In the intricate ecosystem of modern pharmaceuticals, generic drugs serve as a cornerstone of affordable and accessible healthcare. Their journey from concept to patient, however, is far from straightforward, demanding a sophisticated interplay of scientific rigor, regulatory acumen, and astute market strategy. In this demanding environment, partnerships are not merely beneficial; they represent a strategic imperative for companies seeking to gain a competitive edge.

The Strategic Imperative of Partnerships in Generic Drug Development

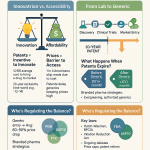

The pharmaceutical industry is experiencing a profound transformation, driven by a confluence of factors including patent expirations, escalating healthcare expenditures, and an increasing global demand for cost-effective medicines. This evolving landscape has firmly positioned generic drugs at the nexus of healthcare policy and business strategy.

The Evolving Landscape of Generic Pharmaceuticals

The trajectory of the pharmaceutical sector is defined by dynamic shifts, compelling companies to rethink traditional models and embrace collaborative paradigms.

The Economic and Healthcare Impact of Generics

Generic drugs are frequently described as the “unsung heroes” of healthcare, providing affordable alternatives to brand-name medications and expanding access to life-saving treatments for millions globally . These medications typically reduce costs by 80-85% compared to their brand-name counterparts, translating into substantial savings for patients, insurance providers, and government healthcare programs . For instance, the U.S. healthcare system alone realized over $445 billion in savings in 2023 due to generic drug utilization .

The profound economic benefits of generic drugs extend beyond direct cost savings, influencing national healthcare budgets and enabling the reallocation of resources to other critical areas of care . This is particularly significant in resource-constrained regions and for the management of widespread health crises, such as epidemics . This systemic impact underscores that the development of generic drugs, supported by robust partnerships, is a vital component of global public health strategy, transcending mere commercial interests. The inherent cost-effectiveness of generics thus generates a powerful societal and governmental impetus for their increased availability. This pressure, in turn, amplifies the demand for efficient generic drug development and approval processes, making strategic collaborations essential for companies aiming to meet this demand and secure market share.

Why Partnerships are More Critical Than Ever

The pharmaceutical industry is undergoing a fundamental shift from transactional engagements to strategic alliances . This evolution is a direct response to a dynamic regulatory environment, the escalating complexity of drug development, and a heightened focus on patient-centric care . These alliances are indispensable for addressing complex business challenges, fostering innovation, streamlining operational processes, and cultivating long-term value through shared risks, pooled resources, and aligned objectives .

This transition from transactional to strategic partnerships reflects a growing recognition that no single entity possesses all the requisite resources, specialized expertise, or risk tolerance to navigate the contemporary generic drug landscape in isolation. The pursuit of “added value” within this industry is increasingly achieved through deeper, more integrated collaborations rather than through simple, short-term exchanges . The emphasis on long-term, multi-year agreements and the allocation of dedicated alliance management resources indicate a future where generic drug companies will increasingly integrate partners into their core operational and strategic planning. This proactive approach aims to cultivate stability and resilience within supply chains, ensuring uninterrupted access to critical therapies, a direct response to past disruptions and market volatility.

Generic Drug Development: A Unique Pathway

Unlike the lengthy and resource-intensive process of novel drug development, generic drug development follows an “abbreviated” pathway. This unique regulatory route primarily focuses on demonstrating bioequivalence to an already approved brand-name drug, rather than re-proving its safety and efficacy. This distinction profoundly shapes the strategic considerations for forming partnerships.

Understanding the Abbreviated New Drug Application (ANDA) Process

Generic drugs, which constitute approximately 90% of prescriptions filled in the United States, are essentially copies of innovator or brand-name prescription drugs . To obtain approval for marketing a generic drug, companies must submit an Abbreviated New Drug Application (ANDA) to the U.S. Food and Drug Administration (FDA) . The ANDA pathway offers a streamlined route to approval, concentrating on demonstrating bioavailability and bioequivalence to the Reference Listed Drug (RLD), thereby circumventing the need for costly and time-consuming animal and clinical (human) studies to establish safety and effectiveness .

A comprehensive ANDA submission package is critical for the FDA’s evaluation of a generic medication’s safety, effectiveness, and quality . The submission must encompass detailed substance information, a clear statement of the medication’s composition, descriptions of manufacturing and packaging processes, in-process controls, specifications for identity, strength, quality, purity, potency, and bioavailability, bioequivalence studies, Chemistry, Manufacturing, and Controls (CMC) information, and accurate labeling .

The abbreviated nature of the ANDA process, while offering a clear advantage in terms of cost and time to market, shifts the primary development burden from extensive clinical trials to rigorous analytical and manufacturing precision. This places immense pressure on generic manufacturers to master bioequivalence studies and CMC, rendering partnerships with specialized Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) indispensable for achieving the required scientific and regulatory standards efficiently. The FDA’s prioritization of certain generic reviews, such as those for shortage products, potential first generics, or drugs related to public health emergencies , combined with the success of the Generic Drug User Fee Amendments (GDUFA) program in reducing review times , fosters a “race to market” environment. This dynamic amplifies the strategic value of partnerships that can accelerate ANDA submission readiness and facilitate regulatory interactions, potentially securing first-to-file advantages and maximizing initial profitability before market saturation.

Here is a table summarizing the key components of an ANDA submission package:

| Component | Description | Significance for FDA Approval & Product Quality |

| Substance Information | Comprehensive list of all components (active and inactive ingredients), detailed specifications, and manufacturer details . | Ensures all raw materials meet quality and safety standards, verifying the active ingredient is identical to the brand-name drug . |

| Product Information | Clear statement of medication’s composition, manufacturing and packaging processes, in-process controls, and specifications for identity, strength, quality, purity, potency, and bioavailability . | Demonstrates the ability to consistently produce a high-quality, stable, and effective drug product . |

| Bioequivalence Studies | Scientific evidence proving the generic medication functions identically to the Reference Listed Drug (RLD) in the body . | Crucial for establishing therapeutic equivalence without repeating costly clinical trials, ensuring the generic delivers the same treatment effect . |

| Chemistry, Manufacturing, and Controls (CMC) Information | Details on tests, analytical procedures, and acceptance criteria for sterility, dissolution rate, and other quality attributes . | Verifies the manufacturing process is robust, reproducible, and yields a product meeting all quality and performance standards . |

| Labeling | Must be identical to the RLD’s labeling, providing accurate information on usage, warnings, and cautions . | Ensures healthcare professionals and patients receive consistent and accurate information for safe and effective use . |

| Facility and Manufacturing Methods Information | Disclosure of facilities and methods employed, ensuring adherence to FDA standards . | Confirms that the production environment and processes meet Good Manufacturing Practices (GMP) for quality and consistency . |

Bioequivalence: The Cornerstone of Generic Approval

The approval of a generic drug hinges on a sufficient demonstration of its “sameness” to the corresponding brand-name product. This “sameness” is primarily defined as “the absence of a significant difference in the rate and extent to which the active ingredient or active moiety in pharmaceutical equivalents or pharmaceutical alternatives becomes available at the site of drug action” . This is most commonly established through pharmacokinetic (PK) data, although pharmacodynamic (PD) or comparative clinical endpoints may be employed when PK-based assessment is not feasible or sufficient .

The FDA mandates that a generic drug’s absorption into the bloodstream and its subsequent therapeutic effect must occur at essentially the same rate and to the same extent as the original drug . To substantiate this, rigorous pharmacokinetic studies are conducted . For instance, the FDA’s bioequivalence guidelines stipulate that a new generic medicine must demonstrate a 90% confidence interval (CI) for the mean AUC (total area under the plasma drug concentration-time curve) and Cmax (maximum plasma drug concentration) within the range of 80% to 125% of the RLD .

While the concept of bioequivalence appears straightforward, its practical achievement, particularly for complex generics, presents considerable scientific and technical challenges. Complex generics include those with intricate active ingredients, formulations, delivery routes, or dosage forms, such as metered dose inhalers, auto-injectors, or ophthalmic emulsions . This inherent complexity often necessitates the application of advanced modeling tools, such as Quantitative Model-informed Drug Development (QMM) , and specialized analytical capabilities. Consequently, partnerships with entities possessing such advanced expertise become crucial. The FDA’s “Critical Path Opportunities for Generic Drugs” initiative and the increasing adoption of Model-informed Drug Development (MIDD) aim to modernize generic development by leveraging mathematical models and big data analytics. This indicates a future where successful generic companies will increasingly rely on collaborations that bring cutting-edge computational and data science capabilities to optimize formulation design and predict bioequivalence more efficiently, thereby reducing development uncertainty, cost, and time .

Chemistry, Manufacturing, and Controls (CMC) in Focus

Beyond demonstrating bioequivalence, generic drug companies are mandated to provide extensive data on their manufacturing processes. This includes demonstrating precisely how the active and inactive ingredients are combined to reliably produce a high-quality product . The submitted information must detail specifications, in-process controls, and provide evidence that the drug will maintain its stability over time and can be produced consistently batch after batch .

Compliance with Good Manufacturing Practices (GMP) is paramount, with FDA inspectors routinely auditing manufacturing facilities to verify strict adherence to these standards . The stringent and complex nature of CMC requirements, coupled with the globalized supply chain where active pharmaceutical ingredient (API) production, formulation, coating, and packaging can occur in disparate facilities worldwide , renders internal control over the entire process incredibly challenging. This inherent complexity drives generic companies towards partnerships with Contract Development and Manufacturing Organizations (CDMOs) and Contract Manufacturing Organizations (CMOs) that possess the necessary state-of-the-art facilities, specialized handling capabilities (e.g., for high-potent drugs or sterile injectables), and expertise in navigating global GMP standards .

Recent challenges, such as widespread drug shortages often linked to quality-related breakdowns in manufacturing and an over-reliance on a limited number of suppliers , underscore the critical need for supply chain resilience. This suggests that future CMC partnerships will increasingly prioritize not just cost-efficiency, but also the geographic diversification of manufacturing facilities, redundancy in supply, and investment in advanced manufacturing technologies to mitigate risks and ensure consistent supply. This trend is already leading to “onshoring” or “friendshoring” initiatives, where production is brought closer to home or to allied nations .

Diverse Forms of Strategic Alliances in the Generic Sector

The generic pharmaceutical industry, much like a complex biological system, thrives on diversity—not only in its product offerings but also in its collaborative structures. From highly specialized service providers to deeply integrated joint ventures, the forms of partnership are as varied as the strategic needs they are designed to address.

Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

These entities represent perhaps the most common and foundational types of partnerships in drug development, offering specialized services that generic companies frequently choose to outsource.

Leveraging Specialized Expertise and Infrastructure

Contract Research Organizations (CROs) provide comprehensive support across various drug development phases, encompassing clinical trial management, regulatory affairs, data management, and statistical analysis . They bring deep knowledge in specific therapeutic areas, technologies, and global regulatory frameworks, which helps sponsors avoid costly errors and make well-informed decisions throughout the development process .

Contract Manufacturing Organizations (CMOs), often functioning as Contract Development and Manufacturing Organizations (CDMOs), offer a wide spectrum of services, ranging from early design and discovery to final packaging. This includes the manufacturing of active pharmaceutical ingredients (APIs) and finished dosage forms (FDFs) . These organizations operate state-of-the-art facilities that adhere strictly to Good Manufacturing Practice (GMP) standards .

The increasing complexity of generic drug development, particularly for “complex generics” , frequently demands highly specialized scientific and technical capabilities. These can include advanced analytical methods, specific formulation expertise, or the intricate integration of drug and device components for combination products. Generic companies, operating with inherently thin profit margins, often find it economically impractical to build and maintain all such capabilities in-house. Therefore, partnerships with CROs and CMOs become a strategic necessity to access this niche expertise and avoid prohibitive capital expenditure, directly influencing product quality and regulatory success. The FDA’s advocacy for “quality by design” (QbD) in generic development and its focus on “model-informed drug development” (MIDD) suggest a future where CROs and CMOs will need to integrate advanced data analytics and modeling capabilities into their service offerings. This implies that successful partnerships will increasingly depend on the partners’ technological sophistication and their ability to leverage data to predict and optimize drug performance, evolving beyond traditional “fee-for-service” models towards more integrated scientific collaboration.

Enhancing Scalability and Cost Efficiency

Outsourcing to CROs and CMOs offers substantial cost reduction by mitigating the high expenses associated with facility maintenance, equipment investment, and workforce management . This is particularly advantageous for small and mid-sized enterprises (SMEs) and emerging biotech firms .

CMOs provide crucial scalability and flexibility, enabling companies to efficiently adjust production volumes—whether ramping up for market demand, scaling down during clinical trial phases, or adapting for commercial launch requirements . Similarly, CROs accelerate development timelines through their established processes, experienced staff, and extensive global site networks . The razor-thin margins and intense price competition that characterize the generic drug market make cost efficiency an absolute necessity. By strategically outsourcing non-core activities to CROs and CMOs, generic manufacturers can convert fixed costs into variable costs, optimize capital allocation, and achieve economies of scale without requiring significant internal investment. This directly enables them to remain competitive in a highly price-sensitive market.

An emerging trend in CDMO partnerships involves “lower up-front costs with contingent success payments” . This signifies a shift towards more aligned financial incentives, where CDMOs are increasingly willing to share development risks. This can manifest through performance-based payments or even royalty models . This evolution has the potential to democratize access to high-quality manufacturing for smaller generic players and foster deeper, more committed long-term relationships where the success of both parties is intrinsically linked.

Co-Development and Joint Ventures

Beyond the provision of services, co-development agreements and joint ventures represent deeper, more integrated partnerships. These arrangements often involve shared intellectual property, responsibilities, and financial outcomes, signifying a higher level of commitment and strategic alignment.

Sharing Risks and Resources for Complex Generics

Co-development agreements typically involve two entities collaborating to develop and commercialize pharmaceutical products, frequently integrating both parties’ proprietary patentable technology and intellectual property (IP) . These agreements facilitate the joint undertaking of further intellectual property development . Such partnerships are increasingly vital in generic drug development for navigating regulatory complexities, managing costs, and accelerating the availability of medications . They empower companies to share the financial burden and inherent risks associated with clinical trials, regulatory submissions, and manufacturing processes .

The increasing prevalence of “complex generics” , which are inherently more challenging and costly to develop than their simpler counterparts , renders the traditional solo development model less viable for many companies. Co-development directly addresses this by distributing the substantial research and development (R&D) investment and regulatory hurdles across multiple partners. This approach mitigates individual financial exposure and leverages complementary scientific and technical strengths, thereby enabling the pursuit of these higher-value, yet higher-risk, products that might otherwise be beyond reach. The FDA’s “Generic Drug Cluster” and “Parallel Scientific Advice (PSA) pilot program” with the EMA for complex generics aim to foster alignment in regulatory approaches. This implies that co-development partners can collectively leverage these harmonization efforts, pooling their regulatory insights and engaging agencies jointly to streamline approval pathways for complex products across multiple jurisdictions. This collaboration can potentially reduce redundant studies and accelerate global market entry.

Accelerating Market Entry and Innovation

Collaborative efforts often lead to faster product development, expanded market reach, and enhanced overall success for all participating parties . Such partnerships can also accelerate market entry for novel products by facilitating access to advanced technologies and specialized expertise, particularly through alliances between generic drug manufacturers and innovative companies .

In a market driven by patent expirations and the pursuit of first-mover advantages, such as the 180-day exclusivity granted to first-to-file Paragraph IV challengers , speed to market is paramount. Co-development accelerates this process by enabling parallel workstreams, combining diverse expertise, and distributing the workload of development and regulatory submissions. This collaborative acceleration directly translates into a competitive edge, allowing partners to capture market share before it becomes saturated. The increasing focus on “value-added medicines” (VAMs)—modified generics offering new formulations, delivery systems, or indications —represents a new frontier for generic innovation. Co-development provides a powerful mechanism for generic companies to collaborate on developing these VAMs, leveraging shared R&D capabilities to create differentiated products with stronger intellectual property protection and potentially higher profit margins, thereby moving beyond pure price competition.

Licensing and Distribution Agreements

These agreements are fundamental to the commercialization of generic drugs, meticulously defining how intellectual property is shared and how products ultimately reach the market and, subsequently, the patient.

Unlocking Intellectual Property and Market Access

Licensing agreements grant one company the authority to develop, manufacture, distribute, or sell another company’s pharmaceutical products or technologies under specified conditions . This broad category encompasses various forms, including single product licenses, technology licenses (e.g., for patented formulations or manufacturing processes), and even trademark licenses (e.g., for authorized generics) .

For smaller biotech companies or research institutions that develop innovative technologies but lack the extensive resources for full clinical development and commercialization, licensing offers a viable pathway to monetize their innovations without relinquishing complete control . Conversely, for established pharmaceutical companies, licensing provides a strategic avenue to expand their product portfolios, enter new therapeutic areas, or access novel technologies without undertaking the full risk and expense of early-stage research and development . Given the patent-driven nature of the pharmaceutical industry, particularly the phenomenon of the “patent cliff” and the necessity to navigate complex “patent thickets” , licensing agreements are critical for generic companies to legally access the necessary intellectual property (e.g., manufacturing processes, specific formulations) required to produce bioequivalent drugs. Without such agreements, market entry would be severely restricted, making licensing a direct enabler of generic competition post-patent expiry.

The rise of “authorized generics”—where a brand-name company licenses its drug to a generic manufacturer to sell under the brand’s own or a different label —illustrates a complex interplay of competition and collaboration. This indicates that licensing is not solely a tool for generic companies to enter the market but also a strategic maneuver for innovator companies to manage patent expirations, retain some market share, and potentially influence the competitive landscape, thereby creating a nuanced dynamic within the generic market.

Strategic Considerations for In-licensing and Out-licensing

Companies engage in both in-licensing and out-licensing based on their distinct strategic needs. In-licensing involves acquiring rights from external sources to enhance a company’s portfolio, enabling firms to access capital for development and marketing processes while bypassing certain aspects of innovation and development . Conversely, out-licensing allows generic players to develop a technology or drug molecule up to a certain phase and then license it to larger pharmaceutical companies, typically in exchange for a development fee and future royalties . The terms of exclusivity, whether exclusive or non-exclusive licenses, significantly influence the value and strategic implications of these agreements, impacting market penetration and the value proposition for individual licensees .

The strategic choice between co-development and licensing often hinges on the desired level of control, risk appetite, and the specific nature of the intellectual property involved . Licensing typically offers less commitment and a more clearly defined transfer of rights, making it suitable for gaining specific IP access or facilitating market entry. In contrast, co-development implies deeper integration and shared creation of new intellectual property, which is ideal for complex or value-added products . This necessitates a nuanced decision-making process where the type of partnership is meticulously matched to the product’s characteristics and the company’s long-term objectives. The increasing global demand for excipients, driven by patent expirations and the growing demand for generic drugs , highlights a critical, often overlooked, area for licensing and manufacturing partnerships. This indicates that strategic generic companies will not only focus on the active pharmaceutical ingredient (API) and the final product but also on securing reliable, high-quality sources and potentially licensing technologies related to excipient development and formulation, which are crucial for achieving bioequivalence and ensuring manufacturing consistency.

Unlocking Competitive Advantage Through Collaborative Synergies

In the fiercely competitive generic drug market, achieving a distinct advantage is not solely about being the first to market; it is increasingly about cultivating an expansive ecosystem of collaboration. This synergistic approach amplifies capabilities, mitigates inherent risks, and accelerates market impact. Partnerships, therefore, serve as the fundamental engines driving this competitive advantage.

Mitigating Risks and Sharing Financial Burdens

Drug development, even for generic products, is inherently fraught with substantial financial and operational risks. Partnerships provide a potent mechanism to distribute these burdens, thereby rendering ambitious projects more feasible. Collaborations enable companies to pool resources and mitigate the inherent risks associated with drug development . Products developed through collaborative efforts are notably more likely to reach the market, with some analyses suggesting they are four times more successful . Strategic partnerships empower companies to share the financial burden and risks tied to clinical trials, regulatory submissions, and manufacturing processes .

The considerable costs associated with bioequivalence studies, regulatory filings, and the establishment of robust manufacturing processes for generic drugs, coupled with the potential for expensive patent litigation , can be prohibitive for individual companies, particularly smaller entities. Partnerships directly address this challenge by pooling capital and expertise, enabling companies to undertake projects that would otherwise be too risky or financially demanding on their own. This ultimately fosters a more diverse and competitive generic market. The increasing focus on “fast fail” strategies in drug development further suggests that partnerships can be structured to quickly identify and terminate non-viable generic candidates, thereby minimizing wasted investment. This indicates a shift towards agile, outcome-focused collaborations where partners are incentivized not just to advance a drug through development, but to make early, data-driven decisions on viability, optimizing portfolio management and overall R&D efficiency.

Accessing Niche Expertise and Advanced Technologies

No single company possesses the entirety of knowledge and resources required for modern drug development. Partnerships serve as conduits, opening doors to highly specialized knowledge and cutting-edge tools that accelerate development and enhance product quality. Collaborations facilitate access to knowledge, expertise, and resources from diverse regions, thereby enhancing the efficiency and effectiveness of the R&D process . Generic manufacturers can leverage each other’s specialized skills and capabilities . For smaller firms, this translates into access to larger resources, including funding, advanced technology, and established distribution networks, as well as crucial expertise in regulatory affairs and manufacturing .

The rapid evolution of scientific methodologies, such as Quantitative Model-informed Drug Development (QMM) and Model-informed Drug Development (MIDD) , and the increasing complexity of certain generic formulations, including biosimilars and sterile injectables , mean that internal R&D capabilities can quickly become outdated or insufficient. Partnerships with specialized CROs, CMOs, or even innovative biotechs directly bridge these knowledge and technology gaps. This enables generic companies to develop and secure approval for products that would otherwise be beyond their technical scope, thereby expanding their product pipeline into more challenging, and often more profitable, areas. The increasing reliance on Artificial Intelligence (AI) and big data analytics in drug discovery and development suggests that future partnerships will increasingly focus on data-sharing and the collaborative development of AI models. This could lead to the formation of “data consortia” or joint ventures specifically designed to leverage collective datasets for predictive analytics in bioequivalence, formulation optimization, and supply chain management, creating a new layer of competitive advantage based on superior data intelligence.

Expanding Market Reach and Global Footprint

The generic drug market is inherently global, characterized by diverse regulatory landscapes and varying patient needs across different regions. Partnerships are instrumental in navigating these complexities and effectively reaching underserved patient populations worldwide. Strategic alliances can serve as a direct gateway to new geographies and therapeutic areas . Collaborating with local partners enables companies to navigate regulatory nuances and cultural differences more effectively, thereby facilitating access to patients who might otherwise remain underserved . International research and development (R&D) collaborations accelerate product development, enhance drug quality, and foster the sharing of knowledge and resources, ultimately empowering manufacturers to bring new treatments to market more rapidly .

The diverse regulatory requirements across various countries, which include differing manufacturing specifications, varying testing requirements, and mandates for local clinical trials , create significant barriers to global market entry for generic drugs. Partnerships with local entities or active participation in international harmonization initiatives directly address these challenges by providing localized regulatory expertise, established distribution networks, and a clear pathway to navigate country-specific nuances. This approach enables broader market penetration and increased access to affordable medicines globally. The current push for “onshoring and friendshoring” in pharmaceutical manufacturing , driven by geopolitical tensions and supply chain vulnerabilities, while seemingly counter to global expansion, actually reinforces the need for strategic international partnerships. This indicates a future where generic companies will seek partners not just for market access, but for geographically diversified manufacturing redundancy, balancing localization needs with global reach to build more resilient and politically viable supply chains.

Streamlining Regulatory Pathways and Accelerating Approvals

Regulatory hurdles frequently represent the most unpredictable and time-consuming aspects of drug development. Strategic partnerships can significantly de-risk and accelerate this crucial process. The FDA’s Generic Drug User Fee Amendments (GDUFA) and Drug Competition Action Plan (DCAP) are initiatives designed to streamline generic drug approval processes, reduce review times, and eliminate barriers to market entry . Companies can significantly reduce approval times by thoroughly studying FDA guidances, such as Product-Specific Guidances (PSGs), requesting early meetings with the FDA, and utilizing controlled correspondence processes .

International collaborations, including the FDA’s Generic Drug Cluster and the FDA-EMA Parallel Scientific Advice program, aim to harmonize regulatory standards and foster alignment in scientific evaluation, thereby reducing unnecessary duplication of studies . Despite these streamlining efforts, the inherent complexity of demonstrating bioequivalence for certain products and the necessity for meticulous ANDA submissions continue to present significant challenges. These can lead to costly delays and rejections; for example, a 2023 study found that 20% of ANDA rejections stemmed from inadequate bioequivalence data . Partnerships with regulatory affairs consultants, CROs specializing in bioequivalence studies, and legal experts in patent challenges (Paragraph IV certifications) directly enhance the quality and completeness of submissions, thereby increasing approval rates and accelerating market entry.

The FDA’s focused attention on “complex generics” and the development of specific guidances (PSGs) for them signal a strategic intent to encourage competition in these more challenging-to-develop segments. This suggests that generic companies, through strategic partnerships, can proactively target these complex products, leveraging shared expertise to meet stringent regulatory requirements and potentially secure a “first generic” advantage with its associated 180-day market exclusivity. This approach transforms regulatory challenges into significant commercial opportunities.

Overcoming Challenges in Generic Drug Partnerships

While partnerships offer immense advantages, they are not without their complexities. Navigating intellectual property mazes, diverse regulatory landscapes, operational hurdles, and human dynamics requires careful foresight and robust management.

Navigating Intellectual Property Complexities and Patent Thickets

Intellectual property forms the lifeblood of the pharmaceutical industry. For generic drug developers, this translates into the critical task of understanding and strategically maneuvering around existing patents.

The Critical Role of Patent Data Analysis

A patent grants an inventor exclusive rights to a drug for approximately 20 years, allowing them to sell their new medication without competition and recoup substantial research and development costs . Generic market entry is typically triggered by the expiration of these patents . However, the patent landscape can be dense and convoluted, often referred to as a “patent thicket,” where a single brand-name drug may be protected by multiple patents covering various aspects such as composition, manufacturing processes, and specific uses .

DrugPatentWatch stands as a crucial tool for patent data analysis, offering detailed information on patent expiration dates, litigation status, and market dynamics . It assists in identifying drugs nearing the end of their exclusivity period and pinpointing opportunities where fewer competitors might enter due to unique characteristics like complex formulations or niche indications . The financial incentive of being a “first generic,” which can secure 180 days of market exclusivity under Paragraph IV challenges , creates a high-stakes race. Without sophisticated patent data analysis tools like DrugPatentWatch, generic companies face the significant risk of infringing on existing patents, delaying market entry, or missing lucrative first-mover opportunities. Consequently, strategic partnerships frequently include legal and analytical firms specializing in intellectual property to ensure precise market timing and avoid costly litigation.

Addressing Patent Litigation Risks and Paragraph IV Challenges

Patent disputes are a significant concern within the pharmaceutical industry, largely due to the high value associated with drug patents . Generic drug manufacturers frequently challenge innovator patents under the Hatch-Waxman Act, aiming to introduce lower-cost alternatives to the market. This process, while intended to balance competition and innovation, often results in protracted and expensive litigation . Filing an Abbreviated New Drug Application (ANDA) with a Paragraph IV certification, which challenges the validity or enforceability of a brand-name drug’s patent, can secure 180 days of market exclusivity for the first generic to receive approval .

The aggressive use of citizen petitions by brand-name firms to delay generic or biosimilar entry highlights a strategic tactic employed to extend market exclusivity beyond the intended patent terms. Generic companies must proactively integrate legal and regulatory partnership strategies to effectively counter these delays, demonstrating that navigating the intellectual property landscape involves not only monitoring patent expiry but also anticipating and responding to anti-competitive maneuvers. The concept of “evergreening,” where brand-name companies make slight modifications to existing drugs to extend patent protection , presents a continuous challenge for generic developers. This indicates that generic partnerships will need to invest more in reverse engineering and formulation science to overcome these subtle intellectual property barriers. This could lead to more co-development agreements focused on innovative generic formulations, such as value-added medicines, that can navigate complex intellectual property landscapes while still offering a cost advantage.

Ensuring Regulatory Compliance Across Borders

The global nature of generic drug development necessitates navigating a complex and often disparate patchwork of regulatory requirements. This presents a significant challenge that strategic partnerships can help to mitigate and overcome.

Harmonization Efforts by FDA and EMA

Regulatory harmonization is a process through which regulatory authorities align technical requirements for the development and marketing of pharmaceutical products. This alignment offers numerous benefits, including fostering favorable market conditions to support early access to medicinal products, promoting competition and efficiency, and reducing unnecessary duplication of clinical testing . The FDA’s Office of Generic Drugs (OGD) actively engages in international activities, collaborating with global regulatory agencies through initiatives such as the Generic Drug Cluster (GDC) and the Parallel Scientific Advice (PSA) pilot program with the European Medicines Agency (EMA) . These collaborative forums aim to increase scientific alignment, achieve a common understanding of regulatory requirements, and facilitate discussions on scientific review issues .

Despite these concerted harmonization efforts, variations in regulatory requirements and scientific approaches continue to exist across different countries . This inconsistency can lead manufacturers to be selective about the markets they enter, potentially limiting access and competition in certain regions. Partnerships that leverage local regulatory expertise and actively participate in international dialogues, such as the PSA program, directly enable companies to navigate these varied frameworks, optimize global development programs, and avoid redundant studies. This approach facilitates broader market penetration and accelerates approvals in multiple regions.

Regional Regulatory Hurdles and Inconsistencies

Developing a single drug product for simultaneous global submission remains a formidable challenge due to the varying regulatory requirements of different countries . Jurisdictions such as Mexico and Brazil possess well-defined regulatory frameworks, while others have less developed systems, compelling manufacturers to navigate a diverse array of requirements . Many Latin American nations, for instance, still mandate local clinical trials for generic drugs .

The requirement for local clinical trials in some regions for generic drugs, which typically rely on bioequivalence for approval, represents a substantial additional cost and time burden, particularly for smaller companies . This trend suggests that generic companies targeting these markets must form partnerships with local Contract Research Organizations (CROs) or co-development partners who possess the necessary infrastructure and expertise to conduct such trials efficiently and compliantly, thereby transforming a regional barrier into a manageable strategic challenge. Furthermore, the lack of explicit regulatory guidelines or formal recognition of “complex products” in many countries outside the United States and European Union creates a “regulatory vacuum” for advanced generics. This indicates that generic companies pursuing global market entry for complex products must engage in proactive regulatory advocacy and form partnerships that can help shape emerging regional regulations, or at least adeptly navigate ambiguous frameworks, to ensure a predictable pathway for their innovations.

Operational Integration and Supply Chain Resilience

The journey of a generic drug from raw material acquisition to patient delivery is a complex global ballet. Ensuring seamless operations and robust supply chains is paramount, and strategic partnerships are at the very core of achieving this.

Addressing Drug Shortages and Supply Chain Vulnerabilities

Drug shortages, particularly affecting generic sterile injectables and oral solids, have a profound negative impact on millions of patients and healthcare providers . These shortages are complex phenomena, frequently linked to disruptions in the global supply chain, an over-reliance on a limited number of active pharmaceutical ingredient (API) sources (e.g., China and India supply over 70% of APIs) , and unsustainable generic drug pricing models . The generic supply chain has been likened to “a tree with a slender trunk”—a disruption occurring early in the chain can cascade and ripple across all downstream producers .

The intense “race to the bottom” in generic pricing, fueled by fierce competition and the consolidation of purchasing groups , actively disincentivizes manufacturers from investing in resilient supply chains. This pressure leads to cost-containment strategies such as reduced maintenance, deferred equipment upgrades, and increased offshoring . These practices directly contribute to quality breakdowns, market exits, and, ultimately, drug shortages. Consequently, partnerships must evolve beyond simply seeking the lowest cost; they must prioritize partners who demonstrate a commitment to investment in quality, redundancy, and ethical sourcing, even if this entails slightly higher upfront costs.

The Imperative of Quality Control and Transparency

Reports have highlighted inconsistent generic drug quality, including varying dissolution rates, contamination issues (e.g., N-Nitrosodimethylamine or NDMA in angiotensin receptor blockers), and subpotent dosing, particularly with internationally sourced generics . FDA inspections are often infrequent, sometimes announced, and face challenges such as language barriers and the loss of experienced inspectors .

The complex, multi-site manufacturing process—where API production, inactive ingredient combination, coating, and packaging are often handled by different entities —creates a “black box” effect. This opacity makes it challenging to trace accountability for quality issues, as typically only one company’s name appears on the final product label . This lack of transparency erodes trust and complicates the resolution of problems. Strategic partnerships should therefore incorporate robust audit clauses, clearly defined quality agreements, and potentially independent third-party testing to ensure end-to-end quality and traceability. The call for “increased domestic manufacturing” and “by-the-batch chemical analysis” suggests a fundamental re-evaluation of the generic drug supply chain model. This indicates that future partnerships may increasingly involve vertical integration or “nearshoring” strategies to gain greater control over manufacturing processes and quality. Furthermore, independent quality verification, perhaps through collaborations with specialized analytical laboratories, will likely become a competitive differentiator, moving beyond sole reliance on regulatory inspections.

Managing Misaligned Interests and Cultural Differences

Even the most strategically sound partnerships can falter due to underlying human and organizational dynamics. Navigating these complexities requires careful attention and proactive management.

Partnerships inherently come with unique challenges, including the complexities of long-term relationships, the intricacies of sharing responsibilities and control with unfamiliar parties, and the potential for interests to become misaligned or to evolve over time . Brand-name firms, for instance, sometimes file citizen petitions with the FDA to delay generic entry , demonstrating a clear instance of misaligned interests. Furthermore, discrepancies between originator and generic product labels can lead to inconsistent information for healthcare professionals and patients, creating additional friction .

The inherent tension between an innovator company’s desire to protect its market exclusivity and a generic company’s drive for rapid market entry creates fertile ground for misaligned interests and strategic conflicts, exemplified by the use of citizen petitions . Moreover, the global nature of generic partnerships frequently introduces cultural differences in communication styles, hierarchical structures, time perception, and risk tolerance . If left unaddressed, these misalignments can lead to costly delays, disputes, and even the outright failure of a partnership. Consequently, establishing robust governance structures, implementing clear communication protocols, and investing in cultural intelligence training are critical for ensuring successful and sustainable long-term collaborations.

The ongoing shift from transactional to strategic alliances implies a deeper level of trust and shared values. This suggests that future generic partnerships will increasingly prioritize “cultural fit” and transparent communication as key selection criteria, moving beyond purely technical or financial considerations. Companies will likely invest in dedicated “alliance management resources” to proactively foster trust, manage expectations, and resolve disputes. This recognizes that human capital and relational dynamics are as critical to partnership success as scientific or market expertise.

Here is a table summarizing the strategic benefits and challenges of generic drug partnerships:

| Category | Specific Benefit | Impact | Specific Challenge | Impact |

| Financial | Cost Reduction | Avoids high capital expenditure, converts fixed to variable costs, crucial for thin margins . | High Development Costs | Bioequivalence studies, regulatory filings, manufacturing setup are expensive . |

| Risk Mitigation | Shares financial burden and inherent risks of development and litigation . | Patent Litigation | Costly and time-consuming disputes, potential for market entry delays . | |

| Operational | Scalability & Flexibility | Adjusts production to market demand, accelerates timelines with established processes . | Supply Chain Vulnerabilities | Over-reliance on few API sources, “race to the bottom” pricing, leading to shortages . |

| Access to Expertise & Infrastructure | Leverages specialized scientific, technical, and manufacturing capabilities without internal investment . | Quality Control Issues | Inconsistent quality, contamination, subpotent dosing, especially from international sources . | |

| Regulatory | Streamlined Approvals | Benefits from FDA/EMA harmonization, improved submission quality, reduced review cycles . | Regulatory Hurdles & Inconsistencies | Diverse national requirements, local clinical trial mandates, “regulatory vacuums” for complex generics . |

| Market Access | Expanded Market Reach | Gateway to new geographies, navigates local nuances, reaches underserved patients . | Limited Market Access | Selective market entry due to regulatory complexities, reduced competition . |

| Intellectual Property (IP) | Unlocking IP & Innovation | Access to patented technologies, enables value-added medicines, manages patent thickets . | Patent Thickets & Evergreening | Multiple patents on one drug, brand tactics to extend exclusivity, complex to navigate . |

| Human/Relational | Shared Vision & Synergies | Fosters innovation, aligns objectives, creates long-term value . | Misaligned Interests | Divergent goals (e.g., brand vs. generic), profit-sharing disputes, citizen petitions . |

| Cultural Intelligence | Navigates diverse communication styles, hierarchies, and risk tolerances in global teams . | Cultural Differences | Misunderstandings, communication barriers, conflicting values in international collaborations . |

The Future of Generic Drug Partnerships: Trends and Innovations

The generic pharmaceutical landscape is far from static; it is a dynamic arena continually shaped by technological breakthroughs, evolving healthcare policies, and the relentless pursuit of broader healthcare access. In this environment, partnerships will continue to serve as the crucible where these powerful forces converge.

The Transformative Impact of AI and Data Analytics

Artificial Intelligence (AI) is no longer a futuristic concept; it is a present-day reality poised to revolutionize nearly every aspect of drug development, including the generic sector. AI is transforming pharmaceutical portfolio management, significantly enhancing decision-making processes, improving operational efficiency, and accelerating both drug discovery and development . It possesses the capability to analyze vast datasets, including genomics, proteomics, and clinical trial results, to predict drug efficacy and safety profiles. Furthermore, AI optimizes clinical trial processes, aiding in more efficient patient recruitment, optimal trial design, and real-time monitoring of patient responses . Generative AI, in particular, demonstrates the ability to design novel molecular structures, refine existing drug candidates, and identify new applications for approved drugs through repurposing .

While AI offers immense potential, “generic AI models often fall short when applied to complex clinical data” . This limitation stems from issues such as the misinterpretation of highly specialized medical language, the “missing middle” problem where models overlook crucial details in large texts, and challenges in processing semi-structured clinical notes . This indicates that successful AI integration in generic drug development will necessitate partnerships with specialized AI firms or data science experts who can develop “purpose-built AI” tailored to the unique complexities of pharmaceutical data. This ensures accuracy and actionable insights for bioequivalence, formulation, and manufacturing optimization. The intense “race to commercialize science” and the “decline in the economics of the typical pharma business model” , driven by persistent pricing pressures, will compel generic companies to seek AI partnerships to gain a competitive edge in efficiency and speed. This suggests that AI will become a critical differentiator, enabling companies to optimize their R&D spend, accelerate time to market, and identify low-competition opportunities more rapidly, fundamentally reshaping the competitive landscape and driving a new wave of “smart” generic development.

Evolving Healthcare Policies and Market Dynamics

Healthcare policies are in a constant state of flux, directly influencing market access, pricing structures, and the overall viability of generic drug development. Partnerships must possess the agility to adapt to these shifting sands. Proposed tariffs on pharmaceutical imports, for instance, could significantly increase costs for domestic production and distribution, further shrinking already slim generic margins and potentially forcing some manufacturers to exit the market, which could exacerbate drug shortages . The increasing push for “increased domestic manufacturing” and a reduced dependence on overseas suppliers is a direct strategic response to identified supply chain vulnerabilities and geopolitical risks .

Government interventions and policy shifts, such as the imposition of tariffs or incentives for domestic production , can fundamentally alter the cost structure and profitability of generic drugs, especially those already operating with low margins. This directly compels generic companies to reassess their global supply chain partnerships, potentially shifting from purely cost-driven decisions to prioritizing supply chain resilience, geographic diversification, and compliance with national security objectives, even if it means higher manufacturing costs. The anticipated “stabilizing of generic costs” after years of consistent decline suggests a maturation of the generic market where extreme price erosion may plateau. This indicates that future generic partnerships will increasingly focus on value-added strategies, such as developing complex generics or biosimilars , and leveraging advanced manufacturing technologies to differentiate products rather than solely competing on price. This evolution could lead to a more sustainable, yet also more R&D-intensive, generic industry.

Building Sustainable and Resilient Alliances

The future viability of generic drug development hinges on forging partnerships that are not only effective in the short term but also robust enough to withstand unforeseen challenges and evolve dynamically with the industry. A truly resilient supply chain is one that proactively prevents disruption, is adequately prepared for potential risks, and can recover swiftly from unexpected events. This resilience is achieved through diversification of supply, encompassing both redundancy in manufacturing capacity and a balanced approach to domestic and diversified foreign sourcing, coupled with reliable and efficient manufacturing practices . Collaborative efforts and scientific innovation are actively stimulating advancements in the generic drug program, as evidenced by GDUFA-funded research that has facilitated the approval of complex generics, such as cyclosporine ophthalmic emulsion .

The historical reliance on single-source or geographically concentrated active pharmaceutical ingredient (API) and finished dosage form (FDF) manufacturing has proven to be a critical vulnerability, leading to widespread drug shortages. This directly necessitates generic companies to forge partnerships that prioritize supply chain diversification and redundancy, moving away from purely transactional relationships to strategic alliances that foster shared investment in resilient infrastructure and manufacturing quality, even if it entails higher initial costs. The increasing complexity of generic drugs, coupled with the imperative for supply chain resilience, will likely lead to a greater emphasis on “co-innovation” within partnerships, rather than just co-development or service provision. This indicates that generic companies and their partners will jointly invest in developing new manufacturing technologies, such as advanced manufacturing techniques for sterile injectables, novel formulation approaches, or even AI-driven predictive maintenance systems. The goal is to proactively prevent quality issues and shortages, thereby creating a more robust and future-proof generic drug ecosystem.

Key Takeaways for Strategic Partnering

The journey through the generic drug landscape reveals a clear truth: partnerships are not merely a convenience, but a strategic imperative. For business and pharmaceutical professionals, leveraging these collaborations effectively is the key to competitive advantage.

- Embrace Strategic Alliances, Not Just Transactions: A fundamental shift in perspective is required, moving from short-term exchanges to long-term, value-creating collaborations. This necessitates aligning objectives, sharing risks, and fostering mutual benefit across all parties involved .

- Master Bioequivalence and Chemistry, Manufacturing, and Controls (CMC) Through Expertise: Recognize the profound scientific and regulatory precision demanded for Abbreviated New Drug Application (ANDA) submissions. Partner with Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) that possess specialized expertise, advanced technologies, and robust quality systems. This is crucial for navigating complex bioequivalence studies and adhering to stringent manufacturing controls .

- Leverage Patent Intelligence for Timely Entry: Employ sophisticated tools like DrugPatentWatch to meticulously track patent expirations, analyze potential litigation risks (particularly Paragraph IV challenges), and identify lucrative low-competition opportunities. Strategic intellectual property partnerships are indispensable for navigating intricate patent thickets and securing critical first-mover advantages .

- Build Resilient, Diversified Supply Chains: Move beyond solely cost-driven considerations in manufacturing partnerships. Prioritize geographic diversification, redundancy in supply, and a strong commitment to quality to mitigate the risk of drug shortages and ensure consistent product availability, even if this means higher upfront investments .

- Navigate Global Regulations Proactively: Actively engage with international harmonization efforts and seek partnerships with local regulatory experts to streamline approval processes across diverse global markets. Companies must be prepared for regional variations, including the potential requirement for local clinical trials for complex generics .

- Invest in Alliance Management and Cultural Intelligence: Acknowledge that successful partnerships are fundamentally built upon trust, clear and open communication, and shared values. Allocate dedicated resources to alliance management and cultural training to effectively overcome the inherent challenges posed by misaligned interests and cultural differences in global collaborations .

- Embrace AI and Data-Driven Collaboration: Integrate Artificial Intelligence (AI) and predictive analytics into partnership strategies for optimizing research and development, ensuring regulatory compliance, and gaining superior market intelligence. Seek partners who can develop purpose-built AI solutions tailored to the unique complexities of pharmaceutical data, thereby transforming raw data into actionable insights .

- Target Value-Added Generics: As the generic market matures and competition intensifies, consider engaging in co-development partnerships for value-added medicines. These products offer differentiation, stronger intellectual property protection, and improved patient outcomes, allowing companies to move beyond a sole focus on price competition .

Frequently Asked Questions (FAQ)

Here are five unique and insightful questions that frequently arise when considering the strategic role of partnerships in generic drug development.

- 1. How do generic drug partnerships specifically address the “patent thicket” challenge, and what role does patent data play?The “patent thicket” refers to the dense and complex web of multiple patents that often protect a single brand-name drug, making generic entry challenging even after the primary patent expires . Partnerships address this by bringing together specialized legal and intellectual property (IP) expertise. A generic company might collaborate with a law firm specializing in Hatch-Waxman litigation to conduct comprehensive patent searches and analyses, aiming to identify vulnerabilities in the brand’s patent portfolio or opportunities for Paragraph IV challenges . Tools like DrugPatentWatch are invaluable in this process, providing detailed data on patent expiration dates, litigation status, and market dynamics, which helps partners pinpoint the precise timing for market entry or identify drugs with fewer existing generic competitors . This collaborative approach ensures that the generic company can navigate the IP maze strategically, either by successfully challenging patents or by developing a non-infringing, bioequivalent product.

- 2. Beyond cost savings, how do CMO and CRO partnerships contribute to the quality and safety of generic drugs, especially given global supply chain complexities?CMO and CRO partnerships are crucial for ensuring the quality and safety of generic drugs, extending their value far beyond mere cost reduction. Contract Manufacturing Organizations (CMOs) operate state-of-the-art facilities that adhere rigorously to Good Manufacturing Practices (GMP) , which is essential for consistent product quality. In a globalized supply chain where active pharmaceutical ingredients (APIs) and finished dosage forms (FDFs) often originate from different international sites , CMOs provide the necessary expertise in quality control, process validation, and regulatory compliance across diverse jurisdictions . Contract Research Organizations (CROs), conversely, ensure the scientific rigor of bioequivalence studies, which form the cornerstone of generic approval . They bring specialized scientific expertise to design and execute these studies, analyze the resulting data, and ensure strict compliance with regulatory standards. This validates that the generic drug performs identically to the brand-name product in the body . This external validation and specialized oversight are vital for maintaining high standards of quality and safety within a complex, often fragmented, global manufacturing environment.

- 3. What are “value-added medicines” in the generic context, and how do partnerships facilitate their development?”Value-added medicines” (VAMs) represent a strategic evolution beyond traditional generics. While still based on existing molecules, VAMs offer significant improvements or modifications to an existing drug, such as a new formulation (e.g., extended-release), a novel delivery system (e.g., oral to injectable), a new indication or therapeutic use, or enhanced tolerability and patient experience . These enhancements create new value for patients, healthcare providers, or payers, offering crucial differentiation in a crowded market and potentially stronger intellectual property protection through new patents . Partnerships are critical for VAM development because these products often demand a deeper level of research and development (R&D), highly specialized formulation expertise, and a sophisticated regulatory strategy, sometimes akin to novel drug development. Co-development agreements, in particular, allow generic companies to pool resources and expertise with partners (e.g., specialized CDMOs, innovative biotechs) to jointly undertake the research, development, and regulatory navigation required to bring these enhanced generic versions to market, leveraging shared intellectual property and distributing the higher development costs and risks .

- 4. How do misaligned interests manifest in generic drug partnerships, and what proactive measures can companies take to prevent them?Misaligned interests in generic drug partnerships can manifest in various ways. For example, a brand-name company might file citizen petitions with the FDA to delay generic entry, even if those petitions lack scientific merit, solely to extend their market exclusivity . Within a generic partnership, interests can diverge concerning profit-sharing arrangements, control over critical decision-making processes, or even the prioritization of different markets. Cultural differences in communication styles, hierarchical expectations, or risk tolerance can further exacerbate these misalignments . Proactive measures to prevent such issues include establishing robust governance structures with clearly defined roles, responsibilities, and dispute resolution mechanisms from the outset of the partnership . Companies should invest in thorough due diligence to ensure a “cultural fit” with potential partners and dedicate resources to “alliance management”—a specialized function focused on fostering trust, maintaining open communication, and proactively addressing evolving interests through regular dialogue . The overarching objective is to cultivate a long-term, strategic relationship where the success of both parties is intrinsically linked, moving beyond purely transactional gains.

- 5. What is the anticipated impact of Artificial Intelligence (AI) on the future structure of generic drug development partnerships?Artificial Intelligence (AI) is poised to fundamentally reshape the structure of generic drug development partnerships. Currently, AI is enhancing pharmaceutical portfolio management, accelerating research and development (R&D), and improving efficiency by analyzing vast datasets and optimizing clinical trial processes . In the future, partnerships will likely evolve towards “co-innovation” in AI, where generic companies collaborate with specialized AI firms or data science experts to develop “purpose-built AI” tailored to the unique complexities of pharmaceutical data . This could involve joint ventures specifically focused on leveraging collective datasets for predictive analytics in bioequivalence, optimizing formulation design, or even developing AI-driven systems for proactive quality control and supply chain resilience . As the “race to commercialize science” intensifies and pricing pressures continue, AI will become a critical differentiator. This will drive generic companies to seek AI partnerships to gain speed, cost efficiency, and superior market intelligence, thereby shaping a new era of “smart” generic development.

References

- FDA. (n.d.). Drug Development Process. Retrieved from https://www.fda.gov/patients/learn-about-drug-and-device-approvals/drug-development-process

- University of Cincinnati. (n.d.). Looking at the 5 Drug Development Stages. Retrieved from https://online.uc.edu/blog/drug-development-phases/

- Yu, L. X. (2008). Critical path opportunities for generic drugs. PubMed, 18446510. Retrieved from https://pubmed.ncbi.nlm.nih.gov/18446510/

- FDA. (n.d.). Impact Story: Modeling Tools Could Modernize Generic Drug Development. Retrieved from https://www.fda.gov/drugs/regulatory-science-action/impact-story-modeling-tools-could-modernize-generic-drug-development

- National Center for Biotechnology Information. (n.d.). Research Collaborations: Benefits and Challenges. Retrieved from https://www.ncbi.nlm.nih.gov/books/NBK210038/

- Seton Hall University School of Law. (n.d.). Successful Partnering in Drug Development. Retrieved from https://law.shu.edu/documents/successful-partnering-drug-development.pdf

- FDA. (n.d.). Generic Drug Development Process. Retrieved from https://downloads.regulations.gov/EPA-HQ-OAR-2024-0196-0003/attachment_87.pdf

- FDA. (2022, March 17). Generic Drug Approval Process. Retrieved from https://www.fda.gov/drugs/cder-conversations/generic-drug-approval-process

- BioAccess LA. (n.d.). Navigating the ANDA and FDA Approval Processes. Retrieved from https://www.bioaccessla.com/blog/navigating-the-anda-and-fda-approval-processes

- Wolters Kluwer. (n.d.). Compare Types of Partnerships – LP, LLP, GP. Retrieved from https://www.wolterskluwer.com/en/expert-insights/compare-types-of-partnerships-lp-llp-gp

- Goodwin Law. (2025, April 23). Five Trends Reshaping Pharmaceutical Manufacturing Partnerships. Retrieved from https://www.goodwinlaw.com/en/insights/publications/2025/04/insights-lifesciences-hltc-five-trends-reshaping-pharmaceutical

- Contract Pharma. (2025, January 27). The Evolution of Strategic Partnerships in the Pharmaceutical Industry. Retrieved from https://www.contractpharma.com/exclusives/the-evolution-of-strategic-partnerships-in-the-pharmaceutical-industry/

- GeneOnline. (2025, April 2). Strategic Partnerships Rise in Generic Drug Development to Share Costs & Risks of Clinical Trials. Retrieved from https://www.geneonline.com/strategic-partnerships-rise-in-generic-drug-development-to-share-costs-risks-of-clinical-trials/

- Practical Law. (n.d.). License, Co-Development, and Co-Commercialization Agreement (Pharmaceutical Drug). Retrieved from https://uk.practicallaw.thomsonreuters.com/w-029-1604?transitionType=Default&contextData=(sc.Default

- Royed Training. (n.d.). A case based understanding in co-development deal. Retrieved from https://royed.in/a-case-based-understanding-in-co-development-deal/

- AMCP. (2017, March 11). Generic Drugs. Retrieved from https://www.amcp.org/legislative-regulatory-position/generic-drugs

- DrugPatentWatch. (2025, May 18). Licensing Agreements in the Pharmaceutical Sector. Retrieved from https://www.drugpatentwatch.com/blog/licensing-agreements-in-the-pharmaceutical-sector/

- UPM Pharmaceuticals. (n.d.). Our Capabilities as a Generic Drug Manufacturer. Retrieved from https://www.upm-inc.com/generic-drug-manufacturer

- Contract-Manufacturers.org. (n.d.). Pharmaceutical Contract Manufacturing. Retrieved from https://contract-manufacturers.org/pharmaceutical-contract-manufacturing/

- Kansas Department of Administration. (2013, November 27). Pharmaceutical WHOLESALER Services Contract. Retrieved from https://admin.ks.gov/media/cms/01ef5984-829c-48d6-9a6d-76848cd32929.pdf

- PatentPC. (n.d.). How to Protect Intellectual Property in Generic Drug Development. Retrieved from https://patentpc.com/blog/how-to-protect-intellectual-property-generic-drug-development

- Gearhart Law, LLC. (n.d.). Unique Challenges for Patents in the Pharmaceutical Industry. Retrieved from https://gearhartlaw.com/unique-challenges-for-patents-in-the-pharmaceutical-industry/

- FDA. (n.d.). Global Generic Drug Affairs. Retrieved from https://www.fda.gov/drugs/generic-drugs/global-generic-drug-affairs

- RAPS. (2025, February 24). Expanding global access to complex generics: The case for regulatory convergence. Retrieved from https://www.raps.org/news-and-articles/news-articles/2025/2/expanding-global-access-to-complex-generics-the-ca

- NIH’s Seed. (n.d.). Small Molecule Drug Reimbursement Case Study PHARMACON Company. Retrieved from https://seed.nih.gov/sites/default/files/2023-12/Drug-Reimbursement-Case-Study-1-Small-Molecule.pdf

- FDA. (2023, March 1). Collaboration and Scientific Innovation Stimulated Advancement in the Generic Drug Program in 2022. Retrieved from https://www.fda.gov/news-events/fda-voices/collaboration-and-scientific-innovation-stimulated-advancement-generic-drug-program-2022

- DrugPatentWatch. (2025, July 19). Uncovering Lucrative Low-Competition Generic Drug Opportunities. Retrieved from https://www.drugpatentwatch.com/blog/uncovering-lucrative-low-competition-generic-drug-opportunities/

- Commonwealth Fund. (2022, March 24). Generic Drugs Help Hold Down Costs, But Slowdowns in Development and Review Present Challenges. Retrieved from https://www.commonwealthfund.org/blog/2022/generic-drugs-help-hold-down-costs-slowdowns-development-and-review-present-challenges

- PwC. (2025, January 8). Next in pharma 2025: The future is now. Retrieved from https://www.pwc.com/us/en/industries/pharma-life-sciences/pharmaceutical-industry-trends.html

- GeneOnline. (2025, April 6). International R&D Partnerships Speed Generic Drug Development, Improve Quality, and Facilitate Resource Sharing. Retrieved from https://www.geneonline.com/international-rd-partnerships-speed-generic-drug-development-improve-quality-and-facilitate-resource-sharing/

- AmerisourceBergen. (n.d.). Addressing generic drug shortages: Contributing factors and public policy recommendations. Retrieved from https://www.amerisourcebergen.com/-/media/assets/amerisourcebergen/pdf/address-generic-drug-shortages-whitepaper.pdf

- Pharmacy Times. (n.d.). USP Expert Discusses Balancing Drug Cost, Quality, and Access in a Changing Trade Landscape. Retrieved from https://www.pharmacytimes.com/view/usp-expert-discusses-balancing-drug-cost-quality-and-access-in-a-changing-trade-landscape

- Contract Pharma. (2025, January 27). The Evolution of Strategic Partnerships in the Pharmaceutical Industry. Retrieved from https://www.contractpharma.com/exclusives/the-evolution-of-strategic-partnerships-in-the-pharmaceutical-industry/

- University of Pennsylvania. (n.d.). UNDERSTANDING THE DIFFERENCES IN STRATEGIC ALLIANCE FORMATION IN THE INDIAN AND CHINESE PHARMACEUTICAL INDUSTRY By Tanya Syngle. Retrieved from https://repository.upenn.edu/bitstreams/dd656bf3-d807-450b-8b38-ffd46bb37f1e/download

- Brookings Institution. (2022, June 14). The FDA could do more to promote generic competition: Here’s how. Retrieved from https://www.brookings.edu/articles/the-fda-could-do-more-to-promote-generic-competition-heres-how/

- PMC. (n.d.). Discrepancies Between the Labels of Originator and Generic Pharmaceutical Products: Implications for Patient Safety. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC7221040/

- FDA. (n.d.). International Regulatory Harmonization. Retrieved from https://www.fda.gov/drugs/cder-international-program/international-regulatory-harmonization

- FDA. (n.d.). FDA’s Efforts to Achieve Global Regulatory Harmonization of Generic Drug Programs. Retrieved from https://www.fda.gov/international-programs/global-perspective/fdas-efforts-achieve-global-regulatory-harmonization-generic-drug-programs

- PMC. (n.d.). A comprehensive study on regulatory requirements for development and filing of generic drugs globally. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC3555014/

- GeneOnline. (n.d.). Latin America’s Generic Drug Market Faces Regulatory Hurdles Despite Growing Middle Class and Healthcare Spending. Retrieved from https://www.geneonline.com/latin-americas-generic-drug-market-faces-regulatory-hurdles-despite-growing-middle-class-and-healthcare-spending/

- DrugPatentWatch. (2025, July 19). Uncovering Lucrative Low-Competition Generic Drug Opportunities. Retrieved from https://www.drugpatentwatch.com/blog/uncovering-lucrative-low-competition-generic-drug-opportunities/

- MedShadow Foundation. (n.d.). INVESTIGATING GENERICS: America’s Overlooked Drug Crisis. Retrieved from https://medshadow.org/are-generic-drugs-safe/

- PMC. (n.d.). A Physician’s Perspective on Generic Drug Quality. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC10391038/

- DrugPatentWatch. (2025, February 25). Compliance Challenges in Generic Drug Development: Lessons Learned. Retrieved from https://www.drugpatentwatch.com/blog/compliance-challenges-in-generic-drug-development-lessons-learned/

- Discover Pharma. (2025, July 3). Why generic AI fails pharma and how purpose-built AI is revolutionizing drug development. Retrieved from https://discover-pharma.com/why-generic-ai-fails-pharma-and-how-purpose-built-ai-is-revolutionizing-drug-development/

- CellCarta. (n.d.). What is a CRO?. Retrieved from https://cellcarta.com/science-hub/contract-research-organization/

- Novotech CRO. (n.d.). FAQ: Role of CROs in Drug Development. Retrieved from https://novotech-cro.com/faq/role-cros-drug-development

- Global Vision. (n.d.). CMOs of Increasing Importance to Pharmaceutical Companies. Retrieved from https://www.globalvision.co/blog/cmos-of-increasing-importance-to-pharmaceutical-companies

- Afton Scientific. (n.d.). Why a CMO?. Retrieved from https://www.aftonscientific.com/why_a_cmo/

- Practical Law. (n.d.). License, Co-Development, and Co-Commercialization Agreement (Pharmaceutical Drug). Retrieved from https://uk.practicallaw.thomsonreuters.com/w-029-1604?transitionType=Default&contextData=(sc.Default

- Adragos Pharma. (n.d.). Value-Added vs. Generic Medicines in the CDMO Landscape. Retrieved from https://adragos-pharma.com/value-added-vs-generic-medicines-in-the-cdmo-landscape/

- MedShadow Foundation. (n.d.). INVESTIGATING GENERICS: America’s Overlooked Drug Crisis. Retrieved from https://medshadow.org/are-generic-drugs-safe/

- University of Pennsylvania. (n.d.). The Pharmaceutical Industry: Challenges and Opportunities. Retrieved from https://repository.upenn.edu/bitstreams/079c25da-7c22-4579-8310-ceb84c2079ad/download

- CSIS. (n.d.). A Bilateral Approach to Address Vulnerability in the Pharmaceutical Supply Chain. Retrieved from https://www.csis.org/analysis/bilateral-approach-address-vulnerability-pharmaceutical-supply-chain

- PharmaDiversity Job Board. (n.d.). Key Cultural Differences to Consider. Retrieved from https://blog.pharmadiversityjobboard.com/?p=312

- Alacrita. (n.d.). The Perils of Misaligned Incentives: Why Drugs Fail Late in Development. Retrieved from https://www.alacrita.com/blog/misaligned-incentives-late-stage-drug-development-failures

- PMC. (n.d.). Discrepancies Between the Labels of Originator and Generic Pharmaceutical Products: Implications for Patient Safety. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC7221040/

- RAPS. (n.d.). Expanding global access to complex generics: The case for regulatory convergence. Retrieved from https://www.raps.org/news-and-articles/news-articles/2025/2/expanding-global-access-to-complex-generics-the-ca

- DrugPatentWatch. (n.d.). The Importance of International R&D Collaborations in Generic Drug Development. Retrieved from https://www.drugpatentwatch.com/blog/the-importance-of-international-rd-collaborations-in-generic-drug-development/

- FDA. (n.d.). Global Generic Drug Affairs. Retrieved from https://www.fda.gov/drugs/generic-drugs/global-generic-drug-affairs

- DrugPatentWatch. (n.d.). The Regulatory Pathway for Generic Drugs Explained. Retrieved from https://www.drugpatentwatch.com/blog/the-regulatory-pathway-for-generic-drugs-explained/

- Impact Factor. (n.d.). Detailed Case Study Generic Drug Co-Development. Retrieved from http://impactfactor.org/PDF/IJDDT/15/IJDDT,Vol15,Issue1,Article48.pdf

- PMC. (n.d.). Bibliometric analysis of complex generic drugs. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC11930681/