Last updated: July 28, 2025

Introduction

INVANZ (Ertapenem for injection) stands as a prominent carbapenem antibiotic developed by Merck & Co., primarily used to treat a broad spectrum of bacterial infections. Its strategic positioning in hospitals and healthcare settings has fueled its market presence. Analyzing its current market dynamics and financial trajectory reveals critical insights into its growth prospects and challenges within the evolving pharmaceutical landscape.

Market Overview

Pharmaceutical Industry Landscape

The pharmaceutical sector is characterized by rapid innovation, high regulatory standards, and considerable R&D investment. The global antibiotic market was valued at approximately USD 44 billion in 2022 [1], with carbapenems constituting a significant segment due to their efficacy against multidrug-resistant organisms.

Therapeutic Position of INVANZ

INVANZ is indicated for complicated intra-abdominal infections, complicated skin and soft tissue infections, and community-acquired pneumonia. Its broad-spectrum activity, extended dosing interval, and low nephrotoxicity differentiate it from other carbapenems, bolstering its appeal in hospital formulary choices [2].

Market Dynamics Affecting INVANZ

1. Rising Antibiotic Resistance

The proliferation of multidrug-resistant bacteria, especially carbapenem-resistant Enterobacteriaceae (CRE), undermines the efficacy of existing antibiotics, including ertapenem. While INVANZ is effective against many resistant strains, its role is challenged by emerging resistance mechanisms such as carbapenemases (e.g., KPC, NDM). This resistance trend pressures the pharmaceutical industry to innovate or reposition existing drugs, affecting INVANZ's market share.

2. Regulatory and Stewardship Challenges

Antimicrobial stewardship programs (ASPs) aim to optimize antibiotic use, limiting overprescription to mitigate resistance. Regulatory agencies increasingly require rigorous data on prescribing practices and resistance impact, which may constrain INVANZ's utilization in some contexts. However, positive clinical outcomes and safety profile support its continued adoption in appropriate cases.

3. Competitive Landscape

INVANZ faces competition from other carbapenems like meropenem, doripenem, and imipenem. Recently, newer agents such as plazomicin or cefiderocol have emerged targeting resistant pathogens, posing substitution threats. Furthermore, biosimilars or generics are pending patent expirations, which could alter pricing dynamics and market positioning.

4. Geographic Expansion and Market Penetration

Emerging markets, particularly in Asia-Pacific and Latin America, present substantial growth opportunities given rising infection rates and expanding healthcare infrastructure. Merck’s strategic efforts to penetrate these regions, coupled with local regulatory approvals, significantly influence INVANZ’s volume growth trajectory.

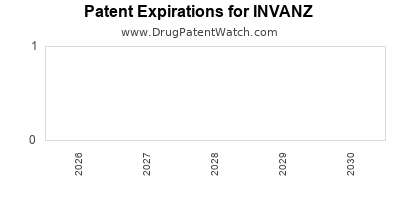

5. Patent Lifecycle and Pricing Dynamics

INVANZ’s patent expiration approaches, expected around the mid-2020s, could lead to increased generic competition, exerting downward pressure on prices. To sustain revenues, Merck is increasingly emphasizing innovative formulations, combination therapies, and new indications.

Financial Trajectory Analysis

Revenue Trends

Historically, INVANZ has contributed steadily to Merck’s infectious disease portfolio. In fiscal year 2022, sales of INVANZ and related antibiotics constituted approximately USD 600 million globally, reflecting stability but with signs of plateau due to increasing competition and resistance concerns [3].

R&D and Pipeline Influence

Merck continues to invest in antibiotic research, exploring new indications, formulations, and combination drugs involving ertapenem. While these R&D activities do not typically generate immediate revenues, they are critical for long-term positioning against resistance and emerging pathogens.

Pricing Strategy and Market Penetration

Pricing strategies focus on value-based models, considering the drug’s clinical benefits versus emerging resistance threats. Discounting and managed entry agreements in price-sensitive markets expand access but may temper margins.

Future Revenue Projections

Expert forecasts suggest that INVANZ’s global sales could experience incremental growth at approximately 2-4% annually over the next five years, contingent upon resistance dynamics, regulatory approvals, and strategic market expansion efforts [4].

Market Challenges and Opportunities

Challenges

- Resistance escalation may curtail effective use and necessitate newer agents, reducing INVANZ’s share.

- Patent expiry could introduce generics, pressure prices, and erode profit margins.

- Regulatory hurdles in emerging markets can delay market expansion.

Opportunities

- Expansion into endemic regions with rising infection burdens.

- Development of novel formulations to improve administration and patient compliance.

- Combination therapies that leverage INVANZ’s spectrum to combat resistant strains.

- Strategic collaborations for resistance management and stewardship programs.

Strategic Recommendations

- Diversify indications: Pursuing approval for additional resistant infections.

- Invest in stewardship partnerships: Enhancing clinical value perception.

- Accelerate pipeline innovations: Exploring novel formulations, fixed-dose combinations, and biosimilars.

- Expand geographic reach: Tailoring strategies for high-growth, underpenetrated markets.

Key Takeaways

- INVANZ remains a critical component of Merck’s infectious disease portfolio, with stable revenues but facing headwinds from resistance and impending patent expirations.

- Its market trajectory depends heavily on combating antimicrobial resistance, expanding into emerging markets, and innovating formulations.

- Competitive pressures from newer antibiotics and generics will require strategic differentiation to sustain profitability.

- Long-term growth hinges on investments in R&D, stewardship collaborations, and geographic expansion.

- Market dynamics necessitate agile responses to evolving bacterial resistance patterns and regulatory landscapes.

FAQs

1. What are the primary therapeutic advantages of INVANZ over other carbapenems?

INVANZ's extended dosing interval, favorable safety profile, and efficacy against a broad spectrum of infections, especially in intra-abdominal and skin infections, provide advantages over some carbapenems, enhancing compliance and reducing hospital stays.

2. How does rising antibiotic resistance impact INVANZ’s market prospects?

Increasing resistance, particularly through carbapenemase production, diminishes INVANZ's effectiveness against certain pathogens, potentially reducing its prescription rates and prompting the need for newer agents or combination therapies.

3. When is patent expiration expected for INVANZ, and what are its implications?

Patent protections for INVANZ are anticipated to expire around the mid-2020s [3], potentially leading to generic manufacturing, price reductions, and increased market access, but also challenging Merck’s revenue margins.

4. What role does geographic expansion play in the future of INVANZ?

Emerging markets offer significant growth opportunities due to rising infection rates and improving healthcare infrastructure. Strategic expansion into these regions can bolster sales, especially if local regulatory approvals are secured.

5. What innovations could extend the market viability of INVANZ?

Developing fixed-dose combinations, alternative formulations, new indications, and leveraging diagnostic advances to target resistant strains can prolong its market relevance and optimize clinical outcomes.

Sources

[1] EvaluatePharma. “Antibiotics Market Size & Forecast.” 2022.

[2] Merck & Co. Official Product Documentation. INVANZ (Ertapenem). 2022.

[3] Merck Annual Report, 2022.

[4] MarketWatch. “Pharmaceuticals Antibiotics Market Outlook,” 2023.