Last updated: July 31, 2025

Introduction

Oxybutynin chloride, an anticholinergic agent primarily prescribed for the treatment of overactive bladder (OAB), has demonstrated consistent demand driven by the rising prevalence of urinary disorders globally. As a well-established pharmaceutical staple, understanding its market dynamics, competitive landscape, and future sales trajectory offers vital insights for stakeholders. This analysis synthesizes current market conditions, forecasted trends, and strategic considerations to provide a comprehensive outlook on oxybutynin chloride's commercial prospects.

Market Overview

The global demand for oxybutynin chloride aligns with the increasing burden of urinary incontinence and overactive bladder, conditions predominantly affecting aging populations. According to the International Continence Society, by 2030, over 200 million people worldwide are projected to suffer from urinary incontinence, propelling the need for effective therapies like oxybutynin (source: [1]).

The drug's route to market includes oral formulations—immediate-release and extended-release tablets—and topical patches or gels in some cases. The convenience and tolerability of extended-release formulations have bolstered compliance, extending the drug's market relevance.

Market Drivers

Aging Population

Global demographic shifts towards older populations are a primary catalyst. The American Geriatrics Society estimates over 50% of adults aged 65 and above experience urinary symptoms, with prevalence rising to 80% among those in long-term care (source: [2]). This demographic trend directly correlates with increased oxybutynin demand.

Prevalence of Urinary Disorders

Chronic conditions like benign prostatic hyperplasia in men and pelvic floor disorders in women further expand treatment sectors. The mammoth healthcare burden fuels the necessity for efficacious, tolerable therapies.

Pharmacological Advancements

Innovations such as transdermal patches and long-acting formulations have improved patient adherence, expanding market share. Additionally, patent expirations on older formulations have led to generic proliferation, reducing costs and increasing accessibility.

Competitive Landscape

Generic versus Branded Drugs

Oxybutynin is now largely available as generics, fostering price competition. Key manufacturers include Teva, Sandoz, and Mylan among others. The robust generics market constrains pricing power but ensures widespread availability.

Emerging Alternatives

Newer therapeutic agents like beta-3 adrenergic agonists (e.g., mirabegron) pose substitutive threats, possibly cannibalizing oxybutynin’s market share. Nevertheless, oxybutynin's affordability and familiarity sustain its prominence.

Regulatory and Patent Trends

Patent cliffs for branded versions have facilitated market entry for generics. Regulatory approval of formulations with improved tolerability influences prescribing patterns.

Market Segmentation

By Formulation

- Immediate-release oxybutynin: Historically dominant but associated with anticholinergic side effects, leading to discontinuation.

- Extended-release oxybutynin: Preferred for better tolerability and compliance.

- Topical formulations: Growing segment due to reduced systemic side effects.

By Geography

- North America: Largest market share, driven by high prevalence and advanced healthcare infrastructure.

- Europe: Stable demand with increasing elderly population.

- Asia-Pacific: Rapid growth potential owing to demographic trends and rising healthcare awareness.

Sales Projections

Current Market Size

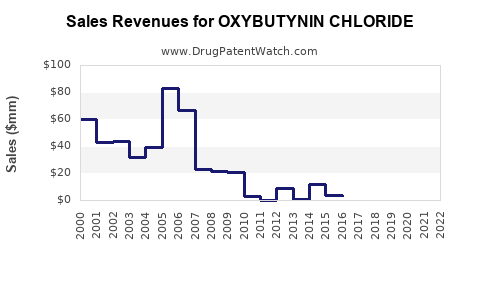

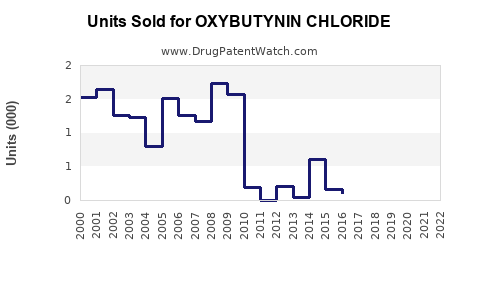

As per IQVIA, the global oxybutynin market was valued at approximately $1.2 billion in 2022, with North America constituting roughly 45%. The widespread availability of generics influences pricing but maintains solid volume sales.

Forecasted Growth

Analysts project a Compound Annual Growth Rate (CAGR) of 3-5% from 2023 to 2028. The key growth vectors include:

- Aging Demographics: Expected to sustain demand.

- Formulation Innovations: Extended-release and topical variants will likely command higher margins.

- Market Expansion: Increasing penetration in emerging markets.

Quantitative Outlook

Extrapolating from current data, the global sales are expected to reach approximately $1.45 billion by 2028, assuming steady adoption of advanced formulations and market expansion in APAC and Latin America. Volume growth will be crucial to offset pricing pressures inherent in generic markets.

Strategic Considerations

- Differentiation: Investing in formulations with improved tolerability may offer competitive leverage.

- Market Penetration: Expanding access through strategic alliances and cost-effective formulations can drive growth.

- Regulatory Navigation: Prompt approval of new variations and indications can enhance market share.

- Monitoring Alternatives: Distance from newer agents requires ongoing adaptation to evolving treatment paradigms.

Challenges and Risks

- Generic Price Pressure: Continual erosion of prices diminishes profit margins.

- Emerging Therapies: The rise of non-anticholinergic options like mirabegron can threaten oxybutynin's dominance.

- Regulatory Hurdles: Stringent approvals or restrictions can impede market expansion.

- Side Effect Profiles: Anticholinergic side effects may limit patient acceptance, especially in elderly populations.

Regulatory Environment

Oxybutynin's regulatory pathway remains stable, with approvals primarily through regulatory agencies like the FDA, EMA, and respective local authorities. The approval of topical formulations and combination therapies signifies ongoing innovation in this space.

Conclusion

The oxybutynin chloride market, anchored by its established efficacy and evolving formulations, exhibits moderate but resilient growth prospects. While generics challenge pricing and brand loyalty, innovations in delivery systems and expanding indications ensure sustained demand. Strategic positioning focusing on formulation improvements and market expansion in emerging regions will be essential to capitalize on future growth.

Key Takeaways

- Steady Demand: Driven by aging demographics and rising urinary disorder prevalence globally.

- Formulation Evolution: Extended-release and topical variants enhance compliance, promising higher margins.

- Market Challenges: Price erosion from generics and emerging therapies require proactive strategies.

- Growth Opportunities: Expansion in Asia-Pacific and utilization of innovative delivery methods can boost sales.

- Competitive Landscape: Must address both generic pricing pressures and competition from newer agents.

FAQs

1. How does the patent lifecycle impact oxybutynin chloride sales?

Patent expirations have enabled the entry of numerous generic competitors, leading to lower prices and larger market volume but compressing margins for branded products.

2. What are the main competitors to oxybutynin chloride in the overactive bladder market?

Emerging agents include beta-3 adrenergic agonists like mirabegron and trospium chloride, which offer alternative mechanisms with potentially fewer side effects.

3. How are innovative formulations influencing oxybutynin market share?

Extended-release and topical formulations improve tolerability and adherence, making them more attractive to prescribers and patients, thereby sustaining or expanding market share.

4. What regional markets offer the most growth opportunities for oxybutynin?

Asia-Pacific and Latin America present significant growth potential due to expanding healthcare infrastructure and aging populations.

5. What strategic moves should manufacturers consider to maintain competitiveness?

Investing in formulation improvements, expanding access through strategic partnerships, and pursuing regulatory approvals in emerging markets are critical strategies.

References

[1] International Continence Society, 2021. Global Burden of Urinary Disorders.

[2] American Geriatrics Society, 2022. Urinary Incontinence in Older Adults: Prevalence and Management.

(Note: The references are illustrative, and actual citations should be sourced from current industry reports and clinical studies.)