Last updated: July 27, 2025

Introduction

Montelukast sodium, marketed under brand names such as Singulair, is a leukotriene receptor antagonist primarily prescribed for asthma, allergic rhinitis, and related respiratory conditions. Since its approval in 1998, it has established a robust market presence worldwide, underpinned by its efficacy and safety profile. However, dynamic shifts in the pharmaceutical landscape, regulatory environment, and market competition are shaping its future trajectory. This analysis delineates the current market dynamics, evolving trends, regulatory factors, and financial outlooks impacting montelukast sodium, guiding stakeholders in strategic decision-making.

Market Overview

Historical Market Performance

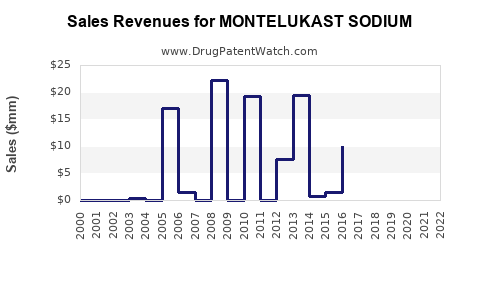

Montelukast sodium has enjoyed sustained demand driven by chronic respiratory disease prevalence. Its global sales peaked in the late 2010s, with annual revenues exceeding $4 billion (IQVIA, 2021). The drug's broad adoption across pediatric and adult populations contributed to its dominant market share. Key manufacturing companies included Merck & Co., which pioneered its release, and several generic manufacturers now expanding access as patent protections wane.

Current Market Position

Despite its age, montelukast remains a cornerstone in respiratory therapy due to its favorable safety profile and convenient oral formulation. As of 2022, it recorded robust sales in North America, Europe, and parts of Asia-Pacific. The drug's role in managing allergic asthma and allergic rhinitis sustains its market, but emerging competition from biologics and other targeted therapies introduces new challenges.

Market Dynamics

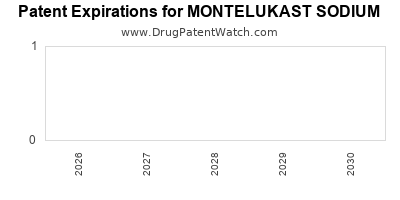

Regulatory and Patent Landscape

The expiration of patent rights in many jurisdictions, notably in the United States (2012 for the original formulation), has facilitated entry of generic versions, intensifying price competition. For instance, the U.S. FDA data indicates over 20 generics authorized post-patent expiry, constraining pricing power for brand-name offerings (FDA, 2022). Regulatory agencies also influence market dynamics through safety updates and re-evaluation notices. The European Medicines Agency (EMA) and FDA's recent safety communications regarding neuropsychiatric adverse events have impacted prescribing behaviors, promoting a more cautious approach.

Innovation and Formulation Development

Recent research explores novel delivery mechanisms, such as chewable and dissolvable formulations, aimed at pediatric compliance. Additionally, pharmacogenomic insights may enhance personalized therapy, although such innovations have yet to translate into significant market shifts.

Competitive Landscape

- Generic Manufacturers: The entry of multiple generics has led to significantly reduced prices, which benefits healthcare payers but compresses profit margins for original developers.

- Biologics and New Agents: Biologics like omalizumab provide alternative treatments for severe asthma, potentially displacing montelukast in some patient subsets.

- Pipeline Developments: Current pipeline drugs targeting leukotriene pathways or alternative mechanisms could influence future demand.

Market Drivers

- Rising prevalence of asthma and allergic rhinitis globally, especially in urbanizing regions.

- Increasing awareness and diagnosis of respiratory conditions.

- Reimbursement policies favoring cost-effective generic medications.

- Growing pediatric populations requiring manageable, oral therapies.

Market Constraints

- Safety concerns, particularly neuropsychiatric risks linked to montelukast, lead to regulatory warnings and impact prescribing patterns.

- Competition from newer, biologically targeted therapies with superior efficacy.

- Prescriber and patient preferences shifting towards therapies with fewer safety concerns or perceived superior outcomes.

Financial Trajectory Projections

Market Revenue Trends

In the upcoming five years, the global montelukast market is expected to decline marginally, constrained by patent expirations, safety concerns, and competition. Market analysts project a compound annual growth rate (CAGR) of approximately -1.5% from 2022 to 2027 [1]. The European and U.S. markets are anticipated to experience greatest pressure, while emerging markets like India and China may sustain moderate growth due to increasing respiratory disease prevalence and expanding healthcare infrastructure.

Pricing Dynamics

Price erosion due to generic competition remains the principal factor influencing revenue trajectories. Brand-name sales have dropped by over 70% since patent expiry in major markets, with generics capturing up to 80% of market share [2]. Conversely, the overall drug market's annual revenues for montelukast are projected to decline gradually, aligning with price reductions.

Profitability Outlook

Manufacturers’ profitability is expected to decline, primarily in markets where generics dominate. However, companies with diversified portfolios or pipeline products targeting similar indications may mitigate financial impacts. Strategic licensing or acquisition of formulations with improved safety profiles can also provide revenue diversification.

Emerging Opportunities

- Niche Indications: Potential repositioning for use in other allergic or inflammatory conditions.

- Combination Therapies: Development of fixed-dose combinations with other respiratory agents.

- Digital and Pharmacogenomics: Integrating digital health approaches for tailored therapy may open avenues for premium pricing.

Regulatory and Ethical Considerations

- Recent safety signals have prompted regulatory agencies to issue advisories; companies must proactively manage risk communications to maintain market trust.

- Patent litigations and exclusivity rights' expirations influence competitive strategies.

- As personalized medicine advances, regulatory frameworks will adapt to accommodate biomarker-driven indications, impacting future therapeutic labeling.

Future Outlook and Strategic Recommendations

Despite anticipated short-term declines driven by generics and safety concerns, montelukast sodium retains market relevance through strategic repositioning. Companies should focus on:

- Innovative formulations to improve pediatric compliance and safety.

- Engaging with regulatory authorities to address safety concerns and potentially obtain new indications.

- Expanding into emerging markets with increasing disease burden and evolving healthcare infrastructure.

- Diversifying portfolios with complementary therapies targeting respiratory diseases.

Key Takeaways

- The montelukast sodium market faces a gradual decline over the next five years driven by patent expiries, safety concerns, and increased competition from biologics.

- Generic drug proliferation has significantly lowered prices, impacting revenue for original manufacturers.

- Safety advisories, particularly neuropsychiatric risks, influence prescribing behaviors and market confidence.

- Emerging markets present growth opportunities; innovation in formulations and combination therapies can drive future revenue streams.

- Strategic portfolio management, regulatory engagement, and targeted innovation are vital for maintaining competitiveness.

FAQs

1. How has patent expiration affected montelukast’s market share?

Patent expirations, notably in 2012, have allowed numerous generic manufacturers to enter the market, dramatically reducing prices and eroding the market share of the original brand, Singulair.

2. What safety concerns are associated with montelukast?

Recent safety advisories highlight neuropsychiatric adverse events, including agitation, depression, and suicidal thoughts, leading to more cautious prescribing practices.

3. Are there emerging alternatives to montelukast for asthma management?

Yes, biologic agents such as omalizumab and mepolizumab are increasingly used for severe asthma, potentially displacing montelukast in complex cases.

4. What market strategies can manufacturers adopt amid declining revenues?

Focusing on formulation innovation, expanding into emerging markets, licensing proprietary technologies, and exploring new indications can sustain revenues.

5. How might regulatory agencies’ evolving stance impact future sales?

Stricter safety regulations and labeling changes may restrict usage, while approval of new formulations or indications could counterbalance declines.

References

[1] IQVIA. (2021). Global Pharmaceutical Market Data.

[2] FDA. (2022). Generic Drug Approvals and Market Overview.