BETASERON Drug Profile

✉ Email this page to a colleague

Summary for Tradename: BETASERON

| High Confidence Patents: | 5 |

| Applicants: | 1 |

| BLAs: | 1 |

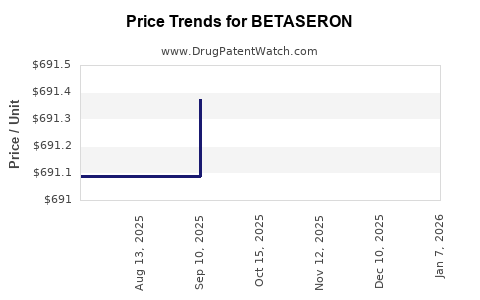

| Drug Prices: | Drug price information for BETASERON |

| Recent Clinical Trials: | See clinical trials for BETASERON |

Recent Clinical Trials for BETASERON

Identify potential brand extensions & biosimilar entrants

| Sponsor | Phase |

|---|---|

| Biogen | Phase 4 |

| National Institutes of Health (NIH) | Phase 2 |

| MediciNova | Phase 2 |

Note on Biologic Patents

Matching patents to biologic drugs is far more complicated than for small-molecule drugs.

DrugPatentWatch employs three methods to identify biologic patents:

- Brand-side disclosures in response to biosimilar applications

- DrugPatentWatch analysis and company disclosures

- Patents from broad patent text search

These patents were identified from disclosures by the brand-side company, in response to a potential biosimilar seeking to launch. They have a high certainty of blocking biosimilar entry. The expiration dates listed are not estimates — they're expiration dates as indicated by the brand-side company.

These patents were identified from searching various sources, including drug labels and other general disclosures from the brand-side company. This list may exclude some of the patents which block biosimilar launch, and some of these patents listed may not actually block biosimilar launch. The expiration dates listed for these patents are estimates, based on the grant date of the patent.

For completeness, these patents were identified by searching the patent literature for mentions of the branded or ingredient name of the drug. Some of these patents protect the original drug, whereas others may protect follow-on inventions or even inventions casually mentioning the drug. The expiration dates listed for these patents are estimates, based on the grant date of the patent.

1) High Certainty: US Patents for BETASERON Derived from Brand-Side Litigation

No patents found based on brand-side litigation

2) High Certainty: US Patents for BETASERON Derived from DrugPatentWatch Analysis and Company Disclosures

| Applicant | Tradename | Biologic Ingredient | Dosage Form | BLA | Patent No. | Estimated Patent Expiration | Source |

|---|---|---|---|---|---|---|---|

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 4,450,103 | 2002-03-01 | DrugPatentWatch analysis and company disclosures |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 4,530,787 | 2004-10-17 | DrugPatentWatch analysis and company disclosures |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 4,588,585 | 2004-09-28 | DrugPatentWatch analysis and company disclosures |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 4,737,462 | 2005-07-10 | DrugPatentWatch analysis and company disclosures |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 4,959,314 | 2005-02-07 | DrugPatentWatch analysis and company disclosures |

| >Applicant | >Tradename | >Biologic Ingredient | >Dosage Form | >BLA | >Patent No. | >Estimated Patent Expiration | >Source |

3) Low Certainty: US Patents for BETASERON Derived from Patent Text Search

| Applicant | Tradename | Biologic Ingredient | Dosage Form | BLA | Patent No. | Estimated Patent Expiration | Source |

|---|---|---|---|---|---|---|---|

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 10,085,955 | 2034-01-08 | Patent claims search |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 10,233,171 | 2037-02-24 | Patent claims search |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 10,265,291 | 2037-02-13 | Patent claims search |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 10,273,252 | 2036-06-14 | Patent claims search |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 10,350,178 | 2038-08-23 | Patent claims search |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 10,428,382 | 2033-03-07 | Patent claims search |

| Bayer Healthcare Pharmaceuticals Inc. | BETASERON | interferon beta-1b | For Injection | 103471 | 10,493,080 | 2037-01-27 | Patent claims search |

| >Applicant | >Tradename | >Biologic Ingredient | >Dosage Form | >BLA | >Patent No. | >Estimated Patent Expiration | >Source |

International Patents for BETASERON

| Country | Patent Number | Estimated Expiration |

|---|---|---|

| European Patent Office | 0102989 | ⤷ Get Started Free |

| South Korea | 910009900 | ⤷ Get Started Free |

| Australia | 2008683 | ⤷ Get Started Free |

| European Patent Office | 0218825 | ⤷ Get Started Free |

| South Africa | 8507906 | ⤷ Get Started Free |

| Luxembourg | 90413 | ⤷ Get Started Free |

| Germany | 3380598 | ⤷ Get Started Free |

| >Country | >Patent Number | >Estimated Expiration |

Supplementary Protection Certificates for BETASERON

| Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|

| 96C0019 | Belgium | ⤷ Get Started Free | PRODUCT NAME: BETAFERON INTERFERON BETA-1B; REGISTRATION NO/DATE: EU/1/95/003/001 19951130 |

| SZ 10/1996 | Austria | ⤷ Get Started Free | PRODUCT NAME: BETAFERON - INTERFERON BETA-1B |

| SPC/GB96/019 | United Kingdom | ⤷ Get Started Free | |

| >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for the Biologic Drug: BETASERON

Introduction

BETASERON (interferon beta-1a) stands as a pioneering biologic therapy for multiple sclerosis (MS), first approved by the FDA in 1983. As a long-standing treatment, its market landscape has evolved alongside scientific advancements, regulatory shifts, and competitive dynamics. This analysis examines the current market environment, key drivers, competitive forces, exclusivity considerations, and financial outlook shaping BETASERON's trajectory in the global MS treatment arena.

Market Landscape for Betaseron

Historical Context and Market Penetration

BETASERON's introduction marked a significant milestone in MS therapeutics, establishing a substantial patient base over the decades. Its Long-acting interferon beta-1a formulation was among the earliest biologics targeting MS, setting the foundation for subsequent therapies. Despite being superseded in some markets by newer disease-modifying therapies (DMTs), BETASERON retains relevance due to its established efficacy and safety profile within specific patient subsets.

Global Market Size and Growth Trends

The global MS therapeutics market was valued at approximately USD 23 billion in 2022, driven by rising prevalence, early diagnosis, and expanding treatment indications [1]. The biologics segment, which includes interferons like BETASERON, accounts for a significant proportion, though its dominance is challenged by newer oral and infusion therapies.

In 2022, BETASERON's market share has diminished relative to high-efficacy agents such as natalizumab, ocrelizumab, and cladribine, mostly owing to its relatively modest efficacy and administration frequency. Nonetheless, it maintains a niche in regions with limited access to newer drugs or where cost constraints favor established biologics.

Regulatory and Patent Considerations

BETASERON is expected to face patent expiration in key markets within the next five years, with generic or biosimilar versions anticipated to enter the market. Patent exclusivity traditionally lasts 20 years from filing, but regulatory and legal hurdles often compress effective market exclusivity. The expiration will eventuate in increased competition, influencing market share and pricing.

Key Market Drivers

Disease Prevalence and Diagnosis Rates

MS prevalence varies globally but is generally measured at approximately 0.3% of the population in developed nations. Early diagnosis and ongoing management are crucial, ensuring continued demand for effective therapies like BETASERON.

Physician and Patient Preferences

Physician prescribing patterns are influenced by efficacy, safety, route of administration, and cost. BETASERON’s subcutaneous injections, administered weekly, are favored by some for convenience and familiarity. Patients prioritizing long-term safety may prefer established biologics over newer agents with limited long-run data.

Pricing and Reimbursement Dynamics

Reimbursement policies significantly impact BETASERON’s market viability. In markets where healthcare systems favor generic biologics, BETASERON's affordability sustains demand. Price reductions post-patent expiry can substantially affect profitability and market share.

Competitive Evolution

Emerging oral DMTs (e.g., fingolimod) and biosimilars threaten BETASERON’s market position. The shift toward personalized treatment regimens favors newer agents with higher efficacy or more convenient routes of administration.

Competitive and Regulatory Landscape

Emerging Biosimilars

The global trend toward biosimilar adoption is accelerating. For interferon beta-1a, biosimilar versions such as Samsung Bioepis’s Lusduna and others are under development or approved in various jurisdictions [2]. Entry of these biosimilars will exert downward pressure on BETASERON's pricing.

Newer Therapeutic Paradigms

High-efficacy agents, including ocrelizumab, alemtuzumab, and cladribine, demonstrate superior efficacy profiles with potentially improved patient adherence due to less frequent dosing schedules. Consequently, they are gaining market share at the expense of traditional interferons.

Regulatory Pathways and Market Access

Regulatory agencies increasingly favor biosimilars and value-based pricing mechanisms. Emerging guidelines facilitate smoother pathways for biosimilar approvals, thus fostering competition and potentially impacting BETASERON’s financial viability.

Financial Trajectory Analysis

Revenue Projections and Market Share

BETASERON’s revenues are anticipated to decline progressively as patent protections lapse and biosimilars gain approval and market adoption. For instance, Pfizer’s period of dominance with IFN-β products has waned with biosimilar entries in Europe and North America, leading to a sustained decline in sales [3].

Profitability and Cost Structure

As a mature biologic, BETASERON benefits from a relatively stable manufacturing cost profile but faces increased marketing and legal costs associated with biosimilar competition and patent defenses. Margins are likely to compress as price competition intensifies.

Potential Lifecycle Extension Strategies

To sustain revenues, companies may pursue strategies such as dosage optimization, formulation improvements, or expanded indications. Additionally, entering emerging markets with less price sensitivity could provide marginal growth.

Investment Outlook

Biotech investors should consider the pending patent expirations and biosimilar entries' timing. Short- to medium-term prospects hinge on legal protections and the success of biosimilars. Long-term, BETASERON’s value will depend on its role within niche patient populations and its integration into combination therapies.

Implications for Stakeholders

- Manufacturers: Need proactive pipeline development, biosimilar partnerships, or lifecycle management strategies to mitigate revenue erosion.

- Healthcare Providers: Must weigh efficacy, safety, and cost when choosing MS therapies, with BETASERON serving specific demographics.

- Patients: Preference for convenience and safety influences treatment adherence, impacting market demand.

- Payers and Regulators: Price controls and reimbursement policies will shape the competitive landscape.

Key Takeaways

- BETASERON remains relevant for certain patient cohorts but faces declining market share amid accelerated biosimilar competition and the rise of high-efficacy oral agents.

- Patent expiration within the next five years will likely lead to significant sales decline unless mitigated by lifecycle extension strategies or biosimilar integration.

- The global MS market is shifting towards personalized, effective, and convenient therapies, with biologics like BETASERON competing alongside innovative newer agents.

- Market success depends heavily on regulatory actions, pricing strategies, and regional healthcare policies that influence biosimilar adoption.

- Future profitability hinges on effective lifecycle management, diversification, and expansion into emerging markets with less price sensitivity.

FAQs

More… ↓