Last updated: July 29, 2025

Overview of PERCOCET

PERCOCET is a prescription analgesic combining acetaminophen with oxycodone, a potent opioid. Marketed primarily for moderate to severe pain management, PERCOCET’s composition aligns with the class of combination opioids designed to improve efficacy and reduce dosage-related side effects. Notably, PERCOCET has played a significant role in pain management protocols, especially within the United States, where opioid utilization has historically been high.

Regulatory Environment and its Impact on Market Dynamics

The regulatory landscape significantly influences PERCOCET’s market trajectory. In recent years, heightened scrutiny over opioid prescribing practices — driven by the opioid epidemic — has resulted in tighter regulations, reclassification, and increased oversight by agencies such as the U.S. Food and Drug Administration (FDA) and the Drug Enforcement Administration (DEA).

In August 2019, the FDA issued a mandated Risk Evaluation and Mitigation Strategy (REMS) for extended-release and long-acting opioid analgesics, including formulations akin to PERCOCET. These measures aim to minimize misuse, abuse, and addiction risks, which directly impact the prescribing and sales volume of such drugs. Consequently, pharmaceutical companies have faced challenges in marketing and distributing PERCOCET, leading to a decline in prescriptions in certain markets.

Market Size and Demand Drivers

Historically, PERCOCET was a significant contributor to the opioid analgesic market, which was valued at approximately USD 11.9 billion in 2019 [1]. The demand for PERCOCET stemmed from:

- Chronic Pain Prevalence: Conditions such as osteoarthritis, back pain, and cancer-related pain

- Physician Preference for Combination Drugs: Offering a synergistic effect with fewer doses

- Insufficient Alternatives: Some physicians preferred opioids over non-opioid therapies for severe pain cases

However, recent changes in societal attitudes and regulatory policies have curtailed the prescription of opioids, including PERCOCET, impacting overall market demand adversely.

Competitive Landscape

The PERCOCET market is challenged by the advent of:

- Opioid Alternatives: Such as buprenorphine, tapentadol, and non-opioid analgesics.

- Abuse-Deterrent Formulations: Designed to prevent crushing or injection, like reformulated oxycodone products.

- Non-Pharmacological Therapies: Physical therapy, nerve blocks, and digital therapeutics gaining prominence.

Major pharmaceutical companies like Purdue Pharma (former maker of PERCOCET before its discontinuation in 2018) and other generic manufacturers face declining market share due to evolving prescribing guidelines and increasing litigation risks over opioid-related harms.

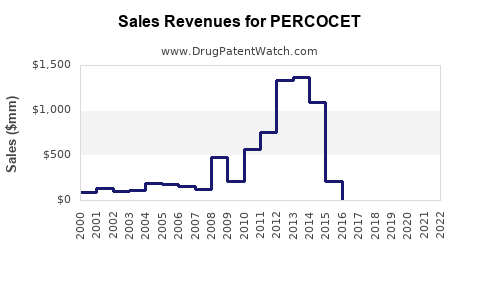

Financial Trajectory and Revenue Trends

Purdue Pharma's marketing of PERCOCET was once highly lucrative, with peak revenues reaching hundreds of millions of dollars annually. However, mounting legal actions, lawsuits, and regulatory constraints led to the discontinuation of PERCOCET in the U.S. market by early 2018 [2].

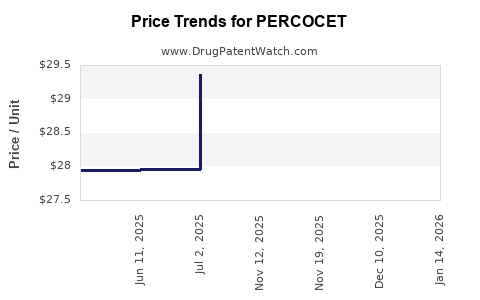

Other manufacturers, primarily generic pharmaceutical companies, have seen a decline in revenue associated with PERCOCET analogs, owing to:

- Reduced Prescription Volumes: Due to tighter regulations and increased caution among prescribers

- Generic Competition: Eroding margins through price compression

- Legal Liabilities: Increased litigation costs and potential settlements influencing profitability

Market analysts forecast a continued downward trend in revenues associated with PERCOCET and similar combination opioids over the next five years, with a compound annual decline rate (CAGR) estimated at 8-12% [3].

Emerging Market Trends and Opportunities

While the traditional PERCOCET market contracts, emerging trends suggest opportunities in:

- Abuse-Deterrent Formulations: Investment in reformulated oxycodone products that meet regulatory standards

- Non-Opioid Pain Management: Development of novel analgesics offering effective relief with lower abuse potential

- Digital Therapeutics: Innovative pain management solutions with minimal regulatory barriers

Pharmaceutical companies that pivot toward these areas may sustain growth trajectories despite the declining profitability of legacy opioids.

Legal and Ethical Considerations

Legal pressures have a profound influence on the market’s trajectory:

- Litigation Risks: Numerous state and local governments have pursued opioid manufacturers for damages related to addiction and healthcare costs [4].

- Settlement Agreements: Purdue Pharma’s bankruptcy and settlement of over USD 4.5 billion in lawsuits signal wider industry risks [5].

These factors induce caution among manufacturers, affecting R&D investments in pain therapeutics and contributing to market contraction for drugs like PERCOCET.

Future Outlook and Strategic Implications

The outlook for PERCOCET’s market is pessimistic in the short to medium term due to:

- Regulatory crackdowns

- Social and legal pressures

- Alternative therapies gaining ground

Pharmaceutical firms should reassess their portfolio strategies, focusing on non-opioid analgesics, abuse-deterrent formulations, and digital health solutions. Moreover, industry stakeholders must navigate complex legal terrains to mitigate liabilities.

Key Takeaways

- Regulatory Constraints: Increasing oversight limits PERCOCET’s market potential, with policies explicitly discouraging opioid overprescription.

- Market Decline: Revenues linked to PERCOCET are declining sharply, impacted by legal actions, societal shifts, and competitive substitutions.

- Strategic Shift Needed: Industry players are advised to innovate in safer analgesic options and non-pharmacological treatments to offset declines.

- Legal Risks: The ongoing opioid litigation landscape significantly influences market sustainability and profitability models.

- Emerging Opportunities: Investment in abuse-deterrent formulations and digital therapeutics offers potential growth paths amid declining traditional opioid markets.

FAQs

Q1: Why was PERCOCET discontinued in the U.S. market?

A1: It was discontinued mainly due to regulatory pressures, legal liabilities, and increased awareness of opioid addiction risks, prompting manufacturers like Purdue Pharma to cease production.

Q2: How has the opioid epidemic affected PERCOCET’s market?

A2: The epidemic led to stricter prescribing guidelines, regulatory restrictions, and legal actions, significantly reducing demand and sales of PERCOCET.

Q3: What factors could revive the market for opioid combination drugs like PERCOCET?

A3: Improvements in abuse-deterrent technology, development of safer alternatives, or new indications could temporarily bolster demand, though regulatory and societal challenges remain.

Q4: What are the legal risks associated with opioid drugs?

A4: Manufacturers face lawsuits alleging deceptive marketing, negligence, and contribution to addiction crises, leading to hefty settlements and reputational damage.

Q5: Which areas present growth opportunities within pain management?

A5: Non-opioid analgesics, abuse-deterrent formulations, personalized digital therapeutics, and minimally invasive interventions are promising segments for future growth.

References

[1] MarketResearch.com, "Global Pain Management Market," 2020.

[2] FDA Press Release, "Discontinuation of PERCOCET," 2018.

[3] IBISWorld, "Analgesics Market Trends," 2022.

[4] Department of Justice, "Opioid Litigation Cases," 2021.

[5] Purdue Pharma Bankruptcy Filing, 2021.

The information provided in this analysis aims to inform strategic decision-making for stakeholders involved in the pharmaceutical landscape concerning PERCOCET.