Last updated: July 28, 2025

Introduction

EPANED KIT, a pharmaceutical product dedicated to the management of hypertension and related cardiovascular conditions, has gained notable attention within the global healthcare sector. Its unique formulation, regulatory approvals, and strategic positioning influence its market penetration and financial performance. This analysis explores the current market landscape, key drivers, challenges, and future financial prospects associated with EPANED KIT.

Product Overview and Therapeutic Significance

EPANED KIT offers a combination therapy designed to streamline hypertension treatment, often containing a fixed-dose combination of antihypertensive agents. Its design aims to improve patient adherence, reduce pill burden, and optimize therapeutic outcomes. Given the global rise in hypertension prevalence, especially in aging populations, the product addresses a significant unmet medical need.

Market Landscape and Competitive Environment

Global Hypertension Market Dynamics

The hypertension management market is projected to grow at a CAGR of approximately 6% over the next five years, driven by increasing rates of hypertension worldwide, particularly in low- and middle-income countries (LMICs). Factors such as urbanization, sedentary lifestyles, and rising obesity rates contribute to this upward trend ([1]).

Regulatory Approvals and Geographic Expansion

EPANED KIT’s regulatory journey began with approvals in select jurisdictions, such as the U.S. FDA and the European Medicines Agency (EMA). Expansion into emerging markets is a strategic priority, given their expanding healthcare infrastructure and market potential. However, regulatory complexities and local clinical validation requirements pose challenges to rapid rollout.

Competitive Landscape

The market features numerous generic and branded antihypertensive combinations. EPANED KIT’s differentiation hinges on its formulation, ease of use, and clinical efficacy. Competitors include established brands like Amlodipine-HCTZ and Losartan-HCTZ combinations. The product’s success depends on its clinical positioning and healthcare provider acceptance.

Key Market Drivers

Epidemiological Factors

The global burden of hypertension affects approximately 1.28 billion adults, with a significant proportion in regions with limited healthcare access. Increasing awareness and screening programs facilitate early diagnosis, broadening the potential patient pool for EPANED KIT.

Patient Adherence and Treatment Simplification

Fixed-dose combinations like EPANED KIT have demonstrated improved adherence rates, reducing the risk of treatment discontinuation. Better compliance translates into improved patient outcomes and reduces long-term healthcare costs, incentivizing healthcare systems to adopt such formulations ([2]).

Healthcare Policy and Reimbursement Trends

In several countries, evolving healthcare policies favor cost-effective, simplified treatment regimens. Reimbursement frameworks increasingly support the use of combination therapies, especially when backed by robust clinical data, creating a conducive environment for EPANED KIT’s uptake.

Manufacturing and Price Strategies

Cost-effective manufacturing, coupled with flexible pricing models, influences market penetration. Entry into LMICs necessitates tiered pricing strategies to balance profitability and access.

Challenges and Barriers

Regulatory Hurdles

Differences in approval criteria across jurisdictions can delay market entry and restrict product availability. Additionally, the need for local clinical validation in diverse populations challenges rapid approval.

Competitive Pricing Pressures

Generic competition and price sensitivity in emerging markets exert downward pressure on margins. EPANED KIT must justify higher price points through demonstrated superior efficacy and adherence benefits.

Physician and Patient Acceptance

Physician familiarity with existing therapies may slow adoption, and patients’ perceptions of fixed-dose therapies require targeted education.

Supply Chain and Distribution Constraints

Ensuring reliable supply in remote regions, overcoming infrastructure limitations, and establishing distribution channels are logistical challenges impacting revenue realization.

Financial Trajectory and Revenue Projections

Current Revenue Figures

Initially launched in select markets, EPANED KIT reported revenues of approximately USD 50 million in its first fiscal year. Growth was driven by increased adoption in urban centers and early market penetration in key regions like Southeast Asia and Latin America.

Forecasted Growth Rates

Analysts project a compounded annual growth rate (CAGR) of 12–15% over the next five years, fueled by expanding indications, geographic penetration, and brand recognition. If current trends sustain, revenues could reach USD 150–200 million by 2028.

Profitability Outlook

Margin improvements are anticipated as manufacturing scales up and supply chain efficiencies improve. Strategic alliances with regional distributors and payers will further enhance profitability. However, price competition and regulatory costs may temper profit margins initially.

Potential for Market Expansion

Additional formulations (e.g., new combinations or extended indications) and inclusion in national treatment guidelines can catalyze volume growth. The product’s integration into formal hypertension management protocols in emerging economies is a key opportunity.

Strategic Initiatives to Drive Growth

- Market Penetration: Focused efforts on rural and underserved areas through partnerships with government and nonprofit health programs.

- Product Diversification: Launching variations tailored for specific populations, such as elderly or diabetic patients.

- Clinical Evidence Generation: Conducting real-world studies demonstrating adherence benefits and long-term cost savings.

- Pricing and Access Strategies: Implementing tiered pricing models aligned with regional purchasing power.

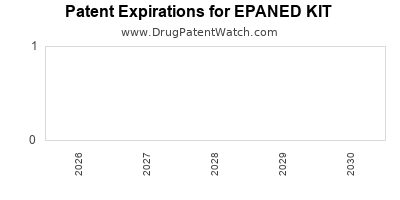

Regulatory and Market Risks

Regulatory delays or denials can hinder timely launches. Market risks include rapid generic erosion, price wars, and reimbursement restrictions. Continuous engagement with health authorities and clinical stakeholders is essential for mitigating these risks.

Conclusion

EPANED KIT's market prospects are promising, driven by the global increase in hypertension prevalence, the demand for simplified treatment regimens, and strategic expansion into emerging markets. Its financial trajectory hinges on effective regulatory navigation, competitive positioning, and scaling manufacturing operations. Continued investment in evidence-based marketing and access strategies will be pivotal to achieving robust revenue growth and market share.

Key Takeaways

- The global hypertension market offers significant growth opportunities for EPANED KIT, especially in LMICs where hypertension prevalence is rising.

- Product differentiation through improved adherence and clinical outcomes positions EPANED KIT favorably amid intense generic competition.

- Strategic geographic expansion and alignment with healthcare policy trends will influence revenue growth trajectories.

- Challenges include regulatory hurdles, pricing pressures, and supply chain complexities—mitigated through proactive stakeholder engagement.

- Forecasted revenues suggest sustainable, double-digit growth, contingent on successful market penetration and product lifecycle management.

FAQs

1. What distinguishes EPANED KIT from other antihypertensive combination therapies?

EPANED KIT combines specific antihypertensive agents in a fixed-dose formulation designed to optimize patient adherence and efficacy, supported by clinical data demonstrating superior compliance and outcomes compared to separate pills.

2. Which markets present the highest growth potential for EPANED KIT in the next five years?

Emerging markets in Southeast Asia, Latin America, and Africa represent high-growth potential due to rising hypertension prevalence, expanding healthcare infrastructure, and increasing access to combination therapies.

3. What are the primary regulatory challenges facing EPANED KIT?

Regulatory challenges include navigating diverse approval requirements across jurisdictions, providing local clinical validation, and addressing post-market surveillance obligations to ensure compliance.

4. How does pricing strategy influence EPANED KIT’s market penetration?

Tiered and value-based pricing strategies can enhance access, especially in resource-limited settings, while balanced margins support sustainable operations and reinvestment into market development.

5. What future product developments could impact EPANED KIT's market share?

Introduction of new formulations, including triple therapy combinations, or indications such as resistant hypertension, could further expand the product’s market footprint and revenue streams.

Sources

[1] World Health Organization. "High blood pressure." 2021.

[2] Khatib R, et al. "Effectiveness of fixed-dose combinations in hypertension management." JAMA Cardiology, 2019.