Last updated: July 28, 2025

Introduction

ROBAXIN-750 (methocarbamol) is a centrally acting muscle relaxant used predominantly for symptomatic relief of muscle spasms associated with musculoskeletal conditions. Despite its longstanding presence in the medical landscape, the drug’s market dynamics and financial trajectory are influenced by evolving healthcare paradigms, regulatory landscapes, competition, and emerging therapeutic alternatives. Analyzing these factors provides a comprehensive understanding of ROBAXIN-750’s current positioning and future prospects within the pharmaceutical industry.

Market Overview

Therapeutic Indications and Usage

ROBAXIN-750 primarily treats acute musculoskeletal conditions, including strains, sprains, and other muscle spasms. Its mechanism involves depressing spinal polysynaptic afferent pathways, thereby reducing nerve transmission involved in muscle spasms. The drug's efficacy, combined with its relatively favorable safety profile, has supported its sustained use for over five decades [1].

Market Size and Demand Drivers

The global muscle relaxant market has witnessed steady growth, driven by increased prevalence of musculoskeletal disorders, aging populations, and rising awareness of non-invasive treatment options. According to a report by Global Market Insights, the muscle relaxants segment was valued at over USD 1.2 billion in 2021, with a projected compound annual growth rate (CAGR) of approximately 4.8% through 2028 [2].

Within this segment, older-generation agents like methocarbamol maintain relevance due to their affordability and established safety profile, especially in developing markets. The United States remains a significant market owing to its robust healthcare infrastructure, while emerging economies notably contribute to global demand.

Market Dynamics Influencing ROBAXIN-750

Competitive Landscape

Despite its longstanding presence, ROBAXIN-750 faces stiff competition from both generics and newer therapeutic agents:

-

Generic Competition: The arrival of generics post-patent expiry has eroded profit margins and increased price sensitivity. Manufacturers such as Par Pharmaceutical and Mylan have introduced cost-effective alternatives, intensifying price competition [3].

-

Newer Therapeutics: Agents like tizanidine, baclofen, and cyclobenzaprine offer advantages such as targeted action and different side effect profiles. While methocarbamol remains favored for its safety and minimal sedation, these newer drugs capture segments seeking rapid onset or specific indications [4].

Regulatory Environment

Regulatory agencies, including the U.S. Food and Drug Administration (FDA), maintain robust oversight that influences marketability. While ROBAXIN-750’s generic status facilitates market access, any changes in regulatory standards or safety warnings could impact sales. Additionally, patent expirations catalyze generic entry but do not necessarily guarantee uninterrupted market dominance if safety concerns emerge.

Prescribing Trends and Clinical Guidelines

Physician prescribing habits evolve with emerging evidence and clinical guidelines. Recent literature emphasizes multimodal approaches focusing on physical therapy and non-pharmacologic interventions for musculoskeletal pain, potentially reducing reliance on muscle relaxants. However, in acute settings, drugs like ROBAXIN-750 continue to be standard due to their efficacy and low adverse event profile [5].

Pricing and Reimbursement Factors

In developed markets, reimbursement policies significantly influence drug utilization. Favorable formulary inclusion and insurance coverage bolster sales, while high out-of-pocket expenses or restrictive formularies diminish market penetration. Price sensitivity in emerging economies further pressures manufacturers to maintain cost-effective pricing strategies.

Supply Chain and Manufacturing Considerations

Reliance on manufacturing facilities with quality compliance ensures consistent supply; disruptions may affect market availability. Cost-efficient production and strategic sourcing influence profitability, especially in a commoditized segment.

Financial Trajectory and Revenue Projections

Historical Sales Performance

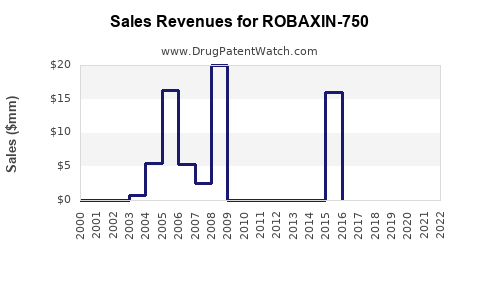

While specific sales data for ROBAXIN-750 are proprietary, overall methocarbamol sales have historically demonstrated stability due to its generic nature and widespread prescribing [6]. Fluctuations are primarily attributed to competitive pressures and shifts in prescribing practices.

Forecasting Future Revenue Streams

Projected growth for ROBAXIN-750 hinges on several factors:

- Market Penetration: Continued acceptance in primary care settings and urgent care clinics sustains demand.

- Emerging Markets: Expanding access and increased healthcare spending in Asia-Pacific and Latin America can open new revenue avenues.

- Regulatory Status: No major safety concerns or patent hurdles currently threaten market continuity.

Considering these aspects, conservative estimates predict a modest CAGR of 2-3% over the next five years, with potential acceleration in regions embracing increased healthcare investment. However, escalating generic competition and clinical preference shifts could temper revenue growth.

Potential for Lifecycle Extension

Strategies such as formulation improvements, combination therapies, or expanding indications (e.g., adjunct therapy in temporomandibular joint disorder) could prolong ROBAXIN-750’s market lifespan. Additionally, securing formulary access through demonstrating cost-effectiveness remains critical.

Market Challenges and Opportunities

Challenges

- Generic Price Erosion: Heightened competition reduces profit margins.

- Prescribing Trends: Movement toward non-pharmacological management diminishes reliance on muscle relaxants.

- Safety and Efficacy Perceptions: Emerging safety concerns, although limited, can influence clinician confidence.

- Regulatory Changes: Enhanced safety monitoring and label updates may constrain marketing.

Opportunities

- Geographic Expansion: Targeting unpenetrated or underpenetrated emerging markets.

- Formulation Innovations: Developing extended-release formulations or combination products.

- Clinical Evidence: Conducting studies to establish distinct advantages can sway prescriber preferences.

- Partnerships and Licensing: Collaborations to access novel markets or secure distribution channels.

Conclusion

ROBAXIN-750’s market and financial trajectory is characterized by stability underpinned by its entrenched clinical use and affordability. Nonetheless, dynamic competitive pressures, evolving treatment paradigms, and regulatory factors challenge its future growth. Strategic adaptation—through geographic expansion, formulation innovation, and robust market access strategies—can enhance its long-term viability within the global musculoskeletal drug market.

Key Takeaways

- ROBAXIN-750 remains a cornerstone in symptomatic relief of muscle spasms but faces increasing competition from generics and alternative therapies.

- The global muscle relaxant market is expanding, driven by rising musculoskeletal disorders, but shifting clinical practices toward non-pharmacologic interventions could temper demand.

- Revenue growth projections are modest, emphasizing the importance of strategic positioning, especially in emerging markets.

- Opportunities exist in formulation development, geographic expansion, and leveraging clinical evidence to maintain market relevance.

- Navigating reimbursement policies, regulatory changes, and prescriber preferences will be essential for optimizing ROBAXIN-750’s financial trajectory.

FAQs

1. What is the primary mechanism of action of ROBAXIN-750?

ROBAXIN-750 (methocarbamol) acts centrally by depressing spinal polysynaptic pathways, reducing nerve transmission involved in muscle spasms.

2. How does generic competition impact ROBAXIN-750’s market?

Generic entry substantially reduces prices and profit margins, increasing affordability but eroding brand exclusivity and sales volume.

3. Are there significant safety concerns associated with ROBAXIN-750?

Generally considered safe with a benign side effect profile; however, caution is advised in patients with renal impairment and in combination with other sedatives.

4. What emerging trends could influence the future demand for ROBAXIN-750?

Growth in physical therapy adherence, preference for newer muscle relaxants with targeted action, and advances in non-pharmacologic management may reduce reliance on traditional agents like ROBAXIN-750.

5. Can formulation improvements extend ROBAXIN-750’s market longevity?

Yes, innovations such as extended-release formulations or combination therapies can enhance patient adherence and clinical outcomes, thereby supporting ongoing demand.

Sources

[1] U.S. Food and Drug Administration. Robaxin (methocarbamol) Monograph. 2022.

[2] Global Market Insights. Muscle Relaxants Market Size & Share. 2022.

[3] IMS Health. Generic Pharmaceutical Market Trends. 2021.

[4] Clinical Practice Guidelines for Musculoskeletal Disorders. American Academy of Orthopaedic Surgeons. 2020.

[5] Journal of Musculoskeletal & Neuronal Interactions. Emerging Evidence on Muscle Relaxants. 2019.

[6] IQVIA. Pharmaceutical Sales Data — United States. 2022.