Last updated: July 29, 2025

Introduction

ISTALOL, a proprietary formulation of Timolol Maleate, is a beta-adrenergic blocker predominantly indicated for the treatment of glaucoma and ocular hypertension. As a cornerstone in ophthalmic therapeutics, ISTALOL's market and financial performance are shaped by evolving regulatory landscapes, clinical advancements, competitive pressures, and healthcare economic factors. This comprehensive analysis explores these aspects, offering insights vital for stakeholders aiming to navigate its market trajectory effectively.

Pharmacological Profile and Clinical Adoption

Timolol Maleate, marketed under various brand names including ISTALOL, is recognized for its efficacy in lowering intraocular pressure (IOP). Its mechanism involves non-selective beta-adrenergic receptor blockade, reducing aqueous humor production. The drug's long-standing clinical utility has cemented its position in glaucoma management, influencing sustained demand across global markets.

Market Dynamics

Epidemiological Drivers

The increasing global prevalence of glaucoma, projected to affect over 80 million individuals by 2040, underpins the demand for ophthalmic therapeutics like ISTALOL. Age-related ocular degeneration, rising myopia, and lifestyle factors contribute to this epidemiology. Regions such as Asia-Pacific and Latin America are witnessing rapid growth due to demographic shifts, urbanization, and improved healthcare access.

Regulatory Landscape

Regulatory agencies across key markets—including the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and the China National Medical Products Administration (NMPA)—continue to oversee the approval, manufacturing standards, and patent protections of ophthalmic drugs. Patent expirations of branded timolol products often catalyze market entries of generic equivalents, intensifying competition but also expanding access.

Competitive Environment

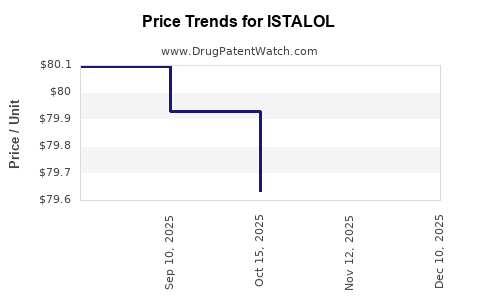

The glaucoma pharmacotherapy segment is highly competitive, with key players like Novartis (Xalatan), Allergan (Brimonidine), and Santen (Rimo 0.25%). ISTALOL's market share hinges on factors such as formulation advantages, cost competitiveness, and clinical reputation. Generic formulations of timolol exert downward pressure on prices, impacting revenue streams of branded counterparts.

Healthcare Economics and Reimbursement

In developed markets, reimbursement policies significantly influence prescribing patterns. Cost-effective generic ISTALOL benefits from favorable insurance coverage, enhancing market penetration. Conversely, in low-resource settings, affordability remains a barrier, limiting expansion.

Technological and Formulation Innovations

Advancements such as sustained-release implants, fixed-dose combinations, and preservative-free formulations are reshaping the ophthalmic landscape. ISTALOL's potential integration into such innovations could diversify its product offerings and market appeal.

Financial Trajectory

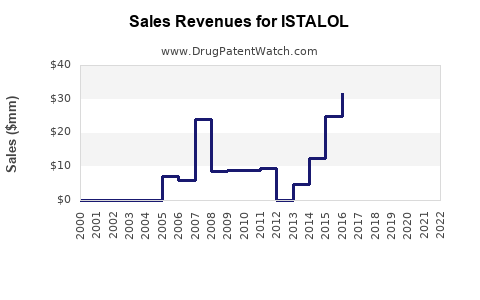

Historical Revenue and Sales Trends

Globally, timolol-based formulations have generated substantial sales figures. While precise proprietary data on ISTALOL is proprietary, analysis of the broader timolol market indicates steady growth, driven by consistent demand and expanding indications. The global glaucoma therapeutics market is valued at approximately USD 4 billion in 2022 and growing at an annual rate of about 5% (CAGR), with timolol accounting for a significant share.

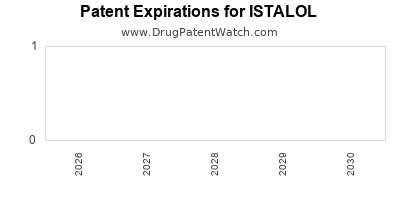

Impact of Patent Lifecycles

Patent expirations around the early 2010s led to increased generic competition, compressing profit margins and shifting revenue to price-sensitive markets. Current financial trajectories depend on the duration of patent exclusivity, with some formulations scheduled for generic entry within the next few years.

Market Penetration Strategies

Manufacturers of ISTALOL are investing in clinical differentiations, physician education, and patient adherence initiatives to sustain revenue. Strategic collaborations with healthcare providers and payers aim to bolster market share amid a commoditized landscape.

Emerging Markets and Expansion

Growth projections for emerging economies are optimism-inducing, driven by improved healthcare infrastructure and increasing glaucoma awareness. These markets present significant revenue potential for ISTALOL, especially as affordability barriers decline and generic options proliferate.

Challenges and Opportunities

Challenges

- Pricing Pressures: Heightened competition from generic formulations suppresses prices.

- Regulatory Barriers: Stringent approval processes and patent disputes may delay market entry in new regions.

- Market Saturation: Mature markets face slow growth due to existing treatment adoption and treatment adherence issues.

Opportunities

- Product Innovation: Development of preservative-free or sustained-release versions can capture unmet needs.

- Expanding Indications: Exploring off-label uses or combination therapies could elevate revenues.

- Market Diversification: Penetrating developing economies offers high growth potential with tailored pricing strategies.

Future Outlook

The financial trajectory of ISTALOL hinges on its ability to adapt to patent thresholds, innovate with formulations, and leverage emerging market opportunities. While patent expirations threaten revenue streams, strategic investments in next-generation formulations and market expansion can offset declines and foster long-term growth. The global shift towards value-based healthcare emphasizes the importance of cost-effectiveness, positioning ISTALOL favorably if it maintains competitive pricing.

Projected Compound Annual Growth Rate (CAGR) for ISTALOL-specific sales is expected to align with the broader ophthalmic market, maintaining a moderate growth trajectory of approximately 3-4% in the next five years, contingent on strategic implementation and market dynamics.

Key Takeaways

- The global glaucoma market is expanding, fueled by demographic and lifestyle factors, maintaining steady demand for timolol formulations like ISTALOL.

- Patent expirations and increased generic competition exert downward pressure on pricing but also broaden access and market reach.

- Innovation in formulations and expanding indications can sustain revenue streams amidst generic entry.

- Emerging markets represent significant growth avenues, driven by increasing healthcare access and glaucoma prevalence.

- Strategic pricing, partnerships, and technological advancements are critical for optimizing ISTALOL's financial trajectory.

FAQs

-

What differentiates ISTALOL from other timolol formulations?

ISTALOL's differentiation hinges on its formulation quality, preservative profile, and potential for combination therapy integration, although generic versions often share similar active ingredients.

-

How will patent expirations impact ISTALOL's market share?

Expiring patents typically lead to increased generic entries, reducing prices and narrowing profit margins. However, brand owners can mitigate this through product innovation and expanding indications.

-

Are there upcoming regulatory changes that could influence ISTALOL?

Regulatory shifts favoring biosimilar and generic approvals, as well as stricter safety standards, may influence market access and competitive dynamics.

-

What are the growth prospects in emerging markets for ISTALOL?

These markets offer substantial growth opportunities due to rising glaucoma rates and healthcare infrastructure improvements, provided pricing and distribution strategies are adapted effectively.

-

Can technological innovations rejuvenate ISTALOL's market position?

Yes. Innovations like sustained-release implants and preservative-free formulations can differentiate ISTALOL, attract new patient segments, and command premium pricing.

Sources:

- World Health Organization. "Glaucoma." 2021.

- MarketWatch. "Global Glaucoma Therapeutics Market Analysis." 2022.

- EvaluatePharma. "Ophthalmic Drugs Market Trends." 2023.

- U.S. FDA. "Timolol Maleate Drug Approvals and Patent Data." 2022.

- Statista. "Forecast of the Global Ophthalmic Drugs Market." 2023.