The pharmaceutical landscape is a dynamic arena, constantly shaped by scientific breakthroughs, evolving regulatory frameworks, and intense market competition. Within this intricate ecosystem, generic drugs stand as pillars of accessibility and affordability, fundamentally transforming healthcare delivery worldwide. For business professionals and pharmaceutical leaders, understanding the labyrinthine generic drug approval process is not merely a regulatory obligation; it is a strategic imperative, a pathway to unlocking significant competitive advantage and driving market success.

This comprehensive guide delves into the multifaceted journey of generic drug approval, illuminating the critical regulatory pathways in the United States and Europe, dissecting the scientific bedrock of bioequivalence, and unveiling the strategic maneuvers involving patents and exclusivities. Furthermore, it explores the operational excellence required in manufacturing and supply chain management, and the transformative power of intelligence in a market where precision and foresight are paramount.

I. The Generic Imperative: A Strategic Overview

Generic drugs, often perceived simply as cost-effective alternatives, are in fact indispensable components of global healthcare systems. They play a pivotal role in making life-saving treatments accessible to millions, thereby bolstering public health and economic stability. The journey from a brand-name drug’s patent expiration to the widespread availability of its generic counterpart is a testament to a carefully constructed regulatory and commercial framework designed to balance innovation with public access.

A. The Evolving Landscape of Generic Pharmaceuticals

The narrative of generic pharmaceuticals has shifted dramatically over the past few decades. Once a niche segment, generic drugs now form the backbone of prescription medication usage in many countries. In the United States, for instance, generic drugs account for approximately 90% of all prescriptions filled, yet remarkably, they represent only about 22% of the total drug costs . This striking disparity highlights their profound impact on healthcare expenditure. The sheer volume of generic prescriptions underscores a fundamental truth: the efficient approval and consistent supply of these medicines are not merely commercial considerations but critical determinants of national healthcare stability. Any disruption in the generic supply chain or delays in approval can directly impede patient access and strain national healthcare budgets, elevating the importance of a streamlined and robust approval process to a matter of public health security.

B. Economic Impact and Market Dynamics: Why Generics Matter

The economic footprint of the generic drug market is substantial and continues to expand. Projections indicate that the global generic drug market, valued at $435.3 billion in 2023, is set to surge to $655.8 billion by 2028, exhibiting a compound annual growth rate (CAGR) of 8.5% . Other analyses forecast an increase from $445.62 billion in 2024 to approximately $728.64 billion by 2034, with a CAGR of 5.04% . This robust growth trajectory is not accidental; it is driven by a powerful confluence of factors, including the impending expiration of patents on numerous blockbuster brand-name drugs, the escalating global demand for affordable healthcare solutions, and proactive government initiatives aimed at promoting the widespread adoption of generics .

This sustained growth signifies a fundamental reorientation within the pharmaceutical industry. Value creation is increasingly shifting from solely novel drug development towards the efficient, high-quality production and strategic market penetration of generic versions. Companies that fail to recognize and invest in robust generic capabilities risk marginalization in this rapidly expanding and economically vital segment. The continuous pressure on brand-name companies to innovate or face significant revenue erosion post-patent is a direct consequence of this evolving market dynamic.

Beyond market size, the true power of generics lies in their ability to deliver substantial cost savings. Generic drugs typically retail at prices 80% to 85% lower than their brand-name counterparts . This remarkable cost-effectiveness translates into immense savings for healthcare systems globally. For example, a study revealed that the use of generic drugs saved the United States an estimated $253 billion in 2014 alone . These savings are not just abstract figures; they directly enhance healthcare accessibility, particularly for vulnerable populations and in developing economies. The affordability fostered by generics has a direct and profound impact on patient medication adherence, especially for chronic conditions, ultimately leading to improved health outcomes worldwide . The direct correlation between generic drug availability and enhanced patient adherence underscores that the generic approval process is more than a commercial endeavor; it is a vital public health mechanism. Regulatory bodies thus bear a dual responsibility: ensuring the safety and efficacy of these medicines while simultaneously facilitating their rapid market entry to maximize these crucial public health benefits.

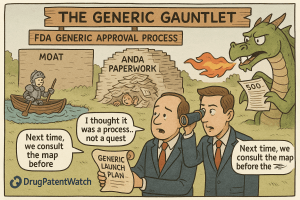

C. Navigating the Regulatory Maze: A Competitive Edge

While the economic benefits are clear, the path to generic drug approval is far from straightforward. It is a complex and often protracted journey, acting as a significant barrier to entry for many . Yet, for the astute pharmaceutical company, mastering this intricate regulatory landscape—whether in the highly structured environment of the U.S. Food and Drug Administration (FDA) or the multi-faceted European Medicines Agency (EMA)—is not merely about achieving compliance. It is about forging a formidable strategic advantage. Organizations that cultivate a deep understanding of these regulatory frameworks and proactively navigate their complexities can significantly expedite their market entry, capitalizing on opportunities faster than their competitors.

This mastery transforms regulatory compliance from a burdensome cost center into a powerful strategic differentiator. Companies that invest in sophisticated regulatory intelligence capabilities and cultivate robust internal processes can effectively convert regulatory complexity into a competitive moat. This allows them to gain crucial first-mover advantages, particularly in markets newly opened by patent expirations, thereby securing substantial market share and establishing a strong competitive position.

II. The US FDA Generic Drug Approval Pathway: The ANDA Journey

The United States generic drug market is fundamentally shaped by a landmark piece of legislation: the Hatch-Waxman Act. This Act created an abbreviated pathway for generic drug approval, significantly influencing market dynamics and patient access to affordable medicines.

A. The Hatch-Waxman Act: A Balancing Act of Innovation and Access

The “Drug Price Competition and Patent Term Restoration Act of 1984,” widely known as the Hatch-Waxman Amendments, stands as a pivotal legislative achievement that profoundly reshaped the U.S. pharmaceutical industry . This seminal Act established the Abbreviated New Drug Application (ANDA) pathway, a streamlined route that allows generic manufacturers to seek FDA approval by demonstrating bioequivalence to an already approved brand-name drug, without the necessity of repeating the costly and time-consuming preclinical and clinical trials for safety and efficacy .

The genius of the Hatch-Waxman Act lies in its dual objective: to strike a delicate balance between incentivizing pharmaceutical innovation through robust patent protection for brand-name companies and simultaneously promoting generic competition to enhance the affordability and accessibility of medications for the public . Prior to this legislation, generic manufacturers faced formidable legal and regulatory hurdles, often being compelled to conduct their own full clinical trials to prove safety and effectiveness, which severely limited the availability of generic drugs .

The Act, therefore, inherently weaves a dynamic tension between innovator and generic manufacturers. This tension is not a flaw in the system but a meticulously designed feature, ensuring that market entry for generics, while abbreviated, is not entirely frictionless, thereby preserving the crucial incentives for brand-name companies to invest in the discovery and development of novel therapies. A deep understanding of this underlying philosophy is indispensable for both brand and generic companies to anticipate competitive strategies and navigate the market effectively. For generic manufacturers, this means recognizing that while the ANDA pathway is abbreviated, it still presents strategic battlegrounds where legal and regulatory acumen are as vital as scientific capability.

B. Abbreviated New Drug Application (ANDA) Submission Lifecycle

The Abbreviated New Drug Application (ANDA) process is the cornerstone of generic drug approval in the U.S., allowing manufacturers to leverage the FDA’s prior findings of safety and effectiveness for a Reference Listed Drug (RLD) . This mechanism significantly compresses the development timeline compared to the extensive process required for a New Drug Application (NDA) of a novel drug .

The journey begins with Pre-ANDA Research and Development. In this foundational phase, companies meticulously identify a suitable brand-name drug for replication. This involves developing a bioequivalent formulation—a critical step that ensures the generic will perform identically to its branded counterpart in the body. Preliminary studies are also conducted to establish baseline safety and efficacy data . Manufacturers must conduct a thorough analysis of the RLD’s chemical composition, formulation, labeling, and regulatory history to ensure their proposed generic precisely matches the original drug. Concurrently, strict adherence to Current Good Manufacturing Practices (cGMP) is essential from the outset, laying the groundwork for a compliant manufacturing process .

Once this groundwork is meticulously laid, the company proceeds to the ANDA Submission and Review Process. The ANDA itself is a comprehensive electronic document, submitted to the FDA’s Center for Drug Evaluation and Research (CDER) via the FDA Electronic Submissions Gateway (ESG) . This extensive dossier must contain detailed information about the drug’s composition, manufacturing processes, and stringent quality control measures. Crucially, it includes the results of bioequivalence studies, which scientifically demonstrate the generic’s equivalence to the RLD. The proposed labeling must also be identical to the RLD, with only minor permissible modifications . Upon receipt, the FDA initiates a rigorous multi-phase review. This involves a scientific evaluation of the drug’s formulation, a meticulous assessment of the bioequivalence data, thorough inspections of the manufacturing facilities to ensure compliance with quality standards, and a detailed review of the proposed labeling .

The culmination of this process is the FDA Review and Decision. The review typically spans approximately 30 months, although applications for priority generics—such as those addressing drug shortages or unmet medical needs—may benefit from expedited review timelines . Throughout this period, the FDA may issue “Information Requests” (IRs) or “Discipline Review Letters” (DRLs), raising questions or concerns about various aspects of the application. The applicant must promptly and comprehensively address these issues, which may necessitate providing additional data, conducting further studies, or making adjustments to manufacturing processes or labeling . If all requirements are satisfactorily met and the FDA is confident in the application and the company’s responses, the generic drug receives final approval. Conversely, if significant deficiencies persist, the FDA issues a Complete Response Letter (CRL), detailing the unresolved concerns that must be addressed before the application can be resubmitted for further review .

The iterative nature of the FDA’s review process, characterized by potential queries and Complete Response Letters, underscores a critical truth: the initial quality of the submission is paramount. A meticulously prepared and thoroughly documented ANDA, one that anticipates potential agency concerns and provides robust data from the outset, can significantly truncate review cycles and accelerate time-to-market. This efficiency directly translates into a stronger competitive stance, as market entry speed is often a decisive factor. The 30-month average review time is merely a statistical mean; a company with superior regulatory intelligence and an unwavering commitment to quality assurance can proactively manage the process, transforming a potential bottleneck into an accelerated pathway to market.

C. Bioequivalence: The Cornerstone of Generic Approval

At the heart of generic drug approval lies the scientific principle of bioequivalence. It is the bedrock upon which the entire abbreviated approval pathway is built, ensuring that generic medicines deliver the same therapeutic effect as their brand-name counterparts.

Defining Bioequivalence and Bioavailability: In essence, bioequivalence means that a generic drug must deliver the same amount of active ingredient to the bloodstream, at the same rate, as the brand-name drug . This ensures that the generic version will have the same therapeutic effect and safety profile as its brand-name counterpart. Bioavailability, a closely related concept, refers to the proportion of a drug that enters the systemic circulation and becomes available at the site of drug action. It is a critical pharmacokinetic property that influences a drug’s efficacy and safety .

Types of Bioequivalence Studies (In Vivo, In Vitro) and Statistical Methods: Bioequivalence is primarily demonstrated through rigorous in vivo studies, typically involving human volunteers, where the generic drug is compared directly to the brand-name reference drug . These studies involve administering both formulations and then meticulously analyzing blood samples collected over time to measure drug concentrations . The focus is on key pharmacokinetic (PK) parameters: Cmax, which represents the maximum (peak) plasma concentration of the drug and reflects the rate of absorption; and Area Under the Curve (AUC), which measures the total exposure to the drug over time and represents the extent of absorption .

The statistical analysis of bioequivalence data is precise and standardized. The most common method is the two one-sided test (TOST) procedure. For a generic drug to be deemed bioequivalent, the 90% confidence interval for the ratio of the geometric means (generic/reference) for both Cmax and AUC must fall entirely within the regulatory acceptance range of 80% to 125% . These studies must be conducted in strict accordance with Good Laboratory Practice (GLP) regulations .

The strict 80-125% bioequivalence criterion, while appearing as a fixed numerical boundary, is deeply rooted in scientific principles. This range is not arbitrary; it is derived from the log-normal distribution of pharmacokinetic parameters and a regulatory determination that differences in systemic drug exposure up to 20% are not clinically significant . This level of precision means that even subtle variations in formulation or manufacturing processes can cause a generic product’s pharmacokinetic profile to fall outside this narrow window, leading to a bioequivalence failure. This reality underscores the immense scientific and technical sophistication required in generic drug development and explains why bioequivalence testing remains one of the top challenges faced by generic drug developers .

Biowaiver Conditions and Considerations: In certain well-defined circumstances, the requirement for conducting expensive and time-consuming in vivo bioequivalence studies may be waived, a process known as a “biowaiver” . This can apply to specific product types, such as parenteral solutions intended for injection, oral solutions, or certain immediate-release solid oral dosage forms, provided they meet stringent criteria. These criteria typically include demonstrating that the generic product contains the same active and inactive ingredients in the same dosage form and concentration, and exhibits similar pH and physicochemical characteristics as the Reference Listed Drug (RLD) . The FDA actively supports generic drug development by publishing product-specific guidances (PSGs) that detail the most appropriate methodologies for bioequivalence studies and outline the conditions under which biowaivers may be granted .

Strategically leveraging biowaivers, where scientifically justifiable, offers a significant opportunity for generic manufacturers. By bypassing the need for costly and time-consuming in vivo studies, companies can substantially reduce their development expenditures and accelerate their time-to-market. This requires not just an awareness of biowaiver possibilities but a deep understanding of the FDA’s product-specific guidances and the ability to construct a robust scientific justification for the biowaiver application. This capability transforms a regulatory exemption into a powerful competitive tool.

D. Quality Control and Manufacturing Standards: The cGMP Mandate

Beyond bioequivalence, the bedrock of generic drug approval and sustained market presence is an unwavering commitment to quality. This commitment is codified in Current Good Manufacturing Practices (cGMP) regulations, which are non-negotiable for all pharmaceutical manufacturers.

Current Good Manufacturing Practices (cGMP) Requirements: Adherence to cGMP regulations is not merely a box to check; it is a fundamental requirement that governs every aspect of drug production. These regulations establish the minimum standards for the manufacturing, processing, packing, and holding of drug products, serving as a critical assurance of their identity, strength, quality, and purity . The FDA’s philosophy is clear: quality must be meticulously “built into the design and manufacturing process at every step,” rather than simply tested for at the end . Key elements of cGMP compliance include the establishment of robust quality management systems, the procurement of appropriate quality raw materials, the implementation of robust operating procedures, diligent detection and investigation of product quality deviations, and the maintenance of reliable testing laboratories . Failure to comply with cGMP regulations can have severe consequences, rendering a drug “adulterated” under the law, which can lead to regulatory actions such as recalls, import bans, or even facility shutdowns .

ICH Q7 Guidelines for Active Pharmaceutical Ingredients (APIs): Complementing general cGMP, the International Council for Harmonization (ICH) provides specific guidelines for Active Pharmaceutical Ingredients (APIs). The ICH Q7 guideline meticulously outlines the Current Good Manufacturing Practice (cGMP) standards for the production of APIs, which are the biologically active components of any drug . This comprehensive guideline covers the entire lifecycle of an API, from the initial procurement of starting materials through the synthesis, purification, and recovery processes, all the way to the final product . It emphasizes the establishment of robust quality management systems, mandatory personnel training, stringent standards for manufacturing facilities and equipment, meticulous documentation practices (Good Documentation Practices – GDP), diligent materials management, and proactive risk management . Compliance with ICH Q7 is a global prerequisite for market approval, ensuring consistent quality and safety of APIs across international supply chains .

FDA Inspection Process and Common Deficiencies: To ensure ongoing compliance, the FDA conducts rigorous and frequent inspections of pharmaceutical manufacturing facilities worldwide, including those producing both active ingredients and finished drug products . These inspections are designed to identify any deviations from cGMP standards. Common deficiencies frequently cited in FDA Warning Letters include inadequacies in facility design, insufficient environmental and personnel monitoring within aseptic processing areas, instances of unreliable laboratory records (such as manipulated or missing data, which raise serious data integrity concerns), and a failure to adequately investigate the root causes of quality failures, such as recurring dissolution failures .

The persistent recurrence of cGMP violations, particularly those related to data integrity and inadequate investigations, points to systemic weaknesses in quality culture and oversight within certain manufacturing operations, especially those located overseas . This presents a significant and ongoing risk for generic companies, as non-compliance can trigger severe regulatory consequences, including import bans, product recalls, and profound reputational damage that can erode market trust and impact the entire supply chain. This reality underscores that proactive, transparent quality systems, potentially leveraging advanced manufacturing technologies and Quality by Design principles, are no longer merely advantageous but absolutely essential for sustained market access and competitive viability.

III. The EU EMA Generic Drug Approval Pathway: A European Perspective

The European Union (EU) represents a vast and complex market for pharmaceuticals, with its own distinct regulatory framework for generic drug approval coordinated by the European Medicines Agency (EMA). While sharing fundamental principles with the U.S. system, the EMA pathway offers unique procedural nuances.

A. Marketing Authorization Application (MAA) for Generic Medicines

In the European Union, the process for approving generic drugs is managed through the Marketing Authorization Application (MAA) system, overseen by the European Medicines Agency (EMA). Much like the FDA’s ANDA, a generic medicine seeking approval in the EU must demonstrate its “sameness” to a reference medicine. This includes possessing the identical active substance(s), being administered at the same dose(s), and being intended for the same therapeutic use(s). The MAA process serves as a comprehensive certification, ensuring that the proposed generic drug has undergone all necessary studies and meets the rigorous EU standards for safety, quality, and efficacy before it can be made available to patients .

B. Diverse Approval Procedures: Centralized, Decentralized, Mutual Recognition, National

One of the distinguishing features of the EU regulatory landscape is its multi-pathway approach to Marketing Authorization Applications, offering strategic flexibility for pharmaceutical companies .

The Centralized Procedure is mandatory for certain innovative drugs, particularly biotechnological products, and is also accessible for generic medicines if their reference product was centrally authorized. Furthermore, a generic can qualify for the centralized procedure if it demonstrates “significant therapeutic, scientific or technical innovation” or if its Union authorization is deemed to be “in the interest of patients at Union level” . This route culminates in a single marketing authorization that is valid across all 27 EU member states, providing a unified market access.

The Decentralized Procedure (DCP) and the Mutual Recognition Procedure (MRP) are the most frequently utilized pathways for generic drug approvals in the EU . The DCP is designed for medicines not yet authorized in any EU member state, allowing for their simultaneous authorization in multiple member states. Conversely, the MRP facilitates the recognition of a marketing authorization already granted by one EU member state (the Reference Member State) by other selected EU countries .

Lastly, the National Procedure allows for a marketing authorization to be granted by a single national health agency within an individual EU member state, with the authorization remaining valid only within that specific country .

The existence of multiple approval pathways in the EU—Centralized, Decentralized, Mutual Recognition, and National—provides generic companies with significant strategic optionality. This allows them to meticulously tailor their submission strategy based on a variety of factors, including the desired market reach (pan-EU versus specific national markets), the characteristics of the product (e.g., “complex generics” might benefit from the Centralized procedure or specific scientific advice), and the anticipated timelines and costs associated with each route . This procedural diversity necessitates sophisticated regulatory intelligence, enabling companies to select the most efficient and commercially viable route for each generic product, thereby optimizing their market entry and competitive positioning across the varied European landscape.

C. Key Requirements: Quality, Bioequivalence, and Data Exclusivity

Regardless of the chosen pathway, all generic drug applications in the EU must satisfy stringent requirements concerning quality, bioequivalence, and respect for exclusivity periods.

EMA Bioequivalence Guidelines: The EMA, like the FDA, mandates that generic medicines demonstrate bioequivalence to their reference products. This means proving that the generic produces the same levels of the active substance in the human body as the original medicine. This is typically achieved through rigorous bioavailability studies, which are essentially pharmacokinetic studies designed to measure the rate and extent of drug absorption . Consistent with international standards, the 90% confidence interval for key pharmacokinetic parameters, namely AUC (Area Under the Curve) and Cmax (maximum concentration), must fall within the accepted range of 80% to 125% . For certain highly variable drugs, the EMA offers a degree of flexibility, allowing the widening of Cmax limits to 70-143% if scientifically justified, though the AUC must invariably remain within the 80-125% range .

Similar to the FDA, the EMA also provides for “biowaivers” in specific scenarios. These waivers can be granted for additional strengths of a drug or for certain types of formulations (e.g., aqueous parenteral solutions), provided that the generic product demonstrates qualitative and quantitative compositional similarity to the reference product and exhibits comparable in vitro dissolution profiles . This flexibility can significantly streamline the development process for eligible products.

Quality Standards and GMP Compliance in the EU: Generic medicines marketed in the EU are held to the same exacting quality standards as all other pharmaceutical products. The foundation of this quality assurance lies in strict adherence to Good Manufacturing Practice (GMP) guidelines, as stipulated by EU legislation, including Directive 2001/83/EC and Directive (EU) 2017/1572 . These guidelines ensure that medicines are consistently produced to high-quality standards, are appropriate for their intended use, and fully comply with the requirements of their marketing authorization . The EMA actively coordinates inspections to verify compliance, and any instances of non-compliance can lead to severe enforcement actions, including the suspension, withdrawal, or refusal of manufacturing authorizations . Common deficiencies identified during inspections often include inadequate documentation, failures in process validation, and product contamination . For example, in 2024, EEA authorities issued 10 GMP non-compliance statements, with 5 originating from manufacturing sites in India .

Data and Market Exclusivity Periods: A crucial aspect of the EU regulatory landscape for generics concerns exclusivity periods. A marketing authorization application for a generic medicine can only be formally submitted once the period of data exclusivity for the reference medicine has elapsed. This period typically lasts for 8 years from the date of the original medicine’s initial authorization. However, even after submission, generic medicines can only be commercially marketed once the full marketing protection period of the reference product has expired, which is usually 10 or 11 years from the date of its first authorization.

The EU’s dual system of data exclusivity (8 years) and market exclusivity (10 or 11 years) creates a nuanced strategic timeline for generic companies. While the expiration of data exclusivity opens the door for an application to be submitted (allowing for the compilation of the dossier and initial regulatory review), the generic product cannot actually be launched until the longer market exclusivity period has also expired. This necessitates meticulous long-term planning and continuous patent and exclusivity monitoring. Companies must strategically time their research and development efforts, bioequivalence studies, and manufacturing preparations to ensure they are fully ready for market entry precisely at the moment both exclusivity protections lapse. This integrated approach to regulatory and market timing is crucial for maximizing the commercial opportunity.

IV. Strategic Patent and Exclusivity Landscape: Unlocking Market Entry

The journey of generic drug approval is inextricably linked to the complex world of intellectual property. Navigating patents and exclusivities is not just a legal exercise; it is a strategic imperative that dictates market entry timing and competitive dynamics.

A. Understanding Patent Protection and Its Expiration

Patents serve as the primary legal shield for innovator pharmaceutical companies, safeguarding their substantial investments in research and development and granting them exclusive market rights for a defined period.

Patent Lifecycle and Effective Patent Life: A new drug patent generally grants protection for 20 years from its filing date . This period is designed to allow the innovator company to recoup the immense financial and time investments poured into discovering, developing, and bringing a novel drug to market . However, the practical reality is that the “effective patent life”—the period of market exclusivity remaining after a drug receives regulatory approval—is often significantly shorter, typically ranging from 7 to 10 years . This reduction is largely due to the protracted R&D and regulatory approval processes that consume a substantial portion of the initial 20-year patent term.

The inherent gap between the statutory 20-year patent term and the often much shorter “effective patent life” creates a profound strategic challenge for innovator companies. This disparity compels them to actively pursue strategies aimed at maximizing their exclusivity window, frequently leading to practices such as “evergreening.” For generic companies, this very gap represents a crucial window of opportunity. It mandates meticulous and continuous competitive intelligence to identify upcoming patent expirations, analyze potential “patent thickets,” and prepare for timely market entry, transforming a brand’s challenge into a generic’s opportunity.

The Role of the Orange Book (US) in Patent Listings: In the United States, the FDA’s “Approved Drug Products with Therapeutic Equivalence Evaluations,” universally known as the Orange Book, is an indispensable resource for both innovator and generic pharmaceutical companies . This comprehensive publication lists all drug products approved by the FDA based on their safety and effectiveness, crucially including detailed patent information relevant to these approved drugs . The types of patents listed typically encompass those claiming the active ingredient(s) (drug substance patents), the specific formulation or composition of the drug product (drug product patents), and particular approved indications or methods of using the drug (method of use patents) . For generic companies, the Orange Book serves as a critical roadmap, identifying the specific patents that must be addressed—either by certifying non-infringement or challenging their validity—in their Abbreviated New Drug Application (ANDA) submissions .

B. Navigating Regulatory Exclusivities (US & EU)

Beyond the realm of patents, regulatory exclusivities provide an additional layer of market protection, often operating independently of patent status. These exclusivities can significantly impact the timing of generic market entry by preventing regulatory bodies from approving competitor drugs .

- New Chemical Entity (NCE) Exclusivity (US): In the U.S., a drug containing an active moiety not previously approved by the FDA may be granted New Chemical Entity (NCE) exclusivity, which provides 5 years of market protection . During this period, the FDA is generally prohibited from accepting or approving any ANDA or 505(b)(2) application for a drug product containing the same active moiety. However, a critical exception exists: if patents are listed in the Orange Book for the brand-name drug, a generic company can submit an ANDA with a Paragraph IV certification as early as the fourth year of the NCE exclusivity period (often referred to as “NCE -1”) . This strategic filing allows the generic company to potentially initiate a patent challenge and position itself for market entry immediately upon the expiration of the NCE exclusivity and any relevant patents.

- Orphan Drug Exclusivity (ODE) (US): To incentivize the development of treatments for rare diseases or conditions (defined as affecting fewer than 200,000 people in the U.S., or where R&D costs are unlikely to be recouped), the Orphan Drug Act grants 7 years of market exclusivity to approved orphan drugs . This exclusivity specifically protects the approved indication for the rare disease, meaning the FDA cannot approve a competing product for the same indication during this period .

- Pediatric Exclusivity (US): As a further incentive for pharmaceutical companies to conduct studies on drug use in pediatric populations, the FDA may grant an additional 6 months of market exclusivity . This “pediatric exclusivity” is appended to any existing patents and/or other exclusivities for the drug, effectively extending the period of market protection and delaying generic competition . This provides a valuable return on investment for companies undertaking the often complex and resource-intensive pediatric studies.

- 180-Day Generic Drug Exclusivity (US): Perhaps one of the most powerful incentives established by the Hatch-Waxman Act is the 180-day generic drug exclusivity. This valuable marketing right is granted to the first generic company that files a substantially complete ANDA containing a “Paragraph IV certification” (asserting that a listed patent is invalid, unenforceable, or will not be infringed) . During this crucial 6-month period, the FDA is prohibited from approving any subsequent generic applications for the same product, effectively creating a temporary duopoly between the brand-name manufacturer and the first generic entrant . This exclusivity can yield significant market share and substantially higher profit margins for the first-to-file generic company compared to later entrants . However, this valuable exclusivity is not without conditions; it can be forfeited under several circumstances, including failure to market the drug within a specified timeframe, withdrawal of the ANDA application, or amendment of the Paragraph IV certification .

The 180-day exclusivity serves as a “golden ticket” for generic manufacturers, offering a substantial competitive advantage and disproportionate profitability compared to subsequent market entrants . This economic reality fuels aggressive patent challenge strategies, making the pursuit of “first-to-file” status with a Paragraph IV certification a high-stakes race. The first generic entrant can often capture significant market share at prices that are only moderately discounted (typically 15-25% below brand pricing), yielding significantly higher margins than when multiple generic competitors enter the market and drive prices down by 80-90% or more . However, the potential for forfeiture, particularly in the context of “pay-for-delay” agreements, introduces a complex legal and antitrust minefield that requires meticulous navigation to secure and retain this valuable exclusivity.

C. Patent Challenges and Litigation Strategies

The strategic landscape of generic drug approval is often defined by direct confrontations over intellectual property, particularly through patent challenges and subsequent litigation.

- Paragraph IV Certifications: The Gauntlet Thrown: A Paragraph IV certification is a bold and direct legal challenge to a brand manufacturer’s patents listed in the Orange Book. In filing such a certification, a generic applicant formally asserts that, in their opinion and to the best of their knowledge, the patent is either invalid, unenforceable, or will not be infringed by the manufacture, use, or sale of their proposed generic product . This certification is not merely a statement; it is legally considered an “artificial act of patent infringement” under U.S. law, designed to trigger potential patent infringement litigation between the brand-name company and the generic applicant .

- The 30-Month Stay: Implications for Generic Entry: Upon receiving a Paragraph IV notice letter, the brand-name manufacturer has a critical 45-day window to initiate a patent infringement lawsuit against the generic applicant. If a lawsuit is filed within this timeframe, an automatic 30-month regulatory stay is triggered . During this period, the FDA is generally prevented from granting final approval to the generic application, providing the brand company with a crucial window to litigate its patent claims. While the 30-month stay is intended to allow for the resolution of patent disputes, studies have indicated that these stays often expire well before generic entry actually occurs, suggesting that other factors—such as additional patents, manufacturing complexities, or strategic settlement agreements—frequently play a more significant role in delaying market entry .

- Case Studies: Successful Paragraph IV Challenges and Market Impact: Successful Paragraph IV challenges can dramatically alter market dynamics and accelerate generic competition. A notable example involves a Federal Circuit decision that upheld the invalidity of Bayer’s Yasmin patent due to obviousness, thereby clearing the path for generic versions to enter the market . This case exemplifies how a well-executed patent challenge can dismantle intellectual property barriers. Research indicates a high success rate (approximately 76%) for first-to-file Paragraph IV challenges, which underscores why the potential payoff justifies the inherent risks and costs of litigation for generic manufacturers .

The strategic landscape of Paragraph IV challenges is akin to a high-stakes chess game, demanding not only scientific and regulatory proficiency but also exceptional legal acumen. Generic companies must possess the capability to identify potentially weak patents, formulate compelling invalidity arguments (e.g., based on prior art or obviousness), and adeptly navigate the complexities of patent litigation. The ability to successfully challenge and invalidate patents is as crucial as demonstrating bioequivalence in securing timely market access. This means generic companies increasingly require specialized internal or external legal expertise to analyze complex patent claims, uncover relevant prior art, and construct robust legal cases, effectively transforming legal strategy into a core competitive capability.

D. Brand-Name Defensive Strategies and Countermeasures

The pharmaceutical industry is a battleground where innovator companies fiercely defend their market exclusivity against generic entrants. This defense often involves sophisticated strategies designed to delay or deter generic competition, necessitating equally robust countermeasures from generic manufacturers.

- “Evergreening” and “Product Hopping” Tactics: Brand-name pharmaceutical companies frequently employ strategies to extend their market monopolies beyond the expiration of their primary patents. “Evergreening” involves obtaining additional patents on minor modifications of an existing drug, such as new formulations, alternative delivery methods, or novel therapeutic indications . These tactics create intricate “patent thickets”—dense and overlapping networks of patents that significantly increase the cost and complexity of litigation for generic challengers . “Product hopping,” a related tactic, involves withdrawing an older product from the market and replacing it with a slightly modified, newly patented version, thereby forcing generic companies to reformulate or re-seek approval for the new version .

- REMS as a Barrier: Overcoming Sample Access Challenges (CREATES Act): Risk Evaluation and Mitigation Strategies (REMS) are safety programs mandated by the FDA for certain drugs associated with serious risks, designed to ensure that the benefits of the medication outweigh its potential harms . However, brand-name companies have, at times, controversially leveraged REMS requirements to impede generic entry. This has occurred by refusing to provide generic manufacturers with samples of the Reference Listed Drug (RLD) needed to conduct essential bioequivalence testing, citing the restricted distribution requirements of the REMS . This withholding of samples effectively blocks generic development. To address this anti-competitive practice, the CREATES Act (Creating and Restoring Equal Access to Equivalent Samples Act) was introduced, aiming to provide a legal pathway for generic manufacturers to obtain necessary samples and prevent brand companies from misusing REMS to delay competition .

- “Pay-for-Delay” Settlements: Antitrust Implications: Among the most contentious defensive strategies are “pay-for-delay” settlements, also known as “reverse payment” agreements. These arrangements involve brand manufacturers compensating generic companies to delay their market entry, typically as part of a settlement to ongoing patent litigation . While proponents argue that these settlements efficiently resolve patent disputes, critics, including the Federal Trade Commission (FTC), vehemently contend that they are anticompetitive. The FTC asserts that such agreements cost consumers billions of dollars annually in higher drug costs by effectively blocking the entry of cheaper generic alternatives . These settlements have been subjected to significant fines and continue to face intense antitrust scrutiny and legal challenges .

The persistent existence of “evergreening,” the strategic use of REMS to withhold samples, and the prevalence of “pay-for-delay” settlements reveal a systemic tension within the pharmaceutical industry. Innovator companies actively exploit existing legal and regulatory frameworks to extend their monopolies beyond their intended duration, maximizing profitability. For generic companies, this means the competitive landscape extends beyond scientific development and regulatory compliance into complex legal and advocacy battles. They must not only understand these tactics but also develop robust counter-strategies, including initiating legal challenges against weak patents and actively supporting legislative reforms (such as the CREATES Act) aimed at dismantling these artificial barriers. This transforms legal defense into a proactive market strategy, essential for ensuring fair competition and timely market entry.

V. Operational Excellence and Risk Mitigation in Generic Drug Development

Achieving generic drug approval and maintaining a competitive edge requires more than just scientific and legal prowess; it demands operational excellence across all facets of development, manufacturing, and post-market surveillance.

A. Implementing Robust Quality Management Systems (QMS)

At the core of operational excellence in generic drug manufacturing is a robust Quality Management System (QMS). A well-implemented QMS is critical for ensuring consistent product quality, patient safety, and unwavering regulatory compliance throughout the entire generic drug lifecycle . Such a system encompasses meticulously documented processes, clear procedures, and defined responsibilities, all geared towards preventing product defects, enhancing operational efficiency, and building enduring trust with customers and regulators alike .

Quality by Design (QbD) Principles and Implementation: The pharmaceutical industry is increasingly embracing Quality by Design (QbD), a systematic and science-driven approach that fundamentally shifts the paradigm of quality assurance. Unlike traditional methods that primarily rely on end-product testing, QbD emphasizes building quality directly into the product design and manufacturing process from the very outset . This proactive approach involves the early identification and rigorous control of Critical Quality Attributes (CQAs)—the inherent properties of a product that ensure its desired quality—alongside Critical Process Parameters (CPPs) and Critical Material Attributes (CMAs), which are the variables in manufacturing and raw materials that significantly impact product quality . Implementing QbD not only enhances manufacturing efficiency and product robustness but also directly contributes to improved patient safety by ensuring consistent product performance .

The adoption of Quality by Design (QbD) in generic manufacturing signifies a profound shift from a reactive, “test-in-quality” approach to a proactive, “design-in-quality” philosophy. This strategic evolution not only leads to demonstrably improved product consistency and a reduction in costly batch failures but also streamlines regulatory reviews. By clearly demonstrating a deep understanding and control of the entire manufacturing process through QbD principles, generic companies can present a more compelling and scientifically sound case to regulatory bodies. This often results in faster approval cycles and fewer deficiency letters, ultimately transforming quality assurance from a mere compliance cost into a significant competitive advantage.

Best Practices for Regulatory Compliance: Beyond the foundational requirements of cGMP, achieving and sustaining regulatory compliance demands a proactive and integrated approach. Best practices include continuously staying informed about evolving regulatory changes and new guidance documents issued by agencies like the FDA and EMA . Implementing robust documentation practices, increasingly leveraging digital systems for enhanced accuracy and accessibility, is crucial . Regular internal audits are essential for identifying and addressing potential compliance gaps before external inspections . Furthermore, establishing effective Corrective and Preventive Action (CAPA) systems ensures that any deviations or non-conformances are thoroughly investigated, corrected, and prevented from recurring . Fundamentally, fostering a pervasive “culture of quality” throughout the organization, where every employee understands and takes responsibility for quality, is paramount for long-term success .

B. Optimizing the Generic Drug Supply Chain

The global generic drug supply chain is a complex, interconnected web, characterized by inherent vulnerabilities and significant risks. A substantial portion of active pharmaceutical ingredients (APIs)—over 70%—are sourced internationally, often from key manufacturing hubs like China and India . This global reliance introduces a spectrum of risks, including potential ingredient shortages, disruptions stemming from geopolitical tensions, and quality-related breakdowns in manufacturing, which historically account for a majority of drug shortages .

Multi-Sourcing and Material Availability: To mitigate these vulnerabilities, generic manufacturers are increasingly adopting multi-sourcing models. This strategy involves procuring raw materials and APIs from multiple qualified suppliers across different geographies, providing crucial leverage to reduce costs and, more importantly, building redundancy into the supply chain . Ensuring real-time visibility across all trading partners—from raw material suppliers to distributors—is critical for proactive inventory management and guaranteeing consistent material availability .

Addressing Supply Chain Vulnerabilities: Strategic measures to fortify the generic drug supply chain include developing multi-tier supply networks with pre-screened and qualified supplier profiles. This proactive approach enables rapid switching of suppliers in the event of disruption, minimizing impact on production . Furthermore, the adoption of advanced technologies like smart logistics, which incorporates cold chain monitoring and granular lot and batch-level traceability, significantly enhances supply chain responsiveness and quality control throughout the distribution network . Predictive intelligence, leveraging data analytics to anticipate potential disruptions or demand fluctuations, also plays a vital role in optimizing the supply chain’s resilience.

The inherent vulnerabilities within the global generic drug supply chain, such as heavy reliance on specific manufacturing regions and the potential for quality issues in overseas facilities, pose a significant threat to market stability and, critically, to patient access. Companies that proactively invest in building supply chain resilience—through strategies like multi-sourcing, establishing real-time visibility across their network, and implementing advanced logistics—can not only effectively mitigate these risks but also carve out a distinct competitive advantage. In a market frequently plagued by drug shortages, a generic manufacturer capable of consistently ensuring product availability due to a diversified and robust supply chain will be highly valued by healthcare providers, payers, and ultimately, patients. This transforms supply chain management from a mere operational necessity into a strategic enabler of market share and reliability.

C. Pharmacovigilance: Ensuring Post-Market Safety and Compliance

The commitment to patient safety in generic drug development extends far beyond initial approval. Pharmacovigilance, the scientific discipline encompassing the detection, assessment, understanding, and prevention of adverse effects or any other drug-related problems, plays an indispensable role throughout the entire generic drug lifecycle, from pre-approval safety evaluations during bioequivalence studies to continuous post-marketing surveillance .

Adverse Event Reporting and Surveillance: Following generic drug approval, manufacturers are legally obligated to report any problems or serious adverse health effects observed with their products to the relevant regulatory agencies. In the U.S., this involves reporting to programs like the FDA’s MedWatch . Regulatory bodies meticulously monitor these incoming reports, conduct periodic inspections of manufacturing plants, and rigorously evaluate any proposed changes to the approved product to ensure ongoing safety and quality . This continuous oversight is crucial because a drug’s safety profile can evolve once it is used by a broader patient population in real-world settings.

Challenges and Best Practices in Post-Market Monitoring: Despite the robust regulatory frameworks, pharmacovigilance for generic drugs faces several inherent challenges. These include the persistent issue of underreporting of adverse events, potential biases in reporting, and the inherent difficulty in definitively attributing an adverse event to a specific generic drug, especially when multiple manufacturers exist for the same compound . To address these complexities and enhance patient safety, best practices in pharmacovigilance involve implementing comprehensive quality management systems that integrate safety monitoring, fostering continuous surveillance, and promoting active collaboration among patients, healthcare professionals, and regulatory agencies .

Effective pharmacovigilance is not merely a regulatory obligation; it functions as a vital, continuous feedback loop that informs product improvement and sustains public trust. In a market where the quality of generic drugs, particularly those manufactured overseas, can sometimes be subject to scrutiny, a transparent and proactive pharmacovigilance system can significantly enhance a generic company’s reputation and market acceptance. The challenges of underreporting and event attribution mean that simply complying with minimum reporting requirements is insufficient. A truly proactive pharmacovigilance system actively seeks out and analyzes real-world data, potentially leveraging advanced analytics or artificial intelligence for early signal detection. This capability allows generic companies to swiftly identify and address safety concerns, thereby building a stronger reputation for consistent quality and reliability—a powerful differentiator in a competitive market where patient and prescriber confidence can be easily eroded.

VI. Leveraging Intelligence for Competitive Advantage

In the fiercely competitive pharmaceutical industry, information is power. For generic drug companies, transforming raw data into actionable intelligence is not just beneficial; it is essential for identifying lucrative opportunities, mitigating risks, and securing a sustainable competitive edge.

A. The Power of Patent Intelligence: Identifying Opportunities

Systematic monitoring and in-depth analysis of drug patent filings offer unparalleled foresight into competitor research and development (R&D) pipelines, emerging technological innovations, and potential market entries, often years before products ever reach commercialization . This strategic vigilance is a cornerstone of competitive advantage.

Tracking Competitor R&D Pipelines through Patent Filings: Patent applications typically become publicly available approximately 18 months after their initial filing . This predictable publication timeline creates a valuable “early warning system” for competitive threats. By diligently tracking new patent filings within their therapeutic areas of interest, pharmaceutical organizations can detect emerging competitive products well before they enter clinical trials or receive regulatory approval. This crucial intelligence empowers companies to make informed decisions regarding their own R&D investments, potentially redirecting resources towards more promising or less crowded therapeutic areas. It also facilitates more accurate forecasting of future market dynamics and competitive landscapes .

Identifying White Space Opportunities in the Patent Landscape: Beyond tracking competitors, sophisticated patent intelligence can reveal significant “white space” opportunities within the intellectual property landscape. This involves identifying therapeutic targets with limited or no existing patent coverage, novel delivery approaches not yet claimed for specific indications, or new applications of existing technologies that currently lack robust patent protection . These “white spaces” represent potentially lucrative avenues for proprietary development or strategic acquisitions, allowing companies to innovate in underserved areas rather than solely competing on price in saturated markets .

Patent intelligence transcends mere defensive patent monitoring; it evolves into a proactive strategic tool for R&D and portfolio management. By identifying “white space” opportunities—areas with limited patent coverage—or by detecting early signals of competitor shifts, generic companies can strategically pivot their R&D investments. This allows them to focus on less crowded, potentially more profitable therapeutic areas or product types, thereby optimizing resource allocation and significantly reducing future competitive pressure. This proactive approach fundamentally shifts the generic business model from a purely reactive, copycat strategy to a strategically proactive, innovation-driven one, leading to higher margins and more sustainable growth.

B. Regulatory Intelligence: Staying Ahead of the Curve

In an industry as heavily regulated as pharmaceuticals, regulatory intelligence serves as a vital compass, guiding strategic decisions and ensuring market positioning. It involves the systematic collection, meticulous analysis, and strategic application of data pertaining to regulatory changes, evolving market trends, and key agency decisions . This continuous vigilance helps companies navigate inherent regulatory complexities, proactively mitigate risks, and ensure steadfast compliance .

Monitoring Regulatory Changes and Guidance Documents: The regulatory landscape for pharmaceuticals is in a constant state of flux, characterized by frequent amendments to existing laws and the periodic issuance of new guidance documents by regulatory bodies worldwide . Proactive and continuous monitoring of these changes is paramount. It allows companies to adapt their internal processes, product development plans, and market strategies swiftly, thereby avoiding costly mistakes, ensuring compliance with new requirements, and maintaining readiness for inspections .

Informing Strategic Market Positioning: Regulatory intelligence plays a pivotal role in shaping strategic business decisions across the entire pharmaceutical value chain, from early-stage manufacturing considerations to late-stage marketing and commercialization strategies . By analyzing regulatory data and trends, companies can identify emerging market opportunities, accurately assess the competitive landscape, and even predict future regulatory changes. This foresight enables them to gain a crucial competitive advantage, positioning their products and pipelines effectively in anticipation of evolving market demands and regulatory expectations .

Regulatory intelligence is far more than a compliance checklist; it is a powerful predictive tool for navigating the dynamic pharmaceutical market. By anticipating regulatory shifts and thoroughly understanding their potential implications, companies can proactively adjust their R&D pipelines, refine their manufacturing processes, and optimize their market entry strategies. This foresight allows them to transform potential regulatory hurdles into strategic advantages, minimizing costly delays and maximizing market opportunities. This proactive stance is essential for maintaining a competitive edge in an industry where regulatory changes can profoundly impact commercial viability.

C. DrugPatentWatch: A Critical Tool for Strategic Insights

In the modern pharmaceutical competitive landscape, access to precise, timely, and actionable intelligence is a non-negotiable asset. This is where specialized platforms like DrugPatentWatch prove invaluable.

DrugPatentWatch stands as a leading global biopharmaceutical business intelligence platform, renowned for providing accurate, actionable, and timely intelligence that empowers companies to make superior strategic decisions . It offers a comprehensive and integrated database encompassing drug patents, detailed generic entry opportunities, insights into confidential royalty and settlement terms, and capabilities for automated reports and custom dashboards .

Real-World Applications for Competitive Analysis: The utility of DrugPatentWatch extends across various critical business functions, offering real-world applications for competitive analysis:

- Identifying Market Entry Opportunities: The platform allows users to meticulously track patent expiration dates, monitor ongoing litigation statuses, and analyze broader market dynamics. This enables companies to precisely identify brand-name drugs nearing the end of their exclusivity periods, signaling lucrative windows for generic market entry .

- Portfolio Management: DrugPatentWatch assists in proactive portfolio management by helping companies anticipate future budget requirements, identify potential generic sources for existing products, and make informed decisions about which generic opportunities to pursue or prioritize within their development pipeline .

- Competitor Analysis: The platform provides deep insights into competitors’ strategies. Users can assess the historical success rates of patent challengers, elucidate the R&D pathways of rival companies, and monitor their drug pipelines for emerging threats or opportunities .

- Risk Mitigation: By offering early detection capabilities, DrugPatentWatch helps companies identify potential competitive movements, assess “freedom-to-operate” constraints for their own pipeline products, and pinpoint opportunities for challenging or invalidating competitor patents . This proactive risk assessment can prevent costly infringement issues or market surprises.

- API Sourcing: The platform also provides valuable information on drug formulation and manufacturing details, which can be crucial for identifying reliable Active Pharmaceutical Ingredient (API) suppliers and understanding the supply chain landscape for generic products .

Turning Patent Data into Actionable Business Intelligence: DrugPatentWatch aggregates and presents a wealth of data, including information on patent litigation, tentative approvals, patent expirations, ongoing clinical trials, and Paragraph IV challenges . This comprehensive data set empowers pharmaceutical companies to transcend reactive decision-making. By leveraging these insights, businesses can identify nascent market opportunities, anticipate competitive threats with greater precision, and make data-driven strategic choices that ultimately enhance their market position and profitability .

Tools like DrugPatentWatch democratize access to critical patent and regulatory data, transforming raw information into actionable competitive intelligence. This empowers generic companies, including smaller players, to compete more effectively with larger pharmaceutical entities by enabling data-driven decisions regarding market entry timing, R&D focus, and litigation strategy. Ultimately, this fosters a more dynamic and competitive generic market, where companies can strategically identify and capitalize on first-to-file opportunities, which often yield substantial profits.

VII. Challenges and Future Outlook: The Road Ahead

The generic pharmaceutical industry, while vital for global healthcare, is not without its formidable challenges. However, it is also on the cusp of transformative innovations that promise to reshape its future.

A. Common Hurdles in Generic Drug Development and Approval

Generic drug development and approval are fraught with complexities that can significantly impede market entry and profitability.

- Regulatory Complexity and Formulation Challenges: Navigating the diverse and constantly evolving regulatory frameworks of agencies like the FDA and EMA remains a significant and often daunting hurdle . This complexity is further compounded when dealing with “complex generics”—products such as injectable formulations, inhalers, or topical drugs. These often involve intricate delivery systems or highly specialized formulations that defy standard bioequivalence testing methodologies, requiring novel scientific approaches and extensive regulatory dialogue .

- Pricing Pressures and Market Commoditization: The generic market is characterized by intense price competition, particularly for “simple” oral solid dosage forms. This fierce rivalry often leads to rapid market commoditization, where profit margins are razor-thin and continuously squeezed . Such intense pricing pressures can drive manufacturers out of the market, especially for older, high-volume generics, and deter new entrants, ultimately impacting supply stability and diversity .

The dual pressures of increasing regulatory complexity, particularly for complex generics, and the relentless forces of market commoditization create a formidable “squeeze” on generic manufacturers. This challenging environment inherently favors companies that can achieve exceptional operational excellence—for instance, through the adoption of Quality by Design (QbD) principles and advanced manufacturing technologies—and pursue strategic product differentiation. This often means focusing on complex generics, which, despite their development challenges, typically face less competition and offer more attractive profit margins. The market is increasingly rewarding sophistication and strategic foresight over a simple volume-driven, low-cost approach.

B. Innovations Transforming the Generic Drug Landscape

Despite the challenges, the generic drug industry is witnessing a wave of innovation, driven by technological advancements that promise to redefine manufacturing, development, and approval processes.

- Advanced Manufacturing Technologies (AMTs): The adoption of advanced manufacturing technologies (AMTs) represents a pivotal shift in generic drug production. Technologies such as continuous manufacturing, 3D printing (additive manufacturing), and sophisticated Process Analytical Technology (PAT) are transforming traditional batch-based processes . These innovations offer a multitude of benefits: they can significantly improve quality control through real-time monitoring, reduce the physical footprint required for manufacturing facilities, accelerate production times, and enhance manufacturing flexibility to respond rapidly to market demand fluctuations. Critically, AMTs also hold the potential to lower long-term production costs . Furthermore, these technologies are recognized as essential for strengthening domestic manufacturing capabilities and bolstering supply chain resilience, thereby mitigating the risk of drug shortages .

- The Impact of AI and Machine Learning on Development and Approval: Artificial intelligence (AI) and machine learning (ML) are rapidly emerging as transformative forces in streamlining generic drug development and approval processes . These advanced computational tools can revolutionize various stages, from identifying potential new generic drug candidates and prioritizing development based on market demand to accelerating drug discovery and significantly streamlining application reviews . The FDA itself is actively exploring and embracing the use of AI to support regulatory decision-making across the entire drug product lifecycle, recognizing its potential to enhance efficiency and scientific rigor .

The integration of Advanced Manufacturing Technologies (AMTs) and Artificial Intelligence/Machine Learning (AI/ML) represents a profound paradigm shift in the generic pharmaceutical industry. This is a move away from traditional, often empirical, batch-based manufacturing and development towards a more data-driven, continuous, and intelligent approach. This technological leap promises not only greater efficiency and substantial cost reductions but also enhanced product quality and potentially faster regulatory pathways. Companies that are early adopters and proficient integrators of these technologies will fundamentally reshape the competitive landscape, gaining a significant advantage over those who lag. This signals a clear imperative for generic manufacturers to embrace digital transformation and invest in these cutting-edge capabilities.

C. The Evolving Global Generic Market: Trends and Predictions

The global generic market is a complex interplay of persistent demand for affordable healthcare, the continuous expiration of brand-name drug patents, and proactive government initiatives aimed at promoting generic utilization . While these factors drive significant growth, the market continues to grapple with challenges such as intense commoditization, persistent quality issues, and complex regulatory hurdles .

Looking ahead, several key trends are poised to shape the future of the generic pharmaceutical industry. There will likely be further refinement of regulatory programs, such as the Generic Drug User Fee Amendments (GDUFA) in the U.S., aimed at maximizing review efficiency . Expect the development of new and more sophisticated guidance for complex generic products, reflecting the increasing scientific complexity of these medicines . Increased international collaboration among regulatory bodies on generic drug approvals is also anticipated, fostering greater harmonization and efficiency across borders . Beyond regulatory changes, there is a growing emphasis on enhanced public reporting of generic drug information, expanded patient education initiatives, and increased collaboration with healthcare providers to further promote the rational and effective use of generic medicines .

The future of the generic market is not simply about volume; it is increasingly about delivering value. This evolution is driven by a powerful confluence of technological advancements, continuously evolving regulatory expectations, and an unwavering global push for both affordability and uncompromised quality. Generic companies must strategically embrace innovation, not only in the products they develop (e.g., complex generics, “super generics” with enhanced features) but also in their fundamental operational processes (e.g., Quality by Design, Advanced Manufacturing Technologies). This strategic evolution is essential for thriving in an increasingly sophisticated and competitive environment, moving beyond simple price competition to a model where differentiation and operational excellence are paramount.

VIII. Key Takeaways

The journey through the generic drug approval process is a testament to the intricate balance between pharmaceutical innovation and public health accessibility. For business professionals and pharmaceutical organizations, navigating this landscape effectively is paramount for competitive advantage.

- Strategic Imperative of Generics: Generic drugs are not merely cost-saving alternatives; they are fundamental pillars of global healthcare, ensuring widespread access to affordable, life-saving medications. The efficiency and predictability of their approval process directly impact public health outcomes and national healthcare economics.

- Mastering Regulatory Pathways: Success in the generic market is inextricably linked to a profound understanding and proactive navigation of diverse regulatory frameworks. This includes the FDA’s Abbreviated New Drug Application (ANDA) pathway in the U.S. and the multifaceted Marketing Authorization Application (MAA) procedures (Centralized, Decentralized, Mutual Recognition, National) in the EU. Strategic selection and meticulous adherence to these pathways are critical.

- Bioequivalence and Quality as Non-Negotiables: Scientific rigor in demonstrating bioequivalence, ensuring the generic drug performs identically to its brand-name counterpart, is foundational. Unwavering adherence to Current Good Manufacturing Practices (cGMP) and ICH Q7 standards is not merely a compliance check but a strategic differentiator. A robust quality management system, ideally incorporating Quality by Design (QbD) principles, builds trust with regulators and healthcare providers, preventing costly delays, recalls, and reputational damage.

- Leveraging Patent and Exclusivity Intelligence: Meticulous monitoring of patent expiration dates and regulatory exclusivity periods (such as New Chemical Entity, Orphan Drug, Pediatric, and the crucial 180-day generic exclusivity) is essential for identifying lucrative market entry opportunities. Strategic Paragraph IV challenges and the development of effective countermeasures against brand-name defensive tactics (like “evergreening” and REMS-related sample withholding) are critical legal battlegrounds that directly impact market timing and profitability.

- Operational Excellence for Competitive Edge: Achieving efficiency and resilience in generic drug development demands operational excellence. Implementing advanced Quality Management Systems (QMS), embracing Quality by Design (QbD) principles from product inception, and optimizing robust, multi-sourced global supply chains are crucial for cost reduction, consistent product quality, and ensuring reliable product availability in the market.

- Innovation as a Future Driver: The generic industry is evolving beyond simple replication. The strategic adoption of Advanced Manufacturing Technologies (AMTs) and the integration of Artificial Intelligence (AI) and Machine Learning (ML) into development and review processes will be key for future success. These innovations enable faster development cycles, enhanced product quality, and the capability to tackle the complexities of harder-to-develop generic products, creating new avenues for differentiation.

- Intelligence as a Strategic Compass: Platforms like DrugPatentWatch and sophisticated internal regulatory intelligence functions are indispensable tools. They transform raw patent, exclusivity, and regulatory data into actionable insights, empowering companies to anticipate market shifts, identify “white space” opportunities, and make data-driven decisions that secure and sustain competitive advantage in a dynamic global market.

“The generic drug market is expected to grow from $435.3 billion in 2023 to $655.8 billion by 2028, at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2028. This growth is driven by several factors, including the expiration of patents on brand-name drugs, increasing demand for affordable healthcare, and government initiatives to promote the use of generic drugs.”

IX. Frequently Asked Questions (FAQ)

1. How has the Hatch-Waxman Act fundamentally reshaped the generic drug industry, and what are its ongoing implications?

The Hatch-Waxman Act of 1984 fundamentally reshaped the pharmaceutical industry by establishing the Abbreviated New Drug Application (ANDA) pathway. This pathway allows generic manufacturers to bypass the need for costly and time-consuming full clinical trials by demonstrating that their product is bioequivalent to an already approved brand-name drug . This legislative innovation dramatically increased the availability of generic medicines, significantly driving down drug costs and improving patient access to essential treatments. Its ongoing implications are profound, creating a complex interplay of patent protection for innovators and accelerated market entry for generics. This dynamic is particularly evident in the strategic use of Paragraph IV certifications and the highly sought-after 180-day generic exclusivity period, which continue to shape market entry dynamics and often lead to strategic litigation between brand and generic pharmaceutical companies .

2. What are the primary differences in generic drug approval requirements between the US FDA and the EU EMA, and how do these impact global market strategies?

While both the U.S. FDA and the European Medicines Agency (EMA) share the core objective of ensuring generic drug safety, efficacy, and bioequivalence, their procedural frameworks exhibit notable differences. The FDA primarily utilizes the single Abbreviated New Drug Application (ANDA) pathway. In contrast, the EMA offers a more diverse set of routes for Marketing Authorization Applications (MAA), including the Centralized Procedure (for pan-EU approval), the Decentralized Procedure, the Mutual Recognition Procedure, and national-level approvals . Furthermore, the EU operates with distinct data and market exclusivity periods (typically 8 years for data exclusivity and 10 or 11 years for market exclusivity) , which differ from the U.S. system’s various exclusivities (e.g., NCE, Pediatric, Orphan). These differences necessitate a highly tailored global market strategy for generic companies, requiring sophisticated regulatory intelligence to navigate diverse requirements, optimize submission pathways, and meticulously time market entries across different jurisdictions to maximize commercial opportunities.

3. How do “patent thickets” and “evergreening” tactics by brand-name companies affect generic drug market entry, and what countermeasures can generic manufacturers employ?

“Patent thickets” and “evergreening” are strategic tactics employed by brand-name pharmaceutical companies to extend their market monopolies. “Evergreening” involves securing additional patents on minor modifications of an existing drug, such as new formulations, alternative delivery methods, or novel methods of use, thereby creating a dense “patent thicket” around the original product . This significantly increases the legal and financial burden for generic companies seeking to enter the market. To counter these tactics, generic manufacturers can employ several strategies: they must conduct robust patent intelligence to identify weak or vulnerable patents within the thicket; they can file Paragraph IV certifications to legally challenge the validity or non-infringement of these patents; and they must be prepared to engage in complex patent litigation . Additionally, legislative initiatives, such as the CREATES Act, aim to prevent brand companies from misusing Risk Evaluation and Mitigation Strategies (REMS) to withhold necessary drug samples required for generic bioequivalence testing, which is another common barrier to entry .

4. What role do advanced manufacturing technologies (AMTs) and artificial intelligence (AI) play in the future of generic drug development and approval?

Advanced Manufacturing Technologies (AMTs) and Artificial Intelligence (AI) are poised to revolutionize the future of generic drug development and approval. AMTs, such as continuous manufacturing, 3D printing, and Process Analytical Technology (PAT), promise to enhance quality control through real-time monitoring, reduce manufacturing costs, accelerate production timelines, and improve overall supply chain resilience . Concurrently, AI and machine learning algorithms are increasingly being leveraged to streamline various stages, from optimizing drug formulations and predicting bioequivalence outcomes to accelerating regulatory review processes . These innovations are critical for generic companies to overcome persistent challenges like intense pricing pressures and the complexities associated with developing intricate formulations. By embracing AMTs and AI, generic manufacturers can bring higher-quality, more affordable medicines to market faster, thereby securing a significant competitive edge and contributing to improved patient access.

5. How can generic pharmaceutical companies leverage competitive and regulatory intelligence platforms like DrugPatentWatch to gain a strategic advantage?