The ground beneath the pharmaceutical industry is shifting. For decades, the path from drug discovery to patient was a well-trodden, albeit labyrinthine, road paved by clinical trials, regulatory approvals, and a complex web of intermediaries: wholesalers, pharmacy benefit managers (PBMs), insurers, and pharmacies. The patient, the ultimate consumer, was often the last and least powerful link in this chain. But what happens when technology doesn’t just streamline this path but dynamites it entirely? What happens when the pharmacy, the doctor’s office, and the prescription pad all collapse into a single, elegant app on your phone?

This is not a hypothetical future; it is the reality forged by a new breed of healthcare company. Digital-first, direct-to-consumer (DTC) telehealth platforms like Ro and Hims & Hers have emerged not merely as tech startups but as fundamental re-architects of the patient journey. They are the vanguard of a great unbundling, deconstructing the monolithic, provider-centric healthcare system into a series of on-demand, digitally native services tailored to the modern consumer.

The COVID-19 pandemic served as a powerful, albeit tragic, catalyst for this transformation. Almost overnight, virtual care transitioned from a niche convenience to an absolute necessity. Consumer adoption of telehealth skyrocketed from just 11% in 2019 to 46% in 2020, forever altering patient expectations.1 This paradigm shift unlocked a torrent of investment and market growth. Venture capital funding in digital health surged by an astonishing 2,325% between 2011 and 2021, and the global telehealth market is now projected to swell from approximately $126.1 billion in 2024 to over $400 billion by 2034.2

For professionals across the pharmaceutical and biotech landscape—from intellectual property strategists and R&D leaders to business development teams and the investors who fund them—understanding this new ecosystem is no longer optional. These platforms are not just another sales channel; they represent a new competitive landscape, a novel partnership model, and a direct line to the patient that the industry has never truly had. This report will dissect the novel business models of these digital disruptors, analyze their strategic implications, and provide a clear-eyed framework for turning this disruption into a competitive advantage.

The Core Tenets of the DTC Revolution

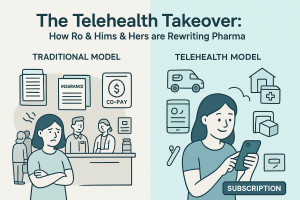

At its heart, the DTC telehealth revolution is built on a few simple but profound strategic pillars. These companies identified deep-seated frustrations within the traditional healthcare experience—opacity, inconvenience, high costs, and stigma—and systematically engineered a new model designed to solve for them. This new model is defined by its deliberate circumvention of legacy systems and its unwavering focus on the patient as the true customer.

Bypassing the Gatekeepers: The Cash-Pay Insurrection

The most audacious and strategically critical decision made by pioneers like Ro and Hims & Hers was to build their primary business models outside the traditional health insurance framework. Instead of navigating the complex and often adversarial world of PBM negotiations, formulary placements, and reimbursement battles, they opted for a simple, transparent, cash-pay system.8

This move was a direct response to a fundamental flaw in the traditional U.S. healthcare system. As Ro’s co-founder and Chief Product Officer, Saman Rahmanian, astutely observed, “when you go to a doctor’s office, or you go into a pharmacy, you may be the patient, but you’re not actually the customer, because the customer is the insurance company”.9 By sidestepping the insurer, these platforms re-centered the entire transaction on the patient. This allows them to offer clear, upfront pricing for consultations and medications, eliminating the surprise bills and byzantine Explanation of Benefits (EOB) statements that plague the insured experience.

Ro’s model, for instance, explicitly avoids working with insurance companies, with a stated mission to drive efficiency and reduce healthcare’s massive costs.8 This cash-pay approach is not a fringe idea; it has become a key trend enabling the explosive growth of the entire DTC health sector.10 It allows these companies to control their pricing, simplify their operations, and focus their resources on the patient experience rather than on administrative overhead tied to billing and collections.

However, the strategic brilliance of this model goes far deeper than simply offering a more straightforward payment option. By disintermediating the insurers and PBMs, these platforms achieve something the pharmaceutical industry has coveted for decades: direct ownership of the patient relationship and, crucially, the associated data. In the legacy model, pharma companies are largely blind to end-user behavior. They spend billions on DTC advertising to drive patients to their doctors, but once a prescription is written, the data trail goes cold. PBMs and insurers become the gatekeepers of information on adherence, switching behavior, and real-world outcomes. By creating a closed-loop, cash-pay ecosystem, telehealth companies capture this entire data stream. They know who their patients are, how they respond to treatment, when they refill their prescriptions, and what other health needs they have. This transforms them from simple service providers into powerful data aggregators, creating a treasure trove of real-world evidence that holds immense value for R&D, commercial strategy, and lifecycle management—a point we will return to in detail.

Patient-Centricity as a Business Model

The second core tenet is a relentless focus on the patient experience. Traditional healthcare is often designed around the needs of the provider and the institution. Appointments are scheduled during rigid business hours, waiting rooms are a feature, not a bug, and discussing sensitive health issues can be an uncomfortable, even shameful, experience. DTC telehealth platforms have inverted this paradigm entirely.8

Their entire operational model is engineered for convenience, discretion, and accessibility. The “front door” to the clinic is no longer a physical building but a mobile app. The patient journey often begins with a dynamic online questionnaire or an asynchronous consultation via secure messaging, allowing patients to communicate their needs on their own time, without the barriers of travel, wait times, or scheduling conflicts.11 This approach is particularly effective for conditions that carry a social stigma, such as erectile dysfunction, hair loss, or mental health, where the anonymity of a digital interaction is a powerful enabler of care-seeking behavior.

This focus on convenience is not just a marketing tactic; it is the primary driver of consumer preference. Studies show that the ability to save time, avoid travel, and access care more flexibly are the top reasons patients choose virtual visits.13 The final step of the journey—discreet, direct-to-home delivery of medication—completes the seamless, consumer-grade experience that patients have come to expect from every other sector of the digital economy.

Andrew Dudum, the CEO of Hims & Hers, captured this philosophy perfectly when reflecting on the traditional healthcare system: “When I look at healthcare, there’s no part of the experience that I love. It’s a cold experience, it’s not personalized to you at all, it wastes your time and your money, and it makes you feel sick. It’s my belief that in the next 10 years, that’s going to change”.15 These companies are not just selling pills; they are selling a fundamentally better, more humane, and more efficient way to access care.

Deconstructing the Disruptors: A Tale of Two Titans

While the core principles of the DTC telehealth movement are shared, the market’s leading players, Ro and Hims & Hers, have pursued remarkably different strategies to achieve scale and market dominance. They represent two divergent, yet equally potent, paths: one built on deep vertical integration and operational control, the other on brand, capital efficiency, and rapid multi-category expansion. Analyzing their respective playbooks provides a masterclass in modern healthcare strategy and reveals critical insights for any pharmaceutical company seeking to navigate this new terrain.

Ro: The Vertically Integrated, Patient-Centric Powerhouse

Ro’s story is one of methodical, deliberate construction. It has pursued a “build and own” philosophy, betting that long-term success lies in controlling every critical step of the patient journey, from initial diagnosis to the final delivery of medication. This capital-intensive strategy aims to build a deep, defensible moat based on a superior and seamless patient experience.

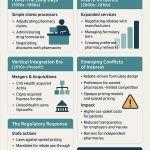

From “Roman” to “Ro”: An Origin Story in Focus

Ro launched in 2017 under the brand name “Roman,” with a laser focus on men’s health, specifically erectile dysfunction (ED) and hair loss.8 This was a shrewd market entry strategy. These were conditions with enormous, underserved patient populations, significant social stigma that discouraged in-person visits, and treatments dominated by well-known, off-patent drugs like sildenafil and finasteride. This created a perfect storm for a cash-pay, discreet, online model.

Roman quickly became the company’s cash cow, generating the vast majority of its early revenue. In 2020, for example, the Roman brand was estimated to contribute around $180 million of Ro’s total $230 million in revenue.1 However, this was always intended as the “tip of the spear.” The goal was to build a trusted brand and a loyal customer base in a niche category and then leverage that relationship to expand into broader healthcare verticals. The company subsequently launched Rory for women’s health and Zero for smoking cessation before consolidating everything under the unified “Ro” brand.8 By 2021, the strategy was bearing fruit: non-Roman revenue was growing at an explosive 150% year-over-year, and more than half of all new treatments initiated on the platform were for conditions other than ED.16

The “Build and Own” Philosophy: Vertical Integration as a Moat

The defining feature of Ro’s long-term strategy is its aggressive pursuit of vertical integration. Unlike competitors who rely on a network of third-party partners, Ro has invested heavily in building and owning its own infrastructure. The centerpiece of this strategy is the Ro Pharmacy Network, a growing system of strategically located pharmacies designed to control the entire medication dispensing and fulfillment process.8 This allows Ro to optimize for speed and cost, with the ambitious goal of providing nationwide next-day delivery at ground shipping rates.

Beyond the pharmacy, Ro has systematically acquired the capabilities needed to offer a more comprehensive, hybrid model of care. Key acquisitions include:

- Workpath (December 2020): A platform that dispatches phlebotomists and other healthcare professionals to patients’ homes for blood draws and other diagnostic tests.1

- Modern Fertility (May 2021): A women’s reproductive health company specializing in at-home fertility tests, acquired for over $225 million.8

- Kit (June 2021): A startup offering a range of at-home diagnostic tests.1

- Dadi (January 2022): A sperm collection and testing startup.1

These acquisitions are not disparate assets; they are the building blocks of a cohesive ecosystem that seamlessly blends virtual consultations with necessary in-person care delivered to the home. This allows Ro to manage more complex conditions that require diagnostics and monitoring, moving beyond simple prescription refills and into the realm of true longitudinal care management.8

The Business Model: A Dual Revenue Stream

Ro’s business model is more nuanced than a simple online pharmacy. The company has architected a dual revenue stream that aligns its incentives with both patients and providers.

- Software as a Service (SaaS) for Providers: Ro’s primary revenue stream comes from providing a full-stack digital clinic management platform to independent physician practices. These practices pay Ro a monthly subscription fee to use its software, which handles everything from patient intake and medical history collection to administrative tasks like payment processing and malpractice insurance procurement.1 In essence, Ro provides the “backend operations of running a digital health clinic ‘as a service'”.9

- Pharmacy Fulfillment: Ro’s second revenue stream is generated when a patient chooses to have their prescription filled by the Ro Pharmacy Network.1 A patient’s initial consultation fee (e.g., $15) goes directly to the physician’s practice, not to Ro. This clever structure means Ro only makes money on the medication fulfillment if it can offer a superior experience—in terms of price, convenience, and speed—that convinces the patient to use its pharmacy over any other pharmacy in the country. As CEO Zachariah Reitano wrote, “Ro must compete on quality, convenience, and price with every single pharmacy across the country. It is on us to make sure we always provide value to our members”.9

Financial Trajectory and Valuation

Investors have rewarded Ro’s ambitious, long-term vision with substantial funding. The company has raised nearly $1 billion since its founding, culminating in a February 2022 venture round that valued the company at a staggering $7 billion.1 In 2021, at a $5 billion valuation, its revenue multiple was an estimated 22x. This was significantly higher than its publicly traded competitor, Hims & Hers, which traded at a 4x multiple at the time.1 This valuation premium reflects strong investor confidence in the defensibility of Ro’s vertically integrated model and its potential to capture a larger share of the healthcare value chain in the long run.

Hims & Hers: The Multi-Category Subscription Juggernaut

If Ro’s strategy is a patient, methodical siege, Hims & Hers’ approach is a lightning-fast blitzkrieg. As a publicly traded company (NYSE: HIMS), its playbook has been one of explosive growth, rapid market share acquisition, and relentless focus on the unit economics of its subscription model. Rather than owning the infrastructure, Hims & Hers has focused on building a powerful consumer brand and a highly efficient, scalable technology platform that can be deployed across a wide array of healthcare categories.

A Public Play: Growth, Scale, and Market Dominance

Hims & Hers has leveraged the public markets to fuel its hyper-growth trajectory. The company’s financial performance is nothing short of spectacular. In 2024, it reported revenue of nearly $1.5 billion, representing a 69% year-over-year increase, and has guided for revenue to reach between $2.3 billion and $2.4 billion in 2025.8

This growth is powered by a massive and loyal subscriber base. As of late 2024, the company served over 2.2 million subscribers, a 45% increase from the previous year.18 The subscription model is the bedrock of its business, accounting for over 90% of total revenue and providing a highly predictable stream of recurring cash flow.18 Critically, the company has demonstrated strong customer loyalty, with an impressive 82% of subscribers remaining on the platform beyond the initial three-month period.18 This high retention rate is the key to a healthy LTV-to-PAC ratio, which we will explore later.

The Asset-Light, Multi-Brand Approach

In stark contrast to Ro’s capital-intensive vertical integration, Hims & Hers operates a more asset-light model. It partners with third-party pharmacies for fulfillment and focuses its internal resources on marketing, technology, and brand building. This has allowed the company to expand its service offerings with remarkable speed, creating a diversified portfolio across several high-growth verticals.

The company’s core specialties include 18:

- Sexual Health: The original foundation of the business, including treatments for ED and hair loss (approximately 30% of revenue).

- Mental Health: A rapidly growing category offering therapy and medications for anxiety and depression (approximately 25% of revenue).

- Dermatology: Skincare solutions for conditions like acne (approximately 20% of revenue).

- Weight Management: The newest and fastest-growing vertical, leveraging compounded GLP-1 therapies, with a projected revenue of $725 million in 2025.

This multi-category strategy is a powerful engine for growth. It allows Hims & Hers to acquire a customer in one vertical and then efficiently cross-sell them into others, significantly increasing the average revenue per user and the overall customer lifetime value.8 Furthermore, the company has expanded its reach beyond its online platform through a wholesale revenue stream, establishing partnerships with major retailers to place its products in over 20,000 physical locations across the U.S..20

Technology as a Scalpel: The Role of MedMatch AI

While its model is asset-light, Hims & Hers is heavily invested in technology as a means of achieving scalability and clinical efficiency. A key component of this is its proprietary AI-powered system called MedMatch.8 This system analyzes a massive dataset of over 50 million de-identified patient data points to help its network of healthcare providers optimize treatment plans, personalize medication dosages, and improve health outcomes.

MedMatch serves a dual purpose. For patients, it promises a more personalized and effective care experience. For the business, it is a crucial tool for achieving operational leverage. By automating aspects of the clinical workflow and providing decision support to providers, the system reduces administrative workload, allowing clinicians to focus on higher-value tasks and manage a larger patient panel more efficiently.18 This technological efficiency is a key reason why Hims & Hers has been able to maintain impressive gross margins in the 80-83% range, even as it scales rapidly.18

The strategic divergence between Ro and Hims & Hers presents a classic business case study of integrated versus modular architectures. Ro is making a long-term bet that owning the full stack—from the software to the pharmacy to the in-home phlebotomist—will ultimately create a superior, stickier, and more defensible patient experience. This requires immense upfront capital and may slow its expansion into new therapeutic areas, but the operational moat it creates could be formidable.

Hims & Hers, on the other hand, is betting on brand, speed, and capital efficiency. Its modular, partnership-based model allows it to enter massive new markets like weight loss with incredible velocity, leveraging its marketing prowess and scalable tech platform without the drag of building physical infrastructure. However, this reliance on third parties, particularly for compounded medications, exposes it to greater supply chain and regulatory risks, as evidenced by its public dispute with Novo Nordisk over the sale of GLP-1 products.10

For a pharmaceutical company, this strategic choice has profound implications. A partnership with Ro could offer a deep, highly integrated collaboration with unparalleled data transparency and control over the patient experience, but it might be confined to Ro’s existing and future infrastructure footprint. A partnership with Hims & Hers offers immediate access to massive scale and a diverse patient population, but it may come with less operational control and a higher degree of brand and regulatory risk. This is not merely a choice of vendor; it is a fundamental strategic decision about how to engage with the future of healthcare delivery.

Table 1: Comparative Analysis of DTC Telehealth Titans

| Feature | Ro | Hims & Hers Health | Thirty Madison |

| Primary Revenue Model | SaaS for providers; Pharmacy fulfillment | Subscription-based product & service sales | Subscription-based, brand-specific care |

| Vertical Integration Strategy | High (Owns pharmacy network, diagnostics, in-home care) | Low (Partners with third-party pharmacies) | Moderate (Acquired Nurx for pharmacy/fulfillment) |

| Insurance Model | Primarily cash-pay; explicitly avoids insurance | Primarily cash-pay; some services may be insurance-eligible | Mix of cash-pay and insurance acceptance (via Nurx) |

| Key Verticals | Men’s/Women’s Health, Weight Management, Skincare, Smoking Cessation | Sexual Health, Mental Health, Dermatology, Weight Management | Chronic/Lifestyle Conditions via distinct brands (Hair Loss, Migraine, Women’s Health) |

| Public/Private Status | Private | Public (NYSE: HIMS) | Private (Acquired by Remedy Meds) |

| 2024 Est. Revenue | ~$300M+ (based on 2021 data and growth trends) | ~$1.5 Billion | ~$220 Million (pre-acquisition) |

The Competitive Arena: Beyond the Big Two

While Ro and Hims & Hers command the spotlight as the billion-dollar titans of DTC telehealth, it would be a strategic error to view the market as a simple duopoly. A vibrant ecosystem of well-funded competitors is actively carving out defensible niches, often by pursuing more specialized, condition-specific strategies. These players, particularly Thirty Madison, represent a different evolutionary path in the digital health landscape and offer further proof that the “one-size-fits-all” model of traditional healthcare is fracturing. The recent wave of consolidation, highlighted by Thirty Madison’s acquisition, signals that the market is entering a new, more mature phase.

Thirty Madison: The “House of Brands” Specialist

Thirty Madison pioneered a unique and highly effective “house of brands” strategy. Instead of a single, monolithic platform, the company built or acquired a portfolio of distinct, vertically-focused brands, each dedicated to providing specialist-level care for a specific chronic condition.21 This approach allowed for hyper-targeted marketing, the creation of strong patient communities, and the development of deep clinical expertise within each vertical.

The company’s flagship brands include:

- Keeps: Focused exclusively on men’s hair loss, offering treatments like finasteride and minoxidil.

- Cove: A comprehensive care platform for migraine sufferers, providing consultations with neurologists and access to a wide range of acute and preventative treatments.

- Picnic: Tailored to individuals with allergies, offering customized treatment plans.

- Nurx: Acquired by Thirty Madison, Nurx is a major player in its own right, focusing on women’s health, including birth control, STI testing, and HIV prevention (PrEP).

This model proved highly successful, allowing Thirty Madison to raise over $210 million in venture capital and achieve a “unicorn” valuation of over $1 billion.21 The strategy’s strength lies in its ability to speak directly to a patient’s specific condition, building a level of trust and authority that a more generalized platform might struggle to achieve.

However, the DTC landscape is rapidly evolving. In a landmark move signaling a new era of consolidation, Thirty Madison was acquired in late 2025 by Remedy Meds, a fast-growing platform focused on weight loss and metabolic health.24 The all-stock deal, valued at over $500 million, creates a combined telehealth powerhouse with a pro-forma annual revenue exceeding $670 million ($450 million from Remedy Meds and $220 million from Thirty Madison) and reported profitability for both entities.

This acquisition marks a pivotal moment in the industry’s maturation. The initial “land grab” phase, characterized by venture-backed, growth-at-all-costs startups, is giving way to a new phase focused on achieving strategic scale and sustainable profitability. The combination of Remedy Meds’ powerful patient acquisition engine and pharmacy infrastructure with Thirty Madison’s portfolio of trusted, condition-specific brands creates a formidable, multi-specialty competitor. For pharmaceutical companies and investors, this is a clear signal: the market is consolidating, and future partnerships will likely be with larger, more integrated, and more financially disciplined players. The era of betting on small, niche upstarts may be drawing to a close as the industry coalesces around a few dominant platforms.

Lemonaid Health and the Broader Ecosystem Integration

The trend toward consolidation and integration extends beyond direct competitors. Other players like Lemonaid Health illustrate a different, but equally important, strategic direction: absorption into larger, data-rich healthcare ecosystems. Lemonaid Health operates a model similar in scope to its larger rivals, offering a broad menu of services across general health, men’s and women’s health, and mental health through a simple, three-step online process.27

The company’s most significant strategic move was its acquisition by the personal genomics and biotechnology company 23andMe in late 2021.28 This transaction was not merely a financial exit; it was a visionary step toward a new paradigm of healthcare. The integration of Lemonaid’s telehealth and pharmacy services with 23andMe’s massive genetic database points toward a future of truly personalized, genetics-based primary care. This combination allows for a model where a patient’s genetic predispositions can directly inform preventative care, diagnostics, and treatment plans, all delivered through a convenient virtual platform.

This type of ecosystem integration represents another potential endgame for standalone telehealth companies. As the market matures, the ability to connect a simple telehealth consultation to a deeper, more personalized data layer—be it genetic data, wearable data, or electronic health records—will become a key competitive differentiator. For the pharmaceutical industry, these integrated platforms offer the tantalizing possibility of engaging in precision medicine at scale, targeting therapies and patient support programs based on a combination of clinical and genetic profiles.

The Playbook for Patient Acquisition in a Digital World

The meteoric rise of companies like Ro and Hims & Hers was not accidental. It was fueled by a sophisticated, data-driven, and often brutally expensive customer acquisition machine. For a pharmaceutical industry accustomed to the traditional model of physician detailing and broad-based television advertising, understanding the digital marketing playbook of these DTC disruptors is essential. Their entire business model rests on a delicate and unforgiving mathematical balance: the cost to acquire a new patient (Patient Acquisition Cost, or PAC) must be significantly lower than the total revenue that patient is expected to generate over their lifetime (Lifetime Value, or LTV). Mastering this equation is the key to survival and dominance in the digital health arena.

The Digital Marketing Machine: From Social Media to Super Bowl Ads

DTC telehealth companies have rewritten the rules of healthcare marketing. They have moved far beyond the staid, compliance-heavy advertisements of traditional pharma, adopting the aggressive, multi-channel tactics of high-growth consumer tech companies. Their goal is twofold: to build a powerful, relatable brand and to acquire customers at a predictable, scalable cost.

Hims & Hers, in particular, has executed this strategy at a massive scale, deploying an annual marketing budget north of $150 million.18 Their approach is a masterclass in modern brand building:

- Performance Marketing: A significant portion of their budget is dedicated to targeted digital advertising on platforms where their target demographic spends its time, such as Instagram and TikTok. These campaigns are relentlessly measured and optimized for conversion.

- Brand Campaigns: To build broad awareness and destigmatize sensitive health topics, the company has invested in high-profile, mainstream advertising, including Super Bowl commercials. These efforts are designed to normalize conversations around issues like ED and hair loss, making it easier for potential customers to seek help.18

- Influencer Marketing: Hims & Hers has built a vast network of over 1,200 micro- and mid-tier influencers who create relatable content that drives an estimated 35% of their conversions. This authentic, peer-to-peer marketing is far more effective at reaching younger audiences than traditional corporate advertising.18

Ro has pursued a different but equally effective strategy, focusing on partnerships with major sports organizations like Major League Baseball (MLB) and NASCAR.8 These sponsorships lend an air of credibility and mainstream acceptance to the brand, helping to build trust in a competitive and often skeptical market. The common thread across all these strategies is a deep understanding of the consumer mindset. These companies meet patients “where they are”—digitally, discreetly, and on their own terms—transforming the act of seeking healthcare from a clinical necessity into a consumer choice.11

The Unforgiving Math: Patient Acquisition Cost (PAC) vs. Lifetime Value (LTV)

Beneath the glossy marketing campaigns lies a cold, hard mathematical reality. The entire DTC business model can be distilled into a single, crucial ratio: LTV/PAC. For the business to be sustainable, the lifetime value of a customer must be substantially greater than the cost to acquire them.

Patient Acquisition Cost (PAC) is the total expense incurred to attract one new paying patient. This includes all marketing and advertising spend, sales and consultation staff salaries, and any other operational costs tied to onboarding.30 PAC can vary dramatically depending on the specialty and level of competition. For general telehealth, it can range from as low as $14 to over $61 per patient, and it is often higher for virtual practices than for traditional brick-and-mortar clinics due to the heavy reliance on digital advertising.32

Lifetime Value (LTV) is the total net profit a company expects to generate from a single customer over the entire duration of their relationship with the company. For subscription-based businesses like Hims & Hers, LTV is a function of the monthly subscription fee, the gross margin on products and services, and the customer churn rate (i.e., how long the average customer stays subscribed).

The interplay between these two metrics is everything. Hims & Hers, for example, saw its customer acquisition costs rise to $929 in 2024.18 In a traditional, one-off transaction business, such a high PAC would be disastrous. However, in a subscription model with high retention, it can be a highly profitable investment. With 85% of its customers staying beyond the first year and a payback period of under 12 months, Hims & Hers can confidently spend nearly a thousand dollars to acquire a customer, knowing that the recurring revenue they generate will far exceed that initial cost over time.18

This relentless focus on the LTV/PAC ratio forces a fundamentally different set of strategic priorities compared to the traditional pharmaceutical model. The blockbuster drug model is a sprint; the goal is to maximize revenue from a single product during its finite period of patent exclusivity. The DTC subscription model is a marathon; the goal is to build a long-term, profitable relationship with a patient.

This imperative to maximize LTV is the driving force behind the cross-selling strategies employed by these platforms. Acquiring a customer is the most expensive part of the process. Once that customer is in the ecosystem, the marginal cost of marketing additional services to them is close to zero. This is why Hims & Hers aggressively markets its skincare, mental health, and weight loss services to its existing base of hair loss and ED patients.8 It’s also why nearly 20% of Ro’s patients begin using the platform for a second, different health condition within their first 30 days as a customer.16 Every additional service a patient subscribes to dramatically increases their LTV, which in turn allows the company to spend more on PAC, creating a powerful, self-reinforcing growth loop.

For pharmaceutical companies, this represents a profound shift in thinking. When partnering with a DTC platform, they are not simply gaining access to a new sales channel; they are plugging into a sophisticated and highly optimized customer relationship management (CRM) and retention engine. This presents a massive opportunity to use the platform to drive medication adherence, introduce patients to companion diagnostics, or provide other value-added services. However, it also comes with a critical caveat: in this model, it is the platform, not the drug manufacturer, that owns the long-term patient relationship. This is a transfer of power with significant strategic implications for the future.

The Regulatory Maze: Navigating a Patchwork of Promise and Peril

The explosive growth of the DTC telehealth industry has occurred in a unique and precarious regulatory environment. Much of the current landscape was forged in the crucible of the COVID-19 pandemic, when long-standing rules were temporarily waived to ensure continuity of care. As the public health emergency recedes, however, federal and state regulators are now grappling with how to create a permanent framework for virtual care. This has created a complex and shifting maze of laws and regulations that represents the single greatest existential threat to the DTC business model. For any investor, partner, or pharmaceutical company operating in this space, a clear-eyed assessment of this regulatory risk is paramount.

The Ryan Haight Act: A Sword of Damocles

At the federal level, the most significant piece of legislation is the Ryan Haight Online Pharmacy Consumer Protection Act of 2008.33 Enacted to combat the rise of rogue online pharmacies, the Act’s central mandate is a requirement for a provider to conduct at least one in-person medical evaluation before prescribing a controlled substance to a patient.33 For over a decade, this rule effectively prohibited the purely remote prescription of medications for conditions like anxiety (e.g., benzodiazepines), ADHD (e.g., stimulants), and substance use disorder (e.g., buprenorphine).

The COVID-19 Public Health Emergency (PHE) changed everything. The Drug Enforcement Administration (DEA) issued waivers that temporarily suspended the in-person requirement, allowing for the prescription of Schedule II-V controlled substances via audio-video telehealth encounters.34 This flexibility was the key that unlocked the rapid growth of telepsychiatry and other services that rely on controlled medications.

However, these waivers were always intended to be temporary. The DEA has since issued a series of temporary extensions, with the current rules set to expire on December 31, 2025.21 This looming deadline hangs like a Sword of Damocles over the industry. The DEA has proposed creating a permanent pathway through a “special registration” process that would allow certain qualified providers to continue prescribing remotely under specific, stringent conditions.34 However, the final rules have yet to be issued, leaving companies and millions of patients in a state of regulatory limbo. The future of a significant portion of the tele-mental health industry rests on the final form these regulations will take.

The Fifty-State Quagmire: Licensure and Corporate Practice of Medicine

Compounding the federal uncertainty is a bewildering patchwork of state-level regulations. In the U.S. healthcare system, the practice of medicine is regulated at the state level. A foundational principle is that care is considered to take place where the patient is physically located at the time of the service.38 This means that a telehealth provider must hold a valid medical license in the state where their patient resides.

For a company aiming to operate a national platform, this creates a massive operational and administrative burden. They must build and maintain a network of clinicians who collectively hold licenses in all 50 states and the District of Columbia. Each state has its own specific rules regarding telehealth practice, informed consent, and prescribing, creating a complex compliance matrix that must be constantly monitored and updated.37 For example, some states may allow a prescription to be issued after an asynchronous (questionnaire-based) consultation, while others may mandate a synchronous (live video) interaction.

Furthermore, many states have “Corporate Practice of Medicine” (CPOM) doctrines, which are laws designed to prevent corporations from employing physicians and influencing their medical judgment. To comply with these laws, telehealth companies must structure themselves carefully, typically by contracting with independent physician groups rather than employing doctors directly. Navigating this 50-state quagmire requires significant legal and operational expertise and represents a substantial barrier to entry for new players.

The New Sheriff in Town: FDA and FTC Scrutiny of Marketing and Compounding

Perhaps the most immediate and active threat to the industry comes from increased scrutiny by the Food and Drug Administration (FDA) and the Federal Trade Commission (FTC), particularly around advertising practices and the use of compounded drugs.

In a significant shift, the FDA has recently launched an aggressive crackdown on DTC drug advertising, and for the first time, has turned its sights squarely on telehealth platforms.41 The agency has issued numerous warning letters to companies, including Hims & Hers, for their marketing of compounded GLP-1 drugs (used for weight loss). The FDA’s primary concern is that these platforms are making misleading claims that imply their compounded products are FDA-approved or equivalent to branded drugs like Ozempic and Wegovy, when they are not.41 This enforcement action signals that the FDA is willing to test the limits of its jurisdiction to regulate the advertising practices of these digital intermediaries.

This regulatory attention has been amplified by Congressional investigations. A recent report from a group of U.S. Senators raised serious concerns about the relationships between pharmaceutical companies and the telehealth platforms they partner with, questioning whether these arrangements are designed to “steer patients toward particular medications” and function as “virtual pill mills”.21 The investigation highlighted alarmingly high prescription rates on these platforms and cursory, often asynchronous, consultation processes as potential evidence of inappropriate prescribing that could undermine independent clinical judgment.43

Finally, the quality of care and patient safety on these platforms are under a microscope. The FDA has issued warnings about serious side effects associated with drugs like finasteride (for hair loss) being prescribed through telehealth platforms, with reports that patients were not adequately warned of the potential risks.45 This raises fundamental questions about the adequacy of virtual consultations for ensuring patient safety and informed consent.

Table 2: The Regulatory Gauntlet for DTC Telehealth

| Regulatory Area | Key Regulation/Issue | Current Status & Risk Level |

| Prescribing Controlled Substances | Ryan Haight Act & PHE Waivers | High: Waivers expire Dec 31, 2025. Permanent rules are pending, creating massive uncertainty for tele-mental health and other specialties. |

| State Licensure | State-by-state medical licensing requirements | Medium: Operationally complex and costly, but a known challenge. Creates a barrier to entry but is manageable for well-capitalized platforms. |

| Advertising & Marketing | FDA/FTC oversight of misleading claims | High: Active and aggressive enforcement by the FDA against telehealth platforms for claims about compounded drugs. High reputational and legal risk. |

| Compounded Drugs | FDA/State Board of Pharmacy regulations | High: Compounded drugs are not FDA-approved, creating risks related to safety, efficacy, and intellectual property. A primary target of current regulatory scrutiny. |

| Data Privacy | HIPAA & State Privacy Laws | Medium: A constant compliance requirement. Risk of breaches is high, but the legal framework is well-established. |

The Pharmaceutical Counter-Revolution: “Pharm-to-Table”

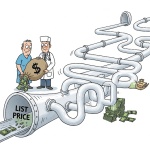

For years, the pharmaceutical industry watched the rise of DTC telehealth from the sidelines, viewing it as a novel distribution channel or a potential marketing partner. Now, in a stunning strategic pivot, some of the industry’s largest players have decided that if you can’t beat them, you should build your own. This “pharm-to-table” movement, which sees major drug manufacturers launching their own DTC platforms, represents a direct and audacious challenge to the established order. It is an attempt to reclaim control over the patient relationship, bypass the powerful intermediaries that have long dominated the supply chain, and fundamentally reshape the economics of the prescription drug market.

The Strategic Rationale: Disintermediating the PBMs

The primary motivation behind this counter-revolution is a long-simmering feud with Pharmacy Benefit Managers (PBMs). For years, the pharmaceutical industry has argued that PBMs—the powerful “middlemen” who manage prescription drug benefits for health plans—are a major driver of high drug costs.48 The argument is that PBMs negotiate substantial rebates from manufacturers in exchange for favorable formulary placement but fail to pass a sufficient portion of these savings on to patients at the pharmacy counter. This results in a large and opaque gap between the drug’s list price and the net price the manufacturer actually receives, a phenomenon known as the “gross-to-net” spread.

By creating their own DTC platforms, pharmaceutical companies can execute an end-run around the entire PBM apparatus. This strategy offers several compelling advantages 48:

- Bypass Intermediaries: They can sell their branded drugs directly to patients at a discounted cash price, cutting PBMs, insurers, and wholesalers out of the transaction.

- Mitigate Gross-to-Net Pressure: By transacting directly with patients, they can capture a greater share of the revenue and reduce the impact of rebate pressures on their bottom line.

- Capture Patient Data: This direct channel allows them to collect invaluable, firsthand data on patient behavior, medication adherence, and demographics—information that is typically lost in the traditional, fragmented distribution system.

- Build Brand Loyalty: It enables them to engage directly with patients, offering educational resources, support services, and a branded experience that can strengthen brand loyalty and patient retention.

Case Studies in Co-option: LillyDirect and PfizerForAll

The theoretical advantages of a pharma-led DTC model have rapidly been put into practice by two of the industry’s giants: Eli Lilly and Pfizer.

LillyDirect, launched by Eli Lilly, is perhaps the most prominent example. The platform provides patients with access to telehealth providers, home delivery of medications, and information about savings programs. Critically, it serves as a direct channel for Lilly’s blockbuster portfolio of drugs, including its highly sought-after GLP-1 medications for diabetes and weight loss.42 The platform partners with independent telehealth companies to facilitate the consultations and prescriptions, effectively creating a streamlined, Lilly-branded pathway from patient interest to medication in hand.

Similarly, PfizerForAll is Pfizer’s foray into the DTC space. This digital platform connects consumers with telehealth providers for conditions like migraine and COVID-19, and provides links to request prescriptions for Pfizer’s relevant medications, such as the migraine treatment Nurtec and the COVID-19 antiviral Paxlovid.42 Like Lilly, Pfizer partners with third-party telehealth and pharmacy delivery services (such as UpScriptHealth and Alto Pharmacy) to power the platform’s functionality.50

The Conflict of Interest Question

While these platforms are marketed as a way to improve patient access and affordability, they have drawn intense scrutiny from regulators and policymakers, who see a significant potential for conflicts of interest. A nine-month investigation by a group of U.S. Senators concluded that these novel relationships between drug manufacturers and the telehealth companies they hand-pick “appear intended to steer patients toward particular medications”.42

The investigation’s findings were stark. It revealed extraordinarily high prescription rates for the manufacturers’ drugs on these affiliated platforms. For example, 74% of patients who went through the LillyDirect platform received a prescription, and in some partnerships, that rate soared to 100%.43 On Pfizer’s partner platform, UpScriptHealth, 85% of telehealth encounters resulted in a prescription.43 These figures have fueled concerns that the platforms are functioning less as objective clinical services and more as highly efficient sales funnels, potentially undermining the independent medical judgment of providers and leading to inappropriate prescribing.42

These arrangements raise serious legal questions, particularly concerning the federal Anti-Kickback Statute, which prohibits offering or receiving remuneration to induce the referral of items or services covered by federal healthcare programs.51 The concern is that the fees paid by pharmaceutical companies to their telehealth partners could be seen as an incentive to favor the manufacturer’s products, regardless of clinical appropriateness.

The emergence of these “pharm-to-table” platforms is far more than a new marketing tactic. It represents a direct assault on the foundational business model of PBMs and could trigger a fundamental realignment of the entire pharmaceutical supply chain. PBMs derive their immense power from their ability to aggregate millions of covered lives and use that leverage to demand rebates from manufacturers. If manufacturers can successfully build a large-scale, parallel channel that goes directly to patients with attractive cash-pay offers, it significantly erodes the PBMs’ leverage.

This could lead to a bifurcated prescription drug market: one channel operating through the traditional insurance/PBM system, and a second, rapidly growing channel that is direct-to-patient. This creates immense strategic complexity for all stakeholders. Payers and PBMs may retaliate by placing drugs available through DTC channels on less favorable formulary tiers, effectively punishing manufacturers for trying to bypass them. Employers will face new challenges in designing their pharmacy benefits. This is not just a skirmish; it is the opening salvo in a new war for control of the prescription drug market, and its outcome will have profound consequences for the cost, access, and delivery of medicines for years to come.

Strategic Imperatives for Pharma & Biotech in the DTC Era

The rise of the direct-to-consumer telehealth model is not a peripheral trend; it is a core disruption that demands a strategic response from every pharmaceutical and biotechnology company. The old playbooks for commercialization, lifecycle management, and patient engagement are being rendered obsolete. For savvy leadership in IP, R&D, and business development, this new landscape presents both a profound threat to established revenue streams and an unprecedented opportunity to forge new pathways to market, build direct patient relationships, and leverage data in ways that were previously unimaginable. The challenge is to move beyond a reactive posture and proactively integrate these new realities into the core of corporate strategy.

The Patent Cliff and Lifecycle Management: A New Strategic Lever

For decades, the patent cliff has been the most feared event in the pharmaceutical lifecycle. The day a blockbuster drug loses its market exclusivity (LOE) has traditionally marked the beginning of a precipitous revenue decline, as generic competitors flood the market at a fraction of the price. The effective patent life of a new drug is often a mere 7 to 10 years after accounting for the lengthy development and regulatory review process, making this window of exclusivity incredibly precious.52

DTC telehealth platforms offer a powerful new tool to manage this transition. One of the most compelling strategies is the launch of an authorized generic. An authorized generic is an identical version of the branded drug, produced by the brand manufacturer but sold under a generic label, often at a lower price.55 By launching an authorized generic through a proprietary or partnered DTC channel at the moment of patent expiration, a pharmaceutical company can achieve several strategic objectives 54:

- Retain Market Share: It allows the company to compete directly with other generic manufacturers, capturing a portion of the market that would otherwise be lost.

- Maintain the Patient Relationship: Patients who have been on the branded therapy can be seamlessly transitioned to the company’s own authorized generic, preventing them from being switched to a competitor’s product by a pharmacy or PBM.

- Control the Narrative: It gives the company control over the pricing and marketing of its own generic, ensuring a consistent brand experience and maintaining patient trust.

This is where a competitive intelligence platform like DrugPatentWatch becomes an indispensable strategic asset. By providing deep, real-time analytics on global drug patents, clinical trials, and, most importantly, patent expiration dates, it allows strategic planning teams to see the patent cliff coming years in advance.56 An IP or commercial strategy team can use DrugPatentWatch to monitor the patent portfolios of both their own products and those of their competitors. This foresight enables them to proactively develop a comprehensive DTC strategy—whether it’s preparing to launch an authorized generic, positioning a next-generation product, or crafting a competitive marketing campaign—well before the LOE event. This transforms lifecycle management from a reactive, defensive exercise into a proactive, offensive commercial strategy.

Generics vs. Branded Drugs: The New Battleground

DTC platforms are creating a new and fascinating competitive dynamic between generic and branded drugs. The conventional wisdom is that a cash-pay model inherently favors generics. Since generics are, on average, 80-85% less expensive than their brand-name counterparts, they are the logical choice for a consumer paying out-of-pocket.57 Indeed, much of the initial success of companies like Hims & Hers was built on providing affordable, generic versions of popular lifestyle drugs.

However, the reality is more nuanced. Consumer and provider perceptions play a significant role in medication choice. Despite their proven bioequivalence, skepticism about generic medications persists. One study found that 46% of patients have specifically asked their provider to prescribe a brand-name drug over a generic alternative.59 This preference is even more pronounced among younger generations. A survey revealed that Gen Z consumers are more likely to prefer brand-name drugs, citing higher trust in the brand (78%), familiarity (69%), and a belief that the brand name signifies higher quality (59%).58

DTC platforms are uniquely positioned to influence this choice architecture. Through their user interface, educational content, and marketing messages, they can guide patient preference. While price will always be a major factor, these platforms also compete on user experience, brand trust, and convenience. This creates an opening for branded drugs to compete in the cash-pay space, not on price, but on the perceived value of the brand, especially if they can offer a superior digital experience, better patient support, or a more trusted platform. This means that even in a post-patent world, a strong brand, amplified through the right DTC channel, can continue to command a premium.

The Data Goldmine: Fueling R&D and Real-World Evidence (RWE)

Perhaps the most transformative long-term impact of the DTC model is the creation of an unprecedented trove of patient data. As previously discussed, by building a direct relationship with the patient, these platforms capture a continuous stream of data on patient behavior, treatment adherence, reported outcomes, and demographic information—data that is completely lost in the fragmented traditional pharmacy channel.48

This data goldmine has profound implications for pharmaceutical R&D and commercial strategy:

- Real-World Evidence (RWE) Generation: The data collected can be aggregated and anonymized to generate powerful real-world evidence on a drug’s effectiveness and safety in a diverse, real-world population. This RWE can be used to support regulatory submissions, justify pricing and reimbursement, and inform clinical guidelines.

- Informing Clinical Trial Design: By analyzing the characteristics of patients who seek out and respond well to certain treatments, companies can gain insights to design more efficient and targeted clinical trials. They can identify high-value patient segments and refine inclusion/exclusion criteria to increase the probability of trial success.56

- Advancing Medical Research: These platforms can function as massive, pre-screened patient registries for future research. In a forward-looking example, Ro has already partnered with the National Institute on Aging to create a registry of patients to accelerate recruitment for future Alzheimer’s disease clinical trials.8

This direct access to patient data forces a fundamental re-evaluation of the traditional pharmaceutical commercial model, particularly the role of the sales representative. For a century, the industry has relied on a large, expensive field force of sales reps visiting physicians’ offices to influence prescribing behavior. In the DTC world, that influence is wielded through different levers: digital marketing, the platform’s user experience, and the algorithms that guide the virtual consultation.

When a company like Eli Lilly or Pfizer partners with a telehealth platform, they are, in effect, outsourcing a portion of their sales and marketing function to that platform’s digital engine. The prescribing data generated by the platform—which physicians are prescribing which drugs to which patients—can then be fed back to the pharmaceutical company. This allows them to target their remaining traditional sales force with surgical precision, focusing their efforts only on the most relevant and high-prescribing physicians.42

The implication for commercial leaders is stark and unavoidable: the structure and purpose of the sales force must be rethought. A dollar invested in a strategic partnership with a platform like Hims & Hers might now yield a higher return on investment than a dollar spent hiring a new sales rep. This demands a new set of skills within commercial teams—a shift away from traditional sales operations and toward digital partnership management, data analytics, and consumer marketing expertise. The pharma company of the future may look less like a traditional B2B enterprise and more like a sophisticated B2C technology company.

The Future of Care: Balancing Convenience, Quality, and Cost

The rise of direct-to-consumer telehealth has irrevocably changed patient expectations and carved out a permanent, significant space in the healthcare landscape. The convenience, accessibility, and patient-centric design of these platforms are here to stay. However, as the industry moves from its frenetic, venture-fueled adolescence into a more mature and consolidated phase, it faces a critical series of questions that will define its future. The long-term viability of this new model will depend on its ability to successfully navigate the complex trade-offs between convenience, the quality and safety of care, and the overall cost to the system. The path forward is not purely virtual, but a thoughtful integration of digital and physical care.

The Quality of Care Debate

The most pressing and persistent question hanging over the DTC telehealth industry is about the quality of care. Can a virtual, often asynchronous, interaction truly replace the diagnostic richness of an in-person visit? The evidence is mixed and highly dependent on the clinical context.

On one hand, numerous studies have demonstrated that for many conditions, telehealth can provide a quality of care that is comparable, or even superior, to traditional in-person visits.60 For chronic disease management, such as diabetes, remote patient monitoring combined with virtual consultations has been shown to improve key clinical metrics like glycemic control.61 In fields like palliative care and mental health, telehealth has dramatically improved access for patients who face geographic or mobility barriers, with studies showing equivalent improvements in quality of life compared to in-person care.60 Patient satisfaction with virtual visits is often high, with many reporting the same or better confidence in their physician compared to office visits.61

On the other hand, significant safety concerns remain, particularly with business models that rely heavily on asynchronous, questionnaire-based consultations without a live interaction. Critics and regulators worry that these streamlined processes can be “cursory,” lacking the depth needed for an accurate diagnosis and potentially leading to inappropriate prescribing.42 The lack of a physical exam can lead to missed diagnoses, and the remote nature of the interaction can make it more difficult to build a strong, empathetic patient-provider relationship.62

The recent FDA warnings regarding the undisclosed side effects of finasteride prescribed through telehealth platforms, and the congressional investigations into “virtual pill mills,” highlight the very real risks when convenience is prioritized over clinical rigor.43 The industry’s future credibility hinges on its ability to implement robust clinical safeguards, ensure true informed consent, and demonstrate consistently positive health outcomes.

The Road to Hybrid Care

The future of healthcare delivery is likely neither purely virtual nor purely in-person, but rather a seamless, intelligent integration of both. This “hybrid care” model leverages the strengths of each modality, using virtual care for convenience, efficiency, and continuous monitoring, while reserving in-person visits for physical exams, complex diagnoses, and relationship-building.

Consumer preferences already point in this direction. While patients embrace virtual visits for prescription refills or simple follow-ups, a majority still prefer in-person care for more complex needs like chronic care management, post-surgical check-ins, and dermatology.13 The ultimate goal, as one expert put it, is to connect care “at the nexus of virtual care and in-person care” to fulfill the true promise of digital health.63

Ro’s strategic acquisitions of companies like Workpath for in-home diagnostics and care delivery represent a clear move toward this hybrid future.8 By building the capacity to send a healthcare professional to the patient’s home when needed, Ro can bridge the gap between the virtual and physical worlds, enabling a more comprehensive and continuous care model. We can expect to see further innovation in this area, with telehealth platforms forging partnerships with traditional brick-and-mortar clinics, retail health hubs, and hospital systems to create a fluid patient journey that moves effortlessly between digital and physical touchpoints.

Concluding Thoughts: A New Ecosystem Emerges

The emergence of DTC telehealth platforms is not a fleeting trend accelerated by a pandemic; it is a permanent and fundamental restructuring of the healthcare value chain. Companies like Ro, Hims & Hers, and their competitors have successfully unbundled the traditional healthcare experience, creating a new, consumer-centric ecosystem that has forever changed patient expectations.

For the pharmaceutical and biotech industries, this represents both an existential threat and an unprecedented opportunity. The threat lies in the disintermediation of traditional commercial models and the potential loss of control over the patient relationship. The old methods of influencing prescribing behavior through physician detailing are becoming less effective in a world where the patient journey begins with a Google search and ends with a subscription in a mobile app.

The opportunity, however, is immense. These platforms offer a direct, data-rich channel to the end consumer, enabling new strategies for lifecycle management, real-world evidence generation, and patient engagement. They provide a laboratory for testing new commercial models, from subscription pricing to authorized generics, and offer a path to building brand loyalty in a way that was never before possible.

The winners in this new era will be the organizations that embrace this complexity. They will be the ones who move beyond viewing telehealth as simply another marketing channel and instead see it as a core component of their strategic planning. They will learn to navigate the intricate regulatory maze, forge intelligent partnerships, and leverage data to create more personalized and effective therapies. The great unbundling of healthcare is underway, and for those prepared to adapt, it offers a new and powerful prescription for growth and market domination.

Key Takeaways

- DTC Telehealth is a Permanent Market Shift: Driven by consumer demand for convenience and accelerated by the pandemic, DTC telehealth is a multi-hundred-billion-dollar market that is fundamentally restructuring healthcare delivery. It is not a temporary trend.

- Two Dominant Strategies Have Emerged: Ro’s vertically integrated “build and own” model (pharmacies, diagnostics) competes with Hims & Hers’ asset-light, multi-brand subscription model. This creates a strategic choice for pharma partners between deep integration (Ro) and massive scale (Hims & Hers).

- The Business Model is LTV > PAC: These companies operate on the unit economics of consumer tech, where the Lifetime Value (LTV) of a subscription customer must exceed the Patient Acquisition Cost (PAC). This forces a focus on long-term relationships and cross-selling, a new discipline for the pharma industry.

- Regulatory Uncertainty is the Greatest Risk: The entire business model is vulnerable to regulatory changes, particularly the looming expiration of waivers for prescribing controlled substances under the Ryan Haight Act and increased FDA scrutiny of advertising and compounded drugs.

- Pharma is Responding with “Pharm-to-Table”: Major players like Eli Lilly and Pfizer are launching their own DTC platforms to bypass PBMs, control pricing, and own patient data. This is a direct challenge to the existing supply chain and raises significant conflict-of-interest concerns.

- A New Playbook for Patent Lifecycle Management: DTC platforms offer pharmaceutical companies a powerful new strategic lever to manage patent cliffs by launching authorized generics, maintaining patient relationships, and capturing market share post-exclusivity. Platforms like DrugPatentWatch are critical for the proactive planning required to execute these strategies.

- Data is the Ultimate Prize: The direct-to-patient model generates an invaluable stream of real-world data on patient behavior, adherence, and outcomes. This data can fuel R&D, inform clinical trial design, and create a significant competitive advantage.

Frequently Asked Questions (FAQ)

1. What is the single biggest regulatory risk facing DTC telehealth companies today?

The most significant and immediate regulatory risk is the uncertainty surrounding the remote prescription of controlled substances. The pandemic-era waivers of the Ryan Haight Act’s in-person visit requirement are set to expire on December 31, 2025. The DEA has not yet finalized its “special registration” rules that would create a permanent pathway for tele-prescribing. Failure to establish a workable permanent solution could cripple the business models of many tele-mental health platforms and other services that rely on these medications, potentially cutting off access for millions of patients.

2. How can a mid-sized biotech company leverage the DTC trend without building its own platform?

A mid-sized biotech can strategically partner with established DTC platforms. Instead of building a costly platform from scratch, they can leverage a platform’s existing infrastructure, patient base, and marketing engine. Key strategies include: 1) Co-promotion agreements where the biotech’s drug is featured on the platform for a specific condition; 2) Data partnerships to gain real-world evidence on their product’s use and outcomes; or 3) Patient support programs hosted on the platform to improve adherence and provide educational resources. The key is to select a partner whose patient demographics and clinical focus align with the biotech’s therapeutic area.

3. From an IP perspective, how do DTC platforms change the strategic value of a drug’s patent portfolio?

DTC platforms add a new dimension to IP strategy by creating a direct channel to execute lifecycle management plans. The value of a patent portfolio is no longer just about defending against generic challengers in court; it’s also about leveraging the post-exclusivity period. A company can use a DTC platform to launch its own authorized generic the day its patent expires, retaining a significant portion of its patient base. This makes patents on formulations, delivery methods, or even combination therapies more valuable, as they can be used to differentiate the authorized generic and the overall user experience on the platform long after the primary composition-of-matter patent has lapsed.

4. Why would a patient choose a more expensive branded drug on a cash-pay platform when a cheaper generic is available?

While price is a major driver, it’s not the only factor. Patients, particularly younger demographics like Gen Z, often choose branded products due to higher trust, brand familiarity, and a perception of superior quality. On a DTC platform, a pharmaceutical company can leverage this by creating a premium, branded experience that goes beyond the pill itself. This could include superior packaging, dedicated customer support, access to specialized content, or integration with digital health tools. In this context, the patient isn’t just buying a drug; they are buying into a trusted brand and a seamless healthcare experience, for which they may be willing to pay a premium over a generic alternative.

5. What are the key differences between Ro’s vertical integration strategy and Hims & Hers’ partnership-based model, and which is better positioned for the future?

Ro’s strategy is to own the supply chain. They build their own pharmacies and acquire diagnostic and in-home care companies to control the entire patient experience. This is capital-intensive and slower to scale but creates a strong, defensible operational moat and allows for the management of more complex conditions. Hims & Hers’ strategy is to own the brand and the customer relationship. They use an asset-light, partnership-based model to scale rapidly across many health categories, focusing their capital on marketing and technology.

Neither model is definitively “better”; they are simply different bets on the future. Ro’s model may be more resilient and better suited for a future of complex, hybrid care. Hims & Hers’ model is more agile and has proven incredibly effective at capturing market share quickly. The future market will likely have room for both: integrated, high-touch platforms for chronic and complex care, and scalable, brand-focused platforms for more straightforward lifestyle and wellness needs.

Works cited

- Ro revenue, valuation & funding | Sacra, accessed October 3, 2025, https://sacra.com/c/ro/

- Telehealth Market Size & Share | Trends Report, 2034, accessed October 3, 2025, https://www.gminsights.com/industry-analysis/telehealth-market

- Telemedicine Market Size, Share, Growth | Global Report [2032] – Fortune Business Insights, accessed October 3, 2025, https://www.fortunebusinessinsights.com/industry-reports/telemedicine-market-101067

- Telehealth Market Size, Share, Trends | Industry Report 2030 – Grand View Research, accessed October 3, 2025, https://www.grandviewresearch.com/industry-analysis/telehealth-market-report

- Investing in Digital Health Startups | Courses, accessed October 3, 2025, https://courses.business.columbia.edu/B8132

- Understanding Venture Capital in Digital Health, accessed October 3, 2025, https://www.rocketdigitalhealth.com/insights/understanding-venture-capital-digital-health

- Venture Capital’s Role in Driving Innovation in Cardiovascular Digital Health – PMC, accessed October 3, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11450906/

- Novel Pharmaceutical Strategies and Business Models: The Rise of Telehealth Companies Like Ro and Hims & Hers – DrugPatentWatch – Transform Data into Market Domination, accessed October 3, 2025, https://www.drugpatentwatch.com/blog/novel-pharmaceutical-strategies-and-business-models-the-rise-of-telehealth-companies-like-ro-and-hims-hers/

- How does Ro make money? – VatorNews, accessed October 3, 2025, https://vator.tv/2021-06-24-how-does-ro-make-money/

- Hims & Hers revenue grows 73% as company touts opportunities behind weight loss drugs, accessed October 3, 2025, https://www.digitalcommerce360.com/2025/08/08/hims-hers-revenue-weight-loss-drugs-q2-fy25/

- About the company: Hims & Hers, accessed October 3, 2025, https://www.hims.com/about/the-company

- Direct to Consumer Telemedicine: Is Healthcare From Home Best? – PMC, accessed October 3, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7431063/

- Is there a virtual health gap? | Deloitte Insights, accessed October 3, 2025, https://www.deloitte.com/us/en/insights/industry/health-care/virtual-health-consumer-demand-and-availability.html

- Consumer preferences, experiences, and attitudes towards …, accessed October 3, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9432716/

- Andrew Dudum, Hims & Hers, on disrupting healthcare by reimagining the patient experience | by Jing Chai | The Pulse by Wharton Digital Health | Medium, accessed October 3, 2025, https://medium.com/wharton-pulse-podcast/andrew-dudum-hims-hers-on-disrupting-healthcare-by-reimagining-the-patient-experience-c0bd9cb8e706

- Let’s talk about it: Growth, Business & Culture at Ro | by Zachariah Reitano – Medium, accessed October 3, 2025, https://medium.com/@zreitano/lets-talk-about-it-growth-business-culture-at-ro-c8b0b51670c5

- How Much Did Ro Raise? Funding & Key Investors | Clay, accessed October 3, 2025, https://www.clay.com/dossier/ro-funding

- Bull of the Day: Hims & Hers Health (HIMS) – Nasdaq, accessed October 3, 2025, https://www.nasdaq.com/articles/bull-day-hims-hers-health-hims

- Hims & Hers Health, Inc. Reports Fourth Quarter and Full Year 2024 Financial Results, accessed October 3, 2025, https://investors.hims.com/news/news-details/2025/Hims–Hers-Health-Inc.-Reports-Fourth-Quarter-and-Full-Year-2024-Financial-Results/

- Hims and Hers Business Model: The Secret Behind Their $4B Success – Bask Health, accessed October 3, 2025, https://bask.health/blog/hims-hers-business-model

- How Much Did Thirty Madison Raise? Funding & Key Investors | Clay, accessed October 3, 2025, https://www.clay.com/dossier/thirty-madison-funding

- Thirty Madison – 2025 Company Profile, Team, Funding & Competitors – Tracxn, accessed October 3, 2025, https://tracxn.com/d/companies/thirty-madison/__YSX_jY3Hf0_XgmWBcwVIy_u9dXlZvnDZi_bBMSlma_M

- Thirty Madison – Virtual-First Specialized Healthcare, accessed October 3, 2025, https://thirtymadison.com/

- Remedy Meds Acquires Thirty Madison in All-Stock Deal Valued at …, accessed October 3, 2025, https://hlth.com/insights/news/remedy-meds-acquires-thirty-madison-in-all-stock-deal-valued-at-over-500m-2025-09-08

- Remedy Meds Acquires Thirty Madison in $500M All-Stock Deal | Femtech Insider, accessed October 3, 2025, https://femtechinsider.com/remedy-meds-acquires-thirty-madison-in-500m-all-stock-deal/

- Remedy Meds Buying Thirty Madison In Deal Valued At Over $500 Million – Pulse 2.0, accessed October 3, 2025, https://pulse2.com/remedy-meds-buying-thirty-madison-in-deal-valued-at-over-500-million/

- Lemonaid Health: Online Doctor & Telehealth Services, accessed October 3, 2025, https://www.lemonaidhealth.com/

- EX-99.1 – SEC.gov, accessed October 3, 2025, https://www.sec.gov/Archives/edgar/data/1804591/000095017022001080/me-ex99_1.htm

- 23andMe Reports FY2022 Second Quarter Financial Results Second quarter revenue of $55 million – SEC.gov, accessed October 3, 2025, https://www.sec.gov/Archives/edgar/data/1804591/000095017021004080/me-ex99_1.htm

- How to Calculate Patient Acquisition Cost? – Maximise Media, accessed October 3, 2025, https://www.maximisemedia.in/blog/calculate-patient-acquisition-cost/

- How to Measure and Improve Patient Acquisition Cost for Your Weight Loss Practice, accessed October 3, 2025, https://robard.com/blog/how-to-measure-and-improve-patient-acquisition-cost-for-your-weight-loss-practice/

- Digital Marketing Expert For Telemedicine Practices ($1999/mon) – PatientGain, accessed October 3, 2025, https://www.patientgain.com/marketing-telemedicine-practices

- Online Prescribing of Controlled Substances – American Psychiatric Association, accessed October 3, 2025, https://www.psychiatry.org/psychiatrists/practice/telepsychiatry/toolkit/ryan-haight-act

- DEA Releases Long-Awaited Telehealth Special Registration Proposal, but Adoption Is Uncertain – McDermott+, accessed October 3, 2025, https://www.mcdermottplus.com/insights/dea-releases-long-awaited-telehealth-special-registration-proposal-but-adoption-is-uncertain/

- Regulating the DTC Telehealth Boom: How Policies Are Shaping the Future of Prescription Fulfillment | Healthcare IT Today, accessed October 3, 2025, https://www.healthcareittoday.com/2025/03/26/regulating-the-dtc-telehealth-boom-how-policies-are-shaping-the-future-of-prescription-fulfillment/

- Third Temporary Extension of COVID-19 Telemedicine Flexibilities for Prescription of Controlled Medications – Federal Register, accessed October 3, 2025, https://www.federalregister.gov/documents/2024/11/19/2024-27018/third-temporary-extension-of-covid-19-telemedicine-flexibilities-for-prescription-of-controlled

- Telehealth and “In-Person Visits”: Tracking Federal and State Updates to Pandemic Era Telehealth Exceptions | Healthcare Law Blog, accessed October 3, 2025, https://www.sheppardhealthlaw.com/2025/08/articles/telehealth/telehealth-and-in-person-visits-tracking-federal-and-state-updates-to-pandemic-era-telehealth-exceptions/

- State Telehealth Policies for Cross-State Licensing – CCHP, accessed October 3, 2025, https://www.cchpca.org/topic/cross-state-licensing-professional-requirements/

- Telehealth in Washington State, accessed October 3, 2025, https://doh.wa.gov/public-health-provider-resources/telehealth/telehealth-washington-state

- Telehealth Information, Division of Corporations, Business and Professional Licensing, accessed October 3, 2025, https://www.commerce.alaska.gov/web/cbpl/TelehealthInformation.aspx

- FDA Launches Sweeping Direct-to-Consumer Advertising Crackdown, accessed October 3, 2025, https://natlawreview.com/article/fda-takes-aim-drug-ads-what-it-means-compounding-pharmacies-medspas-and-telehealth

- a direct-to-consumer telehealth platform investigation – Senator Dick Durbin, accessed October 3, 2025, https://www.durbin.senate.gov/imo/media/doc/DTC%20Investigation%202025.pdf

- DTC Telehealth Partnerships: Navigating Risks in Pharma’s Digital Expansion, accessed October 3, 2025, https://news.syenza.com/dtc-telehealth-partnerships-navigating-risks-pharma/

- A Prescription for Caution: Senators Release Investigative Report on Direct-To-Consumer Telehealth Models – Quarles, accessed October 3, 2025, https://www.quarles.com/newsroom/publications/a-prescription-for-caution-senators-release-investigative-report-on-direct-to-consumer-telehealth-models

- Finasteride Side Effects from Telehealth Providers Lawsuit Investigation | Sauder Schelkopf, accessed October 3, 2025, https://sauderschelkopf.com/investigations/finasteride-side-effects-from-telehealth-providers-lawsuit-investigation/

- Topical Hair Loss Treatment Linked to ED, Anxiety, and Brain Fog, FDA Warns – Health, accessed October 3, 2025, https://www.health.com/telehealth-companies-topical-propecia-finasteride-fda-11726649

- FDA Warns Popular Hair-Loss Product Finasteride May Cause Side Effects – Healthline, accessed October 3, 2025, https://www.healthline.com/health-news/fda-warning-hair-loss-treatment-topical-finasteride

- “Pharm-to-Table”: The Impact of Direct-to-Consumer Pharmaceutical …, accessed October 3, 2025, https://www.debevoise.com/insights/publications/2025/09/pharm-to-table-the-impact-of-direct-to-consumer

- Reimagining Patient Access: Building Direct-to … – Drug Channels, accessed October 3, 2025, https://www.drugchannels.net/2025/10/reimagining-patient-access-building.html

- Pfizer launches digital DTC platform, following Eli Lilly’s lead | Darwin Research Group, accessed October 3, 2025, https://www.darwinresearch.com/pfizer-launches-digital-dtc-platform-following-eli-lillys-lead/

- Life Sciences Partnerships With Telemedicine Platforms Invite New Congressional Scrutiny, accessed October 3, 2025, https://www.sidley.com/en/insights/newsupdates/2024/11/life-sciences-partnerships-with-telemedicine-platforms-invite-new-congressional-scrutiny

- How Drug Life-Cycle Management Patent Strategies May Impact Formulary Management | AJMC, accessed October 3, 2025, https://www.ajmc.com/view/a636-article

- How drug life-cycle management patent strategies may impact formulary management – PubMed, accessed October 3, 2025, https://pubmed.ncbi.nlm.nih.gov/28719222/

- How to own a Market you Don’t Own: Market Access Strategies Post-Patent Expiration, accessed October 3, 2025, https://www.drugpatentwatch.com/blog/how-to-own-a-market-you-dont-own-market-access-strategies-post-patent-expiration/