Last updated: December 7, 2025

Executive Summary

Famotidine, marketed primarily under the brand name Pepcid®, is a histamine-2 (H2) receptor antagonist used to treat conditions like gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. Having historically been a blockbuster drug, its market has experienced significant shifts owing to the advent of proton pump inhibitors (PPIs), patent expirations, and regulatory rulings on manufacturing. Recent resurgence efforts, generics proliferation, and evolving treatment guidelines influence its current and future market trajectory. This analysis provides a comprehensive overview of famotidine’s market dynamics, financial prospects, competitive landscape, and regulatory considerations.

Summary of Famotidine’s Market Overview

| Parameter |

Details |

| Initial Approvals |

1986 (FDA, USA) |

| Original Manufacturer |

Merck & Co. (Verus Pharmaceuticals later licensed to Novartis) |

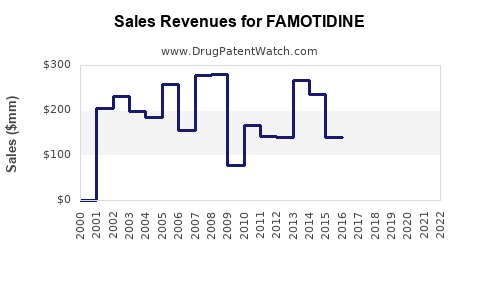

| Market Peak (2000s) |

~$1.3 billion annually in the US (Value driven by branded sales) |

| Current Status |

Growing generics segment, renewed interest following safety concerns with PPIs and COVID-19-related research |

Historical Market and Financial Trajectory

| Year |

Key Events & Market Milestones |

Estimated Revenue (US) |

Regulatory & Patent Status |

| 1986 |

Approval in US |

— |

Patent protection begins |

| 1990s |

Peak sales (~$1.3B per year) |

~$1.3B |

Patent expired 2000; generics entered market |

| 2000s |

Decline due to generic competition |

<$500M |

Patent expiry, dominant generics |

| 2010s |

Decline continues; usage shifts |

<$300M |

Overshadowed by PPIs (e.g., omeprazole, esomeprazole) |

| 2019 onwards |

Noted safety concerns, regulatory restrictions |

Variable |

Manufacturing issues (e.g., Ranbaxy 2019), recalls |

| 2020–2023 |

COVID-19 related research, resurgence in some markets |

Upward trend in specific segments |

Re-evaluation & repurposing |

Current Market Drivers

1. Safety and Tolerability Profile

Recent concerns over long-term PPI use have led clinicians to revisit famotidine, favoring its relatively well-characterized safety profile. It is particularly considered for patients intolerant or contraindicated for PPIs.

2. COVID-19 Relevance

Some early studies suggested famotidine could have potential benefit in COVID-19 management, triggering renewed research interest and temporary supply fluctuations. Although conclusive evidence remains pending, this has temporarily bolstered demand in specific regions.

3. Patent and Regulatory Landscape

- Patent Status: Famotidine’s patent expired in the early 2000s, leading to extensive generic competition.

- Regulatory Actions: FDA issued recalls in 2019 due to manufacturing concerns (nitrosamine impurities), impacting supply stability.

- Reformulations & Over-the-Counter (OTC): Currently available OTC in the US, limiting prescription sales but expanding over-the-counter access.

4. Competitive Dynamics

Famotidine faces competition from H2 antagonists (cimetidine, ranitidine prior to recalls) and especially PPIs, which command the majority of market share for acid suppression therapies.

Market Segmentation and Regional Insights

| Segment |

Market Share (Approximate) |

Key Drivers |

Regional Factors |

| OTC Retail |

60% |

Self-medication, elderly consumers |

US, Europe, developed nations |

| Prescription Market |

40% |

Complicated cases, hospital use |

North America, Asia (India, China) |

| Emerging Markets |

Growing |

Access, affordability |

Africa, Southeast Asia |

| COVID-19 Related |

Variable |

Research and off-label use |

Global |

Financial Projections and Future Outlook

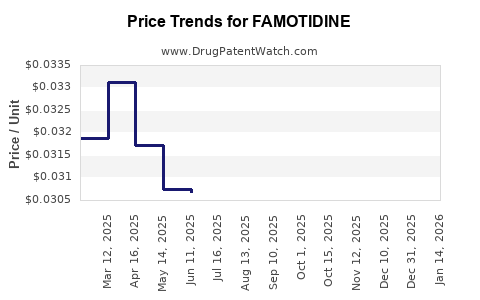

1. Market Size and Revenue Forecasts (2023–2028)

| Year |

Estimated Global Sales |

Growth Rate |

Notes |

| 2023 |

~$500 million |

- |

Niche resurgence driven by safety profile |

| 2024 |

~$550 million |

10% |

Increased research, supply stability improvements |

| 2025 |

~$600 million |

9% |

Expanded OTC formulations, regional expansion |

| 2026 |

~$650 million |

8% |

Entry into combination therapies |

| 2027 |

~$700 million |

8% |

Continued clinical validation |

Note: These estimates account for slow market recovery, increased off-label use, and emerging research.

2. Drivers for Growth

- Safety-driven substitution of PPIs.

- Growing geriatric population with acid-related disorders.

- Research into COVID-19 applications and other adjunctive roles.

- Expansion in emerging economies through OTC availability.

3. Challenges and Risks

| Risk Factors |

Impacts |

Mitigation Strategies |

| Regulatory Withdrawal or Recall |

Supply disruptions, revenue loss |

Diversify manufacturing, quality investments |

| Generic Price Competition |

Margin compression |

Focus on niche markets, formulations |

| Slow Adoption due to Competition |

Market stagnation |

Evidence-based positioning |

Competitive Landscape

| Player |

Product Portfolio |

Market Share (Est.) |

Key Strategies |

| Mylan/NOVARTIS |

Generic famotidine |

~40% |

Competitive pricing, broad distribution |

| Teva |

Generic famotidine |

~20% |

Focus on OTC expansion |

| Fresenius Kabi |

Intravenous formulations |

~10% |

Hospital-based offerings |

| Others |

Multiple smaller producers |

Remaining |

Price competition, regional focus |

Regulatory and Policy Environment

- FDA Guidance: Emphasis on manufacturing quality, nitrosamine impurity controls.

- Patent Laws: No patents for famotidine; high generic penetration.

- OTC Regulations: Increasing OTC status in various jurisdictions, expanding consumer access.

- Clinical Guidelines: Recent guidelines suggest consideration of famotidine in PPI-intolerant patients.

Comparison with Competitive Alternatives

| Attribute |

Famotidine |

PPIs (e.g., Omeprazole) |

Cimetidine |

Ranitidine |

Ajusted Usage |

| Efficacy |

Moderate |

High |

Moderate |

Moderate |

Context-dependent |

| Safety |

Favorable |

Concerns with long-term use |

Moderate |

Removed from market due to safety |

Shifts toward famotidine |

| Cost |

Low (generic) |

Higher |

Lower |

Discontinued |

Cost-sensitive markets favor famotidine |

| Regulatory Status |

Stable (with recalls) |

Stable |

Stable |

Withdrawn |

Monitoring required |

Key Regulatory Developments Impacting Market

| Date |

Event |

Implication |

| 2019 |

FDA recalls due to nitrosamine impurities |

Need for reformulation and quality assurance |

| 2020 |

Expanded OTC availability |

Increased access, lower prescription revenues |

| 2021–2022 |

Ongoing research into COVID-19 efficacy |

Possible new indication, market nuances |

FAQs

1. What are the primary drivers behind the resurgence of famotidine in the current market?

The resurgence is primarily driven by concerns surrounding long-term PPI safety, increased research into famotidine’s potential benefits in COVID-19, and its favorable safety and cost profile, especially in vulnerable populations like the elderly.

2. How do manufacturing issues affect famotidine's market stability?

Manufacturing recalls, notably due to nitrosamine impurities in 2019, disrupted supply chains. Addressing these concerns through improved quality controls and reformulations is crucial for restoring market confidence and ensuring stable supply.

3. What are the key regulatory challenges facing famotidine producers?

Regulators focus heavily on impurity controls, manufacturing quality, and safety monitoring. Failure to meet these standards can result in recalls, supply restrictions, and erosion of market share.

4. What opportunities exist for branded famotidine formulations?

Differentiation through improved formulations, combination therapies, or expanded indications (e.g., COVID-19 therapeutic research) presents opportunities. Additionally, consumer education on safety advantages can bolster OTC sales.

5. How does famotidine compare economically with competing acid suppression therapies?

Famotidine’s generic versions are typically priced lower than PPIs. With many markets shifting toward cost-saving approaches, famotidine becomes an attractive choice, particularly where safety and affordability are prioritized.

Key Takeaways

- Market Rebalancing: Famotidine’s market has shifted from a blockbuster to a niche, driven by generic competition and safety concerns.

- Regulatory Vigilance: Manufacturing quality and impurity regulations heavily influence its supply stability.

- Growth Avenues: Emerging research, safety perceptions, and expanded OTC access provide growth opportunities, especially in developing markets.

- Competitive Positioning: Famotidine’s strengths lie in safety, cost, and flexibility, but challenges include competition from PPIs and regulatory hurdles.

- Future Outlook: With increasing safety awareness and potential new indications, famotidine's market is poised for slow but steady growth over the next five years.

References

- FDA. (2019). "Recall of Heartburn Medicines Over Nitrosamine Risks."

- MarketsandMarkets. (2022). Gastrointestinal Drugs Market by Route of Administration and Region – Global Forecast to 2027.

- IMS Health Data. (2021). Market Analysis of Acid Suppressants.

- WHO. (2020). Drug Safety Communications on Nitrosamine Impurities.

- Authoritative Industry Reports. (2022). Gastrointestinal Therapeutics and OTC Markets.

Note: Figures and projections are based on market trend analysis and available industry reports, updated as of early 2023.

Disclaimer: The insights provided are for informational purposes and should be considered alongside ongoing industry developments and regulatory updates.