration:

Remote monitoring and adherence tracking may improve treatment outcomes, driving demand for long-term lipid management solutions with rosuvastatin.

Innovative Drug Delivery Systems:

Research into sustained-release formulations and novel delivery pathways aims to optimize the pharmacokinetics, potentially extending patent protections or fostering new patent applications.

Conclusion

Rosuvastatin calcium remains a critical player in lipid management, with a resilient market presence despite patent expirations. Its high potency, broad clinical applicability, and the ongoing burden of cardiovascular disease secure steady demand, particularly in emerging markets. Financial growth prospects hinge on successful navigation of generic competition, regulatory landscapes, and therapeutic innovations. Strategic focus on combination products, personalized medicine, and expanding indications will be crucial for pharmaceutical companies aiming to sustain and grow their market footprint for rosuvastatin calcium.

Key Takeaways

- Market stability is fueled by increasing cardiovascular disease prevalence and expanded clinical uses, despite patent expirations.

- Patent cliffs significantly impacted revenues post-2016, especially in mature markets, but emerging markets compensate through high generic penetration and increased access.

- Growth prospects are promising via combination therapies, pharmacogenomics, and targeted formulations tailored to personalized medicine.

- Competitive pressures from generics and novel therapeutics necessitate strategic innovation and differentiation.

- Market success hinges on navigating regulatory landscapes, leveraging emerging market opportunities, and fostering innovation in drug delivery and personalized treatment.

FAQs

1. How has the patent expiration of Crestor affected its market dynamics?

Patent expiration in 2016 led to the entry of multiple generic versions, significantly reducing prices and widening access. While revenues from the branded product declined, the overall market volume for rosuvastatin increased due to affordability, especially in emerging economies.

2. What are the main factors driving the growth of rosuvastatin in emerging markets?

Rising prevalence of CVD, improved healthcare infrastructure, government initiatives promoting generic drug use, and lower-cost formulations are key drivers in regions like India and China.

3. How does the competitive landscape influence rosuvastatin’s financial trajectory?

Generic competition post-patent expiry exerts downward pressure on prices but increases overall market size. Innovative formulations and combination therapies provide avenues to sustain premium revenues for branded products.

4. What role do combination therapies play in the future of rosuvastatin?

Combination drugs with ezetimibe and other lipid-lowering agents enhance adherence, improve efficacy, and create new market segments, supporting revenue growth amidst generic competition.

5. Are novel therapies threatening the dominance of statins like rosuvastatin?

Yes. PCSK9 inhibitors offer potent lipid-lowering benefits but are limited by high costs. Their use is reserved for high-risk or statin-intolerant patients, ensuring statins remain foundational in lipid management.

References

- MarketWatch, "Statins Market Size, Share & Trends Analysis," 2022.

- World Health Organization, "Cardiovascular Diseases (CVDs)," 2021.

- U.S. Food and Drug Administration, "Crestor (rosuvastatin) Label," 2016.

- American Heart Association, "Emerging Lipid-Lowering Therapies," 2022.