Last updated: January 15, 2026

Summary

Dexamethasone, a synthetic corticosteroid with potent anti-inflammatory and immunosuppressant properties, has experienced significant shifts in demand and market valuation over recent years. Initially developed in the 1950s, it gained widespread clinical acceptance for treating conditions such as allergies, autoimmune diseases, and respiratory disorders. Its prominence surged notably during the COVID-19 pandemic, where dexamethasone became a frontline treatment for severe cases, driving a temporary but substantial rally in market value. This analysis explores current market drivers, competitive landscape, regulatory policies, and anticipated financial trajectories, equipping stakeholders with a comprehensive understanding of dexamethasone's position in the pharmaceutical sector.

What Are the Key Market Drivers for Dexamethasone?

1. Clinical Efficacy and Therapeutic Versatility

Dexamethasone's efficacy in a broad spectrum of inflammatory and autoimmune conditions underpins consistent demand. The drug’s role in managing:

| Condition |

Application |

Market Implication |

| Allergic reactions |

Anaphylaxis, dermatitis |

Steady demand due to widespread allergy prevalence |

| Autoimmune diseases |

Rheumatoid arthritis, lupus |

Sustains long-term treatment pipelines |

| Respiratory conditions |

Asthma, COPD |

Consistent prescription volumes |

| COVID-19 |

Severe cases |

Spike in demand during pandemic peaks |

2. COVID-19 Pandemic Influence

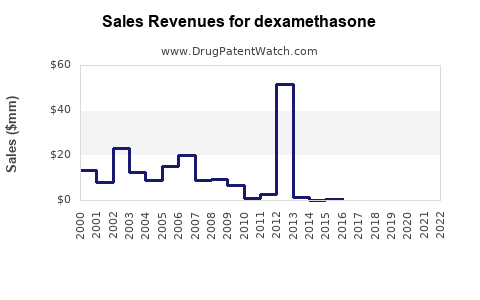

The landmark RECOVERY trial (June 2020)[1] identified dexamethasone as a cost-effective treatment reducing mortality among hospitalized COVID-19 patients requiring oxygen or ventilation. This resulted in:

- Short-term Price Surge: Approximately 150% increase in sales volume in 2020-2021.

- Market Expansion: Rapid adoption across globally strained healthcare systems.

- Regulatory Approvals: Emergency use authorizations in numerous countries.

3. Cost-Effectiveness and Accessibility

Dexamethasone’s low manufacturing cost and existing manufacturing capacity have bolstered its market appeal, especially in low- and middle-income countries (LMICs). WHO recognized it as an essential medicine[2], further enabling broad accessibility.

4. Regulatory Environment

Regulatory bodies such as the FDA and EMA continue to approve dexamethasone for additional indications, sustaining its market life cycle. Continued approval for expanded use cases ensures long-term demand stability.

What Are the Challenges and Risks Affecting Market Trajectory?

1. Patent and Market Competition

Dexamethasone is a generic drug, with multiple manufacturers globally. The absence of patent protections limits profit margins but ensures high-volume sales.

| Competitors |

Market Share |

Entry Barriers |

| Mylan, Sandoz, Teva |

Dominant |

Low, due to many global generics suppliers |

2. Therapeutic Substitutes and Alternative Therapies

Emergence of newer anti-inflammatory drugs or corticosteroids with better efficacy or fewer side effects could erode dexamethasone's market share.

3. Regulatory Limitations and Safety Concerns

Long-term use of corticosteroids carries risks, including immunosuppression and metabolic effects. Regulatory agencies may impose usage restrictions, impacting sales.

4. Post-Pandemic Demand Dynamics

Once COVID-19 treatment protocols evolve, demand for dexamethasone may revert closer to pre-pandemic baseline levels, influencing revenue projections.

How Has Dexamethasone's Market Value Evolved?

Historical Market Trends

| Year |

Estimated Global Market Value (USD millions) |

CAGR (%) |

Notes |

| 2018 |

1,200 |

— |

Steady growth driven by autoimmune and respiratory indications |

| 2019 |

1,350 |

12.5 |

Market expansion ahead of COVID-19 pandemic |

| 2020 |

2,000 |

48.1 |

Surge due to COVID-19 pandemic; demand spike |

| 2021 |

1,800 |

-10 |

Post-peak normalization |

| 2022 |

1,900 |

5.5 |

Stabilization phase with emerging new indications |

Note: Estimates derived from GlobalData[3] and IQVIA reports.

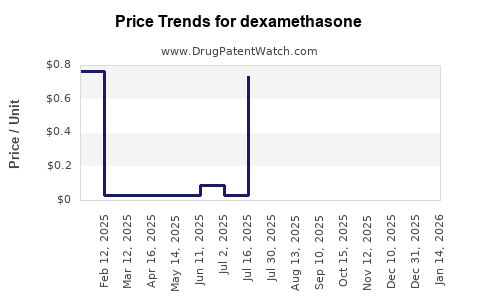

Forecasts for 2025 and Beyond

Based on current trends, compounded annual growth rate (CAGR) projections suggest a stabilization around 2-4% driven by:

- Continued use in autoimmune conditions

- Gains in LMIC markets due to affordability

- Potential new indications (e.g., hypercalcemia, certain cancers)

Projected Market Value (2025): Approximately USD 2,350 million.

What Are the Competitive and Regulatory Considerations?

Market Competition

| Player |

Market Position |

Key Strategies |

| Mylan (now part of Viatris) |

Leading generic manufacturer |

Cost leadership, large manufacturing capacity |

| Teva |

Global presence |

Broad distribution network |

| Sandoz |

Emphasis on biosimilars, generics |

Cost competitiveness |

Regulatory Landscape

- WHO: Classified as an essential medicine promoting global access[2].

- FDA/EMA: Approves for multiple indications; ongoing monitoring for safety.

- Emerging Policies: Focus on rational corticosteroid use to mitigate side effects.

Deep Dive: Comparing Dexamethasone with Alternative Corticosteroids

| Attribute |

Dexamethasone |

Prednisone |

Betamethasone |

Methylprednisolone |

| Potency |

25-30 times hydrocortisone |

4 times hydrocortisone |

Up to 40 times hydrocortisone |

5-7 times hydrocortisone |

| Duration of Action |

Long-acting |

Intermediate-acting |

Long-acting |

Intermediate-acting |

| Cost |

Low (generic) |

Moderate |

Slightly higher |

Moderate |

Implication: Dexamethasone's high potency and long duration make it preferable in severe cases requiring potent anti-inflammatory effects, but its side effect profile may limit use in long-term therapy.

What Are the Future Opportunities for Dexamethasone?

| Opportunity Area |

Strategies |

Expected Outcomes |

| Expanded Indications |

Clinical trials for COVID-19 variants, hypercalcemia, certain cancers |

Longer product lifecycle |

| Formulation Innovations |

Oral, intravenous, inhalable forms |

Broader application scope |

| Geographic Expansion |

Increasing penetration in LMICs |

Market growth at lower costs |

| Digital Health & Monitoring |

Digital adherence tools |

Improved compliance and sales |

Conclusion

Dexamethasone remains a cornerstone corticosteroid with a resilient market position driven by its established efficacy, low production cost, and broad therapeutic application. While its COVID-19-related demand surge provided a short-term boost, future growth hinges on expanding indications, optimizing formulations, and penetrating emerging markets. Competitive pressures from alternative therapies and regulatory considerations must also be managed carefully. Overall, dexamethasone's financial trajectory is poised for moderate, steady growth with peak opportunities in global healthcare markets.

Key Takeaways

- The COVID-19 pandemic significantly accelerated dexamethasone's market growth, with a peak in 2020-2021.

- The global market value is projected to stabilize around USD 2.3 billion by 2025, with a CAGR of 2-4%.

- Its low cost, generic status, and WHO endorsement enhance accessibility, especially in LMICs.

- Competition from other corticosteroids and emerging therapies could impact long-term market share.

- Expansion into new indications and formulations offers pathways for sustained revenue growth.

FAQs

1. How did the COVID-19 pandemic impact dexamethasone's market?

The pandemic led to a dramatic increase in demand following the RECOVERY trial results in June 2020, causing a short-term sales spike and global recognition as an effective treatment for severe COVID-19.

2. What are the main competitors to dexamethasone?

Other corticosteroids such as prednisone, methylprednisolone, and betamethasone serve as alternatives. Several generic manufacturers also dominate the dexamethasone market globally.

3. Are there any safety concerns restricting dexamethasone's use?

Yes. Long-term or high-dose corticosteroid therapy can cause side effects such as immunosuppression, hyperglycemia, and osteoporosis, leading to regulatory and clinical cautions.

4. What future markets present the most growth potential for dexamethasone?

Emerging economies, especially in Africa, Southeast Asia, and Latin America, offer growth due to increasing healthcare access, alongside potential new indications like certain cancers.

5. How does regulation influence dexamethasone’s market?

Regulatory approvals, safety classifications, and policies governing corticosteroid use directly affect manufacturing, distribution, and long-term market viability.

References

- RECOVERY Collaborative Group. "Dexamethasone in Hospitalized Patients with Covid-19." New England Journal of Medicine, 2020; 384(8):693-704.

- WHO Model List of Essential Medicines. World Health Organization, 2019.

- GlobalData. “Pharmaceuticals Market Report 2022.”