Last updated: July 28, 2025

Introduction

Hydroxyzine, a first-generation antihistamine with sedative and anxiolytic properties, has long been utilized in treating allergies, anxiety, and nausea. Market dynamics are shifting as new medications emerge and regulatory landscapes evolve, influencing future sales trajectories. This analysis explores Hydroxyzine’s current market positioning, demand drivers, competitive landscape, regulatory factors, and sales forecast, providing business professionals with strategic insights.

Current Market Landscape

Therapeutic Applications and Usage Trends

Hydroxyzine serves various therapeutic areas:

- Allergic Conditions: Rhinitis, dermatoses, urticaria

- Anxiety and Insomnia: Short-term management

- Nausea and Vomiting: Preoperative and postoperative care

According to IQVIA data, its prescription volume remains stable in the U.S., predominantly in outpatient settings (2022). Though considered older in class, Hydroxyzine retains a niche due to its efficacy and minimal drug interactions.

Physician and Patient Preferences

Physicians often favor Hydroxyzine for short-term anxiety or sleep issues, especially in populations where sedative effects are beneficial. Its off-label use in pediatric sedation remains common but is subject to regulatory scrutiny due to safety concerns.

Patients seek Hydroxyzine for its rapid onset and efficacy. However, preference is gradually waning in favor of newer agents with fewer sedative effects and improved safety profiles.

Competitive Landscape

Hydroxyzine faces competition from:

- Non-sedating antihistamines (e.g., cetirizine, loratadine)

- Benzodiazepines for anxiety

- Other sedatives and sleep aids

While newer agents offer improved safety, Hydroxyzine’s versatility sustains its demand, especially in specific niches [1].

Regulatory and Patent Environment

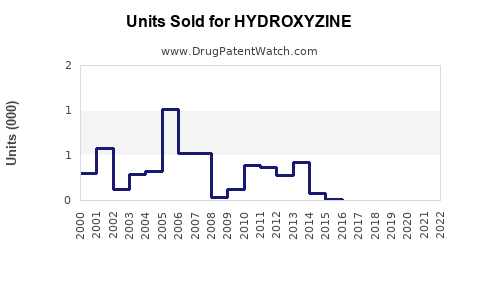

Hydroxyzine is off-patent globally, which has led to increased generic competition. This has exerted downward pressure on prices and margins [2].

In some regions, regulatory agencies have heightened warnings related to sedation and respiratory depression risks, potentially impacting prescribing.

Market Drivers and Constraints

Drivers

- Aging populations with higher allergy and anxiety prevalence

- Growth in outpatient and home healthcare settings

- Off-label use in pediatric sedation

Constraints

- Safety risks associated with sedation

- Availability of safer, non-sedating alternatives

- Regulatory restrictions in certain jurisdictions

Sales Projections

Methodology

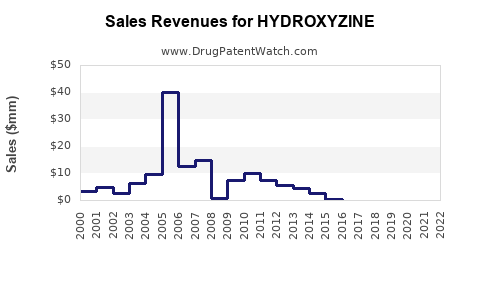

Using historical sales data, prescription trends, and competitive dynamics, projections were modeled over a five-year horizon (2023-2028). Assumptions include:

- Continued generic availability maintaining competitive pricing

- Regulatory environment remains stable

- No major patent litigation or market disruptions

Forecast Summary

| Year |

Projected Global Sales (USD Millions) |

Growth Rate |

Key Factors |

| 2023 |

$250 |

— |

Steady demand in niche indications |

| 2024 |

$265 |

+6% |

Slight increase in allergy and anxiety cases |

| 2025 |

$280 |

+6% |

Growing outpatient and early adoption trends |

| 2026 |

$290 |

+4% |

Marginal impact from newer alternatives |

| 2027 |

$295 |

+2% |

Market saturation in core indications |

| 2028 |

$300 |

+2% |

Stabilization as competition intensifies |

This conservative growth aligns with ongoing regulatory challenges and the gradual shift toward newer medications. Emerging regional markets, particularly in Asia-Pacific, may present additional opportunities, though detailed regional segmentation is pending further data.

Opportunities and Risks

Opportunities

- Expanding use in pediatric sedation protocols

- Developing combination formulations for enhanced compliance

- Increasing awareness in emerging markets

Risks

- Regulatory agency restrictions on sedative use

- Generic price erosion

- Potential shifts towards non-sedating therapies

Strategic Implications

Pharmaceutical companies should focus on maintaining market share through cost-effective production, targeted marketing to specialties like allergists and psychiatrists, and exploring formulations suited for specific populations. Investment in regional markets could offset saturated western markets.

Key Takeaways

- Hydroxyzine remains a stable, though gradually declining, player in allergy and anxiety treatment markets.

- Patent expiry and generic proliferation have subdued pricing power yet sustain accessible demand.

- Safety concerns and competition from newer agents threaten long-term growth prospects.

- Moderate annual sales growth projections suggest sustained profitability in niche markets.

- Strategic positioning should leverage its versatile profile while mitigating safety and regulatory risks.

Conclusion

Hydroxyzine's market outlook reflects a mature, competitive landscape driven by demographic shifts, regulatory factors, and evolving treatment paradigms. While sales will persist, the emphasis for stakeholders must be on differentiation, safety management, and regional expansion to sustain competitive advantage.

FAQs

1. Why has Hydroxyzine remained relevant despite competition from newer antihistamines?

Hydroxyzine offers rapid onset and efficacy in sleep induction and anxiety reduction, with versatile indications that newer, non-sedating antihistamines lack, ensuring its niche sustainability.

2. How do safety concerns impact Hydroxyzine's market prospects?

Warnings regarding sedation-related adverse effects and respiratory depression have restricted its use in certain populations, influencing prescriber choice and regulatory policies.

3. What regions present growth opportunities for Hydroxyzine?

Emerging markets in Asia-Pacific and Latin America are expanding due to increasing allergy and anxiety prevalence, coupled with growing healthcare infrastructure.

4. How does patent expiration influence Hydroxyzine's market?

Off-patent status facilitates generic competition, reducing prices and margins but maintaining demand through affordability and established prescribing practices.

5. What strategies can companies adopt to optimize Hydroxyzine sales?

Focusing on niche indications, developing patient-friendly formulations, engaging in physician education, and expanding regional presence are effective approaches.

References

[1] IQVIA. "Prescription Data and Market Trends." 2022.

[2] Global Data. "Pharmaceutical Patents and Market Dynamics." 2022.