Last updated: July 27, 2025

Introduction

Sildenafil citrate, widely known by its brand name Viagra, transformed the landscape of erectile dysfunction (ED) treatment since its Market approval in 1998. Its unique mechanism—vasodilation via phosphodiesterase type 5 (PDE5) inhibition—made it the first orally effective medication for ED, sparking a global pharmaceutical and healthcare movement. Over past decades, sildenafil's market dynamics and financial trajectory have been shaped by evolving patient demographics, regulatory shifts, competitive innovations, and emerging therapeutic applications.

This analysis explores sildenafil's current market conditions, growth drivers, challenges, and future prospects, providing critical insights for stakeholders in pharmaceutical investment, R&D, and healthcare strategy.

Market Overview and Size

Global Revenue and Market Penetration

The sildenafil citrate market has matured significantly since its debut. As of 2022, the global ED therapeutics market was valued at approximately USD 6.8 billion, with sildenafil accounting for around 45-50% of this segment, equating to roughly USD 3.0-3.4 billion annually [1]. This dominance stems from its established efficacy, familiarity among prescribers, and broad accessibility in many regions.

Regional Market Distribution

- North America: Leading market with high penetration due to mature healthcare infrastructure, favorable reimbursement policies, and heightened awareness.

- Europe: Similar to North America, with strong market presence but constrained by regulatory nuances.

- Asia-Pacific: Growing rapidly, driven by increasing awareness, urbanization, and younger demographics with emerging ED prevalence.

- Emerging Markets: Limited access and affordability remain challenges, but market potential grows as generics enter these regions.

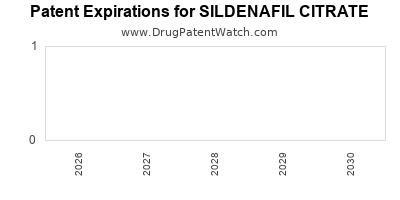

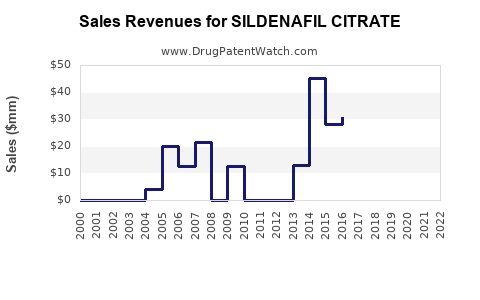

Patent and Generic Landscape

Patent expiry in many jurisdictions around 2013-2018 led to an influx of generic sildenafil products, drastically reducing prices and boosting market volume. Generics now represent around 70% of sildenafil sales globally, heightening competition but ensuring affordability and widespread access.

Market Drivers

Aging Population and Rising ED Prevalence

Globally, the aging population—estimated to reach over 1 billion aged 60+ by 2025—propels demand, as ED prevalence increases with age. Lifestyle factors, comorbidities such as hypertension, diabetes, and cardiovascular disease (which often co-occur with ED), further expand the target patient base [2].

Increased Awareness and Acceptance

Increased social openness about sexual health issues reduces stigma. Physician awareness campaigns and direct-to-consumer advertising (particularly in North America and Europe) promote sildenafil use.

Broader Therapeutic Applications

Beyond ED, sildenafil exhibits promising off-label applications:

- Pulmonary arterial hypertension (PAH): The drug, marketed as Revatio, generated USD 250 million in 2022, expanding sildenafil’s market beyond ED [3].

- Altitude sickness and other off-label uses, although less prevalent, contribute to product diversification.

Product Innovation and Formulation Advancements

While the original sildenafil tablets remain dominant, new formulations (e.g., orodispersible, lower-dose variants, longer-acting formulations) aim to improve patient compliance and broaden usage contexts.

Market Challenges

Generic Competition and Price Erosion

Post-patent expiry, pricing pressures led to an over tenfold decrease in sildenafil's unit cost. Price competition compresses profit margins and limits revenue growth potential for branded formulations.

Regulatory and Patent Challenges

Generic manufacturers face minimal patent hurdles in markets where patents have expired, intensifying pricing and distribution competition.

Emergence of Novel PDE5 Inhibitors and Alternative Therapies

Newer drugs like tadalafil (Cialis) and vardenafil (Levitra) offer longer durations and different efficacy profiles, capturing portions of sildenafil’s market. Additionally, non-pharmacological treatments (psychotherapy, device-based therapies) diversify the ED treatment landscape.

Reimbursement and Prescription Trends

In many North American and European markets, sildenafil’s use is influenced by insurance coverage policies, cost considerations, and prescriber preferences, affecting volume sales.

Financial Trajectory and Investment Outlook

Revenue Trends

Following patent expiration, sildenafil’s revenues plateaued in developed markets but remained robust globally due to volume growth in emerging markets and generics. The global market is expected to grow at a CAGR of approximately 4% through 2028, reaching USD 4.2 billion by 2028, driven primarily by volume increases in developing regions [4].

Profitability and Market Share

Brand-name sildenafil, such as Viagra, retains premium pricing in select markets, aided by branded loyalty and formulations like Cialis or Levitra in other segments. However, generics command significant market share, pressuring margins for patent-holders.

Research and Development Investment

Pharmaceutical companies are investing in innovative sildenafil formulations, combination therapies, and new indications like heart failure or stroke rehabilitation, aiming for incremental revenue streams beyond traditional ED markets.

Strategic M&A Activity

Consolidations among generics producers and licensing deals for formulation licenses dominate recent M&A activities, enabling access to established brands and markets.

Emerging Opportunities and Future Market Directions

Expanding Indications

Ongoing clinical trials exploring sildenafil in neurodegenerative diseases, regenerative medicine, and COVID-19 related treatments present long-term growth avenues.

Personalized Medicine and Digital Health Integration

Developing targeted therapies based on genetic profiles or integrating digital tools (app-based dosing, adherence tracking) can optimize patient outcomes and expand sildenafil’s market reach.

Regulatory Digitalization and Market Access

Streamlined approval protocols and digital distribution platforms facilitate faster product launches, especially in emerging markets.

Conclusion

The sildenafil citrate market exemplifies a drug that revolutionized therapy but now faces a complex, competitive landscape. Patent expirations and price competition have shifted revenues from branded to generic segments, yet continuous innovation and expanding indications maintain its relevance. Growth remains sustainable, particularly in emerging markets, supported by aging demographics, rising awareness, and therapeutic diversification.

Stakeholders must navigate existing challenges through innovation, strategic licensing, and targeted market expansion. By capitalizing on new indications and advanced formulations, sildenafil’s financial trajectory can sustain steady growth over the next decade.

Key Takeaways

- Market saturation in developed regions constrains revenue growth; emerging markets offer significant growth potential.

- Generic competition has driven prices down, compelling manufacturers to innovate through formulations and indications.

- Expansion into new therapeutic areas, such as pulmonary hypertension and neurodegeneration, diversifies revenue streams.

- Continued investment in R&D for improved delivery systems and personalized approaches will be vital.

- Regulatory and reimbursement landscapes will profoundly influence future market access and profitability.

FAQs

-

What is the current market share of sildenafil among ED treatments?

Sildenafil holds approximately 45-50% of the global ED therapeutics market, benefiting from early market entry, established efficacy, and wide availability.

-

How does patent expiry impact sildenafil’s revenue?

Patent expiry significantly reduces brand-name revenue due to generic competition, leading to price erosion but expanding market volume.

-

What are the emerging therapeutic indications for sildenafil?

Beyond ED, sildenafil is used to treat pulmonary arterial hypertension (Revatio), and clinical trials are exploring its role in neurodegenerative diseases and stroke recovery.

-

Which regions are expected to drive future growth for sildenafil?

Asia-Pacific and Latin America are projected to be key growth drivers via increasing healthcare penetration and demographic shifts.

-

What are the main challenges facing sildenafil’s market sustainability?

Major challenges include generic price competition, competition from newer PDE5 inhibitors, regulatory barriers, and evolving treatment preferences.

Sources

[1] Market Research Future, 2022. "Global Erectile Dysfunction Market."

[2] WHO, 2021. "Ageing and health."

[3] Pfizer Inc., 2022. "Revatio Sales Data."

[4] IQVIA, 2023. "Pharmaceutical Market Outlook."