Last updated: July 27, 2025

Introduction

Enalapril maleate, an angiotensin-converting enzyme (ACE) inhibitor, is primarily prescribed for managing hypertension and congestive heart failure. Since its patent expiration, the drug has transitioned from a branded product to a widely accessible generic medication, influencing global market dynamics and financial outcomes. This report analyzes the current landscape, key drivers, competitive factors, and future financial prospects for enalapril maleate.

Market Overview

Historical Context

Enalapril maleate was first introduced in the late 1980s, initially marketed under brand names such as Vasotec (by Merck & Co.). Following patent expiration in the early 2000s, the market saw a surge in generic formulations, leading to increased accessibility and declining prices (1).

Current Market Size

Global prescriptions for enalapril and its formulations, including enalapril maleate, are estimated to exceed 100 million annually. The hypertensive population and heart failure cases underpin this demand, with markets in North America, Europe, and Asia-Pacific representing significant shares.

Geographical Market Distribution

- North America: Dominates the global market due to high hypertension prevalence and advanced healthcare infrastructure.

- Europe: Maintains a robust market owing to stringent guidelines and acceptance of ACE inhibitors.

- Asia-Pacific: Exhibits rapid growth driven by increasing urbanization, lifestyle changes, and expanding healthcare access.

Market Drivers

1. Prevalence of Hypertension and Heart Failure

The global burden of hypertension affects over 1.2 billion people, with a substantial portion prescribed enalapril maleate (2). The aging population and rising prevalence of cardiovascular diseases sustain demand.

2. Cost-Effective Alternative

Generic formulations by multiple manufacturers have made enalapril maleate an affordable option, especially in developing economies, driving volume sales.

3. Expanding Indications

Beyond hypertension, enalapril maleate finds use in diabetic nephropathy and post-myocardial infarction management, broadening its therapeutic scope.

4. Regulatory Support

Stringent guidelines promote the use of affordable ACE inhibitors as first-line therapy, reinforcing its market position (3).

Market Challenges

1. Competitive Landscape

The proliferation of generic ACE inhibitors like lisinopril and ramipril offers alternatives, intensifying competition (4).

2. Patent Protections and Exclusivity

While enalapril's patent expired decades ago, newer formulations and combinations remain protected, limiting certain market segments.

3. Safety Concerns and Side Effects

Adverse reactions such as cough and hyperkalemia, though manageable, may influence prescriber preferences and patient compliance.

4. Market Saturation

In mature markets, growth is plateauing due to saturation and potential de-prescribing trends.

Financial Trajectory and Forecasting

Historical Revenue Trends

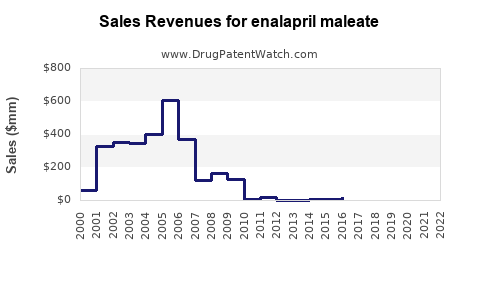

Market analysts estimate that enalapril maleate’s global annual sales peaked between $1.5 billion and $2 billion in the early 2000s, with a subsequent decline in branded sales following patent expiry (5). Currently, the generic market sustains a steady revenue stream, approximating $1 billion annually.

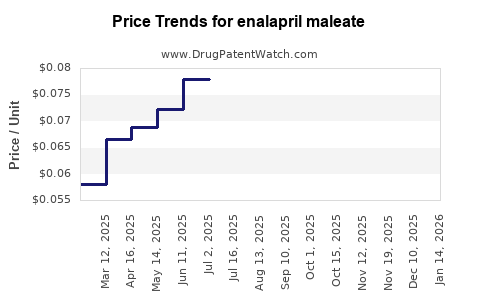

Current Market Dynamics

The competitive environment has led to price erosion, with wholesale prices decreasing by approximately 20-30% over the past decade. This trend favors healthcare systems but compresses profit margins for manufacturers.

Future Market Projections

- Growth Rates: The compound annual growth rate (CAGR) for enalapril maleate is projected to be between 2-4% over the next five years, driven mainly by emerging markets.

- Market Expansion: Increased adoption in developing countries, where hypertension awareness campaigns are intensifying, may bolster demand.

- Combination Therapies: Fixed-dose combinations incorporating enalapril may offer new revenue avenues, especially in polypharmacy-managed populations.

Emerging Trends Impacting Financials

- Biosimilars and New Therapeutics: Competition from novel therapies may limit upside potential.

- Regulatory Incentives: Inclusion in national essential medicines lists enhances accessibility, sustaining demand.

- Digital Health and Telemonitoring: Improved adherence and management could prolong the drug’s lifecycle.

Competitive Landscape

Major manufacturers include Teva Pharmaceuticals, Sandoz, Mylan, and local generic producers. Market share is fragmented, with no single entity dominating globally. Price competition, quality assurance, and supply chain reliability are crucial factors differentiating competitors.

Regulatory and Patent Considerations

While patent exclusivity for enalapril expired in key markets, certain formulations and combination therapies remain under patent or exclusivity protections, influencing market entry and revenue potential. Regulatory approvals for new formulations or indications can expand market share but require significant investment.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on operational efficiencies, cost reduction, and expanding indications to sustain profitability.

- Healthcare Providers: Emphasize the importance of cost-effective therapy options in population health management.

- Patients: Benefit from increased accessibility and affordability of antihypertensive therapy.

- Regulatory Bodies: Need to monitor safety profiles and promote policies that balance innovation incentives with affordability.

Conclusion

The market for enalapril maleate remains stable yet mature, characterized by steady revenue with modest growth prospects. Market dynamics, primarily driven by high prevalence of target conditions and affordability in emerging markets, support ongoing demand. Competitive pressures and increasing generic penetration pose challenges to profitability but also promote price competitiveness and access. Strategic positioning, especially in expanding markets and combination therapies, will determine future financial trajectories.

Key Takeaways

- Market Maturity: Enalapril maleate is a mature, commoditized antihypertensive with stable worldwide demand.

- Growth Drivers: Rising cardiovascular disease burden and affordability focus on generics sustain volume.

- Competitive Pressures: Price erosion due to generics, with the threat of newer agents, limits revenue growth.

- Emerging Opportunities: Expansion into developing markets and combination therapies offer future upside.

- Strategic Focus: Manufacturers must optimize cost efficiencies and diversify offerings to maintain margins.

FAQs

-

What factors influence the declining prices of enalapril maleate?

The expiration of patents, increased competition among generic manufacturers, and regulatory policies favoring cost-effective therapies drive price declines.

-

Are there any new formulations or indications for enalapril maleate?

Most formulations remain unchanged, but fixed-dose combinations and novel delivery systems are emerging in some markets, potentially expanding its therapeutic applications.

-

How does the competitive landscape affect profitability?

High market fragmentation and aggressive pricing strategies among generic producers lead to margin compression but ensure stable volumes.

-

What role do regulatory agencies play in the future of enalapril maleate?

Agencies influence market access through approvals, safety monitoring, and policy incentives, impacting product lifecycle and market expansion.

-

What trends could disrupt the enalapril market in the future?

The development of new antihypertensive drugs, biosimilars, and personalized medicine approaches may reduce reliance on traditional ACE inhibitors.

References

- World Health Organization. Hypertension fact sheet. WHO; 2022.

- Global Burden of Disease Study. Cardiovascular diseases. Lancet. 2021.

- European Society of Cardiology. Guidelines on hypertension management. ESC; 2021.

- MarketWatch. ACE inhibitors market analysis, 2022.

- EvaluatePharma. Market intelligence for cardiovascular drugs, 2021.