Last updated: July 27, 2025

Introduction

Endo International plc stands as a prominent player in the pharmaceutical industry, primarily focusing on specialty and generic pharmaceuticals. Its operations encompass a diverse portfolio that spans across pain management, urology, women's health, and other therapeutic areas. This report offers a comprehensive analysis of Endo’s market position, operational strengths, and strategic initiatives within the competitive landscape, providing vital insights for stakeholders and industry analysts.

Endo’s Market Position

Global Footprint and Market Share

Endo operates in over 100 countries, positioning itself as a key player in both North American and select international markets. Its core revenue streams derive from the U.S. pharmaceutical market, which remains one of the most lucrative but intensely competitive sectors globally. According to recent industry reports, Endo commands an approximate 2-3% share in the pharmaceutical sales landscape, with notable dominance in niche segments like pain management and urology.

Competitive Standing

Endo’s market positioning is challenged by larger conglomerates such as Johnson & Johnson, Pfizer, and Teva Pharmaceutical Industries, which possess extensive portfolios and R&D resources. Yet, Endo’s strategic focus on specialized therapeutic areas allows it to carve out significant customer loyalty and brand recognition within targeted niches. The company's recent restructuring efforts and portfolio realignment aim to bolster its competitiveness amid mounting patent expirations and regulatory pressures.

Operational Strengths

Product Portfolio and Innovation

Endo’s diversified product pipeline encompasses both branded and generic medicines. The firm’s flagship products include active ingredients and formulations utilized in pain relief, urology, and hormone therapy, notably the opioid analgesic sector, which, despite regulatory scrutiny, remains financially significant for the company. Moreover, Endo invests substantially in biosimilars and complex generics, emphasizing its commitment to innovation and market expansion.

Manufacturing and Supply Chain

Endo benefits from integrated manufacturing capabilities that support quality control and cost efficiency. Its facilities are strategically located within the United States and the EU, enabling rapid response to market demands and regulatory compliance. Supply chain resilience, especially amid global disruptions, remains a core operational advantage, supported by robust logistics networks and inventory management systems.

Regulatory and Compliance Competency

Navigating stringent regulatory landscapes, Endo maintains an accreditations portfolio that facilitates swift product approvals and market entry. The company’s proactive engagement with the FDA and EMA has historically enabled it to improve product lifecycle management and compliance standards.

Market Relationships and Distribution Channels

Endo’s longstanding relationships with healthcare providers, wholesalers, and pharmacy chains underpin a stable distribution network. This widespread access, coupled with targeted marketing strategies, sustains its revenue streams even amidst competitive pressures.

Strategic Insights

Portfolio Diversification and Market Expansion

Endo’s recent strategic refocus involves divesting non-core assets and concentrating on high-margin, specialized segments like biosimilars and complex injectables. This aligns with industry trends emphasizing personalized medicine and high-value therapies. The company is also exploring emerging markets such as Asia-Pacific, where aging populations and increasing healthcare expenditure present growth opportunities.

Innovation and R&D Investments

While historically less R&D-intensive than some competitors, Endo has ramped up investments in pipeline development, particularly in biosimilars. Collaborations with biotech firms and licensing agreements are integral to its innovation strategy, aiming to fill the expanding gap left by patent expirations on key products.

Regulatory and Patent Strategy

Endo actively manages its patent portfolio through litigation, licensing, and patent filings to extend product lifecycle and mitigate generic competition. Its focus on complex formulations provides a strategic moat against generic erosion, especially in the U.S. market.

Risk Management and Portfolio Optimization

Given past legal challenges and opioid litigation risks, Endo emphasizes risk mitigation through legal compliance and diversified operations. Portfolio optimization includes divestitures like the sale of its generics business to focus resources on specialty medicines and branded products.

Digital Transformation and Market Responsiveness

Investment in digital health tools, data analytics, and streamlined supply chain management enhances operational efficiency and market responsiveness. Such technological modernization positions Endo to adapt swiftly to changing regulatory and market dynamics.

Challenges and Opportunities

Challenges

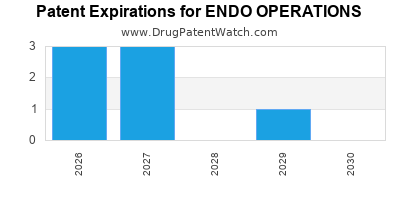

- Patent Expirations and Generic Competition: The loss of market exclusivity for key products compresses margins.

- Regulatory and Legal Risks: Ongoing litigations, notably related to opioids, pose reputational and financial threats.

- Pricing Pressures: Heightened scrutiny on drug prices in major markets demands strategic pricing and value demonstration.

Opportunities

- Growth in Biosimilars: Increasing acceptance offers revenue expansion and market foothold.

- Emerging Markets Expansion: Demographic trends support increased demand in Asia-Pacific and Latin America.

- Specialized Therapeutic Focus: Personalized and high-margin drugs present long-term growth avenues.

Conclusion

Endo’s operational strengths—robust product portfolio, manufacturing expertise, and strategic market focus—serve as pillars supporting its competitive stance. While industry challenges such as patent cliffs and regulatory pressures persist, targeted investments in biosimilars, emerging markets, and digital transformation enable the company to refine its strategic positioning. To sustain competitive advantage, Endo must continue to innovate, diversify, and navigate complex legal landscapes effectively.

Key Takeaways

- Endo maintains a significant niche leadership in pain management and urology, supported by a diversified product portfolio and strong manufacturing capabilities.

- Strategic divestitures and a focus on biosimilars and complex generics position Endo for future growth amid patent expirations.

- Operational resilience, including supply chain robustness and regulatory expertise, underpins its market stability.

- Navigating legal risks and pricing pressures remains critical, necessitating proactive legal and commercial strategies.

- Expansion into emerging markets and digital innovation are vital for capturing new opportunities and enhancing operational efficiency.

FAQs

Q1: How does Endo differentiate itself from larger pharmaceutical competitors?

Endo’s focus on niche therapeutic areas, complex generics, and biosimilars allows it to operate with less direct competition compared to giants dealing with broader portfolios. Its specialized product development and targeted marketing strategies foster customer loyalty in key segments.

Q2: What are Endo's primary growth drivers moving forward?

Growth will stem from expanding biosimilars, penetrating emerging markets, and investing in innovative complex generic formulations. Additionally, strategic pipeline development and potential acquisitions will be pivotal.

Q3: How does Endo mitigate the risks associated with opioid litigation?

Endo emphasizes legal compliance, transparency, and risk management protocols. Diversification into non-opioid segments also reduces reliance on opioid sales, helping buffer legal and reputational risks.

Q4: What role does digital transformation play in Endo’s strategic initiatives?

Digital tools enhance supply chain management, regulatory compliance, and market analytics, enabling Endo to respond swiftly to demand fluctuations and regulatory changes, thus maintaining operational agility.

Q5: Is Endo planning any significant acquisitions or divestments?

While specific moves depend on market conditions, Endo has recently prioritized divesting non-core assets to focus on high-margin therapeutics. Future acquisitions are likely aligned with expanding biosimilars and emerging market presence.

References

- Endo International plc Annual Report 2022.

- Industry analysis reports by EvaluatePharma and IQVIA.

- Market share data from Pharma Intelligence and IQVIA.

- Regulatory updates from the FDA and EMA publications.

- Strategic market projection studies from McKinsey & Co.