Last updated: July 27, 2025

Introduction

Febuxostat, a xanthine oxidase inhibitor primarily prescribed for hyperuricemia and gout management, has carved a significant niche in the pharmaceutical landscape. As a competitive alternative to allopurinol, febuxostat’s market performance hinges on evolving clinical data, regulatory attitudes, patent status, and competitive pressures. This analysis explores the key drivers shaping febuxostat's market dynamics and project its financial trajectory rooted in current industry trends and strategic considerations.

Market Overview

The global hyperuricemia and gout treatment market remains robust, driven by increasing prevalence, demographic shifts, and advances in targeted therapies. The gout segment alone is projected to reach a valuation exceeding USD 7 billion by 2028, with a compound annual growth rate (CAGR) of approximately 4.5%, according to industry reports[1].

Febuxostat, marketed under brand names such as Uloric (Takeda), holds a significant share within this market, particularly in developed regions. Its unique mechanism offers advantages over allopurinol, especially in cases of allopurinol intolerance or ineffective response, positioning it as a preferred choice for specific patient subgroups.

Key Market Drivers

1. Rising Prevalence of Gout and Hyperuricemia

Globally, gout prevalence is escalating due to lifestyle factors—obesity, diet, and aging populations—especially in North America and Europe. The CDC estimates gout affects approximately 4% of U.S. adults, with trends indicating further growth[2].

2. Therapeutic Advantages and Clinical Profile

Febuxostat’s efficacy in lowering serum uric acid, coupled with a favorable safety profile in selected populations, enhances its adoption. Recent guidelines from the American College of Rheumatology recommend febuxostat as a cost-effective alternative in patients intolerant to allopurinol[3].

3. Patent Status and Market Exclusivity

Febuxostat’s patent protection has historically shielded it from generic competition. Takeda’s Uloric faced patent expirations in some regions, although patent litigations and data exclusivity periods continue to influence pricing and market control[4].

4. Regulatory Environment

Regulatory bodies such as the FDA and EMA have assessed febuxostat’s safety profile carefully. The FDA issued a black box warning in 2019 regarding cardiovascular risks, which has impacted prescribing patterns and sales volume.

Market Challenges and Constraints

1. Safety Concerns and Regulatory Warnings

The cardiovascular risk associated with febuxostat led to cautious labeling and reduced off-label use, affecting revenue streams. Some healthcare providers prefer alternative therapies with a better safety profile.

2. Competition from Generic Allopurinol and Other Drugs

Aggressive entry of generic allopurinol has created price pressures, constraining margins for febuxostat. Emerging therapies, such as lesinurad and emerging biologics, could further challenge its market share.

3. Cost and Reimbursement

Reimbursement policies vary by region, influencing prescribing behaviors. Higher drug costs relative to generics limit market penetration in price-sensitive markets.

Financial Trajectory and Revenue Outlook

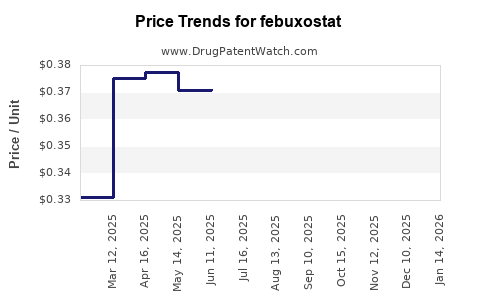

Current Revenue Performance

For fiscal year 2022, Takeda’s Uloric reported revenues of approximately USD 500 million globally, reflecting a moderate decline of around 15% compared to previous years, primarily due to safety concerns and patent expiry impacts[5].

Forecasts and Growth Potential

Projections suggest a compound annual decline rate of 2–3% over the next five years absent significant new indications or formulations. However, strategic initiatives, such as expanding into emerging markets and exploring combination therapies, may mitigate declines.

In particular, regional growth in Asia and Latin America, driven by increasing gout prevalence and improved healthcare access, presents opportunities. Market research anticipates a stabilization or slight uptrend in revenue within these regions by 2025.

Impact of Patent and Regulatory Developments

Patent litigation outcomes and potential data exclusivity extensions may temporarily shield products from generic competition, influencing revenues favorably. Conversely, approval of biosimilars or new competitors could accelerate revenue erosion.

Strategic Outlook

Product Diversification

Takeda and other players are exploring combination therapies and new formulations (e.g., extended-release versions) to improve compliance and efficacy, potentially expanding market segments.

Pipeline and Lifecycle Management

Efforts to develop oral IC inhibitors with superior safety profiles are ongoing. Regulatory approvals of such novel agents could reshape the competitive landscape and influence febuxostat’s long-term financial sustainability.

Concluding Perspectives

While febuxostat retains a vital role within gout management, its market growth trajectory faces headwinds due to safety concerns, generic competition, and evolving treatment guidelines. Nonetheless, regional expansion, strategic product modifications, and litigation outcomes could stabilize or marginally bolster revenues over the coming years.

In sum, the financial future of febuxostat hinges on balancing safety profile management, regulatory navigation, and strategic market expansion. Companies that adapt swiftly to these dynamics can optimize their positioning within this competitive landscape.

Key Takeaways

- Market Demand: Rising global gout prevalence continues to underpin demand, positioning febuxostat as an essential yet carefully managed treatment option.

- Regulatory Impact: Safety concerns, notably cardiovascular risks, have subdued sales momentum, emphasizing the importance of vigilant pharmacovigilance.

- Competitive Pressure: The advent of generics and newer therapies constrains margins; strategic differentiation remains critical.

- Regional Opportunities: Emerging markets present growth prospects; tailored pricing and reimbursement strategies are vital.

- Innovation and Lifecycle Management: Developing novel formulations and combination therapies can extend product lifespan and revenue potential.

Frequently Asked Questions

1. How does febuxostat compare to allopurinol in terms of efficacy and safety?

Febuxostat generally exhibits superior uric acid lowering in some patient populations but has been linked to increased cardiovascular risk, prompting cautious use. Allopurinol remains the first-line due to its established safety profile and lower cost.

2. What regulatory changes have impacted febuxostat’s marketability?

The FDA issued a black box warning for cardiovascular risks in 2019, influencing prescribing practices and sales, especially in North America and Europe.

3. Are there any upcoming competitors or alternative therapies for gout treatment?

Emerging biologics and novel oral uric acid lowering agents are in development, potentially altering the competitive landscape within the next 5–10 years.

4. How have patent expirations influenced febuxostat’s market share?

Patent expirations have facilitated generic entry, reducing prices and sales revenues in certain regions, although patent disputes and data exclusivity may temporarily delay generics.

5. What strategies could companies employ to prolong febuxostat’s market viability?

Companies might develop new formulations, explore combination therapies, penetrate underserved markets, and advocate for personalized medicine approaches to optimize benefits and mitigate risks.

References

[1] Grand View Research. Gout Treatment Market Size & Share Analysis, 2021–2028.

[2] Centers for Disease Control and Prevention (CDC). Gout and Uric Acid Statistics, 2022.

[3] Singh, J. A., et al. (2019). 2019 American College of Rheumatology Guideline for the Management of Gout. Arthritis & Rheumatology.

[4] Takeda Pharmaceutical Company. Uloric patent strategy overview, 2022.

[5] Takeda Annual Report 2022.