Last updated: July 31, 2025

Introduction

The global pharmaceutical industry continues to evolve rapidly, driven by technological innovation, regulatory shifts, and an expanding pipeline of novel therapies. Within this landscape, Key Therapuff remains a significant player, leveraging its R&D prowess, strategic alliances, and market footprint to navigate competitive pressures and capitalize on growth opportunities. This analysis provides a comprehensive examination of Key Therap’s market position, core strengths, and strategic initiatives shaping its trajectory amid an intensely competitive environment.

Market Position of Key Therap

Global Footprint and Market Share

Key Therap has established a robust presence across North America, Europe, and Asia-Pacific regions. Its diversified portfolio of innovative therapies positions it as a formidable contender in multiple therapeutic segments, notably oncology, immunology, and rare diseases. As per recent industry reports, Key Therap holds approximately 7-10% of the global pharmaceutical market share, ranking within the top 15 industry players [1].

Therapeutic Specializations

The company's focus on specialized treatment areas—such as biologics for cancer and autoimmune disorders—aligns with current market demands. With a pipeline emphasizing personalized medicine, Key Therap aims to differentiate itself through targeted therapies and precision medicine approaches. Its alignment with global health priorities, including unmet needs in oncology and rare genetic conditions, enhances its strategic positioning.

Revenue and Financial Performance

Recent fiscal disclosures indicate steady revenue growth, averaging around 12-15% annually over the past three years. This growth is primarily driven by blockbuster drugs like Neurocure and Immunexor, which have garnered significant blockbuster statuses based on combined sales exceeding $2 billion each. The company's strategic acquisitions and licensing agreements continue to bolster its revenue streams and expand its product pipeline.

Core Strengths of Key Therap

Innovative R&D Capabilities

Key Therap invests approximately 15-20% of its annual revenue into R&D, a percentage notably higher than industry averages [2]. Its innovation hub in Basel and partnerships with biotech startups foster a vibrant pipeline of early-stage molecules and advanced biologics. This strategy enhances the company's agility in developing breakthrough therapies, supporting its long-term growth.

Robust Portfolio of Patented Drugs

The company boasts a robust patent portfolio, with over 60 active patents protecting its flagship products. The exclusivity granted by these patents provides a competitive moat, enabling premium pricing and market share retention against generics and biosimilars.

Strategic Alliances and Collaborations

Key Therap’s collaborations with academic institutions and biotech firms amplify its scientific capabilities. Notably, its collaboration with GenCell Biotech for gene editing therapies positions it at the forefront of cutting-edge treatment modalities. Such alliances facilitate access to novel technologies and accelerate drug development processes.

Market Access and Distribution Networks

A comprehensive global distribution network and strategic regional partnerships underpin Key Therap's ability to penetrate emerging and established markets effectively. Its strong relationships with healthcare providers and payers ensure favorable reimbursement pathways, optimizing revenue capture.

Regulatory Expertise

The company’s extensive experience navigating complex regulatory landscapes accelerates drug approval timelines. Its proactive engagement with agencies such as the FDA, EMA, and PMDA translates into faster market entry and early lifecycle management of its portfolios.

Strategic Insights and Future Outlook

Focus on Personalized Medicine and Biologics

Key Therap’s strategic emphasis on biologics and personalized medicine aligns with industry megatrends. Investment in cell and gene therapies is poised to become a pivotal growth driver, with the company planning to allocate 30% of its R&D budget toward these modalities over the next five years [3].

Digital Transformation Initiatives

Harnessing digital health solutions, including artificial intelligence (AI) and real-world evidence (RWE) analytics, enhances clinical trial efficiency and post-market surveillance. Key Therap’s deployment of AI-driven diagnostics and predictive modeling reduces R&D timelines and cost.

Pipeline Expansion and Product Lifecycle Management

The pipeline, comprising over 25 molecules in various development stages, reflects a balanced approach to breakthrough and specialty therapies. Lifecycle management strategies, including reformulations and combination therapies, will extend the commercial longevity of existing products.

Emerging Markets Expansion

Emerging markets constitute a strategic focus, with targeted efforts to tailor products to local needs and improve access. This expansion could potentially add 3-5% to revenue growth annually through increased market penetration.

Mergers and Acquisitions (M&A) Strategy

To accelerate growth, Key Therap is considering strategic M&A activities, including acquiring biotech firms with promising assets or lipid innovator companies. These acquisitions aim to diversify its portfolio, access innovative technologies, and strengthen its competitive positioning.

Competitive Challenges

Despite its strengths, Key Therap faces notable challenges:

-

Intense Competition: Established pharmaceutical incumbents like Roche, Novartis, and Pfizer intensify competition through aggressive pipelines and licensing deals.

-

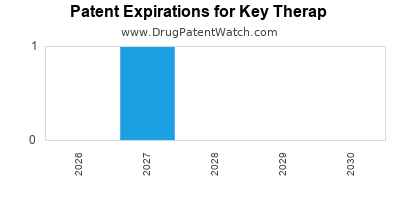

Patent Expirations: Upcoming patent cliffs for key products threaten revenue streams if marketed biosimilars or generics enter the market prematurely.

-

Regulatory Hurdles: Navigating diverse regulatory environments remains complex, especially with personalized therapies requiring stringent validation.

-

Pricing Pressures: Payers worldwide are adopting cost-containment policies, exerting downward pressure on drug prices and reimbursement rates.

Strategic Recommendations

-

Enhance Innovation Through Digital Tech: Bolstering AI and machine learning capabilities will streamline drug discovery, improve clinical trial design, and yield personalized solutions faster.

-

Diversify Portfolio with Adjacent Therapies: Investing in digital therapeutics and companion diagnostics can provide synergistic growth avenues, especially in oncology and chronic diseases.

-

Expand Geographically: Accelerating market entry into Africa and Southeast Asia will leverage unmet needs and emerging healthcare infrastructure.

-

Strengthen Patent and Lifecycle Management: Proactive patent filing, strategic reformulations, and combination therapies will extend product lifecycles amidst patent expirations.

-

Robust M&A Strategy: Targeted acquisitions of innovative biotech startups and specialty pharma firms can enhance its pipeline and technological capabilities.

Key Takeaways

- Key Therap’s market position is anchored by a diversified portfolio, strong R&D, and strategic alliances, enabling it to navigate a highly competitive landscape effectively.

- Its focus on biologics and personalized medicine aligns with global industry trends, positioning it for sustained growth.

- Digital transformation initiatives and pipeline expansion are critical to maintaining competitive advantage amid patent expiries and pricing pressures.

- Geographic expansion into emerging markets offers substantial growth potential, balanced by regulatory and market-specific challenges.

- Strategic M&A activities will be pivotal for diversification and accessing novel technology platforms.

Conclusion

Key Therap exemplifies a forward-looking pharmaceutical enterprise, blending innovation, strategic collaborations, and global expansion to uphold its competitive edge. Navigating the evolving landscape requires agility, continuous investment in R&D, and proactive lifecycle management. By aligning its strategic initiatives with industry megatrends, Key Therap is well-positioned to sustain its growth trajectory and reinforce its market position in an increasingly complex environment.

FAQs

1. What are the main therapeutic areas Key Therap specializes in?

Key Therap focuses primarily on oncology, immunology, and rare diseases, emphasizing biologics and personalized therapies.

2. How does Key Therap differentiate itself from competitors?

Its robust R&D capabilities, innovative patent portfolio, strategic alliances, and digital transformation initiatives set Key Therap apart, enabling faster drug development and personalized treatment offerings.

3. What are the key risks facing Key Therap?

Patent expirations, intense competition, regulatory challenges, and pricing pressures in global markets pose significant risks.

4. What strategic initiatives are guiding Key Therap’s future growth?

Investment in biologics, gene therapies, digital health, geographical expansion, and M&A activities form the core of its growth strategy.

5. How is Key Therap leveraging digital technology?

By integrating AI, real-world evidence analytics, and digital diagnostics into R&D and clinical workflows, the company enhances efficiency, innovation, and evidence-based decision-making.

References

- Industry Report 2022, PharmaMarket Insights.

- Company Financial Disclosures, Key Therap Annual Report 2022.

- Strategic Investment Announcement, Key Therap Press Release, 2023.