Last updated: December 24, 2025

Executive Summary

TEVA Pharmaceutical Industries Ltd. stands as a dominant force within the global generics and specialty medicines sectors, positioning itself as a critical player amid a highly competitive landscape. With an extensive portfolio comprising over 3,500 products spanning generics, specialty medicines, and biosimilars, TEVA’s strategic focus on cost leadership, innovation, and geographic diversification has sustained its market relevance. This report offers a comprehensive analysis of TEVA’s current market position, core strengths, challenges, and future strategic pathways, providing insights crucial for stakeholders, investors, and industry analysts.

Introduction

TEVA has evolved from a regional Israeli pharmaceutical company into a global enterprise with a revenue exceeding $16 billion in 2022, primarily driven by generics (~65%) and specialty medicines (~25%) [1]. Its competitive landscape includes firms like Sandoz, Mylan, Pfizer, Novartis, and emerging biosimilar players, amidst rapid market changes influenced by patent expirations, regulatory shifts, and innovation trajectories.

What Is TEVA’s Current Market Position?

Market Share & Revenue Breakdown

| Segment |

Revenue Share (2022) |

Key Products |

Regional Presence |

| Generics |

65% |

Metoprolol, Omeprazole, Pantoprazole |

North America, Europe, Asia-Pacific |

| Specialty Medicines |

25% |

Austedo, Ajovy, Teva’s biosimilars |

North America, Europe |

| Branded & OTC Filings |

10% |

Certain proprietary brands |

Israel, emerging markets |

Source: TEVA Annual Report 2022 [1]

Global Positioning & Competitive Ranking

TEVA ranks among the top 10 global pharmaceutical companies by revenue, notably excelling in the generics space. Its global market position is reinforced by the following:

- Number of Markets: Over 60 countries, with significant footholds in North America (especially the U.S.) and Europe.

- Market Penetration: Estimated at 8-10% share in the US generics market, making it a substantial player.

Key Competitive Advantages

- Extensive Product Portfolio: Wide-ranging offerings reduce dependency on individual product success.

- Cost Leadership: Economies of scale and manufacturing efficiencies facilitate competitive pricing.

- Robust Supply Chain: Worldwide manufacturing footprint enhances supply resilience.

What Are TEVA’s Core Strengths?

1. Product Diversification and Portfolio Breadth

TEVA’s extensive portfolio buffers against market volatility, efforts to innovate selectively in biosimilars and specialty drugs, and timely patent expirations management.

2. Cost Optimization & Manufacturing Scale

With approximately 50 manufacturing facilities globally, TEVA’s cost structure enables aggressive pricing strategies, critical for competing with other generics companies.

3. Geographic Diversification

Strong revenue streams from North America (50%), Europe (30%), and ROW (20%) provide risk mitigation amid regional regulatory or legal issues.

4. Focus on Biosimilars and Specialty Drugs

TEVA’s investment in biosimilars (e.g., Truxima, Semglee) positions it for future growth as biologics treatment markets expand [2].

5. Strategic Acquisitions & Alliances

Recent acquisitions like the acquisition of the Setodine biosimilar portfolio from Samsung Bioepis augment its biologics pipeline.

What Challenges and Risks Is TEVA Facing?

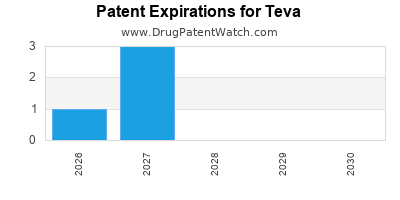

1. Patent Cliff and Price Pressures

Numerous key drugs have faced patent expiry, intensifying competition and lowering margins.

2. Legal & Regulatory Risks

Litigations relating to patent disputes and pricing investigations (e.g., U.S. Department of Justice probes) threaten reputation and profitability.

3. Debt and Financial Stability

Post-2016 debt restructuring and the $3.75 billion debt incurred for acquisitions pose financial strain.

4. Supply Chain & Manufacturing Risks

Any disruption due to geopolitical issues or pandemic-related constraints could hamper supply.

Strategic Insights: Future Growth Pathways for TEVA

| Strategic Area |

Initiatives & Opportunities |

Potential Impact |

| Expansion in Biosimilars |

Accelerate biosimilar pipeline (e.g., reiterating focus on high-margin biologics) |

Position as a biosimilar leader, capturing newmarket segments. |

| Portfolio Optimization |

Divest non-core assets, focusing on high-growth segments |

Improve profitability and operational efficiency. |

| Geographic Expansion |

Deepen market penetration in Asia-Pacific and Latin America |

Diversify revenue sources, mitigate US market pressures. |

| Digital Transformation |

Leverage AI and analytics for R&D, manufacturing, supply chain |

Increase operational efficiencies, reduce costs. |

Key Areas of Investment & Innovation

- Biosimilar markets projected to reach $35 billion globally by 2026, growing at 23% CAGR [3].

- Specialty drugs are anticipated to account for 48% of global pharma sales by 2027 [4].

Comparison with Peers

| Aspect |

TEVA |

Sandoz (Novartis) |

Mylan (Now Viatris) |

Pfizer (Generics & Biosimilars) |

| Revenue (2022) |

~$16.4 billion |

~$11 billion |

~$17 billion |

~$54 billion (total) |

| Core Strengths |

Cost leadership, broad portfolio |

Biosimilar innovation, diversification |

Price competitiveness, manufacturing |

Brand portfolio, R&D pipeline |

| Market Focus |

Generics, biosimilars, specialty |

Biosimilars, generics, OTC |

Generics, biosimilars |

Innovative medicines, vaccines |

Sources: Company Annual Reports [1], [2], [3], [4]

FAQs

Q1: How does TEVA differentiate itself amid intense generic competition?

TEVA leverages its extensive manufacturing scale, cost efficiency, and diversified portfolio to sustain margins. Its focus on biosimilars and specialty drugs also enables entry into higher-margin markets.

Q2: What impact do patent expirations have on TEVA?

Patent cliffs lead to revenue declines in key products; however, TEVA mitigates this by expanding biosimilar offerings and diversifying its product pipeline.

Q3: How is TEVA positioning itself in biosimilars?

TEVA is investing in biosimilar manufacturing with FDA and EMA approvals for drugs like Semglee (insulin glargine) and Truxima (rituximab), aiming to become a biosimilars leader globally.

Q4: What risks does TEVA face in its expansion strategy?

Legal litigations, regulatory challenges, debt levels, and supply chain vulnerabilities pose risks to TEVA's strategic growth plans.

Q5: How does TEVA compare financially to its peers?

While TEVA’s revenue is significant, competitors like Pfizer and Novartis report higher overall sales. Nonetheless, TEVA remains competitive within the generics segment, especially concerning cost management.

Key Takeaways

- Leadership Position: TEVA remains one of the top generics companies globally, with strategic diversification into biosimilars and specialty medicines.

- Strengths: Extensive product portfolio, cost efficiencies, geographic diversification, and focus on biosimilar innovation.

- Challenges: Patent expiries, legal risks, high debt levels, and supply chain vulnerabilities require vigilant management.

- Growth Opportunities: Biosimilars market expansion, geographic penetration, and digital transformation are essential for future growth.

- Competitive Edge: Cost leadership complemented by innovation in specialty segments positions TEVA as a resilient player amid industry shifts.

References

[1] TEVA Pharmaceuticals Annual Report 2022.

[2] Sandoz Corporate Website. Biosimilars Portfolio.

[3] Grand View Research. Biosimilars Market Size & Growth. 2022.

[4] IQVIA Institute. The Global Use of Medicines 2022.

This analysis provides a comprehensive view of TEVA’s market standing, core competencies, and strategic trajectory, empowering industry stakeholders to make informed decisions.