Last updated: December 29, 2025

Executive Summary

MSD (known as Merck & Co. in the United States and Canada) stands as a global pharmaceutical leader with a robust portfolio spanning oncology, vaccines, infectious diseases, and specialty therapies. This analysis evaluates MSD’s market positioning, core strengths, recent strategic initiatives, and competitive landscape. It highlights its differentiation factors, challenges, and opportunities amidst a dynamic industry driven by innovation, regulatory complexities, and shifting market demands.

Key Highlights:

- Market Position: MSD maintains a top-tier position among global pharmaceutical giants, consistently ranking within the top five R&D spenders and revenue generators.

- Core Strengths: Innovative R&D pipeline, extensive vaccine portfolio, strategic partnerships, and a resilient global distribution network.

- Strategic Focus: Emphasizes personalized medicine, biosimilars, and expanding access in emerging markets.

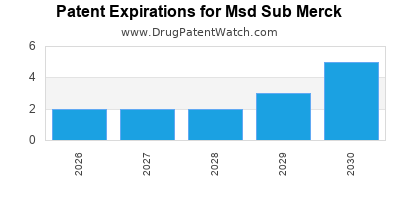

- Competitive Challenges: Patent expirations, pricing pressures, and intensifying competition from biotechs and generics.

What Is MSD’s Current Market Position and Competitive Standing?

Global Market Share & Revenue Breakdown

| Region |

Market Share (Approximate) |

Revenue (2022) |

Key Products & Focus Areas |

| North America |

35% – 40% |

~$21.7B |

Oncology (Keytruda), Vaccines (Gardasil), Diabetes |

| Europe |

20% – 25% |

~$12.5B |

Oncology, Vaccines, Infectious Diseases |

| Emerging Markets |

15% – 20% |

~$9.2B |

Infectious, Vaccines, Specialty Care |

| Others (Asia, RoW) |

15% |

~$4.8B |

Vaccines, Generics, Biosimilars |

Source: MSD Annual Reports 2022, IQVIA Data

Positioning among peers:

- In 2022, MSD ranked among the top five global pharmaceutical companies by revenue, competing with Pfizer, Roche, Novartis, and Johnson & Johnson.

- Keytruda (pembrolizumab) remains a dominant revenue driver, accounting for approximately 15% of total sales.

Market Competitive Edge

- Pipeline Strength: Over 100 projects in clinical development, with a strong focus on oncology, immunology, and vaccines.

- Vaccine Leadership: Gardenress (HPV vaccine) and renewed focus on COVID-19 vaccine development showcase resilience.

- Innovation & R&D Investment: Spent ~$12B in 2022, representing 18% of total revenue, emphasizing commitment to breakthroughs.

What Are MSD’s Core Strengths That Drive Its Strategic Advantage?

1. Robust R&D Pipeline and Innovation

| Indicator |

Details |

| R&D Spend (2022) |

~$12B (18% of revenue) |

| Pipeline Nodes |

120+ active projects, 50+ in late-stage trials |

| Key Focus Areas |

Oncology (immune checkpoint inhibitors, CAR-T), Vaccines, Rare Diseases |

Example:

- Keytruda’s (pembrolizumab) expanding indications across multiple cancers enhances revenue stability.

- Development of Lenvima (lenvatinib) combined therapies demonstrates versatility in oncology.

2. Leading Vaccine Portfolio and Public Health Engagement

| Vaccine Products |

Indications |

Market Penetration |

| Gardasil |

HPV-related cancers |

Dominant in mature markets |

| Pneumovax |

Pneumococcal diseases |

Widespread use worldwide |

| Vaccine Innovation |

mRNA and recombinant technology |

Pioneering efforts in COVID-19 vaccines |

3. Strategic Collaborations & Licensing Agreements

- MSD leverages alliances with biotech startups, universities, and governments to accelerate innovation.

- Recent collaborations include partnerships with BioNTech for mRNA technology and Moderna for vaccine development.

4. Global Manufacturing & Distribution Infrastructure

| Facility Count |

60+ manufacturing plants worldwide |

| Distribution Reach |

150+ countries, ensuring access in emerging markets |

| Supply Chain Resilience |

Focus on agility and digital tracking |

5. Market Diversification

- Balances portfolio with core therapeutic areas and geographical presence to mitigate risks associated with regulatory and patent challenges.

What Strategic Initiatives Are Shaping MSD’s Future?

1. Focus on Personalized Medicine & Biosimilars

| Initiative |

Description |

| Precision Oncology |

Investment in targeted therapies, companion diagnostics |

| Biosimilar Development |

Entry into biosimilars market with Ontruzant (trastuzumab) and others |

2. Expansion in Emerging Markets

- Pledges increased investments and tailored pricing models to improve access in Africa, Asia, and Latin America.

- Example: Local manufacturing plants in India, China, and Brazil contribute to market penetration.

3. Digital Transformation & Data Analytics

- Implementing AI/ML tools to optimize R&D, accelerate clinical trials, and enhance supply chain visibility.

- Adoption of real-world evidence (RWE) to support regulatory submissions and payer negotiations.

4. Commitment to Sustainability & Access

- Goals include reducing carbon footprint (~50% reduction by 2030) and enhancing access initiatives through alliances with WHO and GAVI.

How Does MSD Compare to Major Competitors?

Benchmarking Table: Key Metrics (2022)

| Company |

Revenue (USD B) |

R&D Spend (USD B) |

Key Products |

Market Focus |

| MSD |

~$58.3 |

~$12 |

Keytruda, Gardasil, Lenvima |

Oncology, Vaccines, Infectious Diseases |

| Pfizer |

~$100.3 |

~$13.8 |

Comirnaty, Ibrance |

Vaccines, Oncology |

| Roche |

~$63.3 |

~$9.6 |

Herceptin, Avastin |

Oncology, Diagnostics |

| Novartis |

~$51.9 |

~$9.3 |

Cosentyx, Zolgensma |

Oncology, Biosimilars |

| J&J |

~$54.7 |

~$12 |

Stelara, Janssen vaccines |

Immunology, Consumer Healthcare |

Sources: Company Annual Reports 2022, Evaluate Pharma, IQVIA

Key Differentiators

- MSD’s Keytruda is leading the immuno-oncology market.

- Significant investments in vaccine innovation serve as a competitive advantage, especially amidst the global COVID-19 response.

- Focused expansion into biosimilars uniquely positions MSD for growth as originator patents expire.

What Are the Challenges and Risks Faced by MSD?

1. Patent Expirations & Generic Competition

- Patent cliffs for blockbuster drugs like Remicade (adalimumab) threaten revenue streams.

- Increased biosimilar competition diminishes market exclusivity.

2. Pricing & Reimbursement Pressures

- Governments and payers worldwide push for lower drug prices, especially for high-cost therapies.

- Impacted especially in Europe and the U.S.

3. Regulatory & Political Risks

- Stringent regulation in emerging markets.

- Potential restrictions or delays due to geopolitical tensions.

4. Scientific & Technological Uncertainties

- R&D success rates are inherently uncertain.

- Competition from innovative biotech firms with disruptive technologies.

What Are the Strategic Opportunities for MSD Moving Forward?

1. Investment in Cell & Gene Therapies

- Capitalize on advancements in gene editing (e.g., CRISPR) and personalized cellular treatments.

2. Accelerate Adoption of Digital Health Solutions

- Use real-world data to inform clinical and commercial strategies.

- Enhance remote trials and telemedicine integration.

3. Expand Access & Affordability Programs

- Partner with global health entities.

- Develop tiered pricing models and local manufacturing.

4. Strengthen Portfolio in Rare Diseases & Unmet Needs

- Focus on rare cancers, genetic disorders, & infectious diseases like tuberculosis and HIV.

Conclusion and Key Takeaways

- MSD’s dominant market position hinges on a strong R&D pipeline, portfolio diversification, and strategic innovation.

- Its leadership in oncology (via Keytruda), vaccines (Gardasil), and infectious diseases maintains a competitive edge.

- Ongoing investments in biosimilars, personalized medicine, and emerging markets are crucial for future growth.

- Challenges such as patent expiry, pricing pressures, and regulatory hurdles necessitate agile strategic responses.

- Embracing digital transformation and patient-centric approaches will catalyze MSD’s sustained competitive advantage.

FAQs

1. How does MSD's pipeline compare to its competitors?

MSD’s pipeline is among the strongest, with over 120 active projects, especially in immuno-oncology and vaccines. Its focus on personalized medicine and biotherapeutics sets it apart from peers like Pfizer and Roche.

2. What is the significance of Keytruda for MSD’s market position?

Keytruda remains MSD’s flagship revenue driver, accounting for 15% of total sales (2022). It is a leader in immune checkpoint inhibitors with multiple approved indications, reinforcing MSD’s leadership in oncology.

3. How is MSD expanding its presence in emerging markets?

MSD invests in local manufacturing, licensing agreements, and tailored access programs in Africa, Asia, and Latin America to increase market penetration and improve affordability.

4. What are the primary risks facing MSD in the near future?

Patent expirations, biosimilar competition, pricing pressures, and geopolitical/regulatory risks pose significant challenges. The company plans to address these via pipeline diversification and market expansion.

5. What strategic initiatives will most impact MSD’s future growth?

Focus on biosimilars, personalized medicine, digital innovation, and emerging markets will be vital. Collaborations with biotech firms and investments in gene and cell therapy will deepen innovation capabilities.

References

- MSD Annual Reports 2022

- IQVIA Data 2022

- Evaluate Pharma Market Data 2022

- Company Press Releases & Strategic Reports