Last updated: October 16, 2025

Introduction

Diphenhydramine hydrochloride (DPH HCl) is a first-generation antihistamine extensively used to treat allergic reactions, motion sickness, insomnia, and cold symptoms. Since its initial synthesis in the 1940s, DPH HCl has maintained a significant presence in both over-the-counter (OTC) and prescription drug markets. This report analyzes the market dynamics and financial trajectory of DPH HCl, emphasizing current trends, competitive landscape, regulatory considerations, and forecasting future potential within global pharmaceutical contexts.

Market Overview and Historical Context

Diphenhydramine hydrochloride's widespread use is rooted in its proven efficacy in managing allergic symptoms, including hay fever, urticaria, and allergic conjunctivitis. Additionally, its sedative properties have sustained demand across multiple therapeutic segments. According to IQVIA data, DPH-based products accounted for approximately $1.2 billion globally in 2022, with North America representing over 60% of the market share, driven by high OTC consumption and established consumer familiarity.

Historically, DPH HCl's patent expiration in the late 1980s facilitated generic manufacturing, drastically reducing prices and expanding accessibility. The entry of generics has intensified competition, fostering an environment characterized by price sensitivity and innovation in formulation delivery systems.

Current Market Drivers

1. Consumer Demand for OTC and Self-Care Therapies

The rising inclination toward self-medication, complemented by the prevailing consumer preference for OTC solutions, bolsters demand for DPH HCl. Its inclusion in numerous allergy and cold treatment formulations underscores its persistent relevance. A 2021 survey indicated that 67% of American adults used OTC allergy medications annually, with diphenhydramine constituting a significant segment [1].

2. Aging Population and Chronic Conditions

An aging global population sustains a high demand for OTC antihistamines due to increased prevalence of allergies and sleep disorders among elderly demographics. For example, the World Health Organization projects that by 2050, over 1.5 billion people will be aged 65 or older, many of whom rely on antihistamines and sleep aids.

3. Expansion into Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Africa are experiencing growth in OTC medication consumption driven by rising healthcare awareness, urbanization, and increased disposable income. Pharmaceutical companies are intensifying efforts to supply DPH HCl formulations tailored to these regions, which bear significant growth potential.

4. Formulation Innovations

Development of long-acting, fast-dissolving, and combination formulations of DPH HCl enhances product appeal and compliance, especially for pediatric and geriatric populations. Innovations such as transdermal patches and liquid gels help differentiate products amidst commoditized generic segments.

Market Challenges

1. Regulatory and Safety Concerns

Age-related safety issues, notably sedative effects and anticholinergic burden, raise regulatory scrutiny. The U.S. Food and Drug Administration (FDA) issued warnings in 2006 regarding use in children, leading to restrictions and a decline in pediatric prescriptions [2]. Similarly, increasing awareness of anticholinergic side effects linked to cognitive decline among the elderly impacts prescriber and consumer preferences.

2. Competition from New Pharmacological Alternatives

The advent of second-generation antihistamines (e.g., loratadine, cetirizine, fexofenadine) offers non-sedating options with improved safety profiles, directly competing with DPH HCl. These alternatives have gained market share, especially among health-conscious consumers seeking sedative-free relief.

3. Ethical and Environmental Concerns

Environmental persistence of phenothiazine derivatives and their metabolites, including DPH HCl, raises ecological concerns, potentially leading to regulatory restrictions and manufacturing adjustments.

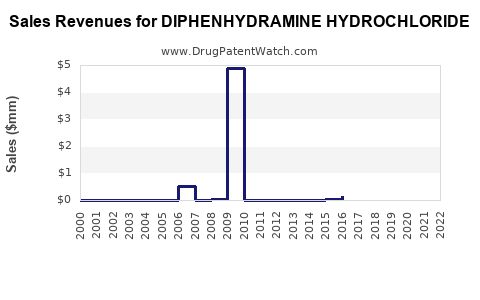

Financial Trajectory and Forecasting

The financial outlook for DPH HCl is characterized by moderate growth prospects with certain caveats:

-

Market Growth Rate: Projected Compound Annual Growth Rate (CAGR) for DPH HCl globally is approximately 2.5% over the next five years, driven by expansion in developing regions and formulation innovations, despite stiff competition from second-generation antihistamines [3].

-

Pricing Dynamics: Generic proliferation maintains a downward price trend; however, premium formulations and combination products command higher margins. OTC sales continue to exert pricing pressure, with companies exploring bundling strategies to maximize revenues.

-

Emerging Opportunities:

- Combination Therapies: Integration of DPH HCl with analgesics, decongestants, or sleep aids to enhance therapeutic utility.

- Novel Delivery Systems: Transdermal patches, nasal sprays, and fast-dissolving tablets promise to capture niche markets.

- Regulatory Approvals: Potential label extensions for indications such as sleep aid and motion sickness in new geographies.

-

Risks:

- Regulatory restrictions due to safety concerns.

- Competitive pressure from safer, non-sedating antihistamines.

- Cultural shifts favoring lifestyle and natural remedies, which could diminish OTC sales.

Competitive Landscape

The marketplace features a spectrum of players ranging from pioneering pharmaceutical companies to generic manufacturers:

- Brand Leaders: Johnson & Johnson’s Benadryl remains a dominant OTC brand, with global sales reaching approximately $400 million annually.

- Generic Manufacturers: Several regional players dominate in local markets, maintaining aggressive price strategies.

- Emerging Innovators: Small biotech firms exploring advanced delivery methods or combination formulations—e.g., transdermal patches—are attracting investment.

Regulatory and Policy Environment

Global regulatory agencies oversee safety and efficacy standards influencing market viability:

- The FDA’s warning on pediatric use has curtailed some markets for DPH HCl in children.

- EMEA and other agencies adopt similar cautionary approaches.

- Policies promoting non-sedating antihistamines could further challenge DPH HCl’s market share.

Global Market Outlook

North America and Europe dominate DPH HCl consumption; however, Asia-Pacific exhibits robust growth potential driven by urbanization, rising affluence, and increasing health literacy. Projections suggest India and China will account for over 40% of the volume growth in antihistamines over the next decade [4].

Conclusion

Diphenhydramine hydrochloride remains a valuable component within the antihistamine landscape but faces evolving market dynamics. Its future relies on strategic formulation enhancements, navigating regulatory landscapes, and expanding into emerging markets. While growth rates are moderate, targeted innovation and geographic expansion could sustain its financial trajectory amid competitive pressures from newer non-sedating agents.

Key Takeaways

- The global DPH HCl market is mature, with steady but moderate growth driven by OTC demand and demographic factors.

- Competition from second-generation antihistamines and safety concerns restrict rapid expansion.

- Emerging markets and formulation innovations represent critical growth avenues.

- Regulatory and environmental challenges necessitate proactive compliance and sustainability strategies.

- Companies should focus on product differentiation, geographic expansion, and safety profile improvements to enhance profitability.

FAQs

1. What are the primary therapeutic uses of diphenhydramine hydrochloride?

Diphenhydramine HCl is predominantly used for allergy relief, motion sickness prevention, sleep aid, and cold symptom management, owing to its antihistaminic and sedative properties.

2. How does safety regulation impact the market for DPH HCl?

Safety concerns, especially regarding sedative effects and anticholinergic risks, have led to regulatory restrictions, particularly in pediatric populations, affecting product formulations and prescribing practices.

3. What are the competitive advantages of newer antihistamines over DPH HCl?

Second-generation antihistamines offer non-sedating, longer-lasting, and fewer side effects, making them preferred options in many markets and diminishing DPH HCl’s market share among conscious consumers.

4. How significant is the growth potential in emerging markets?

Emerging markets in Asia and Latin America exhibit high growth potential due to increasing healthcare awareness, urbanization, and rising disposable incomes, positioning them as critical growth engines for DPH HCl.

5. What strategic moves can companies adopt to sustain DPH HCl’s market relevance?

Innovations in formulation delivery, exploring combination therapies, geographic expansion, and proactive compliance with safety regulations are vital strategies to maintain market relevance and financial stability.

References:

[1] IQVIA. (2022). Global OTC Market Insights.

[2] FDA. (2006). Safety Communication on Diphenhydramine in Children.

[3] MarketWatch. (2023). Antihistamine Markets Analysis.

[4] WHO. (2021). Aging Populations and Pharmaceutical Needs.