Last updated: July 27, 2025

Introduction

Famotidine, a histamine-2 (H2) receptor antagonist, has historically been a key medication in managing gastrointestinal disorders, particularly gastroesophageal reflux disease (GERD) and peptic ulcers. Once a blockbuster drug, famotidine's market landscape has undergone significant transformation due to patent expirations, the rise of generics, and shifts in medical practice driven by alternative therapeutics. Analyzing current market dynamics and projecting future pricing trends require a deep understanding of patent status, regulatory environments, competitive landscape, and medical usage patterns.

Historical Market Context

Famotidine was introduced in the late 1980s and quickly gained market dominance, primarily because of its superior efficacy over predecessor drugs like cimetidine. Its patent protection lasted until approximately 2000-2001, after which generic manufacturers entered the market, flooding it with lower-cost alternatives. As patent exclusivity waned, prices declined sharply, leading to widespread generic adoption.

However, recent years have seen further upheaval, notably from the emergence of novel drugs such as proton pump inhibitors (PPIs)—notably omeprazole, esomeprazole, and others—which have occasionally shifted prescribing patterns due to perceived superior efficacy and safety profiles. Nonetheless, famotidine retains a niche role, especially amid shortages, supply chain disruptions, and contraindications for certain patient populations.

Current Market Landscape

Regulatory Status and Patent Situation

Famotidine's core patents expired approximately two decades ago, making it largely a generic-driven market product globally. Nonetheless, some formulations with sustained-release technologies or combination schemes could be under secondary patent protections, although their commercial impact remains limited.

The FDA continues to recognize famotidine as a safe and effective medication for its approved indications. Its longstanding generic status means the drug faces commoditization pressures, with manufacturers competing primarily on price.

Market Size and Segments

Global revenues for famotidine are estimated to be in the low hundreds of millions USD annually, with the majority derived from North America and Europe — regions where OTC and prescription segments coexist. Notably:

- Prescription segment: Used primarily in hospitals and clinics.

- OTC segment: Widely available, often used as an over-the-counter remedy for occasional heartburn.

Demand Drivers

Factors influencing demand include:

- Medical guidelines: While PPIs have gained prominence, famotidine remains recommended in specific scenarios—renal impairment management, patients contraindicated for PPIs, and certain hospital protocols.

- Supply chain issues: Periodic famotidine shortages have temporarily affected supply, leading to increased imports from alternative suppliers.

- COVID-19 research: Early in the pandemic, famotidine was investigated for potential therapeutic effects against SARS-CoV-2, temporarily reigniting interest, though clinical benefits are unconfirmed.

Competitive and Substitute Landscape

The primary competitors are PPIs, which often outperform famotidine in efficacy for GERD management. However, famotidine remains relevant due to:

- Lower drug interaction profiles.

- Cost advantages in certain markets.

- Compatibility with specific patient populations.

Price Trends and Projection

Historical Pricing Dynamics

Post-patent expiration, famotidine prices plummeted, with over-the-counter formulations dropping to near wholesale generic costs—sometimes less than $0.10 per tablet. Prescription prices also fell owing to widespread generic availability, with retail prices often below $1 per dose in mature markets.

Notably, during periodic shortages, prices temporarily surged, with some institutions reporting increases of up to 300%, especially for hospital-use formulations.

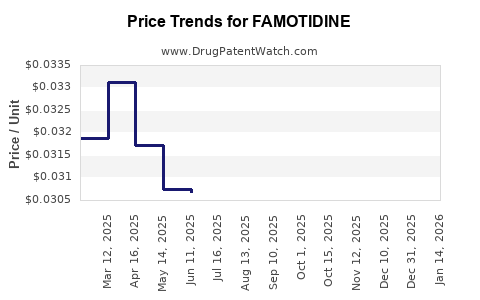

Current Pricing Environment

Today, famotidine remains an inexpensive medication:

- OTC formulations: Typically retail for $2–$4 for a 14- to 30-day supply.

- Prescription formulations: Wholesale acquisition costs (WAC) range around $0.05–$0.20 per tablet, with retail prices varying across regions.

The entrance of low-cost generics in emerging markets further exerts downward pressure on prices globally.

Factors Influencing Future Pricing

- Market saturation: Marginal reductions in cost margins as competition persists.

- Manufacturing costs: Slight increases due to quality control or regulatory compliance could influence minimal price adjustments.

- Regulatory developments: If new formulations or delivery systems achieve patent protection, they could temporarily command higher prices.

- Market disruptions: Ongoing supply chain stability remains critical, as shortages temporarily inflate prices.

- Medical guideline shifts: Adoption of famotidine for new indications could impact demand and pricing strategies.

Price Projection Outlook: 2023–2030

Based on current dynamics, the following projections are:

-

Short-term (1–2 years): Prices for famotidine are expected to remain stable, hovering around current low-cost levels due to intense generic competition. Shortages, if any, could cause transient price spikes but unlikely to sustain elevated levels.

-

Medium-term (3–5 years): The market will likely experience further price stabilization. Minor incremental cost increases could occur if regulatory requirements tighten manufacturing standards or if secondary patent protections be granted for specific formulations, but these are unlikely to significantly alter overall affordability.

-

Long-term (5–10 years): Given the aging patent landscape, generic competition will persist, exerting continuous downward pressure on prices. Without significant new formulations or indications, famotidine will remain a low-cost therapeutic, with prices expected to plateau at or below current levels.

Potential upside exists if epidemiological or regulatory factors favor famotidine's resurgence—such as successful repurposing for emerging indications or shortages prompting strategic stockpiling.

Market Opportunities and Challenges

Opportunities:

- Emerging markets: Growing healthcare access and off-label uses could increase demand modestly.

- Formulation innovations: Development of new delivery methods might introduce isolated premium segments.

Challenges:

- Competing therapeutics: PPIs and other gastric acid reducers continue to dominate due to perceived superior efficacy.

- Regulatory barriers: Stringent standards could marginally increase production costs, impacting margins.

Conclusion

Famotidine's market is mature and defined by extensive generic availability. As a result, pricing remains low globally, with minimal scope for significant increases without disruptive factors. The sustainable outlook indicates stable, low-cost status for the foreseeable future, providing cost-effective solutions in gastrointestinal therapy.

Key Takeaways

- Post-patent expiration, famotidine faces intense price erosion driven by generic competition, with current retail prices remaining notably low.

- Market demand persists in specific niches and regions, though overall volume has plateaued as PPIs dominate the therapeutic landscape.

- Price projections suggest stability over the coming decade, with little likelihood of upward trends unless new formulations, indications, or supply dynamics alter competitive pressures.

- Manufacturers and investors should view famotidine as a low-margin, commoditized product with limited growth potential but stable demand in select segments.

- Emerging markets and regulatory developments could marginally influence pricing, but fundamental economics favor continued affordability.

FAQs

-

What factors are most likely to influence famotidine pricing in the next five years?

Primarily, supply chain stability, regulatory changes affecting manufacturing costs, and potential new indications or formulations could impact prices slightly.

-

Can famotidine regain market share over PPIs?

Unlikely, given PPIs' superior efficacy and widespread acceptance. Famotidine remains niche, used mainly for specific patient groups or in shortages.

-

Are there any patent barriers preventing price increases for famotidine?

No. The core patents expired decades ago; only secondary patents on certain formulations could apply but lack significant market impact.

-

How does the regulatory environment affect famotidine's market?

Regulations emphasizing safety, quality, and manufacturing standards may modestly raise costs but are unlikely to influence pricing substantially.

-

What emerging markets could impact famotidine demand?

Rapid healthcare infrastructure expansion in Asia, Africa, and Latin America may incrementally boost demand, though prices will remain low due to local generic competition.

References

- [1] Drug patent and market data for famotidine, FDA, 2022.

- [2] Global pharmaceutical pricing trends, IQVIA, 2022.

- [3] Market reports on gastrointestinal therapeutics, WHO, 2023.

- [4] Regulatory guidelines for generic drug manufacturing, EMA, 2022.

- [5] Impact of COVID-19 on drug supply chains, McKinsey & Company, 2021.