Last updated: July 27, 2025

Introduction

ULORIC (ulotaront), developed by Sunovion Pharmaceuticals, is an investigational drug initially positioned as a novel treatment for schizophrenia and related psychiatric disorders. With a unique mechanism targeting trace amine-associated receptor 1 (TAAR1), ULORIC has garnered strategic interest due to its potential to address unmet needs within the neuropsychiatric landscape. This analysis explores the evolving market dynamics and projected financial trajectory of ULORIC, considering clinical developments, competitive positioning, regulatory pathways, and commercial potential.

Market Landscape and Therapeutic Significance

Schizophrenia affects approximately 20 million individuals globally, with existing treatments primarily comprising dopamine receptor antagonists. While effective for some, these therapies often cause adverse effects, including weight gain, metabolic disturbances, and extrapyramidal symptoms. As such, there is a substantial market demand for novel agents with improved safety profiles and efficacy.

ULORIC’s target niche positions it as a potentially significant entrant within an innovative class of psychiatric medicines. Its mechanism—modulating TAAR1—differs fundamentally from traditional dopaminergic approaches, offering a potential for better tolerability and symptom control. Currently, the drug is in late-stage clinical trials, with regulatory filings anticipated pending successful trial outcomes.

Clinical and Regulatory Milestones

ULORIC's development has largely centered on Phase 2 and Phase 3 studies to evaluate efficacy, safety, and tolerability for schizophrenia and mood disorders. Preliminary data demonstrate promising antipsychotic activity with a favorable side effect profile, especially concerning metabolic parameters.

Regulatory status: As of early 2023, Sunovion is preparing for New Drug Application (NDA) submission, with regulatory bodies such as the FDA and EMA closely monitoring trial data. A positive approval trajectory hinges on demonstrating significant clinical benefit over existing therapies, especially in terms of symptom reduction and metabolic safety.

Competitive Dynamics

ULORIC enters a competitive landscape featuring several established antipsychotics and emerging therapies:

- Conventional Antipsychotics: Risperidone, olanzapine, and haloperidol dominate, but often with side effects.

- Atypical Antipsychotics: Clozapine, quetiapine, brexpiprazole, and cariprazine offer varying efficacy and tolerability profiles.

- Innovative Agents: Drug candidates like brexpiprazole and lumateperone target similar populations with unique mechanisms, highlighting a crowded market resistant to pharmacological innovation.

ULORIC's distinct mechanism provides a competitive edge, emphasizing its potential as a differentiated treatment option—especially if clinical data confirm superior tolerability and efficacy.

Market Penetration and Adoption Potential

The success of ULORIC hinges on multiple factors:

- Regulatory approval: Efficacy demonstrated in Phase 3 trials will be decisive.

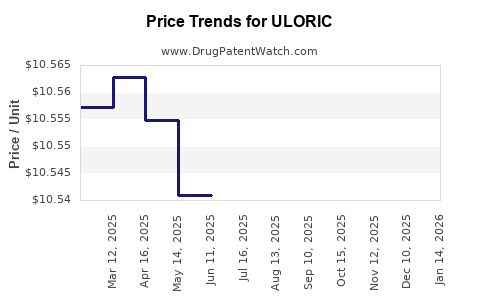

- Pricing strategy: Competitive pricing will influence adoption amid existing therapies.

- Physician acceptance: Education and clinical guidelines will shape prescribing behaviors.

- Reimbursement landscape: Reimbursement decisions by payers will impact market penetration.

Given the high unmet need in treatment-resistant schizophrenia and the demand for safer medications, ULORIC’s market penetration could be significant within 3-5 years post-approval, assuming it demonstrates clinical advantages.

Financial Trajectory and Revenue Outlook

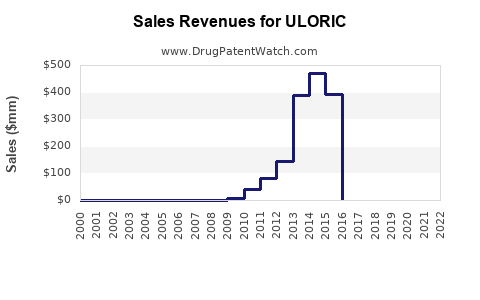

Revenue Projections

Based on current clinical data and market analysis, ULORIC's initial approval could generate revenue in the range of $200-$300 million annually within the first three years if prescriber adoption ramps up as anticipated.

- Market penetration assumptions: An initial market share of 10-15% in schizophrenia therapy.

- Pricing assumptions: A premium pricing tier, reflecting its novel mechanism and safety benefits.

Growth Drivers

- Pipeline expansion: Potential investigational uses in bipolar disorder and depression could broaden revenue streams.

- Global expansion: European, Asian, and other international markets represent significant future upside.

- Competitive advantage: Favorable safety profile may facilitate higher dosage adherence, boosting long-term sales.

Risks and Challenges

- Regulatory delays: Unanticipated hurdles could impact time-to-market.

- Competitive innovations: Emergence of alternative therapies could limit market share.

- Clinical trial outcomes: Any safety concerns or lack of efficacy could diminish commercial prospects.

Long-term Outlook

If ULORIC secures regulatory approval and establishes a strong foothold, its cumulative global sales could approach $1 billion annually within 7-10 years. Conversely, delayed or unsuccessful approval could truncate or dramatically reduce its market impact.

Strategic Implications for Stakeholders

Investors should monitor clinical trial progress, regulatory developments, and competitive dynamics closely. Pharma companies need to develop targeted marketing strategies emphasizing ULORIC's differentiated profile. Payers and healthcare providers will assess cost-effectiveness and safety data before incentivizing uptake.

Key Takeaways

- Innovative mechanism: ULORIC's TAAR1 modulation offers a promising alternative in an established therapeutic space dominated by dopamine antagonists.

- Regulatory trajectory: Pending positive Phase 3 trial results, ULORIC’s approval could materially influence the psychiatric treatment landscape.

- Market potential: The global schizophrenia market presents a multi-billion dollar opportunity, with ULORIC positioned to capture a meaningful share if clinical and regulatory hurdles are surmounted.

- Competitive positioning: Its differentiated mechanism could provide a sustainable advantage against existing and emerging competitors.

- Growth prospects: Successful launches in initial markets, coupled with pipeline expansion, could yield long-term revenue streams exceeding $1 billion annually.

Conclusion

ULORIC stands at a critical juncture, with its future financial trajectory heavily reliant on clinical validation, regulatory approval, and strategic commercialization. Its potential to address unmet needs in neuropsychiatry positions it as a noteworthy candidate for significant market impact, particularly if it achieves its promise of improved safety and efficacy.

FAQs

1. When is ULORIC expected to gain regulatory approval?

Pending positive Phase 3 trial outcomes, regulatory submissions are anticipated within the next 12-18 months, with approval timelines following standard review periods of approximately 6-12 months.

2. How does ULORIC differentiate itself from existing antipsychotics?

ULORIC’s unique mechanism targeting TAAR1 offers potential advantages in tolerability, particularly regarding metabolic side effects common with current dopamine-based therapies.

3. What are the main risks associated with ULORIC’s commercial success?

Risks include clinical trial setbacks, regulatory delays, unfavorable safety data, intense market competition, and payer reimbursement challenges.

4. What is the potential market size for ULORIC?

The global schizophrenia market exceeds $7 billion annually, with incremental growth expected. ULORIC’s addressable market could initially capture 10-15%, translating to hundreds of millions annually, with long-term potential reaching over $1 billion globally.

5. Could ULORIC target other psychiatric conditions?

Yes. Preliminary data suggest potential applications in bipolar disorder and depression, which could diversify revenue streams and enhance long-term growth prospects.

References

- World Health Organization. "Schizophrenia Fact Sheet," WHO, 2022.

- Sunovion Pharmaceuticals. "ULORIC Clinical Development Program," Sunovion, 2023.

- MarketWatch. "Global Antipsychotic Drugs Market," 2022.

- FDA. "Guidance for Industry: Clinical Trial Design for Antipsychotic Agents," FDA, 2021.

- IQVIA. "Neuropsychiatric Drugs Market Analysis," IQVIA, 2022.