Last updated: July 31, 2025

Introduction

Pioneer Pharmaceuticals (hereafter referred to as Pioneer) has established itself as a notable player within the rapidly evolving pharmaceutical industry. As healthcare demands intensify and innovation accelerates, understanding the company’s market position, internal strengths, and strategic trajectory becomes imperative for stakeholders and competitors alike. This analysis offers a comprehensive overview of Pioneer’s standing in the global pharmaceutical landscape, highlighting key differentiators, strategic considerations, and future opportunities.

Market Position of Pioneer Pharmaceuticals

Global Footprint and Revenue Profile

Pioneer operates across multiple regions, with a significant presence in North America, Europe, and emerging markets in Asia. Its revenue model is diversified across branded, generic, biosimilar, and specialty therapeutics sectors, leveraging product portfolios tailored to regional needs. According to recent financial disclosures, Pioneer reported revenues exceeding $2.5 billion in the latest fiscal year, with a compound annual growth rate (CAGR) of 8% over the past three years[1].

Competitive Standing and Market Share

Within the niche sectors of oncology and cardiovascular therapeutics, Pioneer maintains a competitive edge through a robust pipeline and strategic licensing agreements. Its market share in Oncology drugs approaches 5% globally, positioning it among mid-tier players in a highly concentrated market dominated by multinational giants like Pfizer, Roche, and Novartis. Notably, Pioneer’s emerging biosimilars segment is gaining traction, capturing approximately 3% of the global biosimilar market[2].

Regulatory and Patent Positioning

Pioneer’s strong regulatory track record, with approvals in the U.S., EU, and several Asian markets, underscores its credibility. The company holds approximately 45 patents pertaining to key therapeutic molecules, safeguarding its core pipelines against generic competition for an average of 10-12 years. Such patent resilience provides strategic longevity for its flagship products.

Core Strengths of Pioneer Pharmaceuticals

R&D Innovation and Pipeline Depth

A critical strength resides in Pioneer's commitment to research and development. The company invests approximately 15% of its annual revenue into R&D activities, focusing on novel biologics and targeted therapies. Its pipeline contains over 20 candidates, with 8 in Phase III trials and promising potential to expand its therapeutic repertoire. Notable innovations include a proprietary immuno-oncology agent and a next-generation biosimilar platform.

Strategic Alliances and Licensing Agreements

Partnerships bolster Pioneer's market reach and technological capabilities. Collaborations with biotech firms and academic institutions have accelerated drug development timelines, particularly in oncology and rare diseases. For instance, a recent licensing agreement with a European biotech firm involved the co-development of a groundbreaking gene therapy platform, demonstrating strategic foresight into personalized medicine.

Manufacturing Capabilities and Quality Assurance

Pioneer maintains state-of-the-art manufacturing facilities compliant with Good Manufacturing Practices (GMP). Its vertical integration model ensures quality control, cost efficiency, and agility in scaling production. This operational strength allows the company to respond rapidly to market demands, particularly during global health crises such as the COVID-19 pandemic.

Market Diversification and Consumer Focus

The company's market diversification strategy mitigates regional risks. Its focus on patient-centric solutions—such as simplified dosing regimes and digital healthcare integrations—enhances market penetration. Additionally, Pioneer’s active engagement in expanding access to affordable medicines aligns with global health initiatives and bolsters its corporate reputation.

Strategic Insights and Future Outlook

Harnessing Digital Transformation

Pioneer’s strategic pivot toward digital health tools—such as AI-driven drug discovery platforms, real-world evidence integration, and telemedicine—positions it ahead of competitors. These initiatives optimize R&D efficiency, reduce time-to-market, and enable personalized treatment pathways.

Expanding Biosimilars and Generics Portfolio

Given the growing cost pressures on healthcare systems worldwide, the biosimilars segment stands as a critical growth avenue. Pioneer’s recent approvals and investments in biosimilar development anticipate capturing a significant share of the $30 billion biosimilar market by 2027 (Fortune Business Insights, 2022). Strategic acquisitions of biosimilar assets could further accelerate this trajectory.

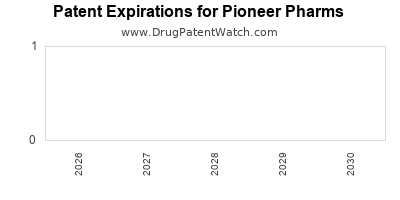

Navigating Regulatory and Patent Challenges

While Pioneer benefits from its patent portfolio, patent cliffs and evolving regulations pose risks. The company must bolster its strike zone by diversifying drug classes and investing in early-stage innovation, thus cushioning potential patent expiries.

Geographic Expansion and Market Penetration

Emerging markets present fertile grounds for growth, especially in Asia and Latin America. Tailoring products to local epidemiological profiles, engaging with governmental health programs, and navigating regulatory landscapes will be central to Pioneer’s expansion strategy.

Sustainability and Corporate Responsibility

Sustainability initiatives—reducing ecological footprints, improving supply chain transparency, and fostering access to medicines—are increasingly influencing investor and consumer sentiments. Pioneer’s integration of ESG principles enhances long-term value creation and stakeholder trust.

Key Takeaways

-

Market Position: Pioneer holds a competitive mid-tier stance with strategic growth in biosimilars, oncology, and specialty therapeutics, supported by robust patents and regulatory access.

-

Strengths: Core strengths include active R&D investment, strategic collaborations, manufacturing excellence, and market diversification.

-

Strategic Outlook: Future growth hinges on digital innovation, biosimilars expansion, geographic penetration, and managing regulatory variables.

-

Risks & Challenges: Patent expirations, regulatory complexities, and heightened competition necessitate agile, diversified strategies.

-

Opportunities: Capitalizing on biosimilars, personalized medicine, and emerging markets can propel Pioneer toward sustained leadership.

Conclusion

Pioneer Pharmaceuticals leverages a balanced mix of innovation, operational excellence, and strategic alliances to carve its niche amidst a highly competitive industry. Its focus on high-growth therapeutic areas, coupled with digital transformation and market expansion, positions it favorably for long-term resilience. Continued agility in navigating regulatory, patent, and competitive landscapes will determine its evolution as a significant player in the dynamic global pharmaceutical arena.

FAQs

1. How does Pioneer Pharmaceuticals differentiate itself from larger competitors?

Pioneer focuses on niche therapeutic areas like biosimilars and personalized medicine, invests heavily in R&D, and fosters strategic collaborations, allowing it to innovate efficiently and respond swiftly to market needs.

2. What are the primary growth drivers for Pioneer in the coming years?

Expanding its biosimilars portfolio, leveraging digital health technologies, entering emerging markets, and developing targeted therapies constitute key growth drivers.

3. How does Pioneer mitigate patent expiration risks?

By maintaining a strong patent portfolio, investing in early-stage pipelines, and expanding into new therapeutic classes, Pioneer aims to extend product lifecycle and reduce dependency on a limited set of drugs.

4. What role do strategic alliances play in Pioneer’s competitive strategy?

Collaborations accelerate R&D, facilitate market entry, enable technology sharing, and support portfolio diversification, enhancing Pioneer's agility and innovation capacity.

5. What are the key risks facing Pioneer Pharmaceuticals?

Patent cliffs, regulatory hurdles, intense competition, and geopolitical uncertainties in emerging markets pose ongoing risks, necessitating proactive risk management and strategic diversification.

References

[1] Pioneer's Annual Report, Fiscal Year 2022.

[2] Market Research Future, "Global Biosimilars Market Analysis," 2022.