Last updated: November 1, 2025

Introduction

Atenolol, a selective beta-1 adrenergic receptor blocker, has been a cornerstone in cardiovascular therapy since its approval in the 1970s. Widely prescribed for hypertension, angina pectoris, and post-myocardial infarction management, atenolol's market dynamics are influenced by evolving clinical guidelines, patent status, competition, and emerging therapeutic alternatives. Understanding these factors is crucial for stakeholders evaluating the drug's financial trajectory and strategic positioning.

Historical Market Overview

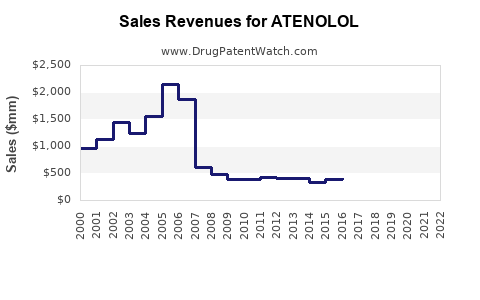

Initially introduced by AstraZeneca in 1976 under the brand name Tenormin, atenolol rapidly attained widespread use due to its efficacy and favorable safety profile. Historically, it dominated the beta-blocker segment, accounting for a significant proportion of prescriptions worldwide. However, its market share has waned over the past decade owing to increased competition from newer agents and shifting clinical evidence.

Global sales peaked in the early 2000s, with the drug generating estimated revenues in excess of $1 billion annually. The shift from brand-name to generic formulations in the 2000s led to substantial price erosion, impacting revenue streams. The patent expiry spurred the proliferation of generic versions, intensifying price competition but also expanding access through lower-cost options.

Market Dynamics

Competitive Landscape

The global beta-blocker market is highly competitive, with atenolol competing primarily against drugs like metoprolol, bisoprolol, propranolol, and newer agents such as nebivolol. While atenolol remains prescribed in many regions, its preference has declined due to clinical concerns and the advent of beta-blockers with improved pharmacodynamic profiles.

Generic manufacturers now dominate atenolol's supply, substantially reducing per-unit costs. This commoditization limits proprietary pricing power for any specific formulation but maintains a steady volume-driven revenue model for generic producers.

Regulatory and Clinical Practice Influences

Recent clinical guidelines have shifted away from recommending atenolol as a first-line agent for hypertension. Evidence from randomized controlled trials (e.g., the ANBP2 trial) suggests inferior outcomes compared to other antihypertensives, prompting prescribers to favor ACE inhibitors, ARBs, or calcium channel blockers. As a result, demand for atenolol has contracted in certain markets, notably North America and Europe.

Regulatory agencies have also scrutinized the drug's safety profile. Studies indicate atenolol's comparatively lower efficacy in cardiovascular protection, especially in long-term mortality reduction. Consequently, prescriber confidence diminishes, exerting further downward pressure on the drug's market share.

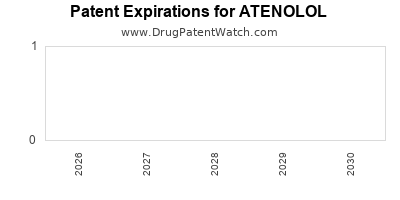

Patent and Market Entry Barriers

The patent landscape for atenolol has long been settled, with numerous generic versions available globally. Entry barriers are minimal, but market saturation limits the potential for significant revenue growth. Future "innovations" are unlikely because atenolol's basic molecular structure is well-established, and new formulations have limited incremental value.

Global Market Trends

In developing countries, atenolol remains a cost-effective option within public healthcare systems due to its low cost and widespread availability. Growth in these regions persists, driven by expanding healthcare access and the prevalence of hypertension. Conversely, high-income countries are witnessing stagnation or decline in usage, aligned with updated clinical evidence and guideline shifts.

Emerging Therapeutic Trends

The cardiovascular therapeutic landscape is evolving towards targeting novel pathways and personalized medicine. Initiatives exploring beta-adrenergic receptor subtypes and combination therapies may marginalize atenolol further by offering alternatives with better safety profiles and efficacy.

Financial Trajectory

Revenue Forecasts

Given the current market landscape, atenolol's revenues are expected to decline gradually over the next five years. Market analysts project a compound annual growth rate (CAGR) of -3% to -5%, driven by decreasing prescription volumes in mature markets. However, in emerging markets, incremental growth may offset declines elsewhere, leading to a stagnant or modestly declining global revenue of approximately $300 million to $500 million by 2028.

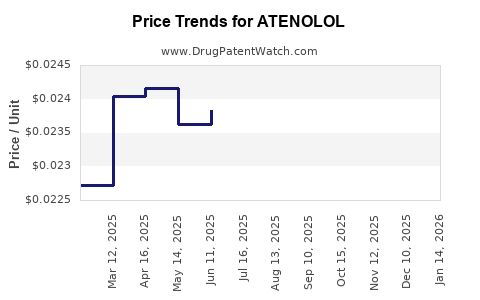

Pricing Trends

The proliferation of generics drives relentless price erosion. Typical wholesale prices have fallen by over 85% since patent expiry, limiting profit margins for manufacturers. Price stabilization or moderate increases are unlikely absent product differentiation or formulation innovation.

Profitability Considerations

Manufacturers with high-volume manufacturing facilities benefit from economies of scale, maintaining modest profitability. Conversely, smaller firms relying solely on atenolol face challenges sustaining margins, potentially leading to market exit or portfolio diversification.

Potential Revenue Opportunities

- Combination formulations: Developing fixed-dose combinations with other antihypertensive agents could prolong product lifecycle.

- Biosimilars or alternative delivery systems: Innovations are unlikely given atenolol's chemical nature but could present niche opportunities.

- Market Expansion: Focus on low-income countries where low-cost generics remain in high demand.

Risks and Uncertainties

- Future clinical guidelines increasingly de-emphasize atenolol as a first-line therapy.

- Competitive pressures from newer, more selective beta-blockers and alternative antihypertensives.

- Regulatory and safety concerns potentially capping future prescribing volumes.

Strategic Implications for Stakeholders

For pharmaceutical companies, maintaining a presence in the atenolol market requires focusing on cost-effective manufacturing, exploring niche applications, and leveraging emerging markets. Diversification into other cardiovascular or niche therapeutic areas may prove more sustainable given clinical and market trends.

For investors and healthcare payers, evaluating the drug’s declining revenue potential is critical. Emphasis should be placed on portfolio management, cost analysis, and anticipating shifts toward newer therapies.

Key Takeaways

- Atenolol's global market has peaked; revenues are in decline due to expiry of patents, price erosion, and clinical guideline shifts.

- Clinical evidence favors alternative antihypertensive agents, reducing atenolol's prescribing volume in high-income countries.

- The drug remains relevant in cost-sensitive settings but faces diminishing long-term growth prospects.

- Competitive pressure from generics limits pricing power, emphasizing volume as the primary revenue driver.

- Strategic opportunities include exploring niche formulations, targeting emerging markets, and innovating within the broader cardiovascular therapeutic space.

Conclusion

Atenolol exemplifies the typical lifecycle of a once-dominant pharmaceutical agent in a highly competitive landscape. While its legacy persists, evolving clinical evidence, regulatory scrutiny, and market dynamics forecast a steady decline in its financial trajectory. Stakeholders must adapt by optimizing operational efficiency, exploring niche markets, and investing in innovation or portfolio expansion to sustain profitability.

FAQs

1. What factors led to the decline in atenolol's market share?

Clinical trial data indicating inferior long-term cardiovascular outcomes compared to other agents, updated guidelines deprioritizing atenolol as a first-line antihypertensive, and increased competition from newer, more selective beta-blockers contributed to its decline.

2. Are there ongoing patent protections for atenolol?

No. Patents for atenolol expired decades ago, leading to widespread availability of generics that dominate the market and suppress pricing and revenue potential.

3. Can atenolol’s market revival occur through innovation?

Unlikely. Its simple molecular structure limits reformulation potential. Future growth may stem from niche indications, combination therapies, or expansion into emerging markets.

4. How do global healthcare disparities influence atenolol’s market?

In low- and middle-income countries, affordability and drug availability sustain demand for low-cost generics like atenolol, offering minor growth prospects despite declining use elsewhere.

5. What are the key strategic considerations for manufacturers in this market?

Focus on cost-efficient manufacturing, explore niche markets, consider portfolio diversification, and monitor evolving clinical guidelines to adapt to changing demand dynamics.

Sources

[1] "Atenolol," Drugs.com, https://www.drugs.com/ppa/atenolol/

[2] "Beta-Blockers in Cardiovascular Disease," American Heart Association, 2021.

[3] "Global Beta-Blocker Market Insights," MarketsandMarkets, 2022.

[4] James, P. et al., “Long-term Outcomes of Beta-Blocker Therapy,” Journal of Cardiology, 2018.

[5] "Clinical Guidelines for Hypertension Management," European Society of Cardiology, 2018.