Executive Summary

The advent of biosimilars has initiated a profound transformation within the biologic drug distribution landscape, fundamentally reshaping traditional models. Driven by compelling imperatives for cost reduction and expanded patient access, biosimilars introduce a dynamic interplay of market forces and regulatory nuances that challenge established practices and foster new opportunities across the entire supply chain. This report delineates how the inherent complexity and specialized handling requirements of biologics, coupled with the economic pressures exerted by biosimilars, necessitate a shift towards more agile, technology-driven, and payer-influenced distribution paradigms. The evolving environment underscores the critical role of intensified market competition and expanded patient access in redefining the flow of these essential medicines.

The introduction of biosimilars presents a discernible “paradox of progress” in the distribution of these complex therapeutic agents. While biologics are inherently intricate, expensive, and demand specialized handling, their traditional distribution often relied on a “push” model from manufacturers.1 Biosimilars emerged as a solution, promising substantial cost savings and broader patient access, which undeniably represents a significant advancement for healthcare systems and patients.5 However, this progress does not simplify the distribution model. Instead, it introduces additional layers of complexity, including the management of a dual market comprising both originator and biosimilar products, the navigation of intricate pricing and rebate strategies, and the imperative to overcome significant perception issues among healthcare providers and patients.11 Consequently, the overall progress in cost savings and access is accompanied by a paradoxical increase in the operational and strategic complexity of the distribution system. This necessitates a heightened degree of sophistication, adaptability, and data-driven decision-making from all stakeholders to effectively manage the flow of these critical medications.

Furthermore, the distribution model is transitioning from a product-centric to a value-centric approach. Historically, biologic distribution was primarily product-centric, driven by the unique clinical attributes of innovator biologics and the manufacturer’s “push” strategy.2 The focus was predominantly on ensuring the product reached the market. The entry of biosimilars, however, fundamentally shifts the market’s focus towards cost-effectiveness and patient affordability.5 This economic imperative significantly empowers payers, including Pharmacy Benefit Managers (PBMs), Managed Care Organizations (MCOs), and Integrated Delivery Networks (IDNs), positioning them as central drivers in the distribution landscape. These entities actively leverage formularies, utilization management tools, and “lowest net cost” strategies to influence prescribing and dispensing decisions.12 This indicates that the distribution model is no longer solely dictated by product availability or clinical uniqueness. Instead, it is increasingly shaped by the drug’s value proposition, particularly its cost-effectiveness, as determined and enforced by payers. This reorientation of distribution strategy demands greater flexibility and responsiveness from the entire supply chain to align with a value-driven mandate.

1. Introduction to Biologics and Biosimilars

1.1. Defining Biologics: Characteristics, complexity, and specialized handling requirements

Biologics constitute a distinct and complex class of therapeutic products derived from living organisms or their components, such as cells, tissues, or microorganisms.1 Unlike conventional chemically synthesized drugs, biologics are characterized by their relatively large and intricate molecular structures, often composed of proteins, carbohydrates, or nucleic acids.1 This inherent complexity extends to their manufacturing and purification processes, which are significantly more complicated and expensive than those for small-molecule drugs, directly contributing to their high market cost.1 The intricate biological origins and production methods also mean that biologics naturally exhibit variability, even between different batches of the same product.5

A critical aspect distinguishing biologic distribution is the absolute requirement for specialized handling, particularly rigorous adherence to “cold chain” logistics. These products consistently necessitate refrigeration, typically maintained at 2-8°C, throughout their entire journey from the manufacturing facility to the patient’s administration site.1 This stringent temperature control is paramount to prevent degradation, maintain product integrity, and avoid contamination by microbes or other unwanted substances, thereby preserving efficacy and safety.1 Furthermore, biologics are typically administered to patients via injection or infused directly into the bloodstream 1, which influences the points of care where they are dispensed and administered, such as hospitals, clinics, or specialty pharmacies. Prominent examples of biologics include blockbuster monoclonal antibodies like Remicade, Enbrel, Humira, and Avastin, which are among the top-selling drugs globally, alongside other categories such as TNF inhibitors, IL inhibitors, and various cell and gene therapies.1

1.2. Defining Biosimilars: “Highly similar” concept, regulatory approval pathways (FDA, EMA), and the significance of interchangeability

A biosimilar is a therapeutic drug that is demonstrated to be “highly similar,” but not structurally identical, to an already approved brand-name biologic, referred to as the reference product.1 Due to the inherent complexity and natural variability of biologics, biosimilars cannot be exact replicas, a fundamental distinction from small-molecule generics.1 For approval, biosimilars must demonstrate “no clinically meaningful differences” from the reference product in terms of safety, purity, and potency, ensuring comparable therapeutic effects.1

FDA Approval (United States): The regulatory pathway for biosimilars in the U.S. was established by the Biologics Price Competition and Innovation Act (BPCIA) of 2010.21 This legislation created an abbreviated approval pathway (Biologics License Application, BLA) specifically designed to promote competition, reduce healthcare costs, and increase patient access to biologic therapies.21 Approval necessitates comprehensive data derived from analytical studies (structural and functional tests), animal studies (toxicity tests), and/or clinical studies (tests in human patients) to demonstrate biosimilarity.1 As of late 2024, the FDA had approved over 60 biosimilar products, with a record 18 approvals in 2024 alone, signaling continued growth as exclusivity periods for reference products expire.21

EMA Approval (European Union): The European Union pioneered biosimilar regulation, with the European Medicines Agency (EMA) approving its first biosimilar in 2006.18 The EMA evaluates biosimilars using the same rigorous standards of pharmaceutical quality, safety, and efficacy that apply to all other biological medicines approved in the EU.18 The EMA and the Heads of Medicines Agencies (HMA) have emphasized that EU-approved biosimilars are “interchangeable from a scientific viewpoint,” meaning they can be used in place of their reference product, or vice versa.18 However, it is important to note that individual EU Member States retain the authority to decide on automatic substitution at the pharmacy level.18

Interchangeability Designation (United States): A unique feature within the U.S. regulatory landscape, an “interchangeable biological product” is a biosimilar that meets additional FDA requirements beyond basic biosimilarity. This designation permits it to be substituted for the reference product at the pharmacy without requiring prior intervention from the prescribing healthcare provider, analogous to how generic drugs are routinely substituted for brand-name drugs.10 Achieving this designation typically requires additional data, often from “switching studies,” to demonstrate that safety and effectiveness are not diminished when alternating between the biosimilar and reference product.25 It is crucial to understand that a biosimilar lacking this designation is not considered inferior in quality or clinical effectiveness; rather, it often indicates that the manufacturer did not seek this additional designation, possibly due to business reasons or because the medication is primarily administered in a hospital or outpatient clinic rather than dispensed by a retail pharmacy.20 The primary relevance of the interchangeability designation is for products dispensed in a retail pharmacy setting.27

1.3. The Economic Imperative: Role of biosimilars in healthcare cost reduction and expanding patient access

The primary driver for the development and adoption of biosimilars is their profound potential to significantly reduce healthcare costs by offering a less expensive alternative to costly originator biologics.5 The cost savings generated by biosimilars are substantial and have a tangible impact on healthcare systems. In 2022, generic and biosimilar drugs combined generated a record $408 billion in savings for the U.S. healthcare system, patients, and taxpayers.9 Biosimilars alone contributed $9.4 billion in savings in 2022, accumulating to $23.6 billion since their first entry in 2015.9 Projections indicate even greater future savings, with estimates suggesting a $44.2 billion reduction in direct spending on biologic drugs from 2014-2024 8 and up to $181 billion through 2027.28

On average, the wholesale acquisition cost (WAC) or average sales price (ASP) for biosimilars can be 30-50% lower than their reference brand biologic price at the time of launch.9 Furthermore, the competitive pressure introduced by biosimilars has been shown to reduce the average sales price of their corresponding brand biologics by an average of 25%.9 This price competition is critical for alleviating the financial burden on healthcare systems.

Beyond direct cost savings, biosimilars play a crucial role in increasing patient access to potentially life-saving or life-improving medications, especially for underserved communities and low-income families who might otherwise struggle to afford treatment.6 This expanded access has translated into hundreds of millions of incremental days of patient therapy that might not have been otherwise accessible. For instance, since 2015, biosimilars have been used in almost 700 million days of patient therapy, with 344 million days representing care that patients would not have received otherwise.9 This demonstrates the significant public health benefit derived from the availability of more affordable biologic treatment options.

The “highly similar, not identical” nuance of biosimilars presents a unique distribution challenge. Biologics are complex molecules with inherent natural variability.1 Biosimilars, while rigorously tested, are “highly similar” but cannot be exact replicas, a fundamental distinction from small-molecule generics.1 This inherent difference necessitates a more stringent and complex approval process for biosimilars compared to generics.6 Crucially, this characteristic contributes to perceived differences and uncertainties among healthcare providers and patients regarding their equivalence and interchangeability.16 This perception directly impacts biosimilar adoption rates and, consequently, the volume and speed at which these products flow through distribution channels. The distribution model, therefore, cannot rely solely on a cost advantage; it must actively address these nuanced perceptions. This requires significant investment in targeted education and trust-building initiatives for all stakeholders, adding a critical “soft” element to the traditionally “hard” logistics of drug distribution.14

Regulatory frameworks, while intended to enable market entry, can also act as bottlenecks. Regulatory bodies like the FDA in the U.S. and the EMA in the EU explicitly designed their frameworks to enable biosimilar market entry and foster competition.18 However, the differing implementation details, particularly concerning patent litigation processes and the specific requirements for interchangeability, have led to varied market outcomes. The EU’s earlier and more unified scientific stance on interchangeability appears to have facilitated higher biosimilar adoption compared to the U.S., where the interchangeable designation is an additional and costly hurdle for manufacturers.18 This divergence implies that regulatory design is not merely a compliance issue but a fundamental determinant of the speed, volume, and predictability of biosimilar flow through distribution. Persistent patent litigation in the U.S., for instance, creates significant delays, acting as a bottleneck that directly impacts supply chain planning and market penetration.32 Harmonization and streamlining of regulatory processes globally could unlock greater efficiency in distribution.

The economic imperative, while a powerful catalyst for biosimilar market growth, functions as a double-edged sword for distribution. The core value proposition of biosimilars is their ability to reduce healthcare costs 5, creating a strong incentive for payers to drive adoption.12 However, this intense focus on cost savings, while beneficial overall, introduces significant complexities into the distribution model. It leads to intricate formulary strategies, aggressive rebate negotiations, and a dynamic pricing environment that influences wholesaler margins and pharmacy purchasing decisions.11 The economic imperative, while a powerful catalyst for biosimilar market growth, simultaneously creates volatility and introduces new layers of financial and operational complexity within the distribution network. All players must adapt their business and operational models to a highly price-sensitive and negotiation-driven environment, where the “lowest net cost” often dictates the flow of goods, challenging traditional, more predictable distribution patterns.

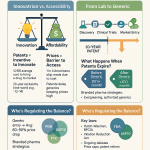

Table 1: Key Differentiating Characteristics: Biologics vs. Biosimilars

| Characteristic | Biologics | Biosimilars |

| Nature | Made from living organisms (cells, tissues, microorganisms) 1 | Highly similar copy of an approved biologic 1 |

| Molecular Complexity | Large, complex molecules (proteins, carbohydrates, nucleic acids) 1 | Highly similar but not identical to reference product 1 |

| Manufacturing | Complex, expensive, and subject to natural variability 1 | Complex, expensive, aims for high similarity to reference product 1 |

| Regulatory Approval Pathway | Full Biologics License Application (BLA) 1 | Abbreviated BLA (BPCIA/EMA comparability studies) 1 |

| Handling Requirements | Requires strict cold chain logistics (refrigeration), often administered via injection/infusion 1 | Requires strict cold chain logistics (refrigeration), often administered via injection/infusion 1 |

| Cost Profile | High due to extensive R&D, manufacturing, and clinical trials 6 | Lower, offering cost-effective alternatives to reference biologics 5 |

| Interchangeability Concept | Not applicable | US-specific designation allowing pharmacy-level substitution without prescriber intervention (if approved) 25 |

| Generic Equivalence | Not a generic drug 6 | Not considered a generic drug due to complexity and variability 6 |

2. Traditional Biologic Drug Distribution Models

2.1. Overview of the Pharmaceutical Supply Chain: Key players (manufacturers, wholesalers, pharmacies, PBMs)

The pharmaceutical supply chain is a sophisticated, multi-tiered network designed to facilitate the movement of drug products from their point of origin to the patient. Its major components include pharmaceutical manufacturers, wholesale distributors, various types of pharmacies, and Pharmacy Benefit Managers (PBMs).35

Pharmaceutical Manufacturers initiate this chain by producing a diverse range of drug products, encompassing biologics, biosimilars, patented brand-name drugs, and generic products.35 These manufacturers primarily manage the initial stages of distribution, predominantly selling their products to drug wholesalers. In specific instances, they may engage in direct distribution to large retail pharmacy chains, specialty pharmacies, hospital networks, or government purchasers, such as the AIDS Drug Assistance Program (ADaPs) and the Veterans Administration.35 Manufacturers also employ various financial strategies, including offering discounts and rebates, which are often contingent on factors like market share and purchasing volume.35

Wholesale Distributors serve as critical intermediaries, significantly enhancing the efficiency of purchasing drug products from manufacturers for a vast network of dispensing outlets. They act as the central conduit connecting approximately 60,000 U.S. pharmacies and outpatient dispensing locations.35 Beyond their fundamental distribution services, wholesalers provide essential functions such as financial management, inventory management, and data processing. For these services, they receive distribution service fees, which are typically calculated as a percentage of the Wholesale Acquisition Cost (WAC).35 Some wholesalers have developed specialized expertise, focusing on particular product ranges, such as biologics, or catering to specific customer segments, like nursing care facilities.35 Their revenues are generally derived from the margin between their purchase and sale prices, supplemented by these service fees.35

Pharmacies represent a diverse category of dispensing entities within the supply chain. This includes independent pharmacies, large chain pharmacies, pharmacies integrated within food or big-box stores, and mail-order pharmacies.35 These outlets typically procure prescription drugs from wholesalers at contracted discounts off the WAC, with the specific rates varying based on their size and overall purchasing power.35 A specialized and increasingly vital segment,

specialty pharmacies, focuses exclusively on providing higher-cost biotechnology drug products, which prominently include both biologics and biosimilars.6 These pharmacies possess the unique infrastructure and expertise required to handle and manage such complex medications.

Pharmacy Benefit Managers (PBMs), while not directly involved in the physical handling of drugs (unless they provide mail-order fulfillment services), have evolved from basic claims administrators into complex organizations exerting substantial influence over the pharmaceutical supply chain.35 Their array of services includes claims processing and adjudication, developing formularies (lists of covered drugs), negotiating significant manufacturer rebates, and determining policies for generic and therapeutic substitution.35 Through their control over formularies and reimbursement policies, PBMs wield significant power in shaping the flow and utilization of drugs, making them crucial, albeit indirect, orchestrators of drug distribution.35

2.2. Distinctive Features of Biologic Distribution: Emphasis on cold chain logistics, specialized processing, and the shift from “push” to “pull” models

The distribution of biologics, and consequently biosimilars, is profoundly shaped by their inherent characteristics, particularly their extreme sensitivity to environmental conditions. These products consistently demand cold chain logistics, necessitating continuous refrigeration, typically maintained at 2-8°C, from the moment they leave the manufacturing facility until they reach the patient for administration.1 This rigorous temperature control is not merely a preference but a vital requirement to prevent degradation, maintain product integrity, and avoid contamination by microbes or other unwanted substances, thereby preserving their efficacy and safety.1 The manufacturing process itself is highly specialized, involving intricate upstream steps such as cell line development, cell culture, and harvest, as well as complex downstream processes like purification and formulation.3 Throughout these phases, precise fluid and cold chain management are integral, including controlled freeze and thaw processes essential for storage and transport.3 Specialized storage freezers capable of maintaining precise and often extremely low temperature ranges (e.g., down to -80°C or even -170°C for certain advanced therapies) are indispensable components of this infrastructure.3 Furthermore, aseptic filling and processing conditions are frequently mandated to ensure product sterility, adding another layer of complexity to the supply chain.3

Historically, pharmaceutical distribution often operated on a “push” model, where manufacturers actively promoted and distributed samples and literature to healthcare providers (HCPs) through sales representatives.2 However, for biologics, a significant and ongoing transition towards a

“pull” model has occurred. In this contemporary paradigm, the demand process is increasingly driven by the specific needs and requests of HCPs.2 This shift reflects broader industry changes, including the increasing specialization of products, where biologics often target smaller, more defined patient populations, and the evolving role of HCPs in clinical decision-making.2 Pharmaceutical companies have responded by “right-sizing” their operations, streamlining processes, and adopting alternative communication methods to align with this demand-driven approach, moving away from simply pushing products into the market.2

The stringent cold chain requirement for biologics and biosimilars functions as both a significant barrier to entry and a key differentiator within the distribution landscape. These products absolutely demand robust cold chain management, which is a non-negotiable operational necessity.1 Implementing and maintaining such a network, encompassing specialized storage, temperature-controlled transport, and advanced monitoring technologies, involves substantial capital investment and deep operational expertise.3 This high cost and complexity inherently limit the number of entities across the supply chain—from manufacturers to logistics providers—that can effectively handle these products, leading to a more concentrated distribution network.35 For existing players, superior cold chain capabilities become a crucial differentiator, ensuring product integrity and reliability. For biosimilar manufacturers, this adds to their already high development costs 37, influencing their strategic partnerships, such as those with specialized logistics providers 19, and often favoring larger, more established companies or those willing to invest heavily in this critical infrastructure. Thus, the cold chain is not merely a logistical challenge but a strategic competitive element profoundly shaping the structure of the distribution landscape.

The shift to a “pull” model has an amplified impact with the introduction of biosimilars. The pharmaceutical industry, particularly for biologics, has transitioned to a “pull” model where healthcare providers (HCPs) drive demand.2 The entry of biosimilars, primarily driven by their cost-saving potential 5, adds a new and powerful dimension to this “pull.” In the biosimilar era, the “pull” from HCPs is increasingly influenced, and in many cases, actively orchestrated, by payer formularies and cost-saving incentives.12 Payers actively encourage or even mandate the use of biosimilars through various mechanisms, such as preferred formulary placement or step therapy requirements. This means the “pull” is no longer solely based on clinical need or traditional physician preference but is heavily weighted by economic factors and payer policies. Effective biosimilar distribution, therefore, requires more than just product availability; it demands deep alignment with payer strategies and robust, targeted communication and education to HCPs to encourage their “pull” for the more affordable, yet clinically equivalent, option. The efficiency of the physical distribution network now hinges significantly on the effectiveness of these financial and informational “pull” mechanisms.

Pharmacy Benefit Managers (PBMs) have emerged as de facto orchestrators of the pharmaceutical supply chain. PBMs have evolved significantly beyond their initial role as basic claims administrators to control formularies, negotiate substantial rebates, and influence drug substitution decisions.35 With the advent of biosimilars, the PBMs’ role in “driving lower net costs” and determining “formulary placement” has become paramount.12 They can actively prefer biosimilars or strategically use biosimilar availability to negotiate lower prices for originator biologics.12 Although PBMs typically do not physically handle drugs themselves, unless engaged in mail-order fulfillment 35, their decisions on formularies and reimbursement effectively dictate which products are financially viable for pharmacies to stock and for providers to prescribe. They possess the power to direct patient and provider choices towards specific products based on net cost considerations.12 This positions PBMs as critical, albeit non-physical, orchestrators of the pharmaceutical supply chain’s strategic direction. The physical distribution network, comprising manufacturers, wholesalers, and pharmacies, is increasingly reactive to the financial and policy decisions made by PBMs. This highlights a fundamental shift in power dynamics, where financial and policy levers exerted by PBMs have a profound and direct impact on the physical flow and market penetration of biologic and biosimilar drugs.

3. Impact of Biosimilars on Key Distribution Stakeholders

3.1. Pharmaceutical Manufacturers

The introduction of biosimilars has created a bifurcated impact on pharmaceutical manufacturers, profoundly influencing both innovator biologic companies and biosimilar developers.

Innovator Biologic Companies: These companies face significant challenges as biosimilars enter the market. The primary impact is a substantial reduction in prices and erosion of market share for their reference products.7 Studies indicate that prices can fall considerably, with observed reductions ranging from 20% to over 70% in certain therapeutic areas and markets, particularly where biosimilar uptake is high.7 In response, innovator companies frequently adopt aggressive pricing strategies. This typically involves reducing “net-of-rebate” prices to maintain sales volume and formulary status, rather than overtly lowering list prices. The actual discounts are achieved by offering larger rebates to PBMs and major payers.11 Innovators also commonly engage in extensive patent litigation, often involving complex “patent thickets” that cover various aspects of their drug products, as a strategy to prolong market exclusivity and delay biosimilar entry.7 Some innovator companies may also strategically launch their own biosimilars or “authorized generics” to compete directly with independent biosimilar developers, thereby retaining some market share.41 Furthermore, to counter the impact of interchangeable biosimilars, innovators might strategically shift their product formulations or concentrations, aiming to move the market away from the interchangeable version.27 Innovators have historically provided financial assistance through specialty copay programs, which could be disrupted or terminated as biosimilar competition intensifies and pressures on net prices increase.11

Biosimilar Manufacturers: These companies enter the market with the explicit objective of providing more affordable alternatives to expensive originator biologics, thereby increasing patient access and helping to mitigate rising drug prices.6 However, the development process for biosimilars is inherently complex and expensive, typically ranging from $100 million to $250 million, far surpassing the cost of generic small-molecule drugs.16 This complexity necessitates the independent development of specialized cell lines and optimized production protocols capable of consistently producing biologically comparable products.38

Biosimilar manufacturers navigate substantial challenges, including intricate regulatory hurdles, extensive patent litigation (often referred to as “patent thickets”), and intense market competition.7 Patent litigation, in particular, can significantly delay market entry by several years, even after FDA approval, impacting the return on their substantial investments.32

Key strategies employed by biosimilar manufacturers to overcome these challenges and succeed in the market include:

- Technological Investment: They invest heavily in advanced analytical techniques, such as Quality-by-Design (QbD), Process-Analytical-Technology (PAT), liquid chromatography-mass spectrometry (LC-MS), and nuclear magnetic resonance (NMR).38 These technologies are crucial for ensuring comparability to the reference product, optimizing production processes, and predicting critical quality attributes. The integration of digital automation and AI analytics further enhances efficiency, monitors performance, and accelerates drug discovery timelines.24 Innovations like single-use bioreactors and modular manufacturing systems improve efficiency, reduce cleaning and validation times, and mitigate cross-contamination risks.38

- Formulation Innovation: Manufacturers develop improved formulations or delivery methods, such as buffer-free systems, high-concentration formulations, or subcutaneous options, to enhance product stability, patient tolerability, and convenience, while remaining within regulatory comparability boundaries.38

- Strategic Collaborations: Forming alliances and partnerships with Contract Manufacturing Organizations (CMOs) and other biopharmaceutical companies (e.g., Biocon/Mylan, Samsung Bioepis/Biogen) is instrumental. These collaborations help share research and development costs, leverage specialized expertise, and expand commercialization capabilities globally.30

- Market Entry and Pricing: Biosimilar manufacturers employ aggressive pricing strategies to gain market share.7 They often opt to settle patent litigation with innovator companies to secure earlier market entry dates, despite the associated legal costs and potential launch delays.33

- Branding and Positioning: Effective branding and positioning strategies are crucial to clearly communicate the comparable efficacy, safety, and quality of their products while emphasizing the significant cost-effectiveness to healthcare professionals and patients.43

3.2. Pharmaceutical Wholesalers

Pharmaceutical wholesalers occupy a pivotal position in the drug distribution ecosystem, and their role is undergoing significant evolution due to the rise of biosimilars.

Evolving Business Models: Traditionally, wholesalers serve as the primary logistical link between drug manufacturers and dispensing pharmacies, ensuring efficient purchasing, inventory management, and timely delivery.35 However, with the increasing prevalence of biosimilars, particularly those administered in clinical settings (the “buy-and-bill” market), wholesalers are strategically expanding their influence beyond conventional drug distribution.47 This involves leveraging

vertical integration, a key strategic shift where major wholesalers, such as Cardinal Health, Cencora, and McKesson, are acquiring stakes in practice management firms and integrating more closely with downstream customers.47 This strategic maneuver solidifies their presence across a broader spectrum of the healthcare supply chain, directly impacting market access for provider-administered drugs, including the growing biosimilar segment.47 This expansion allows them greater control and influence over the flow of these high-value products from manufacturer to patient.

Financial Implications: The market and competitive dynamics surrounding provider-administered biosimilars have distinct financial implications for wholesalers. Their gross margins from biosimilar products tend to be higher than those from traditional brand-name drugs, reflecting the unique pricing structures and competitive landscape of the biologic market.36 However, these margins are generally lower than those derived from generic small-molecule drugs, which typically have very high margins due to less complex manufacturing and regulatory pathways.36 Wholesalers, by their inherent role, cannot directly increase the overall demand for a specific therapeutic class of drugs; their function is to efficiently distribute products based on existing demand.36 Their revenue models are continuously adapting to accommodate the aggressive competitive pricing strategies and complex rebate structures driven by biosimilar entry, requiring sophisticated financial management and contractual agreements with both manufacturers and pharmacies.35

3.3. Pharmacies (Specialty & Retail)

The proliferation of biosimilars has a direct and substantial impact on both specialty and retail pharmacies, necessitating adaptations in their operational models and service offerings.

Adaptation of Specialty Pharmacies: Specialty pharmacies are central to the distribution of biologics and biosimilars. They are specifically designed and equipped to provide higher-cost biotechnology drug products, possessing specialized training and infrastructure to handle and manage these complex, often temperature-sensitive, and high-touch medications.6 The increasing influx of biosimilars is significantly disrupting traditional specialty drug spend patterns, requiring these pharmacies to adapt their services and operational models. This adaptation includes managing new inventory lines for multiple biosimilar versions of a single reference product, navigating complex and dynamic formulary placements dictated by payers, and ensuring appropriate cold chain handling, storage, and patient support specific to biosimilars.11 Their role extends to patient education and adherence programs, which are crucial for biosimilar uptake.

Role of Interchangeability: The FDA’s “interchangeable” designation for certain biosimilars directly impacts pharmacy operations, particularly in retail settings. This designation provides a unique advantage in the U.S. market, allowing pharmacists to substitute an interchangeable biosimilar for its reference product without requiring prior approval from the prescribing physician, subject to varying state pharmacy laws.10 This streamlines the dispensing process, aiming to ensure continuity of care while facilitating patient access to more affordable treatment options.10 However, it is important to understand that a biosimilar lacking this designation is not considered inferior in terms of safety or efficacy; it simply means the manufacturer did not seek or provide the additional data required for interchangeability, possibly due to business reasons or the primary setting of administration (e.g., hospital vs. retail pharmacy).20 Pharmacists are generally required to notify both physicians and patients when such a substitution occurs.25 The practical impact of interchangeability is still evolving, particularly given the mosaic of state laws governing substitution and the fact that many biologics are administered in clinical settings (e.g., infusion centers) rather than dispensed directly by retail pharmacies.27

3.4. Payers (PBMs, Managed Care Organizations, Integrated Delivery Networks)

Payers, including Pharmacy Benefit Managers (PBMs), Managed Care Organizations (MCOs), and Integrated Delivery Networks (IDNs), play a transformative role in driving biosimilar adoption and, consequently, shaping their distribution.

Formulary Management Strategies: These entities are pivotal in influencing prescribing and dispensing patterns through active utilization management tools. They strategically employ formulary placement, designating preferred agents (which can be either biosimilars or originator biologics based on net cost), prior authorization requirements, and step therapy protocols to encourage the uptake of biosimilars, particularly for treatment-naïve patients.12 Their overarching strategy often revolves around identifying and preferring the “lowest net cost” product, irrespective of whether it is an originator or a biosimilar, thereby leveraging competition to drive down overall drug spend.12 Integrated Delivery Networks (IDNs), for instance, demonstrate sophisticated approaches by collaborating closely with Group Purchasing Organizations (GPOs) and 340B programs. They conduct regular, detailed reviews of coverage, patient mix, and the differential between Average Sales Price (ASP) and acquisition cost to strategically prioritize which biosimilars to adopt and promote within their systems.17 Some IDNs further streamline this process by integrating biosimilar tools directly into Electronic Health Records (EHRs) and incorporating prior authorization processes for both reference and biosimilar products, aiming to simplify physician workflows and encourage appropriate utilization.17

Cost Savings and Reimbursement Policies: The potential for significant cost savings is the paramount factor influencing payers’ coverage decisions and their active promotion of biosimilar adoption.13 Reimbursement policies are designed to incentivize biosimilar use. For example, the Centers for Medicare & Medicaid Services (CMS) payment policy for qualifying biosimilars is based on the biosimilar’s ASP plus 6% of the originator’s ASP, providing a financial incentive for providers to use biosimilars.45 To further increase adoption, payers are actively exploring strategies such as reducing patient cost-sharing for biosimilars, making them more financially attractive to patients.8 They are also considering increasing provider reimbursement for these agents to encourage their prescription and administration.14 However, concerns exist that government price negotiations, such as those under Medicare, could inadvertently deter biosimilar manufacturers by creating uncertainty around future revenues, potentially slowing market momentum and limiting the long-term savings potential.29 This highlights a delicate balance between aggressive cost containment and fostering a robust biosimilar market.

3.5. Healthcare Providers and Patients

The successful integration of biosimilars into clinical practice hinges significantly on the acceptance and understanding of both healthcare providers (HCPs) and patients.

Barriers to Adoption: Despite overwhelming evidence of comparable safety and efficacy between biosimilars and their reference products 1, several barriers continue to hinder widespread biosimilar adoption. A significant challenge is the pervasive

knowledge gap among physicians regarding biosimilar basic science, safety, efficacy, and the FDA regulatory process.13 This knowledge deficit is often more pronounced among office-based practitioners.16 Perception issues also play a crucial role, including a lack of confidence in biosimilar interchangeability and lingering concerns about the “true equivalence” of biosimilars, which can, in some cases, lead to a “nocebo effect” (negative outcomes stemming from negative patient expectations).27 Administrative burdens, such as complex and time-consuming prior authorization processes, further impede biosimilar prescription and adoption.13 For providers, complexities related to insurance reimbursement are frequently cited as a major barrier to uptake.48 Furthermore, physician involvement in biosimilar selection can be minimal, often dictated by established practice protocols or, increasingly, by insurance preferences and formulary mandates.13

Enablers for Uptake: To overcome these identified barriers, several strategies are crucial for increasing biosimilar uptake. Most physicians already perceive biosimilar efficacy and safety as highly comparable to originator biologics, providing a strong foundation for increased adoption.13 Targeted

education for prescribers, focusing on robust evidence from switching studies and real-world data, is consistently rated as a highly successful strategy to build confidence.14 Streamlining administrative processes, such as expediting prior authorizations and improving communication between payers and providers regarding coverage criteria and potential cost savings, is vital for reducing friction in the prescribing workflow.14

Financial incentives also play a significant role; reducing patient cost-sharing for biosimilars makes them more accessible and attractive.8 Similarly, increasing provider reimbursement for biosimilars can significantly drive their adoption by aligning financial incentives with utilization goals.14 The integration of biosimilar tools directly into Electronic Health Records (EHRs) can further simplify physician workflows, guiding them towards preferred biosimilar options.17 Ultimately, widespread public support from major medical guidelines and professional organizations, coupled with patient education focusing on the safety, interchangeability, and affordability of biosimilars, is essential for fostering broader acceptance and accelerating market penetration.15

4. Market Dynamics and Future Outlook

4.1. Current Market Landscape and Growth Projections

The global biosimilars market is experiencing robust growth, driven by increasing demand for cost-effective biologic therapies and the rising prevalence of chronic diseases worldwide.23 Valued at approximately US

32.75billionin2024,themarketisprojectedtoreachUS72.29 billion by 2035, advancing at a resilient Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2035.49 Other projections indicate even more aggressive growth, with estimates ranging from $27.20 billion in 2023 to $76.20 billion by 2030 (CAGR of 15.9%) 30 or $29.45 billion in 2023 to $150.3 billion by 2033 (CAGR of 17.7%).24 This strong growth reflects both higher acceptance and adoption rates and an increasing number of regulatory approvals across multiple regions.44

Regional Variations: Europe currently dominates the global biosimilars market, holding an estimated 37-40.8% share in 2024.42 This leadership is attributed to its early and clear regulatory framework established in 2006, robust healthcare systems, high prevalence of diseases, and supportive regulatory environments.18 Europe’s swift adoption and increased awareness among healthcare professionals and patients, coupled with competitive pricing, have resulted in significant cost reductions and enhanced adoption.50 Conversely, the Asia-Pacific region is experiencing the fastest growth, with a projected CAGR of 20.3-24% during 2024-2030.42 This rapid expansion is fueled by increased investments in pharmaceutical R&D, rising demand for affordable treatments, improving disposable incomes, and an aging population in countries like China, India, and Japan, alongside a growing incidence of chronic illnesses.50

Market Share by Therapeutic Area: Oncology currently accounts for the largest market share within the biosimilars market, holding approximately 55% of the revenue in 2024.42 This is driven by the rising prevalence of cancer and the greater availability of oncology-related biosimilars, including those for trastuzumab, bevacizumab, and rituximab.45 Biosimilars for supportive care products (e.g., epoetin alfa, filgrastim, pegfilgrastim) also hold significant market share.45 The infliximab segment held the largest share in 2024 within monoclonal antibodies due to patent expirations and subsequent biosimilar launches.49 Immunology and chronic inflammatory indications are also experiencing rapid growth, with a projected CAGR of 23% from 2025-2030, driven by the high prevalence of autoimmune diseases and the substantial cost of originator therapies.42 Despite the potential, adoption rates vary, with oncology and pegfilgrastim biosimilars achieving higher market shares (average 81% by 5 years post-launch) compared to immunology, filgrastim, epoetin alfa, and insulin glargine biosimilars (average 26% after 5 years).45

4.2. Challenges and Opportunities in the Evolving Supply Chain

The evolving biosimilar market presents a complex array of challenges and opportunities for the drug distribution supply chain, demanding continuous adaptation and strategic innovation.

Challenges:

- Temperature Control and Cold Chain Management: Biosimilars, like biologics, are highly sensitive to temperature fluctuations, necessitating consistent cold chain conditions throughout transportation to maintain efficacy and safety.19 This remains a persistent and costly challenge, requiring specialized infrastructure and meticulous monitoring.3

- Regulatory Compliance and Transparency: Achieving supply chain transparency is crucial for regulatory compliance, but pharmaceutical companies must balance this with the need for security and confidentiality of their products.19 The complexity of global supply chains, involving multiple carriers and customs clearances, introduces potential delays and compliance hurdles.19

- Inventory Management and Visibility: Maintaining accurate inventory levels and real-time visibility across the global supply chain is critical to ensure timely delivery and minimize stockouts, especially given the unpredictable demand for biosimilars.19

- Demand Volatility: Biosimilar demand can be unpredictable due to factors such as changes in treatment protocols, patient preferences, payer policies, and intense market competition.19 This volatility complicates demand forecasting, leading to risks of overestimation (higher costs, disposal expenses) or underestimation (missed market opportunities, reputational damage).52

- Patent Litigation and Market Entry Delays: Despite regulatory pathways designed to facilitate entry, biosimilars frequently face significant delays due to extensive patent litigation initiated by innovator companies.7 This “patent dance” and subsequent litigation can prolong market entry by several years (e.g., median of 2.3-16.5 years after primary patent expiry, depending on litigation outcome).32 These delays directly impact the efficiency of the distribution network by limiting the availability of lower-cost options and hindering market competition.29

- Limited Distribution Networks (LDNs): Some innovator companies employ LDNs, restricting drug distribution to a very small number of distributors. While ostensibly for safety or shortage management, this strategy has been misused to obstruct biosimilar competition by preventing access to samples needed for FDA-required testing.53

Opportunities:

- Cost Savings and Access Expansion: The primary opportunity remains the significant cost savings biosimilars offer, which can alleviate financial burdens on healthcare systems and expand patient access to critical therapies.7

- Increased Competition and Market Growth: Biosimilars intensify market competition, leading to lower prices and fostering innovation across the industry.7 The global biosimilars market is projected for substantial growth, indicating a fertile ground for new entrants and expanded product portfolios.23

- Strategic Partnerships: Collaboration between biosimilar manufacturers and experienced logistics providers, Contract Development and Manufacturing Organizations (CDMOs), and other stakeholders can mitigate complexities and enhance supply chain efficiency.19

4.3. Technological Innovations and Strategic Responses

The evolving landscape of biologic and biosimilar distribution is increasingly shaped by technological advancements and strategic adaptations across the supply chain.

Technological Innovations:

- Advanced Analytics and Digital Platforms: Leveraging technologies such as IoT sensors, blockchain, and advanced analytics significantly enhances supply chain visibility, tracking, and overall management.19 These tools are critical for mitigating temperature control issues, improving inventory management, and enabling quicker responses to demand volatility.19 The integration of AI and machine learning is transforming biosimilar development by analyzing large-scale manufacturing and datasets to predict critical quality attributes and detect process anomalies early, optimizing process design and culture media.38 Digital platforms and AI-driven tools improve the design, stability, and risk assessment of biosimilars.38

- Manufacturing Process Innovations: Bioprocessing innovations are driving the development of modular and flexible manufacturing systems. Single-use bioreactor systems, for instance, significantly reduce cleaning and validation time while mitigating cross-contamination risks, thereby improving overall product safety and accelerating production.38 Advanced analytical techniques like ultrafiltration/diafiltration, multimodal chromatography, and simulated moving bed (SMB) chromatography facilitate high-resolution separation of impurities, improving purification accuracy and consistency during scale-up.38

- Formulation and Delivery Advancements: Strategic innovation in formulation, including the use of buffer-free systems, high-concentration formulations, and nanomedicine approaches (e.g., nanoparticle encapsulation), improves product stability, patient tolerability, and enables sustained release mechanisms.38 These innovations can also lead to more convenient administration methods, such as subcutaneous options, which are gaining uptake over intravenous infusions.42

- Patent Intelligence Platforms: The complexity of intellectual property (IP) in biologics and biosimilars, characterized by “patent thickets,” necessitates sophisticated patent analysis.34 While not explicitly detailed in the provided materials as a “distribution technology,” the ability to navigate and understand the patent landscape through advanced intelligence platforms (implied by the challenges and strategies of manufacturers) is crucial for timely market entry and, by extension, effective distribution planning.54

Strategic Responses:

- Agile Supply Chain Strategies: Companies must develop agile supply chain strategies to adapt quickly to changes in demand, market conditions, and regulatory requirements.19 This involves maintaining flexible manufacturing and distribution networks and building strong relationships with suppliers and logistics providers.19

- Collaboration with Logistics Providers: Partnering with experienced logistics providers, particularly those specializing in cold chain management and global complexities, is essential to ensure the integrity of biosimilar products throughout their journey.19

- Investment in Education and Training: Educating healthcare professionals, patients, and supply chain stakeholders about biosimilars is critical to increase adoption and improve supply chain efficiency. This includes providing training on the proper use, storage, and handling of these products.19

- Regulatory Advocacy: Encouraging regulatory bodies to provide clear and supportive frameworks for biosimilar adoption can help address market blockages and incentivize further development and efficient distribution.19

The complex interplay of policy, market dynamics, and perception significantly influences biosimilar distribution. The regulatory landscape, with its differing approaches to interchangeability and patent litigation in the U.S. versus the EU, directly impacts market entry timelines and competition.18 This regulatory variance, coupled with aggressive pricing strategies from innovators and the unique challenges of biosimilar development, creates a dynamic and often unpredictable market.11 Furthermore, the perception of biosimilars among healthcare providers and patients, often influenced by knowledge gaps and concerns about equivalence, directly affects prescribing patterns and adoption rates.13 The efficiency of biosimilar distribution is thus deeply intertwined with these non-physical factors, requiring a holistic strategy that addresses legal, economic, and educational dimensions to optimize product flow.

The imperative for supply chain resilience and agility is paramount. The inherent complexity of biologics and biosimilars, particularly their cold chain requirements, coupled with the unpredictable demand volatility in a competitive market, necessitates highly resilient and agile supply chains.19 The global nature of these supply chains introduces further complexities related to multiple carriers, customs, and potential international delays.19 This environment demands flexible manufacturing and distribution networks, robust inventory management systems with real-time visibility, and strong collaborative relationships with logistics providers.19 The ability to adapt quickly to market shifts, regulatory changes, and unforeseen disruptions is no longer a competitive advantage but a fundamental requirement for ensuring consistent supply and maximizing patient access.

Data and technology are emerging as the new competitive frontier in biosimilar distribution. The challenges of managing complex manufacturing processes, ensuring product quality and comparability, navigating intricate regulatory pathways, and responding to dynamic market demands are increasingly being addressed through advanced technological solutions.19 The integration of IoT sensors for real-time temperature monitoring, blockchain for enhanced transparency and traceability, and AI/machine learning for predictive analytics and process optimization, are transforming the efficiency and reliability of the supply chain.19 Furthermore, innovations in formulation and delivery methods, driven by scientific advancements, aim to improve patient experience and expand market reach.38 Companies that effectively leverage these data-driven and technological capabilities will gain a significant competitive edge, enabling more efficient development, manufacturing, and distribution of biosimilars, ultimately accelerating patient access and cost savings.

5. Conclusions

The introduction of biosimilars has fundamentally reshaped the biologic drug distribution landscape, moving it from a relatively stable, product-centric model to a dynamic, value-driven ecosystem. This transformation is characterized by a “paradox of progress,” where the undeniable benefits of cost reduction and expanded patient access are accompanied by increased operational and strategic complexity within the distribution chain. The inherent “highly similar, not identical” nature of biosimilars, unlike small-molecule generics, necessitates more rigorous regulatory scrutiny and contributes to perception challenges among healthcare providers and patients, directly impacting adoption rates and the flow of these medicines.

Regulatory frameworks, while essential enablers of biosimilar market entry, also present bottlenecks. Divergent approaches to patent litigation and interchangeability designations, particularly between the U.S. and Europe, have led to varied market penetration and efficiency. This underscores that regulatory design is not merely a compliance issue but a critical determinant of the speed and volume of biosimilar distribution. The economic imperative, driven by the need for cost savings, has empowered payers to become de facto orchestrators of the supply chain. Through sophisticated formulary management, rebate negotiations, and utilization management strategies, payers exert significant influence over product preference and flow, shifting the focus from product availability to “lowest net cost.”

For pharmaceutical manufacturers, this translates into intense competition, aggressive pricing strategies, and complex patent litigation for innovators, while biosimilar manufacturers must navigate high development costs, market entry delays, and the need for continuous technological and formulation innovation. Wholesalers are adapting through vertical integration to secure their position in the evolving “buy-and-bill” market, while specialty pharmacies are crucial for handling complex products and managing the nuances of interchangeability. Healthcare providers and patients, despite recognizing the clinical equivalence and benefits of biosimilars, face barriers related to knowledge gaps and administrative complexities, necessitating targeted education and streamlined processes.

Looking forward, the global biosimilars market is poised for substantial growth, driven by patent expirations and increasing demand for affordable treatments for chronic diseases. However, persistent challenges related to cold chain management, regulatory compliance, demand volatility, and ongoing patent disputes will continue to demand agile and resilient supply chain strategies. The future of biosimilar distribution will increasingly rely on the effective leveraging of data and advanced technologies, including AI, blockchain, and innovative manufacturing processes. These technological advancements, coupled with strategic collaborations and sustained educational efforts, are essential for overcoming existing barriers, optimizing the flow of biosimilars, and ultimately realizing their full potential in enhancing patient access and reducing healthcare costs globally. The industry must continue to adapt and innovate to navigate this complex and evolving landscape successfully.

Works cited

- Biologics and Biosimilars: Background and Key Issues – Congress.gov, accessed July 21, 2025, https://www.congress.gov/crs-product/R44620

- The Evolution of Pharmaceutical Sample Distribution: From Push to Pull, accessed July 21, 2025, https://www.pharmaceuticalcommerce.com/view/evolution-pharmaceutical-sample-distribution

- An introduction to biologic drugs – Single Use Support, accessed July 21, 2025, https://www.susupport.com/knowledge/biopharmaceutical-products/vaccines/biologics-introduction-biologic-drugs

- Ensuring Product Quality, Consistency and Patient Supply over Time for a Large-Volume Biologic: Experience with Remicade – PubMed Central, accessed July 21, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6182491/

- Biosimilars or Biologics: What’s the difference? – Therapeutics Letter – NCBI Bookshelf, accessed July 21, 2025, https://www.ncbi.nlm.nih.gov/books/NBK598450/

- Biologics vs Biosimilars, accessed July 21, 2025, https://biologicmeds.org/biologics-vs-biosimilars/

- The Economics of Biosimilars – Number Analytics, accessed July 21, 2025, https://www.numberanalytics.com/blog/economics-biosimilars-cost-savings-market-dynamics

- The Cost Savings Potential of Biosimilar Drugs in the United States – RAND Corporation, accessed July 21, 2025, https://www.rand.org/content/dam/rand/pubs/perspectives/PE100/PE127/RAND_PE127.pdf

- Report: 2023 U.S. Generic and Biosimilar Medicines Savings Report, accessed July 21, 2025, https://accessiblemeds.org/resources/reports/2023-savings-report-2/

- Transforming healthcare with biosimilars: lower costs, greater access, smarter solutions, accessed July 21, 2025, https://www.wolterskluwer.com/en/expert-insights/transforming-healthcare-biosimilars-lower-costs-smarter-solutions

- Will Biosimilars Disrupt Specialty Drug Spend? – Brown & Brown, accessed July 21, 2025, https://www.bbrown.com/us/insight/will-biosimilars-disrupt-specialty-drug-spend/

- The role of biosimilars in lowering specialty costs – Business Caremark, accessed July 21, 2025, https://business.caremark.com/insights/2022/the-role-biosimilars-lowering-specialty-costs.html

- Evolving Perceptions, Utilization, and Real-World Implementation Experiences of Oncology Monoclonal Antibody Biosimilars in the USA: Perspectives from Both Payers and Physicians – PubMed Central, accessed July 21, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8847267/

- Overcoming barriers to biosimilar adoption: real-world perspectives from a national payer and provider initiative, accessed July 21, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10391006/

- Strategies for Overcoming Barriers to Adopting Biosimilars and Achieving Goals of the Biologics Price Competition and Innovation Act: A Survey of Managed Care and Specialty Pharmacy Professionals – PMC, accessed July 21, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10397695/

- Challenges of Integrating Biosimilars Into Clinical Practice – PMC, accessed July 21, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7857316/

- How Strategic IDNs Boost Biosimilar Adoption – Center for Biosimilars, accessed July 21, 2025, https://www.centerforbiosimilars.com/view/how-strategic-idns-boost-biosimilar-adoption

- Biosimilar medicines: Overview – EMA – European Union, accessed July 21, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/biosimilar-medicines-overview

- Addressing supply chain challenges for biosimilar products …, accessed July 21, 2025, https://www.drugpatentwatch.com/blog/addressing-supply-chain-challenges-for-biosimilar-products/

- 9 Things to Know About Biosimilars and Interchangeable Biosimilars – FDA, accessed July 21, 2025, https://www.fda.gov/drugs/things-know-about/9-things-know-about-biosimilars-and-interchangeable-biosimilars

- Commemorating the 15th Anniversary of the Biologics Price Competition and Innovation Act, accessed July 21, 2025, https://www.fda.gov/drugs/cder-conversations/commemorating-15th-anniversary-biologics-price-competition-and-innovation-act

- Biosimilars | Health Affairs, accessed July 21, 2025, https://www.healthaffairs.org/do/10.1377/hpb20131010.6409/

- Biosimilars Market Outlook, Growth Trends, Regulatory Landscape and Opportunities 2025–2034 | Exactitude Consultancy – GlobeNewswire, accessed July 21, 2025, https://www.globenewswire.com/news-release/2025/06/23/3103549/0/en/Biosimilars-Market-Outlook-Growth-Trends-Regulatory-Landscape-and-Opportunities-2025-2034-Exactitude-Consultancy.html

- Trends in Biosimilars – Clinical Research News, accessed July 21, 2025, https://www.clinicalresearchnewsonline.com/news/2024/11/22/trends-in-biosimilars

- Biosimilar Interchangeability FAQs, accessed July 21, 2025, https://biosimilarscouncil.org/wp-content/uploads/2023/12/2023-Biosimilar-Interchangeability-FAQs.pdf

- Interchangeable Biological Products – FDA, accessed July 21, 2025, https://www.fda.gov/media/151094/download

- Revisiting Interchangeability to Realize the Benefit of Biosimilars Executive Summary, accessed July 21, 2025, https://healthpolicy.duke.edu/sites/default/files/2021-11/Revisiting%20Interchangeability%20to%20Realize%20the%20Benefit%20of%20Biosimilars_0.pdf

- Biosimilars Report Shows Challenges, Opportunities Across Disease States, accessed July 21, 2025, https://www.pharmexec.com/view/biosimilars-report-shows-challenges-opportunities-across-disease-states

- Slow Biosimilar Uptake in Latin America Signals Missed Opportunities for Patient Access, Cost Savings, accessed July 21, 2025, https://www.centerforbiosimilars.com/view/slow-biosimilar-uptake-in-latin-america-signals-missed-opportunities-for-patient-access-cost-savings

- Biosimilars Market Size to Hit $76.2 Billion by 2030 – Driving Value-Based Care for Drugmakers, Regulators & Emerging Markets | The Research Insights – PR Newswire, accessed July 21, 2025, https://www.prnewswire.com/news-releases/biosimilars-market-size-to-hit-76-2-billion-by-2030—driving-value-based-care-for-drugmakers-regulators–emerging-markets–the-research-insights-302495541.html

- Biosimilars: Patient Perspectives, Challenges and Emerging Solutions: Current Opinions, accessed July 21, 2025, https://sciforschenonline.org/journals/drug/JDRD148.php

- Earlier Patent Litigation Could Accelerate US Biosimilar Market Entry, accessed July 21, 2025, https://www.centerforbiosimilars.com/view/earlier-patent-litigation-could-accelerate-us-biosimilar-market-entry

- Accelerating biosimilar market access: the case for allowing earlier standing | Journal of Law and the Biosciences | Oxford Academic, accessed July 21, 2025, https://academic.oup.com/jlb/article/12/1/lsae030/7942247

- Biologics, Biosimilars and Patents: – I-MAK, accessed July 21, 2025, https://www.i-mak.org/wp-content/uploads/2024/05/Biologics-Biosimilars-Guide_IMAK.pdf

- How Does The Pharmaceutical Supply Chain Work? – Datex, accessed July 21, 2025, https://www.datexcorp.com/pharmaceutical-supply-chain-2/

- www.drugchannels.net, accessed July 21, 2025, https://www.drugchannels.net/2022/10/how-biosimilar-boom-boosts-drug.html#:~:text=The%20market%20and%20competitive%20dynamics,a%20therapeutic%20class%20of%20drugs.

- Biosimilar Entry and the Pricing of Biologic Drugs – American Economic Association, accessed July 21, 2025, https://www.aeaweb.org/conference/2022/preliminary/paper/Z3f7ktez

- Innovative Formulation Strategies for Biosimilars: Trends Focused on Buffer-Free Systems, Safety, Regulatory Alignment, and Intellectual Property Challenges – PubMed Central, accessed July 21, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12196224/

- Full article: Estimating the impact of biosimilar entry on prices and expenditures in rheumatoid arthritis: a case study of targeted immune modulators – Taylor & Francis Online, accessed July 21, 2025, https://www.tandfonline.com/doi/full/10.1080/13696998.2022.2113252

- What role do IP rights play in biologics and biosimilars? – Patsnap Synapse, accessed July 21, 2025, https://synapse.patsnap.com/article/what-role-do-ip-rights-play-in-biologics-and-biosimilars

- The biosimilar pathway in the USA: An analysis of the innovator company and biosimilar company perspectives and beyond – PMC, accessed July 21, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9307033/

- Biosimilars Market Size, Trends, Growth & Share Analysis 2025 – 2030 – Mordor Intelligence, accessed July 21, 2025, https://www.mordorintelligence.com/industry-reports/global-biosimilars-market-industry

- Biosimilars in the U.S.: Unraveling Market Dynamics and Winning B2B Collaboration Strategies – Pharma Focus America, accessed July 21, 2025, https://www.pharmafocusamerica.com/articles/biosimilars-in-the-us-unraveling-market-dynamics-and-winning-b2b-collaboration-strategies

- Overcoming Biosimilar Scaling Challenges – Pharmaceutical Technology, accessed July 21, 2025, https://www.pharmtech.com/view/overcoming-biosimilar-scaling-challenges

- Biosimilar Market Share: Growth and Price Trends in Q1 2025, accessed July 21, 2025, https://www.ajmc.com/view/biosimilar-market-share-growth-and-price-trends-in-q1-2025

- Billions in Health Care Savings Realized Through Early Generic, Biosimilar Settlements, accessed July 21, 2025, https://www.centerforbiosimilars.com/view/billions-in-health-care-savings-realized-through-early-generic-biosimilar-settlements

- Pharmaceutical Wholesalers Acquire Stakes in Practice …, accessed July 21, 2025, https://www.geneonline.com/pharmaceutical-wholesalers-acquire-stakes-in-practice-management-firms-to-expand-biosimilar-market-access/

- Survey of biosimilar adoption across oncology pharmacy practices. – ASCO Publications, accessed July 21, 2025, https://ascopubs.org/doi/10.1200/JCO.2022.40.16_suppl.e18813

- Biosimilars Market Growth, Drivers, and Opportunities – MarketsandMarkets, accessed July 21, 2025, https://www.marketsandmarkets.com/Market-Reports/biosimilars-40.html

- Biosimilars Market Products, Applications and Regulations Overview 2025: Increasing Cost of Biologic Drugs, Leading to a Greater Demand for More Affordable Options – Global Forecasts 2024-2030 – ResearchAndMarkets.com – Business Wire, accessed July 21, 2025, https://www.businesswire.com/news/home/20250311461532/en/Biosimilars-Market-Products-Applications-and-Regulations-Overview-2025-Increasing-Cost-of-Biologic-Drugs-Leading-to-a-Greater-Demand-for-More-Affordable-Options—Global-Forecasts-2024-2030—ResearchAndMarkets.com

- Prescriber Perspectives on Biosimilar Adoption and Potential Role of Clinical Pharmacology: A Workshop Summary – PMC, accessed July 21, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10099086/

- Challenges, Risks, and Strategies for Biologic Drug Substance Manufacturing – Patheon, accessed July 21, 2025, https://www.patheon.com/us/en/insights-resources/whitepapers/challenges-risks-and-strategies-for-biologic-substance-manufacturing.html

- Limited Distribution Networks Stifle Competition in the Generic and Biosimilar Drug Industries – American Journal of Managed Care, accessed July 21, 2025, https://www.ajmc.com/view/limited-distribution-networks-stifle-competition-in-the-generic-and-biosimilar-drug-industries

- Addressing Patent Challenges in Biologics and Biosimilars – PatentPC, accessed July 21, 2025, https://patentpc.com/blog/addressing-patent-challenges-biologics-and-biosimilars

- DrugPatentWatch.com Article: Post-ANDA Success Hinges on, accessed July 21, 2025, https://www.geneonline.com/drugpatentwatch-com-article-post-anda-success-hinges-on-patent-analysis-and-stakeholder-relations-for-generics-and-biosimilars/