Last updated: July 28, 2025

Introduction

Hydroxyzine, a first-generation antihistamine primarily utilized for allergic reactions, anxiety, nausea, and sleep disorders, holds a significant position in the pharmaceutical landscape. Despite the emergence of newer agents, hydroxyzine’s versatile therapeutic profile sustains its relevance, supported by ongoing patent protections, manufacturing scalability, and clinical familiarity. This article delineates the evolving market dynamics and project the financial trajectory of hydroxyzine within the contextual framework of industry trends, regulatory landscapes, and competitive forces.

Pharmacological Profile and Clinical Utility

Hydroxyzine (brand names include Vistaril and Atarax) is an antihistamine with anticholinergic and anxiolytic properties. Its primary indications focus on allergic conditions, preoperative sedation, anxiety management, and nausea. The drug’s potency, oral bioavailability, and safety profile underpin its continued use, especially in the United States and Europe, where it remains a preferred choice for certain indications (as per FDA and EMA approvals).

Current Market Landscape

The global antihistamine market, valued at approximately USD 2.5 billion in 2022, maintains stable demand driven by allergy prevalence, mental health awareness, and perioperative care needs [1]. Hydroxyzine’s segment, however, faces both opportunities and challenges:

-

Market Penetration and Share: Hydroxyzine’s market share persists mainly due to its low-cost generic status and physician familiarity. While newer agents like levocetirizine and cetirizine have gained favor for allergy treatments due to fewer sedative effects, hydroxyzine remains a go-to for sedative and anxiolytic applications.

-

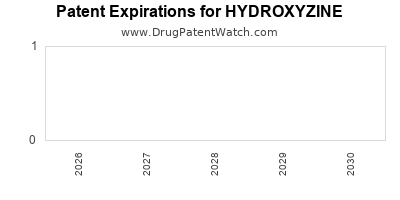

Regulatory Considerations: Patent expirations for some formulations have led to a surge in generic competitors, intensifying price competition. Nonetheless, certain formulations or delivery methods could retain patent protection, providing revenue streams for branded versions.

-

Prescribing Trends: The rising preference for non-sedating antihistamines in allergic rhinitis has marginally reduced hydroxyzine's share for allergy indications but has not significantly impacted its use in anxiety and preoperative sedation.

Market Drivers

-

Prevalence of Allergic Conditions: With an increasing incidence of allergic rhinitis and atopic dermatitis, demand for antihistamines sustains nominal growth. However, hydroxyzine’s role in allergy treatment is diminishing relative to newer agents with more favorable side-effect profiles.

-

Anxiety and Sleep Disorders: The global mental health crisis and sleep disorder prevalence intensify the use of sedative agents, including hydroxyzine. Particularly in hospital and outpatient settings, hydroxyzine remains a cost-effective option, bolstered by generics.

-

Regulatory Environment & Patent Strategies: Patent expirations for formulations released around 2010-2015 have introduced significant generic competition. Strategic patenting of new formulations or delivery methods could temporarily elevate revenue streams.

-

Emerging Indications and Off-Label Use: Hydroxyzine's off-label applications, notably in pruritus or as an adjunct in anxiety, continue to sustain sales, although often with limited regulatory approval.

Market Challenges

-

Competition from Non-Sedating Agents: As patients and clinicians prefer newer, non-sedating antihistamines, hydroxyzine’s market share in allergy indications declines.

-

Safety Profile Concerns: Sedation and anticholinergic side effects pose limitations, especially in elderly populations, prompting cautious prescribing behaviors.

-

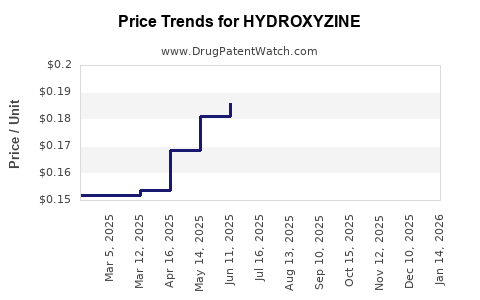

Generic Price Erosion: The proliferation of generic alternatives forces downward pricing, compressing margins for manufacturers.

Financial Trajectory and Projection

Given the current market conditions, hydroxyzine’s revenue trajectory is expected to stabilize with modest growth prospects over the next five years. Key factors influencing this forecast:

Short-term Outlook (1-3 Years)

-

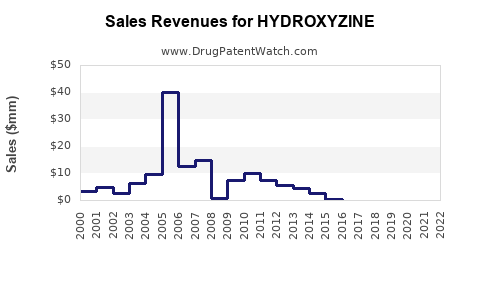

Revenue Plateau: Due to saturated generic markets and declining allergy indication demand, revenues are likely to stabilize or decline slightly. The focus shifts to maintaining market share through formulation innovations or niche indications.

-

Pricing Pressure: Continued generic competition will suppress prices, limiting profit margins unless new patent protections or formulations emerge.

Mid to Long-term Outlook (4-10 Years)

-

Market Contraction or Stabilization: The overarching trend suggests a gradual decrease in hydroxyzine’s market share in allergy treatments. Conversely, in anxiety and preoperative sedation, steady demand persists, especially in older populations.

-

Potential for Growth Residues: If clinical research validates new uses or if new formulations (e.g., sustained-release or transdermal patches) are patented, revenues could experience a temporary uplift.

Growth Opportunities

-

Niche Markets & Pathway Expansion: Targeting off-label or underpenetrated markets, such as pediatric or geriatric populations, may provide incremental revenue.

-

Formulation Innovation: Developing alternative delivery methods could extend patent life and improve adherence, translating into revenue gains.

-

Geographical Expansion: Emerging markets with rising healthcare access and allergic disease prevalence present significant growth potential, particularly where regulatory barriers are manageable.

Revenue Estimates

Based on current generic pricing trends, hydroxyzine’s global sales are estimated at USD 50-70 million annually, predominantly in North America and Europe. Margins are compressed, with many formulations priced below USD 1 per dose. As patents expire in key jurisdictions, these figures may decline by 10-15% over the next three years unless new formulations or indications are pursued.

However, strategic investments in formulation patents and expanding into emerging markets could mitigate decline and stabilize revenues within a USD 50-60 million range by 2028.

Regulatory and Patent Outlook

Patent expirations have historically driven revenue decline, but strategic patent filings targeting new formulations or delivery systems can prolong exclusive market periods. Regulatory approvals in emerging markets remain a vital component of long-term revenue expansion.

Competitive Landscape

Major competitors include generic manufacturers and specialty pharmaceutical firms. The entry of biosimilars and new antihistaminic agents also influences the competitive environment. Companies that innovate in delivery or indications hold the potential for differentiated market positioning.

Key Industry Players

- Pfizer and Allergan: Historically leading providers of hydroxyzine formulations.

- Teva and Sandoz: Major generic producers exerting price competition.

- Emerging Biotech Firms: Exploring alternative formulations or repurposing hydroxyzine for novel indications.

Strategic Implications for Stakeholders

- Manufacturers must focus on patent strategy, formulation innovation, and geographic diversification.

- Investors should monitor patent filings, regulatory approvals, and emerging market trends for hydroxyzine derivatives.

- Healthcare Providers should weigh the balance of efficacy, safety, and cost in prescribing hydroxyzine amidst evolving standards of care.

Key Takeaways

- Hydroxyzine remains relevant in specific therapeutic niches, especially for sedation and anxiety, despite facing competition from non-sedating antihistamines.

- Patent expirations have accelerated generic penetration, compressing revenue margins but offering volume-driven opportunities in emerging markets.

- Innovation in formulations and expanding clinical indications can extend hydroxyzine’s market life.

- The forecast indicates moderate revenue stability over the next five years with potential decline should strategic initiatives not materialize.

- Stakeholders should emphasize patent strategy, market diversification, and targeted clinical research to maximize the drug's commercial value.

FAQs

1. What are the primary factors influencing hydroxyzine's market growth?

Demand is driven by its use in anxiety, preoperative sedation, and niche indications. However, competition from non-sedating antihistamines and patent expirations constrain growth. Market expansion into emerging economies and formulation innovations are potential growth avenues.

2. How does patent expiration impact hydroxyzine’s financial outlook?

Patent expirations lead to increased generic competition, reducing prices and margins. To counteract this, firms may pursue new formulations or indications to maintain revenue streams.

3. Are there any ongoing developments that could revive hydroxyzine’s market appeal?

Yes. Development of new formulations, such as sustained-release tablets or transdermal patches, and validation of off-label uses could extend hydroxyzine’s market life.

4. What regions present the most promising growth opportunities for hydroxyzine?

Emerging markets in Asia, Latin America, and Africa offer significant growth potential due to rising allergic and mental health conditions, combined with less mature generic markets.

5. How are safety concerns affecting hydroxyzine’s prescribing patterns?

Side effects like sedation and anticholinergic effects lead to cautious prescribing, especially in elderly populations, influencing overall demand and market segmentation.

References

[1] Grand View Research, “Antihistamines Market Size & Share Report,” 2022.