Share This Page

Drug Price Trends for ROSUVASTATIN CALCIUM

✉ Email this page to a colleague

Average Pharmacy Cost for ROSUVASTATIN CALCIUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ROSUVASTATIN CALCIUM 40 MG TAB | 82009-0020-30 | 0.06575 | EACH | 2025-12-17 |

| ROSUVASTATIN CALCIUM 40 MG TAB | 82009-0020-10 | 0.06575 | EACH | 2025-12-17 |

| ROSUVASTATIN CALCIUM 20 MG TAB | 82009-0019-90 | 0.05168 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Rosuvastatin Calcium

Introduction

Rosuvastatin calcium, a potent HMG-CoA reductase inhibitor, is widely prescribed for dyslipidemia management and the prevention of cardiovascular disease. Since its approval by the U.S. Food and Drug Administration (FDA) in 2003, it has rapidly gained market share, driven by its efficacy and safety profile. This analysis examines the current market landscape, competitive dynamics, regulatory considerations, and offers price projections over the next five years, equipping stakeholders with strategic insights.

Market Overview

Global Market Size

The global statin market was valued at approximately USD 12.4 billion in 2021, with rosuvastatin accounting for a significant share due to its superior potency and tolerability. The compound is available under several brand names, including Crestor (AstraZeneca), and as generic versions in multiple countries, expanding accessibility and market reach.

Market Drivers

- Increasing Prevalence of Cardiovascular Diseases (CVDs): According to the World Health Organization, CVDs remain the leading cause of death worldwide, with an estimated 17.9 million fatalities annually [1]. The rising incidence fuels demand for lipid-lowering therapies.

- Expanding Treatment Guidelines: Contemporary guidelines recommend statins as a first-line intervention, accelerating adoption.

- Growing Awareness and Screening: Enhanced screening programs and heightened awareness boost prescriptions.

- Patent Expiry and Generic Entry: Patent expiration of branded rosuvastatin (Crestor) in multiple markets has led to price erosion but increased volume due to affordability.

Market Segments

- Brand-Name vs. Generics: While Crestor remains influential, generics now comprise over 75% of the market in mature regions, impacting pricing dynamics.

- Regional Markets: North America and Europe dominate the market, with Asia-Pacific experiencing rapid growth due to expanding healthcare infrastructure and economic development.

Competitive Landscape

Major players include AstraZeneca (original developer), Teva Pharmaceuticals, Mylan, and Sun Pharmaceutical, among others, producing branded and generic formulations. Patent litigations and regulatory approvals influence market shares, with generics exerting downward pressure on prices.

Regulatory Environment

Stringent regulatory standards across jurisdictions influence drug pricing and market entry. Recent biosimilar and generic approvals have increased competition, particularly in mature markets. Patent cliffs continue to reshape competitive dynamics, prompting mergers and acquisitions.

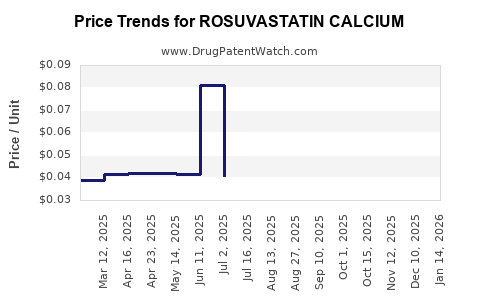

Pricing Trends

Historical Price Trends

Prior to patent expiry, branded rosuvastatin commanded premium prices ranging from USD 2.50 to USD 4.00 per pill in the U.S. store brand equivalents at around USD 0.50 to USD 1.00 per pill. Post patent expiry, prices declined substantially; for instance, generic rosuvastatin in the U.S. now averages USD 0.10 to USD 0.20 per pill.

Current Pricing

- Branded: Approximately USD 2.00–USD 3.50 per tablet in the U.S.

- Generics: USD 0.10–USD 0.30 per tablet, depending on formulation and volume discounts.

Pricing varies across regions, influenced by regulatory policies, insurance coverage, and market competition.

Future Price Projections

The trajectory of rosuvastatin prices over the next five years hinges on several factors:

- Patent Status: Patent expirations in key markets are expected by 2023–2024, accelerating generic penetration.

- Market Competition: Entry of biosimilars, parallel imports, and price negotiations restrict premium pricing.

- Regulatory Policies: Price controls in countries like India, China, and European nations will constrain upward pricing movements.

- Innovation: Lack of significant pharmaceutical innovations targeting rosuvastatin limits price premiums.

- Patient Access Initiatives: Programs to improve medication adherence and affordability are likely to further reduce prices.

Projected Price Trends

| Year | Estimated Price Range per Tablet (USD) | Remarks |

|---|---|---|

| 2023 | USD 0.10 – USD 0.25 | Increased generic market penetration begins. |

| 2024 | USD 0.09 – USD 0.20 | Competition intensifies; prices stabilize. |

| 2025 | USD 0.08 – USD 0.18 | Market saturation; marginal declines. |

| 2026 | USD 0.08 – USD 0.15 | Possible regional price adjustments. |

| 2027 | USD 0.07 – USD 0.15 | Market maturity; stable to slight decline. |

The prices are expected to remain relatively stable due to sustained competition but will largely stay within the low-cost generic range.

Implications for Stakeholders

- Manufacturers: To sustain profitability, focus on cost efficiencies and expanding geographic markets, especially emerging economies.

- Healthcare Providers: Emphasis on prescribing cost-effective generics to improve patient adherence.

- Payers and Governments: Continued negotiation on drug pricing and inclusion in essential medicines lists will shape future costs.

- Investors: Potential opportunities in generic manufacturing and distribution channels in regions with expanding healthcare access.

Key Challenges

- Regulatory Barriers: Approval processes and national drug pricing policies can delay or constrain price reductions.

- Market Saturation: High generic penetration narrows profit margins.

- Pharmaceutical Innovation: Absence of novel formulations limits premium pricing opportunities.

Conclusion

Rosuvastatin calcium's market is characterized by robust demand driven by the global burden of cardiovascular diseases. The impending end of patent exclusivity will catalyze substantial price declines owing to generic competition, stabilizing within the low-cost segment. While pricing will remain competitive, steady volume growth in emerging markets offers incremental revenue streams. Strategic positioning in manufacturing, regulatory navigation, and geographic expansion will be critical for stakeholders seeking sustained growth.

Key Takeaways

- Market dynamics are shifting towards affordability with the widespread availability of generics, leading to significantly lower prices globally.

- Price projections indicate modest declines over the next five years, stabilized by market saturation and national regulations.

- Opportunities exist in emerging markets with expanding healthcare infrastructure and in formulations that enhance adherence.

- Regulatory environments will continue to influence pricing, making regional strategies vital.

- Innovative pricing models and value-added formulations will become increasingly important to maintain margins in a highly competitive landscape.

FAQs

1. When will generic rosuvastatin become widely available in major markets?

Generic rosuvastatin patents primarily expire in 2023–2024 in key regions such as the U.S. and Europe, leading to widespread availability shortly thereafter.

2. How will the price of rosuvastatin in emerging markets evolve?

Prices are expected to decline due to increased competition and regulatory price controls but may remain somewhat higher compared to mature markets owing to import tariffs and distribution costs.

3. Are there any upcoming innovations or formulations for rosuvastatin?

Currently, no significant new formulations or delivery methods are in advanced clinical development, indicating limited innovation-driven price premiums.

4. How do regulatory policies influence rosuvastatin pricing?

Governmental controls and negotiations, particularly in countries with centralized drug procurement, suppress prices and encourage generic competition.

5. What strategies can manufacturers adopt to succeed in the mature rosuvastatin market?

Focus on cost optimization, diversification into emerging markets, pipeline diversification, and forming strategic alliances for distribution.

Sources:

[1] World Health Organization. (2021). Cardiovascular Diseases (CVDs).

More… ↓