Last updated: July 27, 2025

Introduction

Febuxostat is a non-purine xanthine oxidase inhibitor primarily prescribed for the management of hyperuricemia in chronic gout patients. Since its FDA approval in 2009, febuxostat has gained strategic significance within the gout and hyperuricemia treatment landscape. This analysis explores the current market dynamics, competitive positioning, regulatory trends, and price trajectory projections for febuxostat over the next five years, offering insights pertinent to pharmaceutical stakeholders and investors.

Market Overview and Size

The global hyperuricemia and gout therapeutics market was valued at approximately USD 1.8 billion in 2022, with febuxostat accounting for a significant share owing to its efficacy and safety profile compared to traditional therapies like allopurinol. The rising prevalence of gout, estimated at approximately 4% globally, and increasing awareness about managing hyperuricemia contribute to sustained demand.

North America holds the dominant market position, driven by high disease prevalence, advanced healthcare infrastructure, and favorable reimbursement policies. Europe follows closely, with emerging markets in Asia-Pacific displaying increasing adoption due to expanding healthcare access and growing awareness (Grand View Research [1]).

Competitive Landscape

Key Players

- Takeda Pharmaceuticals: Original developer of febuxostat, marketed as Uloric globally.

- Mitsubishi Tanabe Pharma: Licensed rights in multiple regions.

- Generics Manufacturers: Entry into the market is limited; however, patent expirations could catalyze generic competition.

Market Share and Trends

Takeda maintains a dominant position, though recent safety concerns have affected its market share. The availability of the drug in oral form and a relatively favorable side effect profile contribute to its ongoing utilization. Notably, the controversy surrounding cardiovascular risks associated with febuxostat has led to cautious prescribing practices and prompted regulatory review[2].

Regulatory Environment

The FDA issued a Black Box Warning for increased cardiovascular death risk in 2019, leading to decreased prescriptions. Conversely, some regions have classified febuxostat as a preferred option for patients intolerant to allopurinol, balancing safety concerns with therapeutic need.

Price Trajectory and Economic Factors

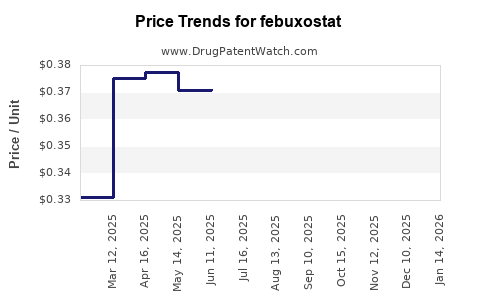

Historical Pricing Trends

Initially, febuxostat was priced higher than allopurinol, averaging USD 4–6 per daily dose. Over time, pricing pressures from generic alternatives, regulatory actions, and market saturation have driven prices downward in various regions.

Influencing Factors on Future Pricing

- Patent Expirations and Generics: Anticipated patent expiry in key markets within 3–5 years could substantially reduce prices due to generic manufacturing.

- Regulatory Rulings: Ongoing safety concerns and potential label modifications could impact pricing strategies.

- Market Penetration: Increased uptake in emerging markets, where pricing sensitivity is high, will exert downward pressure.

- Reimbursement Policies: Expansion of insurance coverage and government formularies influences accessible pricing.

Projected Price Trends (2023–2028)

Based on current trends and regulatory outlooks, the following projections are anticipated:

| Year |

Estimated Average Wholesale Price (USD) per Daily Dose |

Comments |

| 2023 |

$4.50–$6.00 |

Continued brand dominance with minor reductions |

| 2024 |

$3.50–$5.00 |

Patent-related exclusivity wanes; market begins to saturate |

| 2025 |

$2.00–$3.50 |

Entry of generic competitors; price erosion accelerates |

| 2026 |

$1.50–$2.50 |

Market normalization; increased availability of generics |

| 2027 |

$1.00–$2.00 |

Widely available; pricing driven by competition |

| 2028 |

<$1.00 |

Predominantly generics, with prices stabilizing at low levels |

Market Drivers

- Growing Prevalence of Gout and Hyperuricemia: Increase in aging populations and lifestyle-related risk factors will sustain demand.

- Treatment Guideline Adoption: Favoring urate-lowering therapies with established safety profiles.

- Healthcare Accessibility: Improved access in low- and middle-income countries expands potential markets.

- Safety Profile Considerations: Evolving evidence on cardiovascular risks influences prescribing and pricing strategies.

Market Barriers & Challenges

- Safety Concerns: Cardiovascular risk controversy may reduce prescribing frequency.

- Price Sensitivity: Governments and payers favor cost-effective generic options.

- Regulatory Scrutiny: Potential label restrictions based on ongoing safety evaluations.

- Competition: Emerging therapies, such as febuxostat biosimilars and alternative urate-lowering agents, could shift market shares.

Strategic Outlook for Stakeholders

Pharmaceutical companies should monitor patent expiration timelines and regulatory developments closely. Investing in clinical differentiation—such as demonstrating safety in specific patient subgroups—could preserve pricing power post-patent. Additionally, expanding to emerging markets could offset domestic pricing pressures.

Investors should consider the impact of regulatory risks on market access and pricing. Diversifying within hyperuricemia therapeutics portfolio or hedging against patent cliffs for febuxostat may optimize risk exposure.

Conclusion

The febuxostat market is poised for gradual decline in average pricing driven predominantly by patent expirations and generic entrant proliferation. While current prices remain relatively stable, the forecast indicates a significant downward trajectory over the next five years. This trend underscores the importance of strategic innovation, regulatory navigation, and geographic expansion for stakeholders aiming to maximize value from febuxostat.

Key Takeaways

- Market Dynamics: Febuxostat commands a significant share in hyperuricemia treatment, but face competitive and safety-related challenges.

- Pricing Trends: Expected to decline sharply post-patent expiry, with prices potentially dropping below USD 1 daily dose by 2028.

- Regulatory Impact: Safety concerns, especially cardiovascular risks, influence market uptake and pricing strategies.

- Regional Variations: North America remains dominant; emerging markets present growth opportunities amid price sensitivity.

- Strategic Focus: Innovation, safety profile enhancement, and geographic diversification are essential to sustain profitability.

FAQs

Q1: What factors have historically influenced febuxostat pricing?

A1: Patent protections, market exclusivity, safety profile perceptions, and competition from generics have historically driven pricing. Regulatory warnings and market saturation further modulate prices.

Q2: When is febuxostat expected to face significant generic competition?

A2: Patent expiration is projected within 3 to 5 years in major markets such as the U.S. and Europe, opening the pathway for generics.

Q3: How have safety concerns affected febuxostat’s market positioning?

A3: The FDA's Black Box Warning regarding cardiovascular risks has led to decreased prescribing and increased clinician caution, potentially affecting revenue streams and pricing flexibility.

Q4: Will emerging markets adopt febuxostat at lower prices?

A4: Yes. As patents expire and generic options become available, prices are expected to fall, facilitating adoption in cost-sensitive emerging markets.

Q5: What strategic considerations should pharmaceutical companies prioritize in this market?

A5: Companies should monitor regulatory changes, seek differentiation through safety and efficacy, explore geographic expansion, and prepare for patent cliffs with pipeline development or strategic alliances.

References

[1] Grand View Research. Global Hyperuricemia & Gout Market. 2022.

[2] U.S. Food & Drug Administration. FDA Boxed Warning and Safety Labeling for Febuxostat. 2019.