Last updated: July 29, 2025

Introduction

Montelukast sodium, marketed under the brand name Singulair among others, is a leukotriene receptor antagonist primarily used in the management of asthma, allergic rhinitis, and exercise-induced bronchoconstriction. Since its FDA approval in 1998, montelukast has established itself as a cornerstone in respiratory therapeutics. This report provides a comprehensive market analysis and sales projection—crucial for stakeholders assessing investment opportunities, competitive positioning, and long-term planning.

Market Overview

Global Demand Driver Profile

The global respiratory disease market is driven by rising prevalence rates of asthma and allergic rhinitis, influenced by environmental pollution, urbanization, and increasing awareness of respiratory health. According to the Global Asthma Report 2018, approximately 339 million individuals globally suffer from asthma, with prevalence varying significantly across regions [1].

Therapeutic Role of Montelukast

Montelukast's once-daily oral administration offers improved patient compliance over inhalers or injectable therapies, leading to widespread acceptance. The drug's indication spectrum extends from pediatric to adult populations, further broadening its market base.

Regulatory Environment and Patent Landscape

Initially patented in the late 1990s with exclusivity expiring around 2012 in many jurisdictions, generic versions have since entered the market, intensifying competition and affecting pricing strategies. Recent regulatory developments concerning safety concerns, notably neuropsychiatric adverse effects flagged by FDA in 2020, momentarily impacted prescription rates, although the drug retains strong clinical utility [2].

Key Market Segments

By Geography

- North America: Leading market driven by high prevalence of respiratory conditions, insurance coverage, and established healthcare infrastructure.

- Europe: Similar to North America with expanding awareness and reimbursement frameworks.

- Asia-Pacific: Fastest-growing due to rising urbanization, pollution, and increasing healthcare access.

- Rest of World: Emerging markets showing increased adoption.

By Application

- Asthma: Largest market segment; montelukast is often prescribed for long-term control.

- Allergic Rhinitis: Growing segment, particularly in developed countries.

- Exercise-Induced Bronchoconstriction: Niche but increasing as awareness rises.

By Formulation

- Tablets: Predominant form (including chewable variants for children).

- Sachet/Granules: Usage in pediatric populations.

- Generic vs. Branded: Generics account for a substantial market share due to cost competitiveness.

Market Trends and Influences

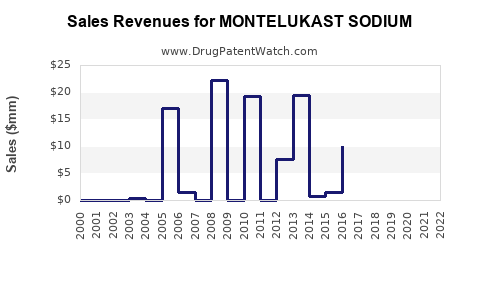

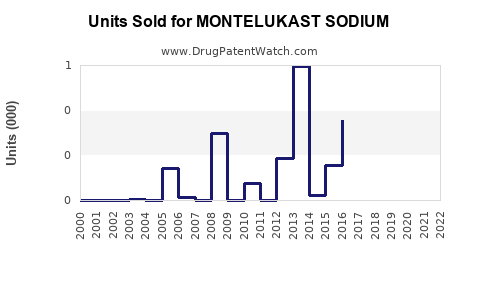

- Generic Competition: Post-patent expiration, generics have eroded brand premium, growing market volume but reducing unit revenues.

- Safety and Efficacy Perceptions: Ongoing safety debates influence prescribing behaviors—though the drug remains in favorable position for managing pediatric asthma.

- Digital Health Integration: Increasing use of telemedicine boosts prescription adherence and monitoring.

- Regulatory Changes: Ongoing reviews and labeling updates impact prescribing trends (e.g., black box warnings).

Sales Projections

Methodology

Forecasting leverages historic sales data, trend analysis, epidemiological statistics, and competition assessment, projecting a compounded annual growth rate (CAGR) over the coming five years. Adjustments factor in macroeconomic trends, regulatory shifts, and demographic factors.

Baseline Assumptions

- Current global sales stand at approximately $2.2 billion (as of 2022), primarily driven by North America (~60%), with Europe (~20%) and Asia-Pacific (~15%) contributing significantly.

- The patent expiry effect stabilizes by 2015, with generics accounting for 70% of market volume by 2022.

- Prescribing rates fluctuate moderately due to safety concerns but predominantly retain patient loyalty because of therapeutic efficacy.

Projected Sales Growth

| Year |

Estimated Global Sales (USD Billion) |

Notes |

| 2023 |

$2.1 - $2.3 billion |

Slight decline due to safety-related disruptions; stabilization anticipated |

| 2024 |

$2.2 billion |

Market begins to stabilize and adapt to safety updates |

| 2025 |

$2.3 - $2.5 billion |

Growth resumes driven by expanding market in Asia-Pacific |

| 2026 |

$2.4 - $2.7 billion |

Increased adoption in developing markets |

| 2027 |

$2.5 - $2.8 billion |

Penetration deepens, especially among pediatric populations |

Key Factors Influencing Sales

- Regulatory Resilience: While safety concerns temporarily impacted prescriptions, ongoing safety management protocols restore confidence.

- Emerging Markets: Accelerated growth anticipated in regions like India, China, and Southeast Asia due to increased healthcare infrastructure.

- Patient Compliance and Education: Digital health tools improve adherence, indirectly boosting sales.

- Pricing Strategies: The proliferation of generics sustains volume but caps revenue per unit.

Competitive Landscape

Major players include Merck (original developer), Teva, Mylan (generic manufacturers), and emerging biotech companies focusing on novel leukotriene pathway agents. Competition engenders commoditization, pressuring margins, but expanding overall volume due to increased disease prevalence.

Market Opportunities and Challenges

Opportunities

- Expansion into pediatric markets with child-specific formulations.

- Integration with digital health monitoring for asthma management.

- Contracting with emerging markets' governments for broader inclusion.

Challenges

- Safety concerns may modify prescribing patterns.

- Generic price erosion constricts profitability.

- Competition from biologics and newer agents targeting severe asthma.

Key Takeaways

- The global montelukast sodium market remains robust, underpinned by high disease prevalence and favorable administration profile.

- Patent expirations have induced significant generic penetration, balancing volume expansion with revenue pressures.

- Asia-Pacific presents the most considerable growth opportunity, driven by expanding healthcare infrastructure and awareness campaigns.

- Safety profile considerations continue to influence prescribing, necessitating ongoing pharmacovigilance.

- Digital health innovations hold potential to improve adherence, indirectly increasing sales.

Frequently Asked Questions

1. How will safety concerns surrounding montelukast influence future sales?

While safety alerts, such as neuropsychiatric risks, temporarily dampen prescription rates, ongoing evidence-based updates and clear labeling mitigate long-term impact. Market resilience depends on effective risk management and physician education.

2. What role do generics play in the current market?

Generics dominate sales volume (>70%), driving down prices and market entry barriers but limiting revenue margins for patent owners. They enable broader access, especially in cost-sensitive regions.

3. Which regions are expected to see the highest growth?

The Asia-Pacific region will experience the fastest growth, supported by rising respiratory disease prevalence, urban pollution, and increasing healthcare access.

4. Are there upcoming innovations that could threaten montelukast's market share?

New biologic agents targeting severe asthma offer alternative treatment options. However, montelukast remains preferred for mild-to-moderate cases and pediatric use due to ease of administration and safety profile.

5. How will digital health influence montelukast sales?

Integration of telemedicine and adherence monitoring improves treatment compliance, potentially increasing prescriptions and sustained use across patient populations.

References

- Global Asthma Report 2018. Global Asthma Network.

- FDA Drug Safety Communication. "FDA updates warnings about neuropsychiatric events associated with montelukast." 2020.