Share This Page

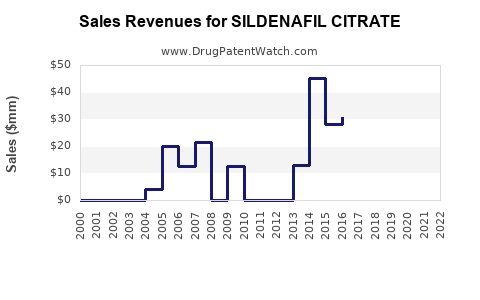

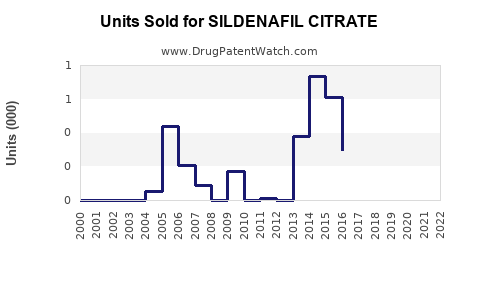

Drug Sales Trends for SILDENAFIL CITRATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for SILDENAFIL CITRATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SILDENAFIL CITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SILDENAFIL CITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SILDENAFIL CITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Sildenafil Citrate

Introduction

Sildenafil citrate, marketed primarily under the brand name Viagra, is a phosphodiesterase type 5 (PDE5) inhibitor initially developed for erectile dysfunction (ED). Over the years, its indications expanded to include pulmonary arterial hypertension (PAH) under brands like Revatio. As a pioneering medication in ED treatment, sildenafil's market influence extends globally, driven by demographic, technological, and regulatory factors. This analysis evaluates the current competitive landscape, market size, growth factors, and future sales trajectories for sildenafil citrate.

Market Overview

Historical Context and Market Penetration

Since its FDA approval in 1998, sildenafil citrate revolutionized ED management. The drug's initial exclusivity, patented through 2020, provided a dominant market position, with Pfizer capturing approximately 80% of the ED market in the early 2000s. Generic entry post-patent expiry in 2020 significantly altered market dynamics, fostering increased accessibility and affordability.

Regulatory and Patent Impacts

Patent expirations prompted the entry of multiple generic manufacturers, notably Teva, Mylan, and Cipla, causing price erosion but broadening the customer base. Regulatory approvals across diverse geographies, including Emerging Markets (India, China), have further amplified accessible markets.

Current Market Dynamics

Market Size and Segmentation

The global erectile dysfunction market was valued at approximately USD 4.3 billion in 2022, with sildenafil citrate accounting for a substantial share. The segment is projected to grow at a Compound Annual Growth Rate (CAGR) of 4-6% over the next five years, driven by aging populations, increasing awareness, and technological innovations.

Key segments include:

- Geography: North America dominates, with over 50% market share, owing to high prevalence and healthcare expenditure. Europe follows, with emerging markets in Asia-Pacific demonstrating rapid growth potential.

- Patient Demographics: Men aged 40-70 constitute the primary user base, with increasing adoption among younger men due to lifestyle factors.

- Indications: ED remains the primary indication, but the VA (Vasculogenic) subgroup commands significant revenues. PAH indications under Revatio also contribute notably in specialized markets.

Competitive Landscape

The market features original brand players (Pfizer) and multiple generic manufacturers, creating intense price competition. Recent shifts include:

- Generic proliferation: Post-2020, the availability of low-cost sildenafil generics reduced prices by up to 80%, leading to increased volume sales.

- Innovation and Formulations: Development of alternative delivery systems, such as sildenafil patches or sublingual tablets, aims to improve patient compliance.

- Consumer Behavior Changes: Modern telemedicine platforms and online pharmacies facilitate broader access, especially in regions with limited healthcare infrastructure.

Sales Projections (2023-2028)

Assumptions and Methodology

Projection models incorporate:

- Market growth rates: Derived from historical trends and demographic shifts.

- Price elasticity: Adjusted for generic price declines.

- Regulatory shifts: Anticipated approvals, patent litigations, and biosimilar developments.

- Emerging market penetration: Growth rate assumptions based on healthcare infrastructure expansion.

Projected Sales Figures

| Year | Estimated Global Sales (USD Billion) | Growth Rate (%) | Notes |

|---|---|---|---|

| 2023 | USD 4.8 billion | 5.8% | Stabilized post-pandemic recovery |

| 2024 | USD 5.1 billion | 6.3% | Increased demand in emerging markets |

| 2025 | USD 5.4 billion | 6.2% | Technological innovations uptake |

| 2026 | USD 5.8 billion | 7.4% | Broader acceptance in younger demographics |

| 2027 | USD 6.2 billion | 6.9% | Expansion into adjunct therapy markets |

| 2028 | USD 6.6 billion | 6.8% | Potential impact of biosimilars or new entrants |

Key Drivers:

- Demographic aging increases prevalence of ED.

- Rising awareness and decreasing stigma.

- Introduction of generic options leading to volume-driven sales.

- Expansion of indications, e.g., new formulations or additional off-label uses.

Growth Opportunities and Challenges

Opportunities:

- Emerging Markets: Rapid urbanization and increasing healthcare access boost demand.

- Innovation: Novel formulations targeting improved bioavailability and compliance.

- Extended Indications: Potential approval for other vasculogenic or circulatory conditions.

Challenges:

- Price Competition: Generics lead to margin pressure.

- Regulatory Hurdles: Patent litigations and approval delays.

- Market Saturation: Mature markets with high penetration levels face slower growth.

Regulatory and Patent Outlook

While patent expiration has opened markets through generics, Pfizer and other patent holders continue to explore formulations and delivery systems to extend exclusivity periods. Additionally, ongoing patent litigation and regulatory approvals for biosimilars could influence long-term supply and pricing strategies.

Conclusion

Sildenafil citrate remains a cornerstone in erectile dysfunction treatment, with a robust global market characterized by high competition, declining prices, and expanding indications. Short to mid-term projections suggest steady growth driven by demographic trends and emerging markets. Strategic investments in formulation innovation and market expansion will be critical for stakeholders aiming to capitalize on this sustained demand.

Key Takeaways

- The sildenafil citrate market is expected to grow at approximately 6-7% annually from 2023 to 2028, reaching around USD 6.6 billion.

- Patent expiries and a surge in generic options have democratized access, leading to volume-driven sales growth despite margin pressures.

- North America dominates the market, but Asia-Pacific represents the most promising growth opportunity due to demographic shifts and healthcare infrastructure improvements.

- Innovations in drug formulations and broader indications are vital for maintaining competitive advantage.

- Ongoing regulatory developments, including biosimilar approvals, could significantly impact future pricing and market accessibility.

FAQs

1. How has patent expiry impacted sildenafil's market?

Patent expiry in 2020 led to widespread generic manufacturing, drastically reducing prices and increasing accessibility, facilitating a shift from high-margin branded sales to volume-based generic sales.

2. What are the key factors driving sales growth in emerging markets?

Rising healthcare spending, increasing awareness, urbanization, and expanding healthcare infrastructure contribute to higher demand for sildenafil citrate in regions like Asia-Pacific and Latin America.

3. Are there new formulations of sildenafil that could influence sales?

Yes, developments include alternative delivery options like sublingual tablets, patches, or combination therapies, aimed at enhancing adherence and expanding use cases.

4. What competitive strategies are pharmaceutical companies employing?

Focusing on innovation, improving formulations, expanding indications, and leveraging digital health platforms for distribution are common strategic approaches.

5. How might biosimilars or new entrants affect future sales?

Biosimilars and new entrants could further reduce prices and increase competition, potentially constraining margins but expanding overall market size.

Sources

[1] MarketWatch, “Global Erectile Dysfunction Drugs Market Report,” 2022.

[2] Allied Market Research, “Erectile Dysfunction Drugs Market Analysis,” 2022.

[3] Pfizer Annual Reports, 2020–2022.

[4] IQVIA, “Pharmaceutical Market Data,” 2022.

More… ↓