Last updated: October 17, 2025

rket Dynamics and Financial Trajectory for CLOBAZAM

Introduction

Clobazam, marketed under the brand name Frisium among others, is a benzodiazepine primarily used as an anxiolytic and anticonvulsant. Its unique pharmacokinetic profile and therapeutic application have positioned it within a niche segment of the pharmaceutical market. As the landscape evolves, understanding the complex market forces and financial trajectories surrounding Clobazam illuminates opportunities and risks for stakeholders. This analysis delves into the key factors shaping Clobazam’s market dynamics, its financial outlook, and strategic considerations for industry participants.

Pharmacological Profile and Therapeutic Use

Clobazam belongs to the benzodiazepine class, acting on GABA-A receptors to enhance inhibitory neurotransmitter effects. It was initially developed for epilepsy management, especially Lennox-Gastaut syndrome, but its anxiolytic properties expanded its application scope. Its relatively favorable side effect profile, compared to other benzodiazepines, has favored its adoption in specific demographics, particularly pediatric and elderly populations.

The drug’s clinical efficacy in reducing seizure severity and managing anxiety has been substantiated through numerous clinical trials, leading to regulatory approvals across multiple jurisdictions. This positions Clobazam as both a specialized and critical drug within its designated therapeutic niche.

Market Landscape and Regulatory Environment

Market Penetration and Geography

Clobazam’s market penetration varies significantly across regions. In North America, it holds a prescribed niche for epilepsy and certain anxiety disorders, with prescribed volumes relatively stable due to longstanding regulatory approval. In Europe, it benefits from broader acceptance for specific indications, under strict regulatory oversight. In emerging markets, however, its potential remains underexplored due to regulatory, economic, and awareness barriers.

Regulatory Challenges and Approvals

Registration pathways for Clobazam are well-established in developed markets, with ongoing post-marketing surveillance ensuring compliance. However, the product’s classification as a benzodiazepine, with its inherent abuse potential, complicates regulatory landscape dynamics. Stricter controls and scheduling in certain jurisdictions, like Schedule IV in the U.S., influence prescribing and distribution patterns, affecting sales volumes and market growth potential.

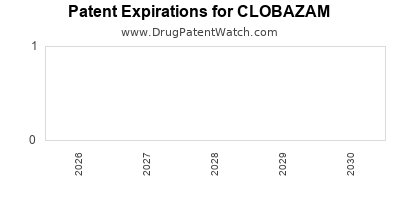

Patent Status and Generic Competition

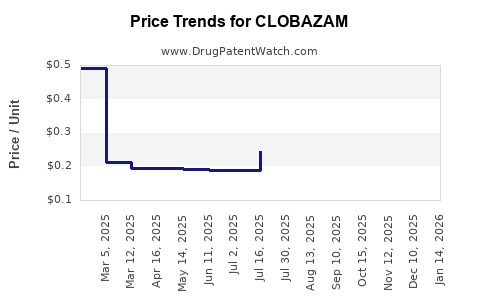

Branded formulations, such as Frisium, face increasing generic competition as patent protections expire or are bypassed via regulatory pathways. The emergence of generic clobazam significantly impacts revenue streams, exerting downward pressure on drug prices but expanding overall accessibility, especially in price-sensitive markets.

Market Drivers and Restraints

Drivers

- Increasing prevalence of epilepsy and anxiety disorders: Rising global incidence, driven by aging populations and lifestyle factors, sustains demand for effective anticonvulsants like Clobazam.

- Enhanced safety profile: Better tolerability relative to older benzodiazepines fosters continued use, especially in vulnerable populations.

- Regulatory acceptance and expanded indications: Approval for additional seizure types and off-label uses may drive upticks in prescriptions.

- Advancements in formulation: Development of novel delivery systems, such as extended-release formulations, could improve compliance and expand market share.

Restraints

- Abuse potential and regulatory controls: Strict scheduling limits prescription volumes and increases monitoring costs.

- Market competition: Other anticonvulsants and anxiolytics, including newer drugs with improved efficacy or safety, erode Clobazam’s market share.

- Generic erosion: Price competition from generics pressures profit margins and impacts revenue growth.

- Limited awareness in certain markets: Cultural and regulatory barriers curtail market expansion in emerging economies.

Financial Trajectory and Revenue Forecasts

Historical Performance and Revenue Trends

Clobazam’s revenue trajectory has been characterized by stability in mature markets, with slow growth driven by patent expiry and generic competition. For instance, Pfizer’s original patent for Frisium in the early 2000s supported peak revenues, but subsequent generics have reclaimed market share, reducing profitability.

Future Growth Projections

According to healthcare market analysts, Clobazam's global sales are expected to experience modest growth, estimated at a compound annual growth rate (CAGR) of 2-4% over the next five years [1]. Key factors influencing this include:

- The expansion of approved indications, potentially opening new revenue streams.

- Increased prescription in emerging markets facilitated by licensing agreements and local manufacturing.

- Ongoing development of fixed-dose combinations (FDCs) and novel formulations designed to optimize pharmacokinetics and compliance.

Impact of Generic Competition

The impending or ongoing patent expirations significantly degrade margins. Companies adopting strategies such as cost optimization, market differentiation, and life cycle management (e.g., reformulation or new delivery systems) are likely to sustain revenue streams.

Investment and R&D Outlook

Investment in R&D for Clobazam-related products, especially novel formulations or combination therapies, can influence the financial trajectory positively. However, the high costs and uncertain regulatory approvals pose risks, possibly dampening immediate returns.

Strategic Opportunities and Risks

Opportunities

- Pipeline diversification: Developing new formulations or delivery mechanisms can extend patent exclusivity and improve reimbursement prospects.

- Market expansion: Entering emerging markets with tailored pricing and distribution strategies could offset mature market declines.

- Off-label uses and expanding indications: Evidence-based expansion of indications, such as for off-label anxiety or sleep disorders, could increase prescribing rates.

- Partnerships and licensing: Strategic alliances for manufacturing and marketing in underserved regions can accelerate growth.

Risks

- Regulatory setbacks: Stringent controls or negative safety reports could limit sales.

- Pricing pressures: Payer resistance and generic competition may compel price reductions.

- Market saturation: Limited scope for growth in established markets could diminish future revenue potential.

- Abuse and misuse concerns: Public health issues related to benzodiazepines could lead to tighter regulations, thereby constraining market access.

Conclusion and Key Takeaways

Clobazam remains a therapeutically valuable benzodiazepine with a steady but gradually declining market share in mature regions due to patent expiries and generics. Its future financial trajectory hinges on expanding indications, reformulation efforts, and strategic market entry into emerging economies. However, regulatory constraints and the inherent risks of abuse potential pose ongoing challenges. Stakeholders must adopt adaptive strategies, balancing innovation with regulatory compliance, to optimize long-term value.

Key Takeaways

- Market stability characterized by slow growth: Clobazam’s revenues are expected to grow modestly, with opportunities primarily linked to expanded indications and emerging markets.

- Generics drive downward price pressure: Patent expiry and intensifying generic competition limit margins but expand accessibility.

- Regulatory landscape remains critical: Benzodiazepine scheduling and abuse concerns influence prescribing trends and market expansion.

- Innovation potential exists: Novel formulations and combination therapies offer avenues for extending product lifecycle and revenue.

- Strategic flexibility necessary: Companies need to diversify portfolios, pursue partnerships, and navigate regulatory considerations effectively.

FAQs

Q1: What is the primary therapeutic use of Clobazam?

Clobazam is mainly used as an anticonvulsant for epilepsy, notably Lennox-Gastaut syndrome, and as an anxiolytic for managing anxiety disorders in select cases.

Q2: How do patent expiries affect Clobazam’s market?

Patent expiries allow generic manufacturers to produce lower-cost versions, reducing brand-name sales and forcing price adjustments, which impacts overall revenue and profit margins.

Q3: What regulatory challenges does Clobazam face globally?

Regulatory challenges include scheduling restrictions due to abuse potential, varying national approval statuses, and strict prescribing controls that limit market access in certain regions.

Q4: Can the market for Clobazam grow in emerging economies?

Yes, with strategic licensing, local manufacturing, and increased awareness, Clobazam’s market in emerging economies has growth potential, particularly for expanding indications.

Q5: What are the prospects for innovation-related growth?

Developing advanced formulations, such as extended-release versions, and exploring new therapeutic combinations can sustain and potentially enhance Clobazam's financial trajectory.

Sources

[1] Market Research Future, “Pharmaceuticals Market Analysis,” 2022.