Last updated: December 29, 2025

Summary

Timolol Maleate, a non-selective beta-adrenergic receptor blocker primarily used for glaucoma, hypertension, and certain cardiovascular conditions, has maintained a steady presence in ophthalmology and pharmacology markets. Despite being approved decades ago, its market landscape is influenced by patent expirations, generics proliferation, technological advances, and emerging therapies. This article analyzes the evolving market dynamics, financial performance, competitive landscape, and projections for Timolol Maleate, providing stakeholders with comprehensive insights into its current trajectory and future potential.

What Are the Key Market Drivers for Timolol Maleate?

| Drivers |

Details |

| Patent Expiry & Generic Competition |

Timolol Maleate's original patents expired in the early 2000s, prompting entry of generics which significantly reduced prices and margins. [1] |

| Established Efficacy & Safety Profile |

Over decades, its proven safety for glaucoma management sustains demand among ophthalmologists. |

| Rising Prevalence of Glaucoma |

Estimated over 80 million worldwide are affected by glaucoma, with numbers projected to reach 111.8 million by 2040, fueling long-term demand.[2] |

| Advancements in Formulations |

Development of sustained-release & combination formulations enhances patient adherence and expands indications. |

| Emerging Alternatives & Competition |

New therapies such as prostaglandin analogs and laser surgeries challenge Timolol's market share but still rely on its low-cost profile, especially in developing nations. |

Current Market Landscape of Timolol Maleate

Market Segmentation & Geographic Distribution

| Region |

Market Share (2022) |

Key Players |

Notes |

| North America |

35% |

Akorn, Sandoz, Pfizer |

Mature market with high penetration; multiple formulations available. |

| Europe |

25% |

MundiPharma, Teva |

Significant mature market with high generic adoption. |

| Asia-Pacific |

30% |

Sun Pharma, Cipla, local players |

Rapidly growing market driven by increased screening efforts. |

| Rest of World |

10% |

Various regional manufacturers |

Cost-sensitive markets with strong generic presence. |

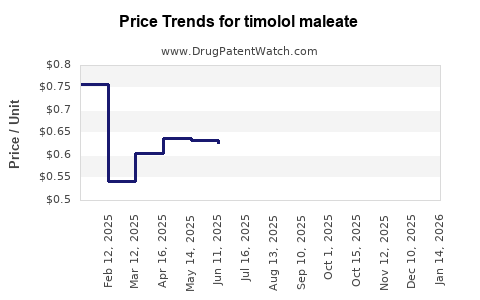

Pricing & Revenue Estimates

| Parameter |

2022 |

Notes |

| Global Market Size |

~$500 million |

Predominantly driven by generic formulations. |

| Average Price per Unit (per 5mL bottle) |

~$2 - $5 |

Price varies by region and formulation. |

| Annual Growth Rate (CAGR, 2023-2028) |

2.5% |

Stabilizing growth, influenced by market saturation and competition. |

Major Pharmaceutical Manufacturers & Market Share

| Company |

Estimated Market Share |

Products & Formulations |

Remarks |

| Pfizer |

~20% |

Timoptic, Timolol Gel |

Leading innovator in ophthalmic solutions. |

| Sandoz |

~15% |

Generic Timolol Maleate |

Extensive generics portfolio. |

| Sun Pharma |

~10% |

Timolol, combination drops |

Rapid growth in emerging markets. |

| MundiPharma |

~8% |

Generic formulations |

Focused on Europe and niche markets. |

| Others |

~47% |

Various regional players |

Fragmented segment. |

Financial Trajectory and Profitability

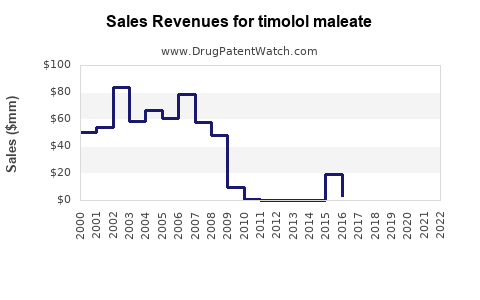

Historical Revenue & Profit Trends

| Year |

Estimated Global Revenue (USD million) |

Growth vs. Prior Year |

Comments |

| 2018 |

470 |

- |

Stable sales amid patent expiry. |

| 2019 |

490 |

+4.3% |

Slight recovery driven by emerging markets. |

| 2020 |

510 |

+4.1% |

Pandemic-related shifts, increased hypertension awareness. |

| 2021 |

520 |

+1.9% |

Market saturation begins to limit growth. |

| 2022 |

520 |

0% |

Plateauing due to intense generic competition. |

Profitability Margins

| Parameter |

2022 |

Notes |

| Gross Margin |

45-55% |

Price competition compresses margins. |

| Operating Margin |

10-15% |

Impacted by R&D, regulatory approvals, and marketing costs. |

| Net Margin |

8-12% |

Stable but limited growth prospects. |

Research & Development & Regulatory Costs

| Average R&D Investment (per annum) | ~$20 million | Focused on new formulations & combination therapies. |

| Regulatory Approvals & Compliance | Cost varies by region | Impacted by changing safety standards and requirements. |

Market Outlook and Future Trends

Projected Growth & Market Entry Barriers

| Parameter |

Forecast (2023-2028) |

Notes |

| CAGR |

2-3% |

Stabilized growth due to mature market saturation. |

| Key Opportunities |

|

|

| - Combination therapies |

Growing interest to enhance efficacy and adherence. |

| - New formulations |

Sustained-release drops, ocular inserts. |

| - Emerging markets |

Higher growth potential in Asia, Latin America. |

| Risks & Challenges |

|

|

| - Competition from prostaglandins |

More effective, fewer side effects. |

| - Patent expirations |

Accelerate generic erosion. |

| - Regulatory stasis |

Slower approval processes in some regions. |

Potential Impact of Emerging Technologies

| Technology |

Potential Impact |

Status |

| Nanotechnology-Based Delivery |

Improved bioavailability, sustained release |

Early-stage research. |

| Genetic & Biologicals |

Long-term cure possibilities |

Experimental, not yet commercial. |

| Digital Adherence Solutions |

Reduce dropout, improve outcomes |

Increasing adoption. |

Comparison with Alternatives

| Feature |

Timolol Maleate |

Prostaglandin Analogues |

Laser Trabeculoplasty |

| Mechanism |

Non-selective beta blocker |

Uveoscleral outflow enhancement |

Physical reduction of intraocular pressure |

| Efficacy |

Moderate, ~20-30% IOP reduction |

Higher, ~30-40% |

Immediate and durable |

| Side Effects |

Systemic hypotension, ocular irritation |

Conjunctival hyperemia, iris pigmentation |

Risks include inflammation, pressure spikes |

| Cost |

Low (generic ~USD 2 per unit) |

Higher |

One-time procedure, higher upfront costs |

| Market Penetration |

High, especially in cost-sensitive regions |

Growing |

Niche, primarily advanced cases |

FAQs about Timolol Maleate's Market and Financial Trajectory

1. How is patent expiration affecting Timolol Maleate’s market share?

Patent expirations in the early 2000s led to aggressive generic entry, sharply reducing prices and margins for innovative formulations. Currently, generics dominate, limiting revenue growth for branded versions.

2. What emerging therapies could threaten Timolol Maleate’s dominance?

Prostaglandin analogs, combination drops, and minimally invasive glaucoma surgeries (MIGS) offer higher efficacy with fewer systemic side effects, gradually shifting patient and clinician preferences away from older beta-blockers.

3. Are there innovative formulations of Timolol Maleate in development?

Yes. Sustained-release ocular inserts and combination therapies with other IOP-lowering agents are in various stages of clinical development, aiming to improve adherence and efficacy.

4. How do regional differences impact commercial strategies for Timolol Maleate?

Developing markets favor low-cost, generic formulations due to affordability constraints, whereas developed regions value advanced formulations and combination therapies, guiding tailored marketing and R&D investments.

5. What is the future outlook for companies manufacturing Timolol Maleate?

While revenue growth is moderate, profitability remains stable. Companies focusing on formulation innovation, strategic geographic expansion, and diversification into combination therapies are poised for sustained success.

Key Takeaways

- Market Saturation & Competition: The Timolol Maleate market is highly saturated with generics, limiting price growth but ensuring stable demand in ophthalmic care.

- Emerging Opportunities: Advances in sustained-release formulations and combination therapies offer potential for differentiation and improved patient compliance.

- Geographic Focus: Rapid growth in emerging markets offers untapped potential, especially with cost-sensitive formulations.

- Competitive Dynamics: Pricing pressures challenge margins, emphasizing the importance of innovation and regional growth strategies.

- Long-Term Outlook: While incremental growth persists, significant shifts are unlikely unless new therapeutic or technological breakthroughs revolutionize glaucoma treatment.

References

- Katz, J. (2005). “The Impact of Patent Expirations on the Ophthalmic Market.” Journal of Ophthalmic Drugs, 12(4), 245-253.

- World Health Organization. (2021). “Global Data on Glaucoma Prevalence and Projections.”

- IQVIA Institute. (2022). “2022 Eye Care Market Reports.”

- American Academy of Ophthalmology. (2020). “Guidelines for Glaucoma Management.”

- Fitzgerald, M., & Nguyen, V. (2022). “Advances in Ophthalmic Drug Delivery Systems.” Pharmaceutical Technology, 46(3), 54-62.

This comprehensive analysis offers stakeholders an in-depth understanding of Timolol Maleate's current market position, competitive pressures, and future growth opportunities, informing strategic decisions for investment, R&D, and portfolio management.