Last updated: July 30, 2025

Introduction

Zhejiang Jingxin Pharmaceutical Co., Ltd. stands out as a prominent player within China’s competitive pharmaceutical industry. With a strategic focus on innovative APIs, bulk pharmaceuticals, and proprietary formulations, Jingxin leverages its core competencies to maintain a resilient market position. This analysis dissects Jingxin’s market standing, elucidates its core strengths, and provides actionable strategic insights to stakeholders seeking to navigate China’s evolving pharmaceutical landscape.

Market Position

Zhejiang Jingxin operates within China’s rapidly expanding pharmaceutical sector, which is driven by increasing domestic healthcare demand, government policies favoring innovation, and expanding export opportunities. As of 2023, Jingxin holds a notable share in the production of APIs, particularly in the fields of cardiovascular, anti-infective, and neuropsychiatric drugs, with a growing footprint in international markets.

The company's strategic alignment with national priorities—such as "Made in China 2025" and innovation-driven growth—further consolidates its positioning. Jingxin’s geographic advantage in Zhejiang Province offers logistical benefits, facilitating exports and supply-chain robustness. While not as large as industry giants like Sinopharm or Shanghai Pharmaceuticals, Jingxin maintains a niche focus, allowing for specialization and higher profit margins in certain segments.

Furthermore, Jingxin’s product diversification and ongoing R&D initiatives position it favorably within the competitive landscape, particularly amid a global shift toward complex biologics and personalized medicine.

Core Strengths

1. Robust API Portfolio and R&D Capabilities

Jingxin’s core competency lies in its extensive API manufacturing capacity, including key products such as amoxicillin, ciprofloxacin, and other antibiotics. Its proprietary synthesis processes meet stringent quality standards, enabling compliance with both domestic and international regulations. The company invests significantly in R&D—approximately 8–10% of revenue annually—fostering innovative API derivatives and novel formulations that meet emerging healthcare needs.

2. Vertical Integration and Manufacturing Excellence

Jingxin’s vertically integrated operations—from raw material procurement to finished product processing—reduce reliance on external suppliers, mitigate supply chain risks, and lower costs. Its advanced manufacturing facilities adhere to GMP standards, facilitating global market entry and enhancing product credibility.

3. Strategic Geographic and Economic Positioning

Located in Zhejiang Province, Jingxin benefits from regional policies favoring biotech and pharmaceutical development, including tax incentives and infrastructure support. The proximity to major ports enhances export capacity, especially to Southeast Asia, Europe, and North America.

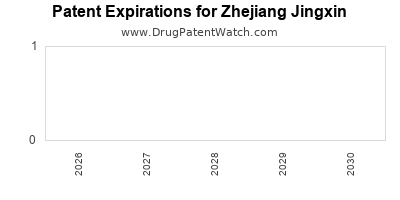

4. Strong Patent Portfolio and Regulatory Expertise

Jingxin actively manages a growing patent portfolio covering APIs and formulations, providing a competitive moat. Its team’s expertise in navigating complex regulatory environments accelerates approvals in key markets, boosting international competitiveness.

5. Focus on Sustainability and Compliance

Embracing environmentally sustainable production practices—such as waste reduction and energy efficiency—Jingxin aligns with global standards, bolstering its reputation and enabling access to eco-sensitive markets.

Strategic Insights

1. Embrace Biotech and Biologics Expansion

Given the global shift toward biologics, Jingxin should diversify into biologic APIs and cell therapy-related substances. Investing in bio-manufacturing facilities and strategic collaborations with biotech firms can position Jingxin as a leader in innovative biologics.

2. Strengthen International Market Penetration

Expanding beyond traditional markets requires enhanced regulatory compliance, strategic partnerships, and localized marketing. Jingxin must prioritize certifications such as FDA approval or EMA approval for flagship products to access high-value markets.

3. Accelerate Innovation through Strategic Alliances

Forming joint ventures with multinational pharmaceutical firms can facilitate technology transfer, co-development of new drugs, and access to advanced R&D platforms. This approach offsets the risks of in-house innovation and accelerates product pipeline development.

4. Leverage Digitalization and Data Analytics

Implementing intelligent manufacturing systems and digital supply chain platforms can optimize operational efficiency, reduce costs, and improve responsiveness to market fluctuations. AI-driven R&D can identify promising compound candidates rapidly.

5. Focus on Quality and Regulatory Excellence

Maintaining high standards in manufacturing and compliance ensures smooth approval processes across jurisdictions. Jingxin must continue to adapt to evolving regulatory requirements, especially regarding environmentally friendly practices and product traceability.

6. Capitalize on China's National Policies

China’s government continues supporting domestic pharmaceutical innovation through grants, favorable policies, and infrastructure investments. Jingxin should proactively engage in government R&D programs and contribute to national initiatives such as the "Healthy China 2030" blueprint.

Competitive Analysis

Compared with domestic peers such as Zhejiang Huahai Pharmaceutical and North China Pharmaceutical Group, Jingxin’s competitive edge stems from its specialized API production and robust R&D pipeline. However, challenges include rapid technological changes and a competitive foreign API manufacturing sector, chiefly in India and Europe.

International competitors often possess advanced biologics capabilities; Jingxin's strategic pivot towards biologics and biosimilars is essential. Additionally, global supply chain disruptions heighten the importance of localized manufacturing, an area where Jingxin’s regional positioning offers a strategic advantage.

Regulatory and Market Trends

Recent global regulatory shifts emphasize stricter quality standards and enhanced transparency—areas where Jingxin’s compliance focus serves as a differentiator. The Chinese government’s push to bolster domestic innovation further supports Jingxin’s strategic positioning, especially as China aims to become a leader in biopharmaceutical innovation by 2030.

Further, the global API market is projected to grow at a CAGR of 6–8%, driven by expanding pharmaceutical manufacturing and biosimilars. Jingxin’s focus on high-value, complex APIs aligns well with this growth trajectory while capitalizing on China’s "dual circulation" strategy to balance domestic demand and international exports.

Key Challenges and Risks

-

Regulatory Risks: Navigating evolving international standards and gaining approvals in strict markets like the US and EU can delay product launches and impact profitability.

-

Market Competition: Both domestic and international competitors are rapidly expanding capacity, threatening Jingxin’s market share.

-

Innovation Risks: Heavy investment in R&D does not guarantee successful product commercialization, especially amidst intense competition and technological rapid changes.

-

Supply Chain Disruptions: Raw material shortages or transportation bottlenecks could impact manufacturing timelines and costs.

Conclusion

Zhejiang Jingxin’s strategic positioning, anchored by its API excellence, R&D focus, and regional advantages, affords it a resilient foothold in China’s competitive pharmaceutical landscape. To maintain growth and expand internationally, Jingxin must deepen its biologics capabilities, enhance regulatory alignment, and leverage digital transformation. Its ability to adapt swiftly amid industry shifts will determine long-term success.

Key Takeaways

- Core Competency: Jingxin’s API specialization and robust R&D are central to its competitive advantage.

- Growth Opportunities: Expansion into biologics and biosimilars offers high-margin expansion avenues.

- Global Strategy: International accreditation, partnerships, and localized manufacturing are pivotal for market penetration.

- Innovation Focus: Investment in digitalization and novel research pipelines can accelerate growth.

- Regulatory Alignment: Near-perfect compliance and quality standards are essential to mitigate market entry barriers worldwide.

FAQs

1. How does Jingxin differentiate itself from other Chinese pharmaceutical companies?

Jingxin specializes heavily in APIs with advanced production processes, a strong patent portfolio, and a strategic regional presence that supports export and innovation. Its focus on quality and R&D further distinguishes it.

2. What are Jingxin’s main growth areas for the next five years?

Biologics and biosimilars, international market expansion, and innovative formulations are primary growth drivers. Leveraging digital transformation and strategic alliances will also enhance growth prospects.

3. What regulatory challenges does Jingxin face in international markets?

Navigating stringent standards such as FDA and EMA approvals, maintaining high-quality compliance, and adapting to evolving environmental regulations pose significant hurdles.

4. How can Jingxin enhance its competitive position globally?

By obtaining international certifications, forming strategic collaborations, investing in biologics, digital supply chain management, and actively engaging in global R&D initiatives.

5. What risks could impede Jingxin’s strategic plans?

Regulatory delays, intensified competition, supply chain disruptions, and technological uncertainties could hinder growth if not proactively managed.

References

- [1] China Pharmaceutical Industry Development Report, 2022.

- [2] Global API Market Analysis, 2023.

- [3] China’s Biopharmaceutical Innovation Policies, 2022.

- [4] Zhejiang Province Regional Development Plan, 2023.

- [5] International Regulatory Compliance Guidelines, 2022.