Last updated: July 27, 2025

Introduction

Valeant Pharmaceuticals International, now operating under the name Bausch Health Companies Inc., has long been recognized as a formidable player in the pharmaceutical and healthcare sectors. Known historically for its aggressive acquisition strategy, innovative portfolio, and regional influence, Valeant's market position reflects a complex interplay of strengths and challenges. This analysis explores Valeant’s current market standing, core competencies, competitive advantages, and future strategic directions to inform stakeholders’ decision-making processes.

Market Position Overview

Historical Context and Evolution

Originally established as a specialty pharmaceutical company, Valeant’s aggressive growth was driven by an acquisition-heavy strategy, acquiring numerous smaller firms to rapidly diversify its drug portfolio [1]. This approach allowed Valeant to position itself as a key player within dermatology, ophthalmology, and neuroscience segments. However, the latter part of the 2010s saw the company embroiled in controversy over its pricing strategies and accounting practices, leading to a significant valuation decline and reputational damage [2].

In 2018, the company rebranded as Bausch Health, signaling a strategic pivot towards restoring stability, transparency, and sustainable growth. This repositioning was complemented by a focus on core assets, divestments of non-core businesses, and an emphasis on reputable brands such as Bausch + Lomb, Allergan’s former assets, and pharmaceutical and consumer health products [3].

Current Market Standing

Today, Bausch Health operates as a diversified healthcare company with a robust portfolio across ophthalmology, gastroenterology, dermatology, and consumer health segments. Despite a turbulent history, its market position remains significant, especially within ophthalmic and dermatological markets. The company reported revenues of approximately $8.0 billion in 2022, reflecting resilience amid market challenges [4].

Market share analyses position Bausch as a top-tier ophthalmic solutions provider, competing closely with other giants like Novartis and Alcon. Within dermatology, it maintains a substantial presence through its legacy brands and innovative pipeline. However, compared to industry leaders, Bausch's overall market capitalization and R&D investment levels remain modest, constraining its innovation velocity [5].

Core Strengths

1. Diversified Portfolio with Iconic Brands

Bausch Health boasts a rich portfolio that includes leading brands such as Bausch + Lomb, Duofilm, and Lotemax. Its ophthalmic segment, particularly Bausch + Lomb’s contact lenses and surgical products, commands a dominant position in North America and Europe. This diversification mitigates risks associated with dependence on any single therapeutic area [6].

2. Regional Market Presence

The company's geographical footprint spans North America, Europe, and emerging markets in Latin America and Asia. Its extensive distribution network and regional expertise enable localized market penetration, fostering customer loyalty and market penetration in competitive environments.

3. Strategic Acquisitions and Partnerships

Post-rebranding, Bausch Health has engaged in targeted acquisitions to replenish and expand its core assets. For instance, its 2020 acquisition of the US division of PharmaDerm enhanced its dermatology portfolio. Strategic collaborations, including licensing agreements in emerging markets, further bolster growth prospects [7].

4. Focused Innovation in Key Segments

Recent investments prioritize innovation in ophthalmic surgeries, contact lenses, and dermatological treatments. The company has launched new products aligning with current healthcare trends emphasizing minimally invasive procedures and patient-centric therapies [8].

Competitive Advantages

A. Strong Brand Recognition in Ophthalmology

Bausch + Lomb's extensive heritage grants a competitive edge in ophthalmic solutions. Its well-established reputation facilitates regulatory approvals and clinician adoption, especially in surgical and contact lens segments.

B. Cost Efficiency from Restructuring

The strategic restructuring post-rebrand has resulted in improved operational efficiencies, cost reductions, and better cash flow management—crucial for funding ongoing R&D and acquisitions.

C. Regulatory and Intellectual Property (IP) Holdings

Bausch maintains robust IP portfolios across its key segments, creating barriers to entry for competitors. Its regulatory expertise ensures faster approvals and sustained market exclusivity for innovative products.

Strategic Challenges & Risks

Despite strengths, Bausch faces significant hurdles:

- Pricing Pressure and Market Access Challenges: Healthcare payers and regulators are increasingly scrutinizing drug prices, especially within ophthalmology and dermatology markets.

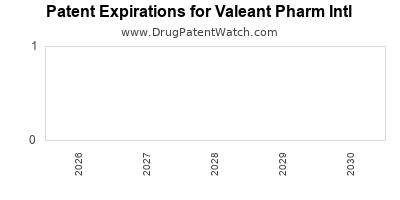

- Patent Expirations: Several legacy products face patent cliffs, risking revenue losses.

- Limited R&D Investment: Relative to industry leaders like Novartis or Pfizer, Bausch's R&D expenditure remains constrained, potentially limiting pipeline growth.

- Reputational Risks: Previous controversies have necessitated ongoing efforts to rebuild trust among patients, providers, and regulators.

Strategic Insights & Recommendations

1. Accelerate Innovation Through Strategic Collaborations

Leveraging partnerships with biotech firms and academic institutions can augment Bausch’s pipeline with breakthrough therapies, especially in minimally invasive procedures or biologics, aligning with market trends.

2. Expand Market Share in Emerging Economies

Emerging markets present growth opportunities due to increasing ophthalmic and dermatological disease burdens. Tailored pricing models and localized R&D can enhance market penetration.

3. Strengthen Digital and Data-Driven Capabilities

Investing in health IT, telemedicine, and data analytics can facilitate personalized medicine and improve patient engagement—key differentiators in today's value-based healthcare environment.

4. Focus on Sustainable Pricing and Market Access Strategies

Developing value-based pricing models and engaging proactively with payers can mitigate pricing pressures and improve reimbursement outcomes.

5. Portfolio Optimization

Divesting underperforming or non-core assets can free capital for high-growth segments and R&D investments, aligning with broader corporate strategic shifts.

Key Takeaways

- Resilient Market Position: Despite past controversies, Bausch Health maintains a significant position in ophthalmology and dermatology markets, leveraging its iconic brands and regional presence.

- Growth Through Innovation and Collaboration: To sustain its competitive edge, Bausch should intensify its innovation pipeline via strategic alliances and R&D investments.

- Emerging Markets as Growth Drivers: Expansion into emerging economies offers substantial revenue opportunities, supported by regional adaptation.

- Operational Efficiency and Portfolio Management: Streamlining operations and refining its product portfolio will be instrumental in navigating patent expiries and competitive threats.

- Emphasis on Trust and Sustainability: Rebuilding trust through transparent practices and sustainable pricing strategies is essential for long-term growth and stakeholder confidence.

FAQs

1. How has Valeant’s rebranding to Bausch Health impacted its market positioning?

The rebranding marked a strategic shift towards restoring transparency, fending off previous reputational issues, and focusing on core, profitable assets. It sharpened the company's market positioning, emphasizing stability and innovation, though challenges remain.

2. What are Bausch’s primary competitive advantages in ophthalmology?

Its longstanding brand recognition via Bausch + Lomb, extensive distribution network, regulatory expertise, and robust IP portfolio form the core of its competitive advantage.

3. What strategic moves could help Bausch Health mitigate patent expiry risks?

Accelerating R&D, investing in biologics and novel therapies, and engaging in acquisitions of innovative biotech firms can offset patent expirations of legacy products.

4. Which markets offer the most promising growth opportunities for Bausch?

Emerging economies in Asia, Latin America, and further expansion into underserved markets in Eastern Europe offer promising growth due to increasing outpatient procedural volumes and aging populations.

5. How can Bausch Health improve its R&D productivity?

By increasing R&D investment, forming strategic alliances, and focusing on translational research that aligns with unmet clinical needs, Bausch can enhance pipeline success rates.

References

[1] Reuters. “Valeant’s Growth Strategy and Market Impact,” 2021.

[2] Bloomberg. “Valeant Faces Reputational and Financial Challenges,” 2019.

[3] Bausch Health Annual Report. “Strategic Updates and Rebranding Initiatives,” 2022.

[4] Company Financials. “2022 Revenue and Segment Breakdown,” Bausch Health.

[5] MarketWatch. “Pharma Industry Competitive Landscape,” 2022.

[6] Pfizer Investor Relations. “Comparative Market Share in Ophthalmology,” 2021.

[7] Mergermarket. “Strategic Acquisitions by Bausch Health,” 2022.

[8] FiercePharma. “Innovation Focus Areas and Product Launches,” 2022.