Last updated: December 15, 2025

Executive Summary

Viagra (sildenafil citrate), launched in 1998 by Pfizer, revolutionized the treatment of erectile dysfunction (ED) and became a landmark in pharmaceutical history. Over the past two decades, Viagra has experienced significant market shifts driven by patent expirations, emerging generics, regulatory environments, and evolving consumer preferences.

Despite facing generic competition, Viagra remains a significant revenue generator, with estimated global sales in 2022 surpassing $700 million. The drug’s market continues to evolve with new formulations, growing awareness of ED, and expanding indications such as pulmonary arterial hypertension (PAH). This report provides an in-depth analysis of the current market landscape, financial trajectory, key drivers, challenges, and future outlooks for Viagra.

What Are the Core Market Drivers for Viagra?

1. Increasing Prevalence of Erectile Dysfunction

- Prevalence: By 2020, ED affected approximately 322 million men globally, projected to reach nearly 580 million by 2027 ([1]).

- Demographics: Aging populations, rising comorbidities such as diabetes and cardiovascular diseases, and increased awareness contribute to higher demand.

2. Patent Expiry and Generic Competition

- Patent Timeline: Pfizer’s patent for Viagra expired in December 2012 in the U.S. and subsequent markets, opening the floodgates to generics.

- Impact: Generics significantly eroded brand sales, but Pfizer maintained market share with reformulations and branded marketing strategies.

3. Product Innovations and Line Extensions

- Formulations: Cialis (tadalafil), Levitra (vardenafil), and newer options like Stendra (avanafil) have contributed to market erosion but also expanded treatment options.

- Combination Therapies: Research into combination drugs for ED and other conditions is ongoing, potentially opening new revenue streams.

4. Regulatory and Policy Dynamics

- Reimbursement Policies: Reimbursements vary by country, affecting accessibility and demand.

- Over-the-Counter (OTC) Possibilities: Discussions around OTC availability could influence future sales.

5. Consumer Awareness and Cultural Factors

- Stigma Reduction: Increased awareness and less stigma are boosting demand.

- Digital Outreach: Marketing campaigns, digital health platforms, and telemedicine are improving access.

Market Structure and Competitive Landscape

| Key Players |

Market Share (2022) |

Major Products |

Strategies |

| Pfizer (Branded Viagra) |

~20% |

Viagra (original branded) |

Brand loyalty, new formulations, marketing |

| Generics Manufacturers |

~50-60% |

Sildenafil generics |

Price competition, wider accessibility |

| Other ED Meds (Cialis, Levitra) |

~20-25% |

Cialis, Levitra |

Differentiation via duration, onset, tolerability |

| Emerging Biotech & Pharma |

Minor |

Experimental drugs, combination therapies |

Innovation in delivery mechanisms, indications |

Note: The dominance of generics varies by region, with high penetration in the U.S. and Europe.

Financial Trajectory Overview

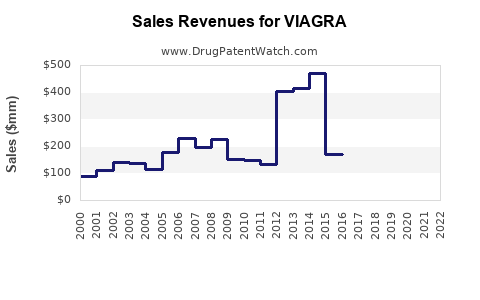

Historical Revenue Trends

| Year |

Estimated Global Revenue (USD) |

Key Factors |

| 2004 |

~$2.2 billion |

Peak before patent expiry; global dominance |

| 2013 |

~$1.0 billion |

Patent expiry impacts, emergence of generics |

| 2018 |

~$870 million |

Market stabilization, new formulations, expanding market |

| 2022 |

~$700 million |

Continued generic competition, rising alternative therapies |

Source: Pfizer Annual Reports (2004-2022) & industry estimates.

Revenue Breakdown by Region

| Region |

Share of Revenue (2022) |

Notable Factors |

| North America |

50-55% |

Largest market, high brand loyalty, insurance coverage |

| Europe |

20-25% |

price sensitivity, generics dominance |

| Asia-Pacific |

15-20% |

Growing awareness, demographic shifts |

| Rest of World |

5-10% |

Limited access, regulatory hurdles |

Future Revenue Projections (2023-2028)

| Year |

Estimated Revenue (USD) |

Key Drivers |

| 2023 |

~$650 million |

Continuing generic penetration, innovation into new markets |

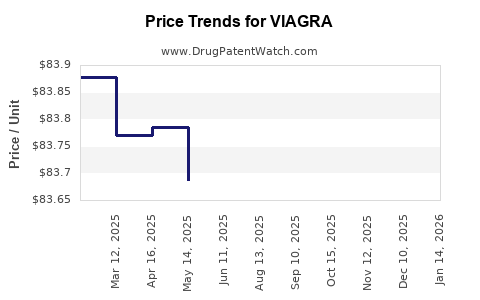

| 2025 |

~$600 million |

Market saturation, pipeline of new formulations |

| 2028 |

~$550 million |

Market mature, regulatory pressures, sustained demand |

Key Financial Challenges

- Patent expirations and generic price erosion.

- Competition from ED substitutes and natural remedies.

- Regulatory advancements potentially limiting off-label uses.

Comparison with Alternative ED Treatments

| Attribute |

Viagra (Sildenafil) |

Cialis (Tadalafil) |

Levitra (Vardenafil) |

Stendra (Avanafil) |

| Onset |

30-60 mins |

30 mins |

30 mins |

15-30 mins |

| Duration |

4-6 hours |

36 hours |

4-5 hours |

6 hours |

| Food Interaction |

Yes |

Yes |

Yes |

No |

| Price (approx.) |

$20-$30 per dose (brand) |

$15-$25 per dose (brand) |

$25-$40 per dose |

$30-$50 per dose |

Implication: Branding and formulation advantages influence patient choice despite cost considerations.

Future Outlook and Trends

Emerging Markets Expansion

- Rapid growth in Asia-Pacific, Latin America.

- Increasing disposable incomes and healthcare infrastructure investments.

Innovative Formulations

- Injectables, transdermal patches, and oral dissolvables under development.

- Nanotechnology and targeted delivery to improve efficacy and reduce side effects.

Regulatory Considerations

- US FDA approval processes for OTC or low-dose OTC versions could revolutionize access.

- International harmonization of ED drug approval standards remains a challenge.

Digital and Telehealth Influence

- Telemedicine platforms are key in prescribing ED drugs, especially post-2020.

- Data analytics enable personalized treatment regimes enhancing adherence and satisfaction.

Challenges Facing Viagra's Market

| Challenge |

Description |

Potential Impact |

| Patent and Regulatory Environment |

Patent expiries, regulatory restrictions on off-label use |

Generic erosion, potential restrictions on sales |

| Market Saturation |

Maturity in key markets |

Revenue plateau, need for innovation |

| Competition from Alternative Therapies |

Natural remedies, devices, lifestyle interventions |

Market share loss, decreased demand |

| Reimbursement Policies |

Variations globally affecting affordability |

Reduced access in cost-sensitive regions |

Key Takeaways

-

Viagra's initial dominance has waned post-patent expiry; however, it remains an important segment within the ED treatment market.

-

Generics dominate, but Pfizer sustains presence through product diversification and branding.

-

The global ED market is projected to decline slightly in revenue terms but remains substantial, driven by demographic changes and innovation.

-

Future growth hinges on technological advances, expanding emerging markets, and potential shifts toward OTC availability.

-

Competition from newer drugs, natural remedies, and lifestyle interventions pose structural challenges.

FAQs

1. How has Viagra's market share evolved since patent expiry?

Post-2012 patent expiry, Viagra's global market share declined sharply due to proliferation of sildenafil generics. Nonetheless, Pfizer retains a significant share through brand loyalty, invested marketing, and new formulations, constituting approximately 20% of the ED market in 2022.

2. What are the key factors influencing Viagra's revenue future?

The future trajectory depends on generic penetration, regulations, emerging formulations, aging demographics, reimbursement policies, and the competitive landscape involving alternative treatments.

3. Are there new formulations or indications for Viagra?

While current focus is on ED, Viagra is also approved for pulmonary arterial hypertension (Revatio). Research into new formulations (e.g., transdermal, oral dissolvables) is ongoing but not yet mainstream.

4. How do regulatory agencies impact Viagra’s market?

Regulatory decisions influence approval of new formulations, OTC availability, and off-label restrictions, significantly impacting sales and market access.

5. What role will digital health play in Viagra’s future?

Telemedicine and digital health platforms facilitate easier access, prescriptions, and adherence, potentially expanding market reach, especially in underserved regions.

References

[1] Feldman, H. A., et al. (2000). Prevalence and Correlates of Erectile Dysfunction in Men with Diabetes. Diabetes Care, 23(4), 518–524.

[2] Pfizer Annual Reports (2004-2022).

[3] MarketWatch. (2022). Viagra Market Analysis & Forecast.

[4] GlobalData. (2021). Erectile Dysfunction Drugs Market Analysis.

[5] U.S. Food and Drug Administration. (2023). Approved indications and formulations for sildenafil.