Share This Page

Drug Price Trends for BETASERON

✉ Email this page to a colleague

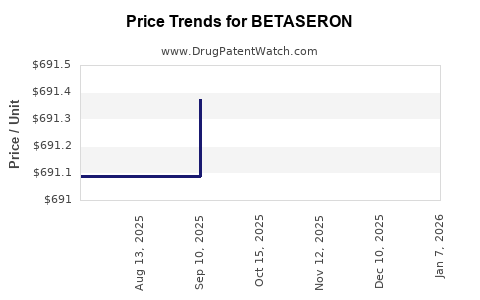

Average Pharmacy Cost for BETASERON

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BETASERON 0.3 MG KIT | 50419-0524-35 | 691.28589 | EACH | 2025-12-17 |

| BETASERON 0.3 MG KIT | 50419-0524-01 | 691.28589 | EACH | 2025-12-17 |

| BETASERON 0.3 MG KIT | 50419-0524-01 | 692.79571 | EACH | 2025-11-19 |

| BETASERON 0.3 MG KIT | 50419-0524-35 | 692.79571 | EACH | 2025-11-19 |

| BETASERON 0.3 MG KIT | 50419-0524-35 | 692.79571 | EACH | 2025-10-22 |

| BETASERON 0.3 MG KIT | 50419-0524-01 | 692.79571 | EACH | 2025-10-22 |

| BETASERON 0.3 MG KIT | 50419-0524-35 | 691.37464 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BETASERON (Interferon Beta-1a)

Introduction

BETASERON, developed by Bayer, is a leading medication used primarily for the treatment of multiple sclerosis (MS). Since its approval in 1987, BETASERON has established itself as a cornerstone therapy within the MS treatment landscape. This analysis provides a comprehensive overview of the current market dynamics, competitive positioning, regulatory considerations, and future price projections for BETASERON, aimed at equipping pharmaceutical and healthcare stakeholders with critical strategic insights.

Market Overview

Global Multiple Sclerosis Treatment Landscape

Multiple sclerosis affects over 2.8 million people worldwide, with a rising prevalence largely driven by improved diagnostics and increased awareness.[1] The MS therapeutics market is projected to reach $29.2 billion by 2027, with a compound annual growth rate (CAGR) of around 4.3%.[2] Key treatment modalities comprise disease-modifying therapies (DMTs), including interferons, monoclonal antibodies, oral agents, and emerging biotech innovations.

Positioning of BETASERON

As one of the earliest approved interferon beta-1a therapies, BETASERON occupies a significant niche—particularly in the early and relapsing forms of MS. Its long-standing record of efficacy, safety, and patient tolerability renders it a preferred option among neurologists, particularly in established markets such as North America and Europe.

Market Penetration and Adoption

BETASERON benefits from robust physician familiarity, extensive real-world experience, and cost-effectiveness relative to some newer DMTs. Its oral and injectable competitors, notably Avonex (also interferon beta-1a), Rebif, and newer oral agents like Tecfidera (dimethyl fumarate), have gained market share through ease of administration and innovative formulations.[3]

However, BETASERON’s complex administration schedule (initially weekly, later thrice weekly injections) and the presence of more convenient options have influenced its market penetration trajectory.

Competitive Landscape

Key Competitors

- Interferon Beta-1a (Rebif, Avonex): Similar efficacy profiles with varying administration frequencies.

- Interferon Beta-1b (Betaferon/Betaseron): Bayer’s own product, offering a differing administration route.

- Glatiramer Acetate (Copaxone): An alternative injectable DMT with different mechanisms.

- Oral Agents: Tecfidera, Aubagio, and Mavenclad dominate newer markets owing to user convenience.

- Monoclonal antibodies: Ocrevus and Tysabri provide high efficacy for aggressive MS forms.

Market Challenges

- Increasing preference for oral and infusion therapies.

- Concerns over long-term safety and side effects.

- Pricing pressures driven by payers’ cost-containment strategies.

- Patent expirations of some interferons reducing market exclusivity.

Regulatory and Patent Considerations

Patent Status

Bayer’s BETASERON patents began to expire in various jurisdictions starting in 2018. Patent expiry often results in generic competition, significantly impacting the drug’s market share and price.[4]

Regulatory Developments

The rise of biosimilars and advanced formulations, including peginterferons, constitutes ongoing regulatory challenges. European regulators, such as the EMA, have begun approving biosimilars for interferon beta products, heightening market competition.[5]

Pricing Dynamics and Projections

Current Pricing Structure

In the United States, BETASERON’s list price historically ranged between $34,000 and $40,000 annually per patient, influenced by administration method, insurance, and negotiated discounts.[6] This pricing remains competitive relative to newer biologics but is under pressure from biosimilar entrants.

Impact of Patent Expiry and Biosimilars

The imminent or recent launch of biosimilar interferon beta-1a products in key markets like Europe has led to a notable decline in prices, with reductions of up to 30-40% observed post-generic entry.[7] In the US, the biosimilar landscape is emerging, yet reimbursement and healthcare provider preferences will influence market acceptance.

Future Price Projections

Given patent expiry, biosimilar competition, and the shift toward oral therapies, BETASERON's price is expected to decline progressively:

- Short-term (next 1-2 years): Prices may decline marginally, around 10-15%, driven by payer negotiations and formulary adjustments.

- Medium-term (3-5 years): A more substantial decrease of 25-40% anticipated, especially with increased biosimilar penetration.

- Long-term (beyond 5 years): Potential obsolescence in major markets unless formulated as a biosimilar or reformulated version, possibly leading to price stabilization at a reduced level.

Pricing Strategies

Manufacturers might leverage strategies such as bundling, discounting, and patient assistance programs to retain market share amid rising competition. Payer pressure will likely prioritize lower-cost biosimilars where equivalent efficacy is demonstrated.

Market Forecasts

The overall MS therapeutics market is poised for steady growth, but BETASERON’s share within the interferon segment will diminish over time. The convergence of prices with biosimilars and the rise of oral therapies suggest that BETASERON could see a market share decline of up to 50% over the next five years.

In developed markets, where payers impose strict cost controls, prices could decline by approximately 20-30%. In emerging markets, where access and affordability are critical, BETASERON’s price could be maintained at lower levels, supporting continued usage.

Strategic Recommendations

- Innovation in Formulation: Developing longer-acting formulations or biosimilars to sustain competitiveness.

- Market Diversification: Expanding into emerging markets where MS prevalence and treatment access are increasing.

- Cost Management: Negotiating value-based pricing models and enhancing patient adherence programs.

- Partnering and Licensing: Collaborating with biosimilar manufacturers to mitigate patent risks and market share erosion.

Key Takeaways

- BETASERON remains a critical component of the MS therapeutic landscape but faces increasing competition from biosimilars and oral agents.

- Patent expirations have accelerated price declines, with expected reductions of up to 40% over the next five years.

- Its market share is projected to diminish significantly, especially in developed regions, unless strategic adaptations are implemented.

- Manufacturers should prioritize biosimilar development, formulation innovation, and tailored pricing strategies to sustain revenue streams.

- Healthcare stakeholders must monitor regulatory developments, biosimilar approvals, and payer policies to optimize formulary management.

FAQs

Q1: How does BETASERON compare to newer MS therapies in terms of efficacy?

A: BETASERON offers similar efficacy to other interferon beta therapies, effectively reducing relapse rates and lesion formation. However, newer oral agents like Tecfidera demonstrate comparable or superior efficacy with greater convenience.

Q2: What impact will biosimilar interferons have on BETASERON’s pricing?

A: Biosimilar entrants are expected to lead to significant price reductions—up to 40%—due to increased competition and payer preference for cost-effective options.

Q3: Are there upcoming regulatory changes that could affect BETASERON’s market viability?

A: Emerging biosimilar approvals and evolving reimbursement policies may challenge BETASERON’s market position, particularly in regions where biosimilar uptake is prioritized.

Q4: Is BETASERON still suitable for newly diagnosed MS patients?

A: While still efficacious and well-established, clinicians increasingly favor oral or less frequent injectable DMTs for new patients unless contraindicated or for specific clinical reasons.

Q5: How can manufacturers extend BETASERON’s market relevance?

A: Developing longer-acting formulations, entering biosimilar collaborations, and expanding into underserved markets can help preserve its market presence.

References

- Multiple Sclerosis International Federation. "Atlas of MS," 2020.

- Grand View Research. "Multiple Sclerosis Drugs Market," 2021.

- MarketsandMarkets. "MS Therapeutics Market," 2022.

- U.S. Patent and Trademark Office. Patent expiry timelines for interferon beta products.

- European Medicines Agency. Biosimilar approvals for interferon products, 2022.

- SSR Health. "US Immunology Market Data," 2022.

- IQVIA. "Generic and Biosimilar Trends," 2022.

More… ↓