Last updated: July 29, 2025

Introduction

Hetero Labs Ltd, a leading player in the generic pharmaceuticals industry, continues to strengthen its foothold through diverse product portfolios and strategic innovation. With a focus on complex generics, biosimilars, and APIs (Active Pharmaceutical Ingredients), Hetero’s latest positioning warrants a comprehensive analysis to inform stakeholders of its competitive advantages, market trajectory, and strategic imperatives. This analysis explores Hetero Labs Ltd’s current market position, key strengths, and strategic insights relevant for business decisions in an evolving pharmaceutical landscape.

Market Position of Hetero Labs Ltd

Global Market Presence

Hetero Labs Ltd has established itself as a significant manufacturer in the global generics and biosimilars segments. Operating across North America, Europe, Asia, and Latin America, the company leverages its expansive manufacturing infrastructure to supply affordable medications, particularly in the oncology, cardiology, and anti-infective sectors. As of 2023, Hetero’s estimated revenue exceeds USD 1.5 billion, reflecting steady growth driven by strategic investments and product launches [1].

Core Business Segments

Hetero’s business is segmented into:

- Generics and Branded Formulations: Offering FDA-approved generics in high-demand therapeutic areas.

- Biosimilars: Developing complex biologic drugs to compete with branded biologics.

- API Manufacturing: Supplying APIs to both internal and external clients, facilitating vertical integration to reduce dependency and control quality.

Competitive Positioning

Within India’s dynamic pharmaceutical industry, Hetero ranks among the top 10 companies by revenue, known for innovation, quality standards, and competitive pricing. Internationally, it competes with firms such as Dr. Reddy’s Laboratories, Cipla, and Mylan, focusing on niche areas like oncology biosimilars and specialized APIs to carve differentiated market segments.

Strengths of Hetero Labs Ltd

1. Extensive Product Portfolios and R&D Capabilities

Hetero’s robust research and development (R&D) infrastructure enables the rapid development of complex generics and biosimilars. The company maintains multiple R&D centers with a focus on biologics, niche therapeutics, and novel drug delivery systems. This technological edge allows Hetero to preempt patent cliffs and meet unmet medical needs [2].

2. Manufacturing Excellence and Regulatory Compliance

Hetero operates several manufacturing facilities compliant with FDA, EMA, and WHO standards, ensuring quality and regulatory approval across key markets. Its vertical integration reduces supply chain risks, enhances quality control, and facilitates cost efficiencies.

3. Strategic Alliances and Licensing Agreements

The company’s alliances with global pharmaceutical firms bolster its product pipeline and market access. Recent collaborations include licensing agreements with biopharmaceutical innovators to develop biosimilars, expanding its presence in high-growth biologics markets.

4. Focus on Niche and Complex Generics

Hetero’s emphasis on complex generics—such as inhalers, injectables, and biosimilars—positions it as a leader in high-margin segments where regulatory and technological barriers reduce competition. This strategic focus mitigates the impact of price erosion common in standard generics.

5. Global Footprint and Market Diversification

Diversification across geographies shields Hetero from regional regulatory or market disruptions. Its distribution channels span developed markets like North America and Europe, alongside high-growth regions in Asia and Africa, balancing risk and opportunity.

Strategic Insights for Hetero Labs Ltd

1. Accelerate Biosimilar Innovation

Given the increasing demand for biosimilars driven by patent expirations of biologics, Hetero’s continued investments in biologic R&D are vital. There is immense market potential, with global biosimilar sales projected to reach USD 29 billion by 2027, growing at a CAGR of 33% [3]. Prioritizing innovative biosimilar candidates with clear cost advantages can cement Hetero’s leadership position.

2. Expansion into Emerging Markets

While Hetero has a strong presence in India and select international markets, further expansion into Africa, Southeast Asia, and Latin America offers high-growth avenues. Tailoring products and pricing models to local affordability and working with regional regulators can accelerate market penetration.

3. Diversify into Specialty Therapeutics and Digital Pharma

To reduce reliance on generic segments, Hetero should explore investments in innovative therapeutics, such as targeted oncology drugs and digital health solutions. Such diversification can unlock new revenue streams and foster sustainable growth.

4. Strengthen Supply Chain Resilience

Global supply chain disruptions have demonstrated the need for agility. Hetero should prioritize supply chain digitization, multi-sourcing strategies, and capacity building at key manufacturing sites to prevent bottlenecks and ensure continuous supply.

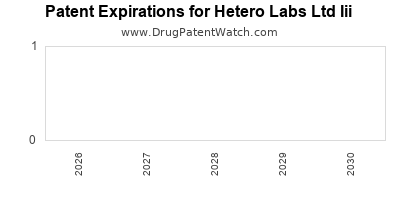

5. Enhance Regulatory Strategy and IP Management

Proactive engagement with regulators and strategic patent management will facilitate faster approvals and mitigate litigation risks. Leveraging its patent portfolio and engaging in lifecycle management can sustain product revenue streams.

Challenges and Risks

Despite its strengths, Hetero faces several challenges:

- Intense Competition: Price erosion within the generics market pressures margins.

- Regulatory Hurdles: Stringent approval processes, especially in developed markets.

- Intellectual Property Risks: Infringement disputes and patent litigations can delay product launches.

- R&D Intensity and Capital Allocation: Sustaining innovations require substantial investments, with uncertain short-term returns.

Addressing these risks necessitates strategic agility, robust compliance practices, and sustained innovation efforts.

Conclusion

Hetero Labs Ltd continues to solidify its position as a prominent player in the global generics and biosimilars sectors through technological innovation, diversified geographical reach, and focus on complex product segments. Its strategic approach to biosimilar development, market expansion, and supply chain enhancement positions it favorably amid industry consolidation and technological advances. However, maintaining competitive advantages will require ongoing investment in R&D, regulatory agility, and market diversification. Stakeholders should monitor Hetero’s capacity to scale biosimilars, expand into emerging markets, and adopt digital solutions to sustain growth.

Key Takeaways

- Diversify Product Portfolio: Emphasize complex generics and biosimilars to command higher margins and gain competitive differentiation.

- Invest in R&D: Focus on biologics innovation to capitalize on the growing biosimilar market, projected to reach USD 29 billion by 2027.

- Expand Geographically: Target emerging markets with tailored strategies to boost growth and mitigate regional risks.

- Enhance Supply Chain Resilience: Implement digitization and multi-sourcing to withstand disruptions.

- Strengthen Regulatory & IP Strategies: Proactive positioning will accelerate approvals and safeguard market share.

FAQs

1. What are Hetero Labs Ltd’s main growth drivers?

Hetero’s growth is driven by innovation in biosimilars and complex generics, strategic international expansion, and its diversified manufacturing infrastructure.

2. How does Hetero differentiate itself from competitors?

Hetero focuses on complex, high-value generics and biosimilars, supported by robust R&D, quality manufacturing standards, and strategic collaborations.

3. What are the primary risks facing Hetero’s market positioning?

Intense price competition, regulatory hurdles, patent litigations, and supply chain disruptions pose significant risks.

4. Which markets offer the highest growth potential for Hetero?

Emerging markets in Asia, Africa, and Latin America present substantial growth opportunities, complemented by the expanding biosimilar segment globally.

5. What strategic moves should Hetero prioritize for future success?

Investing in biosimilar innovation, expanding into high-growth emerging markets, digital transformation, and strengthening IP strategies are critical for sustained growth.

References

[1] GlobalData Industry Reports, 2023

[2] Hetero Labs Ltd Annual Report, 2022

[3] Grand View Research, Biosimilars Market Analysis, 2022