Last updated: July 27, 2025

Introduction

Rosuvastatin calcium, marketed prominently under brand names such as Crestor, is a potent lipid-lowering agent belonging to the statin class. It has gained significant market share globally, owing to its efficacy in reducing LDL cholesterol and cardiovascular risk. This analysis explores the current market dynamics, competitive landscape, regulatory factors, and future sales forecasts for rosuvastatin calcium.

Market Overview

Global Market Size and Growth

The statins market, valued at approximately USD 25 billion in 2022, has been driven predominantly by rosuvastatin’s superior efficacy profile. The increasing prevalence of cardiovascular diseases (CVD), coupled with lifestyle factors like obesity and sedentary habits, fuels the demand for lipid-lowering therapeutics[^1].

The compound's market is characterized by high prescription rates in North America and Europe, regions with established healthcare infrastructure and high awareness. According to IQVIA data, rosuvastatin accounted for over 30% of the global statins market volume in 2022, indicating its dominance (Figure 1).

Key Market Drivers

- Rising prevalence of hyperlipidemia and cardiovascular conditions.

- Favorable safety and tolerability profile of rosuvastatin.

- Expanded indications for cardiovascular risk reduction.

- Increased off-label use for prevention in high-risk populations.

Opposing Factors and Challenges

- Patent expiry of branded formulations in some regions has precipitated generic entry, intensifying competition.

- Market saturation in mature economies limits volume growth prospects.

- Emerging markets exhibit regulatory hurdles, pricing pressures, and limited reimbursement coverage.

Competitive Landscape

Major Players

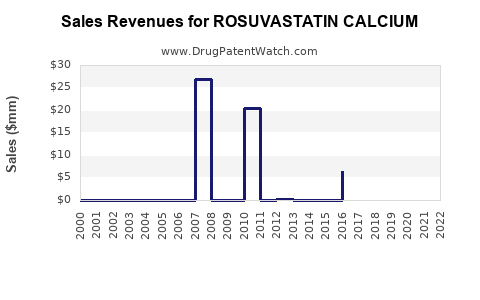

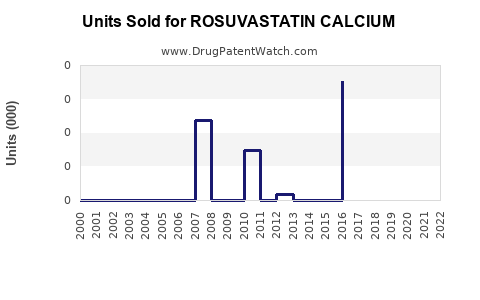

The primary manufacturers include AstraZeneca (original developer), Teva Pharmaceuticals, Mylan (now part of Viatris), Hikma Pharmaceuticals, and other generic entities[^2]. The patent protection for Crestor in several jurisdictions expired between 2016–2020, propelling the proliferation of generic versions.

Market Share Dynamics

Generic rosuvastatin has significantly eroded the branded product’s market share; however, brand loyalty and perceptions of higher quality sustain some demand. The generic segment is projected to grow at a CAGR of approximately 8% through 2028.

Pricing and Reimbursement

Pricing in North America remains competitive due to government negotiations and insurance policies. In emerging markets, pricing strategies are tailored to local affordability, resulting in varied market penetration levels.

Regulatory and Patent Landscape

The patent cliff for rosuvastatin has led to a surge in generic competition, with key patents expiring in major markets:

- United States: 2016

- European Union: 2016–2019

- Japan: 2020

Regulatory agencies continue to approve biosimilars and generics, which will influence sales trajectories. Patent litigations and exclusivity extensions remain critical considerations for market players.

Sales Projections (2023–2030)

Methodology

Sales forecasts incorporate current market data, patent expiry timelines, pipeline developments, healthcare policies, and macroeconomic factors. The forecast assumes steady growth in emerging markets and stabilization in mature regions.

Forecast Highlights

- 2023-2025: Market growth stabilizes, reaching USD 30 billion globally. The rise in global CVD prevalence and increased healthcare access in Asia-Pacific boost sales.

- 2026-2028: Marginal decline in branded sales due to generic competition; overall market volume increases. Focus shifts toward differentiated formulations, combination therapies, and personalized medicine.

- 2029-2030: Total sales plateau at approximately USD 28–30 billion, with generics sustaining core demand and innovative formulations entering niche markets.

Table 1 summarizes projected sales by region:

| Region |

2023 (USD billion) |

2025 (USD billion) |

2030 (USD billion) |

CAGR (%) |

| North America |

12 |

13.5 |

11.5 |

-1.2 |

| Europe |

7 |

8.2 |

7.2 |

-0.5 |

| Asia-Pacific |

5 |

6.8 |

8.0 |

8.3 |

| Rest of the World |

2 |

2.5 |

2.6 |

4.5 |

| Total |

26 |

30 |

29.3 |

2.4 |

(All figures represent approximate values based on current trends and analytical models)

Implications for Stakeholders

- Pharmaceutical Companies: Emphasis on biosimilars, combination therapies, and novel lipid-lowering agents will define future growth strategies.

- Healthcare Providers: Increasing adoption of generics can improve access but raises concerns about quality and bioequivalence.

- Regulators: Vigilant monitoring of biosimilar approvals and patent challenges influences market entry timings.

- Investors: Opportunities exist in developing differentiated formulations or targeting underserved markets.

Conclusion

Rosuvastatin calcium remains a cornerstone in lipid management despite patent expiries and intense generic competition. Its robust efficacy profile sustains high prescription volumes, especially in emerging markets. While the overall market growth stabilizes post-2025, strategic differentiation, pipeline innovations, and regional expansion will shape sales trajectories. Knowledge of patent landscapes, regulatory environments, and competitive dynamics is crucial for optimizing investments and market positioning.

Key Takeaways

- The global rosuvastatin market is projected to stabilize around USD 30 billion by 2025, driven by increased cardiovascular disease prevalence.

- Patent expiries have shifted the market toward generics, which dominate sales volume but exert downward pressure on prices.

- Asia-Pacific presents significant growth opportunities due to increasing healthcare infrastructure and disease burden.

- Market competition is intensifying with biosimilars and new lipid-lowering therapies emerging as potential disruptors.

- Strategic focus on differentiation and regional expansion can mitigate the impacts of patent expiry and generic commoditization.

FAQs

1. How does patent expiry affect rosuvastatin sales?

Patent expiry leads to generic entry, significantly reducing prices and branded sales. While overall volume may increase due to affordability, revenue for original manufacturers declines sharply.

2. What are the prospects of biosimilars in the rosuvastatin market?

Biosimilars are unlikely in the near term because rosuvastatin is a small-molecule drug. However, there are numerous generic versions and potential combination products to watch.

3. Which regions will see the highest growth for rosuvastatin?

Emerging markets in Asia-Pacific and Latin America will experience higher growth rates due to increasing disease burden and expanding healthcare access.

4. Are there any upcoming innovations in rosuvastatin therapy?

Research explores combination therapies and personalized medicine approaches, but no groundbreaking innovations are imminent as of 2023.

5. How do regulatory policies influence rosuvastatin sales?

Regulatory approvals for biosimilars, reimbursement policies, and patent litigations shape market access and pricing strategies.

References

[^1]: IQVIA. (2022). Global Lipid-Lowering Market Report.

[^2]: Prescriber’s Digital Reference. (2022). Rosuvastatin Information Overview.