Last updated: July 27, 2025

Introduction

Oxybutynin chloride, a first-generation anticholinergic agent, remains a cornerstone in managing overactive bladder (OAB) and urinary incontinence. Since its original approval in the late 20th century, the drug has experienced evolving market dynamics driven by advancements in therapeutics, regulatory landscapes, and shifting healthcare paradigms. This article provides a comprehensive analysis of current market trends and projective financial trajectories for oxybutynin chloride, offering critical insights for stakeholders, including pharma companies, investors, and healthcare providers.

Historical Market Overview

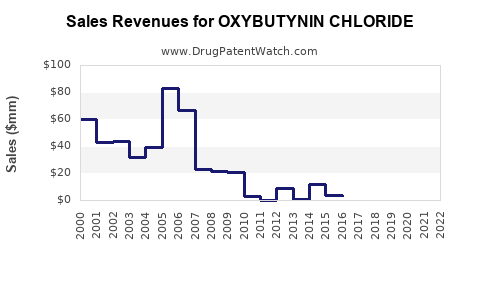

Initially launched in the form of oral tablets, oxybutynin chloride gained rapid adoption due to its efficacy and minimal side effects compared to surgical interventions. The early market was dominated by immediate-release formulations, with sales driven primarily by urology specialists and primary care physicians. According to IMS Health (now IQVIA), oxybutynin registered peak global sales of approximately $1.2 billion in the late 2000s, driven largely by the North American and European markets [1].

Over the years, patent expirations and the advent of generic manufacturing substantially eroded branded sales. Simultaneously, the development of transdermal patches and extended-release formulations diversified its delivery options, expanding patient compliance and market penetration.

Market Dynamics

Technological Innovation and Formulation Diversification

The pharmaceutical industry has continuously innovated on oxybutynin delivery. The transition from oral immediate-release to transdermal patches and extended-release tablets mitigated common adverse effects such as dry mouth and constipation, thus enhancing patient adherence. These advancements, however, also prompted direct competition from newer agents (e.g., mirabegron) and combination therapies.

Regulatory Landscape

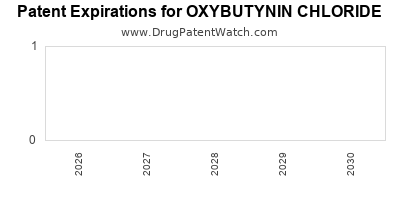

Regulatory agencies like the FDA and EMA have maintained a rigorous approval process for new formulations and combinations. While patent protections on original formulations have expired, patents on specific delivery devices (transdermal patches) and formulations have provided temporary exclusivity, influencing market supply dynamics. Additionally, regulatory labels emphasizing safety profiles have shaped prescribing practices, especially among elderly populations susceptible to anticholinergic side effects.

Competitive Environment

A plethora of generic equivalents has saturated the market, fostering price competition and reducing profit margins. Several pharmaceutical firms have introduced modified-release formulations to maintain market share. Key competitors include branded drugs like Ditropan XL (originally oxybutynin extended-release) and newer classes such as β3-adrenergic agonists (e.g., mirabegron), which are positioned as more tolerable alternatives.

Market Drivers

-

Rising Prevalence of Overactive Bladder: Globally, OAB prevalence increases with age, affecting approximately 12-17% of adults aged over 60 worldwide [2]. Rising geriatric populations potentiate the demand for effective, tolerable therapies.

-

Increased Awareness and Diagnosis: Better diagnostic tools and heightened clinical awareness contribute to higher treatment rates, indirectly fueling demand for oxybutynin and its alternatives.

-

Healthcare Policy and Reimbursement: Variability in insurance coverage influences formulary selections. Government policies favoring cost-effective generics sustain the prevalence of oxybutynin in treatment regimens.

Market Challenges

-

Side-Effect Profile and Patient Discontinuation: Anticholinergic burden, leading to dry mouth, constipation, and cognitive impairment, particularly among older adults, has driven the search for complementary therapies.

-

Emergence of β3-Adrenoceptor Agonists: Drugs like mirabegron present a tolerability advantage, encroaching on oxybutynin’s market share. Their favorable side-effect profile makes them increasingly preferred.

-

Regulatory and Patent Challenges: Patent expirations on key formulations have led to increased generic competition, pressuring prices and margins.

Financial Trajectory

Current Revenue Streams

Despite patent expiry, oxybutynin remains a significant contributor to uroselective treatment options. According to IQVIA, global sales for oxybutynin formulations are roughly USD 400–600 million annually, with the United States accounting for a notable share due to high prevalence and healthcare penetration [3]. The market is expected to sustain this level of revenue primarily through generic proliferation and expand through emerging markets.

Forecasted Market Growth

The global overactive bladder treatment market is projected to grow at a compound annual growth rate (CAGR) of 5-7% through 2028, driven by demographic shifts and product diversification [4]. While newer agents like mirabegron and solifenacin see increasing adoption, oxybutynin's share is anticipated to decline gradually but remain relevant due to its cost-effectiveness and established efficacy.

Emerging Opportunities

-

Combination Formulations: Fixed-dose combinations with other agents to improve compliance.

-

Transdermal Delivery: Continued innovation may extend the life cycle of existing formulations and create premium-priced products.

-

Untapped Markets: Emerging economies with expanding healthcare access and increasing disease awareness present consumption opportunities, especially with low-cost generic versions.

Risks and Mitigation Strategies

-

Market Penetration by Newer Agents: Companies may counter this by emphasizing cost advantages of oxybutynin and developing formulations with improved tolerability.

-

Regulatory Delays: Proactive engagement with regulatory authorities and continual safety data collection are essential to maintain approvals.

-

Patent Challenges: Strategic patent filings on delivery devices and formulations can prolong market exclusivity.

Conclusion

Oxybutynin chloride persists as a vital component within the overactive bladder pharmacotherapy landscape. Its market dynamics are characterized by innovation in delivery methods, intense generic competition, and evolving therapeutic preferences favoring better tolerability. Financially, it is expected to retain a substantial revenue base, especially in cost-sensitive markets, with gradual declines offset by product diversification and emerging market opportunities.

Stakeholders must navigate patent expirations, competitive shifts, and demographic trends to sustain profitability. Emphasizing formulation improvements and market expansion strategies will be critical in shaping the drug’s future financial trajectory.

Key Takeaways

- The oxybutynin chloride market remains substantial globally, driven by the high prevalence of overactive bladder.

- Innovations such as transdermal patches and extended-release formulations have maintained or expanded its market presence.

- The expiration of patents and competition from newer agents are exerting downward pressure on sales and margins.

- Demographic shifts, particularly aging populations, present ongoing growth opportunities, especially in developing markets.

- Strategic formulation development, regulatory engagement, and market diversification are essential to secure oxybutynin’s financial future.

FAQs

-

What factors most influence oxybutynin chloride’s market growth?

Demographic aging, increased awareness and diagnosis of overactive bladder, cost advantages of generics, and advancements in delivery formulations primarily drive growth.

-

How does the emergence of mirabegron affect oxybutynin’s market share?

Mirabegron offers a favorable side-effect profile, attracting patients intolerant to anticholinergics, leading to competitive pressure and potential market share decline for oxybutynin.

-

What are the main risks facing oxybutynin chloride’s future profitability?

Patent expirations, increasing competition from newer therapies, side-effect concerns, and regulatory challenges pose significant risks.

-

Are there promising innovations that could prolong oxybutynin’s market relevance?

Yes, development of better-tolerated formulations, combination therapies, and targeted delivery systems can enhance its appeal.

-

Which markets are expected to see the highest growth in oxybutynin chloride demand?

Emerging economies with increasing healthcare access and aging populations are projected to experience the most significant growth opportunities.

References

[1] IQVIA (formerly IMS Health), "Global Urology Market Data," 2022.

[2] M. Coyne et al., "Prevalence of Overactive Bladder in the United States," Urology, 2018.

[3] IQVIA, "Pharmaceutical Sales Data," 2022.

[4] Grand View Research, "Overactive Bladder Market Size & Trends," 2021.