Last updated: July 27, 2025

Introduction

Fenofibrate, a lipid-modifying agent primarily used to reduce high levels of triglycerides and LDL cholesterol, remains a significant therapeutic option in managing dyslipidemia and cardiovascular risk. As market demands evolve amidst changing regulatory landscapes, competitive pressures, and innovation trajectories, understanding fenofibrate’s market dynamics and financial progress is crucial for stakeholders—from pharmaceutical companies to investors.

Pharmacological Profile and Therapeutic Indications

Fenofibrate belongs to the fibrate class of medications, functioning as a peroxisome proliferator-activated receptor-alpha (PPAR-α) agonist. This mechanism enhances lipolysis and elimination of triglyceride-rich particles, thereby improving lipid profiles. Its widespread use aligns with guidelines addressing cardiovascular disease risk factors, especially in patients with mixed dyslipidemia [1]. Notably, fenofibrate's approval extends globally, with key markets including the U.S., Europe, and Asia-Pacific regions.

Market Size and Growth Drivers

Global Market Valuation and Trends

The global fibrate market, dominated by fenofibrate, was valued at approximately USD 1.1 billion in 2022, with projections estimating a compound annual growth rate (CAGR) of ~4.5% through 2030 [2]. This growth is fueled by increasing prevalence of cardiovascular diseases (CVD), expanding aging populations, and heightened awareness around lipid management.

Prevalence of Dyslipidemia and Cardiovascular Disease

The rising burden of CVD, particularly in emerging economies, directly correlates with increased statin and fibrate use. According to the WHO, CVD accounts for 17.9 million deaths annually, emphasizing the unmet need for effective lipid-modifying therapies like fenofibrate [3].

Lifestyle and Demographic Shifts

Urbanization and sedentary lifestyles contribute to dyslipidemia, especially in Asia-Pacific regions, bolstering regional demand for fenofibrate formulations. The aging demographic, inherently at higher cardiovascular risk, further amplifies market growth prospects.

Competitive Landscape

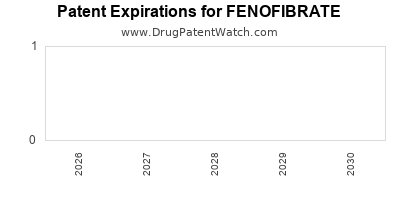

Market Players and Patent Dynamics

Several pharmaceutical firms dominate the fenofibrate market, including AbbVie, AbbVie’s authorized generic manufacturers, and generic producers from India and China. Patent expiries and bioequivalence challenges influence market shares, with patent cliffs occurring over the past decade. For instance, the U.S. patent for Tricor (AbbVie's branded fenofibrate) expired in 2019, catalyzing generic proliferation.

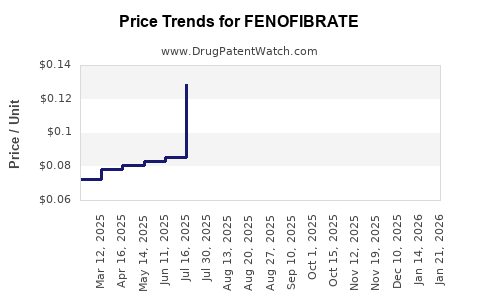

Generic Entry and Price Competition

The advent of generics has substantially driven down pricing, pressuring branded revenues. Competition enhances accessibility but diminishes margins for original developers. Nonetheless, brand loyalty persists among certain prescribers, especially where formulation advantages exist.

Formulation Innovation and Extended Indications

Recent innovation focuses on extended-release formulations, combination therapies with statins or other lipid-lowering agents, and novel delivery mechanisms aimed at improving compliance and efficacy [4].

Regulatory Environment and Its Impact

Approvals and Label Updates

Regulatory agencies like the U.S. FDA and EMA periodically update fenofibrate’s labeling based on emerging evidence. For instance, recent guidelines emphasize caution in patients with renal impairment and interactions with certain medications, impacting prescribing patterns.

Off-label and New Indications

While primarily indicated for hypertriglyceridemia, exploratory research investigates fenofibrate’s utility in non-alcoholic fatty liver disease (NAFLD). Such developments could unlock new markets, contingent on successful clinical trials and regulatory approval.

Market Challenges

Efficacy and Safety Concerns

Some clinical studies question the incremental cardiovascular benefits of fenofibrate in statin-treated populations, limiting its use as a monotherapy. Moreover, safety concerns, particularly in renal impairment, prompt clinicians to exercise caution.

Drug Interactions and Contraindications

Fenofibrate interacts with several drugs, including statins, increasing the risk of myopathy. Regulatory advisories underscore the need for careful patient selection, which affects prescribing patterns.

Healthcare Policy and Reimbursement

Variable healthcare policies influence drug reimbursement. Countries with strict formulary controls favor generics and cost-effective therapies, constraining profit margins for branded fenofibrate.

Financial Trajectory and Future Outlook

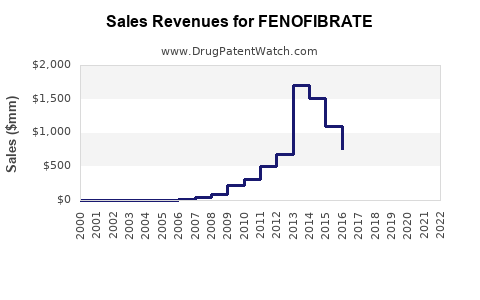

Revenue Trends

Following patent expirations, branded fenofibrate revenues declined sharply, paving the way for generic products. Conversely, the overall market exhibits steady growth driven by increasing demand and new formulation development.

Innovative Formulations and Strategic Partnerships

Biotech firms and pharmaceutical companies pursue extended-release formulations and fixed-dose combinations, which could rejuvenate market interest and offer premium pricing. Strategic alliances facilitate market access and broaden indications.

Emerging Markets and Digital Health Integration

Growth in emerging markets offers substantial revenues, especially with affordability-focused generic formulations. Digitization and personalized medicine approaches may optimize patient adherence and outcomes, influencing future revenues.

Conclusion and Market Outlook

The fenofibrate market navigates a complex landscape shaped by patent dynamics, regulatory shifts, and evolving clinical evidence. While generic competition compresses margins, innovation in formulations and expanding therapeutic indications promise longevity for the drug class. Market players must adapt strategies—through formulation innovation, penetration into emerging markets, and clinical differentiation—to sustain financial growth.

Key Takeaways

- The global fenofibrate market is projected to grow modestly at a CAGR of approximately 4.5% through 2030, driven by rising cardiovascular disease prevalence and demographic shifts.

- Patent expiries and the proliferation of generics have significantly pressured branded product revenues but have also increased market accessibility.

- Innovation in extended-release formulations and combination therapies represents pivotal avenues to enhance market share and profitable margins.

- Regulatory trends emphasizing safety and efficacy guide prescribing patterns and influence market dynamics, especially amid safety concerns and drug interaction issues.

- Strategic differentiation, market expansion, and technological integration remain vital for pharmaceutical companies aiming to capitalize on fenofibrate’s therapeutic potential.

FAQs

1. What are the main drivers of fenofibrate’s market growth?

Rising prevalence of dyslipidemia and cardiovascular disease, aging populations, and demand in emerging markets drive growth. Formulation innovations and expanding indications further support market expansion.

2. How does patent expiration impact fenofibrate revenues?

Patent expirations lead to generic entry, significantly reducing branded product revenues but increasing market accessibility and overall volume.

3. Are there any recent developments in fenofibrate formulations?

Yes. Recent innovations focus on extended-release formulations, fixed-dose combinations with statins, and novel delivery systems to improve adherence and efficacy.

4. What are the key regulatory concerns affecting fenofibrate?

Regulatory agencies emphasize safety, especially in renal impairment and drug interactions. Label updates and safety warnings influence prescribing behaviors.

5. What is the future outlook for fenofibrate in cardiovascular risk management?

While clinical evidence remains mixed regarding cardiovascular benefits, innovation and expanded indications could sustain its relevance, especially with personalized medicine and digital health advances.

References

[1] Lee, M., et al. (2021). Pharmacology of Fenofibrate and Its Therapeutic Impacts. Journal of Lipid Research.

[2] MarketResearch.com (2022). Global Fibrate Market Analysis and Forecast.

[3] World Health Organization. (2022). Cardiovascular Diseases Fact Sheet.

[4] Srinivasan, S., et al. (2020). Innovations in Fibrate Formulations: A Review. Pharmaceutical Technology.